Escolar Documentos

Profissional Documentos

Cultura Documentos

Mcom Oqp

Enviado por

deepsimsrDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Mcom Oqp

Enviado por

deepsimsrDireitos autorais:

Formatos disponíveis

-:on.

133-fJ.::'.

'

0\

o

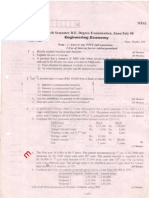

1. A transport company supplies lhe following details in respect of a truck of 5 tonne capacity which carries goods to and from the cily covering a distance of 50 krns. each way. Rs.

COS! of truck

1,80,000 30 1.500 1,500 wages (montllly) (per month)

Diesel, oil, grease (per trip each way) Repairs and maintenance Driver's (monthly) Insurance

I

wages

Cleaner·cum-altendant's (per year) Supervision life (years) Road licence (per year)

750

9,000 3,000

I I•

General Estimated

charpes (per year)

I

I

6,000 10

)

\

I

I ,

While goln~ to the city, freighl Is avallabte fOI a lull load 01 the truck and on its return journey it can fetch freight only up to 20 per cent of its capRcily, O:~ the assumption thai lI1e truck runs on an average 25 days a month, you are rsqutred to determine the following : (il Operating cost per tonne-km, (II) Rate per tonne per trip that the company should charge il profit of 50 per cent on cost Is to be earned, and ,_ (iii) What freight should the Company charge if one wants to ongage 1.10 truck lor one day for a trip 10 the city and back? 2. Following

Particulars Variable cost (Rs. in thousands)

relevant data of a IIrm IS given: Activity

50,000 tons 5.000 1.500 2.500 9,000 60,000 Ions 6.000

Levels

(tons)

80,000 Ions 7,000 1.650 3.000

70.000 tons

B.OOO

1.700 3.000 12,700

Semi'variable Cost I As. III thousa~dsl Fixed Cost ( Rs. in thousands) .' Total cost (As. In thousands)

1.600 2.500 10,100

11,650

The fixed costs follow slep·graph pattern as is clear from the above and the seml-vartable costs change at uniform. rate between the above given activity levels. Given that the firm operates at 55,000 tons level at present, (1) Calcutete the additional/incremental costs if It manufactures additional (a) 10,000 tons (b) 15,000 tons and (2) Advise whether Ihe IIrm should accept 'an)' one' of the foflc',ving additional (special) export market oilers and if Yes, 'which one' should It accept ; (I) ft... 10.000 tons at a salling price of Rs. 125/- per I('n (Ii) lor 15,000 Ions at a selling price of Rs. 150/- per Ion.

[TURN

OVER

Con. 133-AD-1S30·09. 3.

.)'

'.

~'

4.

A man'Jf<'lciuring company uses the lollowing standard mix of their compound in 0 e batch of 100 kgs, of its production line. 50 kgs of male rial X at the standard price 01 Rs. 2. 30 kgs of matenal Y at the standard price of Rs. 3. 20 kg!; 01 rnatartal Z at the standard price 01 As. 4. The actual mix for a batch of '120 kgs was as follows : 60 kgs of material X at the price of As. 3. 40 kgs of material Y at the price 01 As. 2·5. 10 kgs ot material Z at the price of Rs. 3. Calculate the diflerenl material variances. . The lo!]owlng data relate to Process Q : (i) Opening work-in-process 4,000 units costing Rs, 45,600 Degree of completion: Materials 100% Rs. 24,000 Labour 60% Rs. 14,400 overheads 60% Rs. 7,200 (iI) Received during the month of J\pril, 2007 from Process P 40:000 units at Rs. 1,71,000 Expehses incurred In Process Q during the month : Materials Rs. 79,000 Labour Rs, 1,38,230 Overheads ,I Rs. 69 .120 (Iv) Clc·sing work-ln-process Degree of COr1)pletion : 100% Materials Lacour and 0yerheadS . 50% 4,000 units (vi Units scrapped Degree of completion: 100% Materials Labour and overheads 80% (vi) Normal loss : 5% at currdnllnput (vii) Spoiled goods realised As. 1·50 per unil (viii) Completed 36,000 units are transferred to warehouse. Required: Prepare (By FIFO Method) (i) Statement 01 efjuivaient units (ii) Statement of cost per equivalent unit and total costs (iii} Process 0 Account (iiij

cit .cn, 1336. rh'" j

ancu

j'

\1' I

_.-

~

II is car

a'i(

Fi;(

car

ars As!

at 7. (aJ

5.

Rex Enterprises operates an inlElgral system 01 accounting. You are reqUireJ 10 pas; the Journal Entries tor the'following transactIons that 'took place for the ye~r end~j 30'h June, 2007. : Rs. Raw materials purchased (50% on credit) 6,00,000, Materials Issued 10 production incurred charged to production overheads incurred

4,00,00°1

2.00,00°1

Wage!; paid 10 workers Factory overheads Factory overnsads

ao.ooo:

1,00,000 40,000

5,00,000

Sp.iling and distribution Fir "shed goods at cost Sales t50~~ crerlil~

7,50,000

! - ,r

Can. 133·11.0·1530·09.

E: The loliowi'1g information relates to the productive activities cf Delta Ltd.·for 3 morn, ending on 31 st March 2008 : , ./ , Particulars ~~

'II!.-

Variable

Expenses: ' :,;

(at 50% capacity)

-Materials

"I

-Labour -Salesmen's Semi-variilble -Plant -Indirect -Sundry Fixed

Rs. 6,00,000 6,40,000

95,000 13,35,000

Gommission Expenses: (at 50% capacity)

maintenance Labour salaries

62,500 2,47,500 72,500 65,000 4,47,500

2,10,000

=-Salesrnen's

:5

at

Expenses

: Salaries of Machlner~

-Management -Rent -Sundry -Depreciation

and Taxes Office Expenses!

1,40,000 1,75,000

2,22,500

7,47,500

it IS further noted Ihi:lt semi-variable exp nses remain constant between 40% and 70% capacity, Increase by 10% of the aboye figurss between 70% and 85% capacity and mcrease by 15% of the aocve l~gures between 85% and 100% caoaclty. Fixed expenses remain constant whatever the level of activity may QB. Sales at 6G% capacity ere Rs, 25,50,000, at 80% capkcity are Rs. 34,00,000 and at 100% capacity ere Rs. 42,50,000. Assuminq that all items produced are sold, you are required to prepare a flexible b.,dget at 60"10, 80% and 100% capacity.

7. (a) Arnbar construction LId., undertook a contract lor Hs, 20,00,000 on ist April, 2007. On 31 st March, 2008, when the accounts were closed, following details were

available: I Particulars Rs. Materials purchased 4,00,000 Work certified 8,00,000 Materials on hand on 31st March, 2008 1,00,000 Machinery purchased 2,00,000 Cash received 6,00,000 Wages paid 1,80,000 Work uncerHfied 60,000 General expenses 40,000 Wages accrued 20,000 Depreciation on machine ry is to be charged @ 10% per ann urn, However the contract contains an escalation clause as under: "In the event of price 01 materials and rate of wages increase by more tt":an 5%, then the contract price will be increased accordingly by 40% of the rise in the cost 01 materials and wages beyond 5% in each case". II is lound thai after signing the agreement ihe price 01 rnatanals and wage rate increased by 25% each. The value of the work c.erWled does not take into account the eliect 01 the above clause. P'""pare the contract account giving the etlact 01 the above escalation.

1e!1

./

......

I'

[TURN

01'

/'

r=R

//

'/

----Can. 133-AD-1S30-09. tbl 4

COli.

You are given the following mlorrnatlon for the next year: Rs. Parf ie u la rs Sales (10.0;)0 units I 1.20,000 Variable Cost ( 10,000 uruts) 48,000 60,000 Fixed COSI (1) Find out the P.V. ratio and Break·even Point. (2) Evaluate the effect 01 following on P.V. ratio and Break-even point. (a) 10% decrease in Variable Cost (b) 10% decrease IntFixed Cost (e) 10% Increase in physical Sales Volume (d) 5% increase in Seiling Price. Relax Hotel occupancy Ihe year of the rent of

N.B, :

i.

(a (b

S.

has a capacity of 100 ~ingle rooms and 20 double rooms, The average of both single and do'uble rooms is expected to be 80% throughout 365 days. The rent fbr the double room has been fixed at 125% of the single room. The~ costs are as under: Variable Costs: sirgle rooms Rs. 220 each per day. l?.(1uble rooms Rs. 350 each per day Fixed Costs . Single rooms As .. 120 aaen pe r day D~uble rooms Rs. 250 each per day Oalculate the rent chargeable fdr single and· double rooms per day in such a way that I.he hotel earns an ove~1I profil of 20% on hire charges of rooms, (b) A company manufacturing and' markeling a product supplies the following lnforrnaticn : (a)

"

2.

(8 (b

3.

(a) (b)

4.

"TI (a)

I

Units 10,000

Standard Price Rs. 3·00

S~tes Amount Units

~tuat Price As, 5,000 8,000 13,000 3·00 2·50

Sales Amount Rs. 15,000 20,000

(b)

6.

(a) (b) 7. Eva . inte

~Rs,

34,000

Calculate

(I) (2) (3)

Sales value varjance Sales Volume v~riance Sales price varTnce,

8.

-(a')

(q) (a)

9,

Wrrte shari (a) (b) (c) (d) (e) (I)

notes on (any four) :- ~ Inter-link of Budgetary c~ntrol and variance analysis; U!ility 01 Standard Costl g; Different types of Budge s useful for a typical business enterprise; Implications of Ihe angld of incidence; Special loatures 01 Opel:atlng Costing; lmportance of M"lrginal Costing in decision making function.

9,

"

(b) _ '

ro,

(a) (b)

Con.

1444 & (.a)-09.

fl\_.(oW)

1 ,.~

±

Ii.

[CC1fl{fm~cs

~,

(OLD COURSE) (3 Hours)

~ &,,1 nan(e uct. )p b~

CI-

"

•

AD-6579-

.:tJ (u)

[Total Marks:

N.R.:

(1)

All questions Figures

are compulsory. indicate

\'1-Lb~

lull marks.

01 payments

1~

bad 10 10 10

(2)

(a) (b) 2. ge Jut 01 3.

10 the righl

Evaluate

whether

a deficit

in the balance

is necessarily

for a countrv. B ring out tbe superiority Explain Discuss external (a) (b) Reveiw Explain the working the balance. the merits of the monetary approach Or to the balance of payments.

(a)

(b)

of the foreign

trade multiplier. Policy for maintaining

importance

01 the use 01 Fiscal: I

10

and demerits resort

of flconomic

.integration. integrati.on. Should SouthComment,

10 10

the rote 01 ASEAN economics

in ach.ieving economic 10 further

East Asian

integration? :!ivide."

ha

j,19

Or

4.

''The VoITQ has worsened (a] (b) Discuss the relative

the North-South strengths Or

Discuss. rate system. for India.

20

1.0 10 10 exchange the market. probternof 10

5.

01 fixea exchange 01 tile Rupee

~I

I

I

Make a case Explain Discuss the

for Iullconvartibility and effective

uI

·1

6.

(a) (b)

spot, forward,

rates 01 exchange. 01 the foreign

the role at various objectives liquidity. and

constuuerus working

7.

Evaluate international

01 the IMF

in solving

20

Or 8.

(a) (b) Explain Discuss What crisis? 10. (a) (b) Elucidate Review the hnportance the vartous of Euro-currency and Euro-bond market. markel. 01 the 1990's? currency

10

,0 10 10

components

of the Euro-currency

9.

,

'I

(a) (b)

are the major causes Elaborate.

01 the global financial

crisis

What lessons areleamllrom

the South-East Asian and South-American

Or

the role 01 foreign tile relative capital in promoting 01 tarill economic deveiopment. barriers. [TURN 10 me rits and dements a nd non-turiff

10 OVER

\1--,

C~n. 1444-AD-6579-09,

Cor

(~) F<f Il~1 ~ ( ~) \jwit<niln

(.-~) ~r~!ffiWl

("iii )

ct[Q

~i'f. 3fq; ~ ~

T'T ~fihrrff, CJ.C11~

&~

a;~. ~I\jjracllq ~ '"H',ifiliiilliil\'1 ~~.

N.B

'~

CQdE'I((1~<:."Ircl'rn

cnic ilRffl

t: I~ cil d I Ol'01(1 cQ I

rfr f?:q;

<jfrCfi)lJITI}

mrn.

'i'fjT ? quf:,r <!ro.

1.

ft<rr

X (ar) (01')

rcre~;,1:ll'tm !Jurq:;f~ ~ 'i'fjp:fqU;C; ~ ~~ ~e ~" 2.

<if'fW ~tf

CfR~

~.

(.:or)

(01')

3flfij'q;- qq;R'i'ftq;{UII<I Iiii \'1"q I lJUf q ~~ Gfuor-¥~~~~'('Ifl<lHUImR'~~~.~ Gfuur-q,<f ~ ,Jftfcq-qftJT ~I,::flq;-'(UII~I

m'4e;rr

CfHT.

C5T ?

3.

~" 3fTim'tl-rft"ff

T1'irl

<IRf. 4.

~0

f$qr

II. ..~

«rillR ~"~q;U,

ltuc:f~

;:rrR

-c:f~rur .m) fit'!.fTGR' ~~'

i'QT

c:ITilfUlcr JiI'R:

t".

(,Jf) (Ol)

f&~

~QT

~ emr.::'~

~~

vcr~

q<f<ftq~

~

4{

5.

<nU,

~0

'l,'H;fP:r ~

€...

(.3f)

q1"Q"GTC:"(

q,uf ~ JITfUr

qftq{f~~ q~UIlI1CfjRCfi

'\1"Q'R' Cf;;(T.

~"

~0

fll"E CIrn.

6.

(01')

1<:1.

q-&-q ~

~~ 'flU,

OII\lllmfh.'f

~fitu ~

~T.ft

mrf

ClHT.

3!ilm:T~{h:r

~q;J'

:H!ff<IT 'Hl>5FilUQIOlIOl\'1

Jfiom(t<r ::rrDlf.l'!.ft;;m

3~tlCiliil

q CIll<fq~

~"

7.

(...

(ill)

(!il)

qtTR'R 0Il'\m' 3nfUr qit .n~ ~iI 9:~ -.:Rf'1 OII'JlI~I"ql f'itfil'tr trC<5T'<f1'Om

~ <!, <!, co

fuq;-'fi~

ffl;crr

~

~

fll"E

cnu,

~e ~e

ClHI

..

8.

I

q,.

(J.[) (Of)

'<-rrr

GlUChRfr<:r ~ ,JfTftrm~

'IH1.

~~

~~ ~

lJ.Wl a;R'Ul

~1l~1

q;furcft

? "<PTOT'fftr~

c:-fafur-u ..<f

J.TTfUT c:fefOT·~;)q,-"f

~"

~0

3fTqu]'

? I1Qr.!it1<m ~

~

~o.

(\31) (01')

~t:'

Gj"qjR!

"lii~!

J.TTftfq;

ij[ffiR!

f<1<!>m cp.tit1Ulcr

mq&f

'lI..~<H

!JIlT q

]:fCI;'f!(I'

C1'Cf>T.

~" ~

0

3flfUr ~

~~'&lT

Jf<'fl);uri~ ~iG't;r. CIrn.

--.

~,

L_

~~':>,

/ *~

10 the right

I,

t=?c.o,

Gn f"-e

y_;;

".1

(REVISED COURSE)? (3 Hours)

<D

r~2J

.

AD-6580

[TOtal Marks: 100

N.B.:

(1)

Answer Figures

any five qussuons. indicale

(2)

1. (a) (b)

lUll marks.

Discuss its international repercussions. schedules. 10 10

What is Foreign Trade Multiplier? Ex.plain internal and external What is meant by economic Discuss the achievements

balance In terms of IS-LM-6P

2.

(a) (b)

integra_tion ? WhC't are its forms? and prospects of SAARC. on developing countries?

10 10

10 10

3.

(a) (b)

What are the implications Discuss Outline

of the WTO agreements

.:

the various contentions the arguments country.

issues of the WTO. flexible exchange rare s in a

4.

(a) (b)

for and against

10

10 10 10

developing

Define curr ency convertibility.

What are Ihe issues in currency convertibility? Liquidity. role in

5.

(a) (b)

Examine Ihe role vi :MF with regards to Ihe provision of tnternatlonal What

ar s Ihe

sources

of

foreign

capital?

Examir:e

its

developing 6. (a) (b)

countries. features 01 Euro-Currency Market. What are the factors intergration of 10

~0

Explain the important that contributed the world.

to rts growth? Monetary Union in the financial

Discuss the role 01 European

10

7.

(a) (b)

Examine Discuss financial

the nature of international the distinctive Hub. features

financial crises 01 1990's. What lessons that make Singapore the International

10 10

did we learn from it ?

8.

(a) (b)

What do you mean by Non-Tarifi Discuss Ihe process and progress

Barriers?

Explain

them briefly. in India and China.

10

of \:Ilobalization

10

[TURN

OVER

.\'.

'

..

4

Con. 1444 (a)-AO-6580-09

: (0

(fi)utWtft ~

\JtR ~

(~) t

(.31). (q) ~. (-1f) (Oi)

~m~~~1JUT~R1.

l}Il'I'<Ii ~

fw.1Ifi arr.:m

IS-LM

<l>Tt! ? ~

~ 3forf1l

Q ~UIlI4 "1I<il(!

llfi'lI1HleQI

~~'rtaCq<lt;:I'!dldldlcl

~

'<!'<If

<iHI

~0

3IlfUT i'1'W

1

t1~

<:i'm.

~"

~0

.:mttfq; Q<:!lr(tM (h~u)

<l>Ttr ? ~

IfCfiR <liluffi

c;f~

-1fJfucmft

mt~

~rt1lim:~~'Qj

.:miUr

101fudcQI<ilI<ild

~0

<l>tr. (SAAR C)

~. (~)

(~)

11.

a:{t{IR~

~~

i<ld5a"!i:~<:1~~

tim (Implications).

~

~" ~"

~o

~~c:.:t"llilt1"ql

i!Tf-~

~~ ':IT ? ~ ~

R<lIGlfG<; ~

<1m.

(\If)

fitq,~ ~~ {iT.

~G'l1tr q ftRlmn ~

qft-d<ff.'l"<mm;;f1ft;:1

TRflqTGt<ft

~c

(or)

l".

'G~ian l'!it.,.cff.'rqa<fi ~

arfm~

lJt

<l>Tuffi '

~0

!

7

(~) (<il)

it~

d'!({c(llOic:'4fct

rrru)f.1tl'rBn 'll~~

~ ~~

~trl'DT

<l>x!.

'QHT.

~0

wftTq 'Ilisdctl"l1

aTtR

~

q;l-crcft : [aq;'W'I!£ftl'1 ~~

tR1'1\fUI

I~

€...

( ..Jf) (q)

qi1 ~C'R

(fimRf

afWcij ~

tf<ri,'hfi'a

~ ? -ij;~~ ~

~e

<1>'1 •. ~

~ftq::f ~

dli!I'l'!l61 ~

~ ~

w;n

~e

a

~e

\ifT1Tfuq;

~ q_

fil<f\T.r

t{ct>kiflq;{OlldlT

CIHT.

Ill.

(,JI) (OIl

'<

«n ~rCI'n1

<litUliif 'U'6T ~

~q

M~:ih:ql ~ ~ <3ffi1JTRff

qttt;fUT <:i'm. ~.,.

~o

~q"(

,1f!{J1lT

'.

fwrrq:.~ 3ft~

~::11tr,

~fur;cm~

~o

c~

1

( ,IT)

(til)

;zq;:Rffi(

f31<n fWR

<fj",

Gl<PI"d uffi~

q;n:r ? i'<!il)

'l.lT«l

·Jmur

lit1ffi ~~

Jffil;1l'<iT

"if ~

tIT6<fmd" ~m{tl'l <lin. 'tf'tff q>n.

~"

; ,

N.I

Con. 734

• \_/.

s (a)-09. LV l' <"" ) M ,Com.,J:.

OLD

COUR~EI'

N.B. :-

V.

M a. t' kt'}-in q S-rO' aJ-eq" c, (1) Attempt any two questions from each sectibT'i. (2) All questions carry equal marks.

(3) Answer to both sections should be tied togeth Section I

(3 Hours)

13LWI nelS i'1jmt,l[[_

-.... .

AO-3172-3173

&. p! ' ' 0 () ~ ~ Col d &\ 12e\. J \ 'V .91-) Lp I C!.9

25

[Total

§t(;!!

r)rl

: .100

Ma}~s

1.

Explain the meaning of marketing marketing process. What is strategic business unii? various strategic business units.

strategy and e:<plain the stepts involved in strategic

2.

Explain t~e methods •

of allocation

of resources

to

25

3.

Enumerate how changes in demographic and technological environments affect marketing decisions of a company. What is market segmentation? Discuss in brief the bases of market segmentation. Section II

25

4.

25

5,

What is product tife Cicle? life cycle?

What are the strategies adopted at various stages of product

25

6.

Explain the factors determimng the choice of a channel. Stale with reasons whlcll ,ype of channels wou:d you select for home computers, furniture and motor bikes. What is Promotion? Discuss the various elements of promotion mix.

25

"1.

8.

25

25

Write note on any two of the following :(a) Pricing Methods (b) Techniques of Marxeting Control (c) Service Marketing (d) Mass Marketing Vis Niche Marketing .

.,

Con. 734(a)-09. ( REVISED COURSE.! [Total ( 3 Hours) N.B. :(1) (2) (3) Question No.1 is compulsory, Attempt any four questions from QuesFon Nos. 2 to 7, All questions carry equal marks.

AO-3173 MarKs:

inc

1. Answer any four of the following :(a) Discounted cash flow model (b) Porter's five force model (c) Customer lifetime value (d) Product levels (e) Product Elimination (I) Brand Equity (9) Discount Policies.

20

TlIRN (jVFR

rd]'

2. (a) (b) (a) (0) Explain corporate strategy and explain Ihe components 'of corporate Explain the BeG model With the help of a suitable diagram. EXPI~ Ihe concept of strategic business unit. What are the guidelines strategies. 10 10 10 10

c

N.

3.

for forming

a S8U?

Explain the impact of global environmental years. changes on Indian markets in the recent

4.

(a) (b)

Define customer satisfaction and explain the measures for enhancing satisfaction, Discuss the advantages and limitations of market segmentation. Explain in detail the strategies a marketer can adopt at Introduction stage of product life cycle. Define branding. Explain the methods of branding of a product.

customer

10 10

5. (a)

(b) 6. (a)

and Gro v.lth

10

10

and 10 ~

Discuss the important points of differences between skimming pricing penetration pricing strategies. (b) Define integrated market communication. EXplain elements of IMC. Read the following case and answer the questions at the end :-

10'

7.

India has been the home of Ayurveoa; But untillhe early nineties. people preferred allopath~'. The reason behind this preference was the Teeling that allopathy gives quick relief and also it has cure for practically every thing. Himalaya Drugs has been a key player in the Ayurvedic medicines in India. But its products never caught the fancy of India consumers due to marketing deficiencies. The company, along with the brand name. did specify that the medicines are proprietary Ayurvedic medicine. This information was often overlooked by the consumers and the market remained restricted. Also no serious efforts were made by the company to promote tt-,e brand. In order to change the thi:'gs in rls favour and to cash-in on the so-called 'Ayurved fever' the company changed its slrOltegy. Instead. of naming its products independently. the company used a brand name viz. 'Ayurvedic concepts' and started advertising the same. This immediately Gaugh: the fancy of the customers and the market started expanding one very important aspect stressed by the company was thaI their medicines have no side effects and they give positive and promising results wilhin a snort period 15-20 days. Qu~stions : (ai Why was· allopathy preferred over Ayurveda till the early nineties? (b) What new strategy did the company adopt and why? (c) What was the flaw in marileting strategies of the company? (d) Sugg' :c\ ;:Jnytwo strategies for (J successful entry into the global market.

I_

'.

5 5 5 5

2.

o o o

\__..-..... /

N.B. (1) Question

(Ac.c.oufltancy)(3

No.1 is compUlsory.AJ-.J

Hours)

o nCl'd ..p,vna ':'c{o...l Pr GC OLJ fin

M.(on)

[IOlal

MarKS.

IUU

(2) Attempt any other four questions from ques!ion Nos. 2 to 9. (3) Figures to .the right Indicate full marks assigned to each questions. 7\b ~ (4) Give working notes and state clearly your assumptions whenever necessary. 1. From the following Receipt and Payments Nc or Hitashandhani Charitable Trust and other details prepare Income and Expenditure AceG'un! lor Ihe yea r ended 31-3-08 and Balance 'Sheet as on [hal date ._ . Particulars Inlerest Ren! Donation Salaries Medicines Clinical Educational Conveyance Printing Furniture Investments Cash and Bank Balances; Cash Bank and Surgical Grants and Traveling Expenses Equipments tor Clinic Fund 3,000 7,000 3,000 5,000 400' 500 100 2,000 5,000 26,COO 800 6700 33500 Petty Collections Qr. (Rs.) Cr.(Rs.} 15.000 6,000 3,000 2,000

n;o p·fI C!1(5f

20

~A

')

01

o

o

o

o o

J

Postage and Telegrams and Stationary

---

26,000

500

--33500

7,000

Original Trust lund consisted of 5% Investmenl (FV Rs. 3,00,000) Rs. 2,60,000, Building valued at Rs. 1,20,000 and Bank Balance Rs. 5,000. Bank Interest outstandlnq at the end or year was Rs. 1,000. Outsanding BlIIs for suppty medicines etc. were Rs. 500 at the beginning of the year, and Rs 1100 at the end, Furniture at the commencement or the year was Rs. 1,QOO. Accrued Investment Income was RS. 2,000 at the beginning and Rs. 2,200 at the end. Provids 10% depreciation of Furniture and 20% on Clinical Equiprnenls. 2. The Balance

Lla"ililies Share Capilal ; Shares 01 As. 10 aach rully paid Gene rat A aserve Ploli\ and Loss Ale. Bal. as 011tst April 2005 Profit lor the year ended 3151 March, 2006 CrcriilO's Bill Paya ble 1,00,000 1,0",000 60,000 8,00,000 50.000 90,OO\! 80,000 40,000

SheAts of A and B as

A Ltd. (As.)

on

31st March, 2006 were as under:

Assets Land & Buildings Plant II Machinery

20

B Lid. (Rs.)

6 A Ltd. (As,) Lid. (As.)

1,50.000 q,OO;OOO 1,70,000 60,000 50,000

~,OO,OOO

60,000

1,00,000 20,000

Siock Sundry Oebtors flirl Receivable mvcsuncnrs ;

I

ao,ooo

20,000

6,000 Shares of .J. Ltd. at Cost Ca.h/B""k U"lancos I,JO,OOO :'>0.000

II

20.000 3,00.000

-\

~

-il,oo,oOO

3,OO,OQo}

{'URN~"I

~ _... ~~~i~:n:~::;:r~ation (a) (b) (c) (d)

tv. I

~J- ~----

Shares wet« acquired by A Ud'-aS""on 1 st October 2005 Included In the Debiors 01 B lid. is As. 20,000 due from A Ltd. Bt:15 Receivable held by B Ltd. are all accepted by A Ltd. The Slack of B Ltd. includes goods purchased from A Ltd. at Rs. 10,000 which includes prolit charged by A Ltd. @ 25% on Cost, Pr€,,,;_;re Ihe consolidated Balance Sheet of A Ud. and B Ltd. as on 31st March, 2006, snow working of ; Ii) Capital ProJils, (ii) Current Profits (iiil Minority Interest. (iv) Goodwill 3_ From the following inlormation relating to acc Bank I,.Id- Prepare Profit and Loss Account for the year ended 31st March 2009 and Balance sheet as at thai dale in the form prescribed by tile bar:king Regulation Act 1949. Rs. Share Capital: Shares of Rs. 100 each fully paid Statutory Reserve Fund [Fully invested In 5% Govt. Securities at par] Bad debt Establishment Expenses Current Deposits Interest paid Saving Deposit Accounts Acceptances lor customers Discount Profit and Loss Nc( ::!007-08} Fixed Deposits Commission and Exchange Premises Cash In hand lnterest received Investments In Shares (Market value Rs. 2,00,000) Cash with Banks in India Term loans in India Cash credit-hypothecation In India Casll credit-pledge in India Bills purchased Loans to employges for purchase of lap top Saiarles, allowances, bonus, provident lund Dividend paid for 2007-08 Dividend Received on Investments 2,00,000 1,20,000 12,875 1,27,725 13,65,227 7,48,440 17,20,000 47,500 4,95,000 8,20,400 8,75,000 2,92,900 4,80,000 22,650 12,86,400 92,500 2,84.500 10,00,000 12,56,000 9,44,000 16,00,000 40,770 4,45,467 20

20,000

8,000

Additional information: (1) The chief executive of the Bank draws remuneration of As. 40,000 p.a. Director's fees and allowancs are Hs. 8,000, All these are Included In salaries, allowances etc. (2) Unexpired discount as at 3151 March 2009 was Rs, 6,000. (3) Establishment expenses include-

Rs.

Advertisement Stationery Rent Ligilling Audit fees Postage, fax Revenue stamps Stamp papers ., 10,000 63,000 18,000

B,OOO

3,000 4,600 400 l,SOP

Con.208-AO-1269-09. (4) (5) (6) 4.

3 n';!d~

An advance of Rs. 8,000 included in Cash \..'r~dit'hypothecatio@iS doubtful and needs to be fully proviccd for Provide for taxation @ 40% plus surcnarqe 5% (hereon Make 20% appropriation lor Statutory Re:oerve

""-l.

20

Ar:n

From the following Trial Balance of Shirpur Co-operative Purchases and sales Soci;:!ty Ltd. as on 30-6-2003, prepare Trading and Prot:: and Loss Account tor the year ended 30-6-2003 and Balances Sheet as on thaI date, alter considering the adjustments given therealte r. Trial Balance

Particulars Share Capital Reserve Fund Credllors Profit & loss Nc. Or. (Rs.)

20

As on 30·6-2003 c-, (RS.)

3,:36,000 60,000 40,000 Particulars Tm',ol;r>g and Conveyance Pnntlng S. Slationery Admission Fee Purchases Cooli" Charges ) Freight & C~rt3ge Il1vestmenls Sales CaSh in hand Bank Balance Development Fund Dr, 'Rs.) Cr. (Rs.)

18,000 14.000 63,4ll.000

ln12002

Opening Siock Furniture & Equlpments Container Deposit Salaries Sundry OeblOfs Commission RanI & Taxes Postages

3,92,000 1,24,000 32.000 3,00,000 60,00') 86.000 60.000 8.000

1.76,000

2,':;00

1.60,000 2.40,000 76,20,000

6,000 4,00,000

8,000

82,42,000

82,42,000

l

5.

AdJustments: (1) CI<'lsing Stock is Jalued at Rs. 4,40,000. (2) Outstanding nen! Rs. 4,000 and Cnl.lmisslon ?ayablt: As. 20,000 (3) Rs. 8,000 Salary was pairi as advElllce as on 30-6-2003. (4) Accrued lncome on investment Rs. 20,COO (5) Provide 10% depreciation on Furnitur;;> and Equipments. XV ltd. has a branch in New York. As on 3151 Marc:h, 2005. the Trial Balance or tbe Branch was as follows : Particulars Head office Account Sales Goods Irom Head Ollice Siock on 1st April 2004 Furniture Cash in Box 88r1k Balance Salaries Rent Insurance Outstanding Expenses Sundry Deblors Dr. S 20

r's s,

44,000 8,500 9,000 250 1,250 2,800 1,200 150 3,150

Cr. S

8,500 61,000

800

70,300 70,300 The branch account In head of lice shows debit balance As. 2,14,500 and goods sent to branch credit balance 01 Rs. 13,12,500. Depreciate Furniture @ 10% p.a. Stock at Branch 31s1 March 2005 was S 7500. Furniture was purchased in 1997 when one II " As. 20. E.xchange rates were: , On 1/4/2004 1$ " r-s. 2B On 3113/2005 1= Average rate 1S '" As.

RS~10 f ~~

[TURN

OVER

You are required to prepare Branch Trial Balance by convening In Rupees and prepare Branch'Tradlng and Profit 8. Loss Nc for the year ended 31-3-2005, -',ld Balance Sheet as on thai dale, ~ • 6. The Balance Sheet of Adesh Lid. as Of! 31s1 March 2008 f--. Balance Liabi:Ities

Cor

i~ln

as under

20' Lakhs 70 150 250 330 150

N.B

Sheet as on 315t Mach 2008

R5. Lakhs

400 100 115 183 115 37

Assets Goodwill Building (Cost) Machinery (Ne!) Inventory Debtors

as

Share Capital Equity shares of Rs. 10 each Rs. 10% Preference Shares of Rs. 100 each Reserve and Surplus Creditors Bank Loan Provision lor Tax The after tax profits during the immediately 2003-04 2004-05 2005-06 2006-07 2007-08 (a)

1.

2.

950 % Oividend

950

past 5 years were as tollows :20 Loss 6A 133 120 135

Rs. Lakhs

.I

3. 4.

18 20 22 25

The loss of 2003-04 was due to strained Industrial relations, which has since Improved satlstactonly. (b) T"8 "'iarke\ Price of equity Srmres at present IS Rs. 130 per share. (e) The Profit for 21107-08 '.V&S calculated after debit!!1g !I-JeProfit &. Less account with As. 50 lakhs for MO's rernunerauon. In future I! will be Rs. 60 Lakhs lor wnich necessary lormalltias have been completed. (d) A lender subrnlttad in 2006-07 has baen accepted and lhe annual additional earnings for the contract is going to be Hs. 80 t.akhs for Ihe next 5 years with an annual growth 5%. For rhis purpose .. new machinery worth As. 100 Lakhs would be needed and !I will be acquired by issuing paid up shares. The iollowing revaluation have been agreed upon :Buildings Rs. 220 Lakhs Inventory Rs. 350 t.akns Debtors Rs, 165 Lakhs You are required to calculate :(a) Goodwill, if any on the basis of 5 year's purchase of average annual super protits. (tl Valuation 01 equity shares on Asset-backing Method (Net Assets Method) (c) Valuation 01 Equity Shares on earnings basis when normal earnings in Similar kind of business is 16%. (o) Valuation of equity shares on I'ield basis. 7. Write (a) (b) (c) short notes (any lour) :Rebale on Bills discounted Objeclives 01 Inlk'tion Accounting Uses of the value Added Stalement 20 (d) (e) NET ASSETS valuation 01 shares Computation of Earnings PEA SHARE (f) Treatment 01 Bonus shares by subsidiary companies. 10 10 10 10

5.

8. 9.

(a) What IS E P.S.? Whal are the PROVISIONS 01 AS-20 witll respect of E.P-S. ? (b) What;),w value Added statement? Whal are their advantages? What arc Ine accounting corpora Ie rEport!'. ? (b) What are 1I1enotes (a) policies to 1-.'1 kept in mind lor presentation of published

'''M C ., ., .._ Con. 1442 & (a)"09.

B u_sIn0 <;; ...

M u. !"r)Q. Y)

f"

e. sou. 'Y ce ( OLD COURSE)

~

Com r.J\ Q

11 ().,_~c. III

it~

er¢ '\b,fCI)

ene,

-:r .

{n~c::lt'\O.J

(-old R eu AD-6573-6574

,"

( 3 Hours) N.B. ;(>

(1) Question No.1 is cornpulaory.. (2) From the remaining questions attempt any four. (3) Figures to the right indicate full marks. 10

? ~l'l'"

b7

::"'4) IJ U ~ [ Total Marks: 100

1.

(a) Explain the following terms (any five) :(i) Human Resource Research (iv) Role analysis (ii) Recruitment (v) Performance Appraisal (iii) Job discription (vi) Training. (b) Case Study :XYZ Ltd. is a public sector undertaking with a staff strength of around 1200 including 300 offices. As per Ihe recruitment policy of Ihe company most employees join as trainees and after successful completion of training, are absorbed at the lowest intake level. Thus, in the case of workers most start as Technician/Operator Trainees, and of{jcecs, as Management Trainees: The company expects the higher posts to ~ (med by promotions and therefore, as far as possible, direct recruitment to higher positions is avoided. Only when there is an urgent requirement of a person to fill a higher post and no candidates from within the organisation are eligible. is an open advertisement released. In 1982, the company urgently needed one Junior Engtneer"to take charge of one of its plants. At that time, the company had four Junior Engineers (JEs) in position who had joined as Management Trainees in 1980 and had been .reqularised in 1981. Immediately above them was an Assistant Engineer, who in turn reported to the Project Manager. The company released an advertisement fex the post of J.J::. seeking applications-from those with at least two years' experience in the field. One Mr. Ramesh Chaudhari, who had four years' experience In a private concern applied and was selected. He found the terms of appointment lunalive and joined the company in May 1982. As four JEs were already working in the company, Chaudhari became the Junior-most JE as per Ihe promotion policy of the comp311Ythe four JEs would become eligible for promotion to the post of 'Assistant tngineer' in 1985 (on completion of four year's service) and Chaudhari in 1986. In July 1983, the Assistant Engineer left his job and hence, the company decided to fill the vacancy by dfrect recruitment. In the advertisement It was stipulated thai the applicants should have a minimum of five years experience Chaudhari mel the specincatlon since he had four years previous experience plus one year in XYZ Ltd. Therefore, he applied for the post !hroug~ proper channel. The company decided to call the eligible candidates for interview. Accordingly, Chaudhari was also called along with the external candidates. He performed exceedingly well in the interview and was found suitable for the post. The General Manager, who was Chairman of [he Selection Committee congratulated Chaudhari and told him that he had been selected.

[ TURN OVER

.;pa;

~~

~------+~------~--~------~---~-,

2

Con. 1442-AD-6573-09.

However, the General Manager changed his mind subsequently and asked the Personnel Officer nol to issue thc appointment leiter to Chaudhari He gave the following reasons for reverting his decision ;(1.) Mr. Chaudhari would get a higher post after completion of just over one year's service in the organisation as against the normal requirement of four years. (2) When Mr. Chaudhari joined, he was junior to the four JEs by aboU1 one year. If he was offered the higher post. he would suddenly become their boss. This would demoraltse the JEs - in fact they had already decided to seek jobs elsewhere if Cheudhari became Assistant Engineer. The General Manager was convinced that he could not afford to loose four JEs and therefore, he chose to disappoint Chaudhari. Questions1. Did the management make a mistake in calling Chaudhari for an interview and selecting him. when he was "too junior" in the organisation? Why? 2. Are there any drawbacksiilthe recruitment/promotion policies of the company? If yes, elaborate them 5

5

-;r7

2.

Answer any two of the following :(a) What is HRM? Explain its nature. (b) Expla.in the working of HR department and its relationship with other departments. (c) Discu.s!1_,I:!..0~ environmemat influences have constrained HRM practices the Answer (a) (b) (c) any two of the following ;What is HR audit? Why ik4 necessary ? Explain the various components of human resource planning. "Conducting interview is not an easy task." Do you agree? Explain the problems faced by the interviewer. any two of the following ;What is lob analysis? Brjen~ 'explain its techniques. Briefly discuss Ihe limitations of performance appraisal. "Success of training programn"e depends on how it IS conducted."

20

3.

20

e

Answer (a) (b) (e)

20 .~ Explain. 20-

5.

Answer any two of the following :(a) Describe tile various techniques of management development. How are the management development programmes evaluated ? (b) What is successron planning? What are the obstacles in succession planning? . (c) "A human resource manager has to face challenges in the present globalised Indian economy." Discuss. Write short notes on any four of the following :(a) Occupational diseases (d) Video Display Terminus (b) Causes of accidents (e) Internal mobility (c) Org.anisational stressors (f) Valuation of human resources.

~.

20

t-~'.-'

'"

~

In,

.-a:

1442(a)-09.

1t,

3 Yc~tREVISED COU ( 3 Hours)

fA

j-

AD-6574 [ Total Marks: 100

3, :-

Question No. 1 is compulsory, From the remaining questions attempt any four (3) Figures to the right indicate full marks.

(1) (2)

Explain the following (any four) :(af Human Resource Information System (b) Recruitment Agencies (c) Ethical aspects of employee appraisal (d) Succession Planning (e) Safety Measures (1) SPO,' Answer-the following questions :(a) Analyse the impact of the recent globa~QCOnomiccrisis on the HRM practices in India. (b) Explain, step by step, human resource planning process Answer the following questions :(a) Explain in detail how job analysis is done in a manufacturing (b) Distinguish between recruitment acQ.:slection.

20

20

20

company.

/' -...

1

Answer the 'foll()wing questions :(a) What do you mean by manaqernentneveloprnent programme? Examine its need and objectives. ~ (b) State and explain the merits and demerits of performance appraisal

20

ar ........_

---

Answer the following questions :20 (a) 'Self development is a catalyst which ~U!:Lancesself confidence of indIVIduals which inturn helps in their career advancement.' Discuss, (b) Enumerate the factors that cause mental stress in employees, How can it be reduced? Answer the follOWing questions :.;.--" (a) Critically evaluate 'downsizmg' as a HRM strategy. (b) Write- In detail about various employee Incentive schemes. Case Study :The Vice President, Human Resource Department of Global Heallh Care Ltd., is in a difficult decision making situation. He has to fix up the remuneration package for a senior manager from Rand D department and another senior manager from marketing department. Both have been promoted 10 the current position due to their excellent performance in the preceeding years. Till reoently, these decisions, i.e. oectslcns related to the remuneration paid to the top executives were laken by [ TURN OVER

20

20 e

S.

al al

Con. 1442(a)-AD-6574-09. th-e managing director. He used to rely on his discretionary powers while doing so. Hence his decisions were never questioned. This situation has changed since last year when HR department was made more powerful. Clearcut HR policies were designed under this the policy related to employee compensation discriminated line executives and staff executives As per the new policy line executives are to be gi'ven two advance increments alongwith performance linked bonus whenever they are promoted. The policy. however, was silent about staff executives: Unfortunately the policy Was not widely publicised within the company. This issue of discriminating line executives and staff executives with reference 10 compensation during promotion is now questioned by the senior manager, Rand D department. He a!ongwith other members from his department not only questioned the policy but pointed out the deficiency in not recognising the role of Rand D in a pharmaceutical company. In their opinion the growth of the company depends upon innovative drugs developed by their department. The staff executives also questioned about the lack of publicity about Ihe policy changes especially changes related to employee compensation. They wanted the original procedure to be followed. If not they wanted an uniform policy applicable to all executives, irrespective of the positions held by individuals and tha role they play. The HRD along with the top management should have tr;> decide about the HR policy With respect to employee remuneration. Answer the following questions :(a) How are HR policies usefuL!).. {b}-Cornment upon uniform pO;lcy for remuneration of employees (c) Suggest ways for publicing policies in a company. (d) Do you agree with the arg~..:a put forth·by Rand 0 department execulives~ Give reasons.

.......-"l

5 5

"\

Con. 4"38-09.

,

N.B. :-

/'

'

XI-

~-------J)

/y) . CtJP1' CjJ cr)'"'/ (REVISED COURSE)

~-J, 'AD-259B

1II>1'''/.2.~

s.J;n;/ erfC.

(3 H'Ou!~J

/J7Q.J1<Ct

(1) A" questions are compulsory and carry equal marks. (2) Deceptive subject matter snail be treated as unfair means. 10 10

"Z=c;;;

ge/FJ~.ijf-

[ Total

Marks:

100

1. (a) Define the term business policy and explain its significance in modern business world. (b) What are TACTICS? How they are different from strategies?

2, (a) Define strategic management. Explain in detail the limitations of strategiCmanagement, 10 (b) What is environmental scanning? Explain the present economic and Political Environment 10 in India.

OR

2. (a) Explain the meaning and objectives of divestment strategy. 10 (b) What do you mean by stability strategy? Explain the approaches to slability strategy, 10 3, (a) Discuss briefly the relevance of industry and competitor analysis to the strategic choice 10 process. 10 (b) Explain the steps involved in implemenling_'a strategy.

OR

3. (a) Bring out the relationship between strategy and structure. Explain any two structural 10 mechanisms to implement a strategy. (b) Explain the concept of resource allocation. What factors need to be considered while 10 allocating the resources? 4, (a) Briefly explain the nature of strategiC evaluation. Point out the barriers in strategic evaluation. (b) Do you recommend modernisation as a strategy for Indian business? Why?

. OR

10 10

4. (a) What is organisational change? Suggest measures to manage the change. 10 (b) Explain in brief me concepts of corporate culture, personal values and business ethics, 10 5. (a) Slate the features of globalisation and explain in brief the impact of present global economic slowdown on developing countries. (b) Read the case carefully and answer the questions given below :The public sector oil company ABC Ud., the major oil refining and Marketing Company which was also the canalising agency for oil imports and the only Indian Company in the fortune 500 in terms of sales, planned to make a foray inlo the foreign market by acquiring a substantial stake in Ihe proxa oil field in Iran of the Premier Oil, The project was estimated to have recoverable oil reserves of about 14 million lonnes and ABC l.td. was supposed 10 get nearly 06 million tonnes. Wilen ABC Ltd. started talking to the Iranian Company for the acquisition in July 2006, oil prices were at rock bottom ($ 14 per barrel) and most refining companies were closing shop due to falling margins. Indeed, a number of good oil properties in the middle East were up for sale. Using this opportunity, several developing countries made a killing by acquiring oil equities abroad. [TURN OVE 10

Can. 43B-AD-2598-09.

ABC Ltd. needed Government's permission to Invest abroad. Application by ABC Ltd. for investing abroad is to be scrutinised by a special committee represented by the RBI and Finance and Commerce minislTies. By the time the government gave the green signal for the acquisition in November, 2007. (i.e. more than a year after the application was made), the prices had bounced back to $ 28 per barrel. And the FICO of Italy had virtually took away the deal from under ABC Ltd's nose by acquiring the Premier Oil. The RBI which gave ABC Ltd. the approval for $ 20 million Investment, took more Ihan a year for clearing the deal because the structure for such investments were not in place, it was reoerted, Questions (a) (b) :5 5

Discuss whether it is the domestic environment or global environment that hinders the globalisation of Iridian business. What would have been the significance of the foreign acquisition to ABC LId. 7

-.

-,

--

----~-

----'_-

Você também pode gostar

- Cost Volume Profit Analysis For Paper 10Documento6 páginasCost Volume Profit Analysis For Paper 10Zaira Anees100% (1)

- Practice Set 2 (Cost Segregation and CVP)Documento2 páginasPractice Set 2 (Cost Segregation and CVP)Jessica Aningat0% (1)

- Econ Asgment 2Documento6 páginasEcon Asgment 2rahmani_4Ainda não há avaliações

- 100 Moral Stories - Islamic Mobility - XKPDocumento173 páginas100 Moral Stories - Islamic Mobility - XKPIslamicMobility100% (4)

- CMA AssignmentDocumento4 páginasCMA AssignmentniranjanaAinda não há avaliações

- Ca 1Documento4 páginasCa 1VaibhavrvAinda não há avaliações

- 22 - Mtest - Management Accounting Morning 1st HalfDocumento4 páginas22 - Mtest - Management Accounting Morning 1st HalfZohaib NasirAinda não há avaliações

- E Book Mgt705Documento20 páginasE Book Mgt705haf472Ainda não há avaliações

- Sample MAS 3rd Evals KEY Set BDocumento13 páginasSample MAS 3rd Evals KEY Set BJoanna MAinda não há avaliações

- Business Budgets and Budgetary Control: Sma - AbsDocumento4 páginasBusiness Budgets and Budgetary Control: Sma - AbsSai SumanAinda não há avaliações

- ADL 56 Cost & Management Accounting V2Documento8 páginasADL 56 Cost & Management Accounting V2solvedcareAinda não há avaliações

- MAF - Revision 2 1Documento7 páginasMAF - Revision 2 1Sadeep MadhushanAinda não há avaliações

- BudgetDocumento9 páginasBudgetDrBharti KeswaniAinda não há avaliações

- C.A Cost Acc P.PDocumento29 páginasC.A Cost Acc P.PRaja Ubaid100% (1)

- Cost Accounting: T I C A PDocumento4 páginasCost Accounting: T I C A PShehrozSTAinda não há avaliações

- Cost Accounting 2013Documento3 páginasCost Accounting 2013GuruKPO0% (1)

- Costing QN PaperDocumento5 páginasCosting QN PaperAJAinda não há avaliações

- Accounting 12 Management Advisory ServicesDocumento3 páginasAccounting 12 Management Advisory ServicesJoyAinda não há avaliações

- Cost FM Sample PaperDocumento6 páginasCost FM Sample PapercacmacsAinda não há avaliações

- Ccfylv: Ch. 2 Practice QuizDocumento11 páginasCcfylv: Ch. 2 Practice QuizFrank LovettAinda não há avaliações

- Group II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksDocumento23 páginasGroup II - June 2010 Cost and Management Accounting: The Figures in The Margin On The Right Side Indicate Full MarksMahesh BabuAinda não há avaliações

- Unit 4 - Reddy BookDocumento20 páginasUnit 4 - Reddy BookChelladurai KAinda não há avaliações

- Paper - 4: Cost Accounting and Financial Management All Questions Are CompulsoryDocumento24 páginasPaper - 4: Cost Accounting and Financial Management All Questions Are CompulsoryAkela FatimaAinda não há avaliações

- EN E M A: DT R Examin TionDocumento2 páginasEN E M A: DT R Examin TionLokesh GurseyAinda não há avaliações

- END Examination: Ques. L (A) (B) (8+7) Ques. 2 (A) (B)Documento2 páginasEND Examination: Ques. L (A) (B) (8+7) Ques. 2 (A) (B)Lavi LakhotiaAinda não há avaliações

- C&ma RWQDocumento5 páginasC&ma RWQPrabhakar RaoAinda não há avaliações

- Worksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Documento7 páginasWorksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Dinku Mamo100% (1)

- All Chapters Practical QuestionsDocumento14 páginasAll Chapters Practical QuestionsNarayan choudharyAinda não há avaliações

- 1606 - Accounting For Management Model Question PaperDocumento4 páginas1606 - Accounting For Management Model Question Papersiva86Ainda não há avaliações

- Advance Management Accounting Test 2 130520200212Documento7 páginasAdvance Management Accounting Test 2 130520200212PrinceAinda não há avaliações

- Practice ProblemsDocumento4 páginasPractice ProblemsshaiwanaAinda não há avaliações

- Paper15 Set1Documento10 páginasPaper15 Set1Mayuri KolheAinda não há avaliações

- Revisionary Test Paper - Intermediate - Syllabus 2008 - June 2013: Paper - 8: Cost and Management AccountingDocumento70 páginasRevisionary Test Paper - Intermediate - Syllabus 2008 - June 2013: Paper - 8: Cost and Management AccountingsengurlulaAinda não há avaliações

- Cost Grand Test 2Documento4 páginasCost Grand Test 2moniAinda não há avaliações

- Review QsDocumento92 páginasReview Qsfaiztheme67% (3)

- 16-500 Mcqs of Fundamentals of Accounting PDF For All ExamsDocumento50 páginas16-500 Mcqs of Fundamentals of Accounting PDF For All ExamsQasim AliAinda não há avaliações

- CMA AssignmentDocumento3 páginasCMA AssignmentYadavParamjitAinda não há avaliações

- Project Finance: Valuing Unlevered ProjectsDocumento32 páginasProject Finance: Valuing Unlevered ProjectsKelsey GaoAinda não há avaliações

- BBA Sem I QPDocumento3 páginasBBA Sem I QPyogeshgharpureAinda não há avaliações

- Numericals Module 1 & 2Documento7 páginasNumericals Module 1 & 2Akash Singh RajputAinda não há avaliações

- Engineering Economy June July 2008Documento2 páginasEngineering Economy June July 2008mechnoeAinda não há avaliações

- Tutorial AccountingDocumento5 páginasTutorial AccountingMevika MerchantAinda não há avaliações

- Budgetary Control Test QuestionsDocumento4 páginasBudgetary Control Test QuestionsMehul GuptaAinda não há avaliações

- Thapar Institute of Engineering and TechnologyDocumento2 páginasThapar Institute of Engineering and TechnologysahibjotAinda não há avaliações

- OSM Notes PDFDocumento24 páginasOSM Notes PDFGodsonAinda não há avaliações

- 1.05 Cost Accumulation SystemsDocumento37 páginas1.05 Cost Accumulation SystemsmymyAinda não há avaliações

- Tybcaf Sem-VDocumento29 páginasTybcaf Sem-Vkatejagruti3Ainda não há avaliações

- Costing MCQ ScannerDocumento32 páginasCosting MCQ ScannerALAQMARRAJAinda não há avaliações

- Management Accounting Review For Preliminary Examinations: (Sources: Various Books and Testbanks)Documento1 páginaManagement Accounting Review For Preliminary Examinations: (Sources: Various Books and Testbanks)Lorena TuazonAinda não há avaliações

- P10 CMA RTP Dec2013 Syl2012Documento44 páginasP10 CMA RTP Dec2013 Syl2012MsKhan0078Ainda não há avaliações

- Cost Control Techniques PDFDocumento3 páginasCost Control Techniques PDFHosamMohamedAinda não há avaliações

- Revisionary Test Paper - Intermediate - Syllabus 2012 - Jun2014: Answer CDocumento62 páginasRevisionary Test Paper - Intermediate - Syllabus 2012 - Jun2014: Answer CSon DonAinda não há avaliações

- Gujarat Technological University: InstructionsDocumento4 páginasGujarat Technological University: InstructionsSnehalkumar PatelAinda não há avaliações

- Budgetary Control: BY Animesh Kalita 2K10MKT37Documento15 páginasBudgetary Control: BY Animesh Kalita 2K10MKT37Animesh KalitaAinda não há avaliações

- Test Paper 2 CA Inter CostingDocumento8 páginasTest Paper 2 CA Inter CostingtchargeipatchAinda não há avaliações

- The Process of Capitalist Production as a Whole (Capital Vol. III)No EverandThe Process of Capitalist Production as a Whole (Capital Vol. III)Ainda não há avaliações

- Strategy, Value and Risk: A Guide to Advanced Financial ManagementNo EverandStrategy, Value and Risk: A Guide to Advanced Financial ManagementAinda não há avaliações

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesAinda não há avaliações

- Check List For Employee DocumentsDocumento1 páginaCheck List For Employee DocumentsdeepsimsrAinda não há avaliações

- Check List For Employee DocumentsDocumento1 páginaCheck List For Employee DocumentsdeepsimsrAinda não há avaliações

- Business IntelligenceDocumento17 páginasBusiness IntelligencedeepsimsrAinda não há avaliações