Escolar Documentos

Profissional Documentos

Cultura Documentos

Description: Tags: Repay989pa11

Enviado por

anon-587329Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Description: Tags: Repay989pa11

Enviado por

anon-587329Direitos autorais:

Formatos disponíveis

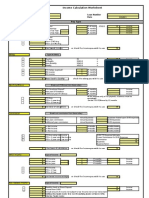

DIRECT SUBSIDIZED AND DIRECT

UNSUBSIDIZED LOAN WORKSHEET PART 2

INCOME CONTINGENT REPAYMENT PLAN

Step One Multiply your principal balance by the constant multiplier (from Chart D)

for the interest rate on your loans

Principal Balance multiplied by Constant Multiplier equals Result

from Chart D

$ x = $

Step Two Next, multiply the result from Step 1 by the income percentage factor

(from Chart E) that corresponds to your income.

Step 1 Result multiplied by Income Percentage equals Result

Factor from Chart E

$ x = $

Step Three Calculate your discretionary income, which is AGI minus the poverty

guideline (from Chart F) for your family size.

AGI minus Poverty Guideline equals Discretionary Income

from Chart F

$ - = $

Step Four Multiply your discretionary income by 20 percent.

Discretionary Income multiplied by .2 equals Result

$ x = $

Step Five Divide the Step 4 result by 12 months

Step 4 Result divided by 12 months equals Result

Factor Interval

$ ÷ = $

Step Six Compare the Step 2 result with the Step 5 result.The lower amount is

your monthly payment. If this amount is greater than $0 but less than $5,

you are required to make a $5 payment.

Step 2 Result Step 5 Result Estimated Monthly Payment

$ $

Você também pode gostar

- Income Calculation WorksheetDocumento1 páginaIncome Calculation Worksheetrush2serveAinda não há avaliações

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)No EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Nota: 3.5 de 5 estrelas3.5/5 (17)

- CH 3 SolutionsDocumento12 páginasCH 3 SolutionsLucia100% (3)

- Break-Even Analysis and Contribution Margin RatiosDocumento3 páginasBreak-Even Analysis and Contribution Margin RatiosLê Chấn PhongAinda não há avaliações

- The Twenty-Something ProjectDocumento36 páginasThe Twenty-Something Projectapi-270947621Ainda não há avaliações

- Guide To Djent ToneDocumento6 páginasGuide To Djent ToneCristiana MusellaAinda não há avaliações

- Science of Happiness Paper 1Documento5 páginasScience of Happiness Paper 1Palak PatelAinda não há avaliações

- Description: Tags: Repay989pa7Documento1 páginaDescription: Tags: Repay989pa7anon-883828Ainda não há avaliações

- Homework #1: By: Kyle Aldwin A. Liwag ME-5301Documento9 páginasHomework #1: By: Kyle Aldwin A. Liwag ME-53013 stacksAinda não há avaliações

- Direct Subsidized and Unsubsidized Loan Worksheet Part 1: Standard Repayment PlanDocumento1 páginaDirect Subsidized and Unsubsidized Loan Worksheet Part 1: Standard Repayment Plananon-987350Ainda não há avaliações

- Cfin 5th Edition Besley Solutions ManualDocumento38 páginasCfin 5th Edition Besley Solutions Manualgarrywolfelsjftl100% (17)

- Ebook Cfin 5Th Edition Besley Solutions Manual Full Chapter PDFDocumento32 páginasEbook Cfin 5Th Edition Besley Solutions Manual Full Chapter PDFseanmosstgdkf2100% (14)

- Cfin 5th Edition Besley Solutions ManualDocumento11 páginasCfin 5th Edition Besley Solutions Manuallaeliavanfyyqz100% (25)

- Finance - Spreadsheet Notes (Answers)Documento51 páginasFinance - Spreadsheet Notes (Answers)Ashfaqullah KhanAinda não há avaliações

- Perf Task 01Documento2 páginasPerf Task 01tati tayagAinda não há avaliações

- Mock Exam Review CFA InstituteDocumento1 páginaMock Exam Review CFA InstituteYAN MAAinda não há avaliações

- 07-01 - An Introduction To Risk and ReturnDocumento69 páginas07-01 - An Introduction To Risk and ReturnSalsabila AufaAinda não há avaliações

- REAL 4000 Ch3 HW SolutionsDocumento6 páginasREAL 4000 Ch3 HW SolutionsnunyabiznessAinda não há avaliações

- Accruals and Prepayments ExplainedDocumento6 páginasAccruals and Prepayments ExplainedLakshmi sajiAinda não há avaliações

- 1 Time Value of MoneyDocumento11 páginas1 Time Value of MoneyAdeeba 1Ainda não há avaliações

- 5.2 Money 5Documento13 páginas5.2 Money 5clinton fifantyAinda não há avaliações

- Compound Interest and Present ValueDocumento20 páginasCompound Interest and Present ValueAHMED MOHAMED YUSUFAinda não há avaliações

- Financial Management:: An Introduction To Risk and Return - History of Financial Market ReturnsDocumento69 páginasFinancial Management:: An Introduction To Risk and Return - History of Financial Market ReturnsBen OusoAinda não há avaliações

- CH3 Mortgage Ready WorksheetDocumento1 páginaCH3 Mortgage Ready WorksheetAbdul Wadood GharsheenAinda não há avaliações

- Quantitative MethodsDocumento14 páginasQuantitative MethodsPaulo Lucas GuillotAinda não há avaliações

- Calm 20 - Test 2 Twenty-Something ProjectDocumento3 páginasCalm 20 - Test 2 Twenty-Something Projectapi-350666556Ainda não há avaliações

- BMAT 230 Chapter 9 2020Documento86 páginasBMAT 230 Chapter 9 2020Jahanzaib MunirAinda não há avaliações

- Chapter 5 - Notes Receivables - 082437Documento7 páginasChapter 5 - Notes Receivables - 082437venturinajocel20Ainda não há avaliações

- Using Financial Functions in Excel or A TI-83 To Solve TVM ProblemsDocumento27 páginasUsing Financial Functions in Excel or A TI-83 To Solve TVM ProblemshillmannAinda não há avaliações

- 9 Mas Capital Budgeting Sessions 3 4Documento14 páginas9 Mas Capital Budgeting Sessions 3 4seya dummyAinda não há avaliações

- Tutorial 6 - SolutionsDocumento8 páginasTutorial 6 - SolutionsNguyễn Phương ThảoAinda não há avaliações

- BFN 2101 - B2C Financial Management: Single AmountDocumento23 páginasBFN 2101 - B2C Financial Management: Single AmountKatring O.Ainda não há avaliações

- m2 Single Amount Finman ReportingDocumento23 páginasm2 Single Amount Finman ReportingKatring O.Ainda não há avaliações

- Tutorial 4Documento17 páginasTutorial 4amirmahdian16Ainda não há avaliações

- R D V Stock Preferred of ValueDocumento42 páginasR D V Stock Preferred of ValueJesper N. Qvist100% (4)

- Step 1:: Break-Even Worksheets: Dollar BasisDocumento2 páginasStep 1:: Break-Even Worksheets: Dollar BasisHendro PranotoAinda não há avaliações

- Answer:: Stock ValuationDocumento3 páginasAnswer:: Stock Valuationmuhammad hasanAinda não há avaliações

- Business Finance 2 Name: ID: Year: 2021: SolutionDocumento5 páginasBusiness Finance 2 Name: ID: Year: 2021: SolutionDua ShabeerAinda não há avaliações

- Anticipated Return (Or Expected Gain) Is The Weighted-Average Outcome in Gambling, ProbabilityDocumento5 páginasAnticipated Return (Or Expected Gain) Is The Weighted-Average Outcome in Gambling, Probabilityroh_10Ainda não há avaliações

- Standard 4c-d Lesson 1 Assignment 4Documento1 páginaStandard 4c-d Lesson 1 Assignment 4CHANIYA VINSONAinda não há avaliações

- BusinessMath - Week 2 PDFDocumento13 páginasBusinessMath - Week 2 PDFKaye VillaflorAinda não há avaliações

- Engineering Economics: Presented by Maj ZahoorDocumento37 páginasEngineering Economics: Presented by Maj Zahoorumair100% (1)

- Calculating Dividend Growth Rate (gDocumento9 páginasCalculating Dividend Growth Rate (gkhalifaAinda não há avaliações

- Final AssignmentDocumento20 páginasFinal AssignmentTabish KhanAinda não há avaliações

- Lecture1 Chapter 1 InvMath2021 UpdatedDocumento38 páginasLecture1 Chapter 1 InvMath2021 UpdatedNada NaderAinda não há avaliações

- Time Value of Money: DR. Mohamed SamehDocumento22 páginasTime Value of Money: DR. Mohamed SamehRamadan IbrahemAinda não há avaliações

- Sibilski OdpDocumento35 páginasSibilski Odpkalineczka.rausAinda não há avaliações

- MOdule 4 Com Int, PV, Disc, NomEffDocumento9 páginasMOdule 4 Com Int, PV, Disc, NomEffDarryll B. OdinebAinda não há avaliações

- Long Term Based ChuchuDocumento22 páginasLong Term Based ChuchuSharmie Angel TogononAinda não há avaliações

- Unit 11 - Lesson 4 - Proportional Progressive Regressive TaxesDocumento10 páginasUnit 11 - Lesson 4 - Proportional Progressive Regressive Taxesapi-260512563Ainda não há avaliações

- SHS Las Q2 Week 2 Business MathDocumento3 páginasSHS Las Q2 Week 2 Business MathHouston IbañezAinda não há avaliações

- ABM11 BussMath Q2 Wk2 Gross-And-Net-EarningsDocumento9 páginasABM11 BussMath Q2 Wk2 Gross-And-Net-EarningsArchimedes Arvie Garcia100% (1)

- 1.FV Function Excel Template 1Documento6 páginas1.FV Function Excel Template 1w_fibAinda não há avaliações

- 2.5 Regular PaymentDocumento26 páginas2.5 Regular PaymentShyla Patrice DantesAinda não há avaliações

- Pro Rata Debt ListDocumento2 páginasPro Rata Debt ListbubuAinda não há avaliações

- Solutions To Chapter 6 Valuing StocksDocumento14 páginasSolutions To Chapter 6 Valuing StocksdevashneeAinda não há avaliações

- Dividends SampleDocumento5 páginasDividends SampleJose Cardona0% (1)

- Discount Rate: Concept 9: Present ValueDocumento5 páginasDiscount Rate: Concept 9: Present Valuekaustavdas1989Ainda não há avaliações

- An Overview of Your Current Financial Picture: Family IncomeDocumento6 páginasAn Overview of Your Current Financial Picture: Family IncomesampaccAinda não há avaliações

- UntitledDocumento1 páginaUntitledBockarie LansanaAinda não há avaliações

- CND CLC FM 22-EngDocumento2 páginasCND CLC FM 22-EngJustin VincentAinda não há avaliações

- Supreme Court: Lichauco, Picazo and Agcaoili For Petitioner. Bengzon Villegas and Zarraga For Respondent R. CarrascosoDocumento7 páginasSupreme Court: Lichauco, Picazo and Agcaoili For Petitioner. Bengzon Villegas and Zarraga For Respondent R. CarrascosoLOUISE ELIJAH GACUANAinda não há avaliações

- Untitled DocumentDocumento2 páginasUntitled DocumentClaudia WinAinda não há avaliações

- Table Topics Contest Toastmaster ScriptDocumento4 páginasTable Topics Contest Toastmaster ScriptchloephuahAinda não há avaliações

- Mr. Honey's Large Business DictionaryEnglish-German by Honig, WinfriedDocumento538 páginasMr. Honey's Large Business DictionaryEnglish-German by Honig, WinfriedGutenberg.orgAinda não há avaliações

- Crypto Portfolio Performance and Market AnalysisDocumento12 páginasCrypto Portfolio Performance and Market AnalysisWaseem Ahmed DawoodAinda não há avaliações

- Parashara'S Light 7.0.1 (C) Geovision Software, Inc., Licensed ToDocumento5 páginasParashara'S Light 7.0.1 (C) Geovision Software, Inc., Licensed TobrajwasiAinda não há avaliações

- Intro To Flight (Modelling) PDFDocumento62 páginasIntro To Flight (Modelling) PDFVinoth NagarajAinda não há avaliações

- Cash Flow StatementDocumento57 páginasCash Flow StatementSurabhi GuptaAinda não há avaliações

- Verbs Followed by GerundsDocumento10 páginasVerbs Followed by GerundsJhan MartinezAinda não há avaliações

- Ash ContentDocumento2 páginasAsh Contentvikasbnsl1Ainda não há avaliações

- Connectors/Conjunctions: Intermediate English GrammarDocumento9 páginasConnectors/Conjunctions: Intermediate English GrammarExe Nif EnsteinAinda não há avaliações

- PHILIPPINE INCOME TAX REVIEWERDocumento99 páginasPHILIPPINE INCOME TAX REVIEWERquedan_socotAinda não há avaliações

- INTRODUCTION Quali Observation ReportDocumento2 páginasINTRODUCTION Quali Observation Reportmira hamzahAinda não há avaliações

- Bombardier CityfloDocumento14 páginasBombardier CityfloBiju KmAinda não há avaliações

- Contemporary Philippine Arts From The RegionsDocumento29 páginasContemporary Philippine Arts From The RegionsDina Ilagan50% (2)

- Mansabdari SystemDocumento10 páginasMansabdari SystemSania Mariam100% (8)

- Design of Efficient Serial Divider Using HAN CARLSON AdderDocumento3 páginasDesign of Efficient Serial Divider Using HAN CARLSON AdderInternational Journal of Innovative Science and Research TechnologyAinda não há avaliações

- 6 Strategies For Effective Financial Management Trends in K12 SchoolsDocumento16 páginas6 Strategies For Effective Financial Management Trends in K12 SchoolsRainiel Victor M. CrisologoAinda não há avaliações

- Debt Recovery Management of SBIDocumento128 páginasDebt Recovery Management of SBIpranjalamishra100% (6)

- Perkin Elmer Singapore Distribution CaseDocumento3 páginasPerkin Elmer Singapore Distribution CaseJackie Canlas100% (1)

- Source: Sonia S. Daquila. The Seeds of RevolutionDocumento6 páginasSource: Sonia S. Daquila. The Seeds of RevolutionJulliena BakersAinda não há avaliações

- Ehlers-Danlos Syndromes (EDS) : Fiona Li Pharm D Candidate University of Saint Joseph School of PharmacyDocumento22 páginasEhlers-Danlos Syndromes (EDS) : Fiona Li Pharm D Candidate University of Saint Joseph School of PharmacyDiogo CapellaAinda não há avaliações

- ASBMR 14 Onsite Program Book FINALDocumento362 páginasASBMR 14 Onsite Program Book FINALm419703Ainda não há avaliações

- Prophetic Prayer Declarations - September, 2021Documento5 páginasProphetic Prayer Declarations - September, 2021Jelo RichAinda não há avaliações

- General Ledger Journal Import ProcessDocumento13 páginasGeneral Ledger Journal Import ProcessMadhavi SinghAinda não há avaliações

- Vadiyanatha AstakamDocumento4 páginasVadiyanatha AstakamRaga MalikaAinda não há avaliações

- Grade 10 To 12 English Amplified PamphletDocumento59 páginasGrade 10 To 12 English Amplified PamphletChikuta ShingaliliAinda não há avaliações

- Futurology and EducationDocumento32 páginasFuturology and EducationMuhammad Abubakar100% (1)