Escolar Documentos

Profissional Documentos

Cultura Documentos

11po Id 4 4 PDF

Enviado por

Marcelo Varejão CasarinDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

11po Id 4 4 PDF

Enviado por

Marcelo Varejão CasarinDireitos autorais:

Formatos disponíveis

Analysis of Strategic Alternatives to configure eBusiness models in the Oil Industry Heitor Mansur Caulliraux PhD GPI/COPPE/UFRJ Adriano

o Proena PhD GPI/COPPE/UFRJ Luiz Fernando de Jesus Bernardo Eng Logistics Manager/CENPES/PETROBRAS Rodolfo Sivieri Eng Electronic Commerce Manager/PETROBRAS Ivan De Pellegrin MSc. GPI/COPPE/UFRJ Roberto dos Reis Alvarez MSc GPI/COPPE/UFRJ Introduction Companies suffer a positive impact on their operational and economic performance, insofar as the business as a whole reacts in a form that adheres closer to external dynamics. For this purpose, it is necessary to have a business model that is supported by the full use of technological resources eBusiness enabling greater integration between customers, vendors, suppliers, business partners and between company units, rendering processes and transaction more efficient and speeding up decision-making. eBusiness in the Oil Industry where and how to invest? Some eBusiness initiatives such as eProcurement and eCommerce, are widely disseminated and may be effective to reduce transaction costs, improve the level of service in trade relations, and explore price elasticity in the competition processes. Rarely, however, are single and partial initiatives, such as electronic purchases or sales, sufficient to provide opportunities for significant improvements in the overall performance of the organization. For instance, it should be noted that, in transport and stocking activities, in the Oil chain, the opportunities to reduce costs upstream from the refineries are little exploited by the current eBusiness initiatives that are concentrated on the external relations of the companies. It should be stressed that approximately 20% of the costs in this industry correspond to logistic activities and that a large proportion of these costs is between production and refining. In this contexts, two issues that have a positive impact on intra and intercompany business may be rendered feasible by an eBusiness model: the integration of processes beyond the borders of business units and the improvement of decision-making by individual players, beginning with the total availability of information in the chain. As results one can achieve better coordination of the interorganizational processes with corresponding benefits, such as cost reduction, response time, reliability in deliveries and operational flexibility. However, although conceptually acknowledged, in practice the difficulty in performing a quantitative analysis of these benefits has been an obstacle to the concentration of investments in eBusiness to support the development of a more integrated business model. In many cases, the lack of appropriate criteria to support decisions of these investments has led to the development of partial and mistaken solutions. A simplified analysis of the Oil chain (Exploration , Production, Transport, Refining, Distribution) might suggest that

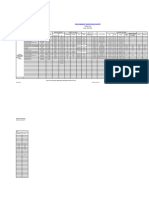

one should concentrate on the Production link, where there is a greater addition of value. In this link the eBusiness could, for instance, flexibilize the exchange of information regarding stocks, enabling the optimization of offloading operations, transport, etc. But possibly a more significant impact would be to reduce project times, development, renovation or start up of production units. Efforts related to collaborative projects and to the acquisition of engineered products, for instance, have a very significant potential for gain in Exploration and Production. From a strictly financial perspective, the acceleration of construction and the start up of production units or the reduction of time needed to renovate operational units may be more useful than the reduction of purchase costs of MROs favored by eProcurement initiatives, for instance. Even if it is specifically a matter of purchasing, the opportunities to reduce the costs of MRO-type materials appear to be very limited if compared to other types of items. In the case of Petrobras purchases for 2001, approximately 62% correspond to engineered items, 11% to electromechanical MROs, 10% to generic MROs, 6% to specific MROs, 9% to special chemicals and 2% to generic chemicals. Out of the total investments performed by the company from 1954 to 1996, approximately 64% are concentrated in E&P activities, 13% in refining, 12% in transport, 7% in subsidiaries and 4% are in other areas. These numbers support the suggestion to concentrate initiatives relating to acquisition in engineered items relating to E&P. However, in order to align the investments in eBusiness with the corporate strategy, it is necessary to understand the interrelations between all the links in the productive chain. It should be observed that the activities of transport, refining and distribution are essential to ensure the appropriability of the profits provided by the production assets, i.e., the maximization of the overall performance of the company depends on all links in the chain, not only on the link that adds the most value. Thus, the criterion of adding value does not appear sufficient for a correct evaluation regarding where and how to apply efforts at eBusiness. It is necessary to analyze the whole chain with a more systemic approach. Along this line, a well-disseminated analysis approach is Business Processes Engineering, which enables a number of qualitative analyses, although it does not satisfy the need for quantitative information to support investment decisions. On the other hand, the alternative of analysis based on Computational Modeling and Simulation (hard simulation) of the productive processes might provide information as return/investment, but encounters a number of technical and methodological difficulties due to the complexity of the system. Anyhow, it is a challenge to be considered by the companies to support investment decisions based on more accurate criteria. A third approach would be Systemic Thinking which establishes a cause-effect relationship for the understanding of relations between objects of the system that is being analyzed, allowing a simplified mathematical representation (soft simulation) and enabling the evaluation of alternative scenarios, from both qualitative and quantitative perspectives.

Conclusion: For companies that see eBusiness as a strategic resource to achieve their objectives, the higher gains will not be achieved with isolated investments in initiatives such as eProcurement or eCommerce. These eBusiness initiatives, in fact, are easily imitated by competitors and do not sustain competitive advantages. These initiatives, without a robust strategy, aligned to corporate planning, can raise the complexity of intracompany integration without achieving significant economic benefits in the intercompany relationship. On the other hand, efforts towards supporting integrated operation of the productive chain offer more interesting opportunities for gain. The difficulty in quantifying gains resulting from changes in business models towards eBusiness appears to be delaying investments in this line. The use of models that are representative of the business and production processes of the company, integrating its various links, as well as the Systemic Thinking approach, may be useful alternatives to guide the development of an eBusiness project, allowing an estimate of the return on investments in different configurations of the business model, including the consideration of the different scenarios that the company takes into account in its corporate strategic planning.

Você também pode gostar

- Development of The Project ProposalDocumento40 páginasDevelopment of The Project Proposalnotruwan100% (3)

- PMP T09 Project Execution Plan RevADocumento40 páginasPMP T09 Project Execution Plan RevAry nAinda não há avaliações

- IBP1142 - 19 Offshore Development: Submarine Pipelines-Soil InteractionDocumento13 páginasIBP1142 - 19 Offshore Development: Submarine Pipelines-Soil InteractionMarcelo Varejão CasarinAinda não há avaliações

- Regional Procurement Unit Organizational Chart or Organizational Chart, Functional Chart and Work FlowchartDocumento8 páginasRegional Procurement Unit Organizational Chart or Organizational Chart, Functional Chart and Work FlowchartJames D. Magpusao100% (1)

- IBM Insurance ModelsDocumento8 páginasIBM Insurance ModelstparajiaAinda não há avaliações

- Supplier Development at SWPDocumento82 páginasSupplier Development at SWPalma millaniaAinda não há avaliações

- 2-Sales and Operations Planning The Supply Chain PillarDocumento11 páginas2-Sales and Operations Planning The Supply Chain PillarSteve DemirelAinda não há avaliações

- Business Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldNo EverandBusiness Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldAinda não há avaliações

- Key Performance Indicators BackgroundDocumento9 páginasKey Performance Indicators BackgroundMeftah MellasAinda não há avaliações

- Supply Chain Finance Management Mba ProjectDocumento14 páginasSupply Chain Finance Management Mba ProjectPooja BansalAinda não há avaliações

- Ifw Process GimDocumento24 páginasIfw Process Gimmyownhminbox485Ainda não há avaliações

- Procurement PlanDocumento3 páginasProcurement Planmmalnar1Ainda não há avaliações

- Consulting Whitepaper Next Generation Application Portfolio Rationalization 09 2011Documento19 páginasConsulting Whitepaper Next Generation Application Portfolio Rationalization 09 2011sardar810% (1)

- Supply Chain MGMTDocumento22 páginasSupply Chain MGMThimanshu111992Ainda não há avaliações

- Supporting Supply Chain Planning & SchedulingDocumento8 páginasSupporting Supply Chain Planning & SchedulingsizwehAinda não há avaliações

- Guidelines For Writing Expediting Report 15.03.01 SOP-01 R01 21-06-2019...Documento13 páginasGuidelines For Writing Expediting Report 15.03.01 SOP-01 R01 21-06-2019...jeswin80% (5)

- Enterprise Architecture For Business Model Innovation in A Connected EconomyDocumento29 páginasEnterprise Architecture For Business Model Innovation in A Connected EconomySergio CompeanAinda não há avaliações

- Evaluating The Procurement Strategy Adopted in The Scottish Holyrood Parliament Building ProjectDocumento13 páginasEvaluating The Procurement Strategy Adopted in The Scottish Holyrood Parliament Building ProjectNnamdi Eze100% (4)

- Benefits of E-Business Adoption by Swedish SMEsDocumento20 páginasBenefits of E-Business Adoption by Swedish SMEsPaiman AwlaAinda não há avaliações

- Benefits of E-Business Adoption by Swedish SMEsDocumento20 páginasBenefits of E-Business Adoption by Swedish SMEsPaiman AwlaAinda não há avaliações

- Assignment PGDM Batch 2018-2020Documento5 páginasAssignment PGDM Batch 2018-2020Mack RaoAinda não há avaliações

- Research Article Supply Chain Management System For Automobile Manufacturing Enterprises Based On SAPDocumento11 páginasResearch Article Supply Chain Management System For Automobile Manufacturing Enterprises Based On SAPKase Hija IndiaAinda não há avaliações

- Best Practice in Leveraging E-Business Technologies To Achieve Business AgilityDocumento21 páginasBest Practice in Leveraging E-Business Technologies To Achieve Business AgilityDandy RamdaniAinda não há avaliações

- Class 5-Activity Based CostingDocumento17 páginasClass 5-Activity Based CostingLamethysteAinda não há avaliações

- Cost Accounting and Company Management in A World Without WallsDocumento14 páginasCost Accounting and Company Management in A World Without WallsEth Fikir NatAinda não há avaliações

- Topics For KalpathaDocumento11 páginasTopics For KalpathaShanthi UnnithanAinda não há avaliações

- Building & Leveraging The Metrics Framework For Driving Enterprise Performance Management (EPM) - A Supply Chain Management ViewDocumento13 páginasBuilding & Leveraging The Metrics Framework For Driving Enterprise Performance Management (EPM) - A Supply Chain Management ViewSameerNagnurAinda não há avaliações

- Supply Chain & BPRDocumento10 páginasSupply Chain & BPRMazhr JaffriAinda não há avaliações

- BI AssignmentDocumento6 páginasBI Assignmentssj_renukaAinda não há avaliações

- Thesis Topics in Logistics and Supply Chain ManagementDocumento5 páginasThesis Topics in Logistics and Supply Chain Managementbsnj6chr100% (1)

- Sustainability 11 06785 v2Documento42 páginasSustainability 11 06785 v2Geoffrey muigaiAinda não há avaliações

- ECO Wpartner Named PDFDocumento11 páginasECO Wpartner Named PDFJosue E. QuirozAinda não há avaliações

- Model for SME E-Business TransitionDocumento3 páginasModel for SME E-Business TransitionmgorisariyaAinda não há avaliações

- Process ApproachDocumento13 páginasProcess ApproachSamik BiswasAinda não há avaliações

- Key Questions for Designing New Organizational Structures in ECDocumento4 páginasKey Questions for Designing New Organizational Structures in ECRejitha Raman0% (1)

- Indian CaptiveDocumento3 páginasIndian CaptiveAvinEbaneshAinda não há avaliações

- Roles of EWIS for CIOs, IS Function Outsourcing, Process StructuringDocumento8 páginasRoles of EWIS for CIOs, IS Function Outsourcing, Process StructuringKevin KibugiAinda não há avaliações

- Journal - Flexibly Designed Cost Accounting Information System - Reliable Support To Modern Company ManagementDocumento14 páginasJournal - Flexibly Designed Cost Accounting Information System - Reliable Support To Modern Company ManagementfukicohAinda não há avaliações

- 4-2 Case Study TwoDocumento6 páginas4-2 Case Study Tworehman aliAinda não há avaliações

- Case Study Pepse CoDocumento13 páginasCase Study Pepse CoRidah MehekAinda não há avaliações

- Transcript The Digital Business Stack-EnDocumento2 páginasTranscript The Digital Business Stack-EnHome UserAinda não há avaliações

- Activity-Based Costing As An Information Basis For An Efficient Strategic Management ProcessDocumento27 páginasActivity-Based Costing As An Information Basis For An Efficient Strategic Management ProcessRichard GerryAinda não há avaliações

- Research Paper On ABC CostingDocumento9 páginasResearch Paper On ABC Costinggz8pheje100% (1)

- Supply Chain Management Term Paper TopicsDocumento5 páginasSupply Chain Management Term Paper Topicsafmzynegjunqfk100% (1)

- Using Option Valuation Approach To Justify The Investment of B2B E-Commerce SystemsDocumento13 páginasUsing Option Valuation Approach To Justify The Investment of B2B E-Commerce SystemsPulkit MehtaAinda não há avaliações

- Claudia Battilani (2022)Documento13 páginasClaudia Battilani (2022)Ridha Vriany PutriAinda não há avaliações

- BPR in EcommerceDocumento41 páginasBPR in Ecommerceপলাশ সূত্রধরAinda não há avaliações

- The Effect of Supply Chain Management Strategy On Operational and Financial PerformanceDocumento18 páginasThe Effect of Supply Chain Management Strategy On Operational and Financial PerformanceĐỗ TúAinda não há avaliações

- Supply Chain ManagementDocumento9 páginasSupply Chain ManagementNo NoneAinda não há avaliações

- Q.1 Explain The Importance of Business Forecasting. List & Explain The Steps in The PERT Planning ProcessDocumento18 páginasQ.1 Explain The Importance of Business Forecasting. List & Explain The Steps in The PERT Planning ProcessSurjith RaufAinda não há avaliações

- Modern Business Strategies and Process Support (2001)Documento7 páginasModern Business Strategies and Process Support (2001)Hany SalahAinda não há avaliações

- Lecture on Developing Sector Strategies and Evolution of IS PlanningDocumento32 páginasLecture on Developing Sector Strategies and Evolution of IS PlanningraobilalAinda não há avaliações

- Analysis of Cost Estimating Through Concurrent Engineering Environment Through Life Cycle AnalysisDocumento10 páginasAnalysis of Cost Estimating Through Concurrent Engineering Environment Through Life Cycle AnalysisEmdad YusufAinda não há avaliações

- Issn 1653-0187 / IsDocumento1 páginaIssn 1653-0187 / IsPoonam ShindeAinda não há avaliações

- Shared Service Center DissertationDocumento7 páginasShared Service Center DissertationPaperWritingServicesLegitimateCanada100% (1)

- Accenture Energy Nonhydrocarbon Supply Chain For Oil and Gas Companies EiaB5Documento12 páginasAccenture Energy Nonhydrocarbon Supply Chain For Oil and Gas Companies EiaB5Ditu DanielAinda não há avaliações

- Business ForecastingDocumento2 páginasBusiness Forecastingruma768Ainda não há avaliações

- Sruti Karthikeyan-BV SrutiKarthikeyan C055Documento2 páginasSruti Karthikeyan-BV SrutiKarthikeyan C055Saurabh Krishna SinghAinda não há avaliações

- ERP and BPR processesDocumento23 páginasERP and BPR processesshirindimatAinda não há avaliações

- Ce Evaluation in Collaborative DesignDocumento18 páginasCe Evaluation in Collaborative DesignChariz AudreyAinda não há avaliações

- Return On Value (ROV) - An Imperative For Next-Generation ROI in High Tech Executive SummaryDocumento4 páginasReturn On Value (ROV) - An Imperative For Next-Generation ROI in High Tech Executive Summarypramod.mitraAinda não há avaliações

- I M K M A R M E: Nformation Odeling and Nowledge Anagement Pproach To Econfiguring Anufacturing NterprisesDocumento20 páginasI M K M A R M E: Nformation Odeling and Nowledge Anagement Pproach To Econfiguring Anufacturing NterprisesijaitjAinda não há avaliações

- HTTPS:/WWW - Mckinsey.com/capabilities/mckinsey Digital/our Insights/a BDocumento14 páginasHTTPS:/WWW - Mckinsey.com/capabilities/mckinsey Digital/our Insights/a Bagu4715001Ainda não há avaliações

- Developing A TargetDocumento6 páginasDeveloping A Targetraja2jayaAinda não há avaliações

- Addressing The Decline - Finding The Silver Lining For ProducersDocumento9 páginasAddressing The Decline - Finding The Silver Lining For ProducersCTRM CenterAinda não há avaliações

- Object KPIs Enable Digital Transformation Through Automated Process OptimizationDocumento12 páginasObject KPIs Enable Digital Transformation Through Automated Process OptimizationMUHAMMAD FIKRI DEVIANESAinda não há avaliações

- Tail-F OSSBSS 10 To Watch 2012 ExcerptDocumento10 páginasTail-F OSSBSS 10 To Watch 2012 ExcerptPrasant Nag KellaAinda não há avaliações

- Research Paper On Supply Chain ManagementDocumento6 páginasResearch Paper On Supply Chain Managementp0zikiwyfyb2100% (1)

- Operations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationNo EverandOperations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationAinda não há avaliações

- The Road to Servitization: How Product Service Systems Can Disrupt Companies’ Business ModelsNo EverandThe Road to Servitization: How Product Service Systems Can Disrupt Companies’ Business ModelsAinda não há avaliações

- IBP1146 - 19 Maintenance Productivity Measurement Study at TranspetroDocumento8 páginasIBP1146 - 19 Maintenance Productivity Measurement Study at TranspetroMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1135 Riopipeline2019 t1135 JST Av1Documento8 páginasRiopipeline2019 1135 Riopipeline2019 t1135 JST Av1Marcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1127 Article Number Ibp1127 19 PDFDocumento10 páginasRiopipeline2019 1127 Article Number Ibp1127 19 PDFMarcelo Varejão CasarinAinda não há avaliações

- IBP1141 - 19 The Use of Optical Sensor To Investigate Dissolved Oxygen in CrudeDocumento12 páginasIBP1141 - 19 The Use of Optical Sensor To Investigate Dissolved Oxygen in CrudeMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1124 Worlds First Remote Deepwater PDFDocumento10 páginasRiopipeline2019 1124 Worlds First Remote Deepwater PDFMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1140 Ibp 1140 Nao Intrusivos Final PDFDocumento4 páginasRiopipeline2019 1140 Ibp 1140 Nao Intrusivos Final PDFMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1138 Rio Paper Rev01 PDFDocumento11 páginasRiopipeline2019 1138 Rio Paper Rev01 PDFMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1137 201906031307ibp1137 19 Increas PDFDocumento10 páginasRiopipeline2019 1137 201906031307ibp1137 19 Increas PDFMarcelo Varejão CasarinAinda não há avaliações

- IBP1128 - 19 In-Service Welding Hot Tap of Refinary Pipeline With Hydrogen and EthyleneDocumento10 páginasIBP1128 - 19 In-Service Welding Hot Tap of Refinary Pipeline With Hydrogen and EthyleneMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1136 Ibp1136 19 Rafael Carlucci Tav PDFDocumento7 páginasRiopipeline2019 1136 Ibp1136 19 Rafael Carlucci Tav PDFMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1120 Ibp1120 19 Transpetro S Worklo PDFDocumento9 páginasRiopipeline2019 1120 Ibp1120 19 Transpetro S Worklo PDFMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1126 Article Number Ibp1126 19 PDFDocumento11 páginasRiopipeline2019 1126 Article Number Ibp1126 19 PDFMarcelo Varejão CasarinAinda não há avaliações

- IBP1122 - 19 High Grade Sawl Linepipe Manufacturing and Field Weld Simulation For Harsh EnvironmentsDocumento11 páginasIBP1122 - 19 High Grade Sawl Linepipe Manufacturing and Field Weld Simulation For Harsh EnvironmentsMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1121 201906051235ibp1121 19 Final PDFDocumento8 páginasRiopipeline2019 1121 201906051235ibp1121 19 Final PDFMarcelo Varejão CasarinAinda não há avaliações

- IBP1119 - 19 Internal Corrosion Detection: Conference and Exhibition 2019Documento4 páginasIBP1119 - 19 Internal Corrosion Detection: Conference and Exhibition 2019Marcelo Varejão CasarinAinda não há avaliações

- IBP1123 - 19 Caliper Ili Experience in Offshore Pre-CommissioningDocumento10 páginasIBP1123 - 19 Caliper Ili Experience in Offshore Pre-CommissioningMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1117 Ibp1117 19 Versao Final para e PDFDocumento8 páginasRiopipeline2019 1117 Ibp1117 19 Versao Final para e PDFMarcelo Varejão CasarinAinda não há avaliações

- IBP 1118 - 19 Relationship With Stakeholders of Transpetro in The Amazon: Fire Prevention PlanDocumento9 páginasIBP 1118 - 19 Relationship With Stakeholders of Transpetro in The Amazon: Fire Prevention PlanMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1112 FM 1112 FinalDocumento10 páginasRiopipeline2019 1112 FM 1112 FinalMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1115 201906070716fm 3811 00 Formato PDFDocumento13 páginasRiopipeline2019 1115 201906070716fm 3811 00 Formato PDFMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1109 201906051455qav Ibp1109 19 Jet PDFDocumento11 páginasRiopipeline2019 1109 201906051455qav Ibp1109 19 Jet PDFMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1114 201905291733ibp1114 19 Optimiz PDFDocumento17 páginasRiopipeline2019 1114 201905291733ibp1114 19 Optimiz PDFMarcelo Varejão CasarinAinda não há avaliações

- IBP1110 - 19 The Relevance of Fuel Transmission Pipelines in BrazilDocumento10 páginasIBP1110 - 19 The Relevance of Fuel Transmission Pipelines in BrazilMarcelo Varejão CasarinAinda não há avaliações

- IBP 1105 - 19 Logistics For Maintenance of The Right-Of-Way (Row) in The Northern RegionDocumento10 páginasIBP 1105 - 19 Logistics For Maintenance of The Right-Of-Way (Row) in The Northern RegionMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1113 201906031824ibp Riopipeline 11 PDFDocumento10 páginasRiopipeline2019 1113 201906031824ibp Riopipeline 11 PDFMarcelo Varejão CasarinAinda não há avaliações

- IBP1111 - 19 Best Alternative For Rigid Offshore Pipelines Decommissioning - A Case StudyDocumento13 páginasIBP1111 - 19 Best Alternative For Rigid Offshore Pipelines Decommissioning - A Case StudyMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1107 201905201751ibp1107 19 Jacques PDFDocumento7 páginasRiopipeline2019 1107 201905201751ibp1107 19 Jacques PDFMarcelo Varejão CasarinAinda não há avaliações

- Riopipeline2019 1106 Ibp 1106 Ultimate High Precisi PDFDocumento9 páginasRiopipeline2019 1106 Ibp 1106 Ultimate High Precisi PDFMarcelo Varejão CasarinAinda não há avaliações

- 00 Supply Chain SeriesDocumento4 páginas00 Supply Chain SeriesSatria ThechildofgreensummerAinda não há avaliações

- Request For Proposal (RFP) Part I (A) - General Information and InstructionsDocumento10 páginasRequest For Proposal (RFP) Part I (A) - General Information and InstructionsHimanshu Sunil KulkarniAinda não há avaliações

- Clarification To Blue MatrixDocumento10 páginasClarification To Blue MatrixMiltoAinda não há avaliações

- Procurement Monitoring Report JuneDocumento2 páginasProcurement Monitoring Report JuneKaJong JaclaAinda não há avaliações

- Updates On DTEs, MVs and SKsDocumento66 páginasUpdates On DTEs, MVs and SKsArman BentainAinda não há avaliações

- EsourcingDocumento37 páginasEsourcingsarin15juneAinda não há avaliações

- Factors Affecting Consultancy ServicesDocumento32 páginasFactors Affecting Consultancy ServicesAnonymous RdkCYC1QfiAinda não há avaliações

- Gibsons Shoe Factory IncorporatedDocumento3 páginasGibsons Shoe Factory IncorporatedJan Michael BuragaAinda não há avaliações

- Functional File Index GeneralDocumento44 páginasFunctional File Index GeneralTanpuia JongteAinda não há avaliações

- Cotton Procurement GuideDocumento24 páginasCotton Procurement Guidekingson007Ainda não há avaliações

- Alligator Inc's Supply Chain Issues and Strategic Sourcing ProcessDocumento12 páginasAlligator Inc's Supply Chain Issues and Strategic Sourcing ProcessInfotainment PlanetAinda não há avaliações

- Lücker BA BMS PDFDocumento15 páginasLücker BA BMS PDFabdelmutalabAinda não há avaliações

- Taking Supplier Collaboration To The Next LevelDocumento11 páginasTaking Supplier Collaboration To The Next LevelparsadAinda não há avaliações

- Electrical Design EngineerDocumento3 páginasElectrical Design EngineerGanesh SantoshAinda não há avaliações

- Img 20230306 0005Documento1 páginaImg 20230306 0005Amang BegedekAinda não há avaliações

- Impact of Material Management On OrganizDocumento44 páginasImpact of Material Management On OrganizbezawitwubshetAinda não há avaliações

- Project Deliverable ManagementDocumento34 páginasProject Deliverable ManagementgurusanthanamAinda não há avaliações

- SourcingDocumento3 páginasSourcingPuneet GulatiAinda não há avaliações

- IKEA's Global Sourcing Challenge Case AnalysisDocumento6 páginasIKEA's Global Sourcing Challenge Case Analysismichael songaAinda não há avaliações

- Passi Cover PageDocumento6 páginasPassi Cover PageEdward PagayonaAinda não há avaliações