Escolar Documentos

Profissional Documentos

Cultura Documentos

Capital Account Convertibility: Opportunities & Challenges: Presentation To Assocham New Delhi

Enviado por

pinku_thakkarTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Capital Account Convertibility: Opportunities & Challenges: Presentation To Assocham New Delhi

Enviado por

pinku_thakkarDireitos autorais:

Formatos disponíveis

Conference on

Capital Account Convertibility: Opportunities & Challenges Presentation to ASSOCHAM New Delhi 31 May 2006 Rajiv Kumar

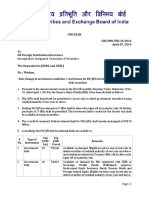

Rules Applicable for NRIs/FDIs

Saving Deposits -(NRE FCNR) All interest and deposits - Repatriable 2. NRO Accounts Repatriable Upto $ 1 Mill 3. Other Investment on Repatriation Basis

- Govt Dated Securities/treasury bills - Units of domestic mutual funds - Non-convertible debentures of a company incorporated in India - Shares in PSE being dis-invested by the government of India - Shares & convertible debentures of Indian co Under FDI scheme - Shares & convertible debentures of Indian companies through stock exchange under portfolio Investment Scheme - perpetual debt instruments and debt capital instruments issued by banks in India

4. Investment in Immovable Property -NRIs can repatriate funds from sales proceeds of immovable property to the extent of

repatriate funds for acquiring the property, upto two properties

5.

Returning NRIs/PIO

May continue to hold, own, transfer any currency, foreign security, property acquired when resident outside India May open, hold, maintain with an AD, a Resident Foreign Currency (RFC) account to transfer balances held in NRE/FCNR (B) accounts

Prerequisites for CAC 1. Fiscal Balance 2. Well designed monetary and ex-rate Policies 3. Financial sector reforms: Arms length regulation

Você também pode gostar

- NRI Deposits in India Trends and DeterminantsDocumento35 páginasNRI Deposits in India Trends and DeterminantsPRAVEEN RADHAKRISHNANAinda não há avaliações

- Nri Services: Facilities For Non-Resident Indians (Nris) /persons of Indian Origin (Pios)Documento3 páginasNri Services: Facilities For Non-Resident Indians (Nris) /persons of Indian Origin (Pios)Bhavika NameAinda não há avaliações

- Foreign Portfolio Investment in IndiaDocumento26 páginasForeign Portfolio Investment in Indiasachin100% (1)

- What Is A Mutual Fund?Documento19 páginasWhat Is A Mutual Fund?Aishwarya Senthil RajanAinda não há avaliações

- Indian Financial SystemDocumento33 páginasIndian Financial SystemVanshika RajAinda não há avaliações

- Investment Analysis & Portfolio ManagementDocumento26 páginasInvestment Analysis & Portfolio Managementluvkush1Ainda não há avaliações

- Revise CMSL in 50 Pages PDFDocumento50 páginasRevise CMSL in 50 Pages PDFjesurajajoseph100% (1)

- GDRDocumento9 páginasGDRSameer KathuriaAinda não há avaliações

- International Finance Options for Indian CompaniesDocumento28 páginasInternational Finance Options for Indian CompaniesVikram MandalAinda não há avaliações

- FS MOD 3 Part 2Documento19 páginasFS MOD 3 Part 2sonaAinda não há avaliações

- Mutual Funds: Rajkumar PR Aju JohnDocumento12 páginasMutual Funds: Rajkumar PR Aju Johnanon_113615062Ainda não há avaliações

- Sub Section - Ii Issues by Foreign Companies in India (Indian Depository Receipts) (Idrs)Documento4 páginasSub Section - Ii Issues by Foreign Companies in India (Indian Depository Receipts) (Idrs)vishal kasaudhanAinda não há avaliações

- Sub Section - Ii Issues by Foreign Companies in India (Indian Depository Receipts) (Idrs)Documento4 páginasSub Section - Ii Issues by Foreign Companies in India (Indian Depository Receipts) (Idrs)Ahkam KhanAinda não há avaliações

- Mutual FundsDocumento5 páginasMutual FundsParthAinda não há avaliações

- FCCB Guide: Foreign Currency Convertible Bonds ExplainedDocumento15 páginasFCCB Guide: Foreign Currency Convertible Bonds ExplainedGautam JainAinda não há avaliações

- Structure of Foreign Portfolio InvestmentDocumento15 páginasStructure of Foreign Portfolio InvestmentNisarg ShahAinda não há avaliações

- Mutual FundDocumento20 páginasMutual FundRupesh KekadeAinda não há avaliações

- Introduction to Key Indian Accounting StandardsDocumento17 páginasIntroduction to Key Indian Accounting StandardsRutvik RavalAinda não há avaliações

- Mutual Fund: Presented By: Ramit BansalDocumento17 páginasMutual Fund: Presented By: Ramit BansalGaurav GuptaAinda não há avaliações

- PORTFOLIO InvestementsDocumento12 páginasPORTFOLIO InvestementsganeshkingofeeeAinda não há avaliações

- Treasury Products for Risk ManagementDocumento22 páginasTreasury Products for Risk ManagementAksAinda não há avaliações

- Finanical ProductsDocumento19 páginasFinanical ProductsHarpreet KaurAinda não há avaliações

- OUTBOUND INVESTMENT REGULATIONS UNDER FEMADocumento11 páginasOUTBOUND INVESTMENT REGULATIONS UNDER FEMAAshok SikarwarAinda não há avaliações

- Investors - Mutual FundDocumento27 páginasInvestors - Mutual FundSandip KunduAinda não há avaliações

- Answer Paper-1 MBL2Documento7 páginasAnswer Paper-1 MBL2Matin Ahmad KhanAinda não há avaliações

- NRI AccountDocumento26 páginasNRI AccountabhishekAinda não há avaliações

- Various Investment CategoriesDocumento20 páginasVarious Investment CategoriesvikasbhattAinda não há avaliações

- Capital Market: Unit-IDocumento17 páginasCapital Market: Unit-IChristine Joy RozanoAinda não há avaliações

- Mutual FundsDocumento17 páginasMutual FundsAkanksha BehlAinda não há avaliações

- Regulatory Framework For Foreign Investments in India Part I An OverviewDocumento4 páginasRegulatory Framework For Foreign Investments in India Part I An OverviewRaviAinda não há avaliações

- GDR of Cox N KingsDocumento80 páginasGDR of Cox N KingsMinal AgrawalAinda não há avaliações

- Reserve Bank of India (RBI)Documento8 páginasReserve Bank of India (RBI)prateeklrAinda não há avaliações

- Foreign Investment in India: An OverviewDocumento25 páginasForeign Investment in India: An Overviewsonakshi100% (1)

- Forex facilities for residents: Rules and limitsDocumento5 páginasForex facilities for residents: Rules and limitsManu MaheshwariAinda não há avaliações

- Corporate Finance Introduction 2Documento21 páginasCorporate Finance Introduction 2Shantanu SinhaAinda não há avaliações

- Investments in Mutual Funds FAQs GuideDocumento17 páginasInvestments in Mutual Funds FAQs GuideSuman SaxenaAinda não há avaliações

- Securities Market in India: References: Ramesh Singh, Mishra and Puri, NCERTDocumento10 páginasSecurities Market in India: References: Ramesh Singh, Mishra and Puri, NCERTridhiAinda não há avaliações

- FII investment limits in Indian government debt securitiesDocumento2 páginasFII investment limits in Indian government debt securitiesJoydeep NtAinda não há avaliações

- Mutual FundDocumento11 páginasMutual FundAnkush KochharAinda não há avaliações

- Startup Series 7 - Exchange Control Provisions For StartupsDocumento12 páginasStartup Series 7 - Exchange Control Provisions For StartupsRavi PatelAinda não há avaliações

- Amfi PPTDocumento203 páginasAmfi PPTmuskaan111Ainda não há avaliações

- Adr and GDRDocumento7 páginasAdr and GDRmanku1986Ainda não há avaliações

- SyllabusDocumento24 páginasSyllabusRipon DebAinda não há avaliações

- Indian Depository RecieptDocumento24 páginasIndian Depository Recieptadilfahim_siddiqi100% (1)

- MF GuideDocumento55 páginasMF GuidesuryakantshrotriyaAinda não há avaliações

- 7 Ps of MARKETING: Don't be afraid to fail bigDocumento8 páginas7 Ps of MARKETING: Don't be afraid to fail bigTeja MullapudiAinda não há avaliações

- 7 Ps of Marketing: Task-4Documento16 páginas7 Ps of Marketing: Task-4Teja MullapudiAinda não há avaliações

- Foreign Portfolio InvestmentDocumento11 páginasForeign Portfolio InvestmentSudha PanneerselvamAinda não há avaliações

- Real Estate Mutual FundDocumento13 páginasReal Estate Mutual Fundsonu238909Ainda não há avaliações

- Real Estate Mutual FundDocumento13 páginasReal Estate Mutual Fundsonu238909Ainda não há avaliações

- Real Estate Mutual FundDocumento13 páginasReal Estate Mutual Fundsonu238909Ainda não há avaliações

- FundingDocumento20 páginasFundingAyinalemAinda não há avaliações

- Financial Management: Howard & UptonDocumento4 páginasFinancial Management: Howard & Uptonak21679Ainda não há avaliações

- Reserve Bank of India Foreign Exchange Department Central Office Mumbai - 400 001Documento9 páginasReserve Bank of India Foreign Exchange Department Central Office Mumbai - 400 001Amrita PatroAinda não há avaliações

- CMR(Money Market Instruments): Commercial Papers, Certificates of Deposits, Treasury Bills, Participatory Notes, Banker's Acceptance & T-BondsDocumento12 páginasCMR(Money Market Instruments): Commercial Papers, Certificates of Deposits, Treasury Bills, Participatory Notes, Banker's Acceptance & T-BondsRicha NandyAinda não há avaliações

- Foreign Direct InvestmentDocumento6 páginasForeign Direct Investmentrohitalbert5Ainda não há avaliações

- Project On AnalysisDocumento100 páginasProject On Analysis19-UCO-084 DHILEEPAN D RAinda não há avaliações

- Importance of This SessionDocumento37 páginasImportance of This SessionAbhinav SahaAinda não há avaliações

- Investing Made Easy: Finding the Right Opportunities for YouNo EverandInvesting Made Easy: Finding the Right Opportunities for YouAinda não há avaliações

- Pet CokeDocumento2 páginasPet Cokepinku_thakkarAinda não há avaliações

- Im30 SRDocumento122 páginasIm30 SRpinku_thakkarAinda não há avaliações

- KoneDocumento2 páginasKonepinku_thakkarAinda não há avaliações

- India's Healthcare Sector To Grow To $158Documento3 páginasIndia's Healthcare Sector To Grow To $158pinku_thakkarAinda não há avaliações

- Material Properties of SteelDocumento33 páginasMaterial Properties of Steelpinku_thakkarAinda não há avaliações

- Transformer Percentage Biased RelayDocumento2 páginasTransformer Percentage Biased Relaypinku_thakkarAinda não há avaliações

- N Din FDocumento4 páginasN Din Fpinku_thakkarAinda não há avaliações

- RPM 8Documento3 páginasRPM 8pinku_thakkarAinda não há avaliações

- Micro Controller Based 8-Stage Power Factor Controller Relay PFC8Documento3 páginasMicro Controller Based 8-Stage Power Factor Controller Relay PFC8pinku_thakkar73% (11)

- JHJHJHJHDocumento4 páginasJHJHJHJHpinku_thakkarAinda não há avaliações

- MRP111233Documento3 páginasMRP111233pinku_thakkarAinda não há avaliações

- Chap 8 Service QualityDocumento35 páginasChap 8 Service QualityAshiabuonwu Julius FreemanAinda não há avaliações

- UFD34Documento2 páginasUFD34pinku_thakkarAinda não há avaliações

- ADDFDDocumento3 páginasADDFDpinku_thakkarAinda não há avaliações

- RealDocumento4 páginasRealpinku_thakkarAinda não há avaliações

- RealDocumento4 páginasRealpinku_thakkarAinda não há avaliações

- FTPDocumento21 páginasFTPdocbkAinda não há avaliações

- Einstein College Engineering Guide Entrepreneurship DevelopmentDocumento47 páginasEinstein College Engineering Guide Entrepreneurship DevelopmentSarim AhmedAinda não há avaliações

- Brand ManagementDocumento17 páginasBrand Managementpinku_thakkarAinda não há avaliações

- Forex MarketDocumento47 páginasForex Marketpinku_thakkarAinda não há avaliações

- Types of Transmission Structures Fact SheetDocumento2 páginasTypes of Transmission Structures Fact Sheetpinku_thakkarAinda não há avaliações

- Social ResponsibilityDocumento24 páginasSocial ResponsibilityAnuj DubeyAinda não há avaliações

- The International Marketing Environment: An Overview of Global Institutions and Trade ConceptsDocumento24 páginasThe International Marketing Environment: An Overview of Global Institutions and Trade Conceptspinku_thakkarAinda não há avaliações

- The Brand Value Chain FrameworkDocumento7 páginasThe Brand Value Chain Frameworkpinku_thakkarAinda não há avaliações

- The Brand Value Chain FrameworkDocumento7 páginasThe Brand Value Chain Frameworkpinku_thakkarAinda não há avaliações

- Marketing Mix 2Documento6 páginasMarketing Mix 2pinku_thakkarAinda não há avaliações

- New Service Development Process DesignDocumento19 páginasNew Service Development Process DesignKarishma BaggaAinda não há avaliações

- New Product Development StrategyDocumento28 páginasNew Product Development StrategyTahirAli67% (3)

- Success in Internet MarketingDocumento32 páginasSuccess in Internet Marketingpinku_thakkarAinda não há avaliações