Escolar Documentos

Profissional Documentos

Cultura Documentos

Sharehoders

Enviado por

Asim Abdelwahab AbdoraboDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Sharehoders

Enviado por

Asim Abdelwahab AbdoraboDireitos autorais:

Formatos disponíveis

Presented by:Mr. Abdel mahmoud B.

M(SIU)

A limited company must have at least one share issued at the time of incorporation. These shareholders are called the subscribers. There is no maximum or minimum share capital and shares can be issued in any currency.

The share capital and issued shares will be stated in the Memorandum and Articles of Association. The shareholders liability is limited to the amount of share capital that they hold.

An example of a typical limited company share structure:-

A company may have an authorised share capital of 1000 that is made up of 1000 individual 1 shares. However there may only be 100 of these that are actually issued. These shares may then be equally divided between two shareholders who own 50 shares each.

The shareholder is the owner of the company and is responsible for appointing the director(s) of the company.

types of shares that may be issued

Ordinary - As the name suggests

these are the ordinary shares of the company with no special rights or restrictions. They may be divided into classes of different value.

Preference - These shares

normally carry a right that any annual dividends available for distribution will be paid preferentially on these shares before other classes.

Cumulative preference - These

shares carry a right that, if the dividend cannot be paid in one year, it will be carried forward to successive years.

Redeemable - These shares are

issued with an agreement that the company will buy them back at the option of the company or the shareholder after a certain period, or on a fixed date. A company cannot have redeemable shares only.

Você também pode gostar

- Lecture 4 LawDocumento11 páginasLecture 4 LawfaiszaAinda não há avaliações

- Unit 9 SharesDocumento39 páginasUnit 9 Shareskonica chhotwaniAinda não há avaliações

- Share MarketDocumento48 páginasShare MarketHariharan SamyAinda não há avaliações

- Share Capital and Basic Legal Documents of A CompanyDocumento62 páginasShare Capital and Basic Legal Documents of A CompanyMuneebAinda não há avaliações

- FINMAN 102 Module-IIDocumento27 páginasFINMAN 102 Module-IIzehra我Ainda não há avaliações

- FM AssignmentDocumento25 páginasFM Assignmentsamy7541Ainda não há avaliações

- 1 Definiton: Common StocksDocumento2 páginas1 Definiton: Common Stocksquỳnh phanAinda não há avaliações

- Shares and ShareholdersDocumento1 páginaShares and Shareholdersandaposa9Ainda não há avaliações

- Assignment On Corporation (Najeeb)Documento5 páginasAssignment On Corporation (Najeeb)Najeeb KhanAinda não há avaliações

- NotesDocumento3 páginasNotesjamescorrect961Ainda não há avaliações

- Shri Guru Ram Rai University: Faculty of Management and Business StudiesDocumento14 páginasShri Guru Ram Rai University: Faculty of Management and Business StudiesKaran BatraAinda não há avaliações

- Accounting ReviewerDocumento9 páginasAccounting Reviewerkeisha santosAinda não há avaliações

- Presentation Manas HadkarDocumento17 páginasPresentation Manas Hadkarprajakta kasekarAinda não há avaliações

- Financial Accounting 1 - Acc 301: Unit One Company AccountsDocumento53 páginasFinancial Accounting 1 - Acc 301: Unit One Company AccountsTrishia ReditaAinda não há avaliações

- Materi PPT Bing SharesDocumento3 páginasMateri PPT Bing SharesSyifa UrrohmahAinda não há avaliações

- Materi PPT Bing SharesDocumento3 páginasMateri PPT Bing SharesSyifa UrrohmahAinda não há avaliações

- Accounting 2 - Book NotesDocumento11 páginasAccounting 2 - Book NotesSimona PutnikAinda não há avaliações

- Share Capital-ADocumento142 páginasShare Capital-Ahippop kAinda não há avaliações

- Shares CHP NotesDocumento10 páginasShares CHP NotesIsha KatiyarAinda não há avaliações

- Module in Financial Management - 07Documento10 páginasModule in Financial Management - 07Karla Mae GammadAinda não há avaliações

- Corporate Accounting - NotesDocumento52 páginasCorporate Accounting - NotesMalkeet SinghAinda não há avaliações

- Assignment, StockDocumento5 páginasAssignment, StockNawshad HasanAinda não há avaliações

- FM ReviewerDocumento20 páginasFM ReviewerBSA - Cabangon, MerraquelAinda não há avaliações

- Chapter 2.financial InstrumentsDocumento30 páginasChapter 2.financial InstrumentsRoxana MariaAinda não há avaliações

- Extra Reading Lecture 02Documento17 páginasExtra Reading Lecture 02iragouldAinda não há avaliações

- A Project Report On: Factor-AnalysisDocumento53 páginasA Project Report On: Factor-Analysisswati_poddarAinda não há avaliações

- MBI Corporate Finance Topic 4 Share CapitalDocumento124 páginasMBI Corporate Finance Topic 4 Share Capitaljonas sserumagaAinda não há avaliações

- Meaning:: Difference Between Equity Shares and Preference SharesDocumento7 páginasMeaning:: Difference Between Equity Shares and Preference SharesAnkita ModiAinda não há avaliações

- StocksDocumento9 páginasStocksHassan Tahir SialAinda não há avaliações

- Share and Share Capital Sangeeta VermaDocumento21 páginasShare and Share Capital Sangeeta VermatjmkAinda não há avaliações

- Shares & DebenturesDocumento7 páginasShares & DebenturesKARISHMA RAJAinda não há avaliações

- Chapter 5: Accounting For CorporationsDocumento36 páginasChapter 5: Accounting For CorporationsFeven WondayehuAinda não há avaliações

- Capital Refers To The Amount Invested in The Company So That It Can Carry On Its ActivitiesDocumento3 páginasCapital Refers To The Amount Invested in The Company So That It Can Carry On Its ActivitiesSheBZzSEkhAinda não há avaliações

- What Are Preferred SharesDocumento9 páginasWhat Are Preferred SharesMariam LatifAinda não há avaliações

- Classes of SharesDocumento2 páginasClasses of SharesMikMik UyAinda não há avaliações

- Types of SharesDocumento4 páginasTypes of SharesMARAinda não há avaliações

- Common Stock and Preffered Stock1Documento5 páginasCommon Stock and Preffered Stock1mengistuAinda não há avaliações

- Types of SharesDocumento10 páginasTypes of Sharesinsomniac_satanAinda não há avaliações

- Equity SharesDocumento3 páginasEquity SharesAnand S PAinda não há avaliações

- Green Shoe OptionDocumento4 páginasGreen Shoe OptionMansi JainAinda não há avaliações

- Features of Rights Issue of SharesDocumento3 páginasFeatures of Rights Issue of SharesHaunter khanAinda não há avaliações

- Share CapitalDocumento8 páginasShare Capitalyash chouhanAinda não há avaliações

- Cbi 01 MFS PPT2Documento18 páginasCbi 01 MFS PPT2rishi raj modiAinda não há avaliações

- Meaning: Asset Company Call Shares Money Creditor Interest Ordinary Shares Means Share Profits ReturnsDocumento10 páginasMeaning: Asset Company Call Shares Money Creditor Interest Ordinary Shares Means Share Profits ReturnskhuushbuAinda não há avaliações

- Financial AssetsDocumento3 páginasFinancial Assetsk gowtham kumarAinda não há avaliações

- Chapter 4 Corporate StockDocumento5 páginasChapter 4 Corporate StockJhanice MartinezAinda não há avaliações

- Topic: Types of SharesDocumento11 páginasTopic: Types of SharesSureshAinda não há avaliações

- Types of SharesDocumento1 páginaTypes of SharesMauti Nyakundi CollinsAinda não há avaliações

- Episode 20 - Corpo LawDocumento16 páginasEpisode 20 - Corpo LawBarem Salio-anAinda não há avaliações

- Chapter 5 Defining Common StockDocumento52 páginasChapter 5 Defining Common StockCezarene FernandoAinda não há avaliações

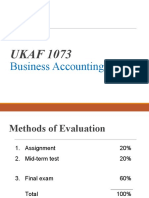

- UKAF 1073: Business Accounting IIDocumento61 páginasUKAF 1073: Business Accounting IIalibabaAinda não há avaliações

- Business Finance Assignment #4 Submitted To: Ma'am Rabia Haq Submitted By: Sakina Abbas (FA16 BBA 016) Date: 18Documento3 páginasBusiness Finance Assignment #4 Submitted To: Ma'am Rabia Haq Submitted By: Sakina Abbas (FA16 BBA 016) Date: 18ismetAinda não há avaliações

- Budget PDFDocumento55 páginasBudget PDFMONIKA R PSGRKCWAinda não há avaliações

- Treasury Stock: Insiders Restricted Stock Shares Outstanding Float Treasury Stocks Voting Rights DistributionsDocumento2 páginasTreasury Stock: Insiders Restricted Stock Shares Outstanding Float Treasury Stocks Voting Rights DistributionsTuhin BhuiyanAinda não há avaliações

- Features of Equity SharesDocumento4 páginasFeatures of Equity SharesAnkita Modi100% (1)

- Company Share Capital 2020Documento26 páginasCompany Share Capital 2020Levin makokhaAinda não há avaliações

- Company Law NotesDocumento6 páginasCompany Law NotesivywnAinda não há avaliações

- Collective Investment Schemes PresentationDocumento3 páginasCollective Investment Schemes PresentationEdwin MudzamiriAinda não há avaliações

- Means of Finance (2003)Documento83 páginasMeans of Finance (2003)TamannaAroraAinda não há avaliações

- A Beginners Guide to Stock Market: Investment, Types of Stocks, Growing Money & Securing Financial FutureNo EverandA Beginners Guide to Stock Market: Investment, Types of Stocks, Growing Money & Securing Financial FutureAinda não há avaliações

- Research Methodology: Ass. Prof. Dr. Mogeeb MoslehDocumento44 páginasResearch Methodology: Ass. Prof. Dr. Mogeeb MoslehAsim Abdelwahab AbdoraboAinda não há avaliações

- Frameworx For New Cable ServicesDocumento10 páginasFrameworx For New Cable ServicesAsim Abdelwahab AbdoraboAinda não há avaliações

- Business Statistics:: The Where, Why, and How of Data CollectionDocumento33 páginasBusiness Statistics:: The Where, Why, and How of Data CollectionAsim Abdelwahab AbdoraboAinda não há avaliações

- OB11 03stDocumento21 páginasOB11 03stChanduChandran100% (1)

- Product Life Cycles and The Boston MatrixDocumento25 páginasProduct Life Cycles and The Boston MatrixAsim Abdelwahab AbdoraboAinda não há avaliações

- Customer Needs LecDocumento23 páginasCustomer Needs LecAsim Abdelwahab AbdoraboAinda não há avaliações