Escolar Documentos

Profissional Documentos

Cultura Documentos

Indian Retail Opportunity - 2005

Enviado por

BikashDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Indian Retail Opportunity - 2005

Enviado por

BikashDireitos autorais:

Formatos disponíveis

IRMC Analysis on

India Retail Opportunity

December 16, 2005

© Integrated Retail Management Consulting

INDIA: #1 EMERGING RETAIL

GROWTH MARKET

A.T. Kearney Global Retail Development Index (GRDI)

Most

Unsaturated:

Modern Retail

Penetration:

< 3%

Large Market:

Retail Market Size:

~US$ 330

billion

Source: A T Kearney

GRDI

© Integrated Retail Management Consulting 2005

WHY INDIA IS #1

RETAIL GROWTH MARKET

Market Growth: 8 - 10% annual growth with 30% + growth Market

rate for modern format retail. Growth:

Overall

Strong Economy: Fourth largest economy on Purchasing

Growth:

Parity Basis.

8 – 10%

Market Opportunities: Growing consumer aspirations CAGR

together with very low penetration of modern format

retailing.

Modern Format

Infrastructure: Large amount of quality retail space being Growth:

added.

25 - 35%

CAGR

© Integrated Retail Management Consulting 2005

INDIA RETAIL GROWTH OPPORTUNITY

(% Penetration) Tremendous

100 Head Room for

90 Growth:

80

75

70

60

55 < 3%

50 40 Penetration

35

40 30

30 20 17

20

10 2.5

0

Taiwan M alaysia Thailand Brazil Indonesia Poland China India

Taiw an Malaysia Thailand Brazil

Indonesia Poland China India

Source: IRMC Research

© Integrated Retail Management Consulting 2005

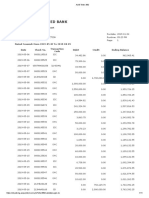

LARGEST RETAIL CHAINS

Largest retailers (number of stores)

Number

Sector Retailer of Stores Largest Chains

Public Distribution System 46300 in Public

Post Offices 16000

Petrol Pumps 1800 Sector:

KVIC 7000

Defense Stores 3400 Large Chains:

Footwear Bata 4700

Health and Beauty care Shahnaz 350

Apparel and textiles Raymond 320 Small

Café Café Coffee Day 200 overall store

Watches Titan 196

Food and grocery Subhiksha 142

numbers

Restaurants Pizza Hut 120

Pharmacies Apollo 90

Music Retail Planet M 75

Jewellery Tanishq 67

Consumer Durables Vivek's 50

Books Retail Crossword 35

Department stores Shoppers' Stop 20

Source: IRMC Research

© Integrated Retail Management Consulting 2005

INDIA: A NATION OF SHOPKEEPERS

Traditional

Indian

Retailing

Number of retail

outlets:

12 million

© Integrated Retail Management Consulting 2005

SHARE OF MODERN RETAIL FORMATS

(US$ billion) Largest

16.00 Opportunity in

14.00 Food Retailing:

12.00

Size of Food

10.00 Retail :

8.00

US$ 151

6.00

billion

4.00

2.00 Share of Modern

Food Retail:

0.00

Health and M edical care Home décor Consumer Jewellery and Books, Clothing Footwear

beauty and durables watches M usic, Gifts < 1%

products furnishing

Traditional Retail Modern Retail

Source: IRMC Research

© Integrated Retail Management Consulting 2005

INDIA NEW MALL DEVELOPMENT

Large Space

Mall Space in Key Indian Cities Development:

25 Additional Mall

20 Space:

Million Sft

15

47 million

10

sft.

5

0

Mumbai NCR Hyderabad Pune Bangalore

Q 1 2005 Additional Space by 2007

Source: Knight Frank

© Integrated Retail Management Consulting 2005

CHINA Vs. INDIA RETAIL

(US$ per capita) Replicating

(US$ billion)

China

1400 700

Retail

1200 600

Success:

1000 500

800 400

Eight

600 300

400 200

year lag

200 100

0 0

1997 1998 1999 2000 2001 2002 2003 2004 2005

China GDP / capita (USD) India GDP / Capita (USD)

China Retail sales (USD bn) India Retail sales (USD bn)

Source: M+M Planet Retail

© Integrated Retail Management Consulting 2005

INDIA NEW MALL DEVELOPMENT

Large Space

Development:

Mall Space in Key Indian Cities

25 Additional Mall

Space:

20

Million Sft

15 47 million

10 sft.

5

0

Mumbai NCR Hyderabad Pune Bangalore

Q 1 2005 Additional Space by 2007

Source: Knight Frank

© Integrated Retail Management Consulting 2005

INDIA RETAIL: REAL ESTATE RENTALS

(US$ per sft per month) Low Rentals for

Prime Real

90

Estate:

80

70

60 US$ 5 / sft

50 per month

40

30

20

10

0

Hong Singapore Shanghai Beijing Bangkok Jakarta Delhi Manila

Kong

Source: CBRE Research

© Integrated Retail Management Consulting 2005

INDIA RETAIL: SALES PER SQUARE FOOT

Opportunity to

Leverage Low

Rentals:

Rent multiples:

15 X

Sales / sft multiples

3X

Source: M+M Planet Retail

© Integrated Retail Management Consulting 2005

INDIAN CONSUMER

© Integrated Retail Management Consulting 2005

Unmatched Demography

Large Young

Working Class

Base:

Population below

25 years of age :

55%

Source : Statistical Outline of India

© Integrated Retail Management Consulting 2005

INDIA CONSUMER BOOM

Ramp-up in mobile subscriber base Large

400

Consuming

Class:

350 India China

New Mobile

300

Connections:

250

1.5 million

Mn Subscribers

200 per month

150

India in Sept 2001 is equal to

100 China’s customers in mid 95

50

0

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

Source: CLSA Asia-Pacific Markets

© Integrated Retail Management Consulting 2005

Our Contact Details

Bangalore

Bikash Kumar

Suryodai Complex,

143 Airport Road,

Bangalore

India

Phone: +91-80-51233766

FAX: +91-80-25205097

Mobile: +91-98450 45742

Email: bikash.kumar@integratedretail.com

Other Offices: Delhi, Manila, Singapore

To Know More About Us Visit www.integratedretail.com

© Integrated Retail Management Consulting 2005

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Feedback Industry Report BicycleDocumento24 páginasFeedback Industry Report BicycleajaxorAinda não há avaliações

- North South University: Final AssignmentDocumento5 páginasNorth South University: Final AssignmentZahid Hridoy100% (1)

- 213010000086page1 PDFDocumento11 páginas213010000086page1 PDFMBM CONSTRUCTIONAinda não há avaliações

- Canadian Importers Lists - Coconut Briquette, CharcoalDocumento6 páginasCanadian Importers Lists - Coconut Briquette, CharcoalIndo Coconut PremiumAinda não há avaliações

- CRM Subway Updated. (2906) .Docx 2Documento13 páginasCRM Subway Updated. (2906) .Docx 2Razi Ul HassanAinda não há avaliações

- Pepsi Vs Coca ColaDocumento24 páginasPepsi Vs Coca ColaWaseem WaqarAinda não há avaliações

- Comparative Analysis Between Tesco and Sainsbury'sDocumento53 páginasComparative Analysis Between Tesco and Sainsbury'sJahid Hasan100% (4)

- Automatic Car Wash 01Documento46 páginasAutomatic Car Wash 01david33% (3)

- SiaHuatCatalogue2017 2018Documento350 páginasSiaHuatCatalogue2017 2018Chin TecsonAinda não há avaliações

- Cadbury ResearchDocumento34 páginasCadbury Researchchinmay parsekarAinda não há avaliações

- Extra Grammar Practice: Reinforcement: Unit 10Documento1 páginaExtra Grammar Practice: Reinforcement: Unit 10toybox 22Ainda não há avaliações

- Individual Written AssignmentDocumento26 páginasIndividual Written Assignmentovina peirisAinda não há avaliações

- Vishal Completes Asset Sale To TPG, Shriram Group - Business LineDocumento1 páginaVishal Completes Asset Sale To TPG, Shriram Group - Business LineDebolin DeyAinda não há avaliações

- StrategicManagementReport PRAVEENDocumento14 páginasStrategicManagementReport PRAVEENPraveen Nair75% (4)

- Food Bazaar - Wholesale Prices: Mega MartDocumento8 páginasFood Bazaar - Wholesale Prices: Mega MartDiwakar SinghAinda não há avaliações

- Account Statement SBI PDFDocumento12 páginasAccount Statement SBI PDFUMESH KUMAR YadavAinda não há avaliações

- A Market Analysis of BritanniaDocumento10 páginasA Market Analysis of Britanniaurmi_patel22Ainda não há avaliações

- PawnshopDocumento25 páginasPawnshopapi-289042707Ainda não há avaliações

- Jameis Winston: Investigation Report and Civil Citation in Crab Leg IncidentDocumento34 páginasJameis Winston: Investigation Report and Civil Citation in Crab Leg IncidentbmortonAinda não há avaliações

- Short Case Layout of Delhaize de Leeuw Supermarket in Ouderghem, BelgiumDocumento2 páginasShort Case Layout of Delhaize de Leeuw Supermarket in Ouderghem, BelgiumSidSinghAinda não há avaliações

- Brochure FT TBR Final 2018Documento13 páginasBrochure FT TBR Final 2018Cico LisadonAinda não há avaliações

- Study The Bar-Chart and Pie-Chart Carefully To Answer The Given QuestionsDocumento28 páginasStudy The Bar-Chart and Pie-Chart Carefully To Answer The Given QuestionsJyoti SukhijaAinda não há avaliações

- Upaya Peningkatkan Melalui Aktivitas: Brand Awareness PT. Go-Jek Indonesia Marketing Public RelationsDocumento13 páginasUpaya Peningkatkan Melalui Aktivitas: Brand Awareness PT. Go-Jek Indonesia Marketing Public RelationsGalih PrimandaAinda não há avaliações

- Value of InformationDocumento19 páginasValue of Informationmishratrilok100% (2)

- StrategyDocumento16 páginasStrategyBeatriz Lança Polidoro100% (1)

- MPM PDF deDocumento16 páginasMPM PDF decyberabad0% (1)

- Market MayhemCase StudyDocumento5 páginasMarket MayhemCase StudyLakshit Garg75% (4)

- Review of Related LiteratureDocumento3 páginasReview of Related LiteratureAya Leah0% (1)

- Travoy Plan BookDocumento29 páginasTravoy Plan Bookadam_8_butlerAinda não há avaliações

- Regulated MarketDocumento12 páginasRegulated Market9406501115100% (2)