Escolar Documentos

Profissional Documentos

Cultura Documentos

GM Asset Sales

Enviado por

Chicago TribuneDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

GM Asset Sales

Enviado por

Chicago TribuneDireitos autorais:

Formatos disponíveis

General Motors Asset Sales 1999 - 2009

($ in millions except per share data)

Divested / Sold Announcement Transaction Transaction

Subsidiary Date Business Description Description Value

Allison Transmission 6/28/2007 Manufacturer of commercial-duty automatic GM sold Allison to Onex Corporation and the Carlyle Group. $ 5,575

transmissions, hybrid propulsion systems, and

related parts.

Isuzu Motors Ltd. 4/11/2006 Manufacturer of commercial vehicles and GM sold its 7.9% holding to a consortium including Mizuho Bank and 302

diesel engines worldwide. Mitsubishi Corp.

GMAC 4/6/2006 Diverse financial services arm offering GM sold GMAC to a consortium led by Cerberus Capital Management. 7,353

automotive finance, mortgage, and insurance

products.

Suzuki Motor Corp. 3/6/2006 Manufacturer of motorcycles, automobiles, Suzuki bought back the 3.0% stake it gave to GM in 1981. 1,926

marine and power products, motorized

wheelchairs, and electro vehicles and houses.

Fuji Heavy Industries Ltd. 10/4/2005 Manufacturer of transportation and aerospace- Toyota purchased 8.7% of the 20% stake GM acquired in Fuji 312

related products Industries. Remaining shares were floated to the public.

GM Asset Management 8/17/2004 An investment advisor that has $111 billion The Mills Corporation purchased a 50% interest in nine regional mall 1,033

Corp. assets under management properties from GM Asset Management Corporation.

Hughes Electronics Corp. 4/9/2003 Provider of digital television entertainment in GM sold its Hughes Electronics subsidiry and its DirecTV service to 6,588

the U.S. News Corp.

General Motors Defense 12/19/2002 Manufacturer of light armored vehicles and General Motors Defense was sold by GM to General Dynamics. 1,100

supporting weapons systems.

Delphi Corporation 5/28/1999 Supplier of vehicle electronics, transportation GM spun off 80.1% stake in Delphi Corp. to its shareholders. 7,892

components, integrated systems and modules,

and other electronic technologies.

Total $ 32,080

Notes:

(a) All comparable information obtained from Capital IQ, a dividion of Standard & Poor's includes announced transactions through January 28, 2009.

(b) The sale of Unisteel Technology Ltd. is pending regulatory approval.

(c) The Transaction Value / EBITDA multiple for the U.S. Foodservice transaction was removed from the calculation of the Simple Average and Weighted Average based on Transaction Value

multiples due to outlier characteristics.

O'Keefe and Associates 1

Você também pode gostar

- Allison Transmissions: How to Rebuild & Modify: How to Rebuild & ModifyNo EverandAllison Transmissions: How to Rebuild & Modify: How to Rebuild & ModifyNota: 5 de 5 estrelas5/5 (1)

- General Motors: Submitted To Submitted byDocumento25 páginasGeneral Motors: Submitted To Submitted bycool_techAinda não há avaliações

- LS Swaps: How to Swap GM LS Engines into Almost AnythingNo EverandLS Swaps: How to Swap GM LS Engines into Almost AnythingNota: 3.5 de 5 estrelas3.5/5 (2)

- General Motors Turnaround StoryDocumento13 páginasGeneral Motors Turnaround StoryABTABH AHMEDAinda não há avaliações

- Data Acquisition from HD Vehicles Using J1939 CAN BusNo EverandData Acquisition from HD Vehicles Using J1939 CAN BusAinda não há avaliações

- GM - Information SystemsDocumento18 páginasGM - Information SystemsAthul George100% (1)

- Lithium-Ion Battery For Hevs, Phevs, and Evs: Hitachi Review Vol. 63 (2014), No. 2Documento6 páginasLithium-Ion Battery For Hevs, Phevs, and Evs: Hitachi Review Vol. 63 (2014), No. 2RAMPRASATH EEEAinda não há avaliações

- Product Solutions For Machinery: Moeller SeriesDocumento20 páginasProduct Solutions For Machinery: Moeller Seriestico.class_568787Ainda não há avaliações

- General MotorsDocumento13 páginasGeneral MotorsSambit RoyAinda não há avaliações

- University of Wales: KCB ID: 12236,12948,9713Documento21 páginasUniversity of Wales: KCB ID: 12236,12948,9713Jeevabharathi PichaikannuAinda não há avaliações

- Merger & Acquisition: Presented ByDocumento21 páginasMerger & Acquisition: Presented ByHardik A SondagarAinda não há avaliações

- LED P C E A L: I G E V: S and Ower Onsumption OF Xterior Utomotive Ighting Mplications For Asoline and Lectric EhiclesDocumento23 páginasLED P C E A L: I G E V: S and Ower Onsumption OF Xterior Utomotive Ighting Mplications For Asoline and Lectric Ehiclesigor petrovskiAinda não há avaliações

- Catalogo Fotovoltaica 2013Documento48 páginasCatalogo Fotovoltaica 2013Juan GalvezAinda não há avaliações

- Operational Research at General MotorsDocumento7 páginasOperational Research at General MotorsMantesh KumarAinda não há avaliações

- Full Year 2021 Results: FEBRUARY 23, 2022Documento58 páginasFull Year 2021 Results: FEBRUARY 23, 2022Jean Carlo Portales ChavezAinda não há avaliações

- Who Killed The Electric CarDocumento4 páginasWho Killed The Electric CarTou Joon HauAinda não há avaliações

- Rhb-Report-My Auto-Autoparts Sector-Update 20230117 Rhb-483379665709538263c5cdd47633e 1673939044Documento8 páginasRhb-Report-My Auto-Autoparts Sector-Update 20230117 Rhb-483379665709538263c5cdd47633e 1673939044Premier Consult SolutionsAinda não há avaliações

- Ch1 InClassExamples PostingDocumento2 páginasCh1 InClassExamples Postinglyw3178Ainda não há avaliações

- DAIMLER TRUCKS in India Strategic AnalysisDocumento30 páginasDAIMLER TRUCKS in India Strategic Analysisgulrez khanAinda não há avaliações

- 6 Whittle MultielementDS240108A4 LRDocumento1 página6 Whittle MultielementDS240108A4 LRYiye Jesus Henriquez SanchezAinda não há avaliações

- Case #13: "Who Killed The Electric Car?"Documento3 páginasCase #13: "Who Killed The Electric Car?"李茂榮Ainda não há avaliações

- Sae Technical Paper Series: John H. Stang, David E. Koeberlein and Michael J. RuthDocumento9 páginasSae Technical Paper Series: John H. Stang, David E. Koeberlein and Michael J. RuthErick RodriguesAinda não há avaliações

- Polymeric Engine Bearings For Hybrid and Start Stop ApplicationsDocumento9 páginasPolymeric Engine Bearings For Hybrid and Start Stop ApplicationskarthisekarAinda não há avaliações

- 03 - Photovoltaic 2017Documento50 páginas03 - Photovoltaic 2017PhaniAinda não há avaliações

- General ElectricDocumento14 páginasGeneral ElectricNajeeb RizviAinda não há avaliações

- Case Study of General MotorsDocumento9 páginasCase Study of General MotorsOSCAR RENUEL POBLETEAinda não há avaliações

- Automotive SemiconductorsDocumento8 páginasAutomotive SemiconductorsRonnie MagsinoAinda não há avaliações

- Change Notice For Memory Backup Battery Manufacturer: MICREX-F/SX SeriesDocumento1 páginaChange Notice For Memory Backup Battery Manufacturer: MICREX-F/SX SeriesshitrioAinda não há avaliações

- Scan 17792 PDFDocumento29 páginasScan 17792 PDFtariq_veAinda não há avaliações

- General Motors Inc AnalysisDocumento9 páginasGeneral Motors Inc AnalysisUbong Akpekong100% (1)

- Best Practices - Aftermarket SparesDocumento24 páginasBest Practices - Aftermarket SparesShikhar Saxena100% (1)

- NA 2007 PCMO Trends 101807Documento29 páginasNA 2007 PCMO Trends 101807C MoraAinda não há avaliações

- 2012 Toyota Prius BrochureDocumento20 páginas2012 Toyota Prius Brochureidreesali8654Ainda não há avaliações

- Descriptive Statistics: © 2019 Cengage. All Rights ReservedDocumento112 páginasDescriptive Statistics: © 2019 Cengage. All Rights ReservedVincent PhiAinda não há avaliações

- A Mar A Raja BatteriesDocumento12 páginasA Mar A Raja Batteriesjoshhere141Ainda não há avaliações

- Https Iptm - Unf.edu Uploadedfiles Symposium Handouts Ruth-USEDRStatus06032022-1Documento207 páginasHttps Iptm - Unf.edu Uploadedfiles Symposium Handouts Ruth-USEDRStatus06032022-1Charles BrazeelAinda não há avaliações

- SWOT Analysis of General MotorsDocumento3 páginasSWOT Analysis of General MotorsMe UnofficialAinda não há avaliações

- Aftected: Through Gas-Guzzling ProfitabilityDocumento3 páginasAftected: Through Gas-Guzzling ProfitabilityAjayAinda não há avaliações

- Truck MirrorsDocumento24 páginasTruck MirrorsLyndon TinongaAinda não há avaliações

- Business Policy AssignmentDocumento21 páginasBusiness Policy AssignmentSyasyaZeeAinda não há avaliações

- Oerlikon Factsheet Surface Solutions Q3 2020Documento1 páginaOerlikon Factsheet Surface Solutions Q3 2020testAinda não há avaliações

- ER - BalKrishna Industries - Group 3Documento17 páginasER - BalKrishna Industries - Group 3shaaqib mansuriAinda não há avaliações

- Case 1 Accounting For Faulty Ignition Switches at General Motors CompanyDocumento12 páginasCase 1 Accounting For Faulty Ignition Switches at General Motors Companymohiyuddinsakhib3260Ainda não há avaliações

- 2013 Asia RulesDocumento130 páginas2013 Asia RulesrickyAinda não há avaliações

- Vodafone Bid HBS Case - ExhibitsDocumento13 páginasVodafone Bid HBS Case - ExhibitsNaman PorwalAinda não há avaliações

- Accomplished. Also, Indicate The Machines, Equipment, Tools and Materials Used, If Any. Practice SafetyDocumento6 páginasAccomplished. Also, Indicate The Machines, Equipment, Tools and Materials Used, If Any. Practice SafetyNeo GarceraAinda não há avaliações

- Practice GMDocumento20 páginasPractice GMValentinAinda não há avaliações

- REPORTDocumento1 páginaREPORTAnnalyn AlmarioAinda não há avaliações

- F1 ESG Briefing Note Motorsport in The Electric Age 1646410903Documento29 páginasF1 ESG Briefing Note Motorsport in The Electric Age 1646410903chandvAinda não há avaliações

- Case Study On General MotorsDocumento17 páginasCase Study On General MotorsViswajeet Biswal100% (1)

- Business Communication 2.0/Winter09/COMPANY DATA MATRIX: HaierDocumento4 páginasBusiness Communication 2.0/Winter09/COMPANY DATA MATRIX: HaierlouqianAinda não há avaliações

- International Business General MotorsDocumento16 páginasInternational Business General MotorsMarieke Martens100% (1)

- GM ReportDocumento7 páginasGM ReportPiyush GoyalAinda não há avaliações

- Takeovers Restructuring and Corporate Governance 4th Edition Mulherin Solutions ManualDocumento10 páginasTakeovers Restructuring and Corporate Governance 4th Edition Mulherin Solutions Manualbdelliumdimehqa100% (14)

- Energy Sector: General ElectricDocumento23 páginasEnergy Sector: General ElectricApoorva SomaniAinda não há avaliações

- KavyaDocumento32 páginasKavyaKavya MadhavAinda não há avaliações

- 伊顿 航空航天产品Documento74 páginas伊顿 航空航天产品孙友师Ainda não há avaliações

- General Electric: Strategic Quality ManagementDocumento26 páginasGeneral Electric: Strategic Quality ManagementPratiekAinda não há avaliações

- General Motors CompanyDocumento8 páginasGeneral Motors CompanyNeha Soningra100% (1)

- CHI Control-Conveyor Switches AW V11 LR 30 11 12Documento16 páginasCHI Control-Conveyor Switches AW V11 LR 30 11 12Nada Ben El HoussainAinda não há avaliações

- Distressed Unit Appeal Board TranscriptDocumento108 páginasDistressed Unit Appeal Board TranscriptChicago TribuneAinda não há avaliações

- Test QuestionnaireDocumento3 páginasTest QuestionnaireChicago TribuneAinda não há avaliações

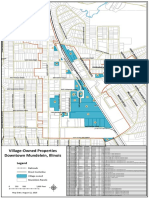

- Mundelein Village-Owned PropertyDocumento1 páginaMundelein Village-Owned PropertyChicago TribuneAinda não há avaliações

- Distressed Unit Appeal Board TranscriptDocumento108 páginasDistressed Unit Appeal Board TranscriptChicago TribuneAinda não há avaliações

- Ty Warner Filing Ahead of Sentencing On Tax Evasion ConvictionDocumento41 páginasTy Warner Filing Ahead of Sentencing On Tax Evasion ConvictionChicago Tribune100% (1)

- Read The Letter That Brought Down HP CEO Mark HurdDocumento8 páginasRead The Letter That Brought Down HP CEO Mark HurdChicago TribuneAinda não há avaliações

- Digital Plus MagazineDocumento24 páginasDigital Plus MagazineChicago Tribune100% (1)

- Tribnation 4Documento1 páginaTribnation 4Chicago TribuneAinda não há avaliações

- Samantha Schacher V Johnny ManzielDocumento3 páginasSamantha Schacher V Johnny ManzielDarren Adam Heitner100% (5)

- IGO - 2011 Budget Options - September 27, 2011-FinalDocumento136 páginasIGO - 2011 Budget Options - September 27, 2011-FinalChicago TribuneAinda não há avaliações

- Tribnation 1Documento1 páginaTribnation 1Chicago TribuneAinda não há avaliações

- Tribnation 3Documento1 páginaTribnation 3Chicago TribuneAinda não há avaliações

- Tribnation 2Documento1 páginaTribnation 2Chicago TribuneAinda não há avaliações

- Tribnation 1Documento1 páginaTribnation 1Chicago TribuneAinda não há avaliações

- Assessment Notice, Page 2Documento1 páginaAssessment Notice, Page 2Chicago TribuneAinda não há avaliações

- 2011 Programming FormDocumento1 página2011 Programming FormChicago TribuneAinda não há avaliações

- United States Bankruptcy Court Voluntary Petition: Northern District of IllinoisDocumento7 páginasUnited States Bankruptcy Court Voluntary Petition: Northern District of IllinoisChicago TribuneAinda não há avaliações

- Fiscal Year 2012 Operating Budget BookDocumento470 páginasFiscal Year 2012 Operating Budget BookChicago TribuneAinda não há avaliações

- Illinois Supreme Court Order On Rahm Emanuel's Emergency Motion For StayDocumento1 páginaIllinois Supreme Court Order On Rahm Emanuel's Emergency Motion For StayRod McCullomAinda não há avaliações

- SC Order - Emanuel PLADocumento1 páginaSC Order - Emanuel PLAChicago TribuneAinda não há avaliações

- CLG418 (Dcec) PM 201409022-EnDocumento1.143 páginasCLG418 (Dcec) PM 201409022-EnMauricio WijayaAinda não há avaliações

- Introduction To Atomistic Simulation Through Density Functional TheoryDocumento21 páginasIntroduction To Atomistic Simulation Through Density Functional TheoryTarang AgrawalAinda não há avaliações

- Upes School of Law Lac & Adr Association: PresentsDocumento7 páginasUpes School of Law Lac & Adr Association: PresentsSuvedhya ReddyAinda não há avaliações

- LspciDocumento4 páginasLspciregistroosAinda não há avaliações

- Multimodal Essay FinalDocumento8 páginasMultimodal Essay Finalapi-548929971Ainda não há avaliações

- Grade 9 Science Biology 1 DLPDocumento13 páginasGrade 9 Science Biology 1 DLPManongdo AllanAinda não há avaliações

- 24 DPC-422 Maintenance ManualDocumento26 páginas24 DPC-422 Maintenance ManualalternativblueAinda não há avaliações

- 07 GDL Web-Site 04 (2021-2022) For 15284Documento2 páginas07 GDL Web-Site 04 (2021-2022) For 15284ABCDAinda não há avaliações

- Kapinga Kamwalye Conservancy ReleaseDocumento5 páginasKapinga Kamwalye Conservancy ReleaseRob ParkerAinda não há avaliações

- Chemistry Investigatory Project (R)Documento23 páginasChemistry Investigatory Project (R)BhagyashreeAinda não há avaliações

- Modern School For SaxophoneDocumento23 páginasModern School For SaxophoneAllen Demiter65% (23)

- Fundamentals of Signal and Power Integrity PDFDocumento46 páginasFundamentals of Signal and Power Integrity PDFjaltitiAinda não há avaliações

- Switching Simulation in GNS3 - GNS3Documento3 páginasSwitching Simulation in GNS3 - GNS3Jerry Fourier KemeAinda não há avaliações

- EKC 202ABC ManualDocumento16 páginasEKC 202ABC ManualJose CencičAinda não há avaliações

- Bad Memories Walkthrough 0.52Documento10 páginasBad Memories Walkthrough 0.52Micael AkumaAinda não há avaliações

- Manual For Tacho Universal Edition 2006: Legal DisclaimerDocumento9 páginasManual For Tacho Universal Edition 2006: Legal DisclaimerboirxAinda não há avaliações

- EdisDocumento227 páginasEdisThong Chan100% (1)

- Understanding PTS Security PDFDocumento37 páginasUnderstanding PTS Security PDFNeon LogicAinda não há avaliações

- Antibiotic Zone Interpretation Guide PDFDocumento2 páginasAntibiotic Zone Interpretation Guide PDFFarandy Insan Sejati100% (2)

- 52 - JB CHP Trigen - V01Documento33 páginas52 - JB CHP Trigen - V01July E. Maldonado M.Ainda não há avaliações

- List of Iconic CPG Projects in SingaporeDocumento2 páginasList of Iconic CPG Projects in SingaporeKS LeeAinda não há avaliações

- Experiment - 1: Batch (Differential) Distillation: 1. ObjectiveDocumento30 páginasExperiment - 1: Batch (Differential) Distillation: 1. ObjectiveNaren ParasharAinda não há avaliações

- 928 Diagnostics Manual v2.7Documento67 páginas928 Diagnostics Manual v2.7Roger Sego100% (2)

- Pioneer vsx-1020-k 1025-k SM PDFDocumento132 páginasPioneer vsx-1020-k 1025-k SM PDFluisclaudio31Ainda não há avaliações

- Practical Modern SCADA Protocols. DNP3, 60870.5 and Related SystemsDocumento4 páginasPractical Modern SCADA Protocols. DNP3, 60870.5 and Related Systemsalejogomez200Ainda não há avaliações

- Chapter 4 - Basic ProbabilityDocumento37 páginasChapter 4 - Basic Probabilitynadya shafirahAinda não há avaliações

- Semi Detailed Lesson PlanDocumento2 páginasSemi Detailed Lesson PlanJean-jean Dela Cruz CamatAinda não há avaliações

- The Kicker TranscriptionDocumento4 páginasThe Kicker TranscriptionmilesAinda não há avaliações

- BSBITU314 Assessment Workbook FIllableDocumento51 páginasBSBITU314 Assessment Workbook FIllableAryan SinglaAinda não há avaliações

- Question Answers of Chapter 13 Class 5Documento6 páginasQuestion Answers of Chapter 13 Class 5SuvashreePradhanAinda não há avaliações

- PPL Exam Secrets Guide: Aviation Law & Operational ProceduresNo EverandPPL Exam Secrets Guide: Aviation Law & Operational ProceduresNota: 4.5 de 5 estrelas4.5/5 (3)

- 2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)No Everand2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)Ainda não há avaliações

- Drilling Supervisor: Passbooks Study GuideNo EverandDrilling Supervisor: Passbooks Study GuideAinda não há avaliações

- Medical Terminology For Health Professions 4.0: Ultimate Complete Guide to Pass Various Tests Such as the NCLEX, MCAT, PCAT, PAX, CEN (Nursing), EMT (Paramedics), PANCE (Physician Assistants) And Many Others Test Taken by Students in the Medical FieldNo EverandMedical Terminology For Health Professions 4.0: Ultimate Complete Guide to Pass Various Tests Such as the NCLEX, MCAT, PCAT, PAX, CEN (Nursing), EMT (Paramedics), PANCE (Physician Assistants) And Many Others Test Taken by Students in the Medical FieldNota: 4.5 de 5 estrelas4.5/5 (2)

- Pilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CNo EverandPilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CAinda não há avaliações

- The Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsNo EverandThe Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsNota: 4.5 de 5 estrelas4.5/5 (77)

- Preclinical Physiology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1No EverandPreclinical Physiology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1Ainda não há avaliações

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessNo EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessNota: 4.5 de 5 estrelas4.5/5 (17)

- NCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsNo EverandNCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsAinda não há avaliações

- NCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsNo EverandNCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsAinda não há avaliações

- CUNY Proficiency Examination (CPE): Passbooks Study GuideNo EverandCUNY Proficiency Examination (CPE): Passbooks Study GuideAinda não há avaliações

- Airplane Flying Handbook: FAA-H-8083-3C (2024)No EverandAirplane Flying Handbook: FAA-H-8083-3C (2024)Nota: 4 de 5 estrelas4/5 (12)

- 1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideNo Everand1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideNota: 3.5 de 5 estrelas3.5/5 (7)

- Textbook of Plastic and Reconstructive SurgeryNo EverandTextbook of Plastic and Reconstructive SurgeryDeepak K. Kalaskar B.Tech PhDNota: 4 de 5 estrelas4/5 (9)

- Note Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusNo EverandNote Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusNota: 3.5 de 5 estrelas3.5/5 (10)

- Substation Maintenance Electrical Technician: Passbooks Study GuideNo EverandSubstation Maintenance Electrical Technician: Passbooks Study GuideAinda não há avaliações

- The Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)No EverandThe Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)Nota: 4 de 5 estrelas4/5 (1)

- Certified Professional Coder (CPC): Passbooks Study GuideNo EverandCertified Professional Coder (CPC): Passbooks Study GuideNota: 5 de 5 estrelas5/5 (1)

- 2024/2025 ASVAB For Dummies: Book + 7 Practice Tests + Flashcards + Videos OnlineNo Everand2024/2025 ASVAB For Dummies: Book + 7 Practice Tests + Flashcards + Videos OnlineAinda não há avaliações