Escolar Documentos

Profissional Documentos

Cultura Documentos

Ch4 Smithville

Enviado por

Lica Dapitilla PerinDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ch4 Smithville

Enviado por

Lica Dapitilla PerinDireitos autorais:

Formatos disponíveis

Chapter 4 Recording operating transactions affecting the General Fund and governmental activities at the government-wide level

Presented below are a number of transactions of the City of Smithville that occurred during the fiscal year for which the budget given in Chapter 3 was prepared, the calendar year 2005. Read all instructions carefully. a. Record the following transactions in the general journal for the General Fund and, if applicable, in the general journal for governmental activities at the government-wide level. For all entries, the date selected should be year 2005. For each of the paragraphs that requires entries in both the General Fund and governmental activities journals, you can either record them in both journals on a paragraph-by-paragraph basis or, alternatively, record all the General Fund journal entries first for all paragraphs, then complete the governmental activities journal entries for all paragraphs last. If you choose the latter method, it might be useful to print the General Fund General Journal entries to assist in making the entries in the governmental activities journal. Regardless of the method you choose, we highly recommend that you refer to the illustrative journal entries in Chapter 4 of the Wilson and Kattelus textbook (13th Edition) for guidance in making all entries. Make all computations and journal entries to the nearest dollar. For each entry affecting budgetary accounts or operating statement accounts, you will be sent to the Detail Journal, as in Chapter 3, to record the appropriate amounts in the detail budgetary or actual accounts. 1. [Para. 4-a-1] Encumbrances in the following amounts for purchase orders issued were recorded against the appropriations indicated: General Government Public Safety--Police Public Safety--Fire Public Safety--Building Safety Public Works Health and Welfare Parks and Recreation Miscellaneous Total $ 58,600 53,020 51,480 5,770 147,420 103,250 77,800 24,740 $522,080

Required: Record the Encumbrances in the General Fund general journal and detail journal as appropriate. (Note: Type 4-a-1 as the paragraph number in the [Transaction Description] box for this entry; 4-a-2 for the next transaction, etc. Careful referencing by paragraph number will be very helpful should you need to determine where you may have omitted a required journal entry or may have made an error.) (In the Detail Journal,

19

select Purchase Orders from the drop down [Transaction Description] menu. You can also type in an alternative description, if desired.] 2. [Para. 4-a-2] On January 1, 2005, the real property tax levy for the year was made to yield the budgeted amount ($980,000), assuming 98 percent of the levy would be collectible. Required: Calculate the required tax levy and record this transaction in both the General Fund and governmental activities journal. (Select Accrued Revenue in the drop down [Transaction Description] menu in the Detail Journal related to the General Fund entry.) 3. [Para. 4-a-3] Additional interest and penalties were accrued on delinquent property taxes in the amount of $5,775. The current balance of Estimated Uncollectible Interest and Penalties was deemed adequate, so the entire $5,775 should be credited to Revenues. Required: Record this accrual in both the General Fund and governmental activities general journals. 4. [Para. 4-a-4] Late in FY 2005, the City of Smithville received notification that the state government would remit $98,000 to it early in the next fiscal year, although this amount is intended to finance certain public safety operations of the current year. This amount had been anticipated and was included in the budget for the current year as "Intergovernmental Revenue. Required: Record this transaction as a receivable and revenue in the General Fund and governmental activities journals. (Note: Select Accrued Revenue in the [Transaction Description] box in the Detail Journal). At the government-wide level, assume that this item is an operating grant to the Public Safety function (The City of Smithville does not classify program revenues in the more detailed sub-function categories of police, fire, or building safety.). 5. [Para. 4-a-5] Cash was collected during the year in the total amount of $3,405,088. These collections were from the following receivables and cash revenues, as indicated: Current Property Taxes $760,000 Delinquent Property Taxes 200,000 Interest and Penalties Receivable on Taxes 34,688 Due from State Government 500,000 Revenues: (total: $1,910,000) Sales Taxes 1,136,400 Licenses and Permits 347,500 Fines and Forfeits 252,000

20

Intergovernmental Charges for Services Miscellaneous Total

100,000 55,000 19,500 $3,405,088

Required: Record the receipt of cash and related credits to receivables and cashbasis revenues accounts in both the General Fund and governmental activities journals. For purposes of the governmental activities entries at the governmentwide level assume the following classifications: General Fund Sales Taxes Licenses and Permits Fines and Forfeits Intergovernmental Charges for Services Miscellaneous Governmental Activities General Revenues-Taxes-Sales Program Revenues-General Government-Charges for Services Program Revenues-General Government-Charges for Services Program Revenues-Public Safety-Operating Grants and Contributions Program Revenues-Parks and Recreation-Charges for Services General Revenues-Miscellaneous

6. [Para. 4-a-6] Invoices for some of the goods recorded as encumbrances in transaction 4-a-1 were received and approved for payment as listed below. Related encumbrances were canceled in the amounts listed below: Expenditures $ 55,856 53,240 44,364 5,770 113,450 105,000 71,000 24,500 $473,180 Encumbrances $ 56,400 52,420 45,000 5,770 113,400 103,050 73,800 24,740 $474,580

General Government Public Safety--Police Public Safety--Fire Public Safety--Building Safety Public Works Health and Welfare Parks and Recreation Miscellaneous

Required: Record the receipt of these goods and the related vouchers payable in both the General Fund and governmental activities journals. At the governmentwide level, you should assume the City uses the periodic inventory method. Thus, the invoiced amounts above should be recorded as expenses of the appropriate functions, except that $12,000 of the amount charged to the Public Works function was for a vehicle (debit Equipment for this item at the Government-Wide Level. Expenditures charged to the Miscellaneous appropriation should be

21

recorded in this case as General Government expenses at the government-wide level. 7. [Para. 4-a-7] Gross General Fund payrolls for the year totaled $2,270,000. Of that amount, $318,300 was withheld for employees' federal income taxes; $173,700 for employees' share of FICA taxes; $61,000 for employees' state income taxes; and the balance was paid to employees in cash. The City of Smithville does not record encumbrances for payrolls. The payrolls were chargeable against the following functions appropriations: General Government Public Safety--Police Public Safety--Fire Public Safety--Building Safety Public Works Health and Welfare Parks and Recreation Miscellaneous Appropriations Total $ 270,000 588,270 563,930 46,080 364,810 236,710 192,000 8,200 $2,270,000

Required: Make summary journal entries for payroll in both the General Fund and governmental activities general journals for the year. Assume that the amount charged to the Miscellaneous Appropriations should be reported as an expense of the General Government Function at the government-wide level. 8. [Para. 4-a-8] The City's share of FICA taxes, $173,700, and the City's contribution to other retirement funds administered by the state government, $116,300, were recorded as liabilities. These items were budgeted as part of the Contributions to Retirement Funds appropriation. Required: Record this transaction in both the General Fund and governmental activities general journals. Assume that the total $290,000 of expenses at the government-wide level should be allocated in the same proportions as in paragraph 4-a-7 above; that is: General Government: [($270,000 + $8,200)/$2,270,000] X $290,000 = $35,541 Public SafetyPolice: ($588,270/$2,270,000) X $290,000 = $75,153 Public SafetyFire: ($563,930/$2,270,000) X $290,000 = $72,044 Public SafetyBuilding Safety: ($46,080/$2,270,000) X $290,000 = $5,887 Public Works: ($364,810/$2,270,000) X $290,000 = $46,606 Health and Welfare: ($236,710/$2,270,000) X $290,000 = $30,240 Parks and Recreation: ($192,000/$2,270,000) X $290,000 = $24,529. [Note: The Parks and Recreation amount was increased by one dollar to compensate for rounding error.]

22

9. [ Para. 4-a-9] Checks were written in the total amount of $1,763,700 during 2005. These checks were in payment of the following items: Vouchers Payable Tax Anticipation Notes Payable Interest on Tax Anticipation Notes Payable (record as Interest Expenditure/Expense) Due to Federal Government Due to State Government Total amount paid $680,000 250,000 (see Chapter 2)

5,000 653,700 175,000 $1,763,700

Note: Interest expenditures are budgeted in Miscellaneous Appropriations. Required: Record the payment of these items in both the General Fund and governmental activities general journals. 10. [Para. 4-a-10] The Appropriations budget for 2005 was legally amended as follows: Decreases Increases General Government $ 3,000 Public SafetyPolice 20,000 Public SafetyFire 5,000 Public SafetyBuilding Safety $ 5,700 Public Works 11,000 Health and Welfare 11,000 Parks and Recreation 3,000 Contributions to Retirement Funds 12,000 Miscellaneous 1,000 $20,700 $51,000 Required: Record the budget amendments in the General Fund general journal only. Budgetary items do not affect the government-wide accounting records. 11. [Para. 4-a-11] Current taxes receivable uncollected at year-end, and the related estimated uncollectible current taxes account, were both reclassified as delinquent. Required: Record this transaction in the General Fund and governmental activities journals.

23

12. [Para. 4-a-12] Interest and penalties receivable on delinquent taxes was increased by $15,000; $6,000 of this was estimated as uncollectible. Required: Record this transaction in the General Fund and governmental activities journals. 13. [Para. 4-a-13] Delinquent taxes receivable in the amount of $17,348 were written off as uncollectible. Interest and penalties already recorded as receivable on these taxes, amounting to $12,404, were also written off. Additional interest on these taxes that had legally accrued was not recorded since it was deemed uncollectible in its entirety. Required: Record this transaction in the General Fund and governmental activities journals. 14. [Para. 4-a-14] Postaudit disclosed that goods amounting to $9,760, which had been recorded as an expenditure in that amount against the General Government appropriation of the General Fund should have been charged to the Solid Waste Disposal Fund, an enterprise fund and a business-type activity at the governmentwide level. This item had also been charged as an expense of the General Government function at the government-wide level. An interfund invoice was prepared to reduce Expenditures of the General Fund for the $9,760 and recognize an interfund receivable. This item will be recognized later in Chapter 7 of this case as an expense of the Solid Waste Disposal Fund. Required: Record this reimbursement transaction in the General Fund and governmental activities journals, debiting Due from Other Funds in the General Fund and Internal Receivables from Business-Type Activities at the governmentwide level. Do not make any entries in the Solid Waste Disposal Fund at this time. 15. [Para. 4-a-15] Services received by the General Government function of the General Fund from the Solid Waste Disposal Fund amounted to $9,800 during the year. Of this amount, $6,000 was paid in cash and $3,800 remained unpaid at year-end. Required: Record the receipt of these services, amounts paid during the year, and remaining liability in the General Fund and governmental activities journals. At the government-wide level the liability should be credited to Internal Payables to Business-Type Activities. Do not record these items in the Solid Waste Disposal Fund until instructed to do so in Chapter 7 of this case. Note: After reviewing all entries for accuracy, including year and paragraph numbers, post all entries to the general ledger accounts and to all subsidiary ledger accounts, by clicking on [Post Entries]. Also post all entries in the governmental activities journal.

24

16. [Closing Entry] Prepare and post at the end of year 2005, the necessary entries to close the Estimated Revenues, Revenues, Appropriations, Expenditures, and Encumbrances accounts to Fund Balance. Be sure to click on the check mark for [Closing Entry] and type Closing Entry in the [Transaction Description] box. It is necessary to reclick [Closing Entry] before closing each individual account. Also, you will be sent to the Detail Journal where you must close each individual budgetary or operating statement account. To determine the closing amounts for both General Ledger and subsidiary ledger accounts, you will need to first print the pre-closing version of these ledgers for year 2005 from the [Reports] menu. Note: DO NOT PREPARE CLOSING ENTRIES FOR GOVERNMENTAL ACTIVITIES AT THIS TIME since governmental activities will not be closed until Chapter 9, after capital projects fund (Chapter 5) and debt service fund (Chapter 6) transactions affecting governmental activities at the government-wide level have been recorded. b. Select Export from the drop down [File] menu to create an Excel worksheet of the General Fund Post-Closing Trial Balance as of December 31, 2005. Use Excel to prepare in good form a Balance Sheet for the General Fund as of December 31, 2005. Follow the format shown in Illustration 4-5 of Wilson and Kattelus, Accounting for Governmental and Nonprofit Entities, 13th Ed. Textbook (hereafter referred to as the textbook. Alternatively, you can click on [Reports] to print the Post-Closing Trial Balance and use the printed copy to manually prepare a Balance Sheet. c. Select Export from the drop down [File] menu to create an Excel worksheet of the General Fund Pre-Closing Operating Statement Account Balances for the year 2005. Use Excel to prepare in good form a Statement of Revenues, Expenditures, and Changes in Fund Balance for the General Fund for the year ended December 31, 2005. (See Illustration 4-6 in the textbook for an example format.) d. Use the Excel worksheet of the General Fund Pre-Closing Operating Statement Account Balances created in part c above to prepare in good form a Statement of Revenues, Expenditures, and Changes in Fund Balance--Budget and Actual for the General Fund for the year ended December 31, 2005. (See Illustration 4-7 in the textbook for an example format.) e. Prepare in good form a reconciliation of total Expenditures reported in your solution to part c of this problem with the total Expenditures and Encumbrances reported in your solution to part d of this problem. (See example in the textbook in the discussion which compares Illustrations 4-6 and 4-7.)

[Note: File the printouts of all your worksheets and your completed financial statements in your cumulative problem folder until directed by your instructor to turn them in, unless your instructor specifies submission of computer files via e-mail.]

25

Você também pode gostar

- 1 Prof Chauvins Instructions For Bingham CH 4Documento35 páginas1 Prof Chauvins Instructions For Bingham CH 4Danielle Baldwin100% (2)

- Week 3 QuizDocumento8 páginasWeek 3 QuizPetraAinda não há avaliações

- Non-Profit Organizations: Learning ObjectivesDocumento12 páginasNon-Profit Organizations: Learning Objectivesbobo kaAinda não há avaliações

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018Ainda não há avaliações

- Non-Profit OrganizationsDocumento44 páginasNon-Profit OrganizationsJayvee BernalAinda não há avaliações

- Output VatDocumento16 páginasOutput VatLica Dapitilla Perin100% (1)

- Observations and RecommendationsDocumento22 páginasObservations and RecommendationsFidela PaguioAinda não há avaliações

- Governmental and Not-For-profit Accounting 5th Chapter 2 SolutionDocumento28 páginasGovernmental and Not-For-profit Accounting 5th Chapter 2 SolutionCathy Gu75% (8)

- Methods of National Income AccountingDocumento13 páginasMethods of National Income AccountingAppan Kandala Vasudevachary100% (5)

- Ch.2 PGDocumento12 páginasCh.2 PGkasimAinda não há avaliações

- Department of Finance Budget PresentationDocumento9 páginasDepartment of Finance Budget PresentationWVXU NewsAinda não há avaliações

- Chapter 2 - Test BankDocumento25 páginasChapter 2 - Test Bankapi-253108236100% (5)

- Missing Money Update - Mark Skidmore & Catherine Austin Fitts (May 2020)Documento18 páginasMissing Money Update - Mark Skidmore & Catherine Austin Fitts (May 2020)Cambiador de MundoAinda não há avaliações

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1No EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Ainda não há avaliações

- Government Accounting SummaryDocumento9 páginasGovernment Accounting SummaryKenVictorino50% (2)

- Acctg 322Documento2 páginasAcctg 322Janine Remoroza Ü100% (1)

- Chapter 20 Beams10e SMDocumento14 páginasChapter 20 Beams10e SMStendy DharmawanAinda não há avaliações

- Acc431 - Exam1-Answers - V1 PDFDocumento18 páginasAcc431 - Exam1-Answers - V1 PDFnovaAinda não há avaliações

- Chap 004Documento58 páginasChap 004Yidersal DagnawAinda não há avaliações

- Part 6Documento10 páginasPart 6Thuy Ngo LeAinda não há avaliações

- General Fundtrial Balance JANUARY 1, 2018 Debits CreditsDocumento2 páginasGeneral Fundtrial Balance JANUARY 1, 2018 Debits CreditsTehone TeketelewAinda não há avaliações

- CH3 SolutionDocumento10 páginasCH3 SolutionGabriel Aaron DionneAinda não há avaliações

- E12.2 Fund and Government-Wide ReportingDocumento5 páginasE12.2 Fund and Government-Wide ReportingHa NoiAinda não há avaliações

- Nineteen: Governmental Entities: Proprietary Funds, Fiduciary Funds, and Comprehensive Annual FinancialDocumento34 páginasNineteen: Governmental Entities: Proprietary Funds, Fiduciary Funds, and Comprehensive Annual FinancialridaAinda não há avaliações

- Govt Accounts NotesDocumento11 páginasGovt Accounts NotesManoj SainiAinda não há avaliações

- Public Sector Accounting II Lecture NoteDocumento65 páginasPublic Sector Accounting II Lecture NoteAtunbi AgnesAinda não há avaliações

- Acct 260 Cafr 2-15Documento6 páginasAcct 260 Cafr 2-15StephanieAinda não há avaliações

- Acc431 Quiz2 Answers V1Documento7 páginasAcc431 Quiz2 Answers V1novaAinda não há avaliações

- Double Account SystemDocumento7 páginasDouble Account SystemBarath Ram50% (2)

- Daily Treasury Statement: TABLE I - Operating Cash BalanceDocumento2 páginasDaily Treasury Statement: TABLE I - Operating Cash BalanceBecket AdamsAinda não há avaliações

- Acct 260 Cafr 7-16Documento5 páginasAcct 260 Cafr 7-16StephanieAinda não há avaliações

- Chapter 4 Accounting For Governmental Operating Activitie Illustrative TransactionsDocumento58 páginasChapter 4 Accounting For Governmental Operating Activitie Illustrative TransactionsSaja AlbarjesAinda não há avaliações

- Ac101 ch3Documento21 páginasAc101 ch3Alex ChewAinda não há avaliações

- Hyde and Analysis: Town Park Management'S DECEMBER 31.2006 Town) Town of For of Municipality Mid FireDocumento10 páginasHyde and Analysis: Town Park Management'S DECEMBER 31.2006 Town) Town of For of Municipality Mid Fireapi-107641637Ainda não há avaliações

- United States Government Notes To The Financial Statements For The Years Ended September 30, 2006, and September 30, 2005Documento62 páginasUnited States Government Notes To The Financial Statements For The Years Ended September 30, 2006, and September 30, 2005losangelesAinda não há avaliações

- ACC 577 Week 1 QuizDocumento8 páginasACC 577 Week 1 QuizMaryAinda não há avaliações

- 2018 AFR GCs Volume I PDFDocumento768 páginas2018 AFR GCs Volume I PDFJenniferAinda não há avaliações

- #13Documento43 páginas#13itsanyuserAinda não há avaliações

- Be A MethodologyDocumento6 páginasBe A MethodologyJames SurowieckiAinda não há avaliações

- June 1, 2009: Escription Ata Sources and Methodology Ata Accuracy OcumentationDocumento32 páginasJune 1, 2009: Escription Ata Sources and Methodology Ata Accuracy OcumentationSagar PatelAinda não há avaliações

- Lesson - 19 National: Income - 1 Circular Flow and Measurement of National IncomeDocumento8 páginasLesson - 19 National: Income - 1 Circular Flow and Measurement of National IncomepraneixAinda não há avaliações

- Cities Annual Report FY 2007-08Documento684 páginasCities Annual Report FY 2007-08L. A. PatersonAinda não há avaliações

- Financial Statements 2019Documento20 páginasFinancial Statements 2019LokiAinda não há avaliações

- January 14Documento51 páginasJanuary 14Nick ReismanAinda não há avaliações

- PFA Final Exam October 2022Documento4 páginasPFA Final Exam October 2022Jay PugonAinda não há avaliações

- Ontario New Democrat Fiscal FrameworkDocumento16 páginasOntario New Democrat Fiscal FrameworkontarionewdemocratAinda não há avaliações

- Essentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions ManualDocumento18 páginasEssentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions Manualdaineil2td100% (28)

- Essentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions Manual Full Chapter PDFDocumento39 páginasEssentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions Manual Full Chapter PDFarianytebh100% (13)

- Chp-3 General Fund PGDocumento16 páginasChp-3 General Fund PGkasimAinda não há avaliações

- Quiz 1Documento5 páginasQuiz 1Sevastian jedd EdicAinda não há avaliações

- Chapter 3 B Accounting For Governmental Operating Activities-Illustrative Transactions and Financial StatementsDocumento33 páginasChapter 3 B Accounting For Governmental Operating Activities-Illustrative Transactions and Financial StatementsAbdii DhufeeraAinda não há avaliações

- Government Budget and The EconomyDocumento10 páginasGovernment Budget and The EconomyFathimaAinda não há avaliações

- Government Report Procedures: Release 12.1 Part Number E13567-04Documento31 páginasGovernment Report Procedures: Release 12.1 Part Number E13567-04Amith MehtaAinda não há avaliações

- One-Time Economic Recovery Payment (ERP) Plan - Administrative ExpensesDocumento10 páginasOne-Time Economic Recovery Payment (ERP) Plan - Administrative Expenses1theologosaAinda não há avaliações

- Homework PDFDocumento8 páginasHomework PDFTracey NguyenAinda não há avaliações

- Introduction To Government Accounting SystemDocumento33 páginasIntroduction To Government Accounting SystemSumeet Tiwary100% (1)

- PSAF - Note 1Documento39 páginasPSAF - Note 1Grace HenryAinda não há avaliações

- WK 6 QuizDocumento5 páginasWK 6 QuizPetraAinda não há avaliações

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsAinda não há avaliações

- Reinsurance Carrier Revenues World Summary: Market Values & Financials by CountryNo EverandReinsurance Carrier Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Direct Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryNo EverandDirect Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesAinda não há avaliações

- Rules For Alphabetic FilingDocumento1 páginaRules For Alphabetic FilingLica Dapitilla PerinAinda não há avaliações

- Table of ASCII CharactersDocumento1 páginaTable of ASCII CharactersLica Dapitilla PerinAinda não há avaliações

- Vat On Importation of GoodsDocumento6 páginasVat On Importation of GoodsLica Dapitilla PerinAinda não há avaliações

- I WK 2 BMDocumento6 páginasI WK 2 BMLica Dapitilla PerinAinda não há avaliações

- 12sm Accountancy Eng 2021 22Documento512 páginas12sm Accountancy Eng 2021 22Piyush ChhajerAinda não há avaliações

- 2022 Budget Document Vol 1Documento552 páginas2022 Budget Document Vol 1FOX 17 NewsAinda não há avaliações

- Govt Test IDocumento2 páginasGovt Test ICreate Ed100% (1)

- CH 1 Accounting For NGOsDocumento15 páginasCH 1 Accounting For NGOsRia ChoithaniAinda não há avaliações

- July 24 2023 Mitchell Board of Education Meeting AgendaDocumento115 páginasJuly 24 2023 Mitchell Board of Education Meeting AgendainforumdocsAinda não há avaliações

- Chapter Two & Three: Priciples & Basis of Accounting For NFP Entities and Accounting & Budgeting ProcessDocumento51 páginasChapter Two & Three: Priciples & Basis of Accounting For NFP Entities and Accounting & Budgeting ProcessabateAinda não há avaliações

- 2008 Certificates of Participation Official Statement PDFDocumento225 páginas2008 Certificates of Participation Official Statement PDFRoldan Hiano ManganipAinda não há avaliações

- Bridgeport CT Adopted Budget 2008-2009Documento516 páginasBridgeport CT Adopted Budget 2008-2009BridgeportCTAinda não há avaliações

- Course Material 2 - The Unified Accounts Codes StructureDocumento34 páginasCourse Material 2 - The Unified Accounts Codes StructureJayvee BernalAinda não há avaliações

- Annual Audit Report Naic 2017Documento103 páginasAnnual Audit Report Naic 2017RNJAinda não há avaliações

- 2023.08.28 FY 24 PH Budget Information UpdateDocumento14 páginas2023.08.28 FY 24 PH Budget Information UpdateWXMIAinda não há avaliações

- Bryan ISD Budget RealignmentDocumento3 páginasBryan ISD Budget RealignmentKBTXAinda não há avaliações

- Public Final ExamDocumento5 páginasPublic Final Examsenbetotilahun8Ainda não há avaliações

- Leftout4000 - 3 - Industrial Plots - YeidaDocumento40 páginasLeftout4000 - 3 - Industrial Plots - YeidaPrateek WadhwaniAinda não há avaliações

- Essentials of Accounting For Governmental and Not-For-Profit Organizations 12th Edition Copley Test Bank 1Documento36 páginasEssentials of Accounting For Governmental and Not-For-Profit Organizations 12th Edition Copley Test Bank 1leahjohnsonfncrigpmxj100% (26)

- Midland County Popular Annual Financial ReportDocumento18 páginasMidland County Popular Annual Financial ReportMidland Daily NewsAinda não há avaliações

- Test I - TRUE or FALSE (15 Points) : College of Business Management and AccountancyDocumento2 páginasTest I - TRUE or FALSE (15 Points) : College of Business Management and AccountancyJamie Rose AragonesAinda não há avaliações

- Revenue Report - July 2021Documento8 páginasRevenue Report - July 2021Russ LatinoAinda não há avaliações

- 2021-2022 Duluth Public Schools BudgetDocumento22 páginas2021-2022 Duluth Public Schools BudgetDuluth News TribuneAinda não há avaliações

- Chapter 6 24Documento5 páginasChapter 6 24MCAinda não há avaliações

- Proposed Operating Book-FINAL PDFDocumento539 páginasProposed Operating Book-FINAL PDFal_crespoAinda não há avaliações

- Government & NPF AssignmentDocumento10 páginasGovernment & NPF AssignmentkiduseAinda não há avaliações

- Akuntansi Lanjutan 2: Accounting For State and Local Governmental UnitsDocumento46 páginasAkuntansi Lanjutan 2: Accounting For State and Local Governmental Unitstamagochi newAinda não há avaliações

- Volume 5 - Budgeting Resource Tools and ApproachesDocumento82 páginasVolume 5 - Budgeting Resource Tools and ApproachesBong RicoAinda não há avaliações

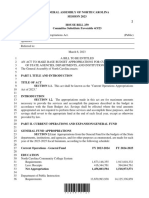

- Updated Version of HB 259, The House's Proposed BudgetDocumento416 páginasUpdated Version of HB 259, The House's Proposed BudgetSteven DoyleAinda não há avaliações

- Direction - Association ConstitutionDocumento20 páginasDirection - Association ConstitutionbinoyjmatAinda não há avaliações