Escolar Documentos

Profissional Documentos

Cultura Documentos

Definitions - Business Studies Unit 1

Enviado por

farazdrums8748100%(1)100% acharam este documento útil (1 voto)

1K visualizações3 páginasLeadership: the art or process of motivating employees to carry out tasks. Democratic Leadership: virtually all authority is delegated to employees. Market research: the collection and analysis of data relating to the marketing of goods and services.

Descrição original:

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoLeadership: the art or process of motivating employees to carry out tasks. Democratic Leadership: virtually all authority is delegated to employees. Market research: the collection and analysis of data relating to the marketing of goods and services.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

100%(1)100% acharam este documento útil (1 voto)

1K visualizações3 páginasDefinitions - Business Studies Unit 1

Enviado por

farazdrums8748Leadership: the art or process of motivating employees to carry out tasks. Democratic Leadership: virtually all authority is delegated to employees. Market research: the collection and analysis of data relating to the marketing of goods and services.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 3

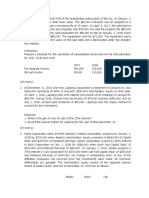

Entrepreneur: an individual Leadership: the art or Democratic Leadership:

who undertakes to supply a process of motivating decisions are made with

good or service to the employees to carry out participation of staff,

market for profit. tasks willingly and although are ultimately

effectively made by the leader.

Autocratic Leadership: Paternalistic Leadership: Laissez-faire leadership:

decisions are made entirely leader takes all the virtually all authority is

by the leader, without staff decisions, but takes a kindly delegated to employees,

participation, and orders are and supporting approach to generally when employees

expected to be followed employees. are highly skilled and

without question. enthusiastic.

Market orientation: Product orientation: Market research: the

prioritizing the customers’s prioritizing high quality and collection and analysis of

wants and needs when the business’s own data relating to the

developing products strengths when developing marketing of goods and

products. services.

Primary research: research Secondary Research: Qualitative data: in-depth

of data that has been research of data that has research into the causes of

collected specifically for the already been collected for consumer behavior,

purpose in question, either some other purpose. attitudes, tastes, etc.

by the firm itself, or by a

market research agency.

Product differentiation: to Sample: a small group of Statistical bias: a situation in

offer different variations of people from a larger group which the characteristics of

a product, or market the (population), thought to the sample do not represent

same product in different represent the characteristicsthose of the population,

ways to different segments. of the population. because more people with a

particular characteristic

were questioned.

Interviewer bias: a situation Sampling discrepancy: a Market size: the size of a

in which the behavior of situation in which the market in terms of sales,

the interviewer leads to characteristics of the sample either number of units or

inaccurate data, e.g. because do not represent the value of goods sold.

the interviewer seemed to characteristics of the

encourage a particular population.

response.

Market share: the total sales Market growth: the Market segmentation: the

of one firm in a market as a percentage increase in the division of a market into

percentage of the total sales size of a market, measured groups of consumers with

in the market. through the level of total shared characteristics, like

sales, over a period of time. age, income, etc.

Niche marketing: the Mass marketing: the Quantitative data: numerical

marketing of a product to a marketing of a product to data like market share,

single, usually small all segments of a market in market size, etc.

segment of a market. almost the same way.

Unique Selling Point: a Overdraft: permission by Market positioning:

characteristic of a product the bank to let an account studying how consumers

that makes it unique or go into debit, up to a view or perceive a product

different from competing specified limit. Interest is in relation to competing

products. charged daily on the products e.g. through

amount of overdraft. market mapping.

Adding value: converting Test marketing: launching a Stakeholder: someone who

inputs into output that is of product in a limited is affected, in monetary

greater value to consumers geographical area to asses terms of otherwise, by the

e.g. raw materials into consumer reaction to the activities of a business e.g.

finished goods. product and identify consumers, employees,

problems with the product. shareholders, those living

near factories.

Trade-off: the loss of one Retained profit: profits Loan: money lent on

opportunity as a result of made that are kept within condition that it is repaid,

taking another opportunity the business, instead of within a specific date,

e.g. choosing between being distributed among the usually with interest.

business ideas or new owners of the business.

products.

Debenture: a type of Venture capitalist: a Ordinary shares: securities

security issued for finance financier specializing in issued to the public,

by a business to the public, funding new and whereby buyers become

whereby the buyer becomes innovative, but also high part owners of the

a lender to the company, risk, businesses in exchange company, have voting

and is paid a fixed amount for shares in the business, rights when electing

of interest annually over a in the hope that the directors, and are paid

period of time. business will grow over dividends based on profits

time.

Market mapping: Leasing: hiring an asset e.g. Leaseback: selling an asset,

identifying key variables in a a machine from a leasing and immediately leasing it.

product, plotting graphically company for a specific This is used to raise finance

how competing products time, in exchange for for the business, while

are located in terms of paying rental charges. It is retaining use, but not

combining two variables, an alternative to buying the ownership, of the asset.

and identifying potential asset.

gaps.

Trade credit: credit given by Limited liability: being liable Cost based pricing: pricing

one company (e.g. a for business debts only to a product based on how

supplier) to another (e.g. a the extent of the amount much it cost to produce it,

buyer). invested in the company. and adding a profit margin.

This arises because the

business is a separate legal

entity.

Psychological pricing: an Penetration pricing: Penetration: the extent to

approach to pricing that charging a low price for a which a product has been

reflects the psychological new product in a market accepted by the total

impacts of pricing, and not with lots of competitors, in possible users, generally

just the economics of the the hope of gaining a expressed as a percentage.

situation e.g. higher prices significant market share.

= higher quality

Price skimming: charging a Fixed costs: costs that do Variable costs: costs that

very high price for a new not change with the level of change with the level of

product to make large output in the short run e.g. output, increasing when

profits, then lowering the rent more output is produced

price when competitors e.g. raw materials, wages

enter the market.

Break even point: the level Margin of safety: the excess Contribution: the amount

of output at which all costs of the level of production that a transaction generates

are covered, and no profit over the break even level. It (revenue – variable costs) to

or loss is made. is the amount by which cover fixed costs and

production can fall before a produce a profit.

loss is made.

Competitive Advantage: an

advantage gained over

competitors by offering

better value, either through

lower prices, or something

that justifies a higher price,

like better advertising or

quality.

Você também pode gostar

- Accounting As Level NoteDocumento38 páginasAccounting As Level NotedakshinAinda não há avaliações

- 2.1 Economic Systems: Igcse /O Level EconomicsDocumento13 páginas2.1 Economic Systems: Igcse /O Level EconomicsJoe Amirtham0% (1)

- Business Terms & Definitions (Self-Compiled) Chapter 1: EnterpriseDocumento34 páginasBusiness Terms & Definitions (Self-Compiled) Chapter 1: EnterpriseKim Seng Onn100% (1)

- Business A2 NotesDocumento120 páginasBusiness A2 NotesMohamedAinda não há avaliações

- PDF Igcse Economics Revision NotesDocumento58 páginasPDF Igcse Economics Revision NotesIsla Wendy100% (1)

- Article 142 Editorial BoardDocumento18 páginasArticle 142 Editorial BoardKamranKhanAinda não há avaliações

- Business Studies NotesDocumento55 páginasBusiness Studies NotesCyrus Ngugi100% (1)

- A'Level Ecos NotesDocumento342 páginasA'Level Ecos NotesBeckham T MaromoAinda não há avaliações

- Revision Checklist For AS Economics 9708 FINAL PDFDocumento10 páginasRevision Checklist For AS Economics 9708 FINAL PDFAkshaya Bhattarai100% (2)

- O Level Bs NotesDocumento19 páginasO Level Bs NotesKush GurbaniAinda não há avaliações

- Business Studies Notes For IGCSEDocumento21 páginasBusiness Studies Notes For IGCSEsonalAinda não há avaliações

- 6.1 Price Inflation: Igcse /O Level EconomicsDocumento11 páginas6.1 Price Inflation: Igcse /O Level EconomicsAditya GhoshAinda não há avaliações

- Business Studies IGCSE - Unit 1. Chapter 3. Forms of Business Org PDFDocumento8 páginasBusiness Studies IGCSE - Unit 1. Chapter 3. Forms of Business Org PDFNadine Salah El-DinAinda não há avaliações

- IGCSE Edexcel Business Studies NotesDocumento30 páginasIGCSE Edexcel Business Studies NotesEllie Housen100% (1)

- IGCSE Economics Notes Units 1 and 2Documento10 páginasIGCSE Economics Notes Units 1 and 2Venkatesh RaoAinda não há avaliações

- BUSINESS AS and A Level NOTES CIE SYLLAB PDFDocumento29 páginasBUSINESS AS and A Level NOTES CIE SYLLAB PDFPrashant Joshi50% (2)

- Business Studies Unit 1,2,4Documento130 páginasBusiness Studies Unit 1,2,4Ujjal Shiwakoti50% (4)

- Economics Unit 1 Revision NotesDocumento32 páginasEconomics Unit 1 Revision NotesJohn EdwardAinda não há avaliações

- Caie Igcse Economics 0455 Definitions v1Documento8 páginasCaie Igcse Economics 0455 Definitions v1Emma WangAinda não há avaliações

- Edexcel AS Business Studies Unit 1 NotesDocumento37 páginasEdexcel AS Business Studies Unit 1 NotesShafik9698% (56)

- Business 9609 AS Chapter 1 Notes PDF For 2023Documento16 páginasBusiness 9609 AS Chapter 1 Notes PDF For 2023khalid malik100% (1)

- CIE AS Level Business Studies NotesDocumento19 páginasCIE AS Level Business Studies NotesGharf Sz75% (8)

- ASAL Economics TR Worksheet AnswersDocumento39 páginasASAL Economics TR Worksheet AnswersMatej MilosavljevicAinda não há avaliações

- Igcse Economics NotesDocumento6 páginasIgcse Economics NotesMunni Chetan0% (1)

- IGCSE ECONOMICS: Trade UnionDocumento2 páginasIGCSE ECONOMICS: Trade Unionkbafna28100% (1)

- Business Studies As Level Notes 9609Documento74 páginasBusiness Studies As Level Notes 9609SAI100% (2)

- Complete A2 Business NotesDocumento59 páginasComplete A2 Business NotesJawad Nadeem100% (1)

- 9609 Business Paper 1 Example Candidate ResponsesDocumento48 páginas9609 Business Paper 1 Example Candidate ResponsesNikoletaAinda não há avaliações

- The Growth of FirmsDocumento12 páginasThe Growth of FirmsAditya GhoshAinda não há avaliações

- IGCSE Economics IntroDocumento16 páginasIGCSE Economics IntrosilAinda não há avaliações

- A Level Accounting NotesDocumento16 páginasA Level Accounting NotesChaiwatTippuwananAinda não há avaliações

- A-Levels Business Studies - UNIT 3, NotesDocumento10 páginasA-Levels Business Studies - UNIT 3, NotesRafay Mahmood100% (4)

- A Level Business Studies (1) - 2Documento58 páginasA Level Business Studies (1) - 2Beckham T Maromo100% (1)

- Skills Exercises Analysis (AO3) and Evaluation (AO4) : Cambridge International AS & A Level Business 9609Documento49 páginasSkills Exercises Analysis (AO3) and Evaluation (AO4) : Cambridge International AS & A Level Business 9609Heeyeon KimAinda não há avaliações

- Caie A2 Business 9609 Theory v1Documento41 páginasCaie A2 Business 9609 Theory v1Tapiwa RusikeAinda não há avaliações

- Business A Level Revision Notes Series A PDFDocumento30 páginasBusiness A Level Revision Notes Series A PDFruvimbo shoniwaAinda não há avaliações

- IGCSE Business Studies Terms GlossaryDocumento15 páginasIGCSE Business Studies Terms GlossaryJayakumar Sankaran67% (3)

- A Level Business Studies Made Easy (Repaired) (Repaired) 1Documento225 páginasA Level Business Studies Made Easy (Repaired) (Repaired) 1Munesuishe ChambokoAinda não há avaliações

- Chapter 6 Motivating WorkersDocumento5 páginasChapter 6 Motivating WorkersSamanthaYau100% (2)

- CIE IGCSE Unit 3.3 - Workers - Occupations, Earnings and The Labour Market - Miss PatelDocumento19 páginasCIE IGCSE Unit 3.3 - Workers - Occupations, Earnings and The Labour Market - Miss PatelJingyao HanAinda não há avaliações

- A-Levels Business Studies - Unit 4, NotesDocumento12 páginasA-Levels Business Studies - Unit 4, NotesRafay Mahmood88% (8)

- O Level Economics SyllabusDocumento17 páginasO Level Economics SyllabusMehreen KhurshidAinda não há avaliações

- Igcse Economics Revision Checklist PDFDocumento4 páginasIgcse Economics Revision Checklist PDFRajeev SinghAinda não há avaliações

- IGCSE ECONOMICS: Spending, Saving and BorrowingDocumento2 páginasIGCSE ECONOMICS: Spending, Saving and Borrowingkbafna28100% (3)

- CIE AS Level Business Studies NotesDocumento19 páginasCIE AS Level Business Studies NotesHassan Asghar100% (1)

- 0450 - 1.3 Enterprise, Business Growth and SizeDocumento15 páginas0450 - 1.3 Enterprise, Business Growth and SizeCherylAinda não há avaliações

- Business Studies Notes For o LevelDocumento2 páginasBusiness Studies Notes For o LevelNuzhat TariqAinda não há avaliações

- Edexcel Economics AS NOTEDocumento30 páginasEdexcel Economics AS NOTEFarhan Ishrak AhmedAinda não há avaliações

- O Level IGCSE Accounting Notes Final NauDocumento14 páginasO Level IGCSE Accounting Notes Final NauRoshan RamkhalawonAinda não há avaliações

- IB Business Management NotesDocumento11 páginasIB Business Management NotesuzairAinda não há avaliações

- A Level Economics Definitions by Wei SengDocumento10 páginasA Level Economics Definitions by Wei Sengkamla sawmynadenAinda não há avaliações

- Exam Igcse Eco CDDocumento9 páginasExam Igcse Eco CDMarisa VetterAinda não há avaliações

- IGCSE ECONOMICS: Factor PaymentsDocumento2 páginasIGCSE ECONOMICS: Factor Paymentskbafna28100% (1)

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersNo EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersNota: 2 de 5 estrelas2/5 (4)

- A level Economics Revision: Cheeky Revision ShortcutsNo EverandA level Economics Revision: Cheeky Revision ShortcutsNota: 3 de 5 estrelas3/5 (1)

- Business Studies Glossary PDFDocumento8 páginasBusiness Studies Glossary PDFAbdulaziz SaifuddinAinda não há avaliações

- Entrep Finals Reviewer - 124143Documento5 páginasEntrep Finals Reviewer - 124143midgeedine.navarroAinda não há avaliações

- KEY TERMS TechnoDocumento3 páginasKEY TERMS TechnoShania KayeAinda não há avaliações

- Business and The Social EnvironmentDocumento19 páginasBusiness and The Social EnvironmentPiran UmrigarAinda não há avaliações

- Aditya Birla Group: Presented by Smriti Dureha Sims CollegeDocumento9 páginasAditya Birla Group: Presented by Smriti Dureha Sims CollegeSmriti DurehaAinda não há avaliações

- Final ExamDocumento5 páginasFinal ExamSultan LimitAinda não há avaliações

- CFR Full NotesDocumento84 páginasCFR Full Notespooja sonu100% (1)

- PenswastaanDocumento11 páginasPenswastaanRidawati LimpuAinda não há avaliações

- VSA Cheat SheetDocumento1 páginaVSA Cheat Sheetne30n250% (2)

- Partnership Dissolution and LiquidationDocumento4 páginasPartnership Dissolution and Liquidationkat kaleAinda não há avaliações

- Anti Take Over Tactics Merger and AcquisitionDocumento29 páginasAnti Take Over Tactics Merger and AcquisitionMuhammad Nabeel Muhammad0% (1)

- Duxbury Clipper 2010-30-06Documento40 páginasDuxbury Clipper 2010-30-06Duxbury ClipperAinda não há avaliações

- Balance Sheet of Indian Oil Corporation PDFDocumento5 páginasBalance Sheet of Indian Oil Corporation PDFManpreet Kaur SekhonAinda não há avaliações

- Form Credit Application NewDocumento2 páginasForm Credit Application NewRSUD AnugerahAinda não há avaliações

- 10.7 Mechanical Theories of The Money SupplyDocumento7 páginas10.7 Mechanical Theories of The Money SupplyHashifaGemelliaAinda não há avaliações

- Ba 224 Module 4Documento3 páginasBa 224 Module 4Honeylet PangasianAinda não há avaliações

- (B) They Share A Majority of Their Common Assets and (C) They Have CommonDocumento5 páginas(B) They Share A Majority of Their Common Assets and (C) They Have CommonSab0% (1)

- Coaching Assembly - Interview AnswersDocumento4 páginasCoaching Assembly - Interview Answersmiraj93Ainda não há avaliações

- Receipt Cum Undertaking LetterDocumento4 páginasReceipt Cum Undertaking LetterSrikanth DogiparthiAinda não há avaliações

- BSBFIM601 Manage FinancesDocumento5 páginasBSBFIM601 Manage FinancesCindy Huang0% (2)

- Broker Business PlanDocumento18 páginasBroker Business PlanJulie FlanaganAinda não há avaliações

- Midterm Test No2 - JIB60 1Documento1 páginaMidterm Test No2 - JIB60 1k60.2112520041Ainda não há avaliações

- Chapter-14 Accounting For Not For Profit Organization PDFDocumento6 páginasChapter-14 Accounting For Not For Profit Organization PDFTarushi Yadav , 51BAinda não há avaliações

- Employee EngagementDocumento25 páginasEmployee EngagementPratik Khimani100% (4)

- Residential Valuation Sydney SampleDocumento6 páginasResidential Valuation Sydney SampleRandy JosephAinda não há avaliações

- Dissolution Deed FormatDocumento2 páginasDissolution Deed FormatMuslim QureshiAinda não há avaliações

- RSWM 3QFY24 PresentationDocumento32 páginasRSWM 3QFY24 PresentationAnand SrinivasanAinda não há avaliações

- Hedge Funds: Origins and Evolution: John H. MakinDocumento17 páginasHedge Funds: Origins and Evolution: John H. MakinHiren ShahAinda não há avaliações

- EFim 05 Ed 3Documento23 páginasEFim 05 Ed 3bia070386100% (1)

- Valuation VariantDocumento4 páginasValuation Variantsrinivas50895Ainda não há avaliações

- Patels Airtemp (India) LimitedDocumento5 páginasPatels Airtemp (India) LimitedAnkit LohiyaAinda não há avaliações

- Summary SheetDocumento7 páginasSummary SheetAbdullah AbualkhairAinda não há avaliações

- Theories of Exchange RateDocumento47 páginasTheories of Exchange RateRajesh SwainAinda não há avaliações

- Dealer Management System v2.3.Xlsx - GetacoderDocumento19 páginasDealer Management System v2.3.Xlsx - Getacoderapsantos_spAinda não há avaliações