Escolar Documentos

Profissional Documentos

Cultura Documentos

The Daily Advertiser 10-8-07 MoneyMakeover

Enviado por

bobmoser3330 notas0% acharam este documento útil (0 voto)

171 visualizações2 páginasThe Daily Advertiser in Lafayette, La., on Nov. 8, 2007, story on personal finance and getting out from underneath massive debt.

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe Daily Advertiser in Lafayette, La., on Nov. 8, 2007, story on personal finance and getting out from underneath massive debt.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

171 visualizações2 páginasThe Daily Advertiser 10-8-07 MoneyMakeover

Enviado por

bobmoser333The Daily Advertiser in Lafayette, La., on Nov. 8, 2007, story on personal finance and getting out from underneath massive debt.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 2

2 ‘Photos by Losile Westhrock/Iwestbrock@theadvertiser.com

Shelley Stely stands surrounded by packed bores in her apartment Friday afternoon. Stely was packing to move from her Lafayette apartment to a

rental home in Opelousas, where she'll save about $60 per month on rent and $100 on day care.

Fundi

Drowning in

debt puts a halt

on savings plan

Bob Moser

bmoser@theadvertisercom

Shelley Stelly's eyes well up

at the thought of saving for

her or her daughter's future,

She's barely paying the

bills now, drowning in $47,514

of credit-card and medical

debt while cutting almost

every “want” from her month-

tomonth lifestyle. Little

Molly, 3, deserves more than

the $0.19 rusting away in her

mom's savings account,

“Idon't even know where to

start,” said Stelly, her head

sunk in hands at the kitchen

table on Sept. 28. She and Carl

Kephart, ‘adviser with

Primerica Financial Service

met in Stelly’s home as part of

The Daily Advertiser's Money

Makeover series,

She was packing to move

ym her Lafayette apartment

toa rental home in Opelousas

where she'll save about $60 per

LOOKING FOR HELP?

Looking for free finan-

ial help for yourself or

your family? The Daily

Advertiser wants to help

‘connect you with a finan

cial adviser fora new

series of business stores,

Email or call repo

Bob Moser at bmoser@the

‘advertisercom, or 371-

3362. We'd like to hear a

bref description of your

‘current financial goals and

challenges,

We may select you as a

subject fora future story,

during which you will

recelve financial planning

service from a local profes-

sional. Some of your finan

« Cial information and the

‘acviser's recommenda.

tions will appear in the

‘newspaper, along with a

Picture, if you're chosen,

's Stelly’s second move

within six months to free up

money.

At age

‘Seo FUNDING on Page 38

oT

Continued from Page 1B

Funding

behind on saving for retire:

ment or Molly's future, But

Stelly can't do that until she

makes a dent in her debt,

which she'd pay off in 2034 at

$1,083 per month, her current

pace that just covers all the

minimums due.

“[have to be in a different

situation within five years,”

she told Kephart. “I'll do

‘whatever you tell me to do.”

Stelly’s story sounds rare,

but only because so few

‘Americans in debt seek help.

‘The average American

household with at least one

credit card has nearly $9,200

in debt (US. families average

seven cards), according to

CardWeb.com. Consumer

credit-card debt has nearly

tripled in the last, 20 years,

from $238 billion in 1989 to

$800 billion in 2005, according.

to an analysis of federal data

by Demos, a national research

and consumer advocacy

-oup.

‘Much of Stelly’s debt has

built recently through little

more than bad breaks.

‘She remembers under-

spending in college and built

good credit up until she was

married, But two health emer-

gencies in three years racked

Up hospital bills, and she ,

inherited debt from her hus:

band following a divorce one

year ago.

‘Necessities like food and

gas are getting more. expen

sive, and health insurance at

the law firm where Stelly

‘works has changed and now

costs more.

“Medical, food and house-

hold costs in the US. have

gone up 11 percent in the past

five years while wages have

stagnated since 2001, accord:

ing to the Center for

American Progress and

Newsweek.

Stelly has found ways to

cut costs. She takes advantage

‘of Angel Food Ministries, @

food co-op at Life Church of

Lafayette (6408 Johnston St.)

‘where anyone can pay $25 for

2 box of name-brand gro-

ceries valued at $55 to $60.

‘She also canceled her

health insurance (though kept

‘Molly on), and finds free activ-

ities to do with her daughter

‘But Kephart gave her anew

game plan to budget and pay

off debt that, though painful

at first, may be the antidote to

hopelessness that Stelly said

she’s sought for so long.

‘She'll begin “debt-stack

ing,” paying off the smallest

debts first and reapplying that

money to the next,

‘The hammer she'll use to

mock out debts grows larger

this way, and it's a confidence

boost to see entire bills disap-

pear. If Stelly stops charging

on the cards now she'll be

debt-free by 2012 on this plan,

saving $17,000 in interest pay-

ments from the way she pays

now.

“Having a plan like that to

control yourself and to see it

fn black and white for the first

time, well that’s huge,” said

Stelly, of the chance to shave

22 years off her debt-free date.

k

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Financing Brazil Biomass-Based EnergyDocumento3 páginasFinancing Brazil Biomass-Based Energybobmoser333Ainda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Brazil Wind Power Eyes Strong Year at 2014 AuctionsDocumento5 páginasBrazil Wind Power Eyes Strong Year at 2014 Auctionsbobmoser333Ainda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Smart Grid Projects Progress Slowly in BrazilDocumento3 páginasSmart Grid Projects Progress Slowly in Brazilbobmoser333Ainda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- BrazilAirports March2012 FutureAirportDocumento2 páginasBrazilAirports March2012 FutureAirportbobmoser333Ainda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Brazil's Airports - Speak Up 292Documento1 páginaBrazil's Airports - Speak Up 292bobmoser333Ainda não há avaliações

- PS June 2012 - BrazilLaborDocumento2 páginasPS June 2012 - BrazilLaborbobmoser333Ainda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- PS Nov 2011 - pp18 - 19 - 21 - 23Documento4 páginasPS Nov 2011 - pp18 - 19 - 21 - 23bobmoser333Ainda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Speak Up #273 - American Basketball in BrazilDocumento2 páginasSpeak Up #273 - American Basketball in Brazilbobmoser333Ainda não há avaliações

- The Daily Advertiser 11-14-07 Tyson BiodieselDocumento4 páginasThe Daily Advertiser 11-14-07 Tyson Biodieselbobmoser333Ainda não há avaliações

- The Drinks Business - Brazil Cachaca Nov 2011Documento2 páginasThe Drinks Business - Brazil Cachaca Nov 2011bobmoser333Ainda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Cachaca Exports From Brazil-SpeakUpFebruary2011Documento1 páginaCachaca Exports From Brazil-SpeakUpFebruary2011bobmoser333Ainda não há avaliações

- BrazilUSshopping SpeakUpDecember2010Documento2 páginasBrazilUSshopping SpeakUpDecember2010bobmoser333Ainda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- PelletMillMagazine-Spring2011 BrazilBagasseDocumento7 páginasPelletMillMagazine-Spring2011 BrazilBagassebobmoser333Ainda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- SpeakUp Favelas Oct2011Documento1 páginaSpeakUp Favelas Oct2011bobmoser333Ainda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Forum Newsletter June 2010Documento16 páginasForum Newsletter June 2010bobmoser333Ainda não há avaliações

- March 2010 Issue of Forum NewsletterDocumento16 páginasMarch 2010 Issue of Forum Newsletterbobmoser333Ainda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- April 2010 Issue of Forum NewsletterDocumento9 páginasApril 2010 Issue of Forum Newsletterbobmoser333Ainda não há avaliações

- AmSoc Forum November 2009Documento16 páginasAmSoc Forum November 2009bobmoser333Ainda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- AmSoc Forum February 2010Documento16 páginasAmSoc Forum February 2010bobmoser333Ainda não há avaliações

- The Daily Advertiser 2-2-07 GlobalWarmingDocumento2 páginasThe Daily Advertiser 2-2-07 GlobalWarmingbobmoser333Ainda não há avaliações

- The Daily Advertiser 12-9-07 Lacassine SorghumDocumento2 páginasThe Daily Advertiser 12-9-07 Lacassine Sorghumbobmoser333Ainda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- December Forum NewsletterDocumento16 páginasDecember Forum Newsletterbobmoser333Ainda não há avaliações

- The Daily Advertiser 7-29-07 Sweet SorghumDocumento2 páginasThe Daily Advertiser 7-29-07 Sweet Sorghumbobmoser333Ainda não há avaliações

- The Daily Advertiser 1-26-08 SportsParkDocumento2 páginasThe Daily Advertiser 1-26-08 SportsParkbobmoser333Ainda não há avaliações

- The Daily Advertiser 2-2-07 GlobalWarmingDocumento2 páginasThe Daily Advertiser 2-2-07 GlobalWarmingbobmoser333Ainda não há avaliações

- The Daily Advertiser 10-27-07 House FireDocumento1 páginaThe Daily Advertiser 10-27-07 House Firebobmoser333Ainda não há avaliações

- The Daily Advertiser 4-8-07 Housing MarketDocumento4 páginasThe Daily Advertiser 4-8-07 Housing Marketbobmoser333Ainda não há avaliações

- The Daily Advertiser 2-12-07 CypressDocumento2 páginasThe Daily Advertiser 2-12-07 Cypressbobmoser333Ainda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Daily Advertiser 2-12-07 CypressDocumento2 páginasThe Daily Advertiser 2-12-07 Cypressbobmoser333Ainda não há avaliações

- Arens14e Ch02 PDFDocumento36 páginasArens14e Ch02 PDFlaksmitadewiasastaniAinda não há avaliações

- 2023 15 11 18 42 18 Statement - 1700053937963Documento32 páginas2023 15 11 18 42 18 Statement - 1700053937963Anand RajAinda não há avaliações

- Management Theory and PracticesDocumento15 páginasManagement Theory and Practicessajidsfa100% (2)

- CH 22 Acc Changes & Error Edited PDFDocumento65 páginasCH 22 Acc Changes & Error Edited PDFStefanAinda não há avaliações

- Taxation Law Bar Exam Questions 2011 AnswersDocumento14 páginasTaxation Law Bar Exam Questions 2011 AnswersYochabel Eureca BorjeAinda não há avaliações

- Bookkeeping FinalDocumento67 páginasBookkeeping FinalKatlene JoyAinda não há avaliações

- IM ACCO 20173 Business and Transfer Taxes Module 5 PDFDocumento5 páginasIM ACCO 20173 Business and Transfer Taxes Module 5 PDFMakoy BixenmanAinda não há avaliações

- Articles of IncorporationDocumento8 páginasArticles of IncorporationMingAinda não há avaliações

- Bhaichung BhutiyaDocumento8 páginasBhaichung BhutiyaPriyankaSinghAinda não há avaliações

- Stephen Beach IFRS Lae PDFDocumento1 páginaStephen Beach IFRS Lae PDFGikamo GasingAinda não há avaliações

- LTD Offer 2019 EurDocumento2 páginasLTD Offer 2019 EurkatariamanojAinda não há avaliações

- CHAPTER 4 Partiner ShipDocumento22 páginasCHAPTER 4 Partiner ShipTolesa Mogos100% (1)

- Departmental Directory IncometaxDocumento362 páginasDepartmental Directory IncometaxShubham SinuAinda não há avaliações

- Oblicon Memory AidDocumento25 páginasOblicon Memory Aidcmv mendozaAinda não há avaliações

- EJERCITO Vs SANDIGANBAYANDocumento2 páginasEJERCITO Vs SANDIGANBAYANeAinda não há avaliações

- Reading 32 Introduction To Commodities and Commodity DerivativesDocumento5 páginasReading 32 Introduction To Commodities and Commodity Derivativestristan.riolsAinda não há avaliações

- 11 NIQ Soil Testing PatharkandiDocumento2 páginas11 NIQ Soil Testing Patharkandiexecutive engineer1Ainda não há avaliações

- Day 1 PM - SEC Rules Updates and Common SEC Findings PDFDocumento144 páginasDay 1 PM - SEC Rules Updates and Common SEC Findings PDFNelson GarciaAinda não há avaliações

- NIMIR Chemicals Annual Report 2016Documento104 páginasNIMIR Chemicals Annual Report 2016Nisar Akbar KhanAinda não há avaliações

- Cost Accounting Methods Practiced by The Infomal Sector in Nigeria2 ReviewDocumento18 páginasCost Accounting Methods Practiced by The Infomal Sector in Nigeria2 ReviewAnonymous D8PyLCAinda não há avaliações

- LAW 20013 Law On Obligations and Contracts Midterm ReviewDocumento14 páginasLAW 20013 Law On Obligations and Contracts Midterm ReviewNila Francia100% (1)

- Fixed Income Portfolio Management CourseworkDocumento2 páginasFixed Income Portfolio Management CourseworkJoel Christian MascariñaAinda não há avaliações

- Community and Management Skills TrainingDocumento42 páginasCommunity and Management Skills TrainingAdnan AkramAinda não há avaliações

- Accenture V Commission G.R. 190102 (Digest)Documento3 páginasAccenture V Commission G.R. 190102 (Digest)mercy rodriguezAinda não há avaliações

- EF3e Int Filetest 2aDocumento6 páginasEF3e Int Filetest 2aJhony EspinozaAinda não há avaliações

- CitiBank ScamsDocumento28 páginasCitiBank ScamsAeman WaghooAinda não há avaliações

- Kotak Mahindra Bank Limited Standalone Financials FY18Documento72 páginasKotak Mahindra Bank Limited Standalone Financials FY18Shankar ShridharAinda não há avaliações

- T MobileDocumento1 páginaT MobileMelissa AnneAinda não há avaliações

- A Study On Working Capital Management With Reference To The India Cements LimitedDocumento10 páginasA Study On Working Capital Management With Reference To The India Cements LimitedEditor IJTSRDAinda não há avaliações

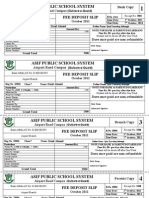

- Asif Public School System: Fee Deposit SlipDocumento1 páginaAsif Public School System: Fee Deposit SlipIrfan YousafAinda não há avaliações