Escolar Documentos

Profissional Documentos

Cultura Documentos

Bangladesh - Steel Market

Enviado por

Hasan BazmiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Bangladesh - Steel Market

Enviado por

Hasan BazmiDireitos autorais:

Formatos disponíveis

Ctg-based large mills move fast on long-steel Mushir Ahmed The countrys major steel mills, based in Chittagong,

have moved very fast in billet manufacturing in a multi-billion taka investment drive that will largely determine who influences most the future of a fast-growing rod market in Bangladesh. Industry leader Abul Khaer Group triggered the race after it opened its letter of credits (LCs) for machinery import for a US$130 million billet plant at its steel hub in Sitakundu, sources said. The billet plant will be the largest steel plant in the country, having the capacity to meet all of AKs 800,000 tonne capacity long-steel making unit. Billet is an intermediate steel product, mainly produced by melting iron ore. It is melted to make rod or other long steel products. Bangladesh has several small billet plants, accounting for only 10 per cent of its need. PHP, a leading player in steel sheet and an old rival of AK, joined the investment drive in long steel late last year, buying the countrys first private TMT steel plant at Ghorasal for Taka 800 million. Kabir Steel started its 400,000 tonne top-grade rod plant last month and has unveiled plan to set up its own billet unit later this year a move it says is a must to stay competitive in the fast-changing sector. BSRM, another of the countrys leading rod manufacturer, said it was watching the gas and energy scenario too closely and has put a plan in place to raise capacity of its billet and rod plants. Industry players said a growing uncertainty over the scrap industry stemming from a slew of law-suits by environmental campaigners against shipbreakers mainly prompted large steel mills to make rapid inroad in long-steel. Traditionally, re-rolled scrap irons used to dominate the countrys long-steel market. But it seems they are hit by one problem after another, said Mohammad Shahjahan, owner of Kabir Steel. Now the top four-five players alone can make up more than 80 per cent of the countrys three million tonne long-steel market, he said, adding quality of their steel is also far superior to the re-rolled rods. Kabir Steel, known as KSRM, last month opened its Taka 4.0 billion top-grade 400,000 tonne steel plant at Sitakundu, raising its total capacity to about 600,000 tonnes a year. It is also planning to go big in billet manufacturing.

Having a billet plant gives you price advantage, makes you competitive over your rivals and hedges you from volatile billet prices in international market, he said. Sources said the recent jumpy prices of steel raw materials was the main reason why AK has moved fast to build the countrys largest billet plant with nearly Taka 10 billion investment. The plant would be the biggest private sector investment by a Bangladeshi group, according to bankers, and it will help the group take a firm grip in $2.0 billion long steel market. Its a clever ploy by the group to move into billet manufacturing with such a massive investment. Their sudden move has left most of their rivals in the lurch, said a source, who is familiar with AKs steel ambition. Experts said the move is a repetation of what AK and its Chittagong-based rival PHP did in corrugated iron (CI) sheet business back in the late 1990s. PHP set up the countrys first Cold-rolled steel coil plant in 1998, which gave them a large advantage over rival CI sheet manufacturers. CI sheet is known as tin in Bangladesh. Until then, Bangladeshi CI sheet manufacturers would import CR Coil and slice it into CI sheets. Fearing that the Coil plant will help PHP dictate local tin market, AK soon set up its own coil factory to remain competitive. Todays race for billet manufacturing is similar to what happened in CR Coil in late 1990s and early 2000s. After PHP and AK, others such as KDS and S Alam set up their own coil plants, said the source. By going into coil making, big CI sheet manufacturers consolidated their backward linkwage, leading to the deaths of scores of CI sheet makers who failed to build their own CR plant. AK officials could not be contacted for comments as the firm has always been secretive about investment plan. But a source said AK has set aside worries over gas and power to move ahead in billet manufacturing. Zahirul Islam, a director of PHP, said the company has taken up a three-year plan to match the main players in long-steel following its acquisition of AMK Steel plant at Ghorasal. The market for long-steel has been growing at 10-15 per cent for the last few years. And in the near future we see the market growing even faster, Mr. Islam told the FE. The group has renamed the AMKs 100,000 tonne plant into PHP Espat and is now planning to raise its capacity three-four fold within a couple of years. We want to do things in phases. We have just started production at the plant. But obviously, we have to go into billet and raise capacity to stay competitive in the market, he said.

Amirhussein Akbarali of BSRM, the main top-grade rod player until AK, KSRM and PHP gate-crashed into the scene, said the company would rather wait and see how the situation evolves. The company has a 25,000 tonne-a-month billet plant, which rougly meets half of the companys annual need. The Chittagong-based firm plans to raise capacity significantly once the gas and power crisis eases. There is no doubt that our long-steel market is poised for a big growth as the construction industry booming fast, Mr. Amirhussein, the BSRM chief executive officer, told the FE last week, But unless the energy situation improve, I dont see how you can go big in new steel plant. A medium sized billet plant can alone consume 20-30 megawatt power. And that is quite a big amount of power, he said. Still, the CEO of BSRM has kept his fingers crossed for further investment in both billet and long-steel in the near future because of the growing apetite for quality steel products in the country.

Shakhawat Hossain The countrys steel industry has been getting continuous investment boom due to steady demands. Steel manufacturers see no major negative impact on their industry as they believe the countrys economy will keep its impressive growth despite the global financial recession. They said the country with nearly six per cent growth in the last three years provides enough clues to consume higher production of mild steel rod to be generated by the big players with their proposed new investments. The rod industry will not face major problem due to growing investment in the sector, said Bangladesh Steel Re-rolling Mills chairman Ali Hossain Akbar Ali. Chance is slim even for the small players to become sick as the growing consumption rate of steel will remain in the coming years despite global financial recession, he told New Age. BSRM, producer of high-grade steel, makes up more than 25 per cent of the total demand. It is now on trial production in its newly installed 3,00,000-tonne plant, set up at a cost of over Tk 3.5 billion. It has also unveiled plans to invest another Tk 500 crore to raise its capacity to around one million tonnes within the next five years. Following the footstep of the company, Kabir Steel and Re-rolling Mills is setting up a 3,00,000-tonne mild steel rod plant in Chittagong. KSRM announcement came just a month after the countrys largest conglomerate, Abul Khayer Group, formally entered the sector, unveiling a Tk 700 crore investment for an 8,00,000-tonne plant. Bashundhara Group, the realtor-turned-tissue to paper giant, also expressed its intention to set up an integrated steel plant. Another Chittagong based mill Ratanpur Steels and Re-rolling Mills has said it has started marketing 75-grade mild steel rod since late last year from its Tk 200 crore state-ofthe-art steel factory. Trade experts and bankers, however, expressed concern that the latest investment boom in rod, a key construction component, will outpace the countrys annual demand for rod and might result in investment glut.

Dismissing such apprehension Akbar Ali said the countrys economic growth was good enough to consume the new and higher steel production that even raised no fear even for the existence of small players of the market. He, however, foresees an intense competition in future due to possible price war which will eventually benefit the consumers. Sheikh Masudul Alam, former general secretary of the Bangladesh Re-Rolling Mills Association, said he did not see any problem in new investment for the small players who were dominating the market with more than 70 per cent share. The consumption of rod will be double in near future which will allow new investors sufficient breathing space, he said. Sensing a fierce competition in the future rod market the small players are re-fixing their strategies. Many of them are adopting technology to produce high-grade rod, he added. The countrys fast growing construction industry uses nearly 25 lakh tonnes of rods every year, the market price of which is Tk 1,000 crore. More than 200 re-rolling and steel mills are producing steel products by using imported and locally available ship scraps. Only a few steel factories use imported billet to produce high quality mild steel rod.

Sarwar A Chowdhury Golam Mostafa, a 55 scaling machine operator at an automated steel melting and re-rolling factory, stood just outside his office as a lorry with a 40-foot container boarded the scaling machine. Briefly, Mostafa looked like a toy beside the giant truck, before he went into the office room and weighed the 36-tonne lorry. The giant lorry then went to the nearby unloading area, where it became a toy next to the mountains of scrap metal. The enormity of a steel factory dwarfs any others, saves perhaps for supertankers. As some workers unload scrap, others are busy liquefying it to make ingot, a long rod that is cast before processing. Still others carry ingots to a platform where workers push the rods onto an automatic belt leading to a huge gas oven. Even several feet away, the 1,260C heat can sear as it melts the ingots into a deep orange glow, before the melted metal moves to an automatic re-rolling machine where sparks fly like a laser show. Many entrepreneurs in the flourishing steel industry are converting from manual to automatic factories, or setting up automated ones, at a time when steel is in demand in Bangladesh and worldwide. Although the first automation in the Bangladesh steel industry took place in the 1980s, the trend accelerated in recent years. Counting small up to the largest scale of mills, there are about 150 steel smelting and rerolling factories across the country, of which so far around 35 are automated, says Masadul Haque Masud, president of Bangladesh Automatic Steel and Re-rolling Mills Association. Many are also doing balancing, modernisation, renovation and expansion or BMRE to convert manual plants to automatic. Kabir Steel, Ahmed and Brothers, Salam Steel and Kalam Steel are all doing BMRE now, says Masud. Years ago, Masud decided to set up an automated steel and re-rolling plant, but the work is still ongoing. It takes two to five years to set up an automatic plant, and the cost range between Tk 100 crore to Tk 3,000 crore, depending on the plant size and production capacity, he says. There is a pay-off for the big investment and lead-time: productivity. Automatic plants produce better steel, have higher capacities and lower production costs. Soon, many believe, manual factories will prove unsustainable in the competitive market. The manual steel plants are also often hazardous to life and the environment, Masud says. But, in the automatic plants it is not so. Masud says conversions are now preferred, as new steel mills face long waits for gas connections, because the government has all but stopped giving gas to new factories. Bangladesh steel factories mostly produce deformed bar rod, angel, channel and coil for the construction industry. They use different types of raw materials; such as ingot and billet, to manufacture rod, angel and channel; cold-rolled sheet is used to produce coil.

The factories melt ship scraps for ingot, while billet and sheet is imported. One leading steel company is planning a hot-rolled plant, the basic industry of the steel sector abroad. We are planning to establish a hot-rolled plant, and it will be a milestone in the Bangladesh steel industry, says Abdus Salam, vice-chairman and director of S Alam Group, which owns S Alam Cold Rolled Steel Mills. There is no precise figure for the nations demand for steel, yet industry people say the domestic industry can meet the current demand. Approximately, the local demand for steel products is about 25 lakh tonnes per year, according to Aameir Alihussain, managing director of BSRM Steel Mills. It is even possible to export steel items, especially to the seven sisters of eastern India, if the sector gets proper policy support. Whether it is construction or industrial goods, steel is one of the main ingredients of economic progress in a nation. Steel is highly recyclable once it is first produced from iron ore, a raw material abundant around the world. Even after decades of use, it can be sent back to the furnaces as scrap, melted and remade into new steel. Bangladeshi steel entrepreneurs are now on the track to modernise their plants with automation, marking a new era for the industry.

Bangladesh has about 295 manufacturing units. Of these, 293 are fully indigenously owned and two are foreign or joint ventures. The countrys steel products include billets, finished long products like buyer rods, rebars, plain rounds, squares, plates, hot-rolled and cold-rolled coils and sheets, and galvanised sheets.

Domestic demand for steel in 2003 was 4 million tonnes per annum (mtpa) and estimated 5.1 mtpa in 2007. The ship breaking industry is the main source of raw material for the steel industry, since Bangladesh does not have a domestic source of iron ore, though it has about 2.5 billion tonnes of high-quality coal deposits.

But the steel industry faces the problem of rising prices of imported steel owing to rising global steel prices. The government wants to privatize some state-owned iron and steel producing mills, including the Dhaka Steel Works, Chittagong Steel Mill, and others

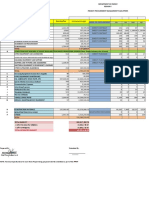

IRON AND STEEL SECTOR AT A GLANCE Number of Steel Plants 100% Local Ownership 100% Foreign /Joint Venture Projects registered with BoI Estimated domestic Demand (tpa in 2003) Estimated Domestic Demand (tpa in 2007 Installed capacity (tpa) 295 293 2 70 4.0 mn 5.1 mn 2.5 mn

Estimated production of steel products was 80,000 metric tons in 2002 down from 90,000 metric tons in 1998. Similarly, production of crude steel ingots declined from 35,000 tons to 30,000 tons during 1998-02. Ship-breaking industry is the main source of raw material for the steel industry. The country does not have domestic source of iron ore. Rising prices of international ships has affected ship-breaking industries. Many ship breaking units in Chittagong have closed down. Bangladesh has about 2.5bn. tons of coal deposits of high quality. Steel industry faces problem of irregular power supply. The country faces problem of rising prices of imported steel due to rising global steel prices.

Government wants to privatize some of the state owned iron & steel producing mills including Dhaka Steel Works Ltd., Prince Iron, Dhaka, Chittagong Steel Mill etc

FE Report The country's steel sector is set for major consolidation as the country's largest conglomerate Abul Khaer has started constructing Bangladesh's biggest mild steel rod plant with an investment of around Tk 7.00 billion, company officials said Monday. The Chittagong-based group has opened a letter of credit to import Chinese machinery for the 800,000 tonnes plant, which will be at least two and half times more than its nearest competitor, officials added. Islami Bank Bangladesh Limited is financing the plant at Sitakundu which will use the latest Thermo-Mechanically-Treated technology to produce 60-grade Mild Steel (MS) rod, the main component in a building. "It will have an integrated melting facility to turn iron ore into billet and then to mild steel rod. It will also have a 74 meg-watt power plant," a senior official of the company said. "It will start operation in the first quarter of 2009," he said, adding the company has bet big in steel because the per capita iron consumption in Bangladesh still remains a low three kilogram, one-fifth of India. Banking sources said the plant is the largest private investment in the country, dwarfing the sugar refineries and the new power plants being constructed by Summit and Youth Group. This is also the largest investment in the country's steel sector. Bangladesh Steel and Rerolling Mills (BSRM) is the main player in the rod business, but its latest plant, which starts operation later this month and uses the TMT technology, can produce only 300,000 tonnes of MS Rod. "On completion, the plant will be able to meet one-third of the country's total demand for rod. It will change the way rod business is done in the country," a banker said. Bangladesh has an annual demand for 2.5 million tonnes of mild steel rod, more than 80 per cent of which are low quality and non-graded produced by the country's more than hundred re-rolling mills. The market, worth around 1.5 billion dollar, is growing at a double-digit rate. Analysts and a major industry player said the arrival of Abul Khaer will result in a major consolidation in the mild steel rod sector.

"Abul Khaer has a reputation of doing thing big. They've proved it time and again in corrugated iron (CI) sheet steel, condensed milk and cement. They hired foreign experts to analyse the rod market and finally went for a huge investment," a source who follows the group said. "Their arrival means the death of the small players," he added. Abul Khaer Co, originally a small tobacco company selling Abul brand bidi, started expanding in early 1990s after founder Abul Khaer's eldest son took its rein. The company set up the country's biggest cold-rolled steel plant in Sitakundu in the late 1990s, which led to a huge consolidation in the tin sheet market.

Você também pode gostar

- IRR Privacy Guidelines VER4.0 CleanDocumento42 páginasIRR Privacy Guidelines VER4.0 CleanciryajamAinda não há avaliações

- Is Oil Downstream: Hydrocarbon Product Management: Introduction/OverviewDocumento40 páginasIs Oil Downstream: Hydrocarbon Product Management: Introduction/OverviewAbdul Rahoof100% (1)

- Piston ManufacturingDocumento41 páginasPiston ManufacturingDima AlinAinda não há avaliações

- Types of Steel BarsDocumento6 páginasTypes of Steel BarsvitamkupaAinda não há avaliações

- Project KamleshDocumento103 páginasProject Kamleshdeep1aroraAinda não há avaliações

- Abul Khair SteelsDocumento39 páginasAbul Khair SteelsMahmudur Rahman83% (6)

- Kuwaiti Code For The Design of ReinforcedDocumento5 páginasKuwaiti Code For The Design of Reinforcedwaheedopple3998Ainda não há avaliações

- ACC Cement Users GuideDocumento51 páginasACC Cement Users GuideArijit dasguptaAinda não há avaliações

- VTZ Steel PlantDocumento48 páginasVTZ Steel PlantAayush PandeyAinda não há avaliações

- Steel TableDocumento9 páginasSteel TableYashwant PatilAinda não há avaliações

- Bokaro Steel PlantDocumento3 páginasBokaro Steel PlantSayan ChatterjeeAinda não há avaliações

- Continuous Casting and Mould Level ControlDocumento15 páginasContinuous Casting and Mould Level Controlsalvador2meAinda não há avaliações

- Gfrpworkshop 2016 Aci c440 PDFDocumento25 páginasGfrpworkshop 2016 Aci c440 PDFromoexAinda não há avaliações

- Integrated Management System Manual Iso 90012008 and Ohsas 180012007 KESBDocumento52 páginasIntegrated Management System Manual Iso 90012008 and Ohsas 180012007 KESBDekerinchi Dk100% (3)

- CR and Galvanized Steel PDFDocumento6 páginasCR and Galvanized Steel PDFthadikkaranAinda não há avaliações

- Structural Analysis 1: Statically Determinate StructuresNo EverandStructural Analysis 1: Statically Determinate StructuresAinda não há avaliações

- RebarDocumento10 páginasRebarSiva SenthilAinda não há avaliações

- Wire DrawingDocumento18 páginasWire DrawingstaniAinda não há avaliações

- Report 4 Group 4 Steel SlagDocumento11 páginasReport 4 Group 4 Steel SlagAshwini SanapAinda não há avaliações

- CES 155-2015 ES-1995 Design of Timber Structures - Part1-1Documento150 páginasCES 155-2015 ES-1995 Design of Timber Structures - Part1-1Hundesa SirajAinda não há avaliações

- Steelmakers of Bangladesh: Forging Ahead Amid Overcapacity: Monthly Business ReviewDocumento5 páginasSteelmakers of Bangladesh: Forging Ahead Amid Overcapacity: Monthly Business Reviewlatiful188Ainda não há avaliações

- 4 Concrete RepairsDocumento3 páginas4 Concrete RepairsBenharzallah KrobbaAinda não há avaliações

- Churros Marketing PlanDocumento20 páginasChurros Marketing PlanViloria, Christine MicahAinda não há avaliações

- Annex 1 CCM ProcessDocumento16 páginasAnnex 1 CCM ProcessehsanAinda não há avaliações

- Engineering Structures: Hadi Panahi, Aikaterini S. GenikomsouDocumento20 páginasEngineering Structures: Hadi Panahi, Aikaterini S. GenikomsouBayuAgungGilangWibowo100% (1)

- Araling Panlipunan: Ang Daigdig Sa Klasikal at Transisyonal Na PanahonDocumento42 páginasAraling Panlipunan: Ang Daigdig Sa Klasikal at Transisyonal Na PanahonWilma Ferrer-Dumlao100% (3)

- Bangladesh Steel Industry Review-2016Documento7 páginasBangladesh Steel Industry Review-2016Mizanur RahmanAinda não há avaliações

- A Journey Through Indian Reinforcing BarsDocumento5 páginasA Journey Through Indian Reinforcing BarssujupsAinda não há avaliações

- Abul Khair Steel Products Surveillance Rating Report 2012 ReDocumento4 páginasAbul Khair Steel Products Surveillance Rating Report 2012 Remadhusri002Ainda não há avaliações

- Rail MaterialDocumento29 páginasRail MaterialRajiv Mahajan100% (1)

- Monojit Paul - Industrial Visit Report On Ramco CementDocumento12 páginasMonojit Paul - Industrial Visit Report On Ramco CementSiladitya MitraAinda não há avaliações

- Presentation Voided PT SlabDocumento11 páginasPresentation Voided PT SlabSaibal SahaAinda não há avaliações

- (Third Revision: Indian StandardDocumento24 páginas(Third Revision: Indian StandardbappadasjuAinda não há avaliações

- Summer Training at Bokaro Steel PlantDocumento16 páginasSummer Training at Bokaro Steel PlantDeepak KumarAinda não há avaliações

- AmiimDocumento9 páginasAmiimRanjan SahooAinda não há avaliações

- Effect of Lathe Waste Review 1Documento22 páginasEffect of Lathe Waste Review 1dreamboy87Ainda não há avaliações

- Aerated Concrete Production Using Various Raw MaterialsDocumento5 páginasAerated Concrete Production Using Various Raw Materialskinley dorjee100% (1)

- JSW CRS TMT RebarDocumento16 páginasJSW CRS TMT Rebarsri projectssAinda não há avaliações

- 25 Rebar CouplerDocumento4 páginas25 Rebar CouplerNivedhan GandhiAinda não há avaliações

- BSRMDocumento42 páginasBSRMPushpa BaruaAinda não há avaliações

- Bhushan Steels Or.Documento189 páginasBhushan Steels Or.Naveen SinghAinda não há avaliações

- Effect of Bracing On Regular and Irregular RCC (G+10) Frame Structure With Different Types of Bracings Under Dynamic LoadingDocumento13 páginasEffect of Bracing On Regular and Irregular RCC (G+10) Frame Structure With Different Types of Bracings Under Dynamic LoadingIJRASETPublicationsAinda não há avaliações

- Is 15622 2006 PDFDocumento20 páginasIs 15622 2006 PDFPatel SumitAinda não há avaliações

- IFAD Procurement GuidelinesDocumento46 páginasIFAD Procurement GuidelinesEd Canela100% (1)

- Ground Improvement Techniques: CE 444: Course Coordinator: Dr. Monowar HussainDocumento2 páginasGround Improvement Techniques: CE 444: Course Coordinator: Dr. Monowar HussainprasadAinda não há avaliações

- Turret Bearing Deflection MonitoringDocumento1 páginaTurret Bearing Deflection MonitoringVinay RajputAinda não há avaliações

- Training Report Rajasthan Housing BoardDocumento13 páginasTraining Report Rajasthan Housing BoardDevendra SharmaAinda não há avaliações

- Analysis of Self Supported Steel ChimneyDocumento4 páginasAnalysis of Self Supported Steel ChimneyAtul Kumar EngineerAinda não há avaliações

- Slenderness Limit of Class 3 I Cross-Sections Made of High Strength SteelDocumento17 páginasSlenderness Limit of Class 3 I Cross-Sections Made of High Strength Steelchucuoi77Ainda não há avaliações

- Types of Structural SteelDocumento4 páginasTypes of Structural SteelPti RaheelAinda não há avaliações

- 철근콘크리트 휨부재의 최소 철근 규정Documento9 páginas철근콘크리트 휨부재의 최소 철근 규정jinwook75Ainda não há avaliações

- en 197 1 2011 SR PDFDocumento1 páginaen 197 1 2011 SR PDFUdari LiyanageAinda não há avaliações

- Design of Steel StructuresDocumento4 páginasDesign of Steel StructuresprkshdvAinda não há avaliações

- Unified SOR Inte RevisedDocumento70 páginasUnified SOR Inte RevisedAncil AlexAinda não há avaliações

- Bs 5400 Part 7Documento24 páginasBs 5400 Part 7Ivy PaulAinda não há avaliações

- Unit-I - Limit State Method Concept and Design of Beams: 1. MaterialsDocumento7 páginasUnit-I - Limit State Method Concept and Design of Beams: 1. MaterialsYAZHINIAinda não há avaliações

- ConcreteDocumento31 páginasConcreteShashank Patole100% (1)

- Strollberg LEO WorkshopDocumento54 páginasStrollberg LEO WorkshopBinod Kumar PadhiAinda não há avaliações

- Advanced Opensees Algorithms, Volume 1: Probability Analysis Of High Pier Cable-Stayed Bridge Under Multiple-Support Excitations, And LiquefactionNo EverandAdvanced Opensees Algorithms, Volume 1: Probability Analysis Of High Pier Cable-Stayed Bridge Under Multiple-Support Excitations, And LiquefactionAinda não há avaliações

- The Iron Puddler My life in the rolling mills and what came of itNo EverandThe Iron Puddler My life in the rolling mills and what came of itAinda não há avaliações

- Pakistan Steel Industry Will Meet Future DemandDocumento12 páginasPakistan Steel Industry Will Meet Future DemandKamran MalikAinda não há avaliações

- HRM 370-172-Bangladesh Engineering & Re-Rolling Mills LTD Final Case - Group CDocumento16 páginasHRM 370-172-Bangladesh Engineering & Re-Rolling Mills LTD Final Case - Group Ctaseen rajAinda não há avaliações

- Steel Industry of BangladeshDocumento3 páginasSteel Industry of BangladeshMISHUM RAHMAN100% (1)

- Bagad For 100 DaysDocumento3 páginasBagad For 100 DaysRaquel dg.BulaongAinda não há avaliações

- Indian Dairy IndustryDocumento2 páginasIndian Dairy Industryharsh7877Ainda não há avaliações

- Capital Budgeting Decisions NotesDocumento15 páginasCapital Budgeting Decisions NotesEbbyAinda não há avaliações

- International Political Economy PDFDocumento5 páginasInternational Political Economy PDFsalmanyz6Ainda não há avaliações

- HR Re-EngineeringDocumento5 páginasHR Re-EngineeringMohammed SelimAinda não há avaliações

- Catalogue Wire StrandDocumento18 páginasCatalogue Wire StrandbronsenwijayaAinda não há avaliações

- 12 - A Complete Guide To Holiday Marketing PDFDocumento223 páginas12 - A Complete Guide To Holiday Marketing PDFRajdeep JosanAinda não há avaliações

- Introduction To Industrial Technology Midterm ReviewerDocumento7 páginasIntroduction To Industrial Technology Midterm ReviewerRenz Moyo ManzanillaAinda não há avaliações

- Ss3 CommerceDocumento20 páginasSs3 CommerceAdio Babatunde Abiodun CabaxAinda não há avaliações

- Know The Latest Features of The Latest Version of Google ChromeDocumento2 páginasKnow The Latest Features of The Latest Version of Google Chromelewis bikerAinda não há avaliações

- Biju Expence DetailsDocumento2 páginasBiju Expence Detailsinfo kattatAinda não há avaliações

- MRL BookDocumento108 páginasMRL BookImran SheikhAinda não há avaliações

- Management Science Unit 4 PPTsDocumento30 páginasManagement Science Unit 4 PPTsFifa 21Ainda não há avaliações

- Jefferson County Tax ListDocumento36 páginasJefferson County Tax ListRichard RothzchildAinda não há avaliações

- Monthly Attendance Report Template FormatDocumento5 páginasMonthly Attendance Report Template FormatNina Jasmin Suing-VitugAinda não há avaliações

- 11 Affidavit of Martin McGahan, Chief Restructuring OfficerDocumento45 páginas11 Affidavit of Martin McGahan, Chief Restructuring OfficerDentist The MenaceAinda não há avaliações

- Hot Consolidation and Mechanical Properties of Nanocrystalline Equiatomic Alfeticrzncu High Entropy Alloy After Mechanical AlloyingDocumento6 páginasHot Consolidation and Mechanical Properties of Nanocrystalline Equiatomic Alfeticrzncu High Entropy Alloy After Mechanical AlloyingBuluc GheorgheAinda não há avaliações

- Develop Business ModelDocumento13 páginasDevelop Business Modelmarie joy ortizAinda não há avaliações

- MCM BusinessDocumento5 páginasMCM BusinessAhmad BadrusAinda não há avaliações

- Abhimanyu 113979767Documento2 páginasAbhimanyu 113979767shankybst9Ainda não há avaliações

- TPBank Golf Privé Club - PR BriefDocumento24 páginasTPBank Golf Privé Club - PR BriefPhap 2TT-19 Dao Minh PhuongAinda não há avaliações

- Nandini BooksDocumento14 páginasNandini Booksvasushukla109Ainda não há avaliações

- BSN Plan FarmingDocumento46 páginasBSN Plan FarmingEphraim UhuruAinda não há avaliações

- Region X: Audio and Visual Presentation and Composing EquiDocumento4 páginasRegion X: Audio and Visual Presentation and Composing EquiKrizza Sajonia TaboclaonAinda não há avaliações

- Dissertation - Upward Trend of The Usage of Integrated Marketing Communications in IndiaDocumento69 páginasDissertation - Upward Trend of The Usage of Integrated Marketing Communications in IndiatanyataustraliaAinda não há avaliações