Escolar Documentos

Profissional Documentos

Cultura Documentos

Portfolio Optimization - Boddie - Previous Ed

Enviado por

f1940003Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Portfolio Optimization - Boddie - Previous Ed

Enviado por

f1940003Direitos autorais:

Formatos disponíveis

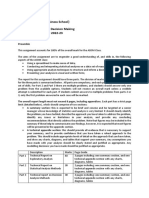

Basic Worksheet

A. Annualized Standard Deviation, Average return, and Correlation Coefficients of International Stocks, 1980-1993

US

GERMANY

UK

JAPAN

AUSTRALIA

CANADA

FRANCE

StD. Dev. (%)

21.1

25.0

23.5

26.6

27.6

23.4

26.6

Avg. Return (%)

15.7

21.7

18.3

17.3

14.8

10.5

17.2

US

GERMANY

UK

JAPAN

AUSTRALIA

CANADA

FRANCE

Correlation Matrix

US

1.00

0.37

0.53

0.26

0.43

0.73

0.44

GERMANY

0.37

1.00

0.47

0.36

0.29

0.36

0.63

US

GERMANY

UK

JAPAN

AUSTRALIA

CANADA

FRANCE

UK

0.53

0.47

1.00

0.43

0.50

0.54

0.51

JAPAN AUSTRALIA

0.26

0.43

0.36

0.29

0.43

0.50

1.00

0.26

0.26

1.00

0.29

0.56

0.42

0.34

B. Covariance Matrix: Cell Formulas + Results

US

GERMANY

UK

445.21

195.18

262.80

195.18

625.00

276.13

262.80

276.13

552.25

145.93

239.40

268.79

250.41

200.10

324.30

360.43

210.60

296.95

246.95

418.95

318.80

JAPAN AUSTRALIA

145.93

250.41

239.40

200.10

268.79

324.30

707.56

190.88

190.88

761.76

180.51

361.67

297.18

249.61

Weighted Reutrn

2.24

3.10

2.61

2.47

2.11

1.50

2.46

0.1429

0.1429

0.1429

0.1429

0.1429

0.1429

0.1429

SUM

Portfolio Variance

Portfolio SD

Portfolio Mean

1.00

314.77

17.74

16.50

0.1429

9.09

3.98

5.36

2.98

5.11

7.36

5.04

0.1429

3.98

12.76

5.64

4.89

4.08

4.30

8.55

0.1429

5.36

5.64

11.27

5.49

6.62

6.06

6.51

0.1429

2.98

4.89

5.49

14.44

3.90

3.68

6.06

38.92

44.19

46.94

41.43

Page 1

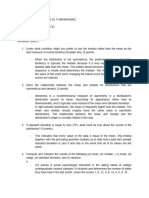

Basic Worksheet

ficients of International Stocks, 1980-1993

CANADA

0.73

0.36

0.54

0.29

0.56

1.00

0.39

FRANCE

0.44

0.63

0.51

0.42

0.34

0.39

1.00

CANADA

360.43

210.60

296.95

180.51

361.67

547.56

242.75

FRANCE

246.95

418.95

318.80

297.18

249.61

242.75

707.56

0.1429

5.11

4.08

6.62

3.90

15.55

7.38

5.09

0.1429

7.36

4.30

6.06

3.68

7.38

11.17

4.95

0.1429

5.04

8.55

6.51

6.06

5.09

4.95

14.44

47.73

44.91

50.65

Page 2

Você também pode gostar

- Stine and Foster Ques/ansDocumento5 páginasStine and Foster Ques/ansRee TuAinda não há avaliações

- Economic and Financial Modelling with EViews: A Guide for Students and ProfessionalsNo EverandEconomic and Financial Modelling with EViews: A Guide for Students and ProfessionalsAinda não há avaliações

- ASDM Individual Assignment 22-23Documento12 páginasASDM Individual Assignment 22-23Soujanya PrabhakarAinda não há avaliações

- Solman PDFDocumento71 páginasSolman PDFdav00034Ainda não há avaliações

- HW5 For Financial MathameticsDocumento9 páginasHW5 For Financial MathameticsshihuiAinda não há avaliações

- Introduction to Linear Regression AnalysisNo EverandIntroduction to Linear Regression AnalysisNota: 2.5 de 5 estrelas2.5/5 (4)

- GB Paper Imi - 1 Sep 2013 ManishDocumento16 páginasGB Paper Imi - 1 Sep 2013 ManishManish KumarAinda não há avaliações

- TOT AL Total Tota L TotalDocumento10 páginasTOT AL Total Tota L TotalGrayma Carbajal MonteroAinda não há avaliações

- EXCEL Output: Regression StatisticsDocumento21 páginasEXCEL Output: Regression StatisticsFranklin NguyenAinda não há avaliações

- Estadistica y ProbabilidadDocumento6 páginasEstadistica y ProbabilidadcastielumetAinda não há avaliações

- 2 - Sample Problem Set - ForecastingDocumento5 páginas2 - Sample Problem Set - ForecastingQila Ila0% (1)

- STAT 2601 Final Exam Extra Practice QuestionsDocumento9 páginasSTAT 2601 Final Exam Extra Practice Questionssubui613Ainda não há avaliações

- Spract 6Documento40 páginasSpract 6xtremfree5485Ainda não há avaliações

- A Paper - DS Final Exam With Solutions 2018-20 (3) (Repaired)Documento7 páginasA Paper - DS Final Exam With Solutions 2018-20 (3) (Repaired)Sidhant Mehta (PGDMM3 19-21)Ainda não há avaliações

- Figure 20.7: Dividend Yields On S& P 500 - 1960 To 1994: Chart1Documento9 páginasFigure 20.7: Dividend Yields On S& P 500 - 1960 To 1994: Chart1minhthuc203Ainda não há avaliações

- Dummy Variable Regression and Oneway ANOVA Models Using SASDocumento11 páginasDummy Variable Regression and Oneway ANOVA Models Using SASRobinAinda não há avaliações

- Tabel As DisTribuiCoesDocumento8 páginasTabel As DisTribuiCoesAlexandre GumAinda não há avaliações

- Another Look at Measures of Forecast AccuracyDocumento18 páginasAnother Look at Measures of Forecast AccuracySaumitra BhaduriAinda não há avaliações

- BusStat 2023 HW13 Chapter 13Documento3 páginasBusStat 2023 HW13 Chapter 13Friscilia OrlandoAinda não há avaliações

- Business AnalyticsDocumento10 páginasBusiness AnalyticsMaurren SalidoAinda não há avaliações

- IASSC Exam Packet: Version: 1.2.0M Publish Date: 12.12.2010Documento21 páginasIASSC Exam Packet: Version: 1.2.0M Publish Date: 12.12.2010ShaikhRizwanAinda não há avaliações

- Chapter 4Documento9 páginasChapter 4Rizwan RaziAinda não há avaliações

- 15.S24 Fundamentals of Financial Mathematics Problem Set 5 Shihui Chen ID: 913599770Documento12 páginas15.S24 Fundamentals of Financial Mathematics Problem Set 5 Shihui Chen ID: 913599770shihuiAinda não há avaliações

- MGS3100: Exercises - ForecastingDocumento8 páginasMGS3100: Exercises - ForecastingJabir ArifAinda não há avaliações

- Tutorial 1-13 Answer Intermediate MacroDocumento40 páginasTutorial 1-13 Answer Intermediate MacroPuteri NelissaAinda não há avaliações

- Ch4sol PDFDocumento7 páginasCh4sol PDFAmine IzamAinda não há avaliações

- The Basics of Risk: Problem 1Documento7 páginasThe Basics of Risk: Problem 1Sandeep MishraAinda não há avaliações

- Tutorial Sheet 1Documento4 páginasTutorial Sheet 1Devang SinghAinda não há avaliações

- QAM-AmoreFrozenFood - Group8Documento14 páginasQAM-AmoreFrozenFood - Group8Ankur BansalAinda não há avaliações

- Lecture 2 PDFDocumento54 páginasLecture 2 PDFhadin khanAinda não há avaliações

- MCQDocumento15 páginasMCQVishal NimbrayanAinda não há avaliações

- Ujian Akhir Bioslanjut 2013Documento8 páginasUjian Akhir Bioslanjut 2013Yasmin AbdullahAinda não há avaliações

- Assignment I-IVDocumento17 páginasAssignment I-IVRojan PradhanAinda não há avaliações

- Quiz 4 - Practice PDFDocumento8 páginasQuiz 4 - Practice PDFNataliAmiranashvili100% (2)

- Solution of Homework-Lecture 1 and 2Documento13 páginasSolution of Homework-Lecture 1 and 2Lân PhạmAinda não há avaliações

- QMT 3001 Business Forecasting Term ProjectDocumento30 páginasQMT 3001 Business Forecasting Term ProjectEKREM ÇAMURLUAinda não há avaliações

- Forecasting HODocumento4 páginasForecasting HOAkashAinda não há avaliações

- Chapter 1: Simple Regression AnalysisDocumento12 páginasChapter 1: Simple Regression AnalysisAnonymous sfwNEGxFy2Ainda não há avaliações

- Chapter 1: Simple Regression AnalysisDocumento12 páginasChapter 1: Simple Regression AnalysisAnonymous sfwNEGxFy2Ainda não há avaliações

- Solution Manual For Basic Econometrics Gujarati Porter 5th EditionDocumento24 páginasSolution Manual For Basic Econometrics Gujarati Porter 5th EditionWilliamHammondcgaz100% (35)

- Multiple Choice Questions Descriptive Statistics Summary Statistics - CompressDocumento15 páginasMultiple Choice Questions Descriptive Statistics Summary Statistics - CompressChristine NionesAinda não há avaliações

- PD7 - 2023-1 (Plantilla)Documento24 páginasPD7 - 2023-1 (Plantilla)Diego EscalanteAinda não há avaliações

- EC5203 Assignment: Opening Case and Case Study 2Documento21 páginasEC5203 Assignment: Opening Case and Case Study 2chenxinyu821Ainda não há avaliações

- Dougherty5e IM 2015 10 30 ch07Documento13 páginasDougherty5e IM 2015 10 30 ch07Chathula NayanalochanaAinda não há avaliações

- PROC FREQ and MEANS - To Stat or Not To Stat: Marge Scerbo, CHPDM/UMBC Mic Lajiness, Eli Lilly and CompanyDocumento17 páginasPROC FREQ and MEANS - To Stat or Not To Stat: Marge Scerbo, CHPDM/UMBC Mic Lajiness, Eli Lilly and CompanyMahesh GvAinda não há avaliações

- SM Basic Econometrics Gujarati Porter 5th EditionDocumento10 páginasSM Basic Econometrics Gujarati Porter 5th EditionMuhammad Mohab83% (6)

- Hasil Evaluasi TiO2 AnataseDocumento12 páginasHasil Evaluasi TiO2 Anatasepermata ulfaAinda não há avaliações

- C 3407Documento61 páginasC 3407Lloyd LagonoyAinda não há avaliações

- SET-I-Practice Questions - Students - ProblemDocumento4 páginasSET-I-Practice Questions - Students - ProblemTushar ChaudharyAinda não há avaliações

- QM1 NotesDocumento81 páginasQM1 Noteslegion2d4Ainda não há avaliações

- (BBA116) (120-634) - Answer Booklet.Documento25 páginas(BBA116) (120-634) - Answer Booklet.Shaxle Shiiraar shaxleAinda não há avaliações

- BS Assignment4Documento2 páginasBS Assignment4Lakshya DewanganAinda não há avaliações

- Solution To Campbell Lo Mackinlay PDFDocumento71 páginasSolution To Campbell Lo Mackinlay PDFstaimouk0% (1)

- Standard Resistance ValuesDocumento1 páginaStandard Resistance ValuesAbhishek SauravAinda não há avaliações

- Sta Chương15Documento4 páginasSta Chương15Nguyễn Thu HươngAinda não há avaliações

- TitanInsuranceCaseStudy Group8Documento17 páginasTitanInsuranceCaseStudy Group8BISHNUDEV DEYAinda não há avaliações

- LT3 Reviewer 2Documento3 páginasLT3 Reviewer 2Paulo SantosAinda não há avaliações

- Cultural Political AlignmentsDocumento1 páginaCultural Political Alignmentsf1940003Ainda não há avaliações

- Black-Scholes Abandon ProjectDocumento4 páginasBlack-Scholes Abandon Projectf1940003Ainda não há avaliações

- KYC - AML - Oct, 13Documento7 páginasKYC - AML - Oct, 13f1940003Ainda não há avaliações

- Entropy: Information Theory and Dynamical System PredictabilityDocumento38 páginasEntropy: Information Theory and Dynamical System Predictabilityf1940003Ainda não há avaliações

- Summer Acceleration Application 2013Documento1 páginaSummer Acceleration Application 2013f1940003Ainda não há avaliações

- Vertebrates: Fishes Amphibians Reptiles Birds MammalsDocumento8 páginasVertebrates: Fishes Amphibians Reptiles Birds Mammalsf1940003Ainda não há avaliações

- Writing Research Reports: Written Analysis and CommunicationDocumento39 páginasWriting Research Reports: Written Analysis and Communicationf1940003Ainda não há avaliações

- Cdam 2001 09Documento39 páginasCdam 2001 09Kota Mani KantaAinda não há avaliações

- Apple Pie 1.get Apple 2. Get Pie 3combine 1 and 2 4 Cook #3 Like Some Lil B Swag Swag 5. Ya Done BishDocumento1 páginaApple Pie 1.get Apple 2. Get Pie 3combine 1 and 2 4 Cook #3 Like Some Lil B Swag Swag 5. Ya Done Bishf1940003Ainda não há avaliações

- Biostatistics For BiotechnologyDocumento128 páginasBiostatistics For Biotechnologykibiralew DestaAinda não há avaliações

- Chapter 4Documento27 páginasChapter 4ShuvoAinda não há avaliações

- Statistical Analysis TemplateDocumento3 páginasStatistical Analysis TemplateJulian Mernando vlogsAinda não há avaliações

- QuartilesDocumento11 páginasQuartilesWindel Q. BojosAinda não há avaliações

- Mean, Variance, and Standard Deviation ofDocumento15 páginasMean, Variance, and Standard Deviation ofShiela Mae GatchalianAinda não há avaliações

- Probability and Statistics Symbols TableDocumento3 páginasProbability and Statistics Symbols TableChindieyciiEy Lebaiey CwekZrdoghAinda não há avaliações

- Ernestorondon High School Unit Test 4thDocumento3 páginasErnestorondon High School Unit Test 4thEric de GuzmanAinda não há avaliações

- PROMIS Strength Impact Scoring ManualDocumento7 páginasPROMIS Strength Impact Scoring ManualAndrea BelicenaAinda não há avaliações

- Graded Quiz - Using Probability Distributions - CourseraDocumento10 páginasGraded Quiz - Using Probability Distributions - CourseranguyenvandongAinda não há avaliações

- Histogram: Data Set No. of Observations Assigned Interval Number Interval Number Interval Minimum Absolute FrequencyDocumento9 páginasHistogram: Data Set No. of Observations Assigned Interval Number Interval Number Interval Minimum Absolute FrequencyAkash K VarmaAinda não há avaliações

- Spearman's Rank Correlation CoefficientDocumento11 páginasSpearman's Rank Correlation Coefficientdev414Ainda não há avaliações

- Errors PPT 1Documento29 páginasErrors PPT 1RAJENDRA BANDALAinda não há avaliações

- Mansinadez Psychstats Midtermexam AnswersheetDocumento3 páginasMansinadez Psychstats Midtermexam Answersheetmain.23002079Ainda não há avaliações

- Measure of Relative PositionDocumento16 páginasMeasure of Relative PositionJunrylAinda não há avaliações

- Long TestDocumento2 páginasLong TestLevi Corral100% (1)

- SPSS Without PainDocumento177 páginasSPSS Without PainĐàm ĐàmAinda não há avaliações

- Admin,+b 2 Guntur Afif MeirinaldiDocumento13 páginasAdmin,+b 2 Guntur Afif MeirinaldiVemmy SoniaAinda não há avaliações

- Question 1 (Chp.2) : Mid 1 July 22nd, 2021, STAT 245, U of Sask Exam Period: 3 HoursDocumento12 páginasQuestion 1 (Chp.2) : Mid 1 July 22nd, 2021, STAT 245, U of Sask Exam Period: 3 HoursJaheda SultanaAinda não há avaliações

- Table 5. Distribution of The Coefficients of Variation (CVS) of The Updated Poverty Incidence Among Families - 2015 and 2018Documento2 páginasTable 5. Distribution of The Coefficients of Variation (CVS) of The Updated Poverty Incidence Among Families - 2015 and 2018PhotchiiAinda não há avaliações

- Measure of Variation: Range: ST RDDocumento10 páginasMeasure of Variation: Range: ST RDRyan wilfred LazadasAinda não há avaliações

- Stats U2 Mean - Unsolved PracticalsDocumento4 páginasStats U2 Mean - Unsolved PracticalsParag NemaAinda não há avaliações

- Bms QuestionsDocumento3 páginasBms Questionskavyaganesan0% (1)

- STATPROB - Moodle - LC3 - Random Sapling and Central Limit TheoremDocumento7 páginasSTATPROB - Moodle - LC3 - Random Sapling and Central Limit TheoremKyle BARRIOSAinda não há avaliações

- Business Statistics AssignmentDocumento9 páginasBusiness Statistics AssignmentkshitijAinda não há avaliações

- Educational Statistics Course Outline 2nd Session 2018-2019Documento8 páginasEducational Statistics Course Outline 2nd Session 2018-2019KobinaAinda não há avaliações

- 2015 Grade 10 Final Exam Nov Math Paper 2 MemoDocumento13 páginas2015 Grade 10 Final Exam Nov Math Paper 2 Memophashabokang28Ainda não há avaliações

- Statistics and Probability Performance Task 3 Quarter AY 2020-2021Documento3 páginasStatistics and Probability Performance Task 3 Quarter AY 2020-2021Shiva Cruz Jr.100% (1)

- 5 代码大礼包?Documento13 páginas5 代码大礼包?Hanxian LiangAinda não há avaliações

- Test Results Summary: Oromia Occupational Competence Assurance AgencyDocumento1 páginaTest Results Summary: Oromia Occupational Competence Assurance AgencykebedeAinda não há avaliações

- Correlation Activity SheetDocumento2 páginasCorrelation Activity SheetKyle Aureo Andagan RamisoAinda não há avaliações