Escolar Documentos

Profissional Documentos

Cultura Documentos

Micro Finance Sacco Software Features PDF

Enviado por

david5441Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Micro Finance Sacco Software Features PDF

Enviado por

david5441Direitos autorais:

Formatos disponíveis

Esacco Microfinance Management System Features 1.

Registration Module Features: Member Registration Captures the following details Member full names Member ID No Member no Town Residence Occupation Email address County Mobile Number Pin Number Date of Registration/Joining Passport Images

Allow adding of members next of kin (optional) Capture beneficiarys personal information Capture beneficiary relationship Captures beneficiary photos

2. Contribution Module Allow members to make contribution to their savings/ shares account on daily, monthly (periodically) basis. Features include: Contribution to member savings account Contribution to multiple saving plan accounts Backdating contributions Contributing towards an outstanding loan Printing out a receipt after the transaction Sending SMS notification to the member after transaction completion

3. Income Module Allow the Organization to capture incomes comprehensively, incomes from members activities like registration, account statement print out, interest from loans among others, and incomes from other investments. Features include: Capture the payee of the income Captures date and amount Allow multiple income entries Issue receipt after the transaction

4. Expenses Module Allow the organization to account for her expenditure. Features include: Captures the receiver of any expenditure funds Captures the reason for every expenditure Captures approvals for every expenditure Captures expenditure date, amount Captures check no if any Captures the account of expenditure affected e.g. office expenses, petty cash, salaries, e.t.c.

5. Loans Module This is the module that automates the loan application, repayment, interests, guarantees, and guarantors. Its working is guided by the organizations by-laws. Features Include: Loan application which captures Amount applied for Reason for the loan Type of the loan Repayment period Disbursement method Allow addition of guarantors to cover for the amount above members available share balance Display loan repayment schedule/ amortization Checks all organizations by laws before finalizing the application

6. Shares Management Module A module used by management to perform share/ savings transfer activities in a transparent manner. Features include: Transfer within individual members account e.g. from savings to loan repayment account Transfer from one member to another member Transfer from member to organization e.g. from member savings to an organizations income account

7. Accounting Module This module performs basic bookkeeping activities for the organization based on the information captured Features include: Journals Addition of assets accounts Addition of liability accounts Profit and Loss statement Bank Reconciliations General Ledger Trial Balance Balance sheet

8. Reporting Module Features include: A Module that avail all reports and statements in the system, which can be exported to other software applications like, excel, printed out, or view only. Features include: Statements including Reports Loan repayment report Guarantors report Guaranteed report Group Issued Loan Report Group Loan balances report Group savings report Group available balances report Group daily transactions report Group periodical transactions report Income report Expenses report Bank (statement) transactions report Withdrawal/ exit reports Contribution group report Feedback reports Member Account Statement Member account mini statement Individual saving plan account statement

9. System Administration Module The system administrator has powers to regulate users and their activities on the system Features include: Create, update, delete, suspend system users Assign, Denial individual user permissions and roles Monitor all system users via audit trail/ user activities log Create, Update, Delete Business/ Organization details like address and letterhead System database back up activities

Você também pode gostar

- Software Sales Business PlanDocumento31 páginasSoftware Sales Business PlanIbrahim Muhammed0% (1)

- Microfinance Bank Proposal AjiboyeDocumento12 páginasMicrofinance Bank Proposal AjiboyeYkeOluyomi Olojo81% (16)

- UK High Tech Consulting Business PlanDocumento38 páginasUK High Tech Consulting Business PlanmzafarshahidAinda não há avaliações

- ITech Software Solution Inc-RIVERA, GLENZIELDocumento40 páginasITech Software Solution Inc-RIVERA, GLENZIELGlenziel RiveraAinda não há avaliações

- Online Car Rental SystemDocumento13 páginasOnline Car Rental SystemRj saMiAinda não há avaliações

- Accounting Books - Ledgers and JournalsDocumento30 páginasAccounting Books - Ledgers and JournalsAbegail BoqueAinda não há avaliações

- Biz Plan - Mhealth AppDocumento25 páginasBiz Plan - Mhealth AppHost Mom100% (1)

- Top 10 ERP Software for Construction IndustryDocumento11 páginasTop 10 ERP Software for Construction IndustryRahul SheokandAinda não há avaliações

- Web Company Business PlanDocumento42 páginasWeb Company Business Plangreat2read100% (1)

- Sacco PlanDocumento4 páginasSacco PlanmochandaAinda não há avaliações

- KAYI INVESTMENT CLUB. Constitution1Documento32 páginasKAYI INVESTMENT CLUB. Constitution1Munguongeyo Ivan100% (1)

- POC Mobile App Scoping Documentv0.1Documento24 páginasPOC Mobile App Scoping Documentv0.1Rajwinder KaurAinda não há avaliações

- Technical Requirements HR System PayrollDocumento115 páginasTechnical Requirements HR System PayrollbhujabaliAinda não há avaliações

- Car Dealer Management SystemDocumento6 páginasCar Dealer Management Systemsudhakar kethanaAinda não há avaliações

- Matatu Sacco Software Features PDFDocumento4 páginasMatatu Sacco Software Features PDFdavid54410% (1)

- Who Moved My Interest Rate - Leading The Reserve Bank of India Through Five Turbulent Years (PDFDrive)Documento294 páginasWho Moved My Interest Rate - Leading The Reserve Bank of India Through Five Turbulent Years (PDFDrive)dev guptaAinda não há avaliações

- Computer Support Business PlanDocumento41 páginasComputer Support Business PlanNgaa SiemensAinda não há avaliações

- Sacco System DocumentationDocumento8 páginasSacco System Documentationdavid54410% (2)

- An Explanatory Sample Mobile App Business Plan For StartupsDocumento6 páginasAn Explanatory Sample Mobile App Business Plan For StartupsFroz Works100% (2)

- Mall@Home: Business ProposalDocumento16 páginasMall@Home: Business ProposalTusharAinda não há avaliações

- Regulatory Onboarding The Fenergo Way USDocumento22 páginasRegulatory Onboarding The Fenergo Way USUtku CetinAinda não há avaliações

- Usiness Equirements Ocument FOR: Business Requirement Document For AcmeDocumento17 páginasUsiness Equirements Ocument FOR: Business Requirement Document For AcmeAmy Brown100% (1)

- TCC Land Bank Business PlanDocumento76 páginasTCC Land Bank Business PlanTriCOGCollaborative100% (1)

- Matatu Sacco User Manual PDFDocumento15 páginasMatatu Sacco User Manual PDFdavid5441100% (1)

- Business Plan For Offshore Software Development Center in IndiaDocumento8 páginasBusiness Plan For Offshore Software Development Center in Indiadrikadrika100% (1)

- Fair Value of Non-Controlling Interest in The Acquiree (Subsidiary) Is Not GivenDocumento11 páginasFair Value of Non-Controlling Interest in The Acquiree (Subsidiary) Is Not GivenPinky Daisies100% (2)

- Company ProfileDocumento6 páginasCompany ProfileMd Rakibul HasanAinda não há avaliações

- CMS Design Quotation 2021Documento1 páginaCMS Design Quotation 2021waiAinda não há avaliações

- Software House (Proposal)Documento17 páginasSoftware House (Proposal)Amna100% (4)

- Car Rental System ProposalDocumento13 páginasCar Rental System ProposalNutty NkosiAinda não há avaliações

- Business Plan - PPTX JymDocumento18 páginasBusiness Plan - PPTX JymTarun SoniAinda não há avaliações

- Jisort System Write-UpDocumento15 páginasJisort System Write-UpsgichoAinda não há avaliações

- Online Sacco SystemDocumento66 páginasOnline Sacco SystemKhamisi Bylal80% (5)

- Sacco SystemDocumento65 páginasSacco SystemKamau Wa Wanja50% (2)

- Financial Institutions Management - Chap011Documento21 páginasFinancial Institutions Management - Chap011sk625218Ainda não há avaliações

- Sample Marketing PlanDocumento27 páginasSample Marketing Plankhuram shahzadAinda não há avaliações

- Platform-as-a-Service Business Plan TemplateDocumento10 páginasPlatform-as-a-Service Business Plan Templatexolilev100% (1)

- Car Pooling Website + Mobile App (Android + Iphone) : Date: March 14, 2016Documento9 páginasCar Pooling Website + Mobile App (Android + Iphone) : Date: March 14, 2016Apoorva Jain GuptaAinda não há avaliações

- ProSacco: The Best Sacco Management SystemDocumento7 páginasProSacco: The Best Sacco Management SystemCyrus M.nAinda não há avaliações

- Superior Sacco and Chama Documentation ProposalDocumento10 páginasSuperior Sacco and Chama Documentation ProposalShady KiokoAinda não há avaliações

- SACCO User GuideDocumento15 páginasSACCO User GuideKyambadde FranciscoAinda não há avaliações

- Bancassurance FAQs for EFU Life InsuranceDocumento7 páginasBancassurance FAQs for EFU Life InsuranceAzeem AnwarAinda não há avaliações

- Functional Requirement - Document (FRD)Documento11 páginasFunctional Requirement - Document (FRD)Aayush PathakAinda não há avaliações

- Mobile Money - Investment Opportunities For SACCOsDocumento20 páginasMobile Money - Investment Opportunities For SACCOsKivumbi WilliamAinda não há avaliações

- Executive SummaryDocumento3 páginasExecutive SummaryArin ChattopadhyayAinda não há avaliações

- Ride Sharing Apps BangladeshDocumento31 páginasRide Sharing Apps BangladeshAbdullah ArafatAinda não há avaliações

- Hotel Reservation Android App ReportDocumento27 páginasHotel Reservation Android App ReportdanielAinda não há avaliações

- Business Plan BPODocumento14 páginasBusiness Plan BPOKNOWLEDGE CREATORS100% (1)

- Functional & Non-Functional RequirementsDocumento12 páginasFunctional & Non-Functional RequirementsAminah ShahzadAinda não há avaliações

- Grocery ProductDocumento53 páginasGrocery ProductpawanAinda não há avaliações

- A Business Proposal For Ademola Liquor SDocumento28 páginasA Business Proposal For Ademola Liquor SMuktar jiboAinda não há avaliações

- Online Courier Management SystemDocumento12 páginasOnline Courier Management SystemParth Patel100% (1)

- Web Design QuotationDocumento1 páginaWeb Design QuotationAnuraag Reyan MahantaAinda não há avaliações

- Huber Ethiopia Transport and Delivery Company: Pharmacies, Restaurants and Super MarketsDocumento2 páginasHuber Ethiopia Transport and Delivery Company: Pharmacies, Restaurants and Super MarketsNardos Kidane100% (1)

- Employee Recognition Framework CharterDocumento3 páginasEmployee Recognition Framework Chartervinaysiri99100% (2)

- Just DialDocumento39 páginasJust DialJagannath Baranwal0% (1)

- Project Proposal: Taxi Booking SystemDocumento22 páginasProject Proposal: Taxi Booking SystemYasser -Ainda não há avaliações

- Digital Marketing ProposalDocumento8 páginasDigital Marketing ProposalROSALIN DASHAinda não há avaliações

- Car Renting Management System Proposal PDFDocumento3 páginasCar Renting Management System Proposal PDFsaqib_dAinda não há avaliações

- Audit ProposalDocumento3 páginasAudit ProposalMaria Carolina100% (1)

- Business Partnering A Complete Guide - 2020 EditionNo EverandBusiness Partnering A Complete Guide - 2020 EditionAinda não há avaliações

- Public Cloud ERP for Small or Midsize Businesses A Complete Guide - 2019 EditionNo EverandPublic Cloud ERP for Small or Midsize Businesses A Complete Guide - 2019 EditionAinda não há avaliações

- Group 1 Pranav Shukla Kunal Jha Navdeep Sangwan Mansi Bharadwaj Nainika Narula Company ProfileDocumento44 páginasGroup 1 Pranav Shukla Kunal Jha Navdeep Sangwan Mansi Bharadwaj Nainika Narula Company ProfileApoorv BajajAinda não há avaliações

- International Business Chapter 16 Exporting, Importing and Countertrade SummaryDocumento19 páginasInternational Business Chapter 16 Exporting, Importing and Countertrade Summarywasiul hoqueAinda não há avaliações

- Topic 4 Risk and ReturnDocumento8 páginasTopic 4 Risk and Returnpepemanila101Ainda não há avaliações

- PNG invoice summary for imported goodsDocumento3 páginasPNG invoice summary for imported goodsProcopio DoysabasAinda não há avaliações

- Meaning of E-Banking: 3.2 Automated Teller MachineDocumento16 páginasMeaning of E-Banking: 3.2 Automated Teller Machinehuneet SinghAinda não há avaliações

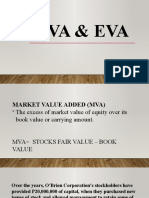

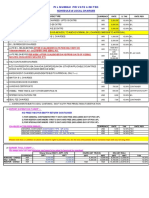

- Mva EvaDocumento11 páginasMva EvaRian ChiseiAinda não há avaliações

- (Studies in Finance and Accounting) Michael Firth (Auth.) - Management of Working Capital-Macmillan Education UK (1976)Documento156 páginas(Studies in Finance and Accounting) Michael Firth (Auth.) - Management of Working Capital-Macmillan Education UK (1976)Vignesh KathiresanAinda não há avaliações

- Solution Problem of Financial DerivativeDocumento16 páginasSolution Problem of Financial DerivativeKhalid Mishczsuski LimuAinda não há avaliações

- Tutorial Week 2 SolutionDocumento13 páginasTutorial Week 2 SolutionXiaohan LuAinda não há avaliações

- Cash MemoDocumento3 páginasCash MemoHimanshu SinghAinda não há avaliações

- Investment Appraisal Camb AL New (1) RIKZY EESADocumento14 páginasInvestment Appraisal Camb AL New (1) RIKZY EESAAyesha ZainabAinda não há avaliações

- نشاط الإنجليزيةDocumento4 páginasنشاط الإنجليزيةsaleh.01chfAinda não há avaliações

- Circular Flow of MoneyDocumento10 páginasCircular Flow of MoneyMadhumitha BalasubramanianAinda não há avaliações

- International Financial Management 5Documento53 páginasInternational Financial Management 5胡依然100% (1)

- KN OW Alex Marchand Dissolving Dollars1Documento145 páginasKN OW Alex Marchand Dissolving Dollars1msid22Ainda não há avaliações

- Accounting-for-Partnership-Corporation-AC-34 (1) - Answer KeyDocumento7 páginasAccounting-for-Partnership-Corporation-AC-34 (1) - Answer KeyRhelyn Dato-onAinda não há avaliações

- Forex Summary Ca Final SFMDocumento13 páginasForex Summary Ca Final SFMNksAinda não há avaliações

- Acct Statement - XX5332 - 11052022Documento2 páginasAcct Statement - XX5332 - 11052022Debendra SathyAinda não há avaliações

- In Voice PDF OneDocumento1 páginaIn Voice PDF OneRodrigo Santibáñez AbrahamAinda não há avaliações

- Viva. The Free Banking Package For Young People and StudentsDocumento3 páginasViva. The Free Banking Package For Young People and StudentsYoussef SaidAinda não há avaliações

- Sad - Text - en - Xls - r1Documento17 páginasSad - Text - en - Xls - r1Samuel SantanaAinda não há avaliações

- Pil Mumbai Private Limited: Schedule of Local ChargesDocumento1 páginaPil Mumbai Private Limited: Schedule of Local ChargesANMOL SUKHDEVEAinda não há avaliações

- What is Venture Capital Funding and How Does it Work? (39Documento24 páginasWhat is Venture Capital Funding and How Does it Work? (39Ashish MahendraAinda não há avaliações

- Cba Sonia Ustinov 010318 - 260518Documento3 páginasCba Sonia Ustinov 010318 - 260518Ranji SoulAinda não há avaliações

- Agrani Bank 2010Documento78 páginasAgrani Bank 2010Shara Binte Hamid100% (1)

- Maf603 Topic 2 Portfolio Management N Asset Pricing TheoryDocumento75 páginasMaf603 Topic 2 Portfolio Management N Asset Pricing Theory2022920039Ainda não há avaliações