Escolar Documentos

Profissional Documentos

Cultura Documentos

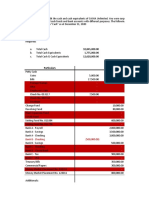

AccAud Prob

Enviado por

Carlo FrioTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

AccAud Prob

Enviado por

Carlo FrioDireitos autorais:

Formatos disponíveis

Auditing and Assurance Services

1) Management assertions are a) b) c) d) 2) Stated as the footnoted to the financial statements

Polytechnic University of the Philippines College of Accountancy

8)

Accepting an Engagement

Which of the following would an auditor least likely perform as part of the auditors preliminary engagement activities? a) b) c) d) Perform procedures regarding the continuance of the client relationship and the specific audit engagement Evaluate compliance with ethical requirements, including independence Establish an understanding of the terms of the engagement Obtain understanding of the legal and regulatory framework applicable to the entity

Implied or expressed representations about the accounts in the financial statements Explicitly expressed representations about the financial statements Provided to the auditor in the Assertions Letter, but are not disclosed on the financial statements

Which of the following statements is not correct? a) b) c) It would be a violation of the completeness assertion if the management would record a sale that did not take place The completeness assertion deals with matters opposite from those of the existence assertion The completeness assertion is concerned with the possibility of omitting items from the financial statements that should have been included d) The existence assertion is concerned with the inclusion of amount that should not have been 9)

Which of the following is not one of the reasons why auditor should perform preliminary engagement activities? a) b) c) d) To ensure that the auditor maintains the necessary independence and ability to perform the engagement To help ensure that there are no issues with management integrity that may affect the auditors willingness to continue the engagement To ensure that there is no misunderstanding with the client as to the terms of the engagement To ensure that sufficient appropriate evidence will be obtained to support the auditors opinion on the financial statements

3)

Which of the following assertions does not relate to balances at period end? a) b) c) d) Existence Occurrence Valuation or allocation Rights and obligation 10)

Which of the following is not normally performed in the preplanning or preengagement phase? a) b) c) d) Deciding whether to accept pr reject an audit engagement Inquiring from predecessor auditor Preparing an engagement letter Making a preliminary estimate of materiality

4)

Which of the assertions does not relate to classes of transactions and events for the period? a) b) c) d) Completeness Cut-off Valuation Accuracy 11)

In making a decision to accept or continue with a client the auditor should consider a. Its competence Its independence Its ability to serve the client properly The integrity of clients management b. c. d. Yes Yes Yes Yes Yes No Yes No Yes Yes Yes No Yes Yes No Yes

5)

An assertion that transactions are recorded in the proper accounting period is a) b) c) d) Classification Accuracy Occurrence Cut-off There are many ways an auditor can accumulate evidence to meet the overall audit objectives b) c) d) Sufficient appropriate evidence must be accumulated to meet the auditors professional responsibility The cost of accumulating the evidence should be minimized Gathering evidence and minimizing costs are equally important considerations that affect the approach the auditors select 13) 12)

Before accepting an engagement to audit a new client, a CPA is required to obtain a) b) c) d) A preliminary understanding of the prospective clients industry and business The prospective clients signature to the engagement letter An understanding of the prospective clients control environment A representation letter from the prospective client

6)

Which of the following statements is not correct? a)

Preliminary knowledge about the clients business and industry must be obtained prior to the acceptance of the engagement primarily to a) b) c) d) Determine the degree of knowledge and expertise required by the engagement Determine the integrity of management Determine whether the firm is independent with the client Gather evidence about the fairness of the financial statements

7)

Which of the following is the correct order of steps in the audit process? A. B. C. D. E. a) b) c) d) Perform tests of control Develop an overall strategy for the expected conduct and scope of the audit Obtain clients written representation Prepare engagement letter Perform substantive tests 14)

A CPA firms quality control procedures pertaining to the acceptance of a prospective audit client would most likely include a) Inquiry of management as to whether disagreements between the predecessor auditor and the prospective client were resolved satisfactorily b) Consideration of whether sufficient competent evidential matter may be obtained to afford a reasonable basis for an opinion

DABEC DBAEC DBCAE DBEAC

Page 1 of 9 eeb.6.30.2013

Auditing and Assurance Services

c)

Polytechnic University of the Philippines College of Accountancy

a) b) c) d) 21) revise

Accepting an Engagement

Inquiry of third parties, such as the prospective clients bankers ad attorneys, about information regarding the prospective client and its management

State that the found material misstatements that the client would not Suggest that the incoming auditor ask the client Suggest that the incoming auditor obtain the clients permission to discuss the reasons Indicate that a misunderstanding occurred

d) 15)

Consideration of whether the internal control structure is sufficiently effective to permit a reduction in the required substantive tests

Prior to the acceptance of an audit engagement with a client who has terminated the services of the predecessor auditor, the CPA should a) Contact the predecessor auditor without advising the prospective client and request a complete report of the circumstance leading to the termination with the understanding that all information disclosed will be kept confidential b) Accept the engagement without contacting the predecessor auditor since the CPA can include audit procedures to verify the reason given by the client for the termination c) Not communicate with the predecessor auditor because this would affect be asking the auditor to violate the confidential relationship between the auditor and client d) Advise the client of the intention to contact the predecessor auditor and request permission for the contact 22)

Before accepting an audit engagement, an incoming auditor should make specific inquiries of the predecessor auditor regarding the predecessors a) b) c) d) Opinion of any subsequent events occurring since the predecessors audit report was issued Understanding as to the reasons for the change of auditors Awareness of the consistency in the application of GAAP between periods Evaluation of all matters of continuing accounting significance An incoming auditor most likely would make specific inquiries of the predecessor auditor regarding a) b) c) d) Specialized accounting principles of the clients industry The competency of the clients internal audit staff The uncertainty inherent in applying sampling procedures Disagreements with management as to auditing procedures

16)

When a CPA is approached to perform an audit for the first time the CPA should make inquiries of the predecessor auditor. This is a necessary procedure because the predecessor may be able to provide the incoming auditor with information that will assist the incoming auditor in determining a) b) c) d) Whether the predecessors work should be utilized Whether the company follows the policy of rotating its auditors Whether in the predecessors opinion internal control of the company has been satisfactory Whether the engagement should be accepted 24) 23)

Which of the following should an auditor obtain from the predecessor auditor prior to accepting an audit engagement a) b) c) d) Analysis of balance sheet accounts Analysis of income statement accounts All matters of continuing accounting significance Facts that might bear on the integrity of management

What information should an incoming auditor obtain during the inquiry of the predecessor auditor to acceptance of the audit? I. II. III. IV. a) b) c) d) Facts that bear on the integrity of management Whether statistical or non-statistical sampling was used to gather evidence Disagreement with management concerning auditing procedures The effect of the clients internal audit function on the scoped of the independent auditors examination I and II I and III I and IV III and IV

17)

Danny, CPA, has been retained to audit the financial statements if San Antonio, Co. San Antonios predecessor auditor was Gary, CPA, who has been notified by San Antonio that Garys services have been terminated. Under the circumstances, which party should initiate the communication between Danny and Gary? a) b) c) d) Danny, the incoming auditor Gary, the predecessor auditor San Antonios controller or CFO The chairman of San Antonios board of directors

18)

In audit, communication between the predecessor and incoming auditor should be a) b) c) d) Authorized in an engagement letter Acknowledged in a representation letter Either written or oral Written and included in the working papers 25)

An incoming auditor should request the new client to authorize the predecessor auditor to allow a review of the predecessors Engagement letter a) b) c) d) Yes Yes No No Working paper Yes No Yes No

19)

Gerry, CPA, is succeeding Rodel, CPA, on the audit engagement of CPAR Corporation. Gerry plans to consult Rodel and to review Rodels prior year working papers. Gerry may do so if a) b) c) d) Rodel and CPAR consent CPAR consent Rodel consent Gerry and Rodel consent 26)

Which of the following factors most likely would cause an auditor not to accept a new audit engagement? a) b) c) d) An inadequate understanding of the entitys internal control The close proximity to the end of the entitys fiscal year Concluding that the entitys management probably lacks integrity An inability to perform preliminary analytical procedures before assessing control risk

20)

Upon discovering material misstatements in a clients financial statements that the client would not revise, the auditor withdrew from the engagement. If asked by the incoming auditor about the termination the engagement, the predecessor auditor should

Page 2 of 9 eeb.6.30.2013

Auditing and Assurance Services

27)

Polytechnic University of the Philippines College of Accountancy

a) b) c) d) 35) Yes Yes Yes No Yes No No No

Accepting an Engagement

Which of the following factors most likely would influence an auditors determination of the auditability of the entitys financial statements a) b) c) d) The complexity of the accounting system The existence of related party transactions The adequacy of the accounting records The operating effectiveness of control procedures

CPAs responsibilities Clients responsibilities Limitation of engagement Yes Yes No No

Which of the following would be least likely to be included in the auditors engagement letter a) b) c) d) Forms of the report Extent of his responsibilities to his client Objectives and scope of the audit Type of opinion to be issued

28)

Hawkins requested permission to communicate with the predecessor auditor and review certain portions of the predecessor auditors work papers. The prospective clients refusal to permit this will bear directly on Hawkins decision concerning the: a) b) c) d) Adequacy of the preplanned audit program Ability to establish consistency in application of accounting principles between years Apparent scope limitation Integrity of management 36)

Which of the following is not one of the principal contents of an engagement letter? a) b) c) d) Objective of the financial statements Unrestricted access to records and documents Limitations of the engagement Managements responsibility for the financial statements Billing arrangement Arrangement concerning clients assistance Details of the procedure that will be performed Expectation of receiving a representation letter from management

29)

Before performing any audit procedures. The auditor and the client should agree on the Type of opinion to be expressed a) b) c) d) Yes No No Yes Terms of engagement Yes Yes No No 38) 37)

An engagement letter would not normally include a) b) c) d)

30)

According to PSA 210, the auditor and the client should agree on the terms of engagement. The agreed terms would need to be recorded in a (n): a) b) c) d) Memorandum to be placed in the permanent section of the audit working papers Engagement letter Client representation letter Comfort letter

The audit engagement letter should generally include a reference to each of the following except a) b) c) d) The expectation of receiving a written management representation letter A request for the client to confirm the terms of the engagement A description of the auditors method of sample selection The risk that material misstatements may remain undiscovered

31)

Which of the following is (are) valid reasons why an auditor send to client an engagement letter? I. II. III. IV. a) b) c) d) To avoid misunderstanding with respect to engagement To confirm the auditors acceptance of the appointment To document the objective and scope of the audit To ensure CPAs compliance to PSA I, II only I, II and III only All of the above statements All of the above statements except III

39)

After preliminary audit, arrangements have been made, an engagement confirmation letter should be sent to the client. The letter usually would not include a) b) c) d) A reference to the auditors responsibility for the detection of errors and irregularities An estimate of the time to be spent on the audit work by audit staff and management A statement that the management advisory services would be made available upon request A statement that a management letter will be issued outlining comments and suggestions as to any procedures requiring the clients attention

32)

If an auditor believes that an understanding with the client has not been established, he or she should ordinarily a) b) c) d) Perform the audit with increased professional skepticism Decline to accept or perform the audit Assess the control risk at the minimum level and perform a primarily substantive audit Modify the scope of the audit to reflect an increased risk of material misstatement due to fraud 41) 40)

Arrangements concerning which of the following are least likely to be included in engagement letter a) b) c) d) I. II. III. Auditors responsibilities Fees and billing CPA investment in client securities Other forms of reports to be issued in addition to the audit report The required communication of significant deficiencies in internal control structure Significantly lower materiality levels that those used in the prior audit The description of any letters or reports that the auditor expects to issue

33)

Engagement letter that documents and confirms the auditors acceptance of the engagement would normally be sent to the client a) b) c) d) Before the audit report is issued After the audit report is issued At the end of fieldwork Before the commencement of the engagement

The use of an engagement letter is the best method of documenting

34)

An engagement letter should ordinarily include information on the objectives of the engagement and

Page 3 of 9 eeb.6.30.2013

Auditing and Assurance Services

IV. a) b) c) d) 42)

Polytechnic University of the Philippines College of Accountancy

4) audit planning? a) b) c) d) 5)

Accepting an Engagement

Notification of any changes In the original arrangements of the audit I and II I and IV II and III III and IV

Which of the following procedures would a CPA ordinarily perform during Obtain understanding of the clients business and industry Review the clients bank reconciliation Obtain clients representation letter Review and evaluate clients internal control

In which of the following situations would the auditor be unlikely to send a new engagement letter to a continuing client? a) b) c) d) Change in terms of the engagement Significant change in the nature or size of the clients business Recent change of the client management Recent change in the partner and/or staff in the audit engagement

In developing the overall audit plan for a new client, factor not to be considered is a) b) c) d) Materiality levels The clients business, including the structure of the organization and accounting systems used The amount of estimated audit fee The audit risks and procedures to be performed to achieve audit objectives

43)

In a continuing engagement, the continuing auditor would most likely send a new engagement letter when a) b) c) d) There is a change in the partner assigned to the engagement There is a recent change in clients management There are new accounting pronouncements affecting the clients financial statements There are expected minor changes in the nature or size of the clients business 6)

In planning the audit engagement, the auditor should consider each of the following except a) b) c) d) Matters relating to the entitys business and the industries in which it operates The entitys accounting policies and procedures Anticipated levels of control risk and materiality The kind of opinion that is likely to be expressed

44)

When the auditor of a parent entity is also the auditor of its subsidiary, branch or division (component); which of the following factors would least likely influence the auditors decision to send separate letter to a component of a parent entity? a) b) c) Geographical location of the component Legal requirements Degree of ownership by parent Degree of independent of components management 7)

A CPA is conducting the first examination of a clients financial statements. The CPA hopes to reduce the audit work by consulting with the predecessor auditor and reviewing the predecessors working papers. This procedure is a) b) c) Acceptable if the client and the predecessor auditor agree to it Acceptable if the CPA refers in the audit report to reliance upon the predecessor auditors work Required if the CPA is to render an unqualified opinion Unacceptable because the CA should bring an independent viewpoint to a new engagement d)

d)

Audit Planning

1) This involves developing an overall strategy for the expected conduct and scope of the examination; the nature, extent, and timing of which vary with the size and complexity, and experience with and knowledge of the entity a) b) c) d) 2) I. II. III. a) b) c) d) 3) I. II. III. IV. a) b) c) d) Audit planning Audit program Audit procedures Audit working papers Precede actions Be flexible Be cost beneficial II and III only I and III only All of the statements above All of the statements above except I Appropriate attention is devoted to important areas All misstatements will be detected Potential problems are identified The work is completed expeditiously All statements above II and IV only I, III and IV I and III 10) 9)

Understanding the entity and its environment

8) Prior to beginning the field work on a new audit engagement in which a CPA does not possess expertise in the industry in which the client operates, the CPA should a) b) c) d) Reduce audit risk by lowering the preliminary levels of materiality Design special substantive tests to compensate for the lack of industry expertise Engage financial experts familiar with the nature of the industry Obtain a knowledge of matters that relate to the nature of the entitys business In performing an audit of financial statements, the auditor should have or obtain a knowledge of the clients business sufficient to a) b) c) d) Make constructive suggestions concerning improvements in internal control Identify transactions and events that may affect the financial statements Develop an attitude of professional skepticism Assess the level of control risk

Audit plans should

Adequate planning of the audit work helps ensure that

Each of the following may be relevant to an auditor when obtaining knowledge about the clients business and industry except a) b) c) d) Discussion with people within or outside the entity Publications related to the industry Visits of the entitys premises Performing a walkthrough tests

Page 4 of 9 eeb.6.30.2013

Auditing and Assurance Services

11)

Polytechnic University of the Philippines College of Accountancy

c) d)

Accepting an Engagement

To obtain an understanding of a continuing clients business in planning an audit, an auditor most likely would a) b) c) d) Perform tests of details of transactions and balances Review prior years working papers and the permanent file for the client Read specialized industry journals Re-evaluate the clients internal control system 17)

Materiality judgments are made in light of surrounding circumstances and necessarily involve both quantitative and qualitative judgments An auditors consideration of materiality is influenced by the auditors perception of the needs of a reasonable person who will rely on the financial statements

In developing the preliminary level of materiality in an audit, the auditor will a) b) c) d) Look to audit standards for specific materiality guidelines Increase the level of materiality if fraud is suspected Rely primarily on professional judgment to determine the materiality level Use the same materiality level as that used for different clients in the same industry

12)

Which of the following statements is correct, when obtaining understanding about the clients business? a) b) The level of knowledge required of the auditor is ordinarily more than the level of knowledge possessed by management Preliminary knowledge about the entity industry must be obtained after accepting the engagement to determine whether the auditor has the necessary knowledge to perform the audit c) Following the acceptance of the engagement, the auditor should obtain detailed knowledge about the clients business preferably at the start of the engagement d) For continuing engagements, the auditor may no longer obtain knowledge about the clients business 19) 18)

In making a preliminary judgment about materiality, the auditor initially determines the aggregate (overall) level of materiality for each statement. For planning purposes, the auditor should use the a) b) c) d) a) b) c) d) Levels separately Average of these levels Largest aggregate level Smallest aggregate level The preliminary level and the final level The company level and the divisional level The account balance level and the detailed item level The financial statement level and the account balance level Balance sheet level Account balance level Income statement level Company-wide level

13)

Information about the clients business appropriately assists the auditor in: I. II. III. a) b) c) d) Assessing risk and identifying potential problems Planning and performing the audit effectively and efficiently Evaluating audit evidence All of the above statements I and III only II nad III only I and II only

In planning the audit, the auditor should assess materiality at two levels

20)

Tolerable misstatement is the term used to indicate materiality at the a) b) c) d)

14)

For initial engagements, PSA 510 does not required the auditor to obtain evidence a) b) c) That the opening balances do not contain material misstatements that materially affect the current periods financial statements That the prior periods ending balances have been correctly brought forward to the current period or when appropriate, have been restated That appropriate accounting policies are consistently applied or changes in accounting policies have been properly accounted for and adequately disclosed d) That the prior period financial statements were audited by an independent CPA 22) 21)

All else being equal, as the level of materiality decreases, the amount of evidence required will a) b) c) d) Remain the same Change in an unpredictable fashion Decrease Increase

In considering materiality for planning purposes, an auditor believes that misstatements aggregating P 100,000 would have a material effect on an entitys income statement, but those misstatements would have to aggregate P 200,000 to materially affect the balance sheet. Ordinarily, it would be appropriate to design auditing procedures that would be expected to detect misstatements that aggregate a) P 100,000 P 200,000 P 150,000 P 300,000 b) c) d)

Materiality

15) According to PSA 320, materiality should be considered by the auditor when: Determining the nature, a) b) c) d) 16) a) Yes Yes No No Evaluating the effects Yes No No Yes 23) timing and extent of audit procedures of misstatements

Which of the following would an auditor most likely use in determining the auditors preliminary judgment about materiality? a) b) c) d) The anticipated sample size of the planned substantive tests The entity annualized interim financial statements The results of the internal control questionnaire The contents of the management representation letter Applies only to publicly held firms Has greater application to the standards of reporting than the other generally accepted auditing standards

Which of the following statements is not correct about materiality? The concept of materiality recognizes that some matters are important for fair presentation of financial statements in conformity with acceptable financial reporting framework, while other matters are not important b) An auditor considers materiality for planning purposes in terms of the largest aggregate level of misstatements that could be material to any one of the financial statements 24)

The concept of materiality with respect to the attest function a) b)

Page 5 of 9 eeb.6.30.2013

Auditing and Assurance Services

c) d) 25)

Polytechnic University of the Philippines College of Accountancy

c) d) 33)

Accepting an Engagement

Requires that relatively more effort be directed to those assertions that are more susceptible to misstatements Requires the auditor to make judgment as to whether misstatements affect the fairness of the financial statements

The auditor will apply an inappropriate audit procedure The auditor will apply an inappropriate measure of audit materiality

When planning a financial statement audit, the auditor should assess inherent risk at the

The relationship between materiality and risk is ordinarily a) b) c) d) Direct Parallel Inverse None 34) a) b) c) d)

Financial statement level

Yes Yes No No

Account balance or transaction class level

Yes No No Yes

26)

When comparing level of materiality used for planning purposes and the level of materiality used for evaluating evidence, one would most likely expect a) b) c) d) The level of materiality to be always similar The level of materiality for planning purposes to be smaller The level of materiality for planning purposes to be higher The level of materiality for planning purposes to be based on total assets while the level materiality for evaluating purposes to be based on net income

Risk in auditing means that the auditor accepts some level of uncertainty in performing the audit function. An effective auditor will a) b) c) d) Take any means available to reduce the risk to the lowest possible level Set the risk level between 5% and 10% Perform the audit procedures first and quantitatively set the risk level before forming an opinion and writing the report Recognize that risk exists and deal with them in an appropriate manner

27)

When assessing materiality levels for audit purposes, the auditor should consider the Amount involved a) b) c) d) Yes Yes No No Nature of misstatement Yes No No Yes 36) b) c) d) 35) a)

The audit risk model is used primarily For planning purposes in determining how much evidence to accumulate While doing tests of controls To determine the type of opinion to express To evaluate the evidence which has been gathered

Inherent risk and control risk differ from detection risk in that inherent and control risks a) b) c) d) Arise from the misapplication of auditing procedures May be assessed in either quantitative or non-quantitative terms Exist independently of the financial statement audit Can be changed at the auditors discretion Detection risk cannot be changed at the auditors discretion If individual audit risk remains the same, detection risk bears an inverse relationship to inherent & control risks c) d) The greater the inherent & control risks the auditor believes exist, the less detection risk that can be accepted The auditor might make separate or combined assessments of inherent risk and control risk

Audit Risk

28) The risk that the auditor may express an incorrect opinion on the financial statements is called a) b) c) d) 29) Inherent risk Detection risk Control risk Audit risk 37)

Which of the following is incorrect statement? a) b)

The susceptibility of an account to misstatements assuming no internal control is referred to as the a) b) c) d) Inherent risk Detection risk Control risk Audit risk 38) Inherent risk Substantive risk Detection risk Control risk 39) A material misstatement will occur in the accounting process Controls will not detect a material misstatement that occurs Audit procedures will fail to detect a weak control system The prescribed control procedures will not be applied 40)

30)

Audit risk consists of all but the following components a) b) c) d)

The acceptable level of detection risk is inversely related to the a) b) c) d) a) b) c) d) a) b) c) Assurance provided by substantive tests Risk of misapplying auditing procedures Preliminary judgment about materiality levels Risk of failing to discover material misstatements Parallel Direct Inverse Equal Internal control over cash receipts is excellent Application of analytical procedures reveals a significant increase in sales revenue in December, the last month of the fiscal year Internal control over shipping, billing, and recording of sales revenue is weak

31)

For a particular assertion, control risk is the risk that a) b) c) d)

Relationship between control risk and detection risk is ordinarily

32)

The audit risk against which the auditor and those who rely on his/her opinion require reasonable protection is a combination of three separate risks at the account balance or class of transactions level. The first is inherent risk. The second risk is that material misstatements will not be prevented or detected by internal control. The third risk is a) b) The auditor will reject a correct account balance as incorrect Material misstatements that occur will not be detected by the audit

Which of the following conditions supports an increase in detection risk?

Page 6 of 9 eeb.6.30.2013

Auditing and Assurance Services

d) 41)

Polytechnic University of the Philippines College of Accountancy

b) c) d) 48) a) b) c) d) 49) procedure

Accepting an Engagement

Study of the business reveals that the client recently acquired a new company in an unrelated industry

Nature of substantive tests from a less effective to a more effective Timing of tests of controls by performing them at several dates rather than at one time Assessed level of inherent risk to a higher level Reduce substantive testing by relying on the assessment of inherent risk and control risk Postpone the planned timing of substantive tests from interim dates to the year-end Eliminate the assessed level of inherent risk from considerations as a planning factor Lower the assessed level of control risk

An auditor uses the assessed level of control risk to a) b) c) d) Evaluate the effectiveness of the entitys internal control policies and procedures Identify transactions and account balances whether inherent risk is at high level Indicate whether materiality thresholds for planning and evaluation purposes are sufficiently high Determine the acceptable level of detection risk for financial statements

As the acceptable level of detection risk decreases, an auditor may

42)

Which of the following would be considered the most conservative settings for inherent risk and control risk? Inherent risk a) b) c) d) 1.0 1.0 0.0 0.5 Control risk 1.0 0.0 0.0 0.5

On the basis of the audit evidence gathered and evaluated, an auditor decides to increase the assessed level of control risk from that originally planned. To achieve an overall audit risk level is substantially the same as the planned audit risk level, the auditor would a) b) c) d) Decrease substantive testing Increase inherent risk Decrease detection risk Increase materiality levels

43)

What is the magnitude of audit risk if inherent risk is .50, control risk is .40 and detection risk .10? a) b) c) d) .20 .04 .10 .02 50)

Which of the following statement is not true about the auditors assessment of inherent risk when planning a financial statement audit? a) b) c) d) In developing the overall audit plan, the auditor should assess inherent risk at the financial statement level In developing an audit program, the auditor should assess inherent risk at the account balance or transaction class level The auditor can make a separate or combined assessment of inherent and control risk The auditor assessment of inherent risk is influenced by the condition of the clients accounting and internal control system

44)

An inherent risk (IR) of 40% and a control risk of (CR) 60% affect planned detection risk and planned evidences differently than an a) b) c) d) IR of 60% and CR of 40% IR of 80% and CR of 30% IR of 100% and 24% IR of 70% and CR of 30% 51)

45)

Inherent risk is defined as the susceptibility of an account balance or class of transactions to error that could be material assuming that there were no related internal controls. Of the following conditions which one does not increase inherent risk? a) b) c) d) The client has entered numerous related party transactions during the year under audit Internal control over shipping, billing, and recoding of sales revenue is weak The client has lost a major customer accounting for approximately 30% of annual revenue The board of directors approved a substantial bonus for the president and chief executive office and also approved an attractive stock option plan for themselves b) c) d) 53) 52)

The auditor should obtain sufficient understanding of the entity and its environment, including its internal control order to

Identify and assess the risk of material misstatement

a) b) c) d) a) Yes Yes No No

Design appropriate audit procedures

Yes No No Yes

According to PSA 315, Risk assessment procedures means Identifying business risks relevant to financial reporting objectives and deciding about actions to address those risks Obtaining understanding of entity and its environment, including its internal control Performing substantive tests and testing the operating effectiveness of the entitys internal control Discussing with the members of the audit team the susceptibility the entitys financial statements to material misstatements Risk assessment procedures would include all of the following except a) b) c) d) Inquiries of management and others within the entity Analytical procedures Observation and inspection Reperformance of clients procedures

46)

According to auditing standards, the auditor uses the assessed level of control risk (together with the assessed level of inherent risk) to determine the acceptable level of detection risk for financial statement assertions. As the acceptable level of detection risk decreases, the auditor may do one or more of the following except change the a) b) c) Nature of substantive tests to more effective procedures Timing of substantive tests, such as using larger sample sizes Assurance provided by substantive tests to a lower level

47)

As the acceptable level of detection risk decreases, an auditor may change the a) Timing of substantive tests by performing them at an interim date rather that at year-end 54)

Which of the following is incorrect about the auditors risk assessment procedures?

Page 7 of 9 eeb.6.30.2013

Auditing and Assurance Services

a) b)

Polytechnic University of the Philippines College of Accountancy

d) 61) completion phases of the audit

Accepting an Engagement

Obtaining understanding control, is a continuous, dynamic process of gathering, updating and analyzing information throughout the audit In performing risk assessment procedures, the auditor may obtain disclosures and related assertions, and about the operating effectiveness of controls, even though such procedures are not specifically planned as substantive tests or test of controls

Analytical procedures may be performed in the planning, testing and

Analytical procedures are used for the following purposes except a) b) c) d) To assist the auditor in planning the nature, timing and extent of other auditing procedures As a substantive test to obtain evidential matter about particular assertion related to account balances or classes of transactions As an overall review of financial information in the final review stage of the audit To evaluate the effectiveness of the clients internal control

c) d)

The auditor should perform substantive procedures and tests of controls after the risk assessment procedures are performed Obtaining understanding of internal control is not normally sufficient to serve as testing the operating effectiveness of the control 62)

For all audits of financial statements made in accordance with PSAs, the use of analytical procedures is required to some extent

Analytical procedures

55) These consists of the analysis of significant ratios and trends including the resulting investigation of fluctuation and relationship that are inconsistent with other relevant information or deviate from predictable amount a) b) c) d) 56) Financial statement analysis Variance analysis Analytical procedures Regression analysis 63)

In the planning stage As substantive test In the review stage

a) b) c) d) a) b) c) d) 64) Yes Yes Yes Yes No Yes Yes No Yes No Yes No

Analytical procedures used in planning an audit should focus on identifying: Material weaknesses in the internal control structure The predictability of financial data from individual transactions The various assertions that are embodied in the financial statements Areas that may represent specific risk relevant to the audit

Analytical procedures used as of risk assessment procedures are performed primarily to assist the auditor in a) b) c) d) Identifying areas that may represent specific risks Obtaining knowledge about the design of internal control Obtaining knowledge about the operating effectiveness of the clients internal control Gathering corroborative evidence about the validity of an account balance

To help plan the nature, timing and extent of substantive auditing procedures, preliminary analytical procedures should focus a) b) c) d) Enhancing the auditors understanding of the clients business and events that have occurred since the last audit date Developing plausible relationships that corroborate anticipated results with a measurable amount of precision Applying ratio analysis to externally generated data such as published industry statistics or price indices Comparing recorded financial information to the results of other tests of transactions and balances

57)

A basic premise underlying analytical procedure is that a) b) c) d) These procedures cannot replace tests of balances and transactions Statistical tests of financial information may lead to the discovery of material misstatements in the financial statements The study of financial ratios is an acceptable alternative to the investigation of unusual fluctuations Plausible relationships among data may reasonably be expected to exist and continue in the absence of known conditions to the contrary 65)

Analytical procedures enable the auditor to predict the balance or quantity for an item under audit, information to develop this estimate can be obtained from all of the following except a) b) Tracing transactions through the system to determine whether procedures are being applied or prescribed Comparison of financial data with data for comparable prior periods, anticipated results(e.g., budgets and forecasts), and similar data for the industry in which the entity operates c) Study of the relations of elements of financial data that would be expected to confirm to a predictable patter based upon the entitys experience d) Study of the relationships of financial data with relevant non-financial data

58)

One reason why an auditor makes an analytical review of the clients operations is to identify a) b) c) d) Improper separation of accounting and other financial duties Weakness of material nature in the system of internal accounting control Unusual transactions Non-compliance with prescribed control procedures

59)

Significant unexpected differences identified by analytical procedures will usually necessitate a (an) a) b) c) d) Consistency explanatory paragraph added to the audit report Review of the internal control structure Explanation in the representation letter Auditor investigation b) c) d) 67) Analytical procedures are required to be performed in the planning phase of the audit b) c) Analytical procedures are required to be done during the testing phase of the audit Analytical procedures are required to be done during the completion phase of the audit 66) a)

An example of an analytical procedure is the comparison of Financial information with similar information regarding the industry in which the entity operates Recorded amounts of major disbursements with appropriate invoices Results of statistical sample with the expected characteristics of the actual population CIS generated data with similar data generated by a manual accounting system Which of the following is not a typical analytical review procedure?

60)

Which of the following statements about analytical procedures is incorrect? a)

Page 8 of 9 eeb.6.30.2013

Auditing and Assurance Services

a) b) c) d)

Polytechnic University of the Philippines College of Accountancy

Accepting an Engagement

Study of relationships of the financial information with relevant nonfinancial information Comparison of the financial information with similar information regarding the industry in which the entity operates Comparisons of recorded amounts of major disbursements with appropriate invoices Comparison of the financial information with budgeted amounts

Planning documentation

68) In developing the overall audit plan and audit program, the auditor should assess inherent risk at the:

Audit plan

a) b) c) d) 69) Financial statement level Account balance level Account balance level Financial statement level

Audit program

Account balance level Financial statement level Account balance level Financial statement level

In developing written audit programs, an auditor should establish specific audit objectives that relate primarily to the a) b) c) d) Timing of audit procedures Selected audit techniques Cost-benefit of gathering evidence Financial statements assertions All material transactions will selected for substantive testing Substantive tests prior to the balance sheet data will be minimized The audit procedures selected will achieve specific audit objectives Each account balance will be tested under tests of controls or tests of transactions

70)

An auditor should design the written audit program so that a) b) c) d)

71)

An audit program should be designed for each individual audit and should include audit steps and procedures to a) b) c) d) Detect and eliminate all fraud Increase the amount of management information available Provide assurance that the objectives of the audit are met Insure that only material items are audited

72)

Which of the following statement is incorrect about the planning documentation? a) b) The audit plan and related programs should no longer be changed once the audit is stated Although the precise form and consent of the audit plan may vary, it should be sufficiently detailed to guide the development of an audit program c) d) The audit program should set out the nature, timing and extent of planned audit procedures required to implement overall audit plan In preparing an audit program, the auditor should consider the specific assessments of inherent and control risks and the required level of assurance to be provided by substantive tests

73)

Which of the following matters would least likely appear in the audit program? a) b) c) d) Specific procedures that will be performed Specific audit objectives Estimated time that will be spent in performing certain procedures Documentation of the accounting and internal control systems being reviewed

Page 9 of 9 eeb.6.30.2013

Você também pode gostar

- AGS CUP 6 Auditing Final RoundDocumento19 páginasAGS CUP 6 Auditing Final RoundKenneth RobledoAinda não há avaliações

- Feu - MakatiDocumento15 páginasFeu - MakatiRica RegorisAinda não há avaliações

- Nfjpia R12 Mock Board Examination: Page 1 of 8Documento8 páginasNfjpia R12 Mock Board Examination: Page 1 of 8Leane MarcoletaAinda não há avaliações

- Which Situation Most Likely Violates The IIA's Code of Ethics and The Standards?Documento5 páginasWhich Situation Most Likely Violates The IIA's Code of Ethics and The Standards?ruslaurittaAinda não há avaliações

- Audit of EquityDocumento5 páginasAudit of EquityKarlo Jude Acidera0% (1)

- Midterm Exam ADocumento16 páginasMidterm Exam ARed YuAinda não há avaliações

- Q3 - Audit of Cash (S. Prob - KEY)Documento7 páginasQ3 - Audit of Cash (S. Prob - KEY)Kenneth Christian WilburAinda não há avaliações

- Review of Auditing and Assurance PrinciplesDocumento23 páginasReview of Auditing and Assurance PrinciplesJoseph BarreraAinda não há avaliações

- Chapter 6 Quiz KeyDocumento3 páginasChapter 6 Quiz Keymar8357Ainda não há avaliações

- Auditing Cup - 19 Rmyc Answer Key Final Round House StarkDocumento13 páginasAuditing Cup - 19 Rmyc Answer Key Final Round House StarkCarl John PlacidoAinda não há avaliações

- AssignmentDocumento6 páginasAssignmentIryne Kim PalatanAinda não há avaliações

- Keme Chap 4Documento5 páginasKeme Chap 4Melissa Kayla Maniulit100% (1)

- Chapter 4 SalosagcolDocumento3 páginasChapter 4 SalosagcolElvie Abulencia-BagsicAinda não há avaliações

- AT Quiz 2 - B1Documento3 páginasAT Quiz 2 - B1AMAinda não há avaliações

- Test Bank - NFJPIA - UP Diliman - Auditing Theory QuestionsDocumento14 páginasTest Bank - NFJPIA - UP Diliman - Auditing Theory QuestionsMarkie Grabillo100% (1)

- Session 3 AUDITING AND ASSURANCE PRINCIPLESDocumento29 páginasSession 3 AUDITING AND ASSURANCE PRINCIPLESagent2100Ainda não há avaliações

- Advanced Financial Accounting and Reporting Preweek LectureDocumento19 páginasAdvanced Financial Accounting and Reporting Preweek LectureVanessa Anne Acuña DavisAinda não há avaliações

- C. Appropriate Professional FeeDocumento1 páginaC. Appropriate Professional Feeelsana philipAinda não há avaliações

- Audit Theory - QuizzerDocumento36 páginasAudit Theory - QuizzerCharis Marie UrgelAinda não há avaliações

- Modified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial StatementsDocumento29 páginasModified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial Statementsfaye anneAinda não há avaliações

- AP-5907 CashDocumento12 páginasAP-5907 CashAiko E. LaraAinda não há avaliações

- Chapter 13Documento25 páginasChapter 13Clarize R. Mabiog50% (2)

- Acctg 100C 01Documento6 páginasAcctg 100C 01Jose Magallanes100% (1)

- 1Documento35 páginas1Rommel CruzAinda não há avaliações

- Lyceum of Alabang: Review Materials in PFRS 3, Business CombinationsDocumento12 páginasLyceum of Alabang: Review Materials in PFRS 3, Business CombinationsThom Santos Crebillo100% (1)

- Abc Stock AcquisitionDocumento13 páginasAbc Stock AcquisitionMary Joy AlbandiaAinda não há avaliações

- Internal Auditing 2015 Ed SolManDocumento3 páginasInternal Auditing 2015 Ed SolManGiovannaAinda não há avaliações

- Philippine Standards and Practice Statements (Final) PDFDocumento4 páginasPhilippine Standards and Practice Statements (Final) PDFMica R.Ainda não há avaliações

- Dokumen - Tips - Auditing Problems by Cabrera Solution Key For Auditing 2009 Ed by Cabrera Audit PDFDocumento3 páginasDokumen - Tips - Auditing Problems by Cabrera Solution Key For Auditing 2009 Ed by Cabrera Audit PDFJoffrey UrianAinda não há avaliações

- AT - Materiality and RisksDocumento7 páginasAT - Materiality and RisksRey Joyce AbuelAinda não há avaliações

- Accounts Receivable Accounts Payable: A. P19,500 GainDocumento6 páginasAccounts Receivable Accounts Payable: A. P19,500 GainTk KimAinda não há avaliações

- Chapter10 - AnswerDocumento21 páginasChapter10 - Answershanerikim100% (1)

- Auditing Reviewer 3Documento3 páginasAuditing Reviewer 3Sheena ClataAinda não há avaliações

- Aud ThEORY 2nd PreboardDocumento11 páginasAud ThEORY 2nd PreboardJeric TorionAinda não há avaliações

- Department of Accountancy: Page - 1Documento16 páginasDepartment of Accountancy: Page - 1NoroAinda não há avaliações

- AGS CUP 6 Auditing Elimination RoundDocumento17 páginasAGS CUP 6 Auditing Elimination RoundKenneth RobledoAinda não há avaliações

- PSA 700, 705, 706, 710, 720 ExercisesDocumento11 páginasPSA 700, 705, 706, 710, 720 ExercisesRalph Francis BirungAinda não há avaliações

- Chapter13 - Answer PDFDocumento5 páginasChapter13 - Answer PDFJONAS VINCENT SamsonAinda não há avaliações

- Audit of Investments - Set ADocumento4 páginasAudit of Investments - Set AZyrah Mae SaezAinda não há avaliações

- Items 1Documento7 páginasItems 1RYANAinda não há avaliações

- Review Materials For Auditing Theory: Multiple Choice QuestionsDocumento16 páginasReview Materials For Auditing Theory: Multiple Choice QuestionsDanica PelenioAinda não há avaliações

- Audit of Cash ActivityDocumento13 páginasAudit of Cash ActivityIris FenelleAinda não há avaliações

- Home Office and Branch Accounting PDFDocumento3 páginasHome Office and Branch Accounting PDFJisselle Marie Custodio0% (1)

- BLR 211 Sacrifice AnswerDocumento19 páginasBLR 211 Sacrifice AnswerSherri BonquinAinda não há avaliações

- Department of Accountancy: Page - 1Documento17 páginasDepartment of Accountancy: Page - 1NoroAinda não há avaliações

- P2 - Installment Sales, O2018 AUFDocumento5 páginasP2 - Installment Sales, O2018 AUFedsAinda não há avaliações

- Aud Theo Compilation1Documento97 páginasAud Theo Compilation1AiahAinda não há avaliações

- Module QuizsDocumento24 páginasModule QuizswsviviAinda não há avaliações

- TTTDocumento6 páginasTTTAngelika BalmeoAinda não há avaliações

- Advac SemifinalDocumento8 páginasAdvac SemifinalDIVINE VILLENAAinda não há avaliações

- University of San Jose-Recoletos Auditing TheoryDocumento10 páginasUniversity of San Jose-Recoletos Auditing TheoryAstraea Hoshi100% (1)

- Accepting An Engagement AuditingDocumento7 páginasAccepting An Engagement AuditingCarlo FrioAinda não há avaliações

- Reviewer Module1 3Documento10 páginasReviewer Module1 3Marwin AceAinda não há avaliações

- ExerciseDocumento4 páginasExercisemuneeraaktharAinda não há avaliações

- 204A Midterm ExaminationDocumento6 páginas204A Midterm ExaminationAldyn Jade GuabnaAinda não há avaliações

- AUD TH QUIZZER MODULE 3 PRE ENGAGEMENT AND PLANNING Set ADocumento11 páginasAUD TH QUIZZER MODULE 3 PRE ENGAGEMENT AND PLANNING Set AGeraldine MayoAinda não há avaliações

- Pre EngagementDocumento3 páginasPre EngagementJanica BerbaAinda não há avaliações

- Audit TheoryDocumento6 páginasAudit TheoryVon Lloyd Ledesma LorenAinda não há avaliações

- 80 Auditing Assurance MCQ'S: © Ca WorldDocumento14 páginas80 Auditing Assurance MCQ'S: © Ca WorldZain Butt50% (2)

- Pre-Planning and PlanningDocumento9 páginasPre-Planning and PlanningJanellaReanoReyesAinda não há avaliações

- BCL ItDocumento8 páginasBCL ItCarlo FrioAinda não há avaliações

- Decision Making Without ProbabilitiesDocumento1 páginaDecision Making Without ProbabilitiesCarlo FrioAinda não há avaliações

- Marketing Study SDocumento36 páginasMarketing Study SCarlo FrioAinda não há avaliações

- Accepting An Engagement AuditingDocumento7 páginasAccepting An Engagement AuditingCarlo FrioAinda não há avaliações

- GuideDocumento1 páginaGuideCarlo FrioAinda não há avaliações

- IKEADocumento22 páginasIKEAKurt MarshallAinda não há avaliações

- Mauldin July 30Documento10 páginasMauldin July 30richardck61Ainda não há avaliações

- GonzalesDocumento2 páginasGonzalesPrecious Gonzales100% (1)

- Branch Accounting ProblemDocumento6 páginasBranch Accounting ProblemGONZALES, MICA ANGEL A.Ainda não há avaliações

- Letter-SB-Request For Special Session-11 October 2023Documento5 páginasLetter-SB-Request For Special Session-11 October 2023cj.pulga.palAinda não há avaliações

- 1BS0 01 Que 20211123Documento24 páginas1BS0 01 Que 20211123Omar BAinda não há avaliações

- PQ - Prequalification Document PDFDocumento56 páginasPQ - Prequalification Document PDFHema Chandra IndlaAinda não há avaliações

- Twitter10 2 18 1Documento74 páginasTwitter10 2 18 1karen hudesAinda não há avaliações

- HDFC Multi Cap Fund With App Form Dated November 2 2021Documento4 páginasHDFC Multi Cap Fund With App Form Dated November 2 2021hnevkarAinda não há avaliações

- Global Economics Paper No.187Documento2 páginasGlobal Economics Paper No.187Velayudham ThiyagarajanAinda não há avaliações

- Affidavit of Lara Ann Lavi - Dec 10 2009 - USA and Oppression - 2Documento32 páginasAffidavit of Lara Ann Lavi - Dec 10 2009 - USA and Oppression - 2asghar_786Ainda não há avaliações

- Pyq - Mat112 - Jun 2019Documento5 páginasPyq - Mat112 - Jun 2019isya.ceknua05Ainda não há avaliações

- Nism PGPSM Placements Batch 2012 13Documento24 páginasNism PGPSM Placements Batch 2012 13P.A. Vinay KumarAinda não há avaliações

- Profit and Loss Projection 1yr 0Documento1 páginaProfit and Loss Projection 1yr 0Suraj RathiAinda não há avaliações

- Axis Bank LTD Payslip For The Month of July - 2019Documento1 páginaAxis Bank LTD Payslip For The Month of July - 2019Rohit Kumar33% (3)

- Response Letter - LOA - VAT 2021 - RAWDocumento2 páginasResponse Letter - LOA - VAT 2021 - RAWGeralyn BulanAinda não há avaliações

- Car Loan FormDocumento5 páginasCar Loan FormDrumaraAinda não há avaliações

- T03 - Home Office & BranchDocumento3 páginasT03 - Home Office & BranchChristian YuAinda não há avaliações

- FAR 3 Lease AccountingDocumento10 páginasFAR 3 Lease AccountingMhyke Vincent Panis100% (1)

- Mathieu, Rapp - 2009 - Laying The Foundation For Successful Team Performance Trajectories The Roles of Team Charters and Performance Strategies.Documento14 páginasMathieu, Rapp - 2009 - Laying The Foundation For Successful Team Performance Trajectories The Roles of Team Charters and Performance Strategies.Carlos PeresAinda não há avaliações

- Lesson 4 Investment ClubDocumento26 páginasLesson 4 Investment ClubVictor VandekerckhoveAinda não há avaliações

- PDD Accounting For Bad Debts and Writeoffs (BDAR2160)Documento37 páginasPDD Accounting For Bad Debts and Writeoffs (BDAR2160)SRDAinda não há avaliações

- GHope-Contents-Directors Profile-Letter To Shareholders-CEO ReviewDocumento98 páginasGHope-Contents-Directors Profile-Letter To Shareholders-CEO ReviewGerald ChowAinda não há avaliações

- Final Prospectus - PIK LSE IPODocumento333 páginasFinal Prospectus - PIK LSE IPObiblionat8373Ainda não há avaliações

- Diagnostic Investments QuestionsDocumento5 páginasDiagnostic Investments Questionscourse heroAinda não há avaliações

- Ho Chi Minh City Q4 2012 ReportDocumento27 páginasHo Chi Minh City Q4 2012 ReportQuin Nguyen PhuocAinda não há avaliações

- Model Residential Construction Contract Cost Plus Version 910Documento30 páginasModel Residential Construction Contract Cost Plus Version 910Hadi Prakoso100% (2)

- Chapter 1. Introduction To Cost and ManagementDocumento49 páginasChapter 1. Introduction To Cost and ManagementHARYATI SETYORINI100% (1)

- Chapter 11 - Allocation of Joint Costs and Accounting For By-ProductsDocumento27 páginasChapter 11 - Allocation of Joint Costs and Accounting For By-ProductsJoann CaneteAinda não há avaliações

- De Beers Insight Report 2014 PDFDocumento90 páginasDe Beers Insight Report 2014 PDFAntonia Maria100% (1)