Escolar Documentos

Profissional Documentos

Cultura Documentos

Jackson Automotive Financial Crisis Recovery

Enviado por

Erika ThengTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Jackson Automotive Financial Crisis Recovery

Enviado por

Erika ThengDireitos autorais:

Formatos disponíveis

Background 1. 2. 3. 4. 5. Jackson Automotive System was founded in 1961.

Larry Edwards took over the business in the mid 1990s. Successfully led the company through 2008-2009 global recessions. Jackson was on pace for its first year of capacity sales since 2007. In 2013, there were over 5,000 supplies in US with less than 200 companies had annual sales of more than $100 million. 6. Located in the Michigan area with the Big Three. 7. In 2008, sales dropping more than 30%; The Industry was running at about 55% capacity during the financial crisis. 8. The industry has rebounded since 2010 and returned profitability 2010 and returned profitability in 2011. Issues 1. Group of dissident shareholders moved Edwards to repurchase 40%of outstanding common shares for $10 million. 2. & 5 million came from cash and the other $5 million came from a 10 month short term loan. 3. Emerging from the financial crisis looking to ramp up production. 4. $2.4 Million worth of capital equipment needed to maintain production capacity 5. $5 Million Short Term Loan Now due 6. Shipment Delays due to material shortages caused shortfall in April-May Actual Sales 7. Shortfalls hindered the companys ability to pay back 5 Million loan in June 8. These components have arrived and items are to be shipped in June

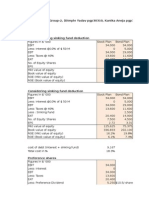

Scenario Comparison for Jackson Automotive Balance Sheet September 30 2013 Scenario 1 Cash 870 Accounts Receivable 5,954 Inventory 7,300 Current Assets 14,124 Gross PP&E Accumulated Depreciation Net PP&E Prepaid Expenses Total Assets Accounts Payable Notes Payable, Bank Accrued Taxes Other Accrued Expenses Costumer Advance Payments Current Liabilities Shareholders' Equity Total Liabilities and Equity 47,900 32,408 15,492 54 29,670 5,200 748 1,142 1,479 8,569 21,101 29,670

Scenario 2 4,470 5,954 7,300 17,724 47,900 32,408 15,492 54 33,270 5,200 748 1,142 1,479 8,569 24,701 33,270

Scenario 3 2,860 5,954 7,300 16,114 47,900 32,408 15,492 54 31,660 5,200 2,000 745 1,142 1,479 10,566 21,094 31,660

Ratio Analysis 2012 Sept 3,267 2.37 0.64 569 23% 42% 14.62 2013 Sept 9,155 3.88 0.79 463 2% 15.71 26%

Aug Net Working Capital Current Ratio Inventory Turnover Average Age of Inventory (Days) Debt Ratio Times Interest Earned 12,917 4.38 0.70 523

Aug 6,107 2.36 0.77 475

5Cs : Credit Character, Credit Capacity, Credit Conditions, Credit Collateral, Credit Capital Conclusion 1. 2. 3. 4. 5. 6. Requesting Extension for 5M dollar short-term loan for 4 months Additional 2.4 M dollar short-term loan Payable over one year Monthly principle payments $200,000 Annual Interest Rate of 7% Interest Payments of $91,000

Você também pode gostar

- Small Money Big Impact: Fighting Poverty with MicrofinanceNo EverandSmall Money Big Impact: Fighting Poverty with MicrofinanceAinda não há avaliações

- Jackson Auto Motives ReportDocumento12 páginasJackson Auto Motives ReportNajat Muna100% (1)

- Toy World - ExhibitsDocumento9 páginasToy World - Exhibitsakhilkrishnan007Ainda não há avaliações

- Week 6 Case AnalysisDocumento2 páginasWeek 6 Case AnalysisVarun Abbineni0% (1)

- Polar SportDocumento4 páginasPolar SportKinnary Kinnu0% (2)

- Investment Analysis Polar Sports ADocumento9 páginasInvestment Analysis Polar Sports AtalabreAinda não há avaliações

- Investment Analysis - Polar Sports (A)Documento9 páginasInvestment Analysis - Polar Sports (A)pratyush parmar100% (13)

- Polar SportsDocumento7 páginasPolar SportsShah HussainAinda não há avaliações

- Case - Polar SportsDocumento12 páginasCase - Polar SportsSagar SrivastavaAinda não há avaliações

- Consolidated Income and Cash Flow StatementsDocumento30 páginasConsolidated Income and Cash Flow StatementsrooptejaAinda não há avaliações

- Glaxo ItaliaDocumento11 páginasGlaxo ItaliaLizeth RamirezAinda não há avaliações

- Polar Sports, Inc SpreadsheetDocumento19 páginasPolar Sports, Inc Spreadsheetjordanstack100% (3)

- Polar Sports Level Production AnalysisDocumento15 páginasPolar Sports Level Production Analysisjordanstack0% (1)

- Polar SportsDocumento9 páginasPolar SportsAbhishek RawatAinda não há avaliações

- Jackson Automotive Systems ExcelDocumento5 páginasJackson Automotive Systems Excelonyechi2004Ainda não há avaliações

- Polar Sports, IncDocumento15 páginasPolar Sports, IncJennifer Jackson91% (11)

- Polar SportsDocumento15 páginasPolar SportsjordanstackAinda não há avaliações

- Toy World, Inc - Projected Balance Sheet and Income StatementDocumento4 páginasToy World, Inc - Projected Balance Sheet and Income StatementMartin Perrone0% (1)

- Teuer Furniture Case AnalysisDocumento3 páginasTeuer Furniture Case AnalysisPankaj KumarAinda não há avaliações

- Polar Sports Inc.Documento4 páginasPolar Sports Inc.Talia100% (1)

- Jones Electrical DistributionDocumento4 páginasJones Electrical Distributioncagc333Ainda não há avaliações

- LinearDocumento6 páginasLinearjackedup211Ainda não há avaliações

- Jones Electrical Faces Cash Shortfall Despite ProfitsDocumento5 páginasJones Electrical Faces Cash Shortfall Despite ProfitsAsif AliAinda não há avaliações

- Continental CarriersDocumento6 páginasContinental CarriersVishwas Nandan100% (1)

- Lecture 7-Toy WorldDocumento5 páginasLecture 7-Toy Worldonlyur44100% (2)

- Flash Memory IncDocumento7 páginasFlash Memory IncAbhinandan SinghAinda não há avaliações

- Should Industrial Grinders Produce Plastic RingsDocumento6 páginasShould Industrial Grinders Produce Plastic RingsCarrie Stevens100% (1)

- Bunker Company Negotiated A Lease With Gilbreth Company That BeginsDocumento1 páginaBunker Company Negotiated A Lease With Gilbreth Company That Beginstrilocksp SinghAinda não há avaliações

- Dividend Decision at Linear TechnologyDocumento8 páginasDividend Decision at Linear TechnologyNikhilaAinda não há avaliações

- Flash Memory IncDocumento3 páginasFlash Memory IncAhsan IqbalAinda não há avaliações

- Case 34 - The Wm. Wrigley Jr. CompanyDocumento72 páginasCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- Flash Memory CaseDocumento6 páginasFlash Memory Casechitu199233% (3)

- Flash MemoryDocumento9 páginasFlash MemoryJeffery KaoAinda não há avaliações

- Toy World CaseDocumento9 páginasToy World Casedwchief100% (1)

- Owens and Minor TemplateDocumento22 páginasOwens and Minor TemplatePrashant Pratap Singh0% (1)

- Ma Case WriteupDocumento4 páginasMa Case WriteupMayank Vyas100% (1)

- SureCut Exhibits and QuestionsDocumento16 páginasSureCut Exhibits and Questionssergej0% (1)

- Hampton Machine Tool CompanyDocumento2 páginasHampton Machine Tool CompanySam Sheehan100% (1)

- Surecut Shears, Inc.: AssetsDocumento8 páginasSurecut Shears, Inc.: Assetsshravan76Ainda não há avaliações

- Polar Sports: Where Does Polar Sports Fit in The Course?Documento21 páginasPolar Sports: Where Does Polar Sports Fit in The Course?Hugo100% (1)

- Condensed Income and Balance Sheet Data 1991-1993Documento18 páginasCondensed Income and Balance Sheet Data 1991-1993Lu Cheng50% (2)

- Midland EnergyDocumento9 páginasMidland EnergyPrashant MishraAinda não há avaliações

- (S3) Butler Lumber - EnGDocumento11 páginas(S3) Butler Lumber - EnGdavidinmexicoAinda não há avaliações

- Play Time Toys. Supplement 1 (To Do) Pro Forma Income Statements Under Level Production (1991)Documento12 páginasPlay Time Toys. Supplement 1 (To Do) Pro Forma Income Statements Under Level Production (1991)cpsharma15Ainda não há avaliações

- Industrial Grinders N VDocumento9 páginasIndustrial Grinders N Vapi-250891173100% (3)

- HAMPTON MACHINE TOOL Case - PresentationDocumento7 páginasHAMPTON MACHINE TOOL Case - PresentationChaitanya90% (10)

- Jackson Automotive Systems Company MarketDocumento8 páginasJackson Automotive Systems Company MarketKirtiKishanAinda não há avaliações

- Cadillac Cody CaseDocumento13 páginasCadillac Cody CaseKiran CheriyanAinda não há avaliações

- Cartwright Lumber Company Forecast Analysis (38Documento9 páginasCartwright Lumber Company Forecast Analysis (38Douglas Fraser0% (1)

- Dividend Policy at Linear TechnologyDocumento9 páginasDividend Policy at Linear TechnologySAHILAinda não há avaliações

- Exhibit No.1 Toy World, Inc.'s Pro-Forma Balance Sheet Under Level Production, 1994 (Thousands of Dollars)Documento5 páginasExhibit No.1 Toy World, Inc.'s Pro-Forma Balance Sheet Under Level Production, 1994 (Thousands of Dollars)Rohit Jhawar100% (2)

- Case Analysis - Toy WorldDocumento11 páginasCase Analysis - Toy Worldvarjin71% (7)

- ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFDocumento11 páginasACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFPiyal HossainAinda não há avaliações

- Ambac Writeup 2Q13Documento15 páginasAmbac Writeup 2Q13Mietek BiskupskiAinda não há avaliações

- Caso Jackson Automotive SystemDocumento7 páginasCaso Jackson Automotive SystemDiego E. Rodríguez100% (2)

- Exhibit 99.1 Message To ShareholdersDocumento8 páginasExhibit 99.1 Message To ShareholdersWilliam HarrisAinda não há avaliações

- Federal Reserve - June 2011 Consumer Credit (G.19)Documento2 páginasFederal Reserve - June 2011 Consumer Credit (G.19)rryan123123Ainda não há avaliações

- F9 RM QuestionsDocumento14 páginasF9 RM QuestionsImranRazaBozdar0% (1)

- FME520 Practice QuestionsDocumento3 páginasFME520 Practice QuestionsMatende SimionAinda não há avaliações

- Trend Analysis of Ultratech Cement - Aditya Birla Group.Documento9 páginasTrend Analysis of Ultratech Cement - Aditya Birla Group.Kanhay VishariaAinda não há avaliações

- Fundamentals of Corporate Finance, 2/e: Robert Parrino, Ph.D. David S. Kidwell, Ph.D. Thomas W. Bates, PH.DDocumento50 páginasFundamentals of Corporate Finance, 2/e: Robert Parrino, Ph.D. David S. Kidwell, Ph.D. Thomas W. Bates, PH.DThành NguyễnAinda não há avaliações

- Case-Digest-28 Inchausti Vs YuloDocumento8 páginasCase-Digest-28 Inchausti Vs YuloAiemiel ZyrraneAinda não há avaliações

- Xisaab XidhDocumento1 páginaXisaab XidhAbdiAinda não há avaliações

- A Project Report On Microfinance in IndiaDocumento73 páginasA Project Report On Microfinance in IndiaAjinkya ManeAinda não há avaliações

- SAP Global Implementation Conceptual-Design-Of-Finance and ControllingDocumento172 páginasSAP Global Implementation Conceptual-Design-Of-Finance and Controllingprakhar31Ainda não há avaliações

- Review of LiteratureDocumento5 páginasReview of LiteraturePOOONIASAUMYA100% (1)

- Simple Annuity Activity (Math of Investment)Documento1 páginaSimple Annuity Activity (Math of Investment)RCAinda não há avaliações

- Dianne FeinsteinDocumento5 páginasDianne Feinsteinapi-311780148Ainda não há avaliações

- Investing in Sustainable DevelopmentDocumento156 páginasInvesting in Sustainable DevelopmentIanDavidBocioacaAinda não há avaliações

- Flyleaf BooksDocumento32 páginasFlyleaf BooksAzhar MajothiAinda não há avaliações

- Cash Budget:: Hampton Freeze Inc. Cash Budget For The Year Ended December 31, 2009Documento11 páginasCash Budget:: Hampton Freeze Inc. Cash Budget For The Year Ended December 31, 2009renakwokAinda não há avaliações

- T-Accounts E. Tria Systems ConsultantDocumento8 páginasT-Accounts E. Tria Systems ConsultantAnya DaniellaAinda não há avaliações

- Assignment 1Documento2 páginasAssignment 1Babar Ali Roomi0% (1)

- Britannia IndsDocumento16 páginasBritannia IndsbysqqqdxAinda não há avaliações

- Enterprise Risk Management - Beyond TheoryDocumento34 páginasEnterprise Risk Management - Beyond Theoryjcl_da_costa6894100% (4)

- Project Report On "Role of Banks in International Trade": Page - 1Documento50 páginasProject Report On "Role of Banks in International Trade": Page - 1Adarsh Rasal100% (1)

- NMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYDocumento5 páginasNMIMS MUMBAI NAVI MUMBAI Student Activity Sponsorship and Exp - POLICYRushil ShahAinda não há avaliações

- Accounting 1 ReviewerDocumento3 páginasAccounting 1 ReviewerCortez, Charish BSAIS 1210 - BULACANAinda não há avaliações

- Rentberry Whitepaper enDocumento59 páginasRentberry Whitepaper enKen Sidharta0% (1)

- Answer To The Questions No - 6: A) Write Short Note - Monetary Policy and Fiscal Policy. 'Monetary Policy'Documento5 páginasAnswer To The Questions No - 6: A) Write Short Note - Monetary Policy and Fiscal Policy. 'Monetary Policy'obydursharifAinda não há avaliações

- Global Dis Trip Arks ProspectusDocumento250 páginasGlobal Dis Trip Arks ProspectusSandeepan ChaudhuriAinda não há avaliações

- Cost of CapitalDocumento68 páginasCost of CapitalJohn Ervin TalagaAinda não há avaliações

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 páginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Anita GaourAinda não há avaliações

- Plastic Money Full Project Copy ARNABDocumento41 páginasPlastic Money Full Project Copy ARNABarnab_b8767% (3)

- 3.1.2 IFM Module2Documento18 páginas3.1.2 IFM Module2Aishwarya M RAinda não há avaliações

- Jump Start Co JSC A Subsidiary of Mason Industries ManufactDocumento1 páginaJump Start Co JSC A Subsidiary of Mason Industries ManufactAmit PandeyAinda não há avaliações

- Insak personality test questions and English language examplesDocumento5 páginasInsak personality test questions and English language examplesPai YeeAinda não há avaliações

- Shamik Bhose September Crude Oil ReportDocumento8 páginasShamik Bhose September Crude Oil ReportshamikbhoseAinda não há avaliações

- CRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSDocumento6 páginasCRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSRovern Keith Oro CuencaAinda não há avaliações

- Invoice #100 for Project or Service DescriptionDocumento1 páginaInvoice #100 for Project or Service DescriptionsonetAinda não há avaliações