Escolar Documentos

Profissional Documentos

Cultura Documentos

Ordinance No. 506: An Ordinance Providing Guidelines For The Implementation of Ordinance No. 501

Enviado por

Vanny Joyce Baluyut0 notas0% acharam este documento útil (0 voto)

13 visualizações10 páginasordinance PPC

Título original

Ordinance No 506

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PPT, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoordinance PPC

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

13 visualizações10 páginasOrdinance No. 506: An Ordinance Providing Guidelines For The Implementation of Ordinance No. 501

Enviado por

Vanny Joyce Baluyutordinance PPC

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PPT, PDF, TXT ou leia online no Scribd

Você está na página 1de 10

ORDINANCE NO.

506

AN ORDINANCE PROVIDING GUIDELINES FOR THE IMPLEMENTATION OF ORDINANCE NO. 501 .

ORDINANCE NO. 506

Section 1. Title. This Ordinance shall be cited as An Ordinance providing guidelines for the implementation of Ordinance No. 501 series of 2011.

ORDINANCE NO. 506

Section 2. Implementation Scheme.

The collection of Real Property Taxes provided for in Ordinance No. 501 shall be graduated for a period of two (2) years as follows:

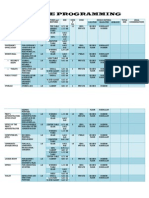

ORDINANCE NO. 506 On Land:

CLASS ASSESSMENT LEVELS 20% 40% 15% 40% 20% 20% 1st Year (2012) 75% 70% 100% 100% 100% 100% 2nd Year (2013) 100% 100%

Residential Commercial Agricultural Industrial Mineral Timberland

ORDINANCE NO. 506

Section 3. Tax payers who are already paid in advance or in full their Real Property Taxes ahead of this Implementing Scheme shall be entitled to tax credit for the ensuing taxable quarter or year.

ORDINANCE NO. 506

Section 4. Separability Clause. In the event that any provision of this Ordinance be declared void by a competent court, provisions not declared to be so shall remain in full force and effect. Section 5. Repealing Clause. Ordinances, rules and regulations, and other issuances inconsistent with any of the provision of this Ordinance are hereby repealed, amended or modified accordingly.

ORDINANCE NO. 506

Section 6. Effectively Clause. This Ordinance shall take effect fifteen (15) days after completion of its publication in a newspaper of general circulation. S0 ORDAINED.

APPROVED: Ordinance No. 506 on Feb. 08, 2012

ORDINANCE NO. 506

EXAMPLE COMPUTATION: GIVEN:

CLASS ORD. 56 EXISTING RPT(1998) ORD.501 APPEAL 1ST YEAR APPEAL 2ND YEAR

RESL. COMML.

10% 16.5%

20% 40%

15% 28%

20% 40%

ORDINANCE NO. 506

COMPUTATION: RESIDENTIAL:

MKT. VALUE ASSESSMENT LEVEL P 327,000.00 P 327,000.00 ASSESSED VALUE 1ST YEAR (2012) 2ND YEAR (2013)

10% 20%

32,700.00 65,400.00 75%

P 327,000.00

20%

65,400.00

100%

ORDINANCE NO. 506

COMPUTATION: COMMERCIAL:

MKT. VALUE P 327,000.00 P 327,000.00 P 327,000.00 ASS. LEVEL ASSESSED VALUE 1ST YEAR 2ND YEAR

16.5% 40% 40%

53,955.00 130,800.00 130,800.00 70% 100%

Você também pode gostar

- Casino Jackpot Accounting TreatmentDocumento14 páginasCasino Jackpot Accounting Treatmentkenjames007Ainda não há avaliações

- US Internal Revenue Service: rp-00-11Documento24 páginasUS Internal Revenue Service: rp-00-11IRSAinda não há avaliações

- Set-On (In Case of Huge Profits,)Documento10 páginasSet-On (In Case of Huge Profits,)Dhananjayan GopinathanAinda não há avaliações

- Revenue Regulations No. 7 - 2006: Quezon City May 18, 2006Documento2 páginasRevenue Regulations No. 7 - 2006: Quezon City May 18, 2006Sy HimAinda não há avaliações

- Companies (Accounting Standards) Rules, 2006: TG TeamDocumento5 páginasCompanies (Accounting Standards) Rules, 2006: TG TeamSun DaygyAinda não há avaliações

- Illinois Senate Bill 1 Conference Committee Final ReportDocumento327 páginasIllinois Senate Bill 1 Conference Committee Final ReportReboot IllinoisAinda não há avaliações

- Budget Circular No 2023 3 December 14 2023Documento6 páginasBudget Circular No 2023 3 December 14 2023Salvacion BandoyAinda não há avaliações

- Budget Circular No 2022 05 Dated Dec 28 2022Documento5 páginasBudget Circular No 2022 05 Dated Dec 28 2022Richard Rae PrestozaAinda não há avaliações

- US Internal Revenue Service: td8947Documento7 páginasUS Internal Revenue Service: td8947IRSAinda não há avaliações

- Irr Ra 11701Documento3 páginasIrr Ra 11701Darren RuelanAinda não há avaliações

- 2012 FednewsDocumento2 páginas2012 FednewsMarketsWikiAinda não há avaliações

- CPCS Implementing Circular No.2016-01 (Re-Eissued)Documento4 páginasCPCS Implementing Circular No.2016-01 (Re-Eissued)lejigeAinda não há avaliações

- India:: Decoding IBC (Amendment) Ordinance, 2020 For Creditors and Corporate DebtorsDocumento4 páginasIndia:: Decoding IBC (Amendment) Ordinance, 2020 For Creditors and Corporate Debtorsanon_200519719Ainda não há avaliações

- Labstan Finals RevisionDocumento16 páginasLabstan Finals RevisionAinah KingAinda não há avaliações

- Govt Press FormsDocumento52 páginasGovt Press Formsmunupattnaik2719Ainda não há avaliações

- Concurring and Dissenting of Del Castillo, J.:: Authority To Augment SavingsDocumento7 páginasConcurring and Dissenting of Del Castillo, J.:: Authority To Augment SavingsDashaHoopAinda não há avaliações

- Reg NCR Wo 8Documento19 páginasReg NCR Wo 8Justin SacedonAinda não há avaliações

- Notification GSR 739Documento4 páginasNotification GSR 739Varinder AnandAinda não há avaliações

- Supplements SLCMDocumento78 páginasSupplements SLCMSriram PRAinda não há avaliações

- Payment of Wages Act, 1936 IDocumento30 páginasPayment of Wages Act, 1936 Iprathu601Ainda não há avaliações

- Supplements SLCMDocumento97 páginasSupplements SLCMgauravAinda não há avaliações

- Bars On Initiation of CIRPDocumento4 páginasBars On Initiation of CIRPAtulya Singh ChauhanAinda não há avaliações

- Directions NBFCDocumento6 páginasDirections NBFChhhhhhhuuuuuyyuyyyyyAinda não há avaliações

- CPCS 2021-005 Grant of Night Shift DifferentialDocumento3 páginasCPCS 2021-005 Grant of Night Shift DifferentialEdson Jude DonosoAinda não há avaliações

- Payment Services Regulations 2019Documento48 páginasPayment Services Regulations 2019asdAinda não há avaliações

- Supplement Company LawDocumento39 páginasSupplement Company LawUmesh PrasadAinda não há avaliações

- Contract Labour (R&A) Act 1970Documento71 páginasContract Labour (R&A) Act 1970prathu601100% (2)

- Draft File (Shafin)Documento11 páginasDraft File (Shafin)MD Shafin AhmedAinda não há avaliações

- Dodd-Frank Act - Final and Proposed Rules Compliance Matrix and CalendarDocumento1 páginaDodd-Frank Act - Final and Proposed Rules Compliance Matrix and CalendarIQ3 Solutions GroupAinda não há avaliações

- Possibilities in Taxation - Atty. Bobby LockDocumento14 páginasPossibilities in Taxation - Atty. Bobby LockROCHELLEAinda não há avaliações

- S. 2747Documento10 páginasS. 2747kirkilsenAinda não há avaliações

- G.R. Nos. 240163 & 240168-69Documento11 páginasG.R. Nos. 240163 & 240168-69Lino MomonganAinda não há avaliações

- 413rr04 08Documento2 páginas413rr04 08Sy HimAinda não há avaliações

- Wage Order No. Rbiii-10Documento23 páginasWage Order No. Rbiii-10Mr. Mark B.Ainda não há avaliações

- Irr Ra 11701Documento3 páginasIrr Ra 11701howell.sanchez001Ainda não há avaliações

- The Industrial Employment Standing Orders Act, 1946Documento31 páginasThe Industrial Employment Standing Orders Act, 1946Abhiraj RaviAinda não há avaliações

- Reg 07 - Wo 7Documento15 páginasReg 07 - Wo 7bebs CachoAinda não há avaliações

- Mitt Romney's FY 2004 BudgetDocumento63 páginasMitt Romney's FY 2004 BudgetAndrew KaczynskiAinda não há avaliações

- Federal Register / Vol. 76, No. 163 / Tuesday, August 23, 2011 / Rules and RegulationsDocumento8 páginasFederal Register / Vol. 76, No. 163 / Tuesday, August 23, 2011 / Rules and RegulationsMarketsWikiAinda não há avaliações

- Sarbanes Oxley and Internal Controls After The Dodd Frank ActDocumento17 páginasSarbanes Oxley and Internal Controls After The Dodd Frank ActGeorge LekatisAinda não há avaliações

- Guidance Note On Accounting For Depreciation in CompaniesDocumento25 páginasGuidance Note On Accounting For Depreciation in CompaniesMANISH SINGHAinda não há avaliações

- US Internal Revenue Service: rp-03-62Documento12 páginasUS Internal Revenue Service: rp-03-62IRSAinda não há avaliações

- CPCS 2021-001 Grant of Year-End Bonus and Cash GiftDocumento4 páginasCPCS 2021-001 Grant of Year-End Bonus and Cash GiftEdson Jude DonosoAinda não há avaliações

- Chapter XXVI Nidhis Rules, 2014Documento32 páginasChapter XXVI Nidhis Rules, 2014Jitendra RavalAinda não há avaliações

- © The Institute of Chartered Accountants of IndiaDocumento50 páginas© The Institute of Chartered Accountants of Indiaprabhawagarwalla9690Ainda não há avaliações

- Bouns Act 1965Documento22 páginasBouns Act 1965ravishankerramanAinda não há avaliações

- RTP Ipcc-P5Documento52 páginasRTP Ipcc-P5aliabbas966Ainda não há avaliações

- Budget Circular No. 2022 4 Dated December 20 2022Documento7 páginasBudget Circular No. 2022 4 Dated December 20 2022Antipolo City BudgetAinda não há avaliações

- Reg NCR - Wo 10Documento18 páginasReg NCR - Wo 10Carlo LansangAinda não há avaliações

- AuditorDocumento9 páginasAuditorRamesh RanjanAinda não há avaliações

- Department of The Treasury: Washington, DC 20220Documento33 páginasDepartment of The Treasury: Washington, DC 20220Chris GonzalesAinda não há avaliações

- Code of Fiscal BenefitsDocumento19 páginasCode of Fiscal Benefitsantonior70Ainda não há avaliações

- Commission On Audit Circular No. 90-332 April 20, 1990 TODocumento2 páginasCommission On Audit Circular No. 90-332 April 20, 1990 TOJOHAYNIEAinda não há avaliações

- Law 2 2019 PDFDocumento26 páginasLaw 2 2019 PDFeissa.liAinda não há avaliações

- US Internal Revenue Service: n-07-45Documento9 páginasUS Internal Revenue Service: n-07-45IRSAinda não há avaliações

- 220 Schedule2017 2018Documento92 páginas220 Schedule2017 2018Felipe Aguirre CuartasAinda não há avaliações

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisAinda não há avaliações

- Youth Amba 2014 Application Form FinalDocumento2 páginasYouth Amba 2014 Application Form FinalVanny Joyce BaluyutAinda não há avaliações

- CADTDocumento24 páginasCADTVanny Joyce Baluyut100% (1)

- Space ProgrammingDocumento4 páginasSpace ProgrammingVanny Joyce Baluyut0% (1)

- Insular Life Assurance Co., Ltd. v. Serafin D. Feliciano, Et Al. - 074 Phil 468Documento8 páginasInsular Life Assurance Co., Ltd. v. Serafin D. Feliciano, Et Al. - 074 Phil 468Vanny Joyce BaluyutAinda não há avaliações

- 2143 4646 1 PBDocumento19 páginas2143 4646 1 PBjayrenzo26Ainda não há avaliações

- UST GN 2011 Criminal Law ProperDocumento262 páginasUST GN 2011 Criminal Law ProperLariza AidieAinda não há avaliações

- Chainsaw ActDocumento12 páginasChainsaw ActolofuzyatotzAinda não há avaliações

- G.R. No. 92492 June 17, 1993 - Thelma Vda. de Canilang v. Court of Appeals, Et Al.Documento11 páginasG.R. No. 92492 June 17, 1993 - Thelma Vda. de Canilang v. Court of Appeals, Et Al.Vanny Joyce BaluyutAinda não há avaliações

- G.R. No. 47593 September 13, 1941 - The Insular Life Assurance Co. v. Serafin D. Feliciano, Et Al. - 073 Phil 201Documento14 páginasG.R. No. 47593 September 13, 1941 - The Insular Life Assurance Co. v. Serafin D. Feliciano, Et Al. - 073 Phil 201Vanny Joyce BaluyutAinda não há avaliações

- RA 7277 - Magna Carta of Disabled PersonsDocumento18 páginasRA 7277 - Magna Carta of Disabled PersonsVanny Joyce Baluyut100% (3)

- Bill of Rights Reviewer FullDocumento31 páginasBill of Rights Reviewer Fullroansalanga100% (22)

- The Wake of Typhoon YolandaDocumento2 páginasThe Wake of Typhoon YolandaVanny Joyce BaluyutAinda não há avaliações

- Balanced Scorecard TemplateDocumento3 páginasBalanced Scorecard TemplateVanny Joyce BaluyutAinda não há avaliações

- G.R. No. 171035 - William Ong Genato v. Benjamin Bayhon, Et Al.Documento9 páginasG.R. No. 171035 - William Ong Genato v. Benjamin Bayhon, Et Al.Vanny Joyce BaluyutAinda não há avaliações

- Cases of Insurable InterestDocumento10 páginasCases of Insurable InterestVanny Joyce BaluyutAinda não há avaliações

- Different Economic SystemsDocumento24 páginasDifferent Economic SystemsVanny Joyce BaluyutAinda não há avaliações

- G.R. No. 131622. November 27, 1998 Medel, Medel and Franco vs. Court of Appeals, Spouses Gonzales - 299 SCRA 481Documento8 páginasG.R. No. 131622. November 27, 1998 Medel, Medel and Franco vs. Court of Appeals, Spouses Gonzales - 299 SCRA 481Vanny Joyce BaluyutAinda não há avaliações

- Cases of Insurable InterestDocumento10 páginasCases of Insurable InterestVanny Joyce BaluyutAinda não há avaliações

- Monitoring and Assessment Quality Objectives - Form - Admin.2Documento3 páginasMonitoring and Assessment Quality Objectives - Form - Admin.2Vanny Joyce BaluyutAinda não há avaliações

- Finals Reviewer - Labor StandardsDocumento36 páginasFinals Reviewer - Labor StandardsAldrich Alvaera100% (2)