Escolar Documentos

Profissional Documentos

Cultura Documentos

Eps

Enviado por

Katrina MoëtDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Eps

Enviado por

Katrina MoëtDireitos autorais:

Formatos disponíveis

Fleet notes were pretty quiet in terms of contracting RDC '13:-2.

4% '14:-5% '15:+2% New contract on the Bob Keller w/ Aramco for 10 years at a rate of $178k/day. Thhere was incremental downtime in 2013. New downtime in 2014 was due to rigs be ing off rate for inspection. I did not capitalize the costs on this new downtime because RDC capitalizes costs on major equipment upgrades. DO '13:+1% (less downtime and the Ocean King got a contract (300' JU in the GOM wit h Energy XXI) at 120k/day for about 3 months. I had some downtime on this rig to account for contracting risk) '14: flat '15: flat The Ocean Quest in Malaysia is still shown as being actively marketed HERO [Most of the rigs got a $2000k+ bump in dayrates because of costs increases '13: +3% '14: -1% (downtime shifted from the end of 2013 to 2014 and The 267 (was waiting on work permits in Angola) just started working on the 18th ) '15: flat New contracts on the Hercules 202 (200 'MC with EPL $107k/day. Not a new leading edge rate.) The 253 (250' MS got a contract with EPL at $105k/day) The Resilience is still uncontracted Liftboat dayrates were flat at 23.5k/day but utilization went up 9 percentage po ints to 73%.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Manual de Referencia PlanmecaDocumento288 páginasManual de Referencia PlanmecaJorge Escalona Hernandez100% (2)

- Module A Specimen Questions January2020 PDFDocumento5 páginasModule A Specimen Questions January2020 PDFShashi Bhusan SinghAinda não há avaliações

- Vturn-NP16 NP20Documento12 páginasVturn-NP16 NP20José Adalberto Caraballo Lorenzo0% (1)

- Past The Shallows EssayDocumento2 páginasPast The Shallows EssaycaitlinAinda não há avaliações

- Fundamentals of Fast SwimmingDocumento9 páginasFundamentals of Fast SwimmingTorcay Ulucay100% (1)

- fLOW CHART FOR WORKER'S ENTRYDocumento2 páginasfLOW CHART FOR WORKER'S ENTRYshamshad ahamedAinda não há avaliações

- TDS Versimax HD4 15W40Documento1 páginaTDS Versimax HD4 15W40Amaraa DAinda não há avaliações

- Circulatory System Packet BDocumento5 páginasCirculatory System Packet BLouise SalvadorAinda não há avaliações

- Forest Fire Detection and Guiding Animals To A Safe Area by Using Sensor Networks and SoundDocumento4 páginasForest Fire Detection and Guiding Animals To A Safe Area by Using Sensor Networks and SoundAnonymous 6iFFjEpzYjAinda não há avaliações

- Treatment of Fruit Juice Concentrate Wastewater by Electrocoagulation - Optimization of COD Removal (#400881) - 455944Documento5 páginasTreatment of Fruit Juice Concentrate Wastewater by Electrocoagulation - Optimization of COD Removal (#400881) - 455944Victoria LeahAinda não há avaliações

- New Microsoft Excel WorksheetDocumento4 páginasNew Microsoft Excel WorksheetRaheel Neo AhmadAinda não há avaliações

- Montgomery County Ten Year Comprehensive Water Supply and Sewerage Systems Plan (2003)Documento228 páginasMontgomery County Ten Year Comprehensive Water Supply and Sewerage Systems Plan (2003)rebolavAinda não há avaliações

- Strauss Dental Catalog 2013Documento74 páginasStrauss Dental Catalog 2013d3xt3rokAinda não há avaliações

- Executive Order 000Documento2 páginasExecutive Order 000Randell ManjarresAinda não há avaliações

- Life Overseas 7 ThesisDocumento20 páginasLife Overseas 7 ThesisRene Jr MalangAinda não há avaliações

- LH 11 180 190 220 230 270 280 390 400 Breaker Safety & Operating InstructionsDocumento304 páginasLH 11 180 190 220 230 270 280 390 400 Breaker Safety & Operating InstructionshadensandorAinda não há avaliações

- Challenges of Tourism Students in Commercial CookingDocumento29 páginasChallenges of Tourism Students in Commercial CookingMaeve Anne JaimeAinda não há avaliações

- Stress and FilipinosDocumento28 páginasStress and FilipinosDaniel John Arboleda100% (2)

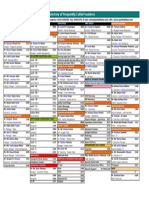

- Directory of Frequently Called Numbers: Maj. Sheikh RahmanDocumento1 páginaDirectory of Frequently Called Numbers: Maj. Sheikh RahmanEdward Ebb BonnoAinda não há avaliações

- RHS NCRPO COVID FormDocumento1 páginaRHS NCRPO COVID Formspd pgsAinda não há avaliações

- 05 AcknowledgementDocumento2 páginas05 AcknowledgementNishant KushwahaAinda não há avaliações

- 10059-DC-K-01-A Design BasisDocumento34 páginas10059-DC-K-01-A Design BasisAnonymous RvIgDUAinda não há avaliações

- QRF HD785-7Documento2 páginasQRF HD785-7Ralf MaurerAinda não há avaliações

- Myth and Realism in The Play A Long Day's Journey Into Night of Eugene O'neillDocumento4 páginasMyth and Realism in The Play A Long Day's Journey Into Night of Eugene O'neillFaisal JahangeerAinda não há avaliações

- 8-26-16 Police ReportDocumento14 páginas8-26-16 Police ReportNoah StubbsAinda não há avaliações

- Diagnostic and Statistical Manual of Mental Disorders: Distinction From ICD Pre-DSM-1 (1840-1949)Documento25 páginasDiagnostic and Statistical Manual of Mental Disorders: Distinction From ICD Pre-DSM-1 (1840-1949)Unggul YudhaAinda não há avaliações

- Universal Basic IncomeDocumento31 páginasUniversal Basic IncomeumairahmedbaigAinda não há avaliações

- Mod 6 Soft Tissue InjuriesDocumento5 páginasMod 6 Soft Tissue Injuriesrez1987100% (1)

- Zygomatic Complex FracturesDocumento128 páginasZygomatic Complex FracturesTarun KashyapAinda não há avaliações