Escolar Documentos

Profissional Documentos

Cultura Documentos

Problem 18-7

Enviado por

api-2546351360 notas0% acharam este documento útil (0 voto)

100 visualizações4 páginasTítulo original

copy of problem 18-7

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

XLS, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato XLS, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

100 visualizações4 páginasProblem 18-7

Enviado por

api-254635136Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato XLS, PDF, TXT ou leia online no Scribd

Você está na página 1de 4

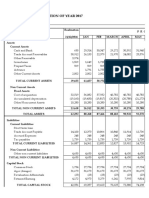

DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT

101 Cash in Bank 22,323 22,323 22,323

115 Accts. Receivable 1,737 1,737 1,737

125 Merchandise Inventory 23,654 534 24,188 24,188

130 Supplies 3,971 2,922 1,049 1,049

135 Prepaid Insurance 1,800 675 1,125 1,125

140 Store Equipment 25,395 25,395 25,395

145 Office Equipment 15,239 15,239 15,239

201 Accounts Payable 11,051 11,051 11,051

207 Federal Corporate Income Tax Payable 177 177 177

210 Employees' Federal Income Tax Payable 519 519 519

211 Employees' State Income Tax Payable 142 142 142

212 Social Security Tax Payable 408 408 408

213 Medicare Tax Payable 137 137 137

215 Sales Tax Payable 1,871 1,871 1,871

216 Federal Unemployment Tax Payable 51 51 51

217 State Unemployement Tax Payable 263 263 263

301 Capital Stock 40,000 40,000 40,000

305 Retained Earnings 14,908 14,908 14,908

310 Income Summary 534 534 534

401 Sales 128,231 128,231 128,231

405 Sales Discounts 214 214 214

410 Sales Returns and Allowances 1,289 1,289 1,289

501 Purchases 67,118 67,118 67,118

505 Transportation In 1,172 1,172 1,172

510 Purchases Discounts 810 810 810

515 Purchases Returns and Allowances 322 322 322

601 Advertising Expense 2,938 2,938 2,938

605 Bankcard Fees Expense 185 185 185

620 Federal Corporate Inocme Tax Expense 3,650 177 3,827 3,827

630 Insurance Expense 675 675 675

640 Maintenance Expense 2,450 2,450 2,450

645 Miscellaneous Expense 3,929 3,929 3,929

647 Payroll Tax Expense 834 834 834

650 Rent Expense 10,750 10,750 10,750

655 Salaries Expense 4,670 4,670 4,670

660 Supplies Expense 2,922 2,922 2,922

670 Utilities Expense 5,395 5,395 5,395

198,713 198,713 4,308 4,308 199,424 199,424 108,368 129,897 91,056 69,527

Net Income 21,529 21,529

129,897 129,897 91,056 91,056

INCOME STATEMENT BALANCE SHEET

Shutterbug Cameras

Worksheet

For the Year Ended August 31, 2010

ACCOUNT NAME

ACCT

NO.

TRIAL BALANCE ADJUSTMENTS

ADJUSTED TRIAL

BALANCE

PAGE 6

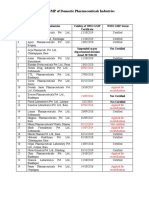

DESCRIPTION

POST

REF DEBIT CREDIT

GENERAL JOURNAL

DATE

Account Account No.

Debit Credit

Account Account No.

Debit Credit

Account Sales Account No.

Debit Credit

Account Account No.

Debit Credit

Account Account No.

Debit Credit

Account Account No.

Debit Credit

Account Account No.

Debit Credit

Account Account No.

Debit Credit

Account Account No.

Debit Credit

Account Account No.

Debit Credit

Account Account No.

Debit Credit

Account Account No.

Debit Credit

Balance

Date Description Post. Ref. Debit Credit

Balance

Date Description Post. Ref. Debit Credit

Balance

Date Description Post. Ref. Debit Credit

Balance

Date Description Post. Ref. Debit Credit

Balance

Date Description Post. Ref. Debit Credit

Date

Balance

Date Description Post. Ref. Debit Credit

Date Description Post. Ref. Debit Credit

Balance

Credit

Balance

Description Post. Ref. Debit Credit

Balance

Balance

Date Description Post. Ref. Debit

General Ledger (Partial)

Date Description Post. Ref. Debit Credit

Date Description Post. Ref. Debit Credit

Balance

Date Description Post. Ref. Debit Credit

Balance

Date Transaction

1-May Jack Hines invested $50,000 in the business, Memo 1.

2-May

The owner, Jack Hines, invested a desktop computer and printer

(Office Equipment) worth $3,500, Memo 2.

2-May Issued Check 101 for $125 for the purchase of office supplies.

Bought office furniture for $2,700 on account from Office Systems,

Invoice 457.

Bought a Web Server from Computer Specialists Inc. on account for

$35,000, Invoice WS 972.

Received $1,500 from James Mason for Web site services

Você também pode gostar

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineAinda não há avaliações

- Problem 19-7 QDocumento3 páginasProblem 19-7 Qapi-250474715Ainda não há avaliações

- Problem 19-7 QDocumento3 páginasProblem 19-7 Qapi-250474715Ainda não há avaliações

- Problem 18-8Documento4 páginasProblem 18-8api-254635136Ainda não há avaliações

- IMT CeresDocumento10 páginasIMT Cerescabmeuk07Ainda não há avaliações

- Lion Brewery (Ceylon) PLC: Interim Condensed Financial Statements For The Third Quarter Ended 31st December 2021Documento13 páginasLion Brewery (Ceylon) PLC: Interim Condensed Financial Statements For The Third Quarter Ended 31st December 2021hvalolaAinda não há avaliações

- FIMA 30013 FS Analysis Premium Notes P1Documento5 páginasFIMA 30013 FS Analysis Premium Notes P1dcdeguzman.pup.pulilanAinda não há avaliações

- January-December. All Values PHP MillionsDocumento19 páginasJanuary-December. All Values PHP MillionsJPIA Scholastica DLSPAinda não há avaliações

- Chapter 2Documento32 páginasChapter 2AhmedAinda não há avaliações

- Lecture - 5 - CFI-3-statement-model-completeDocumento37 páginasLecture - 5 - CFI-3-statement-model-completeshreyasAinda não há avaliações

- New Model of NetflixDocumento17 páginasNew Model of NetflixPencil ArtistAinda não há avaliações

- Practice Problems, CH 12Documento6 páginasPractice Problems, CH 12scridAinda não há avaliações

- CR-July-Aug-2022Documento6 páginasCR-July-Aug-2022banglauserAinda não há avaliações

- Nabil Bank Q1 FY 2021Documento28 páginasNabil Bank Q1 FY 2021Raj KarkiAinda não há avaliações

- Financials VTL FinalDocumento19 páginasFinancials VTL Finalmuhammadasif961Ainda não há avaliações

- HBL Financial Statements for the nine months ended September 30, 2022Documento69 páginasHBL Financial Statements for the nine months ended September 30, 2022Irfan MasoodAinda não há avaliações

- Acct 401 Tutorial Set FiveDocumento13 páginasAcct 401 Tutorial Set FiveStudy GirlAinda não há avaliações

- Financial Report For The Year 2020-21Documento280 páginasFinancial Report For The Year 2020-21Amanuel TewoldeAinda não há avaliações

- Acc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291Documento201 páginasAcc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291290acc100% (2)

- AMARILODocumento8 páginasAMARILOIngrid Molina GarciaAinda não há avaliações

- MS Brothers Super Rice MillDocumento9 páginasMS Brothers Super Rice MillMasud Ahmed khan100% (1)

- Tugas (TM.5) Manajemen KeuanganDocumento12 páginasTugas (TM.5) Manajemen KeuanganFranklyn DavidAinda não há avaliações

- HBL Financial Statements - December 31, 2022Documento251 páginasHBL Financial Statements - December 31, 2022Muhammad MuzammilAinda não há avaliações

- Lesson 2 - Activity FSA2Documento4 páginasLesson 2 - Activity FSA2jeffrey galanzaAinda não há avaliações

- Anchor Compa CommonDocumento14 páginasAnchor Compa CommonCY ParkAinda não há avaliações

- Unaudited - Quarterly - Result - Q4 - 2076-77 NIBLDocumento23 páginasUnaudited - Quarterly - Result - Q4 - 2076-77 NIBLManish BhandariAinda não há avaliações

- PROJECTED FINANCIAL STATEMENTSDocumento3 páginasPROJECTED FINANCIAL STATEMENTSNouman BaigAinda não há avaliações

- Financial Position 2019 2020Documento1 páginaFinancial Position 2019 2020Anacristina PincaAinda não há avaliações

- A. Change Analysis Apple Blossom Cologne Company Working Trial Balance - Balance Sheet 12-31-03 Per Audit 12-31-02 Per Books 12-31-03 Dollar ChangeDocumento6 páginasA. Change Analysis Apple Blossom Cologne Company Working Trial Balance - Balance Sheet 12-31-03 Per Audit 12-31-02 Per Books 12-31-03 Dollar ChangeLintang UtomoAinda não há avaliações

- HHB - Announcement - 1Q FY2022 Result - 20210803Documento14 páginasHHB - Announcement - 1Q FY2022 Result - 20210803Dennis HaAinda não há avaliações

- Interim Financial Statements For The Period Ended 30 September 2022Documento10 páginasInterim Financial Statements For The Period Ended 30 September 2022kasun witharanaAinda não há avaliações

- SCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022Documento13 páginasSCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022kimAinda não há avaliações

- CFI 3 Statement Model Complete in ClassDocumento10 páginasCFI 3 Statement Model Complete in ClassThiện NhânAinda não há avaliações

- Tab D - Detailed Financial StatementsDocumento13 páginasTab D - Detailed Financial Statementsarellano lawschoolAinda não há avaliações

- M4 Example 2 SDN BHD FSADocumento38 páginasM4 Example 2 SDN BHD FSAhanis nabilaAinda não há avaliações

- Solutions For Bubble and BeeDocumento12 páginasSolutions For Bubble and BeeMavin Jerald100% (6)

- Reliance CommunicationsDocumento117 páginasReliance Communicationsrahul m dAinda não há avaliações

- Swisstek (Ceylon) PLC Swisstek (Ceylon) PLCDocumento7 páginasSwisstek (Ceylon) PLC Swisstek (Ceylon) PLCkasun witharanaAinda não há avaliações

- Coca-Cola and Pepsi Economic Analysis ReportDocumento39 páginasCoca-Cola and Pepsi Economic Analysis ReportJing Xiong67% (3)

- CF Export 28 11 2023Documento17 páginasCF Export 28 11 2023juan.farrelAinda não há avaliações

- Case Assignment 2 (Rocky Mountain Chocolate Factory) TEMPLATEDocumento10 páginasCase Assignment 2 (Rocky Mountain Chocolate Factory) TEMPLATESindhu KatireddyAinda não há avaliações

- mc21 - 090716 - MCB LTD - Financial Statements - tcm55-52628Documento7 páginasmc21 - 090716 - MCB LTD - Financial Statements - tcm55-52628Jessnah GraceAinda não há avaliações

- Draft Nine Months AccountsDocumento5 páginasDraft Nine Months AccountsHenry James NepomucenoAinda não há avaliações

- Balance Sheet & P & LDocumento3 páginasBalance Sheet & P & LSatish WagholeAinda não há avaliações

- Enterprise GroupDocumento8 páginasEnterprise GroupFuaad DodooAinda não há avaliações

- Bursa Announcement DIYQ12022Documento13 páginasBursa Announcement DIYQ12022Quint WongAinda não há avaliações

- Tutorial 4B : Excel: More Applications in AccountingDocumento7 páginasTutorial 4B : Excel: More Applications in Accountingasdsad dsadsaAinda não há avaliações

- Spreadsheet-Company A - Quiz 2Documento6 páginasSpreadsheet-Company A - Quiz 2BinsiboiAinda não há avaliações

- ATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)Documento15 páginasATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)eunjoAinda não há avaliações

- PDJM NEW KGJGJGJKGJGJGDocumento72 páginasPDJM NEW KGJGJGJKGJGJGNabila Intan SariAinda não há avaliações

- Redco Textiles Q1 2022 ReportDocumento11 páginasRedco Textiles Q1 2022 ReportTutii FarutiAinda não há avaliações

- LWL Dec2021Documento7 páginasLWL Dec2021Shabry SamoonAinda não há avaliações

- Budget Artikel ExcelDocumento8 páginasBudget Artikel ExcelnugrahaAinda não há avaliações

- Budget PT Abcd Balance Sheet Projection of Year 2017Documento8 páginasBudget PT Abcd Balance Sheet Projection of Year 2017Abdul SyukurAinda não há avaliações

- PT JayatamaDocumento24 páginasPT Jayatamaputri apriliaAinda não há avaliações

- Directors Report Q3 2018 PerformanceDocumento24 páginasDirectors Report Q3 2018 PerformanceMOORTHYAinda não há avaliações

- Comparative Analysis of Filinvest Land Inc. and Subsidiaries' Statement of Financial Position from 2017-2021Documento28 páginasComparative Analysis of Filinvest Land Inc. and Subsidiaries' Statement of Financial Position from 2017-2021Kris MacuhaAinda não há avaliações

- Robi Retail Holdings Inc. annual income statement analysisDocumento19 páginasRobi Retail Holdings Inc. annual income statement analysisDyrelle ReyesAinda não há avaliações

- Marta's Financial AspectDocumento20 páginasMarta's Financial AspectMarvin GamboaAinda não há avaliações

- Plant Assets - Riovaldo & SyifaDocumento14 páginasPlant Assets - Riovaldo & SyifaMuhammad RafiAinda não há avaliações

- 011 - Audit PlanDocumento9 páginas011 - Audit PlanMildred AbadAinda não há avaliações

- 3A Micro Finance PromisorryDocumento1 página3A Micro Finance PromisorryNeil Mhartin NapolesAinda não há avaliações

- Langkawi - AcommodationDocumento8 páginasLangkawi - AcommodationSaidahMohamedAinda não há avaliações

- Dr. Martin's OfficeDocumento4 páginasDr. Martin's OfficeCheryl CastanedaAinda não há avaliações

- A. Introduction "Always Listening, Always Understanding"Documento5 páginasA. Introduction "Always Listening, Always Understanding"Vũ Hải AnhAinda não há avaliações

- Online Shoping With ShopeeDocumento7 páginasOnline Shoping With ShopeeXII MM1Reiza Fauzan FirdausAinda não há avaliações

- Emerald Plaza Brochure, GurgaonDocumento13 páginasEmerald Plaza Brochure, GurgaonPuneet JainAinda não há avaliações

- E-Crm: Submitted By: Kreepa Shankar Chowrasia - A36Documento10 páginasE-Crm: Submitted By: Kreepa Shankar Chowrasia - A36Kreepa Chowrasia ABS, NoidaAinda não há avaliações

- INHTA Resolution No. 01-14 Increasing Truck RatesDocumento6 páginasINHTA Resolution No. 01-14 Increasing Truck RatesPortCalls80% (5)

- Far 01 Introduction To AccountingDocumento11 páginasFar 01 Introduction To AccountingRafael Renz DayaoAinda não há avaliações

- Nabard Micro Finance Report 2009-10Documento224 páginasNabard Micro Finance Report 2009-10Sanaa Kulsum100% (1)

- 0b8a014c0000001306696 ESTATEMENT 012023 0b8a014c00000013 PDFDocumento7 páginas0b8a014c0000001306696 ESTATEMENT 012023 0b8a014c00000013 PDFV TravelAinda não há avaliações

- ANJNAEYA BOREWELLS - Rebore InvDocumento2 páginasANJNAEYA BOREWELLS - Rebore InvnallammalparaliAinda não há avaliações

- Audit of Cash and Cash Equivalents, Part 1: Activity SectionDocumento2 páginasAudit of Cash and Cash Equivalents, Part 1: Activity SectionALMA MORENAAinda não há avaliações

- CASA Product SheetDocumento89 páginasCASA Product SheetRockyAinda não há avaliações

- 13use Bank Reconciliation ToolsDocumento9 páginas13use Bank Reconciliation ToolsJinky BulahanAinda não há avaliações

- Test Ii AccountsDocumento17 páginasTest Ii AccountsDhrisha GadaAinda não há avaliações

- Challan Form 500Documento1 páginaChallan Form 500Baba Net100% (2)

- B. Cross-Functional: Bài 01: Introduction To Business ProcessesDocumento81 páginasB. Cross-Functional: Bài 01: Introduction To Business ProcessesTrương Quốc PhongAinda não há avaliações

- Barclays CMBS Strategy Weekly Comparing Moodys and Kroll Valuations On 2015 CondDocumento20 páginasBarclays CMBS Strategy Weekly Comparing Moodys and Kroll Valuations On 2015 CondykkwonAinda não há avaliações

- Statement of Accountrcelispromotircppc112123032023111117Documento2 páginasStatement of Accountrcelispromotircppc112123032023111117jack.rccorpAinda não há avaliações

- FTPartnersResearch InsuranceTechnologyTrendsDocumento248 páginasFTPartnersResearch InsuranceTechnologyTrendsmeAinda não há avaliações

- Invoice 26100221899 20230528Documento6 páginasInvoice 26100221899 20230528Paula VargasAinda não há avaliações

- Airtel Bill AprilDocumento3 páginasAirtel Bill AprilHiten ChudasamaAinda não há avaliações

- Excercise Questions - Part 1 - With AnswerDocumento8 páginasExcercise Questions - Part 1 - With AnswerFelicia VpAinda não há avaliações

- Status of Nepali Pharma GMP CertificationDocumento2 páginasStatus of Nepali Pharma GMP CertificationDapper Yourself100% (1)

- CCIE Data Center v3 Learning MatrixDocumento17 páginasCCIE Data Center v3 Learning MatrixBob DoleAinda não há avaliações

- Account - 11208100007124 Saiyad Akil Zilani: AddressDocumento21 páginasAccount - 11208100007124 Saiyad Akil Zilani: AddressAamena BanuAinda não há avaliações

- Saqib Bin Qadir: Chennai To Bangalore Jabbar TravelsDocumento2 páginasSaqib Bin Qadir: Chennai To Bangalore Jabbar TravelsSaqib Bin QadirAinda não há avaliações

- Ms Mbaruku Mfaume 1252Documento3 páginasMs Mbaruku Mfaume 1252Mbaruku FerejiAinda não há avaliações