Escolar Documentos

Profissional Documentos

Cultura Documentos

Tourism Flows Outbound in The United Arab Emirates

Enviado por

Ana Cojocaru100%(1)100% acharam este documento útil (1 voto)

414 visualizações10 páginasTítulo original

Tourism Flows Outbound in the United Arab Emirates

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

100%(1)100% acharam este documento útil (1 voto)

414 visualizações10 páginasTourism Flows Outbound in The United Arab Emirates

Enviado por

Ana CojocaruDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 10

TOURISM FLOWS OUTBOUND IN

THE UNITED ARAB EMIRATES

Euromonitor International

October 2013

T OURI S M F L OWS OUT B OU ND I N T HE UNI T E D A RA B E MI RA T E S P a s s p o r t I

E u r o mo n i t o r I n t e r n a t i o n a l

LIST OF CONTENTS AND TABLES

Headlines ..................................................................................................................................... 1

Trends .......................................................................................................................................... 1

Destinations .................................................................................................................................. 2

Business Vs Leisure ..................................................................................................................... 2

Prospects ..................................................................................................................................... 3

Category Data .............................................................................................................................. 4

Table 1 Departures by Destination 2007-2012 .......................................................... 4

Table 2 Departures by Mode of Transport 2007-2012 .............................................. 4

Table 3 Departures by Purpose of Visit 2007-2012 ................................................... 4

Table 4 Business Departures: MICE Penetration % Breakdown 2007-2012 ............. 5

Table 5 Leisure Departures by Type 2007-2012 ....................................................... 5

Table 6 Outgoing Tourist Expenditure by Geography: Value 2007-2012 .................. 5

Table 7 Outgoing Tourist Expenditure by Category: Value 2007-2012 ..................... 6

Table 8 Method of Payments for Outgoing Tourism Spending: % Breakdown

2007-2012 .................................................................................................... 6

Table 9 Forecast Departures by Destination 2012-2017 ........................................... 6

Table 10 Forecast Departures by Mode of Transport 2012-2017................................ 7

Table 11 Forecast Departures by Purpose of Visit 2012-2017 .................................... 7

Table 12 Forecast Outgoing Tourist Expenditure by Geography: Value 2012-

2017 ............................................................................................................. 7

T OURI S M F L OWS OUT B OU ND I N T HE UNI T E D A RA B E MI RA T E S P a s s p o r t 1

E u r o mo n i t o r I n t e r n a t i o n a l

TOURISM FLOWS OUTBOUND IN THE

UNITED ARAB EMIRATES

HEADLINES

Number of trips increases by 9% and outgoing tourist expenditure rises by 2% to reach 5.3

million and AED28.7 billion in 2012

Leisure and business departures alike benefit from growing economic confidence in the

country

Spend per trip decreases by 5% in current value terms in 2012 over the previous year

Number of trips expected to rise at a CAGR of 10% but just a 2% constant value CAGR

expected for outgoing tourist expenditure expected for forecast period

TRENDS

Helped by stronger economic conditions, rising disposable incomes and further population

growth outbound departures recorded a strong rise of 9% in volume in 2012. More low- to

middle-income expatriate consumers for example increasingly embarked on trips back home,

not least because of the widening offer of low-cost airlines such as Flydubai and Air Arabia.

Business departures also picked up due to renewed investments in the country and closer

international ties between companies. Finally, sea departures gained in importance towards

the end of the review period as cruises have become a popular type of holiday in the United

Arab Emirates.

The rise in departures in 2012 was therefore slightly faster than the review period CAGR of

8%. Nonetheless, growth rates during the review period were characterised by high volatility.

Following on from high growth in 2008, tourism outbound flows collapsed in 2009 as a result

of the economic crisis as many expatriates left the country whilst other consumers restrained

their spending.

Due to the high number of expatriates in the country, nearly all residents in the United Arab

Emirates engage in international travel. However, whilst lower-income consumers will save up

their money for a trip back to their home country, consumers with higher income travel

sometimes even several times a year, in order to visit friends or family back home but also to

explore other countries.

Still, the higher percentage of lower-income consumers travelling towards the end of the

review period resulted in growth in outgoing tourist expenditure to significantly lag behind the

rise in the number of outbound departures. In addition, tour operators also offered more

promotions in order to incentivise consumers in the United Arab Emirates to embark on more

trips.

Air accounted for more than half of overall departures in 2012 and recorded considerable

growth with a 9% rise in departures over the previous year. Growth in air departures was

supported by ongoing expansion in route networks by various airlines, including Emirates and

Etihad but also Flydubai and Air Arabia. Land travel posted the fastest growth, helped by a

higher number of leisure land departures since more UAE residents embarked on trips to

neighbouring countries.

Finally, sea departures also account for a significant (44%) share of outbound tourism and

witnessed 9% growth in 2012. Dubai is not only an increasingly popular port for many cruises,

but it also serves as a home port for leading cruise lines such as Costa Cruises, Aida Cruises,

T OURI S M F L OWS OUT B OU ND I N T HE UNI T E D A RA B E MI RA T E S P a s s p o r t 2

E u r o mo n i t o r I n t e r n a t i o n a l

Royal Caribbean International, TUI Cruises and FTI Cruises. These companies became

increasingly active in promoting their tours to UAE residents towards the end of the review

period.

DESTINATIONS

Saudi Arabia not only accounted for 29% of overall departures in 2012, but also recorded the

fastest growth with a rise of 15% in the number of trips over the previous year. This is due to

the popularity of religious tourism to the country, particularly during the Hajj season of

September and November, whilst many visit Mecca or Medina throughout the year.

Departures to the country were also boosted by the construction of the Mafraq-Ghweifat

motorway in 2012, with this linking Abu Dhabi to the Saudi Arabian border. The three-lane

327-kilometre motorway is lit and encouraged more consumers to travel by road between the

United Arab Emirates and Saudi Arabia.

In addition, Saudi Arabia is a significant destination for business travellers, accounting for the

majority of business departures from the United Arab Emirates. Strong growth in departures

to the country was also supported by close economic links between the two countries and a

rise in investments and business activities in 2012.

Departures to South Africa, Turkey, and Germany also saw above average growth in 2012,

each witnessing double-digit increases over 2011. Stronger growth rates were partly due to

expansion in flight capacity to these countries. However, trade links with South Africa and

Germany boosted business departures to these countries, whilst Turkey benefited from

ongoing investment from its tourist board in attracting Middle Eastern tourists. Marketing

focusing on Turkeys Islamic, historical and cultural heritage continued to prove popular

amongst residents in the United Arab Emirates in 2012.

Egypt and Lebanon accounted for the highest share of outgoing tourist expenditure in 2012,

with 15% and 10% of the total, respectively. This is mostly due to the fact that luxury travel is

popular to these countries, with Egypts Sharm el Sheikh and Nile cruises, for example,

proving popular attractions. Casinos and high-priced nightclubs in these countries also hold a

strong appeal for many travellers from the United Arab Emirates.

Credit card is the dominant method of outgoing tourist expenditure, accounting for 52% share

of the total and gaining a further percentage point in share in 2012 over the previous year.

This came largely at the expense of prepaid cards, which lost a percentage point in share to

account for 7% in 2012, with more lower-income consumers qualifying for credit rather than

prepaid cards. Debit cards remained stable in second place with a 25% value share in the

year. Cash accounted for just a 5% share towards the end of the review period, with the

majority of travellers preferring card payment methods as these are perceived to be safer and

more convenient.

BUSINESS VS LEISURE

Business and leisure departures progressed at the same rate in 2012 with an increase of 9%

each over the previous year. Even though business departures took longer to recover from

the economic crisis, both leisure and business departures benefited from improved economic

conditions towards the end of the review period, as business activities picked up and

consumers had more money to spend on international travel.

Leisure departures dominate, accounting for 84% of overall outbound trips and 82% of

outgoing tourist expenditure in 2012. One reason is the countrys very high percentage of

expatriates, standing at 88% in 2012. Many of them visit their home countries and families in

T OURI S M F L OWS OUT B OU ND I N T HE UNI T E D A RA B E MI RA T E S P a s s p o r t 3

E u r o mo n i t o r I n t e r n a t i o n a l

the year. Moreover, high income levels amongst many Emirati households allow them to take

holidays on a frequent basis.

Families account for the largest share of leisure departures from the United Arab Emirates,

with a trip volume share of 24% in 2012. Whilst this group is largely accounted for by Emirati

families, which typically travel together, middle- to high-income consumers also tend to take

their families with them to the United Arab Emirates and return home for the summer to their

home countries. However, group holidays is also popular with 15% of outbound departures as

many Emirati residents like to rely on organised trips to visit other countries.

Whilst sea and land departures are significant within leisure departures, being a convenient

way for families to travel, air departures dominate in business departures, accounting for a

share of 94% in 2012. For most business travellers, time is precious and they are thus keen to

travel by the swiftest manner possible. In addition, for most international business trips it is not

feasible to drive.

MICE business travel is less important for outbound tourism than it is for inbound flows.

Nonetheless, MICE departures comprised 38% of overall business departures in 2012, down

only slightly from the previous year. Business travel towards the end of the review period was

mostly boosted by company meetings rather than conferences and events.

PROSPECTS

Outbound tourism will be boosted by several factors over the review period. Further

population growth will result in a higher consumer base, with a rise in expatriate residents in

particular leading to more consumers wanting to explore the region from the United Arab

Emirates as a base as well as taking trips back to their home countries. Rising disposable

incomes will meanwhile enable both expatriate and Emirati residents to spend more on trips

abroad.

The ongoing development of the countrys leading airports, chiefly Dubai and Abu Dhabi, as

well as the route expansion of Emirates and Etihad will lead to an ever-increasing offer of

flights for UAE consumers. The entry of new affordable airlines is also expected to drive

growth, with 2012, for example, seeing the entry of low-cost carrier MMA Airline.

Whilst Dubais airport is seeing ongoing investments and improvements already, Al Maktoum

International Airport in Dubai World Central is due to open at the end of 2013. This will result

in the Hungarian budget airline Wizzair commencing operations. The airport, which has been

handling cargo flights since June 2010, is expected to ultimately comprise five runways and to

have capacity to move 160 million passengers per year.

Abu Dhabi International Airport meanwhile is expected to see the completion of the first phase

of its Midfield Terminal Complex by the end of the review period, increasing the airports

capacity from 12 million passengers per annum to 20 million.

Therefore, outbound tourism is predicted to see even stronger growth over the forecast

period, with an expected rise in the number of trips at a CAGR of 10% in comparison to a

review period CAGR of 8%. Growth during the review period was significantly hampered by

the poor economic conditions and the resulting exodus of many expatriate consumers. Thus,

a renewed economic downturn, even on a global basis, remains the largest threat to growth

over the forecast period.

Amongst destinations, Turkey is expected to see the fastest growth during the forecast period,

with an expected 14% CAGR in departure numbers during the forecast period, followed by

South Africa and Saudi Arabia. Turkey is keen to boost Islamic tourism and is thus likely to

continue to target the United Arab Emirates with attractive marketing campaigns emphasising

its Islamic heritage. Consumers in turn will likely be attracted to Turkey by its low prices.

T OURI S M F L OWS OUT B OU ND I N T HE UNI T E D A RA B E MI RA T E S P a s s p o r t 4

E u r o mo n i t o r I n t e r n a t i o n a l

CATEGORY DATA

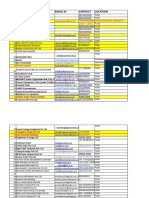

Table 1 Departures by Destination 2007-2012

'000 trips

2007 2008 2009 2010 2011 2012

Bahrain 18.1 17.5 16.6 17.0 16.7 17.1

Egypt 50.2 57.8 69.5 75.6 74.1 76.1

France 16.3 17.0 17.7 17.9 18.2 18.7

Germany 101.8 110.4 102.4 118.7 134.0 148.1

India 30.5 31.6 32.8 33.9 35.8 38.0

Iran 12.3 11.7 11.2 11.6 12.0 12.5

Jordan 15.6 16.1 16.7 16.9 17.2 17.5

Kuwait 18.3 17.7 17.1 17.6 17.8 18.2

Lebanon 250.9 253.0 295.6 323.2 342.6 365.8

Malaysia 60.0 70.6 73.5 82.2 87.7 93.9

Oman 232.7 320.7 302.3 312.3 326.7 345.7

Pakistan 22.8 22.7 22.8 22.9 23.1 23.8

Qatar 23.5 23.9 22.6 23.3 24.4 25.6

Saudi Arabia 955.0 1,617.2 1,000.0 1,256.5 1,419.8 1,625.7

Singapore 29.1 29.7 30.5 31.5 32.6 34.1

South Africa 11.7 12.5 13.4 15.5 17.5 19.9

Thailand 48.9 60.6 57.7 61.1 64.9 69.3

Turkey 14.6 14.7 14.6 28.8 32.0 35.9

United Kingdom 165.6 172.6 170.3 178.5 187.2 197.4

USA 25.3 25.5 24.2 25.3 26.6 28.2

Other Destinations 1,494.9 1,581.1 1,631.2 1,788.7 1,913.9 2,052.5

Departures 3,598.0 4,484.4 3,942.5 4,459.0 4,824.9 5,264.0

Source: Euromonitor International from official statistics, trade associations, trade press, company research,

trade interviews, trade sources

Table 2 Departures by Mode of Transport 2007-2012

'000 trips

2007 2008 2009 2010 2011 2012

Air 3,300.3 4,103.3 3,613.1 2,327.9 2,508.1 2,737.4

Land 253.5 332.1 276.9 169.8 185.4 204.8

Rail - - - - - -

Sea 44.2 49.1 52.4 1,961.4 2,131.5 2,321.8

Departures 3,598.0 4,484.4 3,942.5 4,459.0 4,824.9 5,264.0

Source: Euromonitor International from official statistics, trade associations, trade press, company research,

trade interviews, trade sources

Table 3 Departures by Purpose of Visit 2007-2012

'000 trips

2007 2008 2009 2010 2011 2012

Business 1,014.0 1,256.1 1,090.4 702.9 753.6 822.4

Leisure 2,584.0 3,228.3 2,852.1 3,756.1 4,071.3 4,441.6

Departures 3,598.0 4,484.4 3,942.5 4,459.0 4,824.9 5,264.0

T OURI S M F L OWS OUT B OU ND I N T HE UNI T E D A RA B E MI RA T E S P a s s p o r t 5

E u r o mo n i t o r I n t e r n a t i o n a l

Source: Euromonitor International from official statistics, trade associations, trade press, company research,

trade interviews, trade sources

Table 4 Business Departures: MICE Penetration % Breakdown 2007-2012

'000 trips

2007 2008 2009 2010 2011 2012

MICE 379.5 505.2 436.9 281.2 293.9 316.6

Other Business Travel 634.5 750.9 653.4 421.8 459.7 505.7

Total 1,014.0 1,256.1 1,090.4 702.9 753.6 822.4

Source: Euromonitor International from official statistics, trade associations, trade press, company research,

trade interviews, trade sources

Note: MICE refers to meetings, incentives, conventions, exhibitions

Table 5 Leisure Departures by Type 2007-2012

% number of trips

2007 2008 2009 2010 2011 2012

Singles 11.4 12.2 13.2 14.0 14.3 14.5

Couples 11.8 11.9 11.8 12.5 12.9 13.1

Families 21.7 21.8 21.5 22.0 23.0 24.0

Group 15.8 15.3 14.8 14.3 14.1 14.9

Others 39.3 38.9 38.7 37.2 35.8 33.5

Total 100.0 100.0 100.0 100.0 100.0 100.0

Source: Euromonitor International from official statistics, trade associations, trade press, company research,

trade interviews, trade sources

Table 6 Outgoing Tourist Expenditure by Geography: Value 2007-2012

AED million

2007 2008 2009 2010 2011 2012

Bahrain 335.3 422.9 381.3 386.1 393.5 405.1

Egypt 2,581.0 3,592.7 3,913.3 3,988.6 4,085.1 4,231.4

France 333.8 420.6 377.9 382.8 391.0 402.2

Germany 1,242.8 1,625.5 1,462.8 1,486.0 1,519.3 1,570.3

India 769.5 978.7 802.0 814.6 830.6 826.2

Iran 236.6 294.7 247.1 250.1 255.5 263.0

Jordan 300.4 378.1 369.9 376.9 386.6 401.3

Kuwait 409.2 521.0 455.2 461.6 470.7 485.4

Lebanon 2,047.4 2,771.3 2,650.0 2,704.3 2,774.3 2,905.1

Malaysia 1,114.9 1,451.5 1,275.4 1,296.8 1,327.7 1,374.8

Oman 1,727.0 2,240.2 1,923.9 1,957.6 2,007.8 2,089.8

Pakistan 507.3 663.5 554.8 563.4 575.1 593.4

Qatar 522.4 667.6 557.7 566.1 577.9 595.7

Saudi Arabia 1,596.9 2,067.6 1,740.7 1,792.0 1,841.2 1,909.0

Singapore 717.9 928.6 882.2 901.4 938.7 978.9

South Africa 233.5 294.5 263.8 267.2 272.4 280.2

Thailand 369.7 483.5 460.9 469.5 480.7 498.9

Turkey 285.1 359.5 354.3 361.4 371.6 385.5

United Kingdom 1,428.1 1,854.1 1,596.0 1,617.2 1,653.8 1,706.0

USA 693.7 896.5 763.3 775.2 791.7 816.7

Other countries 4,189.6 5,304.0 5,681.7 5,733.1 5,825.5 5,987.9

Total 21,642.3 28,216.6 26,714.2 27,151.7 27,770.9 28,706.6

T OURI S M F L OWS OUT B OU ND I N T HE UNI T E D A RA B E MI RA T E S P a s s p o r t 6

E u r o mo n i t o r I n t e r n a t i o n a l

Source: Euromonitor International from official statistics, trade associations, trade press, company research,

trade interviews, trade sources

Table 7 Outgoing Tourist Expenditure by Category: Value 2007-2012

AED million

2007 2008 2009 2010 2011 2012

Accommodation 5,275.6 6,878.0 6,411.4 6,503.3 6,614.4 6,787.8

Entertainment 2,949.4 3,845.3 3,472.8 3,541.2 3,623.0 3,748.0

Excursions 2,406.9 3,137.9 2,938.6 2,998.3 3,083.8 3,203.9

Food 3,586.2 4,676.0 4,541.4 4,601.0 4,701.0 4,859.5

Shopping 5,554.4 7,241.6 6,678.6 6,809.7 6,974.1 7,224.6

Travel Within Country 1,869.8 2,437.7 2,671.4 2,698.2 2,774.6 2,882.8

Other Outgoing Tourist - - - - - -

Expenditure

Outgoing Tourist 21,642.3 28,216.6 26,714.2 27,151.7 27,770.9 28,706.6

Expenditure

Source: Euromonitor International from official statistics, trade associations, trade press, company research,

trade interviews, trade sources

Note 1: Entertainment includes attractions, theatres, guided city tours, etc

Note 2: Food includes restaurants

Note 3: Other outgoing tourist expenditure includes travel agent services

Table 8 Method of Payments for Outgoing Tourism Spending: % Breakdown 2007-

2012

% value

2007 2008 2009 2010 2011 2012

Cash 6.0 5.0 6.0 5.0 4.9 4.8

Credit Card 49.0 50.0 49.0 50.5 51.0 52.0

Charge Card 5.0 6.0 7.0 6.0 7.1 7.2

Debit Card 24.0 25.0 24.0 24.5 25.0 25.0

Traveller's Cheques 6.0 5.0 5.0 5.0 4.0 4.0

Prepaid Cards 10.0 9.0 9.0 9.0 8.0 7.0

Total 100.0 100.0 100.0 100.0 100.0 100.0

Source: Euromonitor International from official statistics, trade associations, trade press, company research,

trade interviews, trade sources

Note 1: Direct purchases only

Note 2: Table represents method used at time of purchase

Table 9 Forecast Departures by Destination 2012-2017

'000 trips

2012 2013 2014 2015 2016 2017

Bahrain 17.1 17.5 18.0 18.7 19.5 20.4

Egypt 76.1 78.3 80.7 83.8 87.0 90.6

France 18.7 19.3 20.0 20.8 21.6 22.7

Germany 148.1 162.5 175.6 187.9 200.3 216.0

India 38.0 40.1 42.8 46.2 50.0 54.3

Iran 12.5 13.0 13.7 14.5 15.3 16.3

Jordan 17.5 18.2 18.9 19.7 21.0 22.4

Kuwait 18.2 18.8 19.6 20.5 21.6 22.9

Lebanon 365.8 391.1 419.6 452.7 493.9 543.7

Malaysia 93.9 99.3 104.5 109.6 115.5 122.4

T OURI S M F L OWS OUT B OU ND I N T HE UNI T E D A RA B E MI RA T E S P a s s p o r t 7

E u r o mo n i t o r I n t e r n a t i o n a l

Oman 345.7 366.8 388.1 409.3 430.3 450.9

Pakistan 23.8 24.8 25.9 26.8 27.6 28.4

Qatar 25.6 26.9 28.4 30.0 31.8 33.7

Saudi Arabia 1,625.7 1,875.3 2,134.1 2,406.4 2,681.4 2,955.7

Singapore 34.1 35.8 37.6 39.7 41.6 43.5

South Africa 19.9 22.7 25.9 29.3 33.4 37.6

Thailand 69.3 74.3 79.9 85.4 90.9 96.6

Turkey 35.9 40.8 46.5 53.5 60.9 68.7

United Kingdom 197.4 209.2 222.5 237.4 254.8 274.3

USA 28.2 29.9 31.6 33.3 35.0 36.7

Other Destinations 2,052.5 2,226.9 2,427.1 2,648.3 2,902.5 3,189.2

Departures 5,264.0 5,791.4 6,361.0 6,973.8 7,636.0 8,347.1

Source: Euromonitor International from trade associations, trade press, company research, trade interviews,

trade sources

Table 10 Forecast Departures by Mode of Transport 2012-2017

'000 trips

2012 2013 2014 2015 2016 2017

Air 2,737.4 3,010.6 3,301.0 3,614.2 3,954.9 4,317.9

Land 204.8 227.6 253.2 281.4 312.3 346.4

Rail - - - - - -

Sea 2,321.8 2,553.2 2,806.8 3,078.1 3,368.8 3,682.7

Departures 5,264.0 5,791.4 6,361.0 6,973.8 7,636.0 8,347.1

Source: Euromonitor International from trade associations, trade press, company research, trade interviews,

trade sources

Table 11 Forecast Departures by Purpose of Visit 2012-2017

'000 trips

2012 2013 2014 2015 2016 2017

Business 822.4 904.2 989.7 1,082.5 1,184.4 1,293.8

Leisure 4,441.6 4,887.2 5,371.3 5,891.3 6,451.6 7,053.3

Departures 5,264.0 5,791.4 6,361.0 6,973.8 7,636.0 8,347.1

Source: Euromonitor International from trade associations, trade press, company research, trade interviews,

trade sources

Table 12 Forecast Outgoing Tourist Expenditure by Geography: Value 2012-2017

AED million

2012 2013 2014 2015 2016 2017

Bahrain 405.1 410.8 419.6 428.6 432.1 436.5

Egypt 4,231.4 4,320.9 4,432.9 4,543.5 4,640.2 4,775.5

France 402.2 408.7 418.1 427.1 435.2 446.1

Germany 1,570.3 1,598.0 1,636.8 1,675.1 1,706.4 1,742.7

India 826.2 838.2 855.7 874.7 889.2 901.8

Iran 263.0 266.6 272.1 276.1 281.5 288.8

Jordan 401.3 411.0 422.3 434.7 444.6 455.7

Kuwait 485.4 492.6 504.4 515.7 522.9 532.7

Lebanon 2,905.1 2,967.4 3,063.2 3,138.5 3,206.2 3,292.8

Malaysia 1,374.8 1,400.7 1,438.4 1,466.8 1,493.5 1,508.4

Oman 2,089.8 2,140.0 2,206.0 2,267.2 2,315.4 2,378.1

T OURI S M F L OWS OUT B OU ND I N T HE UNI T E D A RA B E MI RA T E S P a s s p o r t 8

E u r o mo n i t o r I n t e r n a t i o n a l

Pakistan 593.4 603.7 618.6 632.3 641.9 657.9

Qatar 595.7 605.5 620.4 633.8 645.0 664.3

Saudi Arabia 1,909.0 1,952.9 2,008.1 2,061.6 2,110.3 2,166.3

Singapore 978.9 1,008.6 1,037.0 1,067.6 1,089.6 1,120.1

South Africa 280.2 285.6 291.0 296.1 300.6 304.9

Thailand 498.9 509.6 523.0 536.6 547.9 561.6

Turkey 385.5 393.2 404.3 414.5 424.3 439.7

United Kingdom 1,706.0 1,741.2 1,786.1 1,727.2 1,703.3 1,733.0

USA 816.7 831.4 851.5 871.0 889.2 914.7

Other countries 5,987.9 6,048.4 6,162.6 6,390.4 6,591.2 6,771.7

Total 28,706.6 29,235.1 29,972.3 30,678.9 31,310.7 32,093.4

Source: Euromonitor International from trade associations, trade press, company research, trade interviews,

trade sources

Você também pode gostar

- Start Your Own Private Jet Charter Brokerage Business: Your Step by Step Guide to SuccessNo EverandStart Your Own Private Jet Charter Brokerage Business: Your Step by Step Guide to SuccessNota: 4 de 5 estrelas4/5 (1)

- Development of Tourism in Dubai Grace Chang MazzaDocumento24 páginasDevelopment of Tourism in Dubai Grace Chang MazzaMohit AroraAinda não há avaliações

- A&F Method OfInspectionDocumento26 páginasA&F Method OfInspectionzoomerfins22100% (1)

- Future of Travel in Middle East to 2020Documento21 páginasFuture of Travel in Middle East to 2020Hamzah B ShakeelAinda não há avaliações

- Sample Cover Letter Oil and GasDocumento1 páginaSample Cover Letter Oil and GasNadira Aqilah67% (3)

- Customer Satisfaction Measurement in Tourism IndustryDocumento41 páginasCustomer Satisfaction Measurement in Tourism IndustryAshis karmakar50% (4)

- Unit 8 Risk in The WorkplaceDocumento11 páginasUnit 8 Risk in The WorkplaceAnonymous WalvB8Ainda não há avaliações

- Manage Hospital Records with HMSDocumento16 páginasManage Hospital Records with HMSDev SoniAinda não há avaliações

- Dubai Debt Crisis: Summary of The CrisisDocumento4 páginasDubai Debt Crisis: Summary of The CrisisHarsh ShahAinda não há avaliações

- Module 1 (Social Innovation)Documento7 páginasModule 1 (Social Innovation)Marinette Medrano50% (2)

- Tourism IndustryDocumento22 páginasTourism IndustryKrishAinda não há avaliações

- MODEL QUESTION PAPER OF HRM Open CourceDocumento2 páginasMODEL QUESTION PAPER OF HRM Open CourceTitus Clement100% (3)

- CCG 2014 - Uae - Export and BusinessDocumento108 páginasCCG 2014 - Uae - Export and BusinessPandey AmitAinda não há avaliações

- Company Name Email Id Contact Location: 3 Praj Industries Limited Yogesh960488815Pune-Nagar Road, SanaswadiDocumento65 páginasCompany Name Email Id Contact Location: 3 Praj Industries Limited Yogesh960488815Pune-Nagar Road, SanaswadiDhruv Parekh100% (1)

- Global tourism trends set to break 1 billion arrivals barrier by 2010Documento7 páginasGlobal tourism trends set to break 1 billion arrivals barrier by 2010sainidharmveer1_6180Ainda não há avaliações

- Interview Tips 1Documento19 páginasInterview Tips 1mdsd57% (7)

- Sustainable Tourism After COVID-19: Insights and Recommendations for Asia and the PacificNo EverandSustainable Tourism After COVID-19: Insights and Recommendations for Asia and the PacificAinda não há avaliações

- Tourism Flows Inbound in The United Arab EmiratesDocumento11 páginasTourism Flows Inbound in The United Arab EmiratesAna CojocaruAinda não há avaliações

- Dubailand Final Case StudyDocumento8 páginasDubailand Final Case StudyShubhangMattooAinda não há avaliações

- TOPIC: Impact of COVID-19 On The TourismDocumento39 páginasTOPIC: Impact of COVID-19 On The Tourismchandan tiwariAinda não há avaliações

- Economic Impact of TT 2013 Annual Update - SummaryDocumento4 páginasEconomic Impact of TT 2013 Annual Update - SummaryMaties LucianAinda não há avaliações

- A3.1 Assignment - Create A Company Analysis and Recommendations ReportDocumento5 páginasA3.1 Assignment - Create A Company Analysis and Recommendations ReportHala Khaled ArarAinda não há avaliações

- Dubai Tourism Case Study: Rapid Growth and DevelopmentDocumento15 páginasDubai Tourism Case Study: Rapid Growth and Developmentabidaliabid1Ainda não há avaliações

- Technology Innovation in DubaiDocumento9 páginasTechnology Innovation in DubaiBharat NarulaAinda não há avaliações

- Tourism Case Study - AyeshaDocumento7 páginasTourism Case Study - Ayeshaabidaliabid1Ainda não há avaliações

- MENA Tourism and Hospitality Report: September 2013Documento13 páginasMENA Tourism and Hospitality Report: September 2013Chandrah VAinda não há avaliações

- Vudu Business CaseDocumento25 páginasVudu Business Casesalmanhatta6425Ainda não há avaliações

- Tourism Trends in IndiaDocumento6 páginasTourism Trends in IndiaNitam Baro0% (1)

- Travel Tourism Industry Business PlanDocumento24 páginasTravel Tourism Industry Business PlanAmna FarooquiAinda não há avaliações

- Dubai: Jeffin Raju Shayna Mason Comm. 421 Jing Chen November 16, 2007Documento19 páginasDubai: Jeffin Raju Shayna Mason Comm. 421 Jing Chen November 16, 2007samiullahAinda não há avaliações

- Eppm2033 International Business Set 2 SEMESTER 1 SESI 2017/2018Documento16 páginasEppm2033 International Business Set 2 SEMESTER 1 SESI 2017/2018lolAinda não há avaliações

- Trends in Tourism Industry Recovery in 2021Documento31 páginasTrends in Tourism Industry Recovery in 2021Riches DizonAinda não há avaliações

- Euromonitor Global Overview 2012 FinalDocumento47 páginasEuromonitor Global Overview 2012 FinalNeha ShariffAinda não há avaliações

- Coors UaeDocumento14 páginasCoors UaeSamer Al-MimarAinda não há avaliações

- Topics STADocumento3 páginasTopics STAThinkLink, Foreign Affairs www.thinklk.comAinda não há avaliações

- Introduction To Maldives As A DestinationDocumento15 páginasIntroduction To Maldives As A DestinationAnonymous sxsYbB0NUAinda não há avaliações

- South Australia 2025Documento29 páginasSouth Australia 2025lrot962Ainda não há avaliações

- CCG 2013 - UAE Latest Eg Ae 065913Documento94 páginasCCG 2013 - UAE Latest Eg Ae 065913Chandru SAinda não há avaliações

- Airlines in The BRICSDocumento63 páginasAirlines in The BRICSakshaymehraAinda não há avaliações

- TourismDocumento10 páginasTourismSyed Faisal AliAinda não há avaliações

- Contentid 6&linkpath Home The Uae Aviation in UaeDocumento4 páginasContentid 6&linkpath Home The Uae Aviation in UaeShashank VarmaAinda não há avaliações

- Chalhoub Group White Paper 2013 EnglishDocumento9 páginasChalhoub Group White Paper 2013 EnglishFahad Al MuttairiAinda não há avaliações

- Customer Satisfaction at Bhagyashri TravelsDocumento75 páginasCustomer Satisfaction at Bhagyashri Travelssadsea2003Ainda não há avaliações

- Tourism in U.A.EDocumento30 páginasTourism in U.A.EalzinatiAinda não há avaliações

- Reading Practice ADocumento11 páginasReading Practice AMaurizka Callista ChairunnisaAinda não há avaliações

- QTA Annual Report 2013Documento1 páginaQTA Annual Report 2013shabina921Ainda não há avaliações

- The Term "Business Travel"Documento8 páginasThe Term "Business Travel"Nithin SamuelAinda não há avaliações

- Indian Travel, Tourism and Hospitality IndustryDocumento16 páginasIndian Travel, Tourism and Hospitality Industrysukriti2812Ainda não há avaliações

- Thomas Cook India PVT LTD (Soumit)Documento90 páginasThomas Cook India PVT LTD (Soumit)Soumit BiswasAinda não há avaliações

- Dubai's Retail Sector Riding Tourism's WaveDocumento6 páginasDubai's Retail Sector Riding Tourism's WaveJed HollenbeckAinda não há avaliações

- Gucci S Marketing Project by SHAZIDocumento32 páginasGucci S Marketing Project by SHAZISanju DurgapalAinda não há avaliações

- Chapter 1 Research Chapter 1Documento48 páginasChapter 1 Research Chapter 1Pritz MishraAinda não há avaliações

- Oxford Economics Explaining Dubai's Aviation Model June 2011Documento67 páginasOxford Economics Explaining Dubai's Aviation Model June 2011Saad AliAinda não há avaliações

- ENGL102 Unit 1Documento11 páginasENGL102 Unit 1Donald FloodAinda não há avaliações

- S Sssssssss SssssssssDocumento4 páginasS Sssssssss SssssssssGohar AfshanAinda não há avaliações

- 406 2023 GeY4 Tourism GrowthNTrends LA5 EMDocumento5 páginas406 2023 GeY4 Tourism GrowthNTrends LA5 EMvdAinda não há avaliações

- GCC Hospitality Fourth Draft - 04october - FinalDocumento86 páginasGCC Hospitality Fourth Draft - 04october - FinalAyesha ZakariaAinda não há avaliações

- GCC Wealth Insight ReportDocumento23 páginasGCC Wealth Insight ReporthoussamzreikAinda não há avaliações

- Global Business Environment Assignment: Industry - Information Technolgy (It)Documento20 páginasGlobal Business Environment Assignment: Industry - Information Technolgy (It)Akshit GuptaAinda não há avaliações

- Travel in India: Euromonitor International September 2019Documento10 páginasTravel in India: Euromonitor International September 2019piyush saxenaAinda não há avaliações

- Tourism Industry Profile IndiaDocumento23 páginasTourism Industry Profile IndiaPrince Satish Reddy50% (2)

- Tourism IndustryDocumento22 páginasTourism IndustryAzad PandeyAinda não há avaliações

- Amadeus Travel TrendsDocumento44 páginasAmadeus Travel TrendsAlexandra ChevalierAinda não há avaliações

- Excellence in Development: The Role of Internal and Foreign Investments in Dubai's Development VisionDocumento7 páginasExcellence in Development: The Role of Internal and Foreign Investments in Dubai's Development VisionFahd KhanAinda não há avaliações

- DET - Annual Visitor Report 2021Documento23 páginasDET - Annual Visitor Report 2021H&M TRADERS INTERNATIONALAinda não há avaliações

- Travel Trends FinalDocumento18 páginasTravel Trends Finalkvir30613Ainda não há avaliações

- National Strategies for Carbon Markets under the Paris Agreement: Current State, Vulnerabilities, and Building ResilienceNo EverandNational Strategies for Carbon Markets under the Paris Agreement: Current State, Vulnerabilities, and Building ResilienceAinda não há avaliações

- United Arab Emirates2013Documento28 páginasUnited Arab Emirates2013Ana CojocaruAinda não há avaliações

- United Arab Emirates Country ProfileDocumento8 páginasUnited Arab Emirates Country ProfileAna CojocaruAinda não há avaliações

- UAE Benchmarking 2013Documento21 páginasUAE Benchmarking 2013Ana CojocaruAinda não há avaliações

- Country Profile - United Arab Emirates (Uae)Documento27 páginasCountry Profile - United Arab Emirates (Uae)Sandra MianAinda não há avaliações

- Transportation in The United Arab EmiratesDocumento9 páginasTransportation in The United Arab EmiratesAna CojocaruAinda não há avaliações

- The Principles of Islamic Marketing CH1Documento24 páginasThe Principles of Islamic Marketing CH1Shah AzeemAinda não há avaliações

- Walt DisneyDocumento27 páginasWalt DisneyAna CojocaruAinda não há avaliações

- Essential earthquake preparedness stepsDocumento6 páginasEssential earthquake preparedness stepsRalphNacisAinda não há avaliações

- Creating A Simple PHP Forum TutorialDocumento14 páginasCreating A Simple PHP Forum TutorialLaz CaliphsAinda não há avaliações

- Climate Smart Agriculture Manual FINAL 2 2 Sent in Sierra Leones PDFDocumento201 páginasClimate Smart Agriculture Manual FINAL 2 2 Sent in Sierra Leones PDFKarthikAinda não há avaliações

- Holmes 1993Documento8 páginasHolmes 1993Rumaisa KrubaAinda não há avaliações

- Costs-Concepts and ClassificationsDocumento12 páginasCosts-Concepts and ClassificationsLune NoireAinda não há avaliações

- Training Prospectus 2020 WebDocumento89 páginasTraining Prospectus 2020 Webamila_vithanageAinda não há avaliações

- 6 Hagonoy V NLRCDocumento2 páginas6 Hagonoy V NLRCChristiane Marie Bajada0% (1)

- Banking Software System Monitoring ToolDocumento4 páginasBanking Software System Monitoring ToolSavun D. CheamAinda não há avaliações

- Yale Smart Door Locks GuideDocumento50 páginasYale Smart Door Locks GuidejaganrajAinda não há avaliações

- Philippine Supreme Court Acquits Man of Estafa Due to Lack of KnowledgeDocumento2 páginasPhilippine Supreme Court Acquits Man of Estafa Due to Lack of KnowledgeUrsulaine Grace FelicianoAinda não há avaliações

- Learn About Intensifiers and How to Use Them Effectively in WritingDocumento3 páginasLearn About Intensifiers and How to Use Them Effectively in WritingCheryl CheowAinda não há avaliações

- SESSON 1,2 AND 3 use casesDocumento23 páginasSESSON 1,2 AND 3 use casessunilsionAinda não há avaliações

- People VS Yancon-DumacasDocumento2 páginasPeople VS Yancon-Dumacasvincent nifasAinda não há avaliações

- Cs614-Mid Term Solved MCQs With References by Moaaz PDFDocumento30 páginasCs614-Mid Term Solved MCQs With References by Moaaz PDFNiazi Qureshi AhmedAinda não há avaliações

- How To Block Facebook in Mikrotik Using L7 Protocols (Layer 7) - Lazy Geek - )Documento11 páginasHow To Block Facebook in Mikrotik Using L7 Protocols (Layer 7) - Lazy Geek - )oscar_198810Ainda não há avaliações

- CE 462 Construction ManagementDocumento100 páginasCE 462 Construction Managementmonicycle companyAinda não há avaliações

- GA 7 Parts ManualDocumento565 páginasGA 7 Parts ManualDave SchallAinda não há avaliações

- E. Market Size PotentialDocumento4 páginasE. Market Size Potentialmesadaeterjohn.studentAinda não há avaliações

- Project CST 383Documento1.083 páginasProject CST 383api-668525404Ainda não há avaliações

- Daa M-4Documento28 páginasDaa M-4Vairavel ChenniyappanAinda não há avaliações

- Office of The Controller of Examinations Anna University:: Chennai - 600 025Documento4 páginasOffice of The Controller of Examinations Anna University:: Chennai - 600 025M.KARTHIKEYANAinda não há avaliações

- Indian Banking SystemDocumento10 páginasIndian Banking SystemSony ChandranAinda não há avaliações