Escolar Documentos

Profissional Documentos

Cultura Documentos

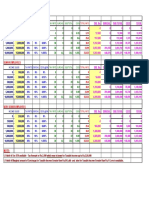

Gratuity Types & Tax Exemptions

Enviado por

Paymaster Services100%(1)100% acharam este documento útil (1 voto)

1K visualizações1 páginaGratuity Types & Tax Exemptions

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoGratuity Types & Tax Exemptions

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

100%(1)100% acharam este documento útil (1 voto)

1K visualizações1 páginaGratuity Types & Tax Exemptions

Enviado por

Paymaster ServicesGratuity Types & Tax Exemptions

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 1

1.

An Employee Covered by the "Payment of Gratuity Act":

The least of the following is exempt from gratuity:

1. 15 days' salary based on salary last drawn for every completed year of service

or part thereof in excess of 6 months;

2. Maximum of Rs.3,50,000;

3. Gratuity actually received.

Note: Salary of 15 days is calculated by dividing the salary last drawn by 26

2. In The Case Of any Other Employee:

The least of the following is exempt from gratuity:

1. 15 days' salary based on salary last drawn for every completed year of service;

2. Maximum of Rs.3,50,000;

3. Gratuity actually received.

Note 1: While calculating completed years of service, any fractionof the year will be ignored.

Note 2: Salary is calculated on the basis of the average last 10 months salary preceding

the month of payment.

Digitally signed by Cyrus Paymaster

Cyrus Paymaster DN: cn=Cyrus Paymaster, o=Paymaster

services, ou, email=callcyrus@gmail.com, c=IN

Date: 2009.11.21 19:11:04 +05'30'

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- LTA DeclarationDocumento1 páginaLTA DeclarationPaymaster ServicesAinda não há avaliações

- New - Cost Inflation IndexDocumento1 páginaNew - Cost Inflation IndexPaymaster ServicesAinda não há avaliações

- Tax Proof Summary Form For Tax Relief - Ye 31.03.2017Documento1 páginaTax Proof Summary Form For Tax Relief - Ye 31.03.2017Paymaster ServicesAinda não há avaliações

- Detailed Tax Slabs - FY 2017-18Documento1 páginaDetailed Tax Slabs - FY 2017-18Paymaster ServicesAinda não há avaliações

- Only Tax Slabs - Fy 2017-18Documento2 páginasOnly Tax Slabs - Fy 2017-18Paymaster ServicesAinda não há avaliações

- Cost Inflation IndexDocumento1 páginaCost Inflation IndexPaymaster ServicesAinda não há avaliações

- Perquisite Details - Y.E. 2017Documento4 páginasPerquisite Details - Y.E. 2017Paymaster ServicesAinda não há avaliações

- Key Highlights of The Finance Budget - 2017Documento1 páginaKey Highlights of The Finance Budget - 2017Paymaster ServicesAinda não há avaliações

- Marginal Relief To Income Tax - Fy 2016-17Documento2.489 páginasMarginal Relief To Income Tax - Fy 2016-17Paymaster ServicesAinda não há avaliações

- Gratuity Types & Tax ExemptionsDocumento1 páginaGratuity Types & Tax ExemptionsPaymaster Services100% (1)

- LTA Claim Form - Period 1.jan.2006 To 31.dec.2009Documento1 páginaLTA Claim Form - Period 1.jan.2006 To 31.dec.2009Paymaster Services100% (1)

- Profession Tax Challan - MaharashtraDocumento1 páginaProfession Tax Challan - MaharashtraPaymaster ServicesAinda não há avaliações

- Proof of Investment - Y.E. 31.03.2011Documento5 páginasProof of Investment - Y.E. 31.03.2011Paymaster ServicesAinda não há avaliações

- Form 16 & Form 12ba Details - F.Y. Ending 31.03.2017Documento3 páginasForm 16 & Form 12ba Details - F.Y. Ending 31.03.2017Paymaster ServicesAinda não há avaliações

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Documento1 páginaTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesAinda não há avaliações

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Documento1 páginaTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesAinda não há avaliações

- Tax Declaration Form For Tax Relief - Ye 31.03.2017Documento1 páginaTax Declaration Form For Tax Relief - Ye 31.03.2017Paymaster ServicesAinda não há avaliações

- Proof of Investment - Y.E. 31.03.2011Documento5 páginasProof of Investment - Y.E. 31.03.2011Paymaster ServicesAinda não há avaliações

- Tax Declaration Form - Ye. 31.03.2014 - AllDocumento1 páginaTax Declaration Form - Ye. 31.03.2014 - AllPaymaster ServicesAinda não há avaliações

- ITR 1 Sahaj For Assesment Year 2011-12, Financial Year 2010-11Documento6 páginasITR 1 Sahaj For Assesment Year 2011-12, Financial Year 2010-11Paymaster ServicesAinda não há avaliações

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Documento1 páginaTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesAinda não há avaliações

- Key Features of Finance Budget For Financial Year - 2012-13Documento18 páginasKey Features of Finance Budget For Financial Year - 2012-13Paymaster ServicesAinda não há avaliações

- ITR - 2 For Assessment Year 2011-12, Financial Year 2010-11Documento8 páginasITR - 2 For Assessment Year 2011-12, Financial Year 2010-11Paymaster ServicesAinda não há avaliações

- Key Features of Indian Union Budget FY - 2011-12Documento23 páginasKey Features of Indian Union Budget FY - 2011-12Paymaster ServicesAinda não há avaliações

- ITR-3 For Assessment Year 2011-12, Financial Year 2010-11Documento7 páginasITR-3 For Assessment Year 2011-12, Financial Year 2010-11Paymaster ServicesAinda não há avaliações

- Budget Speech by Finance Minister On 28 February, 2011Documento35 páginasBudget Speech by Finance Minister On 28 February, 2011Paymaster ServicesAinda não há avaliações

- Tax Declaration Form For Tax Relief Form - Ye 31.03.2012Documento1 páginaTax Declaration Form For Tax Relief Form - Ye 31.03.2012Paymaster ServicesAinda não há avaliações

- Taxability of GiftsDocumento6 páginasTaxability of GiftsPaymaster ServicesAinda não há avaliações

- Employee State Insurance - ESICDocumento3 páginasEmployee State Insurance - ESICPaymaster ServicesAinda não há avaliações