Escolar Documentos

Profissional Documentos

Cultura Documentos

Crossrail The Impact On Londons Property Market

Enviado por

api-249461242Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Crossrail The Impact On Londons Property Market

Enviado por

api-249461242Direitos autorais:

Formatos disponíveis

Winter 2013/14

Crossrail:

The Impact on Londons

Property Market

Crossrail is Europes largest infrastructure

project and its impact on London will be far

reaching. It will cut journey times by up to

40 minutes and increase capacity on the

capitals transport network by 10%.

The step change in both connectivity and

capacity will open up new parts of London,

as well as trigger wider investment and

regeneration. As a result, we expect house

prices to increase by an average of 2.5% per

year around host stations.

In property terms, Crossrail is a game changer. It has already affected key investment

decisions, acting as a catalyst for further development and providing a signifcant boost to

property values.

In the West End, retail will be a real winner. This is particularly true around Tottenham

Court Road, where a much needed makeover is already underway. Meanwhile, Farringdon

is set to become a key transport interchange and as a result, will emerge as one of the

most prominent offce locations in London. But perhaps the largest benefciary from an

offce perspective will be Canary Wharf. Here the public transport capacity will increase by

50%, which will subsequently unlock huge expansion and value potential.

The local housing markets along the Crossrail stretch will beneft from both the improved

connectivity and the wider regeneration. As a result, we anticipate house prices will

increase by an average of 2.5% per year around Crossrail stations. This equates to a total

increase of 13% over and above wider underlying capital appreciation, by the time

Crossrail becomes fully operational. In Central London, the overall increase is more likely

to be in the region of 20%.

2|3

Crossrail will cut journey times into Central

London by an average of 15 minutes. This

time saving equates to roughly 25% of the

average London commute. Moreover, the

outer suburban stations will make even

greater gains, with journey times slashed

by up to 40 minutes in Maidenhead, Taplow

and Burnham. Generally speaking, the

western suburbs will see a more

pronounced reduction in travel times,

compared with the towns to the east.

Crossrail will not only increase accessibility

to and from Londons suburbs, but it will

also strategically link up its key business

and retail districts. There will be fast links

from Heathrow to the West End, through

the City and Canary Wharf, and out towards

Stratford and beyond. Strengthening these

connections will enable these areas to

expand, inevitably unlocking further

development and value potential.

Since its announcement, Crossrail has

given London and the South East a frm

economic boost, employing over 10,000

people across 40 construction sites to date.

It has also been a key factor in bringing

forward investment around Crossrail

stations. It will encourage further over-site

development and stimulate considerable

regeneration. The economic impact will be

substantial and it will not just be exclusive

to London; it is estimated that 62% of new

businesses created as a result of Crossrail

will be outside of London.

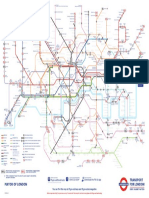

A transport transformation

Crossrail will completely transform Londons public transport

system. It will increase its capacity by 10%, enabling over 200m

passengers to make their way in and around London per year, as

well as signifcantly reduce journey times. These improvements will

have a huge impact on the economy of London and the South East,

connecting new areas and creating new opportunities for businesses

to grow.

UNDERGROUND TUNNELS WILL

SPAN THE LENGTH OF THE

LONDON MARATHON

ESTIMATED TO CREATE

55,000

NEW JOBS

ESTIMATED

COST

14.8bn

ESTIMATED

BENEFIT

42bn

2.5%

ANNUAL INCREASE

IN RESIDENTIAL

PROPERTY PRICES

AROUND AFFECTED

STATIONS UP TO

2018

13%

TOTAL INCREASE

IN PRICES UP

TO 2018

100K

AVERAGE INCREASE

IN PROPERTY

VALUE IN CENTRAL

LONDON OVER THE

NEXT FIVE YEARS

14.7BN

TOTAL INCREASE IN

RESIDENTIAL

VALUES AROUND

CROSSRAIL

STATIONS

20%

INCREASE IN

PROPERTY PRICES

AROUND AFFECTED

STATIONS SINCE

IT GAINED

ROYAL ASSENT

26

MILES

OF UNDERGROUND

TUNNELS

7

NEW

STATIONS

10

MINUTES

REDUCTION IN

TRAVEL TIME

INCREASES

PROPERTY

PRICE BY 18%

AVERAGE

REDUCTION IN

TRAVEL TIMES

TO CENTRAL

LONDON

15

MINUTES

45

1.5 MILLION

MORE PEOPLE

WILL BE WITHIN

A 45 MINUTE

COMMUTE TO

CENTRAL

LONDON

MINUTES

TRAINS WILL BE

LONG

200 METRES

200

MILLION

PASSENGERS

WILL TRAVEL ON CROSSRAIL EVERY YEAR

EACH

TRAIN

WILL FIT PEOPLE 1,500

2.5%

ANNUAL INCREASE

IN RESIDENTIAL

PROPERTY PRICES

AROUND AFFECTED

STATIONS UP TO

2018

13%

TOTAL INCREASE

IN PRICES UP

TO 2018

100K

AVERAGE INCREASE

IN PROPERTY

VALUE IN CENTRAL

LONDON OVER THE

NEXT FIVE YEARS

14.7BN

TOTAL INCREASE IN

RESIDENTIAL

VALUES AROUND

CROSSRAIL

STATIONS

20%

INCREASE IN

PROPERTY PRICES

AROUND AFFECTED

STATIONS SINCE

IT GAINED

ROYAL ASSENT

26

MILES

OF UNDERGROUND

TUNNELS

7

NEW

STATIONS

10

MINUTES

REDUCTION IN

TRAVEL TIME

INCREASES

PROPERTY

PRICE BY 18%

AVERAGE

REDUCTION IN

TRAVEL TIMES

TO CENTRAL

LONDON

15

MINUTES

45

1.5 MILLION

MORE PEOPLE

WILL BE WITHIN

A 45 MINUTE

COMMUTE TO

CENTRAL

LONDON

MINUTES

TRAINS WILL BE

LONG

200 METRES

200

MILLION

PASSENGERS

WILL TRAVEL ON CROSSRAIL EVERY YEAR

EACH

TRAIN

WILL FIT PEOPLE 1,500

2.5%

ANNUAL INCREASE

IN RESIDENTIAL

PROPERTY PRICES

AROUND AFFECTED

STATIONS UP TO

2018

13%

TOTAL INCREASE

IN PRICES UP

TO 2018

100K

AVERAGE INCREASE

IN PROPERTY

VALUE IN CENTRAL

LONDON OVER THE

NEXT FIVE YEARS

14.7BN

TOTAL INCREASE IN

RESIDENTIAL

VALUES AROUND

CROSSRAIL

STATIONS

20%

INCREASE IN

PROPERTY PRICES

AROUND AFFECTED

STATIONS SINCE

IT GAINED

ROYAL ASSENT

26

MILES

OF UNDERGROUND

TUNNELS

7

NEW

STATIONS

10

MINUTES

REDUCTION IN

TRAVEL TIME

INCREASES

PROPERTY

PRICE BY 18%

AVERAGE

REDUCTION IN

TRAVEL TIMES

TO CENTRAL

LONDON

15

MINUTES

45

1.5 MILLION

MORE PEOPLE

WILL BE WITHIN

A 45 MINUTE

COMMUTE TO

CENTRAL

LONDON

MINUTES

TRAINS WILL BE

LONG

200 METRES

200

MILLION

PASSENGERS

WILL TRAVEL ON CROSSRAIL EVERY YEAR

EACH

TRAIN

WILL FIT PEOPLE 1,500

2.5%

ANNUAL INCREASE

IN RESIDENTIAL

PROPERTY PRICES

AROUND AFFECTED

STATIONS UP TO

2018

13%

TOTAL INCREASE

IN PRICES UP

TO 2018

100K

AVERAGE INCREASE

IN PROPERTY

VALUE IN CENTRAL

LONDON OVER THE

NEXT FIVE YEARS

14.7BN

TOTAL INCREASE IN

RESIDENTIAL

VALUES AROUND

CROSSRAIL

STATIONS

20%

INCREASE IN

PROPERTY PRICES

AROUND AFFECTED

STATIONS SINCE

IT GAINED

ROYAL ASSENT

26

MILES

OF UNDERGROUND

TUNNELS

7

NEW

STATIONS

10

MINUTES

REDUCTION IN

TRAVEL TIME

INCREASES

PROPERTY

PRICE BY 18%

AVERAGE

REDUCTION IN

TRAVEL TIMES

TO CENTRAL

LONDON

15

MINUTES

45

1.5 MILLION

MORE PEOPLE

WILL BE WITHIN

A 45 MINUTE

COMMUTE TO

CENTRAL

LONDON

MINUTES

TRAINS WILL BE

LONG

200 METRES

200

MILLION

PASSENGERS

WILL TRAVEL ON CROSSRAIL EVERY YEAR

EACH

TRAIN

WILL FIT PEOPLE 1,500

4|5

The impact of Crossrail on property will be

far-reaching; it is estimated that it could

prompt the delivery of 57,000 new homes,

as well as a considerable quantum of

commercial space around the central

stations. Although the frst lines wont be

operational until 2018, its impact is already

being felt as the imminent improvements

drive confdence and become key

considerations in strategic investment

decisions.

Crossrail will create new rail linkages, and

strengthen existing ones, across London

and the South East. The substantial

increase in capacity will help key retail and

offce districts expand, such as the West

End and Canary Wharf, as well as allow

new markets to emerge. In addition,

Crossrail has the potential to reposition

many locations that are currently

considered tertiary, unlocking their

dormant value.

Aside from the actual improvements to the

transport network, Crossrail is also

prompting a raft of wider investment and

development above ground. There are

extensive over-site plans for many of the

stations, based around the concept of

placemaking. Tottenham Court Road is a

great example of an area that, despite its

inherently good position, has been

overlooked historically and its property

market has under-performed as a result.

However, there are now substantial

redevelopment plans underway that will

see the creation of much more attractive

and pedestrian-friendly public space at

street level.

Since Crossrail got the go ahead, house

prices around the affected stations have

increased by 20%. This is on top of

underlying capital appreciation in London

and the South East. Although this partly

pre-empts the actual transport benefts and

value increases that will be felt from 2018,

at this stage it mostly refects the swell of

confdence into these areas and the

physical regeneration already underway.

We anticipate that these factors will

continue to drive values around the

affected stations, with house price growth

in the region of 2.5% per annum until the

frst lines are operational in 2018. In

absolute terms, this growth should add

around 60,000 additional value per

property on average over this fve year

build up.

These increases are likely to be even more

pronounced in Central London, at 3.7% per

annum, or around 100,000 per property,

over the next fve years. Overall, Crossrail

could add around 14.7bn to the residential

property sector across the 37 stations.

In the western stations, where the reduction

in travel times are the greatest, we expect

some of the largest impacts on residential

values, outside of Central London. Our

model suggests that Crossrail will trigger

house price increases of around 2.9% per

annum between Maidenhead and Acton, or

around 50,000 per property over the fve

year period. This is roughly four times the

average increase in East London, which is

likely to be closer to 1.7% per annum, or

21,000 over the fve years.

Overall, the biggest winners will be Ealing

Broadway, Farringdon, Paddington, Bond

Street and Tottenham Court Road. Homes

in these areas could see higher increases,

of up to 100,000.

The impact on property

The impact of Crossrail on property will be two-fold. Firstly,

the improvement in connectivity will open up new districts and

reduce travel times, both of which will directly drive values in the

commercial and residential sectors. Secondly, it will act as a catalyst

for broader investment and development around the afected stations.

These wider improvements will also unlock considerable underlying

value.

A 10% reduction in

commuting times can

cause house prices to

increase by 6%

We anticipate total

house price growth of 13%

around Crossrail stations

between now and 2018,

with up to 20% in Central

London. This is expected

in addition to underlying

capital growth.

2.5%

ANNUAL INCREASE

IN RESIDENTIAL

PROPERTY PRICES

AROUND AFFECTED

STATIONS UP TO

2018

13%

TOTAL INCREASE

IN PRICES UP

TO 2018

100K

AVERAGE INCREASE

IN PROPERTY

VALUE IN CENTRAL

LONDON OVER THE

NEXT FIVE YEARS

14.7BN

TOTAL INCREASE IN

RESIDENTIAL

VALUES AROUND

CROSSRAIL

STATIONS

20%

INCREASE IN

PROPERTY PRICES

AROUND AFFECTED

STATIONS SINCE

IT GAINED

ROYAL ASSENT

26

MILES

OF UNDERGROUND

TUNNELS

7

NEW

STATIONS

10

MINUTES

REDUCTION IN

TRAVEL TIME

INCREASES

PROPERTY

PRICE BY 18%

AVERAGE

REDUCTION IN

TRAVEL TIMES

TO CENTRAL

LONDON

15

MINUTES

45

1.5 MILLION

MORE PEOPLE

WILL BE WITHIN

A 45 MINUTE

COMMUTE TO

CENTRAL

LONDON

MINUTES

TRAINS WILL BE

LONG

200 METRES

200

MILLION

PASSENGERS

WILL TRAVEL ON CROSSRAIL EVERY YEAR

EACH

TRAIN

WILL FIT PEOPLE 1,500

2.5%

ANNUAL INCREASE

IN RESIDENTIAL

PROPERTY PRICES

AROUND AFFECTED

STATIONS UP TO

2018

13%

TOTAL INCREASE

IN PRICES UP

TO 2018

100K

AVERAGE INCREASE

IN PROPERTY

VALUE IN CENTRAL

LONDON OVER THE

NEXT FIVE YEARS

14.7BN

TOTAL INCREASE IN

RESIDENTIAL

VALUES AROUND

CROSSRAIL

STATIONS

20%

INCREASE IN

PROPERTY PRICES

AROUND AFFECTED

STATIONS SINCE

IT GAINED

ROYAL ASSENT

26

MILES

OF UNDERGROUND

TUNNELS

7

NEW

STATIONS

10

MINUTES

REDUCTION IN

TRAVEL TIME

INCREASES

PROPERTY

PRICE BY 18%

AVERAGE

REDUCTION IN

TRAVEL TIMES

TO CENTRAL

LONDON

15

MINUTES

45

1.5 MILLION

MORE PEOPLE

WILL BE WITHIN

A 45 MINUTE

COMMUTE TO

CENTRAL

LONDON

MINUTES

TRAINS WILL BE

LONG

200 METRES

200

MILLION

PASSENGERS

WILL TRAVEL ON CROSSRAIL EVERY YEAR

EACH

TRAIN

WILL FIT PEOPLE 1,500

2.5%

ANNUAL INCREASE

IN RESIDENTIAL

PROPERTY PRICES

AROUND AFFECTED

STATIONS UP TO

2018

13%

TOTAL INCREASE

IN PRICES UP

TO 2018

100K

AVERAGE INCREASE

IN PROPERTY

VALUE IN CENTRAL

LONDON OVER THE

NEXT FIVE YEARS

14.7BN

TOTAL INCREASE IN

RESIDENTIAL

VALUES AROUND

CROSSRAIL

STATIONS

20%

INCREASE IN

PROPERTY PRICES

AROUND AFFECTED

STATIONS SINCE

IT GAINED

ROYAL ASSENT

26

MILES

OF UNDERGROUND

TUNNELS

7

NEW

STATIONS

10

MINUTES

REDUCTION IN

TRAVEL TIME

INCREASES

PROPERTY

PRICE BY 18%

AVERAGE

REDUCTION IN

TRAVEL TIMES

TO CENTRAL

LONDON

15

MINUTES

45

1.5 MILLION

MORE PEOPLE

WILL BE WITHIN

A 45 MINUTE

COMMUTE TO

CENTRAL

LONDON

MINUTES

TRAINS WILL BE

LONG

200 METRES

200

MILLION

PASSENGERS

WILL TRAVEL ON CROSSRAIL EVERY YEAR

EACH

TRAIN

WILL FIT PEOPLE 1,500

2.5%

ANNUAL INCREASE

IN RESIDENTIAL

PROPERTY PRICES

AROUND AFFECTED

STATIONS UP TO

2018

13%

TOTAL INCREASE

IN PRICES UP

TO 2018

100K

AVERAGE INCREASE

IN PROPERTY

VALUE IN CENTRAL

LONDON OVER THE

NEXT FIVE YEARS

14.7BN

TOTAL INCREASE IN

RESIDENTIAL

VALUES AROUND

CROSSRAIL

STATIONS

20%

INCREASE IN

PROPERTY PRICES

AROUND AFFECTED

STATIONS SINCE

IT GAINED

ROYAL ASSENT

26

MILES

OF UNDERGROUND

TUNNELS

7

NEW

STATIONS

10

MINUTES

REDUCTION IN

TRAVEL TIME

INCREASES

PROPERTY

PRICE BY 18%

AVERAGE

REDUCTION IN

TRAVEL TIMES

TO CENTRAL

LONDON

15

MINUTES

45

1.5 MILLION

MORE PEOPLE

WILL BE WITHIN

A 45 MINUTE

COMMUTE TO

CENTRAL

LONDON

MINUTES

TRAINS WILL BE

LONG

200 METRES

200

MILLION

PASSENGERS

WILL TRAVEL ON CROSSRAIL EVERY YEAR

EACH

TRAIN

WILL FIT PEOPLE 1,500

Case Study: Isle of Dogs

In the 1980s, the Isle of Dogs was

dominated by low quality, local

authority housing stock and there was

simply no offce market. However, the

arrival of the Docklands Light Railway

and over a decade later, the Jubilee

Line, completely changed this. These

large-scale infrastructure

improvements helped transform

Canary Wharf into one of the capitals

leading offce markets and one of the

worlds most infuential fnancial

districts. The housing market

subsequently responded, with

high-end developers seizing the

opportunity and building tall residential

towers like Pan Peninsula and

Baltimore Wharf. Crossrail now is likely

to play a similar role as a catalyst for

investment and development.

6|7

Impact on house prices

NEW STATION

SURFACE LINE

EXISTING STATION

TUNNEL

TAPLOW

MAIDENHEAD

BURNHAM

SLOUGH

LANGLEY

IVER

WEST

DRAYTON

HAYES

& HARLINGTON

HEATHROW

SOUTHALL

WEST

EALING

EALING

BROADWAY

PADDINGTON

BOND

STREET

TOTTENHAM

COURT ROAD

LIVERPOOL

STREET

FARRINGDON

WHITECHAPEL

CUSTOM HOUSE ABBEY WOOD

STRATFORD

MARYLAND

FOREST

GATE

MANOR PARK

ILFORD

SEVEN

KINGS

CHADWELL

HEATH

ROMFORD

GIDEA PARK

HAROLD

WOOD

BRENTWOOD

SHENFIELD

ACTON

MAIN LINE

HANWELL

WOOLWICH

GOODMAYES

CANARY WHARF

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

10

20

30

40

10

20

30

40

10

20

30

40

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

0

30%

20%

10%

40%

0

30%

20%

10%

40%

0

30%

20%

10%

40%

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL

TAPLOW

MAIDENHEAD

BURNHAM

SLOUGH

LANGLEY

IVER

WEST

DRAYTON

HAYES

& HARLINGTON

HEATHROW

SOUTHALL

WEST

EALING

EALING

BROADWAY

PADDINGTON

BOND

STREET

TOTTENHAM

COURT ROAD

LIVERPOOL

STREET

FARRINGDON

WHITECHAPEL

CUSTOM HOUSE ABBEY WOOD

STRATFORD

MARYLAND

FOREST

GATE

MANOR PARK

ILFORD

SEVEN

KINGS

CHADWELL

HEATH

ROMFORD

GIDEA PARK

HAROLD

WOOD

BRENTWOOD

SHENFIELD

ACTON

MAIN LINE

HANWELL

WOOLWICH

GOODMAYES

CANARY WHARF

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

10

20

30

40

10

20

30

40

10

20

30

40

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

0

30%

20%

10%

40%

0

30%

20%

10%

40%

0

30%

20%

10%

40%

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL

TAPLOW

MAIDENHEAD

BURNHAM

SLOUGH

LANGLEY

IVER

WEST

DRAYTON

HAYES

& HARLINGTON

HEATHROW

SOUTHALL

WEST

EALING

EALING

BROADWAY

PADDINGTON

BOND

STREET

TOTTENHAM

COURT ROAD

LIVERPOOL

STREET

FARRINGDON

WHITECHAPEL

CUSTOM HOUSE ABBEY WOOD

STRATFORD

MARYLAND

FOREST

GATE

MANOR PARK

ILFORD

SEVEN

KINGS

CHADWELL

HEATH

ROMFORD

GIDEA PARK

HAROLD

WOOD

BRENTWOOD

SHENFIELD

ACTON

MAIN LINE

HANWELL

WOOLWICH

GOODMAYES

CANARY WHARF

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

10

20

30

40

10

20

30

40

10

20

30

40

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

0

30%

20%

10%

40%

0

30%

20%

10%

40%

0

30%

20%

10%

40%

8|9

The central section

The majority of these are areas that,

despite being inherently well located, have

been overlooked historically in terms of

investment and development.

Subsequently, their property markets

underperform relative to their surrounding

areas. Improving connectivity in and out of

London, as well as increasing the sheer

capacity for passenger numbers, will mean

a real step change for all central stations.

For example, accessibility at Paddington

will change signifcantly as a result of

Crossrail and the addition of a new

Crossrail station. These enhancements are

also likely to produce a marked

improvement to the surrounding residential

market, which has struggled to keep pace

with its more successful neighbours.

Elsewhere, Farringdon is now more likely to

realise its huge potential as a prime

business district, having traditionally only

performed well when supply in the West

End and City has been tight.

In the West End itself, the retail and leisure

offering is already by far the most

prominent in London. However, key

stations like Bond Street do not currently

have suffcient capacity to service any

increase, despite likely latent demand.

Other stations in the central section, such

as Tottenham Court Road, have simply

been overlooked and are in desperate need

of improvements, particularly in relation to

the accessibility and permeability of the

public realm.

Crossrail and associated development will

transform all of these areas, enabling them

to reach their potential, as places people

can easily reach, and where they want to

work, shop and spend their leisure time.

This change is underway, and the property

market is responding.

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL

PADDINGTON

BOND

STREET

TOTTENHAM

COURT ROAD

LIVERPOOL

STREET

FARRINGDON

WHITECHAPEL

CANARY WHARF

10

20

30

40

0

30%

20%

10%

40%

10

20

30

40

0

30%

20%

10%

40%

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL

PADDINGTON

BOND

STREET

TOTTENHAM

COURT ROAD

LIVERPOOL

STREET

FARRINGDON

WHITECHAPEL

CANARY WHARF

10

20

30

40

0

30%

20%

10%

40%

10

20

30

40

0

30%

20%

10%

40%

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL CUSTOM HOUSE ABBEY WOOD

STRATFORD

MARYLAND

FOREST

GATE

MANOR PARK

ILFORD

SEVEN

KINGS

CHADWELL

HEATH

ROMFORD

GIDEA PARK

HAROLD

WOOD

BRENTWOOD

SHENFIELD

WOOLWICH

GOODMAYES

CANARY WHARF

10

20

30

40

10

20

30

40

0

30%

20%

10%

40%

0

30%

20%

10%

40%

10

20

30

40

0

30%

20%

10%

40%

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL CUSTOM HOUSE ABBEY WOOD

STRATFORD

MARYLAND

FOREST

GATE

MANOR PARK

ILFORD

SEVEN

KINGS

CHADWELL

HEATH

ROMFORD

GIDEA PARK

HAROLD

WOOD

BRENTWOOD

SHENFIELD

WOOLWICH

GOODMAYES

CANARY WHARF

10

20

30

40

10

20

30

40

0

30%

20%

10%

40%

0

30%

20%

10%

40%

10

20

30

40

0

30%

20%

10%

40%

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

The impact of Crossrail will be felt most acutely in its central

section, in the heart of the capital. Already a raf of investment

and development is underway at key stations, and is starting to

transform entire areas.

Totenham Court Road

Tottenham Court Road is set to be a key

benefciary from Crossrail. From 2018, the

new station will be able to accommodate

70m passengers a year, putting it on an

equal footing with Oxford Circus. This

boost to footfall into the area immediately

makes it a more attractive retail and offce

location. In addition to the improvements to

connectivity, Tottenham Court Road will

undergo real transformation above ground.

Historically, the area has been relatively

neglected, despite its inherently good

location, and property rents and values

refect this. However, this is all changing,

as part of the 1bn investment programme.

The immediate area is undergoing a

complete overhaul, particularly in regard to

the public realm. It currently functions very

poorly, so the improvements in

permeability, making it a much more

user-friendly area, will be of huge beneft.

The pace and scale of change has

triggered a huge surge in confdence,

particularly in retail. The frst in a new wave

of anchor stores has now taken occupation,

in the form of Primark, which is already

strengthening the shopping offer at the

east end of Oxford Street. Crossrail is

prompting the largest surge of retail stock

renewal in the West End for a generation,

which will fundamentally shift current

shopping pitches; many tertiary pitches will

become secondary and secondary

pitches prime.

The offce sector is also starting to see the

benefts, as rents in the eastern part of

Oxford Street surpass peak-2007 levels.

Signifcant new development is now

underway, or in some cases, has already

been delivered. For example, Central Saint

Giles demonstrates the importance of

major public realm improvements,

particularly in relation to permeability. As

this continues, in tandem with the delivery

of Crossrail itself, rental values in this area

are expected to realign with the wider West

End market.

Central Saint Giles also highlights the latent

demand for high quality residential space

in these areas, and the potential values that

can be achieved. It is a stand-out scheme

in terms of design, particularly with regards

to public realm at ground. As a result, the

launch of the upper residential units was

met with a furry of international interest in

2011. Averaging 1,385 psf and reaching

5.5m for a penthouse, it easily broke

through local price ceilings.

Similarly, Fiztroy Place has been one of the

fastest selling schemes in the whole of

London over the past few years, with the

most impressive value growth, underlying

the strong demand in this area.

Almacantars revival of Centre Point is set

to be the next big thing in this

neighbourhood, transforming the 1960s

offce block into 82 high-end apartments

with spectacular views across the capital.

This will cement the areas transformation

into a prime residential zone.

Our analysis indicates that the substantial

upgrade in accessibility at Tottenham Court

Road will increase embedded residential

values in the area by 2.9% per annum until

2018, or by 15.5% in total over this period.

However, given the central location, the

opportunity and appetite for prime

residential space is palpable. We therefore

anticipate that developers will maximise

the potential for additional value uplift and

focus on delivering high-end products.

Mirroring the wave of new iconic schemes

currently underway on the Southbank, the

bias towards prime development will most

likely prompt a sharper uptick in new build

values in the Tottenham Court Road area.

The 1bn spend programme at Totenham Court Road

is the most signifcant transport investment in the West

End for decades. This is also the most extensive over-site

development on the entire Crossrail network. The

subsequent boost in confdence is already evident in the

local property market, across all sectors.

10|11

Crossrail will give Farringdon a huge boost as an ofce location, making it one of the most

sought afer occupier locations in London. We expect ofce rents to increase by an average

of 6.1% per annum over the next fve years. House prices are also set to surge in this area,

by an average of 5% per year until Crossrail becomes operational, or 28% in total, on top of

underlying capital growth.

Farringdon

Another pocket of Central London that has

been largely overlooked is Farringdon. It

has historically underperformed relative to

its neighbours across all property sectors.

However, it is now on the brink of becoming

one of the best connected areas in the

capital, thus completely repositioning its

property offering.

Farringdon will become one of the major

Crossrail hubs, in relation to both

connectivity and capacity. With Crossrail,

Thameslink and the existing underground

network, Farringdon will be the UKs

busiest station, with 140 trains per hour. It

will offer the only interchange between the

Thameslink and Crossrail, and provide

direct access to Heathrow, Luton and

Gatwick airports.

This signifcant enhancement of

Farringdons connectivity has already had a

noticeable impact on its offce market,

boosting its appeal among occupiers,

particularly in the technology, media and

telecoms sector. Sixty London is a great

example; all 206,000 sq ft was let prior to its

completion in Summer 2013 to Amazon,

which now looks likely to make Farringdon

their London base; it is rumoured to be in

the market with a similar size requirement,

also in this area.

The transport connections themselves, as

well as the street-level placemaking

endeavours, are all encouraging further

inward investment. Sixty London illustrates

how far new developments are starting to

elevate Farringdons reputation,

repositioning it with surrounding markets.

We expect rents to continue to rise and

ultimately out-perform competing markets.

The rapid pace and scale of change will

also boost the residential offering, both in

terms of the appeal of current stock and by

attracting more high-end developers. We

expect Farringdon to experience the

greatest value uplift across all of the central

stations, at 5% per annum until 2018.

However, similar to Tottenham Court Road,

it is it is also likely to become a target for

prime development and as such, we could

see new build values take an even sharper

jump over the next few years, refecting

both the relative switch-up in product, as

well as the wider improvements.

Canary Wharf

Canary Wharf station will be one of the

largest on the entire route. It will be the

equivalent of One Canada Square - Canary

Wharfs centre piece laid on its side. It is

being built on dock water on the North

Dock of West India Quay and when

complete, will comprise six storeys of retail

provision, along with a landscaped park,

restaurant and community facility on the

top foor. In keeping with its contemporary

surroundings, the station will be draped in

an elegant, semi-open-air lattice roof,

which will allow views out over the dock to

the rest of Canary Wharf and beyond.

The capacity of the public transport

network at Canary Wharf will increase by

50%. The improvements will bolster the

resilience of the current transport

connections and overall connectivity,

especially to the City and to Heathrow.

Crossrail will unlock the largest

development pipeline in the whole of

London, with around 8m sq ft of offce

space potential. The surge in development

will help consolidate its reputation as a key

business district and assist with attracting a

broader range of occupiers to new

developments such as Wood Wharf. The

additional retail and leisure space that will

emerge as a result will reinforce the areas

heavyweight status as a business location.

The capacity of Canary Wharfs public transport network will increase by 50% as a result

of Crossrail. This will completely alter the development potential of the area, making it ripe

for expansion. This will fundamentally shif its value proposition.

When Canary Wharf originally emerged as

a key business district, a number of

residential developers sprang into action.

We anticipate the same response this time

round, as it expands signifcantly. The local

market will primarily be driven by the

increase in the local workforce, which will

put additional pressure on demand for high

quality housing. However, it will also be

boosted by the general enhancement to the

quality of the area. We anticipate that this

will drive residential growth by 3.6%

per annum.

In terms of new development. there are

nearly 10,000 units in the planning and

construction pipeline in the Docklands. The

area is attracting a furry of interest from

high-end developers, looking to build out

high density towers and take advantage of

its now frmly entrenched prime status.

12|13

In residential terms, the western section is

likely to beneft much more than the

eastern, given the sharper reductions in

travel times. Again, this will be supported

by associated regeneration work, and in

many cases, underpinned by already

strong and mature housing markets.

We envisage average uplift in residential

values along this western stretch of 2.9%

per annum until Crossrail opens, or 15.6%

in total over this fve year period. The

greatest gains will be made in the Southall

to Acton corridor where growth of around

3.7% per annum is expected.

Over the next fve years, this would equate

to an average additional uplift of 80,000

per house, on top of any underlying capital

appreciation. Ealing, in particular, could

see the greatest increase, with the average

property shooting up by 100,000 over

this period.

The western section

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL

TAPLOW

MAIDENHEAD

BURNHAM

SLOUGH

LANGLEY

IVER

WEST

DRAYTON

HAYES

& HARLINGTON

HEATHROW

SOUTHALL

WEST

EALING

EALING

BROADWAY

ACTON

MAIN LINE

HANWELL

10

20

30

40

0

30%

20%

10%

40%

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL CUSTOM HOUSE ABBEY WOOD

STRATFORD

MARYLAND

FOREST

GATE

MANOR PARK

ILFORD

SEVEN

KINGS

CHADWELL

HEATH

ROMFORD

GIDEA PARK

HAROLD

WOOD

BRENTWOOD

SHENFIELD

WOOLWICH

GOODMAYES

CANARY WHARF

10

20

30

40

10

20

30

40

0

30%

20%

10%

40%

0

30%

20%

10%

40%

10

20

30

40

0

30%

20%

10%

40%

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL CUSTOM HOUSE ABBEY WOOD

STRATFORD

MARYLAND

FOREST

GATE

MANOR PARK

ILFORD

SEVEN

KINGS

CHADWELL

HEATH

ROMFORD

GIDEA PARK

HAROLD

WOOD

BRENTWOOD

SHENFIELD

WOOLWICH

GOODMAYES

CANARY WHARF

10

20

30

40

10

20

30

40

0

30%

20%

10%

40%

0

30%

20%

10%

40%

10

20

30

40

0

30%

20%

10%

40%

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

The main story of the of the western section of Crossrail is in the

residential market. The substantial reduction in travel times on this

leg of the route will trigger house price increases in the region of 2.9%

per annum.

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL

TAPLOW

MAIDENHEAD

BURNHAM

SLOUGH

LANGLEY

IVER

WEST

DRAYTON

HAYES

& HARLINGTON

HEATHROW

SOUTHALL

WEST

EALING

EALING

BROADWAY

ACTON

MAIN LINE

HANWELL

10

20

30

40

0

30%

20%

10%

40%

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

SOUT HAL L

ACT ON

EAL I NG

GREENFORD

Gunnersbury

A

3

0

0

5

M

4

M4

A4020

A4020

A

4

0

6

A

4

0

6

A40

A40

A

4

0

6

A40

A40

A

3

1

2

A4090

A

4090

A

3

1

2

A

4

0

0

0

A

4

0

0

0

A

4

0

0

0

UXBRIDGE ROAD

WESTERN AVENUE

G

rand U

ni on C

anal

G

r

a

n

d

U

n

i o

n

C

a

n

a

l

South Avenue Gardens

Northol t

Greenford

Peri val e

Hanger Lane

Eal i ng Common

Boston Manor

South Eal i ng

North Acton

East Acton

Acton Town

West

Acton

Chi swi ck

Park

Turnham

Green

North Eal i ng

Park Royal

Drayton Green

Castl e Bar Park

South

Greenford

West

Eal i ng

Wi l l esden

Juncti on

Acton Central

South

Acton

THE VALE

Northfields

Hanwell

Ealing

Broadway

Acton

Mainline

Southall

7

4

8

9

2

3

1

6

5

Permi ssi on

Appl i cati on

Under constructi on

SOUT HAL L

ACT ON

EAL I NG

GREENFORD

Gunnersbury

A

3

0

0

5

M

4

M4

A4020

A4020

A

4

0

6

A

4

0

6

A40

A40

A

4

0

6

A40

A40

A

3

1

2

A4090

A

4

0

9

0

A

3

1

2

A

4

0

0

0

A

4

0

0

0

A

4

0

0

0

UXBRIDGE ROAD

WESTERN AVENUE

G

rand U

ni on C

anal

G

r

a

n

d

U

n

i

o

n

C

a

n

a

l

South Avenue Gardens

Northol t

Greenford

Peri val e

Hanger Lane

Eal i ng Common

Boston Manor

South Eal i ng

North Acton

East Acton

Acton Town

West

Acton

Chi swi ck

Park

Turnham

Green

North Eal i ng

Park Royal

Drayton Green

Castl e Bar Park

South

Greenford

West

Eal i ng

Wi l l esden

Juncti on

Acton Central

South

Acton

THE VALE

Northfields

Hanwell

Ealing

Broadway

Acton

Mainline

Southall

7

4

8

9

2

3

1

6

5

Permi ssi on

Appl i cati on

Under constructi on

SOUT HAL L

ACT ON

EAL I NG

GREENFORD

Gunnersbury

A

3

0

0

5

M

4

M4

A4020

A4020

A

4

0

6

A

4

0

6

A40

A40

A

4

0

6

A40

A40

A

3

1

2

A4090

A

4

0

9

0

A

3

1

2

A

4

0

0

0

A

4

0

0

0

A

4

0

0

0

UXBRIDGE ROAD

WESTERN AVENUE

G

rand U

ni on C

anal

G

r

a

n

d

U

n

i

o

n

C

a

n

a

l

South Avenue Gardens

Northol t

Greenford

Peri val e

Hanger Lane

Eal i ng Common

Boston Manor

South Eal i ng

North Acton

East Acton

Acton Town

West

Acton

Chi swi ck

Park

Turnham

Green

North Eal i ng

Park Royal

Drayton Green

Castl e Bar Park

South

Greenford

West

Eal i ng

Wi l l esden

Juncti on

Acton Central

South

Acton

THE VALE

Northfields

Hanwell

Ealing

Broadway

Acton

Mainline

Southall

7

4

8

9

2

3

1

6

5

Permi ssi on

Appl i cati on

Under constructi on

SOUT HAL L

ACT ON

EAL I NG

GREENFORD

Gunnersbury

A

3

0

0

5

M

4

M4

A4020

A4020

A

4

0

6

A

4

0

6

A40

A40

A

4

0

6

A40

A40

A

3

1

2

A4090

A

4

0

9

0

A

3

1

2

A

4

0

0

0

A

4

0

0

0

A

4

0

0

0

UXBRIDGE ROAD

WESTERN AVENUE

G

rand U

ni on C

anal

G

r

a

n

d

U

n

i

o

n

C

a

n

a

l

South Avenue Gardens

Northol t

Greenford

Peri val e

Hanger Lane

Eal i ng Common

Boston Manor

South Eal i ng

North Acton

East Acton

Acton Town

West

Acton

Chi swi ck

Park

Turnham

Green

North Eal i ng

Park Royal

Drayton Green

Castl e Bar Park

South

Greenford

West

Eal i ng

Wi l l esden

Juncti on

Acton Central

South

Acton

THE VALE

Northfields

Hanwell

Ealing

Broadway

Acton

Mainline

Southall

7

4

8

9

2

3

1

6

5

Permi ssi on

Appl i cati on

Under constructi on

Ealing

Crossrail will reduce travel times from

Ealing into Central London by 32 minutes.

This will have an immediate and signifcant

impact on its appeal to commuters. In

addition, the area is already undergoing

marked improvement: Ealing Broadway

station is receiving a makeover, the town

centre has substantial regeneration plans,

and the Ealing Broadway Shopping Centre

is also ear-marked for a major upgrade. So

while the improvements are thoroughly

cross-sector, the most distinctive

improvement will be in the overall quality of

the place as a residential district. As a

result, we anticipate that underlying values

will increase by 3.3% per annum.

Encouraged by such positive underlying

growth prospects, the area is seeing

increased interest from developers. In

residential terms, the most notable scheme

underway is the St Georges development

on New Broadway, which is currently under

construction and will ultimately deliver

nearly 700 units, of which nearly 500 will

be private.

With regards to the commercial markets,

the most signifcant concentrations of offce

space within West London are along the

M4/A4 corridor. Key hubs are currently in

Hammersmith, Chiswick and around

Heathrow. However, the marked reduction

in travel times into London will elevate

Ealings offering and both occupiers

and developers will be poised to

take advantage of this.

Ref Site Private units Status

1 2-16 Western Road, Southall 34 Application

2 Green Man Lane Estate - Phase 2B, Singapore Road, Hanwell 126 Application

3 Havelock Estate - Phase 1, Southall 121 Application

4 81-85 Madeley Road, Ealing 25 Permission

5 Heath Lodge, Church Road, Ealing 22 Permission

6 4-14 Shakespeare Road, Hanwell 22 Permission

7 Corner Plot, Victoria Road / Chase Road, Acton 131 Permission

8 Dickens Yard, 2-12 New Broadway, Ealing 488 Under construction

9 The Apex (Westel House), Uxbridge Road, Ealing 102 Under construction

Slough

Elsewhere on the western route, Slough is

well positioned to beneft from the

improved transport links into Central

London. Currently, the best offce space in

Slough is just west of the town centre,

some distance from the station. This has

been popular with a number of large

corporate occupiers as their headquarters,

such as O2, Blackberry, Reckitt Benckiser

and Black and Decker.

However, a signifcant number of

commercial and residential schemes are

planned for the town centre, which should

see a shift of activity back towards the

station. The arrival of Crossrail, in addition

to further infrastructure improvements

around the station and town centre, is likely

to escalate this shift. Two notable offce

schemes in the pipeline are Heart of

Slough and SL1.

Source: Molior

Residential Development Pipeline, Southall and Ealing

Residential Development Pipeline: Map Key

14|15

The eastern section

The new services will underpin ongoing

regeneration of areas like Stratford, that are

already on their way up, having undergone

considerable investment relating to

the Olympics.

From a residential perspective, there will be

a ripple out effect from the transport

improvements and associated regeneration

works, as the surrounding areas also feel

the boost. We anticipate a general uplift in

the eastern section in the region of 1.7%

per annum until Crossrail opens; or 8.8%

over the fve year period.

However, this will be felt more acutely in

areas that see more drastic cuts in travel

times. For example, both Woolwich and

Abbey Wood look likely to do very well.

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL CUSTOM HOUSE ABBEY WOOD

STRATFORD

MARYLAND

FOREST

GATE

MANOR PARK

ILFORD

SEVEN

KINGS

CHADWELL

HEATH

ROMFORD

GIDEA PARK

HAROLD

WOOD

BRENTWOOD

SHENFIELD

WOOLWICH

GOODMAYES

CANARY WHARF

10

20

30

40

10

20

30

40

0

30%

20%

10%

40%

0

30%

20%

10%

40%

10

20

30

40

0

30%

20%

10%

40%

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL CUSTOM HOUSE ABBEY WOOD

STRATFORD

MARYLAND

FOREST

GATE

MANOR PARK

ILFORD

SEVEN

KINGS

CHADWELL

HEATH

ROMFORD

GIDEA PARK

HAROLD

WOOD

BRENTWOOD

SHENFIELD

WOOLWICH

GOODMAYES

CANARY WHARF

10

20

30

40

10

20

30

40

0

30%

20%

10%

40%

0

30%

20%

10%

40%

10

20

30

40

0

30%

20%

10%

40%

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

NEW STATION

SURFACE LINE EXISTING STATION

TUNNEL CUSTOM HOUSE ABBEY WOOD

STRATFORD

MARYLAND

FOREST

GATE

MANOR PARK

ILFORD

SEVEN

KINGS

CHADWELL

HEATH

ROMFORD

GIDEA PARK

HAROLD

WOOD

BRENTWOOD

SHENFIELD

WOOLWICH

GOODMAYES

CANARY WHARF

10

20

30

40

10

20

30

40

0

30%

20%

10%

40%

0

30%

20%

10%

40%

10

20

30

40

0

30%

20%

10%

40%

T

I

M

E

S

A

V

I

N

G

i

n

t

o

c

e

n

t

r

e

o

f

L

o

n

d

o

n

(

m

i

n

u

t

e

s

)

H

O

U

S

E

P

R

I

C

E

I

N

C

R

E

A

S

E

(

p

e

r

c

e

n

t

a

g

e

)

Crossrail will deliver a step change to East Londons accessibility

when it becomes fully operational. By cuting journey times so

signifcantly in places like Abbey Wood, Crossrail will create

new commuter zones that are much more afordable than the

current alternatives.

Stratford

Already well connected on the rail and tube

network, Stratford will now have the

additional advantage of being directly

linked to Heathrow; an important

consideration for international offce

occupiers. Crossrail will also increase the

capacity of the station, which will help ease

some of the congestion that currently

exists, particularly on the Central Line.

Crossrail will complement the existing

infrastructure in Stratford and offer further

comfort for the growing offce market.

There is now 5m sq ft in the development

pipeline, with both Westfeld and Lend

Lease having substantial plans for the area.

There will also be a ripple out effect, as the

benefts of Crossrail spill further into East

London. For example, Canning Town and

Royals Docks will also be serviced by the

new line via Custom House. This will totally

transform accessibility in these parts and

again, act as a major catalyst for further

regeneration.

Abbey Wood

For Abbey Wood, travel times to Heathrow

will be reduced by 40 minutes, and to Bond

Street and Canary Wharf by around 20

minutes. This throws the area into a new

demand bracket, as it morphs into a

serious commuter zone.

It is likely that Abbey Wood will become an

incredibly attractive yet relatively

affordable home for commuters. Average

house prices are currently around 180,000

and look likely to increase by 41,000 over

the next fve years. This refects an annual

uplift of 4.3% and overall uplift of 23%

between now and 2018.

16|17

Abbey Wood Station

Conclusion

There is no doubt that Crossrail will be a

game changer in property terms.

By increasing the volume of people

travelling into Central London, Crossrail will

unlock huge expansion potential. From an

offce perspective, areas like Farringdon

and Canary Wharf are particularly exciting.

The retail provision in the West End will

get a considerable boost, as currently

underperforming areas like Tottenham

Court Road undergo a much

needed makeover.

But perhaps the biggest story in the

property world is in the residential market.

Home owners along the entire stretch of

the route will continue to see their homes

increase in value, as their neighbourhoods

get better and their trips to work get

shorter. Overall, house prices are likely to

increase by 13% over the next fve years in

areas around affected stations. This is

likely to be closer to 20% in

Central London.

Infrastructure projects on the scale of

Crossrail are essential to both the London

economy and that of the wider UK,

ensuring that we keep pace in an

increasingly globalised marketplace. With a

total cost envelope of 14.8bn and an

overall estimated beneft of 42bn, there

will surely be plenty of winners.

18|19

Kevin McCauley

Head of Central London

Research, Senior Director

T: +44 (0) 20 7182 3620

E: kevin.mccauley@cbre.com

Jennet Siebrits

Head of Residential Research

Senior Director

T: +44 (0) 20 7182 2066

E: jennet.siebrits@cbre.com

Andrew Marston

Head of UK National Research,

Director

T: +44 (0) 20 7182 3907

E: andrew.marston@cbre.com

Helen Gray

Residential Research

Associate Director

T: +44 (0) 20 7182 2068

E: helen.gray@cbre.com

Peter Burns

Central London Development,

Executive Director

T: +44 (0) 20 7182 2716

E: peter.burns@cbre.com

Mark Collins

London Residential

Chairman

T: +44 (0) 20 7182 2264

E: mark.collins2@cbre.com

Mark Teale

Head of Retail Research,

Director

T: +44 (0) 20 7182 3611

E: mark.teale@cbre.com

Lisa Hollands

London Residential

Executive Director

T: +44 (0) 20 7420 2004

E: lisa.hollands@cbre.com

cbre.co.uk/residential CBRE Henrietta House, Henrietta Place, London W1G 0NB

Você também pode gostar

- Coca Cola HellenicDocumento2 páginasCoca Cola Hellenicapi-249461242Ainda não há avaliações

- Zooplus Research NoteDocumento1 páginaZooplus Research Noteapi-249461242Ainda não há avaliações

- Miko Research NoteDocumento1 páginaMiko Research Noteapi-249461242Ainda não há avaliações

- Songbird Estates Research NoteDocumento1 páginaSongbird Estates Research Noteapi-249461242Ainda não há avaliações

- Thorntons Research NoteDocumento2 páginasThorntons Research Noteapi-249461242Ainda não há avaliações

- Fujitec Research Note 3Documento2 páginasFujitec Research Note 3api-249461242Ainda não há avaliações

- Mondelez Research Note 1Documento1 páginaMondelez Research Note 1api-249461242Ainda não há avaliações

- Good Energy Research NoteDocumento2 páginasGood Energy Research Noteapi-249461242Ainda não há avaliações

- Global Brass and Copper Holdings Research Note 1Documento2 páginasGlobal Brass and Copper Holdings Research Note 1api-249461242Ainda não há avaliações

- Stef Research Note 1Documento1 páginaStef Research Note 1api-249461242Ainda não há avaliações

- Theravance Inc - Form 4may-13-2014Documento2 páginasTheravance Inc - Form 4may-13-2014api-249461242Ainda não há avaliações

- Otis - FujitecDocumento2 páginasOtis - Fujitecapi-249461242Ainda não há avaliações

- 1-27454190 EprintDocumento2 páginas1-27454190 Eprintapi-249461242Ainda não há avaliações

- News2008 03 28Documento2 páginasNews2008 03 28api-249461242Ainda não há avaliações

- Stef Research NoteDocumento1 páginaStef Research Noteapi-249461242Ainda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Fitzroy Apartments Host Brochure (1) - 1Documento33 páginasThe Fitzroy Apartments Host Brochure (1) - 1Peter ToAinda não há avaliações

- 0343 222 1234 T .Gov - Uk/Travel-Tools Download The TFL Go AppDocumento1 página0343 222 1234 T .Gov - Uk/Travel-Tools Download The TFL Go AppIoanAinda não há avaliações

- The Nutritional SolutionDocumento33 páginasThe Nutritional SolutionDaevid AndersonAinda não há avaliações

- FiftyOne BrochureDocumento20 páginasFiftyOne BrochureHermieAinda não há avaliações

- You Can Find This Map at T .Gov - Uk/maps and T .Gov - Uk/accessguidesDocumento2 páginasYou Can Find This Map at T .Gov - Uk/maps and T .Gov - Uk/accessguidesDave FullerAinda não há avaliações

- TFL Bus Spider Map For Ealing CommonDocumento1 páginaTFL Bus Spider Map For Ealing Commonhrpwmv83Ainda não há avaliações

- Uxbridge SouthDocumento1 páginaUxbridge SouthJoan AndresAinda não há avaliações

- TFL Bus Spider Map For Acton ValeDocumento1 páginaTFL Bus Spider Map For Acton Valehrpwmv83Ainda não há avaliações

- Historical Walk NortholtDocumento6 páginasHistorical Walk NortholtJJ JJAinda não há avaliações

- Charlotte Iserbyt-Deliberate Dumbing Down of AmericaDocumento738 páginasCharlotte Iserbyt-Deliberate Dumbing Down of AmericakitommollufaSS100% (1)

- Bus Map RuislipDocumento1 páginaBus Map Ruislipapi-101484433Ainda não há avaliações