Escolar Documentos

Profissional Documentos

Cultura Documentos

Sugar Sector & Stock Picks - Technical View: Retail Research

Enviado por

Bharat0 notas0% acharam este documento útil (0 voto)

27 visualizações8 páginasThe document provides technical analysis and recommendations for several Indian sugar stocks - Bajaj Hindustan, Dhampur Sugar, Renuka Sugar, EID Parry, and Balrampur Chini. For each stock, it analyzes technical indicators like support levels, volume, RSI, MACD, and ADX to identify accumulation and support an intermediate-term uptrend. The document recommends accumulating these stocks within given price bands over the next 6-18 months, with sequential price targets and stop losses provided. International and NCDEX sugar markets are also discussed as experiencing new uptrends, which could boost profits for Indian sugar companies.

Descrição original:

sugar report technical june 2014

Título original

Sugar Report

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe document provides technical analysis and recommendations for several Indian sugar stocks - Bajaj Hindustan, Dhampur Sugar, Renuka Sugar, EID Parry, and Balrampur Chini. For each stock, it analyzes technical indicators like support levels, volume, RSI, MACD, and ADX to identify accumulation and support an intermediate-term uptrend. The document recommends accumulating these stocks within given price bands over the next 6-18 months, with sequential price targets and stop losses provided. International and NCDEX sugar markets are also discussed as experiencing new uptrends, which could boost profits for Indian sugar companies.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

27 visualizações8 páginasSugar Sector & Stock Picks - Technical View: Retail Research

Enviado por

BharatThe document provides technical analysis and recommendations for several Indian sugar stocks - Bajaj Hindustan, Dhampur Sugar, Renuka Sugar, EID Parry, and Balrampur Chini. For each stock, it analyzes technical indicators like support levels, volume, RSI, MACD, and ADX to identify accumulation and support an intermediate-term uptrend. The document recommends accumulating these stocks within given price bands over the next 6-18 months, with sequential price targets and stop losses provided. International and NCDEX sugar markets are also discussed as experiencing new uptrends, which could boost profits for Indian sugar companies.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 8

RETAIL RESEARCH

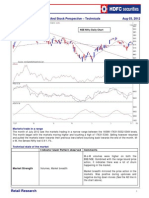

Sugar Stock Picks Technical

Stock CMP Recommended Action Sequential Targets Stop Loss Time Horizon

Bajaj Hind 28.05 Accumulate between 28.05 to 20.0 68 and 122 17.0 6-18 months

Dhampur Sugar 55.25 Accumulate between 55.25 to 45.0 85 and 108 40.0 6-18 months

Renuka Sugar 25.75 Accumulate between 25.75 to 23.0 38 and 59 21 6-18 months

EID Parry 203.75 Accumulate between 203.75 to 170 289 160 6-18 months

Balrampur Chini 77.15 Accumulate between 77.15 to 60 128 and 168 55 6-18 months

Internati onal Sugar On a new l ong term uptrend

International sugar has been on a long term uptrend since 2004. However, while the trend has been up, there were several bear phases

in the last ten years that saw violent corrections.

International sugar has entered into a new intermediate uptrend by finding support at the ten year old trend line in J an 2014 at around the

$15 levels and moving up smartly in the last few months. The sugar prices have also formed a higher bottom. This new uptrend is likely to

accelerate once the price moves above $19, which corresponds to the upper end of the downward sloping channel in which it is currently

trading within.

Momentum readings like the 14-month RSI too are not overbought, thereby lending support to the current long term uptrend. This also

augurs well for Indian sugar stocks as their profits could increase as international sugar prices go up.

RETAIL RESEARCH

Sugar Sector & Stock Picks Technical View

May 24, 2014

RETAIL RESEARCH

NCDEX Sugar Technical

NCDEX Sugar On a new i ntermedi ate uptrend

NCDEX Sugar too has entered into a new intermediate uptrend. The commodity has reversed its intermediate downtrend and broken out

of a downward sloping trend line in the process. Momentum readings like the 14-week RSI too are not overbought, thereby lending

support to the current intermediate uptrend.

The current weakness/correction could therefore provide a buying opportunity to accumulate more of this commodity and also sugar

stocks as the NCDEX prices may not fall much below the current levels and could reverse soon. The following pages highlight sugar

stocks investors could look at accumulating.

RETAIL RESEARCH

Bajaj Hindustan

Bajaj Hindustan has made a double bottom around the 11.85-12.0 levels, which has also acted as a major support in 2003.

This week, the stock has convincingly broken out of its recent highs and zoomed higher on the back of higher than average

volumes. This indicates significant accumulation has been happening in this counter.

Technical indicators are giving encouraging signals. The 14-week RSI has moved higher and is above its 9-week EMA.

The MACD indicator too is above its 9-day EMA and the Weekly ADX readings are in rising mode. At 33.13, the weekly ADX

readings are indicating that the current uptrend is not matured and there is more upside potential in the intermediate term.

We recommend an accumulate in the band of CMP of Rs.28.05 to 20.0. Stop loss can be placed at 17.0. Our intermediate

upside targets are at 68 and 122. Holding period is 10-24 months.

Note: Once the market opens for trade, the analyst will review it and decide to give the call through an internal mail/SMS at the same or different

levels of entry, target and stop loss or not give the call at all or give a call in Futures/call/put. Clients could get in touch with the analyst through their

designated dealers to check about this.

RETAIL RESEARCH

Dhampur Sugar

Dhampur Sugar has made a double bottom around the 27-28 levels during Nov 13 - Feb 14. The stock had also found support

around the same levels in Dec 2011 before rebounding strongly.

This week, the stock has convincingly broken out of its recent highs and zoomed higher on the back of higher than average

volumes. This indicates significant accumulation has been happening in this counter and the stock is ready to continue the next

leg of its intermediate uptrend.

Technical indicators are giving encouraging signals. The 14-week RSI has moved higher and is above its 9-week EMA.

The MACD indicator too is above its 9-day EMA and the Weekly ADX readings are in rising mode. At 29.76, the weekly ADX

readings are indicating that the current uptrend is not matured and there is more upside potential in the intermediate term.

We recommend an accumulate in the band of CMP of Rs.55.25 to 45. Stop loss can be placed at 40. Our intermediate upside

targets are at 85 and 108. Holding period 6-18 months.

Note: Once the market opens for trade, the analyst will review it and decide to give the call through an internal mail/SMS at the same or different

levels of entry, target and stop loss or not give the call at all or give a call in Futures/call/put. Clients could get in touch with the analyst through their

designated dealers to check about this.

RETAIL RESEARCH

Renuka Sugar

Renuka Sugar has made a double bottom around the 14.5-15.0 levels during J uly 13 Aug 13. The stock had also found

support around the same levels during Feb-March 2007 before rebounding strongly.

This week, the stock has convincingly broken out of its recent highs and zoomed higher on the back of higher than average

volumes. This indicates significant accumulation has been happening in this counter and the stock is ready to continue the next

leg of its intermediate uptrend.

We also observe that the stock has broken out of a downward sloping trend line that has held down the highs of the last few

years.

Technical indicators are giving encouraging signals. The 14-week RSI has moved higher and is above its 9-week EMA.

The MACD indicator too is above its 9-day EMA and the Weekly ADX readings are in rising mode. At 27.3, the weekly ADX

readings are indicating that the current uptrend is not matured and there is more upside potential in the intermediate term.

We recommend an accumulate in the band of CMP of Rs.25.75 to 23. Stop loss can be placed at 21. Our intermediate upside

targets are at 38 and 59. Holding period 6-18 months.

Note: Once the market opens for trade, the analyst will review it and decide to give the call through an internal mail/SMS at the same or different levels of

entry, target and stop loss or not give the call at all or give a call in Futures/call/put. Clients could get in touch with the analyst through their designated

dealers to check about this.

RETAIL RESEARCH

EID Parry

EID Parry has reversed the intermediate downtrend that the stock was in since 2011. This downtrend was reversed during Nov

2013 when the stock took out its previous intermediate highs of 150.

The stock then made a higher bottom around the 117 levels during Feb 2014.

Last week, the stock has convincingly broken out of its recent highs and zoomed higher on the back of higher than average

volumes. This indicates significant accumulation has been happening in this counter and the stock is ready to continue the next

leg of its intermediate uptrend.

Technical indicators are giving encouraging signals. The 14-week RSI has moved higher and is above its 9-week EMA.

The MACD indicator too is above its 9-day EMA and the Weekly ADX readings are in rising mode. At 25.67, the weekly ADX

readings are indicating that the current uptrend is not matured and there is more upside potential in the intermediate term.

We recommend an accumulate in the band of CMP of Rs.203.75 to 170. Stop loss can be placed at 160. Our intermediate

upside targets are at 289. Holding period 6-18 months.

Note: Once the market opens for trade, the analyst will review it and decide to give the call through an internal mail/SMS at the same or different levels of

entry, target and stop loss or not give the call at all or give a call in Futures/call/put. Clients could get in touch with the analyst through their designated

dealers to check about this.

RETAIL RESEARCH

Balrampur Chini

Balrampur Chini has reversed the intermediate downtrend that the stock was in since 2009. This downtrend was reversed during

March 2014 when the stock took out its previous intermediate highs of 52.

The stock in the process made a higher bottom around the 36 levels during Feb 2014. It also broke out of a downward sloping

trend line that has held down the highs of the stock of the last few years.

This week, the stock has convincingly broken out of a significant intermediate high of 74.55 to end the week at 77.15.

This weeks rise also came on the back of higher than average volumes. This indicates significant accumulation has been

happening in this counter and the stock is ready to continue the next leg of its intermediate uptrend.

Technical indicators are giving encouraging signals. The 14-week RSI has moved higher and is above its 9-week EMA.

The MACD indicator too is above its 9-day EMA and the Weekly ADX readings are in rising mode. At 32.83, the weekly ADX

readings are indicating that the current uptrend is not matured and there is more upside potential in the intermediate term.

We recommend an accumulate in the band of CMP of Rs.77.15 to 60. Stop loss can be placed at 55. Our intermediate upside

targets are at 128 and 168. Holding period 6-18 months.

Note: Once the market opens for trade, the analyst will review it and decide to give the call through an internal mail/SMS at the same or different levels of

entry, target and stop loss or not give the call at all or give a call in Futures/call/put. Clients could get in touch with the analyst through their designated

dealers to check about this.

RETAIL RESEARCH

Analyst: Subash Gangadharan

HDFC securities Limited, I Think Techno Campus, Building B, Alpha, Office Floor 8, Near Kanjurmarg Station, Opposite

Crompton Greaves, Kanjurmarg (East), Mumbai 400042, Fax: (022) 30753435

Di sclai mer: This document has been prepared by HDFC securities Limited and is meant for sole use by the recipient and not for circulation. This document

is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The

information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such.

We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform

investment banking, or other services for, any company mentioned in this document. This report is intended for non- Institutional Clients only

Você também pode gostar

- 10 Tips For Better Legal WritingDocumento12 páginas10 Tips For Better Legal WritingYvzAinda não há avaliações

- The Improved R2 StrategyDocumento4 páginasThe Improved R2 Strategyhusserl01Ainda não há avaliações

- RSI Strategy Guide PDFDocumento7 páginasRSI Strategy Guide PDFcoachbiznesuAinda não há avaliações

- Interview With Andrew Cardwell On RSIDocumento27 páginasInterview With Andrew Cardwell On RSIpsoonek86% (7)

- Cost Accounting and Management Essentials You Always Wanted To Know: 4th EditionDocumento21 páginasCost Accounting and Management Essentials You Always Wanted To Know: 4th EditionVibrant Publishers100% (1)

- 9 Advanced and Profitable Trading StrategiesDocumento44 páginas9 Advanced and Profitable Trading StrategiesKrish RajAinda não há avaliações

- My Top Three Scalping Trading StrategiesDocumento8 páginasMy Top Three Scalping Trading StrategiesNikos KarpathakisAinda não há avaliações

- Buy and Sell Day Trading Signals: Profitable Trading Strategies, #4No EverandBuy and Sell Day Trading Signals: Profitable Trading Strategies, #4Ainda não há avaliações

- Day Trading Strategies For Beginners: Day Trading Strategies, #2No EverandDay Trading Strategies For Beginners: Day Trading Strategies, #2Ainda não há avaliações

- Reading Exercise 2Documento2 páginasReading Exercise 2Park Hanna100% (1)

- How Long A Trend Is Needed For Success - by Daryl GuppyDocumento5 páginasHow Long A Trend Is Needed For Success - by Daryl GuppyBhavya ShahAinda não há avaliações

- How Common Indian People Take Investment Decisions Exploring Aspects of Behavioral Economics in IndiaDocumento3 páginasHow Common Indian People Take Investment Decisions Exploring Aspects of Behavioral Economics in IndiaInternational Journal of Innovative Science and Research TechnologyAinda não há avaliações

- Developing A Biblical WorldviewDocumento22 páginasDeveloping A Biblical WorldviewAaron AmaroAinda não há avaliações

- Stock Market TipsDocumento8 páginasStock Market TipsRahul AssawaAinda não há avaliações

- Objectives: A. Identify The Reasons For Keeping Business Records and B. Perform Key Bookkeeping TaskDocumento11 páginasObjectives: A. Identify The Reasons For Keeping Business Records and B. Perform Key Bookkeeping TaskMarife CulabaAinda não há avaliações

- Professional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.No EverandProfessional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.Ainda não há avaliações

- FIDP Business Ethics and Social Responsibility PDFDocumento7 páginasFIDP Business Ethics and Social Responsibility PDFRachell Mae Bondoc 1Ainda não há avaliações

- Camisole No.8 Pattern by MyFavoriteThingsKnitwearDocumento7 páginasCamisole No.8 Pattern by MyFavoriteThingsKnitwearGarlicAinda não há avaliações

- Mid Cap Technical Picks: Retail ResearchDocumento8 páginasMid Cap Technical Picks: Retail ResearchAnonymous y3hYf50mTAinda não há avaliações

- Monthly Market, Sectoral and Stock Perspective - Technicals Dec 08, 2012Documento5 páginasMonthly Market, Sectoral and Stock Perspective - Technicals Dec 08, 2012GauriGanAinda não há avaliações

- Monthly Market, Sectoral and Stock Perspective - Technicals June 29, 2013Documento6 páginasMonthly Market, Sectoral and Stock Perspective - Technicals June 29, 2013GauriGanAinda não há avaliações

- Monthly Market, Sectoral and Stock Perspective - Technicals Aug 03, 2012Documento5 páginasMonthly Market, Sectoral and Stock Perspective - Technicals Aug 03, 2012GauriGanAinda não há avaliações

- TECHNICAL ANALYSIS - Yash ShahDocumento4 páginasTECHNICAL ANALYSIS - Yash ShahYash ShahAinda não há avaliações

- ICICI Direct - Technical Delivery Call Dredging Corporation of India - Apr 01, 2014Documento5 páginasICICI Direct - Technical Delivery Call Dredging Corporation of India - Apr 01, 2014Nandeesh KodimallaiahAinda não há avaliações

- Weekly Technical Report: Retail ResearchDocumento6 páginasWeekly Technical Report: Retail ResearchGauriGanAinda não há avaliações

- Chase Weekly Technical Analysis Report (22-April-2024)Documento5 páginasChase Weekly Technical Analysis Report (22-April-2024)Abdullah CheemaAinda não há avaliações

- LKP Sec 7 Techno FundaDocumento11 páginasLKP Sec 7 Techno FundaAnonymous W7lVR9qs25Ainda não há avaliações

- Weekly Trends: Earnings To The RescueDocumento4 páginasWeekly Trends: Earnings To The RescuedpbasicAinda não há avaliações

- Weekly: Join in Our Telegram Channel - T.Me/Equity99Documento9 páginasWeekly: Join in Our Telegram Channel - T.Me/Equity99Lingesh SivaAinda não há avaliações

- Weekly Update 3rd Dec 2011Documento5 páginasWeekly Update 3rd Dec 2011Devang VisariaAinda não há avaliações

- WeeklyTechnicalPicks 04june2021Documento6 páginasWeeklyTechnicalPicks 04june2021RkkvanjAinda não há avaliações

- Traders Watch 13Documento8 páginasTraders Watch 13Kamal RanaAinda não há avaliações

- Moving Average Convergence Divergence (MACD)Documento2 páginasMoving Average Convergence Divergence (MACD)vinaAinda não há avaliações

- DaburIndia ICICI 130412Documento2 páginasDaburIndia ICICI 130412Vipul BhatiaAinda não há avaliações

- Optioneering Newsletter Oct 30Documento14 páginasOptioneering Newsletter Oct 30Alejandro MufardiniAinda não há avaliações

- Long Term Commodity ReportDocumento6 páginasLong Term Commodity ReportPramod ManeAinda não há avaliações

- Market Slides Into Oversold Region 070612 - ProshareDocumento3 páginasMarket Slides Into Oversold Region 070612 - ProshareProshareAinda não há avaliações

- FDWMS Research Report - TVS Electronics Ltd.Documento3 páginasFDWMS Research Report - TVS Electronics Ltd.dakshbajajAinda não há avaliações

- Weekly Trading Highlights & OutlookDocumento5 páginasWeekly Trading Highlights & OutlookDevang VisariaAinda não há avaliações

- WeeklyTechnicalPicks 05august2022Documento9 páginasWeeklyTechnicalPicks 05august2022AJayAinda não há avaliações

- Weekly Trading Highlights & OutlookDocumento5 páginasWeekly Trading Highlights & OutlookDevang VisariaAinda não há avaliações

- Weekly Trading Highlights & OutlookDocumento5 páginasWeekly Trading Highlights & OutlookDevang VisariaAinda não há avaliações

- Fin F313 Security Analysis and Portfolio ManagementDocumento5 páginasFin F313 Security Analysis and Portfolio ManagementNikita NawapetAinda não há avaliações

- MACD + RSI Powerful Forex Trading Strategy - Vladimir RibakovDocumento13 páginasMACD + RSI Powerful Forex Trading Strategy - Vladimir RibakovReporter553 Reporter553Ainda não há avaliações

- 2019 Feb 3Documento16 páginas2019 Feb 3Alejandro MufardiniAinda não há avaliações

- Abcd AirtelDocumento12 páginasAbcd AirtelPrakhar RatheeAinda não há avaliações

- 2019 Feb 17Documento9 páginas2019 Feb 17Alejandro MufardiniAinda não há avaliações

- Weekly Trading Highlights & OutlookDocumento5 páginasWeekly Trading Highlights & OutlookDevang VisariaAinda não há avaliações

- Top 5 Equities League 12202013Documento3 páginasTop 5 Equities League 12202013Stephen OtaroAinda não há avaliações

- June 2019 Investor LetterDocumento7 páginasJune 2019 Investor LetterMohit AgarwalAinda não há avaliações

- Case Study: Pairs Trading: Andrew Coatsworth Finance 466 Professor Brogaard December 3, 2015Documento9 páginasCase Study: Pairs Trading: Andrew Coatsworth Finance 466 Professor Brogaard December 3, 2015api-318180354Ainda não há avaliações

- Stock and Price On The Date Date Last CommentedDocumento9 páginasStock and Price On The Date Date Last Commentedaseemjain7120Ainda não há avaliações

- CPR BY KGS Newsletter Issue 17Documento5 páginasCPR BY KGS Newsletter Issue 17ApAinda não há avaliações

- Thematic Reports - PSU-Banks - 23022021Documento7 páginasThematic Reports - PSU-Banks - 23022021krishnaheetAinda não há avaliações

- Premarket DerivativesStrategist AnandRathi 30.11.16Documento3 páginasPremarket DerivativesStrategist AnandRathi 30.11.16Rajasekhar Reddy AnekalluAinda não há avaliações

- Weekly Update 24 Sept 2011Documento5 páginasWeekly Update 24 Sept 2011Mitesh ThackerAinda não há avaliações

- Technical Weekly Picks - 27 Nov - 27-11-2020 - 18Documento6 páginasTechnical Weekly Picks - 27 Nov - 27-11-2020 - 18vicky6677Ainda não há avaliações

- Market Commentary: Vol.14.144 29th Oct 2010Documento4 páginasMarket Commentary: Vol.14.144 29th Oct 2010Navin JainAinda não há avaliações

- Commodity Channel Index (CCI)Documento7 páginasCommodity Channel Index (CCI)Shahzad DalalAinda não há avaliações

- 3rd Premium SubscriptionDocumento16 páginas3rd Premium SubscriptionManish SachdevAinda não há avaliações

- T I M E S: Market Yearns For Fresh TriggersDocumento22 páginasT I M E S: Market Yearns For Fresh TriggersDhawan SandeepAinda não há avaliações

- Technical Analysis of Equity Shares Project ReportDocumento117 páginasTechnical Analysis of Equity Shares Project Reportvs1513Ainda não há avaliações

- Weekly Update 17th Dec 2011Documento6 páginasWeekly Update 17th Dec 2011Devang VisariaAinda não há avaliações

- 2019 Jan 27Documento16 páginas2019 Jan 27Alejandro MufardiniAinda não há avaliações

- Analysis SADocumento5 páginasAnalysis SAM43CherryAroraAinda não há avaliações

- Weekly Update 26th Nov 2011Documento5 páginasWeekly Update 26th Nov 2011Devang VisariaAinda não há avaliações

- Initiating Coverage Ruchi Soya Industries LTDDocumento20 páginasInitiating Coverage Ruchi Soya Industries LTDShruti SharmaAinda não há avaliações

- Opening Bell: Market Outlook Today's HighlightsDocumento8 páginasOpening Bell: Market Outlook Today's HighlightsBharatAinda não há avaliações

- Opening Bell: Market Outlook Today's HighlightsDocumento7 páginasOpening Bell: Market Outlook Today's HighlightsBharatAinda não há avaliações

- Daily DerivativesDocumento3 páginasDaily DerivativesBharatAinda não há avaliações

- Daily Calls: January 29, 2016Documento17 páginasDaily Calls: January 29, 2016BharatAinda não há avaliações

- Closing Bell: Indices Close Change Change%Documento5 páginasClosing Bell: Indices Close Change Change%BharatAinda não há avaliações

- Countryclub1 3699Documento2 páginasCountryclub1 3699BharatAinda não há avaliações

- Payment ReceiptDocumento1 páginaPayment ReceiptBharatAinda não há avaliações

- GVKPower&Infra AshishChugh MultibaggerDocumento7 páginasGVKPower&Infra AshishChugh MultibaggerBharatAinda não há avaliações

- Sharing Files, Data, and Information. in A NetworkDocumento17 páginasSharing Files, Data, and Information. in A NetworkBharatAinda não há avaliações

- SPSSTutorial 1Documento50 páginasSPSSTutorial 1BharatAinda não há avaliações

- Andhra Bank: Quality Franchise at Attractive ValuationDocumento3 páginasAndhra Bank: Quality Franchise at Attractive ValuationBharatAinda não há avaliações

- Marcato Capital - Letter To Lifetime Fitness BoardDocumento13 páginasMarcato Capital - Letter To Lifetime Fitness BoardCanadianValueAinda não há avaliações

- N4 Fortran Codes For Computing The Space-Time Correlations of Turbulent Flow in A ChannelDocumento47 páginasN4 Fortran Codes For Computing The Space-Time Correlations of Turbulent Flow in A Channelabhi71127112Ainda não há avaliações

- 8.31 - Standard CostingDocumento109 páginas8.31 - Standard CostingBhosx Kim100% (1)

- News Lessons Cosplaying Hobbit Worksheet Intermediate 941615Documento5 páginasNews Lessons Cosplaying Hobbit Worksheet Intermediate 941615Advennie Nuhujanan0% (1)

- Seerah of Holy ProphetDocumento19 páginasSeerah of Holy Prophetammara tanveerAinda não há avaliações

- Defining Pediatric SepsisDocumento2 páginasDefining Pediatric SepsisArisa DeguchiAinda não há avaliações

- May 29Documento2 páginasMay 29gerrymattinglyAinda não há avaliações

- Karling Aguilera-Fort ResumeDocumento4 páginasKarling Aguilera-Fort Resumeapi-3198760590% (1)

- LifeSkills - Role PlayDocumento7 páginasLifeSkills - Role Playankit boxerAinda não há avaliações

- Battleship PotemkinDocumento7 páginasBattleship PotemkinMariusOdobașa100% (1)

- Help Us Clean The Government HospitalsDocumento3 páginasHelp Us Clean The Government HospitalsSelva GanapathyAinda não há avaliações

- Youcastr Case StudyDocumento2 páginasYoucastr Case StudyMomina NadeemAinda não há avaliações

- AS and A Level GraphsDocumento16 páginasAS and A Level GraphsManibalanAinda não há avaliações

- Sui Man Hui Chan and Gonzalo CoDocumento22 páginasSui Man Hui Chan and Gonzalo CoKatrina Anne Layson YeenAinda não há avaliações

- Competition Commission of India: Mahendra SoniDocumento16 páginasCompetition Commission of India: Mahendra SoniSuman sharmaAinda não há avaliações

- Simple Past News Biography Regular and Irregular VerbsDocumento15 páginasSimple Past News Biography Regular and Irregular VerbsDaniela MontemayorAinda não há avaliações

- Intersection of Psychology With Architecture Final ReportDocumento22 páginasIntersection of Psychology With Architecture Final Reportmrunmayee pandeAinda não há avaliações

- Unit - 3 Consignment: Learning OutcomesDocumento36 páginasUnit - 3 Consignment: Learning OutcomesPrathamesh KambleAinda não há avaliações

- Review Paper On Three Phase Fault AnalysisDocumento6 páginasReview Paper On Three Phase Fault AnalysisPritesh Singh50% (2)

- The SacrificeDocumento3 páginasThe SacrificeRoseann Hidalgo ZimaraAinda não há avaliações

- All State CM and Governers List 2022Documento4 páginasAll State CM and Governers List 2022Tojo TomAinda não há avaliações

- Chapter 3 - ABCDocumento50 páginasChapter 3 - ABCRizwanahParwinAinda não há avaliações