Escolar Documentos

Profissional Documentos

Cultura Documentos

Online Digests - Warehouse Receipts Law

Enviado por

Maria Reylan Garcia100%(2)100% acharam este documento útil (2 votos)

2K visualizações9 páginasOnline Digests - Warehouse Receipts Law

Online Digests - Warehouse Receipts Law

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoOnline Digests - Warehouse Receipts Law

Online Digests - Warehouse Receipts Law

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

100%(2)100% acharam este documento útil (2 votos)

2K visualizações9 páginasOnline Digests - Warehouse Receipts Law

Enviado por

Maria Reylan GarciaOnline Digests - Warehouse Receipts Law

Online Digests - Warehouse Receipts Law

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 9

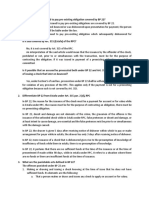

Online DIGESTS warehouse receipts

Bank of P.I. v. Herridge

FACTS:

The insolvent Umberto de Poli was for several years engaged on an extensive scale in the exportation of Manila

hemp, maguey and other products of the country.

He was also a licensed public warehouseman, though most of the goods stored in his warehouses appear to have

been merchandise purchased by him for exportation and deposited there by he himself.chanr

In order to finance his commercial operations De Poli established credits with some of the leading banking institutions

doing business in Manila at that time, among them the Hongkong & Shanghai Banking Corporation, the Bank of the

Philippine Islands, the Asia Banking Corporation, the Chartered Bank of India, Australia and China, and the American

Foreign Banking Corporation.

De Poli opened a current account credit with the bank against which he drew his checks in payment of the products

bought by him for exportation.

Upon the purchase, the products were stored in one of his warehouses and warehouse receipts issued therefor

which were endorsed by him to the bank as security for the payment of his credit in the account current.

When the goods stored by the warehouse receipts were sold and shipped, the warehouse receipt was exchanged for

shipping papers, a draft was drawn in favor of the bank and against the foreign purchaser, with bill of landing

attached, and the entire proceeds of the export sale were received by the bank and credited to the current account of

De Poli.chanroble

De Poli was declared insolvent by the Court of First Instance of Manila with liabilities to the amount of several million

pesos over and above his assets. An assignee was elected by the creditors and the election was confirmed by the

court

Among the property taken over the assignee was the merchandise stored in the various warehouses of the insolvent.

This merchandise consisted principally of hemp, maguey and tobacco.

The various banks holding warehouse receipts issued by De Poli claim ownership of this merchandise under their

respective receipts, whereas the other creditors of the insolvent maintain that the warehouse receipts are not

negotiable, that their endorsement to the present holders conveyed no title to the property, that they cannot be

regarded as pledges of the merchandise inasmuch as they are not public documents and the possession of the

merchandise was not delivered to the claimants and that the claims of the holders of the receipts have no preference

over those of the ordinary unsecured creditors.law lib

ISSSUE:

Whether or not the warehouse receipts issued are negotiable?

HELD:

Yes, a warehouseman who deposited merchandise in his own warehouse, issued a warehouse receipts therefore

and thereafter negotiated the receipts by endorsement. The receipt recites that the goods were deposited por orden

of the depositor, the warehouseman, but contained no statement that the goods were to be delivered to the bearer of

the receipts or to a specified person. It is in the form of a warehouse receipts and was not mark nonnegotiable.

Therefore the receipts was negotiable warehouse receipts and the words por orden must be construed to mean to

the order.

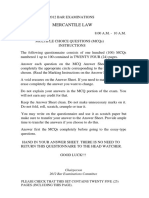

COMMISSIONER OF INTERNAL REVENUE, petitioner,

vs.

HAWAIIAN-PHILIPPINE COMPANY, respondent.

FACTS:

The petitioner, a corporation duly organized in accordance with law, is operating a sugar central in the City of Silay,

Occidental Negros. It produces centrifugal sugar from sugarcane supplied by planters. The processed sugar is

divided between the planters and the petitioner in the proportion stipulated in the milling contracts, and thereafter is

deposited in the warehouses of the latter. (Pp. 4-5, t.s.n.) For the sugar deposited by the planters, the petitioner

issues the corresponding warehouse receipts of "quedans". It does not collect storage charges on the sugar

deposited in its warehouse during the first 90 days period counted from the time it is extracted from the sugarcane.

Upon the lapse of the first ninety days and up to the beginning of the next milling season, it collects a fee of P0.30

per picul a month. Henceforth, if the sugar is not yet withdrawn, a penalty of P0.25 per picul or fraction thereof a

month is imposed. (Exhibits "B-1", "C-1", "D-1", "B-2", "C-2", p. 10, t.s.n.)

The storage of sugar is carried in the books of the company under Account No. 5000, denominated "Manufacturing

Cost Ledger Control"; the storage fees under Account No. 521620; the expense accounts of the factory under

Account No. 5200; and the so-called "Sugar Bodega Operations" under Account No. 5216, under which is a Sub-

Account No. 20, captioned, "Credits". (Pp. 16-17, t.s.n., Exhibit "F".) The collections from storage after the lapse of

the first 90 days period are entered in the company's books as debit to CASH, and credit to Expense Account No.

2516-20 (p. 18, t.s.n.).

The credit for storage charges decreased the deductible expense resulting in the corresponding increase of the

taxable income of the petitioner. This is reflected by the entries enclosed in parenthesis in Exhibit "G", under the

heading "Storage Charges". (P. 18, t.s.n.) The alleged reason for this accounting operation is that, inasmuch as the

"Sugar Bodega Operations" is considered as an expense account, entries under it are "debits". Similarly, since

"Storage Charges" constitute "credit", the corresponding figures (see Exhibit "C") are enclosed in parenthesis as they

decrease the expenses of maintaining the sugar warehouses.

Upon investigation conducted by the Bureau, it was found that during the years 1949 to 1957, the petitioner realized

from collected storage fees a total gross receipts of P212,853.00, on the basis of which the respondent determined

the petitioner's liability for fixed and percentage taxes, 25% surcharge, and administrative penalty in the aggregate

amount of P8,411.99 (Exhibit "5", p. 11, BIR rec.)

After due hearing the Court of Tax Appeals ordered the CIR to refund to respondent Hawaiian-Philippine Company

the amount of P8,411.99 representing fixed and percentage taxes assessed against it and which the latter had

deposited with the City Treasurer of Silay, Occidental Negros

ISSUE:

Whether or notpetitioner is a warehouseman liable for the payment of the fixed and percentage taxes prescribed in

Sections 182 and 191 of the National Internal Revenue Code

HELD:

YES.

Respondent disclaims liability under the provisions quoted above, alleging that it is not engaged the business of

storing its planters' sugar for profit; that the maintenance of its warehouses is merely incidental to its business of

manufacturing sugar and in compliance with its obligation to its planters. We find this to be without merit.

It is clear from the facts of the case that, after manufacturing the sugar of its planters, respondent stores it in its

warehouses and issues the corresponding "quedans" to the planters who own the sugar; that while the sugar is

stored free during the first ninety days from the date the it "quedans" are issued, the undisputed fact is that, upon the

expiration of said period, respondent charger, and collects storage fees; that for the period beginning 1949 to 1957,

respondent's total gross receipts from this particular enterprise amounted to P212,853.00.

A warehouseman has been defined as one who receives and stores goods of another for compensation (44 Words

and Phrases, p. 635). For one to be considered engaged in the warehousing business, therefore, it is sufficient that

he receives goods owned by another for storage, and collects fees in connection with the same. In fact, Section 2 of

the General Bonded Warehouse Act, as amended, defines a warehouseman as "a person engaged in the business

of receiving commodity for storage."

That respondent stores its planters' sugar free of charge for the first ninety days does not exempt it from liability

under the legal provisions under consideration. Were such fact sufficient for that purpose, the law imposing the tax

would be rendered ineffectual.

Gonzalez vs Go Tiong

Facts:

Go Tiong (respondent) owned a rice mill and warehouse, located in Pangasinan. Thereafter, he obtained a

license to engage in the business of a bonded warehouseman.

Subsequently, respondent Tiong executed a Guaranty Bond with the Luzon Surety Co to secure the

performance of his obligations as such bonded warehouseman, in the sum of P18,334, in case he was unable

to return the same.

Afterwards, respondent Tiong insured the warehouse and the palay deposited therein with the Alliance Surety

and Insurance Company.

But prior to the issuance of the license to Respondent, he had on several occasions received palay for deposit

from Plaintiff Gonzales, totaling 368 sacks, for which he issued receipts.

After he was licensed as a bonded warehouseman, Go Tiong again received various deliveries of palay from

Plaintiff, totaling 492 sacks, for which he issued the corresponding receipts, all the grand total of 860 sacks,

valued at P8,600 at the rate of P10 per sack.

Noteworthy is that the receipts issued by Go Tiong to the Plaintiff were ordinary receipts, not the "warehouse

receipts" defined by the Warehouse Receipts Act (Act No. 2137).

On or about March 15, 1953, Plaintiff demanded from Go Tiong the value of his deposits in the amount of

P8,600, but he was told to return after two days, which he did, but Go Tiong again told him to come back.

A few days later, the warehouse burned to the ground.

Before the fire, Go Tiong had been accepting deliveries of palay from other depositors and at the time of the fire,

there were 5,847 sacks of palay in the warehouse, in excess of the 5,000 sacks authorized under his license.

After the burning of the warehouse, the depositors of palay, including Plaintiff, filed their claims with the Bureau

of Commerce.

However, according to the decision of the trial court, nothing came from Plaintiff's efforts to have his claim paid.

Thereafter, Gonzales filed the present action against Go Tiong and the Luzon Surety for the sum of P8,600, the

value of his palay, with legal interest, damages in the sum of P5,000 and P1,500 as attorney's fees.

While the case was pending in court, Gonzales and Go Tiong entered into a contract of amicable settlement to

the effect that upon the settlement of all accounts due to him by Go Tiong, he, Gonzales, would have all actions

pending against Go Tiong dismissed.

Inasmuch as Go Tiong failed to settle the accounts, Gonzales prosecuted his court action

ISSUE:

Whether or not Plaintiffs claim is governed by the Bonded Warehouse Act due to Go Tiongs act of issuing to the

former ordinary receipts, not warehouse receipts?

RULING:

YES. SC ruled in favor Plaintiff.

Act No. 3893 provides that any deposit made with Respondent Tiong as a bonded warehouseman must

necessarily be governed by the provisions of Act No. 3893.

The kind or nature of the receipts issued by him for the deposits is not very material much less decisive since

said provisions are not mandatory and indispensable

Under Section 1 of the Warehouse Receipts Act, the issuance of a warehouse receipt in the form provided by it

is merely permissive and directory and not obligatory. . "Receipt", under this section, can be construed as any

receipt issued by a warehouseman for commodity delivered to him

As the trial court well observed, as far as Go Tiong was concerned, the fact that the receipts issued by him were

not "quedans" is no valid ground for defense because he was the principal obligor.

Furthermore, as found by the trial court, Go Tiong had repeatedly promised Plaintiff to issue to him "quedans"

and had assured him that he should not worry; and that Go Tiong was in the habit of issuing ordinary receipts

(not "quedans") to his depositors.

Furthermore, Section 7 of said law provides that as long as the depositor is injured by a breach of any obligation

of the warehouseman, which obligation is secured by a bond, said depositor may sue on said bond.

In other words, the surety cannot avoid liability from the mere failure of the warehouseman to issue the

prescribed receipt.

ROMAN V. ASIA BANKING CORPORATION

FACTS: U. de Poli, for value received, issued a quedan convering the 576 bultos of tobacco to the Asia Banking

Corporation (claimant & appellant). It was executed as a security for a loan. The aforesaid 576 butlos are part

and parcel of the 2, 766 bultos purchased by U. de Poli from Felisa Roman (claimant & appellee).

The quedan was marked as Exhibit D which is a warehouse receipt issued by the warehouse of U. de Poli for

576 bultos of tobacco. In the left margin of the face of the receipt, U. de Poli certifies that he is the sole owner of

the merchandise therein described. The receipt is endorsed in blank; it is not markednon-negotiable or not

negotiable.

Since a sale was consummated between Roman and U. de Poli, Romans claim is a vendors lien. The lower

court ruled in favor of Roman on the theory that since the transfer to Asia Banking Corp. (ASIA) was neither a

pledge nor a mortgage, but a security for a loan, the vendors lien of Roman should be accorded preference over

it.

However, if the warehouse receipt issued was non-negotiable, the vendors lien of Roman cannot prevail against

the rights of ASIA as indorsee of the receipt.

ISSUE: WON the quedan issued by U. de Poli in favor of ASIA. is negotiable, despite failure to mark it as not

negotiable?

HELD: YES. The warehouse receipt in question is negotiable. It recited that certain merchandise deposited in

the ware house por orden of the depositor instead of a la orden, there was no other direct statement showing

whether the goods received are to be delivered to the bearer, to a specified person, or to a specified order or his

order. However, the use of por orden was merely a clerical or grammatical error and that the receipt was

negotiable.

As provided by the Warehouse Receipts Act, in case the warehouse man fails to mark it as non-negotiable, a

holder of the receipt who purchase if for value supposing it to be negotiable may, at his option, treat such receipt

as imposing upon the warehouseman the same liabilities he would have incurred had the receipt been

negotiable. This appears to have given any warehouse receipt not marked non-negotiable practically the same

effect as a receipt which, by its terms, is negotiable provided the holder of such unmarked receipt acquired it for

value supposing it to be negotiable, circumstances which admittedly exist in the present case. Hence, the rights

of the indorsee, ASIA, are superior to the vendors lien.

CONSOLIDATED vs ARTEX

Facts: Consolidated Terminals Inc (CTI) operated a customs warehouse in Manila. It received 193 bales

of high density compressed raw cotton worth P99k. It was understood that CTI would keep the cotton on behalf of

Luzon Brokerage until the consignee Paramount Textile had opened the corresponding letter of credit in favor of

Adolph Hanslik Cotton. By virtue of forged permits, Artex was able to obtain the bales of cotton and paid P15k.

Issue: W/N CTI as warehouseman was entitled to the possession of the bales of cotton?

Ruling: No. CTI had no cause of action. It was not the owner of the cotton. It was not a real party of interest in the

case. CTI was not sued for damages by the real party in interest.

PNB v. Atendido

FACTS:

Laureano Atendido obtained from PNB a loan of P3k and pledged 2000 cavans of palay to guarantee

payment which were then deposited in the warehouse of Cheng Siong Lam & Co and to that effect the

borrower endorsed in favour of the bank the corresponding warehouse receipt.

Before the maturity of the loan, the 2000 cavans of palay disappeared for unknown reasons in the

warehouse. When the loan matured, the borrower failed to pay obligation

Defendant claimed that the warehouse receipt covering the palay which was given as security having been

endorsed in blank in favour of the bank and the palay having been lost or disappeared, he thereby became

relieved of liability.

ISSUE: Whether the surrender of the warehouse receipt covering 2000 cavans of palay given as security, endorsed

in blank, to PNB, has the effect of transferring their title or ownership OR it should be considered merely as a

guarantee to secure the payment of the obligation of Defendant?

HELD:

Nature of contract is Pledge supported by the stipulations embodied in the contract signed by Defendant

when he secured the loan from PNB.

The 2000 cavans of palay covered by the warehouse receipt were given to PNB only as a guarantee to

secure the fulfilment by Defendant in his obligation. This clearly appears in the contract wherein it is

expressly stated that said 2000 cavanes of palay were given as collateral security.

It follows that by the very nature of the transaction its ownership remains with the pledgor subject only to

foreclosure in case of non-fulfillment of the obligation.

By this we mean that if the obligation is not paid upon maturity the most that the pledge can do is to sell the

property and apply the proceeds to the payment of the obligation and to return the balance, if any, to the

pledgor. This is the essence of the contract, for, according to law, a pledge cannot become the owner of, nor

appropriate to himself the thing given in pledge.

If by the contract of pledge, the pledgor continues to be the owner of the thing pledged during the pendency

of the obligation, it stands to reason that in case of loss of the property, the loss should be borne by the

pledgor.

The fact that the warehouse receipt covering the palay was delivered, endorsed in blank, to the bank does

not alter the situation, the purpose of such endorsement being merely to transfer the juridical possession of

the property to the pledge and to forestall any possible disposition thereof on the part of the pledgor.

Where a warehouse receipt or quedan is transferred or endorsed to a creditor only to secure the

payment of a loan or debt, the transferee or endorsee does not automatically become the owner of

the goods covered by the warehouse receipt or quedan but he merely retains the right to keep and

with the consent of the owner to sell them so as to satisfy the obligation from the proceeds of the

sale. This is for the simple reason that the transaction involved is not a sale but only a mortgage or pledge,

and that if the property covered by the quedans or warehouse receipts is lost without fault or negligence of

the mortgagee or pledge or the transferee or endorsee of the warehouse receipt or quedan, then said goods

are to be regarded as lost on account of the real owner, mortgagor or pledgor.

Siy Cong Bien vs HSBC

FACTS

Plaintiff is a corporation engaged in business generally, and that the Defendant HSBC is a foreign bank

authorized to engage in the banking business in the Philippines.

On June 25, 1926, Otto Ranft called the office of the Plaintiff to purchase hemp (abaca), and he was offered the

bales of hemp as described in the contested negotiable quedans.

The parties agreed to the aforesaid price, and on the same date the quedans, together with the covering invoice,

were sent to Ranft by the Plaintiff, without having been paid for the hemp, but the Plaintiff's understanding was

o that the payment would be made against the same quedans,

o and it appear that in previous transaction of the same kind between the bank and the Plaintiff, quedans

were paid one or two days after their delivery to them.

Immediately these Quedans were pledged by Otto Ranft to the Defendant HSBC to secure the payment of his

preexisting debts to the latter.

The baled hemp covered by these warehouse receipts was worth P31,635; 6 receipts were endorsed in blank by

the Plaintiff and Otto Ranft, and 2 were endorsed in blank, by Otto Ranft alone

On the evening of the said delivery date, Otto Ranft died suddenly at his house in the City of Manila.

When the Plaintiff found out, it immediately demanded the return of the quedans, or the payment of the value,

but was told that the quedans had been sent to the herein Defendant as soon as they were received by Ranft.

Shortly thereafter the Plaintiff filed a claim for the aforesaid sum of P31,645 in the intestate proceedings of the

estate of the deceased Otto Ranft, which on an appeal from the decision of the committee on claims, was

allowed by the CFI Manila.

In the meantime, demand had been made by the Plaintiff on the Defendant bank for the return of the quedans, or

their value, which demand was refused by the bank on the ground that it was a holder of the quedans in due

course.

ISSUE

Whether or not the Quedans endorsed in blank gave the HSBC rightful and valid title to the goods?

HELD

YES. SC ruled in favour of Defendant HSBC.

It may be noted,

o first, that the quedans in question were negotiable in form;

o second, that they were pledged by Otto Ranft to the Defendant bank to secure the payment of his

preexisting debts to said bank;

o third, that such of the quedans as were issued in the name of the Plaintiff were duly endorsed in blank

by the Plaintiff and by Otto Ranft;

o and fourth, that the two remaining quedans which were duly endorsed in blank by him.

The bank had a perfect right to act as it did, and its action is in accordance with sections 47, 38, and 40 of the

Warehouse Receipts Act

However, the pertinent provision regarding the rights the Defendant bank acquired over the aforesaid quedans

after indorsement and delivery to it by Ranft, is found in section 41 of the Warehouse Receipts Act (Act No.

2137):

o SEC. 41. Rights of person to whom a receipt has been negotiated. A person to whom a negotiable

receipt has been duly negotiated acquires thereby:

(a) Such title to the goods as the person negotiating the receipt to him had or had ability to convey to a

purchaser in good faith for value, and also such title to the goods as the depositor of person to

whose order the goods were to be delivered by the terms of the receipt had or had ability to convey

to a purchaser in good faith for value, and. . . .

Therefore, the bank is not responsible for the loss; the negotiable quedans were duly negotiated to the bank and

as far as the record shows, there has been no fraud on the part of the Defendant.

Moreover, Plaintiff is estopped to deny that the bank had a valid title to the quedans for the reason that the

Plaintiff had voluntarily clothed Ranft with all the attributes of ownership and upon which the Defendant bank

relied. Subsequently, Plaintiff in this case has suffered the loss of the quedans, but as far as the court sees it,

there is now no remedy available to the Plaintiff equitable estoppel place the loss upon him whose misplaced

confidence has made the wrong possible as ruled in National Safe Deposit vs. Hibbs (a US case)

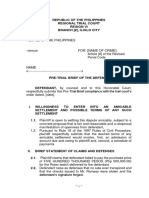

Lopez v Del Rosario

Facts:

> Benita Del Rosario is the owner of a bonded warehouse in Manila where copra and other merchandise are

deposited.

> Among those who had copra deposited in the warehouse was Froilan Lopez, the owner of 14 warehouse receipts

with a declared value of P107,990.40 in his name.

> Del Rosario secured insurance on the warehouse and its contents with 5 different insurance companies in the

amount of P404,800.

> All policies were in the name of Del Rosario, except for one (with Natl Insurance Co.) for 40T, in favor of

Compania Copra de Tayabas.

> The warehouse and its contents were destroyed by fire. When Bayne, a fire loss adjuster, failed to effect a

settlement between the Insurance companies and Del Rosario, the latter authorized Atty. Fisher to negotiate with the

Companies.

> An agreement was reached to submit the matter to arbitration. The claims by different people who had stored

copra in the warehouse were settled with the exception of Friolan Lopez.

> A case was filed in CFI by Lopez. The court awarded him the sum of P88,492.21 with legal interest.

Issue:

Whether or not Del Rosario acted as the agent of Lopez in taking out the insurance on the contents of the warehouse

or whether she acted as the reinsurer of the copra.

Held:

She acted as the agent of Lopez.

The agency can be deduced from the warehouse receipts, the insurance policies and the circumstances surrounding

the transaction. Under any aspect, Del Rosario is liable. The law is that a policy effected by a bailee and covering by

its terms in his own property and property held in trust, inures, in the event of loss, equally and proportionately to the

benefit of all owners of the property insured. Even if one secured insurance covering his own goods and goods

stored with him, and even if the owner of the stored goods did not request or know the insurance, and did not ratify it

before the payment of the loss, it has been held by a reputable court that the warehouseman is liable to the owner of

such stored goods for his share.

In a case of contributing policies, adjustments of loss made by an expert or by a board of arbitrators may be

submitted to the court NOT as evidence of the facts stated therein, or as obligatory, but for the purpose of assisting

the court in calculating the amount of liability.

Você também pode gostar

- Warehouse CasesDocumento9 páginasWarehouse CasesNica09_foreverAinda não há avaliações

- Due Process Rights Upheld in Deportation CaseDocumento2 páginasDue Process Rights Upheld in Deportation CaseJannm Elise BarreyroAinda não há avaliações

- Sales ReviewerDocumento16 páginasSales ReviewerOnat PAinda não há avaliações

- Philippine Revised Penal Code Book 2 Midterm ReviewerDocumento20 páginasPhilippine Revised Penal Code Book 2 Midterm ReviewerArnold ArizaAinda não há avaliações

- Choice of Law - A SummaryDocumento3 páginasChoice of Law - A SummaryRichardAinda não há avaliações

- 2 D (XV) Paulino vs. The Capital InsuranceDocumento1 página2 D (XV) Paulino vs. The Capital InsuranceJunmer OrtizAinda não há avaliações

- Land Titles and Deeds GuideDocumento3 páginasLand Titles and Deeds GuideReah CrezzAinda não há avaliações

- 8 Rolando de La Paz Vs L&JDocumento2 páginas8 Rolando de La Paz Vs L&JNaomi InotAinda não há avaliações

- Banking Laws Villanueva OCRDocumento20 páginasBanking Laws Villanueva OCRJohn Rey Bantay RodriguezAinda não há avaliações

- Legal Ethics - CompreDocumento13 páginasLegal Ethics - CompreFlynn AguilarAinda não há avaliações

- Severino vs Severino Guarantor Consideration Lawsuit DismissalDocumento1 páginaSeverino vs Severino Guarantor Consideration Lawsuit DismissalChristian Paul ChungtuycoAinda não há avaliações

- 22 People vs. Ong, 204 SCRA vs. 942 PDFDocumento2 páginas22 People vs. Ong, 204 SCRA vs. 942 PDFSilver Anthony Juarez PatocAinda não há avaliações

- 5th BatchDocumento48 páginas5th BatchEmmanuel Enrico de VeraAinda não há avaliações

- Sectrans Notes For Finals PDFDocumento137 páginasSectrans Notes For Finals PDFjeffdelacruzAinda não há avaliações

- Santos vs. Santos 366 SCRA 395, October 02, 2001Documento14 páginasSantos vs. Santos 366 SCRA 395, October 02, 2001Justin Jomel ConsultaAinda não há avaliações

- The Law On Alternative Dispute Resolution: Private Justice in The PhilippinesDocumento4 páginasThe Law On Alternative Dispute Resolution: Private Justice in The PhilippinesNicco AcaylarAinda não há avaliações

- A.M. No. 11-1-6-SC Jan 11, 2011Documento22 páginasA.M. No. 11-1-6-SC Jan 11, 2011vivivioletteAinda não há avaliações

- Credit Transaction Cases - 2020Documento12 páginasCredit Transaction Cases - 2020SamKris Guerrero MalasagaAinda não há avaliações

- Presumption of InnocenceDocumento3 páginasPresumption of InnocenceGenevieve PenetranteAinda não há avaliações

- Liam Law vs. Olympic Sawmill Co., 124 SCRA 439Documento15 páginasLiam Law vs. Olympic Sawmill Co., 124 SCRA 439Jay-r Mercado ValenciaAinda não há avaliações

- Credits Bar-QDocumento34 páginasCredits Bar-QJovy Balangue MacadaegAinda não há avaliações

- SPL Final ExamDocumento7 páginasSPL Final ExamSam ReyesAinda não há avaliações

- ADR MidtermDocumento8 páginasADR MidtermDewm DewmAinda não há avaliações

- Villanueva v. IpondoDocumento1 páginaVillanueva v. IpondoMigz Dimayacyac100% (2)

- Civil Pro ReviewDocumento23 páginasCivil Pro ReviewjamesAinda não há avaliações

- 48 PAGES AC Enterprises, Inc. vs. Frabelle Properties CorporationDocumento48 páginas48 PAGES AC Enterprises, Inc. vs. Frabelle Properties CorporationRustom IbañezAinda não há avaliações

- Pale ExamDocumento4 páginasPale ExamPatrick Tan100% (1)

- 03 PNB Vs SorianoDocumento2 páginas03 PNB Vs SorianoKelsey Olivar MendozaAinda não há avaliações

- Sabitsana v. MuarteguiDocumento2 páginasSabitsana v. MuarteguiChristian RoqueAinda não há avaliações

- Perfection of Insurance Bar QuestionDocumento1 páginaPerfection of Insurance Bar Questionjingmit888Ainda não há avaliações

- List of Cases in Credit TransactionsDocumento2 páginasList of Cases in Credit TransactionsGrace Managuelod GabuyoAinda não há avaliações

- Special Penal Laws Reviewer 2Documento17 páginasSpecial Penal Laws Reviewer 2Aya BeltranAinda não há avaliações

- Law111 Oblicon - 2010 Bar QandADocumento3 páginasLaw111 Oblicon - 2010 Bar QandACassieAinda não há avaliações

- Lexrex Land Registration Case Digest 1979-2002Documento62 páginasLexrex Land Registration Case Digest 1979-2002Alessandra Mae SalvacionAinda não há avaliações

- SAMAYLA, Luriza Legal Forms Week4-5Documento11 páginasSAMAYLA, Luriza Legal Forms Week4-5Luriza SamaylaAinda não há avaliações

- Notes in Insurance - BemJamison PDFDocumento9 páginasNotes in Insurance - BemJamison PDFBeverlyn JamisonAinda não há avaliações

- Case Digests For WillsDocumento12 páginasCase Digests For WillsThea BarteAinda não há avaliações

- SPECPRODocumento92 páginasSPECPROapril75Ainda não há avaliações

- Credit TransactionsailaaaaaaaDocumento7 páginasCredit TransactionsailaaaaaaaBer Sib JosAinda não há avaliações

- Transportation Corporation v. Board of TransportationDocumento17 páginasTransportation Corporation v. Board of TransportationKIM COLLEEN MIRABUENAAinda não há avaliações

- Common Carriers Civil CodeDocumento6 páginasCommon Carriers Civil Codeizzy_bañaderaAinda não há avaliações

- Philippines Supreme Court rules on mortgage foreclosure caseDocumento14 páginasPhilippines Supreme Court rules on mortgage foreclosure caseEra Lim- Delos ReyesAinda não há avaliações

- Albano Top 400 Civil Law ProvisionsDocumento59 páginasAlbano Top 400 Civil Law ProvisionsKathrine TingAinda não há avaliações

- Credit Trans Finals QuestionsDocumento2 páginasCredit Trans Finals QuestionsEdcarl CagandahanAinda não há avaliações

- Exam Bus OrgDocumento2 páginasExam Bus OrgcrissilleAinda não há avaliações

- Sales CasesDocumento10 páginasSales CasesGee EsoyAinda não há avaliações

- 2012Documento54 páginas2012slumbaAinda não há avaliações

- In Re Petition For Exemption From Coverage by The SSS Roman Catholic Bishop of Manila vs. SSCDocumento2 páginasIn Re Petition For Exemption From Coverage by The SSS Roman Catholic Bishop of Manila vs. SSCJMarcAinda não há avaliações

- Portugal V IACDocumento1 páginaPortugal V IACJoshua PielagoAinda não há avaliações

- Trust Receipt Case DigestDocumento5 páginasTrust Receipt Case DigestIman MarionAinda não há avaliações

- Banking DigestsDocumento9 páginasBanking DigestsMiguel ManzanoAinda não há avaliações

- BPI V HerridgeDocumento3 páginasBPI V HerridgeMonaliza LiztsAinda não há avaliações

- Law On Credit Transactions 4 Year Review Class St. Thomas More School of LawDocumento181 páginasLaw On Credit Transactions 4 Year Review Class St. Thomas More School of LawAlexis EnriquezAinda não há avaliações

- G.R. No. L-14921 December 31, 1960 DOLORES B. GUICO, ET AL., Plaintiffs-Appellants, PABLO G. BAUTISTA, ET. AL., Defendants-AppelleesDocumento2 páginasG.R. No. L-14921 December 31, 1960 DOLORES B. GUICO, ET AL., Plaintiffs-Appellants, PABLO G. BAUTISTA, ET. AL., Defendants-AppelleesAnonymous YPrTXgAinda não há avaliações

- Case DigestDocumento3 páginasCase DigestmichaelargabiosoAinda não há avaliações

- 060-Vicente vs. Geraldez 52 Scra 210Documento9 páginas060-Vicente vs. Geraldez 52 Scra 210wewAinda não há avaliações

- 3rd Assignment DigestsDocumento6 páginas3rd Assignment DigestsKat PichayAinda não há avaliações

- Case Law On Warehouse Receipts LawDocumento9 páginasCase Law On Warehouse Receipts LawynnaAinda não há avaliações

- Court Rules Hawaiian-Philippine Company Liable for Storage Fees TaxesDocumento2 páginasCourt Rules Hawaiian-Philippine Company Liable for Storage Fees TaxesWonder WomanAinda não há avaliações

- Office of The Solicitor General For Petitioner. Hilado and Hilado For RespondentDocumento11 páginasOffice of The Solicitor General For Petitioner. Hilado and Hilado For RespondentellaAinda não há avaliações

- Pauline 1. Application FormDocumento3 páginasPauline 1. Application FormMaria Reylan GarciaAinda não há avaliações

- Testimonial of Good Moral CharacterDocumento1 páginaTestimonial of Good Moral CharacterZendy PastoralAinda não há avaliações

- Territorial Jurisdiction of Courts in IloiloDocumento1 páginaTerritorial Jurisdiction of Courts in IloiloMaria Reylan Garcia100% (1)

- Certified True Copy CertificateDocumento1 páginaCertified True Copy CertificateMaria Reylan GarciaAinda não há avaliações

- Certified True Copy TextDocumento1 páginaCertified True Copy TextMaria Reylan GarciaAinda não há avaliações

- Voluntary Surrender Loose FirearmDocumento4 páginasVoluntary Surrender Loose FirearmMaria Reylan GarciaAinda não há avaliações

- Pauline 1. Application FormDocumento3 páginasPauline 1. Application FormMaria Reylan GarciaAinda não há avaliações

- SPA PRCDocumento2 páginasSPA PRCMaria Reylan Garcia100% (1)

- Singapore 2016 Date/Time Destination How To Get There: China TownDocumento4 páginasSingapore 2016 Date/Time Destination How To Get There: China TownMaria Reylan GarciaAinda não há avaliações

- Jurisprudence - Child AbuseDocumento6 páginasJurisprudence - Child AbuseMaria Reylan GarciaAinda não há avaliações

- Revised Rules On Summary ProcedureDocumento7 páginasRevised Rules On Summary Procedurejimart10Ainda não há avaliações

- LTO Med - Cert PDFDocumento1 páginaLTO Med - Cert PDFPaul BalbinAinda não há avaliações

- 2004 Rules on Notarial Practice ApprovedDocumento20 páginas2004 Rules on Notarial Practice ApprovedirditchAinda não há avaliações

- Certified True Copy TextDocumento1 páginaCertified True Copy TextMaria Reylan Garcia100% (1)

- Rule 11 evidence in photos and videosDocumento1 páginaRule 11 evidence in photos and videosMaria Reylan GarciaAinda não há avaliações

- Revised Rules For The Issuance of Co CsDocumento25 páginasRevised Rules For The Issuance of Co CsMaria Reylan GarciaAinda não há avaliações

- Counter AffidavitDocumento8 páginasCounter AffidavitMaria Reylan GarciaAinda não há avaliações

- Practicability SpeechDocumento3 páginasPracticability SpeechMaria Reylan GarciaAinda não há avaliações

- Resolved That The Military Be Allowed To Use Propaganda in School - AFFIRMATIVEDocumento3 páginasResolved That The Military Be Allowed To Use Propaganda in School - AFFIRMATIVEMaria Reylan GarciaAinda não há avaliações

- Practicability SpeechDocumento3 páginasPracticability SpeechMaria Reylan GarciaAinda não há avaliações

- Wicked TripDocumento1 páginaWicked TripMaria Reylan GarciaAinda não há avaliações

- Legal forms for People vs Rufina Caliwan caseDocumento1 páginaLegal forms for People vs Rufina Caliwan caseMaria Reylan GarciaAinda não há avaliações

- Fast Craft Rates and SchedDocumento1 páginaFast Craft Rates and SchedMaria Reylan GarciaAinda não há avaliações

- 2004 Rules on Notarial Practice ApprovedDocumento20 páginas2004 Rules on Notarial Practice ApprovedirditchAinda não há avaliações

- PRESIDENTIAL DECREE No. 1606Documento3 páginasPRESIDENTIAL DECREE No. 1606Maria Reylan GarciaAinda não há avaliações

- Republic Act No. 8369 Family CourtsDocumento6 páginasRepublic Act No. 8369 Family CourtsNylinad Etnerfacir ObmilAinda não há avaliações

- Property List of CasesDocumento10 páginasProperty List of CasesMaria Reylan GarciaAinda não há avaliações

- Japan Trip June 2017 - Tokyo, Mt Fuji, Kyoto & Osaka SightsDocumento2 páginasJapan Trip June 2017 - Tokyo, Mt Fuji, Kyoto & Osaka SightsMaria Reylan GarciaAinda não há avaliações

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocumento11 páginasBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledMaria Reylan GarciaAinda não há avaliações

- Pretrial BriefDocumento3 páginasPretrial BriefMaria Reylan GarciaAinda não há avaliações

- The Effect of Dodd-Frank On Divorcing Citizens 1Documento5 páginasThe Effect of Dodd-Frank On Divorcing Citizens 1Noel CookmanAinda não há avaliações

- Easa Ad Us-2017-09-04 1Documento7 páginasEasa Ad Us-2017-09-04 1Jose Miguel Atehortua ArenasAinda não há avaliações

- Scharlau Chemie: Material Safety Data Sheet - MsdsDocumento4 páginasScharlau Chemie: Material Safety Data Sheet - MsdsTapioriusAinda não há avaliações

- Timely characters and creatorsDocumento4 páginasTimely characters and creatorsnschober3Ainda não há avaliações

- Obiafatimajane Chapter 3 Lesson 7Documento17 páginasObiafatimajane Chapter 3 Lesson 7Ayela Kim PiliAinda não há avaliações

- Amul ReportDocumento48 páginasAmul ReportUjwal JaiswalAinda não há avaliações

- Ijimekko To Nakimushi-Kun (The Bully and The Crybaby) MangaDocumento1 páginaIjimekko To Nakimushi-Kun (The Bully and The Crybaby) MangaNguyễn Thị Mai Khanh - MĐC - 11A22Ainda não há avaliações

- Rhodes Motion For Judicial NoticeDocumento493 páginasRhodes Motion For Judicial Noticewolf woodAinda não há avaliações

- Abinisio GDE HelpDocumento221 páginasAbinisio GDE HelpvenkatesanmuraliAinda não há avaliações

- Condy LatorDocumento11 páginasCondy LatorrekabiAinda não há avaliações

- Um 0ah0a 006 EngDocumento1 páginaUm 0ah0a 006 EngGaudencio LingamenAinda não há avaliações

- Biomotor Development For Speed-Power Athletes: Mike Young, PHD Whitecaps FC - Vancouver, BC Athletic Lab - Cary, NCDocumento125 páginasBiomotor Development For Speed-Power Athletes: Mike Young, PHD Whitecaps FC - Vancouver, BC Athletic Lab - Cary, NCAlpesh Jadhav100% (1)

- Amar Sonar BanglaDocumento4 páginasAmar Sonar BanglaAliAinda não há avaliações

- Conceptual FrameworkDocumento24 páginasConceptual Frameworkmarons inigoAinda não há avaliações

- EASA TCDS E.007 (IM) General Electric CF6 80E1 Series Engines 02 25102011Documento9 páginasEASA TCDS E.007 (IM) General Electric CF6 80E1 Series Engines 02 25102011Graham WaterfieldAinda não há avaliações

- Waves and Thermodynamics, PDFDocumento464 páginasWaves and Thermodynamics, PDFamitAinda não há avaliações

- Vidura College Marketing AnalysisDocumento24 páginasVidura College Marketing Analysiskingcoconut kingcoconutAinda não há avaliações

- Impolitic Art Sparks Debate Over Societal ValuesDocumento10 páginasImpolitic Art Sparks Debate Over Societal ValuesCarine KmrAinda não há avaliações

- Liber Chao (Final - Eng)Documento27 páginasLiber Chao (Final - Eng)solgrae8409100% (2)

- The Sound Collector - The Prepared Piano of John CageDocumento12 páginasThe Sound Collector - The Prepared Piano of John CageLuigie VazquezAinda não há avaliações

- How To Check PC Full Specs Windows 10 in 5 Ways (Minitool News)Documento19 páginasHow To Check PC Full Specs Windows 10 in 5 Ways (Minitool News)hiwot kebedeAinda não há avaliações

- TLE8 Q4 Week 8 As Food ProcessingDocumento4 páginasTLE8 Q4 Week 8 As Food ProcessingROSELLE CASELAAinda não há avaliações

- SD-SCD-QF75 - Factory Audit Checklist - Rev.1 - 16 Sept.2019Documento6 páginasSD-SCD-QF75 - Factory Audit Checklist - Rev.1 - 16 Sept.2019Lawrence PeAinda não há avaliações

- Doe v. Myspace, Inc. Et Al - Document No. 37Documento2 páginasDoe v. Myspace, Inc. Et Al - Document No. 37Justia.comAinda não há avaliações

- Corn MillingDocumento4 páginasCorn Millingonetwoone s50% (1)

- Single-Phase Induction Generators PDFDocumento11 páginasSingle-Phase Induction Generators PDFalokinxx100% (1)

- Weekly Choice - Section B - February 16, 2012Documento10 páginasWeekly Choice - Section B - February 16, 2012Baragrey DaveAinda não há avaliações

- Insize Catalogue 2183,2392Documento1 páginaInsize Catalogue 2183,2392calidadcdokepAinda não há avaliações

- Health Education and Health PromotionDocumento4 páginasHealth Education and Health PromotionRamela Mae SalvatierraAinda não há avaliações

- Living Nonliving DeadDocumento11 páginasLiving Nonliving DeadArun AcharyaAinda não há avaliações