Escolar Documentos

Profissional Documentos

Cultura Documentos

Jaiib Ques

Enviado por

Muralidhar Goli0 notas0% acharam este documento útil (0 voto)

136 visualizações30 páginasThe document contains a list of questions related to banking, finance and accounting concepts. Some of the key topics covered include:

1) The Reserve Bank of India as the primary regulator of banking business.

2) Regulations around acceptance of deposits by non-banking financial companies.

3) Key definitions such as "customer" and "demand draft".

4) Accounting concepts such as depreciation, profit and loss, partnership accounts.

5) Banking processes like loans, deposits and types of ledgers maintained.

So in summary, the document tests knowledge of Indian banking laws and regulations, financial and accounting concepts, and banking operations and accounts.

Descrição original:

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe document contains a list of questions related to banking, finance and accounting concepts. Some of the key topics covered include:

1) The Reserve Bank of India as the primary regulator of banking business.

2) Regulations around acceptance of deposits by non-banking financial companies.

3) Key definitions such as "customer" and "demand draft".

4) Accounting concepts such as depreciation, profit and loss, partnership accounts.

5) Banking processes like loans, deposits and types of ledgers maintained.

So in summary, the document tests knowledge of Indian banking laws and regulations, financial and accounting concepts, and banking operations and accounts.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

136 visualizações30 páginasJaiib Ques

Enviado por

Muralidhar GoliThe document contains a list of questions related to banking, finance and accounting concepts. Some of the key topics covered include:

1) The Reserve Bank of India as the primary regulator of banking business.

2) Regulations around acceptance of deposits by non-banking financial companies.

3) Key definitions such as "customer" and "demand draft".

4) Accounting concepts such as depreciation, profit and loss, partnership accounts.

5) Banking processes like loans, deposits and types of ledgers maintained.

So in summary, the document tests knowledge of Indian banking laws and regulations, financial and accounting concepts, and banking operations and accounts.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 30

Model Paper-I [LRAB]

1) ....... is the primary regulator of banking business:

2) Banks can refuse to permit opening an a/c of:

3) Acceptance of deposits by non-banking financial companies is regulated

by RBI under:

4) A Non-banking financial company wanting to collect public deposits is

governed by act.

5) The term 'Customer' is defined under:

6) Companies whose principle business is not finance or lending are

permitted to accept deposits under Sec. 45(s) of RBI Act only from:

7) Every banking company is required to use the word 'Bank' in its name

and no company other a banking company can use the words 'bank, banker

or banking' as a part of its name as per:

8) Under the general provision of loss reserves maximum of......... % of total

risk weighted assets qualify for ........... capital:

9) Section 10 (A) of the B.R. Act stipulates ......... of Banking: Company:

10) What is the maximum tenure for a part time director of a banking

company including extension?

11) The whole time CMD of the bank shall hold office for a period not

exceeding:

12) Garnishee order will not attach ......... of CC limit:

13) The relation between a banker and a customer in the case of safe

deposit lockers is that of a Lessor and a lessee. The right of lien therefore

........ :

14) The right of Set-off can be exercised only when the relationship between

the banker and the customer is that of:

15) A Banker can exercise the right of Set-off only in respect of:

16) Right of Set-off cannot be exercised by the Bank in respect of .........

debt:

17) In an overdraft account, when the notice of death of the partner is

received, the bank should stop the operations to avoid application of .........

:

18) Act acts deals with the right of Appropriation:

19) Your branch has sanctioned a Demand Loan against FDR. When can the

right of Set-off be exercised?

20) Any payment made by a debtor in the first instance is to be applied

towards satisfaction of ........ :

21) ........ is the Garnishee in & Garnishee Order:

22) Garnishee Order" is issued under:

23) Garnishee Order attaches:

24) Bank should stop operations in the judgment debtor's a/c upto amount

mentioned and allow the operations for balance amount if a .......... is

served:

25) The Garnishee order will be applicable only when the banker and

customer would be having following relationship:

26) SLR can be maintained in..........

27) The definition of ........ is given under Section 85-A of the N.I. Act:

28) For availing remedy under Section 138,-holder will have to give notice to

the drawer:

29) How many times a negotiable instrument can be negotiated:

30) .......... is not bound on a negotiable instrument as drawer, acceptor or

endorser:

31) Cheque is a ........ :

32) A bill drawn in Paris in favour of a trader in Mumbai and payable in

Chennai is:

33) Under COPRA, there is a ......... approach to Redressal:

34) A person who is, or who has been, or is qualified to be .......... can be

its President in District forum:

35) The Right to Information Act came to force on .........

36) What does "Right to Information" mean?

37) A cheque drawn in two languages/ handwriting is presented to the

drawee bank. Is the cheque in order........

38) ......... also includes bodies constituted by notification issued or orders

made by the appropriate Government, body owned, controlled or.

substantially financed by Govt, and NGO substantially financed directly or

indirectly by the appropriate Government:

39) What is the time limit to get the information I rejection from PIO in case

no third party information is involved?

40) Bailee has the right of ........ in a bailment contract:

41) Safe custody is a contract of bailment, here the banker's general lien

.........

42) Bailment can be Gratuitous or Non-gratuitous bailment. A Nongratuities

bailment is one where there is ........ :

43) A person who comes by an article is not obliged to pick it up. But if he

does so, he becomes a .......... :

44) Delivery of bailed goods to the Bailee may be actual or ......... :

45) In the case of a pledge, the Pawnee does not have the right ....... the

pawned goods:

46) In a pledge delivery may be:

47) When a key cash credit is extended to a customer, the delivery is:

48) When a bank lends against pledge of goods to a Limited Company, the

charge on the goods need not be registered as the goods are in......... and

the bank has the right to sell in case of default:

49) The relationship between agent & the principal can be created by:

50) Who can employ an agent?

Answers:

1) Reserve Bank of India

2) Undesirable persons

3) Non-banking Financial Companies Acceptance of Public Deposits (Reserve

Bank) Directions, 1998.

4) Companies Act 1956

5) KYC guidelines

6) Relatives in the form of loans

7) Section 7 of Banking Regulation Act

8) 1.25, Tier II

9) Qualifications for the direct

10) 8 years

11) 5 years

12) Undrawn portion

13) Does not apply

14) Debtor and creditor

15) Debts due and determined

16) Contingent debt

17) Clayton's Rule

18) indian Contract Act

19) On maturity

20) lnterestdue

21) Bank

22) Rule 46 of Order XXI of the Schedule to the code of Civil procedure

1908.

23) Credit balances available at the time of serving the order to bank.

24) Order Nisi

25) Debtor-creditor

26) Cash, Gold and Approved securities

27) Demand draft

28) Within 30 days of return of cheque.

29) No limit within validity

30) A lunatic, an alien enemy, an insolvent and a Minor

31) Bill of Exchange

32) A foreign bill

33) Three tier

34) A District Judge

35) 12th October, 2005 (120th day of its enactment).

36) Right to inspect works, documents, records to take notes, extracts or

certified copies of documents or record and to take certified samples of

material.

37) It can be paid, if otherwise in order

38) Public Authorities

39) Within 30 days of the receipt of the request.

40) Lien

41) Doesxjot apply

42) Consideration

43) Bailee

44) Constructive

45) Use the pawned g

46) Actual or Constructive

47) Actual

48) Actual possession

49) Express agreement or Implied Contract

50) A person who is a major and is of sound mind

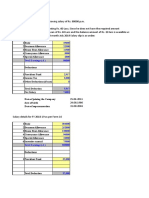

Model Paper-I [AFB]

01) If depreciation is not charged, Profit & loss a/c will show:

a) More profits

b) Less profits

c) Nominal profits

d) Original profits

02) A public company having a share capital:

a) Must issue a prospectus

b) Cannot file a statement in lieu of prospectus

c) May file a statement in lieu of prospectus

d) Doesn't need prospectus

03) Share premium is used for:

a) To issue fully paid bonus shares

b) To write off preliminary expenses

c) To issue shares at discount

d) Both a & b

04) In which method amount of depreciation decreases every

year:

a) Straight line method

b) Written down value method ,

c) Annuity method

d) Sinking fund method

05) Shares can be issued at discount within..........month of

sanction of Company Law Board:

a) 1 b) 2 c) 4 d) 5

06) Discount on issue of share is a a/c:

a) Real

b) Nominal

c) Personal

d) Loss

07) If Dissolution expenses are paid by any partner, then they

are transferred to:

a) His capital a/c

b) Cash a/c

c) Bank a/c

d) None of these

08) Trading account is a:

a) Personal a/c

b) Real a/c

c) Nominal a/c

d) None

09) At the time of death of a partner, his total share is given to:

a) His loan a/c

b) His executor a/c

c) His capital a/c

d) His current a/c

10) Liabilities in a company are of Rs. 80,000 and owner's

equity is Rs. 70,000. What is the amount of total equity?

a) Rs. 80,000

c) Rs. 10,000

b) Rs. 70,000

d) Rs. 1,50,000

Answers:

1-a, 2-c, 3-d, 4-b, 5-b, 6-b, 7-a, 8-c, 9-b, 10-d

11) Goodwill on two years purchase of the average profit of

last three years profits of 20,000,10,000,15,000 is:

a) Rs 50,000

b) Rs. 30,000

c) Rs. 45,000

d) Rs. 40,000

12) The minimum subscription is to be received in:

a) 45 days

b) 120 days

c) 130 days

d) 50 days

13) R, N, S share profits in 5:3:2. If N retire then new ratio of R

and S is 2:3. Gaining ratio is ......... :

a) 1:1

b) 1:4

c) 0:4

d) 4:0

14) Bills receivable endorsed are debited to:

a) B/R a/c

b) Debtors a/c

c) Creditors a/c

d) Drawer a/c

15) Sacrificing ratio is calculated at the time of:

a) Admission

b) Retirement

c) Death

d) None

16) On the admission of a partner, decrease in the value of

machinery is debited to:

a) Revaluation a/c

b) Machinery a/c

c) Old partner's capital a/c

d) Depreciation a/c

17) A firm earning losses and is in dissolution process, have:

a) Nominal goodwill

b) Full value of goodwill

c) Goodwill equal to share of partners

d) No goodwill

18) When all partner's are insolvent, the loss is then borne by:

a) Government

b) Creditors

c) Partners

d) Firm collectively

19) Short term loans are due for payment within:

a) 6 month

b) 1 year

c) 2 year

d) 30 days

20) Dividends are usually paid on:

a) Called-up-capital

b) Subscribed-capital

c) Paid-up-capital.

d) Issued capital

Answers:

11-b, 12-b, 13-c, 14-c, 15-a, 16-a, 17-d, 18-b, 19-b, 20-c

21) Profit on re-issue of forfeited shares is transferred to:

a) Profit and loss a/c

b) Capital Reserve a/c

c) Share capital a/c

d) General reserve a/c

22) Book of accounts of a bank includes:

a) Current a/c ledger

b) Investment ledger

c) Loan ledger

d) Bill discounted ledger

e) All of above

23) The purpose of depreciation is to:

a) Reduce fixed assets

b) Save income tax

c) Reduce fixed assets to nil

d) Allocate the cost

24) Accounts in banks are closed on ......... every year.

a) 31 Dec. b) 31 Mar. c) 30 June d) 31 July

25) Partnership is a form of business organisation in which

business debts can be recovered from:

a) The partners

b) All the managers

c) The firm

d) The firm and all the partners

26) Which of following is contingent liability?

a) Claim against company not acknowledged as debt

b) Unpaid liability of shares

c) Arrear of fixed cumulative dividend

d) Contracts remaining to be executed

e) All above

27) Purchase a/c always have a:

a) Debit balance

b) Credit balance

c) Either debit or credit balance

d) None

28) Error of principle are committed due to:

a) Incomplete knowledge of capital & revenue expenditure

b) Incomplete recording of amount

c) Incorrect balancing of ledger a/c's

d) Wrong posting in ledger

29) Insurance unexpired is a:

a) Personal a/c

b) Real a/c

c) Nominal a/c

d) Both a & b

30) Depletion is used in relation to:

a) Plant and Machinery

b) Good-will

c) Stock in trade

d) Mines

Answers:

21-b, 22-e, 23-d, 24-a, 25-d, 26-e, 27-a, 28-a, 29-a, 30-d

31) Opening Stock includes:

a) Stock of raw material

b) Work in progress stock

c) Finished goods

d) All above

32) A and B are partners in the ratio of 7:3. C is admitted for

2/7th share of profits. What is the new ratio?

a) 7:2:2 b) 7:3:2 c) 7.4.5 d) 7 3,4

33) Direct expenses form a part of .........

a) Selling & distribution expenses

b) Goods manufactured

c) Administrative expenses on sales

d) Goods purchased and manufactured

34) M and N are partners in the ratio of 3:2. Q is admitted and

the new ratio is 4:3:2. What is the sacrificing ratio?

a) 3:2 b) 4:3 c) 7:3 d) 4:5

35) Gross profit is calculated as:

a) Net sales - Loss

b) Sale x Rate of G.P/100

c) Net Profit - Expenses

d) Both a & b

36) Purchase of machinery for cash, results in:

a) Decrease in total assets

b) Increase in total assets

c) No change in total assets

d) Increase in liability

37) Rate of depreciation in reducing balance method is:

a) High , b) Moderate c) Low ' d) 5%

38) If an asset is sold on 30 June while the accounts are closed

on 31 Dec., then depreciation is calculated for:

a) 1 year

b) 6 month

c) 1 month

d) 5 month

39) The accounting year of banks ends on:

a) 31st March

b) 30th June

c) 31st December

d) 31st July

40) Discount received in advance is a:

a) Real a/c

b) Personal a/c

c) Nominal a/c

d) None

Answers:

31-d, 32-d, 33-d, 34-c, 35-d, 36-c, 37-a, 38-b, 39-c, 40-b

41) Dual concept records transaction on bases of:

a) Single entry system

b) Double a/c system

c) Double entry system

d) All of these

42) Which of the following is an accounting equation?

a) Assets = Liabilities

b) Assets = Equity - Liability

c) Assets = Capital + Liabilities

d) Liability = Asset + Capital

43) In Dissolution payment is made:

a) To the outsiders

b) Capital of partner

c) Partner's loan

d) Any balance

44) If partner has debit balance of capital a/c, then:

a) Debit side of capital a/c

b) Credit side of capital a/c

c) Credit side of current a/c

d) Debit side of current a/c

45) Salary payable is a:

a) Liability b) Expense c) Asset d) Revenue

46) Solvency means:

a) Financial soundness of business

b) Financial unsoundness of business

c) Capital position of business

d) None of these

47) Creditors are included in:

a) Fixed liability

b) Current asset

c) Current Viability

d) Loan capital

48) Net profits are considered as:

a) Remuneration of enterprise

b) Salary to Manager

c) Remuneration to partner only

d) Gross income

49) Goods given as charity of Rs 500 are:

a) Credited to charity a/c

b) Debited to purchase a/c

c) Debited to charity a/c

d) Credited to purchase a/c

e) Both c and d.

50) Expenses proprietor equity:

a) Increase

b) No effect

c) Changes

d) Decrease

Answers:

41-c, 42-c, 43-a, 44-a, 45-a, 46-a, 47-c, 48-a, 49-c, 50-d

51) Decrease in asset is credited but decrease in capital

a) Credited

b) Debited

c) Either a or b

d) None

52) Goods are returned:

a) Due to defect

b) Due to delay in dispatch

c) Due to violation of item

d) Any of these

53) Journal proper records:

a) All transaction

b) Credit transactions

c) Transaction not recorded in subsidiary books

d) Cash transactions in any subsidiary book

54) If furniture is purchased on credit then it be shown in:

a) Debit side of cash book

b) Not shown in cash book

c) Credit side of cash book

d) Either a) or b)

55) Excess of credit side over debit side is called:

a) Credit balance

b) Debit balance

c) Over draft only

d) Either b or e

56) All liabilities has ........ 2. opening balance:

a) Debit

b) Credit

c) None

d) Only a

57) Withdrawal from bank can be made through:

a) Pay-in-slip

b) Deposit slip

c) Cheque

d) Cash

58) When a cheque is deposited in bank, bank will our a/c:

a) Credit

b) Debit

c) Add

d) Subtract

59) Underwriting commission on share issued by banking

company can't exceed:

a) 2V2 of paid up capital

b) 2% of paid up capital

c) 3% of paid up capital

d) 2 1/2 of called up capital

60 ) ........ is the whole time servant of bank.

a) Director b) Chairman c) Manager d) Member

Answers:

51-b, 52-d, 53-c, 54-b, 55-a, 56-b, 57-c, 58-a, 59-a, 60-b

61) Debit the debtor and credit the creditor' rule apply to:

a) Real A/c b) Personal a/c c) Nominal a/c d) None

62) In double entry system, credit means:

a) Decrease in loss

b) Increase in asset

c) Decrease in capital

d) Increase in expenses

63) Narration starts with word:

a) To b) By c) Being d) With

64) Cash discount is allowed at time of:

a) Payment b) Purchase c) Sale d) None

65) Which of following is contra entry?

a) Cash withdrawn from office

b) Cash deposited in bank

c) Cheque withdrawn for domestic use

d) Goods withdrawn

66) Bank column of cash book has ......... balance:

a) Debit

b) Credit

c) Either a or b

d) None

67) Trade discount is shown in:

a) Cash book

b) Subsidiary books

c) Journal

d) Ledger

68) Which of following is special journal?

a) Purchase book

b) Creditor a/c

c) Debtor a/c

d) Capital a/c

69) Sales book do not contain:

a) Credit sales

b) Credit sales of goods

c) Cash sales

d) Trade discount

70) Subsidiary book contain:

a) Interest on capital

b) Credit items

c) Sale of asset

d) Loss of goods

Answers:

61-b, 62-a, 63-c, 64-a, 65-b, 66-c, 67-b, 68-a, 69-c, 70-b

71) If a partner draw amount of Rs 1,000 p.m in beginning of

every month, what will be the interest on drawing @ 15%:

a) Rs 800

b) Rs 900

c) Rs 975

d) Rs 825

72) Partner capital a/c do not contain:

a) Interest on capital

b) Balance of capital

c) Salary paid

d) Increase in asset

73) Q, R wants to admit C in firm but M does not agree:

a) C will not be admitted

b) C will be admitted

c) M will be retired

d) M will be agreed & C will be admitted

74) At least ........ persons are needed to form a partnership:

a) 4 b) 3 c) 2 d) 1

75) In Govt. Company, govt, has paid-up capital of:

a) 51% b) 49% c) 50% d) 25%

76) Registered companies do not include:

a) Unlimited pubic companies

b) Unlimited private companies

c) Limited private companies

d) Company Limited by guarantee

77) The minimum subscription is required to be received in

........ period:

a) 5 days

b) 10 days

c) 1 month

d) 120 days

78) A applied for 200 shares but was allotted only 60 shares. If

application money is Rs 2, then share application will be

debited with:

a) 120 b) 400 c) 280 d) 450

79) If Article of Association is not given then ........ will apply:

a) Table B of companies Act

b) Table C of companies Act

c) Table A of companies Act

d) Table D of companies act

80) A machine was purchased for Rs 1,16,000 payments made

Rs 10,000 by cheque and remaining by issue of shares of Rs 10

each @ 10.50 each. Number of share allotted will be:

a) 11000 b) 9000 c) 10000 d) 8000

Answers:

71-b, 72-d, 73-a, 74-c, 75-a, 76-d, 77-d, 78-b, 79-c, 80-c

81) Debentures can be redeemed by:

a) Purchase in open market

b) Drawing a lot

c) Redemption in lumpsum

d) All above

82) 7000 shares of Rs 100 were issued at discount of 10% and

redeemed at premium of 5%. Loss at time of issue is equal to:

a) 1,05,000

b) 70,000

c) 45,000

d) 7,00,000

83) Goodwill is raised at the time of:

a) Dissolution

b) Admission

c) Death

d) Both b & c

84) Claim 'of a retiring partner can be paid:

a) In full

b) In installment

c) Half yearly

d) Both a & b

85) Purchase A/c shows only:

a) All purchases of goods & Assets

b) Only cash of goods & Assets

c) All cash and credit purchase of trading goods

d) Only credit of goods

86) Posting is made at ...... side of any a/c appearing at debit

side of cash book:

a) Debit

b) Credit

c) Either a or b

d)none

87) Personal a/c may have ....... balance:

a) Debit

b) Credit

c) Either a or b

d) None

88) Interest collected by bank is in our passbook:

a) Credited

b) Debited

c) Subtracted

d) Not shown

89) Bank reconciliation statement is prepared by:

a) Bank

b) Customer

c) Creditor

d) Firm

90) The debit balance of passbook is:

a) Plus balance

b) Minus balance

c) Either a or b

d) none

Answers:

81-d, 82-b, 83-d, 84-d, 85-c, 86-b, 87-c, 88-a, 89-b, 90-b

91) Trial balance shows:

a) Arithmetic accuracy of books

b) Only ledger balances

c) Necessary adjustments

d) Only cash transactions

92) Sale of goods to Mohan for Rs 500 is passed in books only

with Rs 50. It is:

a) Compensating error

b) Omission error

c) Principal error

d) None

93 ) ........ has credit balance:

a) Drawing a/c

b) Sales A/c

c) Debtor A/c

d) Purchase A/c

94) Preparation of Trial balance is :

a) Compulsory

b) Important

c) Optional

d) Situational

95) Rent paid Rs.900 was credited to rent a/c will be rectified

by:

a) Debiting Rent A/c with 1800

b) Crediting suspense a/c with 900

c) Debiting Rent a/c with 900

d) Debiting rent a/c with 1000

96) Excess debit in Suspense a/c is written as:

a) To balance b/d

b) To balance c/d

c) By balance b/d

d) By balance c/d

97) A partner can:

a) Borrow money

b) Endorse bills of exchange

c) Sell goods on credit

d) Only a or b

e) Either (a) or (b) or (c)

98) Partnership deed do not contain term:

a) Name of partner

b) Rights, duties of partner

c) Appointment of arbitrator

d) Audit of A/c

99 ) ......... a/c can show negative balance:

a) Fixed capital a/c

b) Fluctuating capital a/c

c) Cash a/c

d) Balance sheet

100) Profits are shown in ........ side of balance sheet:

a) Asset side

b) Capital a/c

c) Liabilities side

d) Loan capital

Answers:

91-a, 92-a, 93-b, 94-c, 95-a, 96-c, 97-e, 98-d, 99-b, 100-c

Principles and Practices of Banking[PPB]

1) Regional Rural Banks have been set up with the basic objectives of:

2) A Bank, which is not included in the Second Schedule of RBI Act 1934, is

called ........ :

3) Banking Companies get licenses under........ :

4) CRR funds are kept by the Banks in ....... :

5) An increase in CRR by RBI leads to ....... :

6) The scheme "National Equity Fund" is meant for ....... :

7) ........ is entrusted with the task of developing international trade in India:

8) Issue Department of RBI maintains assets for issue of currency in the

form of:

9) RBI monitors and controls the Scheduled Banks through:

10) The Banking Regulation Act does not apply to:

11) Scheduled Banks are required to transfer a minimum of ........ % of their

profits to Statutory Reserve Fund:

12) Banks are required to preserve their records (including instruments)

under which provisions of Banking Regulation Act?

13) ....... committee, launched the process of reforms of financial system in

India :

14) The term primary and secondary market is used in the context of ....... :

15) The main business of Banks is to accept deposits from the public.

However a Bank can refuse to permit opening an account for:

16) Companies whose principle business is not finance or lending are

permitted to accept deposits under Section 45(s) of RBI Act only from:

17) RBI is a Banker to GOI. It is obligatory on its part to undertake Banking

business on behalf of the government. This is provided under Section....... :

18) Every Banking company requires the permission of RBI under Section 22

of Banking Regulation Act. This is issued by way of a .......

19) Banks are not required to take the permission of RBI if the change in the

location of an existing place of business is within the:

20) Banking companies are permitted to issue only the ...... shares:

21) The whole time chairman of a Banking company may continue the office

at the end of the term of the office until his successor assumes office subject

to the approval of:

22) If the office of the Chairman falls vacant and RBI feels that

nonappointment may adversely affect the interest of the Banking Company,

the Reserve Bank may appoint a suitable person and such appointments will

be for a maximum period of:

23) Commercial risk can rise out of:

24) Banks extend loans at their Prime lending rate to customers who:

25) The On-site inspection of RBI is focused on the CAMELS model. Capital

adequacy, Asset quality, Management, Earnings appraisal are some of the

components of this CAMELS model. The other components are:

Answers:

1) Providing credit deposit and other Banking facilities to people in

rural areas

2) Non Scheduled Bank

3) Section 22 of Banking Regulations Act

4) Balance in a Special Account with RBI

5) Decrease in lendable resources

6) Small Scale Industry

7) EXIM Bank

8) Gold at least value Rs. 115 crore and Gold and foreign exchange

reserve value Rs. 200 crore

9) Off site monitoring, On site inspections and Licensing

requirements

10) A primary agricultural credit society

11) 25% of the profits before dividend

12) Section 45Y

13) Narsimham Committee

14) Capital Market

15) Undesirable persons

16) Relatives in the form of loans

17) 20 of the RBI Act

18) Licence

19) Same Town/Village

20) Equity shares

21) Reserve Bank of India

22) 3 years

23) Lack of growth in demand and excess supply of the product of the

borrower in question

24) Who are perceived as minimal/zero risk customers

25) Liquidity & Systems control

26) RBI has issued detailed instructions under KYC rules. KYC rules are

made for knowing the customer properly in order to:

27) The legal provisions for winding up of Banking companies are laid down

in:

28) An order of moratorium is issued by:

29) The court can appoint RBI or SBI as the liquidator for winding up of

a Banking company as per Section ......... of B.R.Act 1949:

30) Retail Banking sector is characterized by:

31) ...... means offering all type of financial products like retail and

wholesale (corporate) banking, insurance, mutual funds, capital market

related products etc all at one place.

32) Where are American Depository receipts traded?

33) Is it possible to have an IDR for an Indian Company?

34) What is meant by the term Merchant Banking?

35) SENSEX comprising of 30 stocks is maintained by ....... :

36) For which of the following purposes an Asset Management Company is

promoted?

37) Market capitalization can be worked as product of which of

the following?

38) What is meant by the term Coupons?

39) What is the role of a merchant Banker?

40) What is a Factoring service?

41) When a customer purchases goods against issued credit card, the role of

card issuing company is ...... :

42) What are the benefits to the Bank under Securitization?

43) What period of notice is required for taking over the assets by he Bank

under SARFAESI Act?

44) What is Bancassurance?

45) The funds wherein investments can be made around the year are known

as ....... :

46) How does Tele Banking functions?

47) ....... is known as the third pillar of Basel-ll accord:

48) The key element of Pillar 3 in Basel II accord is:

49) Basel II has introduced capital change on the following type of risk for

the first time:

50) Under Basel II, Pillar 3, Banks are required to give additional information

/ disclosures to public once in for the given parameters:

Answers:

26) Discourage money laundering and to avoid frauds due to impersonations

27) Banking Regulation Act 1949

28) High Court under whose jurisdiction the Bank is situated

29) Section 39

30) Multiple Products, Multiple channels and Multiple customer groups

31) Universal Banking

32) In USA only

33) No, IDRs can be issued only for Foreign Registered Companies

34) Services provided to capital market and finance to corporate sector

35) Bombay Stock Exchange

36) To manage the funds of a mutual funds

37) Out standing shares x current market price of shares

38) Token for payments of interest attached to a bearer security

39) They work as an intermediary to an issue in primary market.

40) Outright purchase of receivables

41) That of a guarantor

42) The Banks pass their risk on to the buyer of assets and locked funds

come in circulation

43) 60 days

44) Sale of insurance products through Banking channels

45) Open ended funds

46) Bank's computers respond to customers telephonic enquiries

47) Market discipline

48) Disclosure

49) Operational Risk

50) 6 months

Model Paper-I [PPB-Functions Of Banks]

1) The term 'Customer' is defined under:

2) The relationship between Banker and Customer in relation to standing

instruction is:

3) Your branch gets authentic information that Mr. Balan who is maintaining

a satisfactory Current account in the name of his Proprietorship firm has

been imprisoned. How will you handle the account and the cheques drawn

on the account before and during the period of imprisonment?

4) Bankers duty of Secrecy is defined under ....... Act:

5) The Banker-Customer relationship when the bank accepts articles for

keeping in safe custody from customers is :

6) The customer has submitted his Insurance Policy as a security for a loan

from the Bank. The Banker-Customer relationship in the context of

Insurance Policy is:

7) Ramesh Shivalkar has deposited a FD receipt as security for guarantee

issued by the Bank. The validity of guarantee has since expired. However,

his Current a/c with the branch is overdrawn. Can the Bank exercise right of

Lien on it?

8) The Right of Lien is applicable only in the case of ....... and ........ which

come in to the Banker's possession in the normal course of business.

9) A Banker can exercise the right of Set-off only in respect of:

10) In an overdraft account, when the notice of death of the partner is

received, the Bank should:

11) Can you exercise right of Set-off in respect of time barred debts?

12) Who is Garnishee under a Garnishee Order?

13) The Bank receives Garnishee Order. What is the relationship between

Banker and Customer?

14) A and B have a joint account. Income Tax Department have served an

Attachment order for B. How will you handle the order?

15) Garnishee order is issued under .........

16) Which orders are first issued before issuing the absolute Garnishee

order?

17) Your branch receives a Garnishee order for Mr. Amit and Mr. Manish.

There is no account in the joint names of Amit and Manish. However, they

maintain their individual accounts. How will you handle the order?

18) Jitinder deposited a cheque for collection and Bank had given credit

against this cheque. Before the amount was withdrawn, Bank receives a

garnishee order on the a/c. How should the Bank act?

19) Reliance Bank has received an order under Sales Tax Act in the name of

Kavita Kumari who has a fixed deposit account, which has already matured.

Should the Bank ask for FDR while making the payment under the order?

20) In the case of either or survivor mandate can be accepted :

21) Under which act, Banker also includes the Post Office - Savings Bank

schemes.

22) Under Section 25 of N.I. Act, public holidays are declared by ........:

23) When a Bill is dishonored, the provision regarding noting is described

under Section ....... of N.I. Act:

24) As per the Negotiable Instrument Act, the notice period by the

holder to the drawer U/s 138 is ......... days:

25) Under which section of N.I. Act, meaning of Negotiable Instruments is

given ?

1

Pages- 1, 2,

Answers:

1) KYC guidelines

2) Agent-Principal

3) Cheques drawn on the account, both before and during the period of

imprisonment Will be honored if otherwise in order.

4) Banking Companies (Acquisition and Transfer of Undertaking

Act), 1970

5) Bailey and Bailor

6) Assignee and Assignor.

7) As the FDR has come into Banker's possession in the ordinary course of

business, general lien can be exercised and the Bank can appropriate FDR

proceeds and adjust the OD.

8) Goods and Securities

9) Debts due and determined

10) Stop the operations to avoid application of Clayton's case.

11) Yes

12) Bank on whom order is issued.

13) Debtor - Creditor

14) Can attach 50% of the balance in joint a/c.

15) Rule 46 of Order XXI ofCPC

16) Order Nisi

17) The garnishee order will attach the individual accounts of Mr. Amit and

Mr. Manish, as they are jointly and severally liable for the joint debt.

18) The order does not apply to amount of the cheque as funds are

yet to be received.

19) The Bank cannot insist for production of FDR.

20) Only if both the account holder authorized it.

21) NI Act-Sec-03

22) Central Govt, by notification in the official gazette

23) Sec 99 of Nl Act

24) 15 days

25) Sec 13 of NIAct

26) Under which act, Currency Notes issued by Reserve Bank of India are

not considered as Negotiable Instruments:

27) You come across a Cheque on which neither the words 'bearer' nor

'order' are written. You will make the payment of this cheque by treating it

as:

28) A Certificate of Deposit is what type of instrument?

29) A promissory note is payable on demand which has been written on lOth

Jan 2005, presented for payment on 15th Jan 2005. From which day, the

due date will be calculated?

30) A bill drawn in Paris in favor of a trader in Mumbai and payable in

Chennai is called:

31) What will be the starting point of limitation on a bill of exchange payable

at a fixed time after date:

32) Certificate after Noting of dishonor issued by Notary Public is

known as ........ :

33) Balwant has drawn a bill of exchange on Chiman and endorsed the same

to Mahesh, who endorsed the same in favor of Manish. The bill has been

dishonored. From whom Manish can recover the amount?

34) What is the maximum period for which a Usance bill of exchange can be

drawn?

35) Your branch has received a bill payable on demand. From which date,

you will calculate the limitation period?

36) In which type of bills, Noting and Protest is essential in case of dishonor?

37) Your branch has received a bill for presentation, which was sent for

acceptance. For one week, the drawee did not accept the bill. What will be

the position of the bill ?

38) Not-Negotiable crossing is a caution to:

39) Not- Negotiable crossing means:

40) A cheque having "Account Payee" crossing has been presented by the

Bank on the counter of drawee Bank for cash payment. How should the

drawee Bank handle the cheque?

41) Mr. Suresh receives a cheque as a gift in his wedding. He becomes

holder or holder in due coursse:

42) A cheque payable to Rohit is endorsed as "Pay to Kapil on his marriage".

Which type of endorsement is this?

43) A order cheque is transferable only by:

44) M endorsed a cheque in a favor of D with the condition that pay to D,

after death of R, but D received the payment without fulfilling the condition.

In this case from whom can M recover the amount:

45) A cheque is payable to A or order. A endorses it in favor of B. B loses the

cheque. C finds it and after forging the endorsement of B delivers it to D. D

for valuable consideration further endorses it to E. The cheque is dishonored.

What are the rights of E on the cheques?

46) In which case the paying Bank can get protection u/s 85 (I) of Nl Act:

47) Mr. Strong approaches the branch for encashment of a bearer cheque

issued in his favor by one of your account holder. The cashier before making

the payment insist on signatures of the payee i.e., Mr Strong, as receipt for

having received the amount. Mr. Strong refuses to sign on the reverse of the

cheque. How will you handle Mr. Strong?

48) Mr. Menon has a saving Bank account and also a Current account. A

cheque for Rs. 6,500/- drawn on the Current account is received. However

the account is showing a credit balance of only Rs. 5000. The counter clerk

informs that Mr. Menon is maintaining a saving Bank account and it is

showing a credit

balance of Rs. 10,000. Can the Bank appropriate and pay the cheque

received in Current account?

49) A Cheque, after payment, becomes the property of .......... :

50) Why do Banks accept cheques for collection from its customers?

2

Pages- 1, 2,

Answers:

26) Sec 04 of Nl Act-1881

27) An order cheque

28) Usance promissory note

29) DP note is payable on demand.

30) A foreign bill

31) When the bill becomes due for payment

32) Protest

33) Balwant, Mahesh & Chiman

34) No limit

35) Date of the bill

36) Foreign bill

37) It will be considered as dishonored due to non-acceptance

38) Endorsee

39) Holder in due course will not get the better title.

40) Make payment of the cheque as it is payable to a bank.

41) Holder only

42) Conditional endorsement

43) Endorsement and delivery

44) From D only

45) E can recover money only from D.

46) For forged endorsement

47) The payee may be given the option of signing a duly stamped ( as per

Stamp Act) money receipt on a plain paper.

48) The Bank cannot appropriate and the cheque will be returned.

49) Drawer

50) It is Bank's ancillary function as per of Sec 6 of Banking Regulation Act

-

Você também pode gostar

- SME Business Division: Question BankDocumento26 páginasSME Business Division: Question BankKawoser AhammadAinda não há avaliações

- RECALLED QUESTIONS (2016-18) : (Ibps Different Banks Promotion Test)Documento11 páginasRECALLED QUESTIONS (2016-18) : (Ibps Different Banks Promotion Test)Arun PrakashAinda não há avaliações

- JaiibDocumento105 páginasJaiibManikantha PattugaralaAinda não há avaliações

- Retail Loan in BankingDocumento27 páginasRetail Loan in Banking...ADITYA… JAINAinda não há avaliações

- MSMEs BookletDocumento72 páginasMSMEs Bookletlucky_rishikAinda não há avaliações

- Deceased With Nomination PDFDocumento11 páginasDeceased With Nomination PDFmindhunter786Ainda não há avaliações

- Notes On RBI POLICIES & GUIDELINES 2019 - DarpanDocumento49 páginasNotes On RBI POLICIES & GUIDELINES 2019 - DarpannitinspaulAinda não há avaliações

- Recollected QuestionsDocumento138 páginasRecollected Questionssunil251Ainda não há avaliações

- Assessment of Working Capital Requirements Form Ii - Operating StatementDocumento42 páginasAssessment of Working Capital Requirements Form Ii - Operating StatementkhajuriaonlineAinda não há avaliações

- Provident Fund in India - An OverviewDocumento9 páginasProvident Fund in India - An Overviewedwards1steveAinda não há avaliações

- General Guidelines On Loans & Advance: Sachin Katiyar-Chief ManagerDocumento53 páginasGeneral Guidelines On Loans & Advance: Sachin Katiyar-Chief Managersaurabh_shrutiAinda não há avaliações

- Principles and Practices of Banking - JAIIB: Timing: 3 HoursDocumento20 páginasPrinciples and Practices of Banking - JAIIB: Timing: 3 HoursMallikarjuna RaoAinda não há avaliações

- DocumentationDocumento36 páginasDocumentationRamesh BethaAinda não há avaliações

- Loan CalculatorDocumento15 páginasLoan CalculatorMahrukh ZubairAinda não há avaliações

- The Khadi and Village Industries Commission Promoting Ivory Product - Sukanya KadyanDocumento26 páginasThe Khadi and Village Industries Commission Promoting Ivory Product - Sukanya KadyanAbhishek Kadyan100% (1)

- Gold Loan InterestDocumento29 páginasGold Loan InterestCLERK MBFAinda não há avaliações

- Promotion Study Material I To II and II To III-1Documento131 páginasPromotion Study Material I To II and II To III-1Shuvajoy ChakrabortyAinda não há avaliações

- Corp EMI Calculator 0Documento7 páginasCorp EMI Calculator 0Pardeep WadhwaAinda não há avaliações

- Sme WC AssessmentDocumento8 páginasSme WC Assessmentvalinciamarget72Ainda não há avaliações

- Project Report-Final - Sens Revised Final 22-07-2020Documento38 páginasProject Report-Final - Sens Revised Final 22-07-2020Abhishek RaiAinda não há avaliações

- KVIC PMEGP ManualDocumento13 páginasKVIC PMEGP ManualD SRI KRISHNAAinda não há avaliações

- Principles and Practices of BankingDocumento57 páginasPrinciples and Practices of BankingYogesh Devmore100% (1)

- Jaiib2 - 2 Latest Changes Recalled & Expected QuestionsDocumento46 páginasJaiib2 - 2 Latest Changes Recalled & Expected QuestionsDeepak SINGHAinda não há avaliações

- Working CapitalDocumento62 páginasWorking CapitalHrithika AroraAinda não há avaliações

- Balance Sheet & Ratio AnalysisDocumento102 páginasBalance Sheet & Ratio AnalysisAshokkumar MadhaiyanAinda não há avaliações

- Sme Study Modules For Quick Reference PDFDocumento180 páginasSme Study Modules For Quick Reference PDFNilima ChowdhuryAinda não há avaliações

- UnionGyanKasauti Q and A For Nov 15Documento69 páginasUnionGyanKasauti Q and A For Nov 15Anindya NandiAinda não há avaliações

- Project Profile On Children GarmentsDocumento2 páginasProject Profile On Children GarmentsPankaj GogoiAinda não há avaliações

- Letter of Credit Appraisal NoteDocumento8 páginasLetter of Credit Appraisal NoteNimitt ChoudharyAinda não há avaliações

- CMA FormatDocumento10 páginasCMA Formatcvrao0480% (5)

- MSME Application Up To Rs.2.00 CRDocumento9 páginasMSME Application Up To Rs.2.00 CRsayanAinda não há avaliações

- Day 1 1.1 Session-1 1.2 Banking System in India: AnswersDocumento51 páginasDay 1 1.1 Session-1 1.2 Banking System in India: AnswersAkella LokeshAinda não há avaliações

- Module VIII Reading Material Branch Managers TNGDocumento273 páginasModule VIII Reading Material Branch Managers TNGIrshadAhmedAinda não há avaliações

- JAIIB-Accounts-Free Mock Test Jan 2022Documento4 páginasJAIIB-Accounts-Free Mock Test Jan 2022kanarendranAinda não há avaliações

- OJAS Pocket Diary HRDI PKL PDFDocumento59 páginasOJAS Pocket Diary HRDI PKL PDFJyoti SharmaAinda não há avaliações

- Actuals Actuals Estimated Projected Projectionsprojection 2007 2008 2009 2010 2011 2012Documento23 páginasActuals Actuals Estimated Projected Projectionsprojection 2007 2008 2009 2010 2011 2012Priyanka DashAinda não há avaliações

- Retail Loan User Manual-393Documento41 páginasRetail Loan User Manual-393Arindam MukherjeeAinda não há avaliações

- Project Profile On Gem Cutting and PolishingDocumento2 páginasProject Profile On Gem Cutting and Polishingpramod kumar singh100% (1)

- Question Bank 1 Jan 2019Documento5 páginasQuestion Bank 1 Jan 2019jitendra singhAinda não há avaliações

- Raj Bank Ratio Analysis PDFDocumento72 páginasRaj Bank Ratio Analysis PDFRonak VaishnavAinda não há avaliações

- Promn Exam MCQs 23-01-2022 - 5470497Documento17 páginasPromn Exam MCQs 23-01-2022 - 5470497Ghanshyam KumarAinda não há avaliações

- Gist of Important RBI CircularsDocumento9 páginasGist of Important RBI CircularsrajvkramAinda não há avaliações

- Study Material (1) .OdsDocumento322 páginasStudy Material (1) .OdsmichelleAinda não há avaliações

- 32nd Issue E-Gyan April, 2016Documento47 páginas32nd Issue E-Gyan April, 2016sj_pune5444Ainda não há avaliações

- MMGS Ii To Iii Model Objective Question Paper 1 PDFDocumento16 páginasMMGS Ii To Iii Model Objective Question Paper 1 PDFPRABHU JOTHAinda não há avaliações

- Doucmentation Manual of BankDocumento518 páginasDoucmentation Manual of BankSamsul ArfinAinda não há avaliações

- PNB Retail Lending SchemesDocumento6 páginasPNB Retail Lending Schemesanon_617153150Ainda não há avaliações

- Study Material 2018 Czc-BhopalDocumento233 páginasStudy Material 2018 Czc-BhopalCA Alpesh TatedAinda não há avaliações

- Government Sponsored SchemesDocumento5 páginasGovernment Sponsored SchemesClassicaverAinda não há avaliações

- Recalled MCQs 2021 22Documento16 páginasRecalled MCQs 2021 22Ghanshyam KumarAinda não há avaliações

- Mrunal Sir Latest 2020 Handout 3 PDFDocumento19 páginasMrunal Sir Latest 2020 Handout 3 PDFdaljit singhAinda não há avaliações

- Bank Form IbDocumento4 páginasBank Form IbRocky singhAinda não há avaliações

- 166-2020 Roi PDFDocumento47 páginas166-2020 Roi PDFANJAN SINGH 3AAinda não há avaliações

- Material For Pre-Prom-Officers-2018 - Final PDFDocumento292 páginasMaterial For Pre-Prom-Officers-2018 - Final PDFRahulAinda não há avaliações

- Final Caiib MatDocumento227 páginasFinal Caiib MatPrince VenkatAinda não há avaliações

- PNB Roi New Supplementry Agreement-WordDocumento2 páginasPNB Roi New Supplementry Agreement-WordAnonymous XsYDXMVAinda não há avaliações

- BK ObjectivesDocumento8 páginasBK ObjectivesAru PalAinda não há avaliações

- JIIB Test PpersDocumento51 páginasJIIB Test PpersPriyanka LincolnAinda não há avaliações

- Model Paper - 4Documento7 páginasModel Paper - 4Shiva DubeyAinda não há avaliações

- JaiibprinciplesbankingmodulesabquestionsDocumento59 páginasJaiibprinciplesbankingmodulesabquestionssanjaykv98100% (1)

- BFM CDocumento10 páginasBFM CMuralidhar Goli100% (1)

- DEMONITISATIONDocumento2 páginasDEMONITISATIONMuralidhar GoliAinda não há avaliações

- Memorised CAIIB BFM Questions MAY 2013Documento3 páginasMemorised CAIIB BFM Questions MAY 2013Pratheesh Tulsi33% (3)

- Letter of CreditDocumento1 páginaLetter of CreditMuralidhar GoliAinda não há avaliações

- Rating MigrationDocumento1 páginaRating MigrationMuralidhar GoliAinda não há avaliações

- Risk Management IDocumento2 páginasRisk Management IMuralidhar GoliAinda não há avaliações

- ABM-numerical With Solutions by Neeraj AgnihotriDocumento23 páginasABM-numerical With Solutions by Neeraj AgnihotriMuralidhar Goli100% (5)

- Full Page PhotoDocumento1 páginaFull Page PhotoMuralidhar GoliAinda não há avaliações

- Caiib Sample QuestionsDocumento15 páginasCaiib Sample QuestionsVijay25% (4)

- Abm CCDocumento3 páginasAbm CCMuralidhar GoliAinda não há avaliações

- BFM BDocumento12 páginasBFM BMuralidhar GoliAinda não há avaliações

- NurseDocumento89 páginasNurseMuralidhar Goli100% (1)

- PC Magazine - March 2014Documento152 páginasPC Magazine - March 2014Muralidhar GoliAinda não há avaliações

- Balance Sheet Managementmodule DDocumento2 páginasBalance Sheet Managementmodule DMuralidhar GoliAinda não há avaliações

- Recruitment Notice 2011 NoDocumento5 páginasRecruitment Notice 2011 NoSrikant PandeyAinda não há avaliações

- Bed MakingDocumento14 páginasBed MakingHarold Haze Cortez100% (1)

- Hospital BedsDocumento21 páginasHospital BedsMuralidhar GoliAinda não há avaliações

- AptitudeDocumento5 páginasAptitudeKamaraj MuthupandianAinda não há avaliações

- Twin Deficits HypothesisDocumento3 páginasTwin Deficits HypothesisinnovatorinnovatorAinda não há avaliações

- Three Perspectives On The Valuation of Derivative InstrumentsDocumento10 páginasThree Perspectives On The Valuation of Derivative InstrumentsNiyati ShahAinda não há avaliações

- FABM2 LESSON 3 Statement of Changes in EquityDocumento4 páginasFABM2 LESSON 3 Statement of Changes in EquityArjay CorderoAinda não há avaliações

- LK BMHS 30 September 2021Documento71 páginasLK BMHS 30 September 2021samudraAinda não há avaliações

- Accounting II BBA 3rdDocumento9 páginasAccounting II BBA 3rdTalha GillAinda não há avaliações

- LETTER OF ADVICE OrigninalDocumento2 páginasLETTER OF ADVICE OrigninalSebastian Wienbreyer67% (6)

- 2020 Beximco and Renata Ratio AnalysisDocumento18 páginas2020 Beximco and Renata Ratio AnalysisRahi Mun100% (2)

- 44th Annual Report 2005-2006: National Organic Chemical Industries LimitedDocumento73 páginas44th Annual Report 2005-2006: National Organic Chemical Industries Limitedsandesh1506Ainda não há avaliações

- Tci Freight NL01AA2959 261354914 31.12.2020Documento1 páginaTci Freight NL01AA2959 261354914 31.12.2020Doita Dutta ChoudhuryAinda não há avaliações

- Calculating Contractors MarkupDocumento3 páginasCalculating Contractors MarkupHorace Prophetic DavisAinda não há avaliações

- Jurnal Eliminasi - Inter Company ProfitDocumento14 páginasJurnal Eliminasi - Inter Company ProfitIrfan JayaAinda não há avaliações

- Homework: Working Capital Management 2021coardbulji: ActivityDocumento3 páginasHomework: Working Capital Management 2021coardbulji: ActivityMa Teresa B. CerezoAinda não há avaliações

- Sample Financial Aid Appeal Letter Asking For More Money - Sample Letter HQDocumento5 páginasSample Financial Aid Appeal Letter Asking For More Money - Sample Letter HQSeb TegAinda não há avaliações

- The Economics of Commercial Real Estate PreleasingDocumento33 páginasThe Economics of Commercial Real Estate PreleasingSuhas100% (1)

- Notes - Chapter 4Documento6 páginasNotes - Chapter 4OneishaL.HughesAinda não há avaliações

- Quiz 8 - BTX 113Documento3 páginasQuiz 8 - BTX 113Rae Vincent Revilla100% (1)

- Solution of Chapter 1Documento3 páginasSolution of Chapter 1Văn TạAinda não há avaliações

- PFM3063 - Advanced Financial Management Quiz 2 and 3 (Dec 2023)Documento5 páginasPFM3063 - Advanced Financial Management Quiz 2 and 3 (Dec 2023)Putri YaniAinda não há avaliações

- Profit Prior To IncorporationDocumento4 páginasProfit Prior To Incorporationgourav mishraAinda não há avaliações

- Mayer Steel Pipe Corp. and Hong Kong Gov't Supplies Dept v. CA, South Sea Surety and Insurance Co., and Charter Insurance CorpDocumento6 páginasMayer Steel Pipe Corp. and Hong Kong Gov't Supplies Dept v. CA, South Sea Surety and Insurance Co., and Charter Insurance CorpKarl SaysonAinda não há avaliações

- Michael Rubel ResumeDocumento1 páginaMichael Rubel Resumeapi-207919284Ainda não há avaliações

- Postpaid Monthly Statement: This Month's SummaryDocumento6 páginasPostpaid Monthly Statement: This Month's SummaryShri KanthAinda não há avaliações

- Lesson 1.1 Simple Interest Visual AidDocumento13 páginasLesson 1.1 Simple Interest Visual AidJerald SamsonAinda não há avaliações

- Chapter 1: Introduction To The Study of GlobalizationDocumento80 páginasChapter 1: Introduction To The Study of GlobalizationAshton Travis HawksAinda não há avaliações

- Project Management Final Paper 1Documento10 páginasProject Management Final Paper 1JM SericaAinda não há avaliações

- An Overview of The Nigerian Financial SystemDocumento9 páginasAn Overview of The Nigerian Financial SystemHayatu A. NuhuAinda não há avaliações

- Paper 5Documento4 páginasPaper 5hbyhAinda não há avaliações

- AJG Marine P&I Commercial Market Review September 2015Documento94 páginasAJG Marine P&I Commercial Market Review September 2015sam ignarskiAinda não há avaliações

- LECTURE/ TUTORIAL 5, 6, 7 - Examples of Present Worth Methods Example-1Documento8 páginasLECTURE/ TUTORIAL 5, 6, 7 - Examples of Present Worth Methods Example-1Veejay SalazarAinda não há avaliações

- Project Report: "A Descriptive Analysis of Depository Participant WithDocumento97 páginasProject Report: "A Descriptive Analysis of Depository Participant WithJOMONJOSE91Ainda não há avaliações