Escolar Documentos

Profissional Documentos

Cultura Documentos

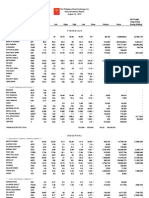

The Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2014

Enviado por

Chris DeDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

The Philippine Stock Exchange, Inc Daily Quotations Report March 14, 2014

Enviado por

Chris DeDireitos autorais:

Formatos disponíveis

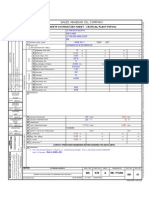

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

6,185,287

FINANCIALS

**** BANKS ****

ASIATRUST

ASIA UNITED

ASIA

AUB

71.1

71.9

71.9

71.9

71.1

71.9

96,960

6,916,053

BDO UNIBANK

BDO

83.6

83.65

84.5

84.5

83

83.6

1,884,020

157,518,960.5

78,297,752

BANK PH ISLANDS

BPI

89.2

89.35

89.5

90

89

89.2

1,515,750

135,393,065.5

(74,811,504)

CHINABANK

CHIB

58.1

58.5

58.5

58.5

58.5

58.5

3,400

198,900

CITYSTATE BANK

EXPORT BANK

EXPORT BANK B

EAST WEST BANK

CSB

EIBA

EIBB

EW

9.4

28.75

12.5

28.8

28.35

28.75

28.3

28.75

277,700

7,939,495

6,842,615

METROBANK

MBT

80.2

80.9

80.6

80.9

79.7

80.9

3,510,580

282,350,615.5

(8,717,414)

PB BANK

PBB

23.55

23.6

23.6

23.6

23.55

23.6

29,900

705,515

PBCOM

PHIL NATL BANK

PBC

PNB

61.05

85.1

66

85.9

85.35

85.9

85

85.9

346,490

29,471,816

6,716,656.5

PSBANK

PHILTRUST

RCBC

PSB

PTC

RCB

133.1

83

49.75

138.6

49.8

49.9

49.9

49.5

49.75

1,509,550

75,101,905

12,372,642.5

SECURITY BANK

SECB

111.6

111.9

111.7

112.4

111

111.9

335,490

37,485,660

(8,647,900)

UNION BANK

UBP

128.6

129.4

128.5

129.4

128.5

128.6

10,700

1,379,819

262,287

**** OTHER FINANCIAL INSTITUTIONS ****

AG FINANCE

AGF

3.24

3.35

3.25

3.33

3.25

3.33

9,000

29,410

BANKARD

BDO LEASING

COL FINANCIAL

BKD

BLFI

COL

1.98

2.02

17.5

1.99

2.07

18.48

1.96

2.01

18

2

2.01

18.48

1.96

2.01

18

1.99

2.01

18.48

214,000

1,000

1,200

424,230

2,010

21,648

9,000

FIRST ABACUS

FILIPINO FUND

FAF

FFI

0.79

7.98

0.84

8.2

7.98

7.98

7.98

7.98

6,700

53,466

IREMIT

MACAY HLDG

MEDCO HLDG

MANULIFE

NTL REINSURANCE

I

MACAY

MED

MFC

NRCP

2.6

23

0.241

740

1.37

2.72

25.2

0.248

760

1.42

2.58

740

1.42

2.58

740

1.42

2.58

740

1.42

2.58

740

1.42

6,000

200

20,000

15,480

148,000

28,400

PHIL STOCK EXCH

SUN LIFE

PSE

SLF

300

1,345

300.2

1,350

301

1,351

302

1,351

300

1,345

300

1,345

14,490

225

4,367,266

303,305

(861,942)

13,450

VANTAGE

2.6

2.65

2.6

2.65

2.6

2.65

175,000

462,500

FINANCIALS SECTOR TOTAL

VOLUME :

9,968,355

VALUE :

740,317,519.5

INDUSTRIAL

**** ELECTRICITY, ENERGY, POWER & WATER ****

ALSONS CONS

ACR

1.45

1.48

1.44

1.49

1.44

1.45

3,727,000

5,437,910

173,400

ABOITIZ POWER

AP

39.8

39.9

40.05

40.7

39.3

39.9

5,241,300

209,462,870

4,772,170

ENERGY DEVT

EDC

5.53

5.56

5.6

5.6

5.43

5.53

9,636,700

53,086,637

(5,579,515)

FIRST GEN

FGEN

18

18.06

18.1

18.1

17.96

18.06

2,056,900

37,044,570

(10,145,660)

FIRST PHIL HLDG

FPH

72.65

72.75

72.5

72.65

71.55

72.65

710,610

51,551,177.5

(1,046,225)

CALAPAN VENTURE

MERALCO

H2O

MER

6.49

286

6.7

290

282.6

290

281

290

1,300,760

374,220,810

51,668,270

MANILA WATER

MWC

23.6

23.65

23.55

23.8

23.4

23.6

11,553,800

272,060,695

241,609,805

PETRON

PCOR

13.9

14

13.9

14

13.82

14

2,269,000

31,599,212

25,148,290

PHOENIX

PNX

5.07

5.1

5.08

5.1

5.07

5.1

82,300

418,646

(50,728)

SALCON POWER

SPC

4.5

4.6

4.51

4.51

4.51

4.51

10,000

45,100

(45,100)

TRANS ASIA

TA

2.08

2.09

2.13

2.13

2.08

2.09

7,951,000

16,686,320

1,960,460

VIVANT

VVT

11

11.94

1,000

15,900

4,000

262,134

**** FOOD, BEVERAGE & TOBACCO ****

AGRINURTURE

BOGO MEDELLIN

CNTRL AZUCARERA

ANI

BMM

CAT

3.94

51.5

15

4

68

17

4

16.3

4

16.5

4

16.3

4

16.5

DEL MONTE

DMPL

22.3

22.4

22.7

22.7

22.3

22.4

6,600

148,130

(18,340)

DNL INDUS

EMPERADOR

DNL

EMP

8.23

11.86

8.24

11.9

8.23

11.96

8.36

11.96

8.1

11.8

8.24

11.86

11,394,400

12,154,200

93,881,476

144,646,060

38,132,534

17,107,264

ALLIANCE SELECT

GINEBRA

FOOD

GSMI

1.3

18.5

1.31

18.7

1.31

18.7

1.31

18.7

1.28

18.66

1.31

18.7

512,000

1,400

661,890

26,164

JOLLIBEE

JFC

165

165.7

167

167

164

165

503,250

82,953,091

(38,681,181)

LIBERTY FLOUR

LFM

51.05

76

76.5

76.5

76.5

76.5

20

1,530

PANCAKE

PCKH

23

24

23

24.5

22.8

24.5

5,800

134,690

PUREFOODS

PF

222.4

227

222.2

227.8

222

227

4,690

1,055,016

628,414

PEPSI COLA

PIP

4.68

4.69

4.7

4.71

4.68

4.68

935,000

4,383,940

(1,344,470)

ROXAS AND CO

RFM CORP

ROXAS HLDG

RCI

RFM

ROX

3.09

5.6

5.7

3.3

5.62

5.83

3.2

5.6

5.68

3.2

5.6

5.9

3.2

5.56

5.5

3.2

5.6

5.7

2,000

2,278,600

507,200

6,400

12,726,224

2,909,335

1,221,274

(50,200)

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

SWIFT FOODS

UNIV ROBINA

SFI

URC

0.122

138.1

0.133

138.3

140

140

138

138.3

2,560,720

354,400,194

(79,581,755)

VITARICH

VICTORIAS

VITA

VMC

0.68

3.63

0.7

3.66

0.68

3.66

0.7

3.7

0.68

3.55

0.68

3.63

985,000

1,945,000

671,160

7,096,090

73,600

**** CONSTRUCTION, INFRASTRUCTURE & ALLIED SERVICES ****

ASIABEST GROUP

ABG

11.9

12.22

12.36

12.7

11.9

11.9

33,000

400,150

CONCRETE A

CONCRETE B

SEACEM

CA

CAB

CMT

38.5

15

1.06

55

1.1

1.06

1.06

1.06

1.06

47,000

49,820

DAVINCI CAPITAL

DAVIN

EEI CORP

EEI

FED RESOURCES

HOLCIM

LAFARGE REP

FED

HLCM

LRI

MEGAWIDE

MWIDE

PHINMA

PNCC

SUPERCITY

TKC STEEL

VULCAN INDL

1.06

1.08

1.09

1.09

1.05

1.08

179,000

190,080

11.58

11.6

11.66

11.7

11.56

11.6

1,617,800

18,829,892

(6,110,114)

10

13

9.03

13.2

13.2

9.06

13

9.11

13

9.11

13

8.9

13

9.06

100

1,300

644,900

5,789,944

(1,471,442)

12.74

12.88

12.7

12.74

12.5

12.74

38,800

487,602

PHN

PNC

SRDC

T

VUL

0.81

1.7

1.45

1.72

1.49

1.72

1.49

1.72

1.49

1.7

1.49

1.72

1.49

17,000

38,000

29,060

56,620

CHEMPHIL

CHEMREZ

EUROMED

CIP

COAT

EURO

75

3.49

1.65

100

3.5

1.7

3.5

1.68

3.5

1.68

3.5

1.68

3.5

1.68

228,000

25,000

798,000

42,000

LMG CHEMICALS

LMG

3.44

3.58

3.5

3.5

3.44

3.5

201,000

699,280

METROALLIANCE A

METROALLIANCE B

MABUHAY VINYL

PRYCE CORP

MAH

MAHB

MVC

PPC

2.37

-

2.47

-

2.36

-

2.36

-

2.36

-

2.36

-

10,000

-

23,600

-

**** CHEMICALS ****

**** ELECTRICAL COMPONENTS & EQUIPMENT ****

CIRTEK HLDG

CHIPS

12.2

14.14

14.18

14.18

14.18

14.18

3,400

48,212

CONCEPCION

GREENERGY

INTEGRATED MICR

CIC

GREEN

IMI

27

0.01

2.95

27.1

0.011

3.1

27

0.011

2.95

27

0.011

2.95

27

0.01

2.95

27

0.011

2.95

17,800

300,000

34,000

480,600

3,200

100,300

IONICS

PANASONIC

ION

PMPC

0.405

5.5

0.46

5.6

FILSYN A

FILSYN B

PICOP RES

SPLASH CORP

FYN

FYNB

PCP

SPH

1.75

1.8

1.76

1.76

1.75

1.75

25,000

43,770

(17,520)

STENIEL

STN

**** OTHER INDUSTRIALS ****

INDUSTRIAL SECTOR TOTAL

VOLUME :

81,814,180

VALUE :

1,785,892,293.5

HOLDING FIRMS

**** HOLDING FIRMS ****

ASIA AMLGMATED

AAA

1.7

1.77

1.71

1.71

1.7

1.7

91,000

154,800

ABACORE CAPITAL

AYALA CORP

ABA

AC

0.495

563.5

0.5

564

0.495

560

0.495

570

0.495

558

0.495

564

10,000

620,410

4,950

350,184,640

(4,950)

7,684,395

ABOITIZ EQUITY

ALLIANCE GLOBAL

AEV

AGI

58

29.15

59

29.2

58.2

29.55

59

29.75

57.25

29.2

59

29.2

1,263,060

8,233,400

73,314,479.5

242,052,165

(15,881,196)

(70,335)

ANSCOR

ANGLO PHIL HLDG

ANS

APO

6.75

1.76

6.8

1.85

1.9

1.9

1.76

1.76

288,000

523,350

43,330

ATN HLDG A

ATN

1.51

1.56

1.5

1.57

1.5

1.56

20,000

30,480

ATN HLDG B

BHI HLDG

COSCO CAPITAL

ATNB

BH

COSCO

1.51

282.4

9.43

1.57

720

9.47

1.5

9.75

1.58

9.75

1.49

9.39

1.58

9.43

49,000

9,409,100

74,940

89,140,061

(24,116,781)

DMCI HLDG

DMC

67.8

67.85

68

68.1

67.5

67.8

1,165,010

78,995,425

(15,767,404)

FIL ESTATE CORP

FILINVEST DEV

FC

FDC

4.92

5.02

92,700

463,604

(26,104)

FJ PRINCE A

FJ PRINCE B

FORUM PACIFIC

GT CAPITAL

FJP

FJPB

FPI

GTCAP

3.1

3.12

0.174

805.5

3.23

3.78

0.188

812

800.5

812

796.5

812

85,770

69,157,735

56,869,825

HOUSE OF INV

HI

6.7

6.74

6.53

6.7

6.53

6.7

30,400

201,716

6,530

JG SUMMIT

JGS

49

50

47.5

50

47.5

50

7,884,400

388,933,010

121,323,460

JOLLIVILLE HLDG

KEPPEL HLDG A

KEPPEL HLDG B

LODESTAR

JOH

KPH

KPHB

LIHC

4.51

4.5

4.22

0.76

5.25

4.98

6.2

0.77

0.78

0.79

0.77

0.77

559,000

434,030

(82,390)

LOPEZ HLDG

LT GROUP

LPZ

LTG

4.44

18.72

4.45

18.74

4.42

18.68

4.45

18.98

4.41

18.3

4.45

18.74

854,000

4,919,700

3,798,820

92,272,220

476,870

17,284,228

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

MABUHAY HLDG

MHC

0.64

0.66

0.65

0.65

0.65

0.65

200,000

130,000

MINERALES IND

MJC INVESTMENTS

METRO PAC INV

MIC

MJIC

MPI

4.9

3.2

4.51

5.1

4.24

4.53

5.1

4.51

5.1

4.53

5.1

4.49

5.1

4.53

20,000

19,703,000

102,000

88,769,730

13,205,280

PACIFICA

PA

0.038

0.039

0.038

0.038

0.038

0.038

1,000,000

38,000

PRIME ORION

PRIME MEDIA

POPI

PRIM

0.455

1.61

0.475

1.7

0.475

1.6

0.475

1.61

0.475

1.6

0.475

1.61

10,000

52,000

4,750

83,650

REPUBLIC GLASS

REG

2.41

2.52

2.4

2.41

2.4

2.4

11,000

26,410

(24,010)

SOLID GROUP

SYNERGY GRID

SINOPHIL

SGI

SGP

SINO

1.22

196

0.325

1.23

239.8

0.33

1.23

0.325

1.24

0.335

1.23

0.32

1.23

0.325

75,000

-

92,280

-

2,050,000

673,250

(97,500)

SM INVESTMENTS

SM

716

718.5

712

718.5

710.5

718.5

292,330

209,078,805

45,022,355

SAN MIGUEL CORP

SMC

61

61.1

55.85

63.5

55.85

61

2,386,910

144,343,439

(16,999,866)

SOUTH CHINA

SEAFRONT RES

SOC

SPM

1.01

1.75

1.05

1.88

1.74

1.89

1.74

1.89

3,000

5,520

TOP FRONTIER

UNIOIL HLDG

WELLEX INDUS

ZEUS HLDG

TFHI

UNI

WIN

ZHI

72

0.235

0.181

0.32

72.5

0.245

0.187

0.34

72.65

-

72.65

-

69.5

-

72

-

213,060

-

15,226,831

-

(367,730)

-

HOLDING FIRMS SECTOR TOTAL

VOLUME :

61,861,500

VALUE :

1,868,830,315.5

PROPERTY

**** PROPERTY ****

ARTHALAND CORP

ALCO

0.232

0.234

0.235

0.239

0.232

0.232

13,010,000

3,030,690

(2,257,170)

ANCHOR LAND

AYALA LAND

ALHI

ALI

12.82

28.35

13.42

28.4

12.82

28.7

13.42

28.7

12.82

28.15

13.42

28.4

6,500

11,042,900

83,630

313,679,590

(83,513,815)

ALPHALAND

ARANETA PROP

ALPHA

ARA

1.55

1.59

1.6

1.6

1.55

1.55

32,000

49,700

BELLE CORP

BEL

5.66

5.67

5.69

5.7

5.57

5.67

2,027,500

11,475,204

2,797,205

A BROWN

BRN

1.26

1.29

1.3

1.33

1.3

1.31

20,000

26,210

6,560

CITYLAND DEVT

CDC

1.02

1.08

1.02

1.02

1.02

1.02

10,000

10,200

(10,200)

CROWN EQUITIES

CEI

0.087

0.089

0.087

0.087

0.087

0.087

800,000

69,600

CEBU HLDG

CENTURY PROP

CEBU PROP A

CEBU PROP B

CHI

CPG

CPV

CPVB

5.11

1.56

4.8

5.2

5.12

1.57

5.5

5.5

5.25

1.56

5.2

5.26

1.58

5.2

5.11

1.54

5.2

5.12

1.56

5.2

175,500

7,973,000

50,000

904,522

12,436,070

260,000

(466,620)

-

CYBER BAY

CYBR

0.49

0.5

0.49

0.49

0.49

0.49

110,000

53,900

EMPIRE EAST

EVER GOTESCO

ELI

EVER

0.92

0.29

0.93

0.3

0.91

0.3

0.92

0.3

0.91

0.29

0.92

0.29

283,000

4,330,000

260,210

1,272,700

(70,750)

FILINVEST LAND

GLOBAL ESTATE

FLI

GERI

1.42

1.96

1.43

1.97

1.43

1.85

1.45

2.12

1.41

1.78

1.43

1.96

6,292,000

67,336,000

8,983,660

135,088,860

(1,057,210)

23,561,080

GOTESCO LAND A

GOTESCO LAND B

8990 HLDG

GO

GOB

HOUSE

6.57

7.1

7.2

7.2

6.57

6.57

22,100

156,427

IRC PROP

IRC

1.3

1.32

1.29

1.32

1.29

1.32

54,000

69,860

KEPPEL PROP

CITY AND LAND

KEP

LAND

2.83

1.81

3.1

1.88

1.8

1.88

1.8

1.88

16,000

28,960

(18,000)

MARSTEEL A

MARSTEEL B

MEGAWORLD

MC

MCB

MEG

4.1

4.14

4.1

4.15

4.1

4.1

14,511,000

59,688,710

4,352,980

MRC ALLIED

PHIL ESTATES

MRC

PHES

0.094

0.37

0.096

0.375

0.093

0.375

0.096

0.38

0.092

0.375

0.096

0.375

2,200,000

280,000

204,230

106,000

19,200

-

PRIMETOWN PROP

PRIMEX CORP

ROBINSONS LAND

PMT

PRMX

RLC

2.56

20.75

2.76

20.8

2.78

20.75

2.78

20.85

2.78

20.5

2.78

20.8

2,000

876,900

5,560

18,218,570

4,621,360

PHIL REALTY

ROCKWELL

RLT

ROCK

0.53

1.74

0.55

1.76

0.53

1.69

0.55

1.84

0.53

1.68

0.53

1.74

995,000

5,247,000

541,720

9,273,480

(173,300)

SHANG PROP

SHNG

3.09

3.13

3.12

3.19

3.1

3.13

117,000

366,580

(106,900)

STA LUCIA LAND

SLI

0.63

0.64

0.63

0.65

0.62

0.63

1,046,000

662,990

30,530

SM PRIME HLDG

SMPH

14.4

14.5

14.6

14.62

14.4

14.4

24,931,000

360,019,464

2,484,788

STARMALLS

STR

3.39

3.52

3.4

3.41

3.4

3.4

78,000

265,330

SUNTRUST HOME

SUN

1.09

1.1

1.12

1.14

1.08

1.1

1,623,000

1,806,040

21,600

PHIL TOBACCO

UNIWIDE HLDG

VISTA LAND

TFC

UW

VLL

16.68

5.27

26.95

5.28

5.28

5.3

5.21

5.28

1,980,000

10,441,916

1,701,217

PROPERTY SECTOR TOTAL

VOLUME :

167,477,400

VALUE :

949,540,583

SERVICES

**** MEDIA ****

ABS CBN

ABS

30.3

30.4

30.4

30.5

30.3

30.3

19,000

576,750

GMA NETWORK

GMA7

7.67

7.7

7.78

7.78

7.62

7.67

637,800

4,888,054

MANILA BULLETIN

MB

0.55

0.57

0.56

0.57

0.56

0.57

29,000

16,380

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2014

Name

MLA BRDCASTING

Symbol

MBC

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

2.02

**** TELECOMMUNICATIONS ****

GLOBE TELECOM

GLO

1,651

1,652

1,650

1,654

1,650

1,652

51,490

85,018,060

(39,585,500)

LIBERTY TELECOM

LIB

1.57

1.75

1.59

1.75

1.59

1.75

2,000

3,340

PTT CORP

PLDT

PTT

TEL

2,662

2,666

2,700

2,700

2,660

2,666

145,985

389,558,550

(102,799,040)

**** INFORMATION TECHNOLOGY ****

DFNN INC

DFNN

6.84

6.84

6.84

34,800

239,905

IMPERIAL A

IMPERIAL B

ISLAND INFO

ISM COMM

IMP

IMPB

IS

ISM

4.5

0.036

1.64

4.66

52.5

0.04

1.68

4.5

1.68

4.5

1.68

4.5

1.68

4.5

1.68

1,000

-

4,500

-

6,000

10,080

MG HLDG

NEXTSTAGE

MG

NXT

0.415

2.22

0.425

2.25

0.415

2.22

0.415

2.22

0.415

2.22

0.415

2.22

60,000

8,000

24,900

17,760

TRANSPACIFIC BR

PHILWEB

TBGI

WEB

1.85

6.56

2.09

6.58

6.75

6.82

6.48

6.58

922,000

6,068,932

(2,758,773)

YEHEY CORP

YEHEY

1.11

1.19

1.11

1.11

1.11

1.11

5,000

5,550

**** TRANSPORTATION SERVICES ****

2GO GROUP

2GO

2.51

2.57

2.68

2.68

2.51

2.51

380,000

967,780

ASIAN TERMINALS

CEBU AIR

ATI

CEB

11.16

47.9

11.9

48.25

11.8

48.7

11.8

48.7

11.16

47.8

11.8

47.9

4,900

180,300

57,692

8,683,705

(3,899,880)

INTL CONTAINER

ICT

99.85

100.1

99.5

100.4

98.85

100.1

4,334,130

430,318,103

6,511,973.5

LORENZO SHIPPNG

MACROASIA

LSC

MAC

1.28

2.08

1.41

2.09

2.1

2.11

2.08

2.08

397,000

831,340

(361,220)

PAL HLDG

PAL

5.4

5.54

5.4

5.42

5.4

5.4

12,700

68,680

GLOBALPORT

HARBOR STAR

PORT

TUGS

6

1.74

8.15

1.77

1.73

1.79

1.73

1.74

127,000

221,980

85,560

**** HOTEL & LEISURE ****

ACESITE HOTEL

ACE

1.16

1.24

1.15

1.25

1.15

1.24

71,000

87,760

BOULEVARD HLDG

BHI

0.146

0.147

0.16

0.162

0.146

0.146

379,630,000

58,959,750

1,293,980

DISCOVERY WORLD

DWC

1.83

1.85

1.83

1.85

1.83

1.85

24,000

44,250

11,050

GRAND PLAZA

WATERFRONT

GPH

WPI

25.3

0.32

45

0.33

0.33

0.34

0.33

0.34

190,000

62,800

(3,400)

**** EDUCATION ****

CENTRO ESCOLAR

CEU

10.2

10.6

10.6

10.6

10.6

10.6

6,900

73,140

(73,140)

FAR EASTERN U

FEU

1,105

1,105

1,105

1,103

1,103

145

160,035

IPEOPLE

STI HLDG

IPO

STI

11.26

0.66

12.3

0.67

0.67

0.68

0.66

0.67

7,115,000

4,729,380

18.5

9.7

23

9.72

9.76

9.76

9.55

9.7

6,202,900

60,079,377

(22,209,266)

0.013

14.94

0.014

15.1

0.014

15

0.014

15.1

0.013

15

0.014

15.1

3,800,000

2,006,600

49,800

30,099,030

(30,000,000)

**** CASINOS & GAMING ****

BERJAYA

BLOOMBERRY

BCOR

BLOOM

IP EGAME

PACIFIC ONLINE

EG

LOTO

LEISURE AND RES

LR

7.88

7.89

7.8

7.88

261,900

2,056,898

1,164,300

MELCO CROWN

MCP

13.1

13.2

13.12

13.2

12.88

13.2

4,920,800

64,731,370

6,326,026

MANILA JOCKEY

PRMIERE HORIZON

PHIL RACING

TRAVELLERS

MJC

PHA

PRC

RWM

1.85

0.295

8.9

9.91

1.97

0.3

9.4

9.99

10.14

10.22

9.91

9.91

2,843,400

28,685,584

(7,625,392)

3.22

45.5

3.27

45.7

3.23

45.4

3.28

45.8

3.23

44.9

3.28

45.7

66,000

376,200

213,820

17,176,630

(32,300)

11,400,745

**** RETAIL ****

CALATA CORP

PUREGOLD

CAL

PGOLD

ROBINSONS RTL

RRHI

68

68.1

67.65

68.1

67.6

68.1

971,570

65,799,928

4,239,487.5

PHIL SEVEN CORP

SEVN

97

98.9

99

99

97

97

3,360

328,639

144,530

**** OTHER SERVICES ****

APC GROUP

APC

EASYCALL

NOW CORP

PAXYS

ECP

NOW

PAX

PHILCOMSAT

PHC

0.6

0.62

0.62

0.62

0.6

0.6

970,000

585,120

2.59

0.365

2.52

2.82

0.38

2.53

2.52

2.55

2.52

2.53

151,000

382,440

1,555,910

SERVICES SECTOR TOTAL

VOLUME :

419,628,380

VALUE :

1,278,604,677

MINING & OIL

**** MINING ****

ATOK

APEX MINING

AB

APX

15.22

3.66

17.9

3.75

3.8

3.8

3.6

3.75

425,000

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2014

Name

Symbol

Bid

Ask

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

161,000,000

373,900

2,000

780,100

5,418,518

15,000

1,109,028

-

Open

High

Low

0.0049

14.5

7.5

0.0049

14.5

7.5

0.0049

14.5

7.5

0.0048

14.46

7.5

7.4

7.6

7.34

7.4

7.34

7.4

800

5,902

0.81

0.58

0.82

0.63

0.83

0.58

0.84

0.58

0.81

0.57

0.83

0.57

525,000

320,000

433,060

183,280

(33,200)

112,290

0.0048

14.46

7.33

Close

ABRA MINING

ATLAS MINING

BENGUET A

AR

AT

BC

0.0048

14.5

7.5

BENGUET B

BCB

COAL ASIA HLDG

CENTURY PEAK

COAL

CPM

DIZON MINES

DIZ

6.2

6.4

6.53

6.53

6.2

6.2

71,600

445,130

GEOGRACE

GEO

0.41

0.415

0.41

0.41

0.41

0.41

40,000

16,400

LEPANTO A

LC

0.39

0.395

0.39

0.395

0.39

0.39

3,620,000

1,412,950

LEPANTO B

LCB

0.395

0.4

0.41

0.41

0.4

0.4

3,640,000

1,459,450

400,000

MANILA MINING A

MANILA MINING B

MARCVENTURES

MA

MAB

MARC

0.016

0.017

3.65

0.017

0.018

3.68

0.017

0.018

3.72

0.017

0.018

3.73

0.017

0.018

3.64

0.017

0.018

3.65

115,300,000

9,000,000

5,396,000

1,960,100

162,000

19,861,060

54,000

475,200

NIHAO

NICKEL ASIA

NI

NIKL

2.7

18.02

2.73

18.1

2.82

18

2.82

18.2

2.59

17.9

2.73

18.1

1,257,000

2,016,900

3,349,320

36,477,870

(170,870)

20,548,488

OMICO CORP

ORNTL PENINSULA

OM

ORE

0.38

1.59

0.39

1.6

1.6

1.6

1.59

1.59

1,062,000

1,693,240

PHILEX

PX

8.75

8.79

8.84

8.84

8.76

8.79

740,700

6,518,149

1,115,837

SEMIRARA MINING

SCC

375.8

376

380

380

374.8

376

210,810

79,239,878

(22,017,148)

UNITED PARAGON

UPM

0.01

0.011

0.011

0.011

0.011

0.011

3,800,000

41,800

0.244

0.017

0.018

0.035

5.6

0.249

0.018

0.019

0.036

5.62

0.243

0.017

0.035

5.52

0.25

0.018

0.036

5.6

0.243

0.017

0.035

5.52

0.245

0.017

0.036

5.6

260,000

11,500,000

12,200,000

200

63,650

195,800

428,100

1,112

38,500

-

8.02

8.06

8.01

8.13

8.01

8.06

64,300

518,590

418,361

**** OIL ****

BASIC PETROLEUM

ORIENTAL A

ORIENTAL B

PHILODRILL

PETROENERGY

BSC

OPM

OPMB

OV

PERC

PX PETROLEUM

PXP

MINING & OIL SECTOR TOTAL

VOLUME :

332,826,210

VALUE :

162,236,369

PREFERRED

ABC PREF

ABS HLDG PDR

ABC

ABSP

30.2

30.75

30.2

30.9

30.2

30.45

446,500

13,539,895

(11,643,015)

AC PREF A

AC PREF B

ACPA

ACPB

530

533

530

533

530

533

160

84,980

BC PREF A

DMC PREF

FGEN PREF F

FGEN PREF G

FPH PREF

GLO PREF A

GMA HLDG PDR

BCP

DMCP

FGENF

FGENG

FPHP

GLOPA

GMAP

11.5

111.5

110.1

7.82

112.4

8

8.4

8.4

7.78

7.82

145,000

1,163,340

LR PREF

PF PREF

PCOR PREF

SFI PREF

SMC PREF 2A

LRP

PFP

PPREF

SFIP

SMC2A

1.02

1,038

106.4

1.16

75.4

1.03

1,040

106.5

75.5

1.03

106.4

75.45

1.03

106.5

75.5

1.03

106.4

75.4

1.03

106.5

75.4

105,000

2,230

251,590

108,150

237,392

18,981,995

(497,970)

SMC PREF 2B

SMC PREF 2C

SMC2B

SMC2C

76

78.5

77

79.45

78.5

78.5

78.5

78.5

18,500

1,452,250

SMC PREF 1

TEL PREF HH

SMCP1

TLHH

PREFERRED TOTAL

VOLUME :

968,980

VALUE :

35,568,002

PHIL. DEPOSITARY RECEIPTS

PHIL. DEPOSIT RECEIPTS TOTAL

VOLUME :

VALUE :

WARRANTS

LR WARRANT

LRW

0.92

0.98

0.97

1.01

0.92

0.92

1,963,000

1,905,500

23,000

MEG WARRANT

MEG WARRANT 2

MEGW1

MEGW2

2.82

2.85

3.11

3.3

110,616

WARRANTS TOTAL

VOLUME :

1,963,000

VALUE :

1,905,500

SMALL & MEDIUM ENTERPRISES

MAKATI FINANCE

IRIPPLE

MFIN

RPL

SMALL & MEDIUM ENTERPRISES TOTAL

2

12.04

14.2

14.2

14.2

14.18

VOLUME :

7,800

14.18

7,800

VALUE :

110,616

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2014

Name

Symbol

Bid

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

5,690

581,800

EXCHANGE TRADED FUNDS

FIRST METRO ETF

FMETF

EXCHANGE TRADED FUNDS TOTAL

TOTAL MAIN BOARD

102.4

102.5

103

103

VOLUME :

VOLUME :

102

102.5

5,690

1,073,589,515

VALUE :

VALUE :

581,800

6,786,114,173.5

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2014

Name

Symbol

Bid

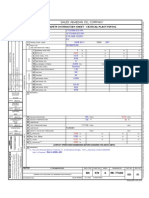

NO. OF ADVANCES:

NO. OF DECLINES:

NO. OF UNCHANGED:

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

60

94

51

NO. OF TRADED ISSUES:

NO. OF TRADES:

205

35,944

ODDLOT VOLUME:

ODDLOT VALUE:

172,190

162,237.77

BLOCK SALE VOLUME:

BLOCK SALE VALUE:

18,580,160

773,640,310.23

BLOCK SALES

SECURITY

PRICE

TEL

2,686.5662

TEL

2,686.5662

AC

565.7654

FPH

72.7718

MWC

23.7000

VLL

5.2400

AP

38.5000

VOLUME

12,000

8,000

539,820

500,000

2,050,100

8,000,000

7,470,240

VALUE

32,238,793.20

21,492,528.80

305,411,478.23

36,385,900.00

48,587,370.00

41,920,000.00

287,604,240.00

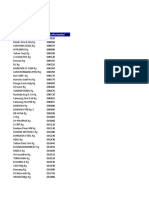

SECTORAL SUMMARY

Financials

Industrials

Holding Firms

Property

Services

Mining & Oil

SME

ETF

PSEi

All Shares

OPEN

HIGH

LOW

CLOSE

%CHANGE

PT.CHANGE

VOLUME

VALUE

1,552.03

9,883.57

5,835.98

2,426.93

1,915.3

14,371.62

1,552.03

9,883.57

5,893.42

2,427.04

1,915.3

14,379.16

1,539.33

9,748.73

5,797.1

2,401.32

1,885.77

14,238.34

1,547.11

9,803.97

5,893.42

2,410.13

1,891.65

14,276.81

(0.79)

(0.82)

0.43

(0.96)

(1.23)

(0.48)

(12.34)

(81.43)

25.09

(23.3)

(23.65)

(68.69)

9,969,774

91,892,736

62,412,578

175,489,847

419,661,036

332,902,404

7,800

5,690

740,334,639.25

2,158,494,910.77

2,174,296,440.49

991,487,176.64

1,332,362,109.96

162,249,028.38

110,616.00

581,800.00

6,423.18

3,876.48

6,423.18

3,876.48

6,343.85

3,837.67

6,391.24

3,866.72

(0.6)

(0.31)

(38.55)

(12.1)

1,092,341,865

7,559,916,721.49

GRAND TOTAL

Note: Sectoral and Grand Total include Main Board, Oddlot, and Block Sale transactions.

FOREIGN BUYING:

FOREIGN SELLING:

NET FOREIGN BUYING/(SELLING):

TOTAL FOREIGN:

Php 4,180,256,859.68

Php 3,918,379,819.92

Php 261,877,039.76

Php 8,098,636,679.60

Securities Under Suspension by the Exchange as of March 14 , 2014

ABC PREF

AC PREF A

ALPHALAND

ASIATRUST

EXPORT BANK

EXPORT BANK B

FIL ESTATE CORP

FPH PREF

FILSYN A

FILSYN B

GOTESCO LAND A

GOTESCO LAND B

METROALLIANCE A

METROALLIANCE B

MARSTEEL A

MARSTEEL B

PICOP RES

PHILCOMSAT

PRIMETOWN PROP

PNCC

PRYCE CORP

ABC

ACPA

ALPHA

ASIA

EIBA

EIBB

FC

FPHP

FYN

FYNB

GO

GOB

MAH

MAHB

MC

MCB

PCP

PHC

PMT

PNC

PPC

The Philippine Stock Exchange, Inc

Daily Quotations Report

March 14 , 2014

Name

PTT CORP

SMC PREF 1

STENIEL

TEL PREF HH

UNIWIDE HLDG

Symbol

Bid

PTT

SMCP1

STN

TLHH

UW

Ask

Open

High

Low

Close

Volume

Value, Php

Net Foreign

Buying/(Selling),

Php

Você também pode gostar

- Competition Law and Economic Regulation in Southern Africa: Addressing Market Power in Southern AfricaNo EverandCompetition Law and Economic Regulation in Southern Africa: Addressing Market Power in Southern AfricaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 06, 2014John Paul Samuel ChuaAinda não há avaliações

- The Front Office Manual: The Definitive Guide to Trading, Structuring and SalesNo EverandThe Front Office Manual: The Definitive Guide to Trading, Structuring and SalesAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 19, 2014John Paul Samuel ChuaAinda não há avaliações

- ASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesNo EverandASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 13, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 13, 2014John Paul Samuel ChuaAinda não há avaliações

- The Art of Better Retail Banking: Supportable Predictions on the Future of Retail BankingNo EverandThe Art of Better Retail Banking: Supportable Predictions on the Future of Retail BankingAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2014Documento9 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 28, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 17, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 09, 2015srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 25, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 14, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 14, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report January 09, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report January 07, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 27, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 24, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 24, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report January 02, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report January 02, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2016Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report March 07, 2016J CervAinda não há avaliações

- PSE-DAILYDocumento9 páginasPSE-DAILYMelissa BaileyAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 07, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 04, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 04, 2014John Paul Samuel ChuaAinda não há avaliações

- PSE Daily Report Philippine Stock Exchange Daily Quotations Report January 27, 2015Documento8 páginasPSE Daily Report Philippine Stock Exchange Daily Quotations Report January 27, 2015Art JamesAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 02, 2015RafaelAndreiLaMadridAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 12, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 12, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report November 03, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report November 03, 2014nadonecAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 05, 2015srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 21, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2014Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 26, 2014John Paul Samuel ChuaAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 10, 2015srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report July 26, 2016Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report July 26, 2016Paul JonesAinda não há avaliações

- Stockquotes 02042015 PDFDocumento8 páginasStockquotes 02042015 PDFsrichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report April 07, 2016Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report April 07, 2016craftersxAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Paul JonesAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report January 30, 2015srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013Documento7 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report August 15, 2013srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 03, 2015srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report July 12, 2016Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report July 12, 2016Paul JonesAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013Documento7 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report May 15, 2013srichardequipAinda não há avaliações

- Stockquotes 08162013Documento7 páginasStockquotes 08162013srichardequipAinda não há avaliações

- PSE REPORTDocumento7 páginasPSE REPORTsrichardequipAinda não há avaliações

- Stockquotes 08132013Documento7 páginasStockquotes 08132013srichardequipAinda não há avaliações

- Philippine Stock Exchange Daily Report Provides Financial Sector and Stock PerformanceDocumento7 páginasPhilippine Stock Exchange Daily Report Provides Financial Sector and Stock PerformancesrichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report August 06, 2013Documento6 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report August 06, 2013srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report July 22, 2016Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report July 22, 2016Paul JonesAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report August 08, 2013Documento6 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report August 08, 2013srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Documento7 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report October 02, 2013Ryan Samuel C. CervasAinda não há avaliações

- Stockquotes 08122013Documento7 páginasStockquotes 08122013srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013Documento7 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report May 16, 2013srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013Documento7 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report April 26, 2013srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013Documento7 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report February 18, 2013srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report March 10, 2015Documento8 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report March 10, 2015Paul JonesAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013Documento7 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report May 14, 2013srichardequipAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013Documento7 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report March 18, 2013srichardequipAinda não há avaliações

- Stockquotes 05202016Documento8 páginasStockquotes 05202016Radney BallentosAinda não há avaliações

- PSE Daily Quotations Report August 05 2013Documento6 páginasPSE Daily Quotations Report August 05 2013srichardequipAinda não há avaliações

- PSE Daily ReportDocumento7 páginasPSE Daily ReportsrichardequipAinda não há avaliações

- Definition and Details of PipesDocumento3 páginasDefinition and Details of PipesChris DeAinda não há avaliações

- General Piping DesignDocumento32 páginasGeneral Piping DesignS_hassan_16Ainda não há avaliações

- Saudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingDocumento1 páginaSaudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingChris DeAinda não há avaliações

- R 771202031 X 01Documento1 páginaR 771202031 X 01Chris DeAinda não há avaliações

- Breaking The Seduction Code PDFDocumento176 páginasBreaking The Seduction Code PDFjasiel1000Ainda não há avaliações

- Saudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingDocumento1 páginaSaudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingChris DeAinda não há avaliações

- IELTS Location 1Documento1 páginaIELTS Location 1Chris DeAinda não há avaliações

- Top 500 AdjectivesDocumento15 páginasTop 500 AdjectivesChris DeAinda não há avaliações

- Recommended Practice ProcedureDocumento3 páginasRecommended Practice ProcedureChris DeAinda não há avaliações

- Saudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingDocumento1 páginaSaudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingChris DeAinda não há avaliações

- R 771202031 X 01Documento1 páginaR 771202031 X 01Chris DeAinda não há avaliações

- R 771202031 X 01Documento1 páginaR 771202031 X 01Chris DeAinda não há avaliações

- Saudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingDocumento1 páginaSaudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingChris DeAinda não há avaliações

- Saudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingDocumento1 páginaSaudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingChris DeAinda não há avaliações

- R 771202006 X 01Documento1 páginaR 771202006 X 01Chris DeAinda não há avaliações

- R 771202031 X 01Documento1 páginaR 771202031 X 01Chris DeAinda não há avaliações

- R 771202006 X 01Documento1 páginaR 771202006 X 01Chris DeAinda não há avaliações

- R 771202031 X 01Documento1 páginaR 771202031 X 01Chris DeAinda não há avaliações

- R 771202031 X 01Documento1 páginaR 771202031 X 01Chris DeAinda não há avaliações

- R 771202031 X 01Documento1 páginaR 771202031 X 01Chris DeAinda não há avaliações

- Saudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingDocumento1 páginaSaudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingChris DeAinda não há avaliações

- Saudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingDocumento1 páginaSaudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingChris DeAinda não há avaliações

- R 771202031 X 01Documento1 páginaR 771202031 X 01Chris DeAinda não há avaliações

- Saudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingDocumento1 páginaSaudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingChris DeAinda não há avaliações

- Saudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingDocumento1 páginaSaudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingChris DeAinda não há avaliações

- R 771202031 X 01Documento1 páginaR 771202031 X 01Chris DeAinda não há avaliações

- Saudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingDocumento1 páginaSaudi Arabian Oil Company: Safety Instruction Sheet - Critical Plant PipingChris DeAinda não há avaliações

- R 771202031 X 01Documento1 páginaR 771202031 X 01Chris DeAinda não há avaliações

- R 771202031 X 01Documento1 páginaR 771202031 X 01Chris DeAinda não há avaliações

- Avolta Partners VC MA Tech Trends France Q2 2022Documento21 páginasAvolta Partners VC MA Tech Trends France Q2 2022David GoubetAinda não há avaliações

- Express Power of Corporation and RequisitesDocumento5 páginasExpress Power of Corporation and RequisiteshoneyAinda não há avaliações

- Legal Aspects of Business MCQ Questions and Answers Part - 3 - SAR PublisherDocumento8 páginasLegal Aspects of Business MCQ Questions and Answers Part - 3 - SAR PublisherPRATIK MUKHERJEEAinda não há avaliações

- 07 - Handout - 1 (5) Business LAwDocumento15 páginas07 - Handout - 1 (5) Business LAwAries Christian S PadillaAinda não há avaliações

- Dissolution and Winding Up of a PartnershipDocumento2 páginasDissolution and Winding Up of a PartnershipReniva KhingAinda não há avaliações

- Stock Acquisition - Subsequent To DOADocumento2 páginasStock Acquisition - Subsequent To DOAShekinah Grace SantuaAinda não há avaliações

- MDAXDocumento3 páginasMDAXJesu JesuAinda não há avaliações

- Lecture NotesDocumento12 páginasLecture NotesSabina Ioana AioneseiAinda não há avaliações

- Billionaries 1Documento1 páginaBillionaries 1ashishch4Ainda não há avaliações

- Deloitte - Wikipedia, The Free EncyclopediaDocumento9 páginasDeloitte - Wikipedia, The Free Encyclopediakimmu5100% (1)

- Ojiambo Kevin Lucky (Best Entrepreneurs in The World)Documento29 páginasOjiambo Kevin Lucky (Best Entrepreneurs in The World)Ijala DeograciousAinda não há avaliações

- What Is The Difference Between Restricted and Unrestricted Stock - QuoraDocumento3 páginasWhat Is The Difference Between Restricted and Unrestricted Stock - QuoraAlan PetzoldAinda não há avaliações

- Mergers, Acquisitions and Corporate RestructuringDocumento15 páginasMergers, Acquisitions and Corporate RestructuringSubrahmanya100% (2)

- VIL Begins OperationsDocumento6 páginasVIL Begins OperationsSunil JainAinda não há avaliações

- Tangerine Bank Schedule of Investments and Financial Positions.Documento44 páginasTangerine Bank Schedule of Investments and Financial Positions.OmojoAinda não há avaliações

- Advance Corporate Accounting Syllabus IDocumento2 páginasAdvance Corporate Accounting Syllabus IJøël JøëlAinda não há avaliações

- PA Agreement Ownership & RolesDocumento4 páginasPA Agreement Ownership & RolesSithmbiso100% (6)

- Company locations and industriesDocumento72 páginasCompany locations and industriessujitaAinda não há avaliações

- Auditing Share Capital: Assertions, Risks and Procedures - 1620034489284Documento8 páginasAuditing Share Capital: Assertions, Risks and Procedures - 1620034489284Farhan Osman ahmedAinda não há avaliações

- ISJ026Documento76 páginasISJ0262imediaAinda não há avaliações

- On January 1 2015 James Company Purchases 70 of TheDocumento1 páginaOn January 1 2015 James Company Purchases 70 of TheMuhammad ShahidAinda não há avaliações

- 1st Bank Approved TemplateDocumento21 páginas1st Bank Approved TemplaterahmondamilolaolamilekanAinda não há avaliações

- Regulation and CorporateDocumento20 páginasRegulation and CorporateRamesh ValasaAinda não há avaliações

- Advanced Financial Accounting (Acfn3151)Documento2 páginasAdvanced Financial Accounting (Acfn3151)alemayehu100% (4)

- Company Name Security SymbolDocumento58 páginasCompany Name Security SymbolIsmail AhmedAinda não há avaliações

- Chapter 2Documento10 páginasChapter 2Rafael GarciaAinda não há avaliações

- Entrepreneurial Finance Assignment No 1Documento6 páginasEntrepreneurial Finance Assignment No 1IBRAHIMAinda não há avaliações

- TENEZA - Corporation Law Case Digest PDFDocumento22 páginasTENEZA - Corporation Law Case Digest PDFMay Angelica TenezaAinda não há avaliações

- Inst of Directors-WCFCG Global Covention-Paper Prof J P Sharma-What Went Wrong With Satyam NewDocumento19 páginasInst of Directors-WCFCG Global Covention-Paper Prof J P Sharma-What Went Wrong With Satyam NewBastian Nugraha SiraitAinda não há avaliações

- Research Project Report of Nidhi SoniDocumento104 páginasResearch Project Report of Nidhi SoniVipin VermaAinda não há avaliações

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedNo EverandSummary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedNota: 5 de 5 estrelas5/5 (78)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeNo EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeNota: 4.5 de 5 estrelas4.5/5 (85)

- Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotNo EverandRich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotAinda não há avaliações

- The Holy Grail of Investing: The World's Greatest Investors Reveal Their Ultimate Strategies for Financial FreedomNo EverandThe Holy Grail of Investing: The World's Greatest Investors Reveal Their Ultimate Strategies for Financial FreedomNota: 5 de 5 estrelas5/5 (7)

- Bitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerNo EverandBitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerNota: 4 de 5 estrelas4/5 (52)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeNo EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeNota: 4 de 5 estrelas4/5 (1)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)No EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Nota: 4.5 de 5 estrelas4.5/5 (12)

- Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can TooNo EverandBaby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can TooNota: 5 de 5 estrelas5/5 (321)

- Summary of 10x Is Easier than 2x: How World-Class Entrepreneurs Achieve More by Doing Less by Dan Sullivan & Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisNo EverandSummary of 10x Is Easier than 2x: How World-Class Entrepreneurs Achieve More by Doing Less by Dan Sullivan & Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisNota: 4.5 de 5 estrelas4.5/5 (23)

- A Happy Pocket Full of Money: Your Quantum Leap Into The Understanding, Having And Enjoying Of Immense Abundance And HappinessNo EverandA Happy Pocket Full of Money: Your Quantum Leap Into The Understanding, Having And Enjoying Of Immense Abundance And HappinessNota: 5 de 5 estrelas5/5 (158)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNo EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNota: 5 de 5 estrelas5/5 (231)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterNo EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterNota: 5 de 5 estrelas5/5 (1)

- Summary: Trading in the Zone: Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude by Mark Douglas: Key Takeaways, Summary & AnalysisNo EverandSummary: Trading in the Zone: Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude by Mark Douglas: Key Takeaways, Summary & AnalysisNota: 5 de 5 estrelas5/5 (15)

- Financial Feminist: Overcome the Patriarchy's Bullsh*t to Master Your Money and Build a Life You LoveNo EverandFinancial Feminist: Overcome the Patriarchy's Bullsh*t to Master Your Money and Build a Life You LoveNota: 5 de 5 estrelas5/5 (1)

- The 4 Laws of Financial Prosperity: Get Conrtol of Your Money Now!No EverandThe 4 Laws of Financial Prosperity: Get Conrtol of Your Money Now!Nota: 5 de 5 estrelas5/5 (388)

- Meet the Frugalwoods: Achieving Financial Independence Through Simple LivingNo EverandMeet the Frugalwoods: Achieving Financial Independence Through Simple LivingNota: 3.5 de 5 estrelas3.5/5 (67)

- Rich Dad's Cashflow Quadrant: Guide to Financial FreedomNo EverandRich Dad's Cashflow Quadrant: Guide to Financial FreedomNota: 4.5 de 5 estrelas4.5/5 (1384)

- Financial Intelligence: How to To Be Smart with Your Money and Your LifeNo EverandFinancial Intelligence: How to To Be Smart with Your Money and Your LifeNota: 4.5 de 5 estrelas4.5/5 (539)

- How to Day Trade for a Living: A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading PsychologyNo EverandHow to Day Trade for a Living: A Beginner's Guide to Trading Tools and Tactics, Money Management, Discipline and Trading PsychologyAinda não há avaliações

- Rich Dad's Increase Your Financial IQ: Get Smarter with Your MoneyNo EverandRich Dad's Increase Your Financial IQ: Get Smarter with Your MoneyNota: 4.5 de 5 estrelas4.5/5 (643)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsNo EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsNota: 4.5 de 5 estrelas4.5/5 (94)

- Rich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together . . . FinallyNo EverandRich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together . . . FinallyNota: 4 de 5 estrelas4/5 (8)

- Napkin Finance: Build Your Wealth in 30 Seconds or LessNo EverandNapkin Finance: Build Your Wealth in 30 Seconds or LessNota: 3 de 5 estrelas3/5 (3)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumNo EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumNota: 3 de 5 estrelas3/5 (12)