Escolar Documentos

Profissional Documentos

Cultura Documentos

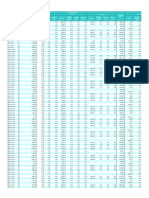

PSEi COMPANIES

Enviado por

Jeremiah GilbolingaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

PSEi COMPANIES

Enviado por

Jeremiah GilbolingaDireitos autorais:

Formatos disponíveis

As of: 10/28/2014

Price

COL

Rating

Date of

Update

COL

FV

Buy

Below

Outstanding

Shares (Mil)

Market Cap

(PhpMil)

2012

95.75

94.55

49.50

25.90

82.15

85.00

53.00

143.20

118.00

BUY

HOLD

HOLD

BUY

BUY

HOLD

N/A

BUY

HOLD

10/28/14

8/4/14

8/8/14

8/11/14

8/12/14

8/18/14

N/A

8/13/14

10/28/14

107.00

102.00

61.00

40.00

111.00

94.00

N/A

155.00

142.00

85.00

81.00

48.00

32.00

88.00

75.00

N/A

124.00

113.00

3,581

3,627

1,573

1,128

2,745

1,104

1,276

603

641

1,389,838

342,869

371,495

84,963

29,226

225,485

106,177

67,610

86,325

75,688

267,145

60,625

47,384

13,960

9,784

55,868

17,593

29,742

14,048

18,142

321,490

75,010

52,498

15,097

13,165

78,924

24,565

28,391

12,312

21,528

43.60

70.50

11.20

7.50

112.90

9.49

27.80

8.89

11.74

BUY

BUY

BUY

HOLD

HOLD

N/A

Under Review

N/A

N/A

8/14/14

9/10/14

8/18/14

9/1/14

8/8/14

N/A

1/6/14

N/A

N/A

44.60

90.00

13.70

6.71

121.50

N/A

N/A

N/A

N/A

35.00

72.00

10.90

5.30

97.00

N/A

N/A

N/A

N/A

872

599

1,036

3,361

2,034

5,824

2,047

2,400

9,375

672.50

49.50

24.45

7.43

15.14

86.55

1,014.00

58.45

14.54

4.79

772.00

73.40

BUY

N/A

BUY

BUY

Under Review

BUY

HOLD

HOLD

N/A

BUY

HOLD

N/A

8/18/14

N/A

9/25/14

8/18/14

10/16/14

8/18/14

8/18/14

8/18/14

N/A

10/10/14

8/8/14

N/A

816.00

N/A

31.60

11.50

N/A

139.80

970.00

59.53

N/A

5.91

770.00

N/A

652.00

N/A

25.00

9.20

N/A

111.00

776.00

47.00

N/A

4.70

616.00

N/A

599

5,522

10,115

7,405

13,277

608

174

7,017

10,821

26,026

796

2,377

CONCEPCION INDUSTRIAL CORPORATION

CENTURY PACIFIC FOOD INC

D&L INDUSTRIES INC

EMPERADOR INC

JOLLIBEE FOODS CORPORATION

PUREGOLD PRICE CLUB INC

PEPSI-COLA PRODUCTS PHILS. INC c

RFM CORPORATION c

ROBINSONS RETAIL HOLDINGS INC

UNIVERSAL ROBINA CORPORATION

40.00

16.02

13.52

10.58

190.50

32.55

4.68

5.07

63.90

182.80

BUY

BUY

HOLD

HOLD

HOLD

HOLD

N/A

N/A

BUY

HOLD

8/23/14

10/3/14

8/8/14

8/19/14

8/14/14

8/18/14

N/A

N/A

8/18/14

8/14/14

49.75

19.00

11.50

11.05

143.00

45.00

N/A

N/A

79.00

170.00

39.00

15.20

9.20

8.80

114.00

36.00

N/A

N/A

63.00

136.00

340

2,230

3,571

15,000

1,052

2,766

3,694

3,160

1,366

2,182

9,874,733

37,104

42,720

11,606

25,208

229,871

55,268

56,033

21,331

110,064

2,891,298

403,836

274,160

251,097

55,021

201,021

47,845

176,740

410,155

157,343

124,749

614,775

174,555

1,020,543

13,585

35,719

48,286

158,700

202,409

90,047

17,287

17,747

87,289

398,779

4,708,834

28,984

37,904

13,691

12,086

30,780

19,935

14,289

8,205

424,795

1,659,296

109,889

77,635

94,606

60,680

51,740

99,669

16,125

135,253

62,657

27,807

223,877

699,359

316,800

6,940

6,375

22,812

71,059

57,467

19,494

10,998

57,393

71,202

BELLE CORP

BLOOMBERY RESORTS CORP

LIESURE & RESORTS WORLD CORP c

MELCO CROWN PHILS RESORTS CORP

TRAVELLERS INTERNATIONAL HOTEL GROUP INC

5.10

15.02

9.46

13.60

8.92

BUY

BUY

N/A

HOLD

BUY

8/13/14

8/4/14

N/A

1/6/14

9/25/14

6.16

13.80

N/A

14.25

12.40

4.90

11.00

N/A

11.40

9.90

10,559

10,590

1,180

4,426

15,756

431,601

53,853

159,059

11,351

66,796

140,542

NICKEL ASIA CORP

PHILEX MINING CORP

SEMIRARA MINING

39.05

9.05

122.80

HOLD

HOLD

HOLD

9/25/14

8/5/14

8/20/14

41.00

10.85

140.00

32.00

8.60

112.00

2,519

4,937

1,069

ABOITIZ POWER CORP

PNOC ENERGY DEV CORP

FIRST GEN CORPORATION

MANILA ELECTRIC COMPANY

40.35

7.59

25.55

264.60

BUY

HOLD

BUY

HOLD

8/1/14

9/25/14

8/18/14

9/25/14

44.90

8.20

34.60

291.30

35.00

6.50

27.00

233.00

7,359

18,750

3,335

1,127

AYALA LAND INC

CENTURIES PROPERTIES GROUP

FILINVEST LAND INC

MEGAWORLD CORP

ROBINSONS LAND

SM PRIME HOLDINGS

VISTA LAND & LIFESCAPES INC

32.60

1.08

1.52

4.68

23.95

17.02

5.92

BUY

BUY

BUY

BUY

BUY

BUY

BUY

8/13/14

8/13/14

8/14/14

8/19/14

8/18/14

8/4/14

8/18/14

37.50

2.10

2.35

5.73

28.10

20.30

7.00

30.00

1.60

1.80

4.50

22.40

16.20

5.60

14,173

11,685

24,250

32,101

4,094

27,819

8,539

1,655.00

3,194.00

HOLD

HOLD

8/6/14

8/6/14

1,800.00

3,345.00

1,440.00

2,676.00

133

216

Ticker

Company Name

Banks and Financials

BDO

BPI

CHIB

EW

MBT

PNB

RCB

SECB

UBP

BANCO DE ORO

BANK OF PHILIPPINE ISLANDS

CHINA BANKING CORP

EASTWEST BANKING CORP

METROPOLITAN BANK & TRUST

PHILIPPINE NATIONAL BANK

RIZAL COMMERCIAL BANKING CORP c

SECURITY BANK CORP

UNION BANK OF PHILIPPINES

Commercial and Industrial

ABS

CEB

EEI

GMA7

ICT

LRI

MWC

MWIDE

PCOR

ABS-CBN BROADCASTING CORP

CEBU AIR INC

EEI CORPORATION

GMA NETWORK INC

INTL CONTAINER TERM SVCS

c

LAFARGE REPUBLIC INC

MANILA WATER COMPANY

MEGAWIDE CONSTRUCTION CORP c

c

PETRON CORP

Conglomerates

AC

AEV

AGI

COSCO

DMC

FPH

GTCAP

JGS

LTG

MPI

SM

SMC

AYALA CORPORATION

ABOITIZ EQUITY VENTURES INC c

ALLIANCE GLOBAL

COSCO CAPITAL INC

DMCI HOLDINGS INC

FIRST PHILIPPINE HLDGS

GT CAPITAL HLDGS

JG SUMMIT HLDGS

c

LT GROUP INC

METRO PACIFIC INVESTMENTS

SM INVESTMENTS CORP

c

SAN MIGUEL CORP

Consumer

CIC

CNPF

DNL

EMP

JFC

PGOLD

PIP

RFM

RRHI

URC

Gaming

BEL

BLOOM

LR

MCP

RWM

Mining

NIKL

PX

SCC

Power

AP

EDC

FGEN

MER

Property

ALI

CPG

FLI

MEG

RLC

SMPH

VLL

Telecoms

GLO

TEL

GLOBE TELECOM INC

PHILIPPINE LONG DISTANCE TEL

MARKET

PSEi

PSEi ex-TEL, GLO

*

c

Source: Bloomberg

Consensus Forecast

Revenue

2013

2014E

2015E

2012

Revenue Growth

2013

2014E

320,591

76,198

55,877

16,946

14,769

70,101

26,683

23,920

15,091

21,006

356,894

84,494

62,934

18,606

17,192

75,888

30,214

27,463

17,187

22,916

12%

11%

13%

10%

34%

14%

1%

10%

20%

10%

20%

24%

11%

8%

35%

41%

40%

-5%

-12%

19%

0%

2%

6%

12%

12%

-11%

9%

-16%

23%

-2%

11%

11%

13%

10%

16%

8%

13%

15%

14%

9%

5,433,158

33,378

41,004

10,524

12,951

36,188

23,212

15,280

10,880

463,638

1,907,024

136,941

89,570

113,206

77,180

55,971

93,308

105,547

147,633

55,792

30,863

253,293

747,720

375,042

7,588

19,023

10,766

29,865

80,283

73,177

22,462

10,240

67,254

80,995

6,024,225

32,984

51,017

11,552

11,895

45,011

25,473

17,076

11,565

493,526

2,077,357

154,309

91,546

118,612

90,154

56,976

94,818

123,135

200,986

58,258

34,661

271,278

782,624

425,516

9,433

21,843

11,655

29,888

87,257

86,070

25,040

11,996

80,075

93,534

6,730,690

36,687

57,047

12,994

13,104

49,677

28,592

18,977

13,784

567,823

2,279,781

171,498

99,906

131,454

101,024

69,638

104,471

141,503

228,974

64,612

38,844

290,342

837,515

482,547

10,819

24,319

12,523

33,681

94,524

96,335

28,557

13,200

93,996

109,730

1023%

13%

12%

56%

8%

7%

15%

19%

6%

55%

28%

27%

13%

70%

46%

8%

43%

125%

10%

92%

26%

12%

31%

17%

24%

82%

34%

14%

47%

14%

6%

19%

6%

15%

15%

8%

-23%

7%

18%

16%

7%

33%

9%

15%

25%

15%

20%

27%

8%

-6%

555%

9%

-11%

11%

13%

7%

18%

9%

69%

31%

13%

27%

15%

-7%

17%

14%

11%

-1%

24%

10%

-8%

24%

10%

12%

6%

6%

9%

13%

2%

5%

17%

2%

2%

17%

36%

4%

12%

7%

5%

13%

24%

15%

8%

0%

9%

18%

11%

17%

19%

15%

12%

11%

12%

12%

10%

10%

12%

11%

19%

15%

10%

11%

9%

11%

12%

22%

10%

15%

14%

11%

12%

7%

7%

13%

15%

11%

7%

13%

8%

12%

14%

10%

17%

17%

35,063

437

0

4,429

0

30,196

49,436

2,624

10,826

5,085

53

30,848

76,988

5,821

23,849

3,273

12,877

31,168

97,116

6,482

28,745

3,486

24,773

33,630

14%

-37%

15%

15%

41%

500%

15%

2%

56%

122%

120%

-36%

24218%

1%

26%

11%

21%

7%

92%

8%

274,671

98,718

44,711

131,243

823,410

296,920

142,313

85,948

298,230

1,284,564

462,583

12,613

36,860

150,431

98,047

473,482

50,549

909,733

219,651

690,082

18,625,720

44,455

11,607

8,698

24,150

205,916

62,153

28,369

64,471

50,923

184,891

54,705

8,804

10,685

23,630

13,515

57,215

16,336

249,479

86,446

163,033

7,627,424

48,243

11,110

9,802

27,331

235,646

72,055

25,656

81,284

56,651

219,583

76,337

9,304

10,478

27,740

15,904

59,794

20,025

254,552

90,500

164,052

8,795,932

66,565

26,023

11,089

29,452

240,647

70,751

27,949

86,144

55,803

250,848

89,829

10,985

12,759

32,558

17,414

63,639

23,664

264,782

99,015

165,767

9,680,952

88,990

37,677

12,467

38,846

266,741

78,296

35,488

95,196

57,760

284,787

102,894

12,890

14,432

36,951

19,126

70,786

27,707

280,251

110,045

170,206

10,778,806

-17%

-9%

-43%

-6%

11%

14%

16%

11%

5%

46%

33%

123%

26%

18%

6%

113%

21%

8%

6%

10%

173%

9%

-4%

13%

13%

14%

16%

-10%

26%

11%

19%

40%

6%

-2%

17%

18%

5%

23%

2%

5%

1%

15%

38%

134%

13%

8%

2%

-2%

9%

6%

-1%

14%

18%

18%

22%

17%

9%

6%

18%

4%

9%

1%

10%

34%

45%

12%

32%

11%

11%

27%

11%

4%

14%

15%

17%

13%

13%

10%

11%

17%

6%

11%

3%

11%

7,922,101

2,897,968

3,322,006

3,587,147

3,976,164

25%

15%

8%

11%

7,012,368

2,648,489

3,067,454

3,322,365

3,695,913

27%

16%

8%

11%

2015E

2012

Net Income

2013

2014E

2015E

2012

Net Income Growth

2013

2014E

2015E

2012

2013

EPS

2014E

2015E

2012

EPS Growth

2013

2014E

4.52

4.60

3.54

1.76

5.44

7.11

4.85

12.47

11.86

6.22

5.19

3.57

1.82

8.02

4.88

3.95

8.31

14.07

6.34

5.01

3.40

2.02

6.62

4.92

3.81

10.10

11.12

7.18

5.75

3.86

2.59

7.35

5.98

4.61

11.93

12.15

18%

16%

27%

1%

-30%

41%

1%

9%

12%

15%

12%

38%

13%

1%

3%

47%

-31%

-19%

-33%

19%

2.13

5.89

0.94

0.33

2.49

0.49

2.24

0.91

0.08

2.69

0.84

0.88

0.34

3.06

0.64

2.34

1.13

0.46

1.84

4.91

0.97

0.25

3.82

0.56

2.72

0.79

0.40

2.19

5.47

1.11

0.40

4.74

0.67

3.16

0.79

1.14

17.03

4.34

1.38

0.21

0.74

16.06

44.50

1.99

1.44

0.24

31.76

8.72

20.53

3.81

1.70

0.45

1.43

4.09

49.70

1.48

0.85

0.29

34.85

13.43

28.46

3.80

1.49

0.45

0.85

8.50

49.41

2.62

0.55

0.32

37.32

5.00

32.70

4.09

1.69

0.50

1.02

10.88

64.24

2.61

0.83

0.39

40.39

7.31

3.28

0.41

0.33

3.58

1.11

0.23

0.21

2.89

3.70

2.21

0.50

0.39

0.39

4.45

1.43

0.24

0.25

3.79

4.60

2.01

0.77

0.46

0.44

5.15

1.44

0.24

0.29

2.35

5.11

2.33

0.85

0.53

0.50

6.04

1.61

0.28

0.31

2.95

5.88

-12%

-32%

-1%

32%

-5%

-9%

15%

29%

34%

-90%

14%

17%

13%

17%

91%

2%

418%

67%

-38%

112%

7%

-8%

75%

50%

9%

2%

120%

14%

14%

188%

33%

149%

64%

0.05

(0.07)

0.28

(0.08)

0.42

0.35

(0.02)

0.22

(0.74)

0.17

0.19

0.56

0.70

(0.54)

0.37

0.38

0.69

1.11

0.17

0.43

0.88

0.04

17.85

0.82

0.07

21.11

4.10

0.26

19.24

6.71

0.31

26.93

3.32

0.48

1.90

15.19

2.52

0.25

0.98

15.55

2.15

0.45

1.26

15.87

2.43

0.59

1.76

18.33

0.68

0.21

0.14

0.28

1.04

0.58

0.52

0.84

0.19

0.16

0.31

1.09

0.59

0.59

0.99

0.21

0.17

0.29

1.15

0.69

0.71

1.15

0.23

0.20

0.32

1.36

0.78

0.78

77.10

169.70

87.17

179.00

97.75

183.11

104.75

187.71

322

339

361

416

78,850

14,483

16,352

5,018

1,817

15,399

4,709

5,949

7,516

7,607

95,547

22,608

18,811

5,103

2,056

22,488

5,124

5,321

5,012

9,025

93,065

23,058

19,477

5,400

2,285

18,636

6,056

4,929

6,090

7,134

106,861

26,044

22,583

6,138

2,918

20,655

7,467

6,068

7,190

7,798

23%

38%

28%

0%

5%

40%

1%

18%

12%

15%

21%

56%

15%

2%

13%

46%

9%

-11%

-33%

19%

-3%

2%

4%

6%

11%

-17%

18%

-7%

22%

-21%

15%

13%

16%

14%

28%

11%

23%

23%

18%

9%

420,564

1,581

3,572

979

1,617

6,042

2,807

5,490

1,012

1,701

159,102

10,504

23,965

13,910

1,525

9,736

9,175

6,590

13,553

12,757

5,907

24,674

26,806

22,945

426

1,012

5,000

3,727

2,719

849

676

1,200

7,763

475,674

2,146

512

916

1,667

7,318

3,647

5,752

1,396

5,247

176,114

12,778

21,027

17,218

3,332

18,937

2,350

8,640

10,098

8,669

7,565

27,446

38,053

30,341

511

744

1,399

5,831

4,672

3,959

903

788

2,745

10,045

471,885

1,528

2,976

1,010

1,206

8,657

4,009

6,719

1,429

4,189

155,427

17,054

20,959

15,182

3,332

11,263

4,766

8,612

18,420

5,936

8,341

29,705

11,858

33,784

683

1,582

1,639

6,544

5,414

3,971

892

972

3,214

11,138

579,252

1,812

3,317

1,153

1,943

9,588

4,794

7,809

1,899

11,151

180,828

19,595

22,603

17,143

3,720

13,571

6,106

11,196

18,317

8,942

10,169

32,148

17,318

39,209

790

1,898

1,878

7,522

6,354

4,460

1,036

1,100

4,030

12,829

1302%

-32%

-1%

32%

-5%

7%

14%

29%

35%

-80%

26%

12%

13%

64%

95%

1%

333%

98%

-37%

119%

17%

16%

53%

63%

9%

51%

117%

15%

76%

194%

33%

148%

67%

13%

36%

-86%

-6%

3%

21%

30%

5%

38%

208%

11%

22%

-12%

24%

118%

95%

-74%

31%

-25%

-32%

28%

11%

42%

32%

20%

38%

17%

25%

46%

6%

17%

129%

29%

-1%

-29%

481%

10%

-28%

18%

10%

17%

2%

-20%

-12%

33%

0%

-12%

0%

-41%

103%

0%

82%

-32%

10%

8%

-69%

11%

34%

113%

17%

12%

16%

0%

-1%

23%

17%

11%

23%

19%

11%

14%

61%

11%

20%

16%

33%

166%

16%

15%

8%

13%

12%

20%

28%

30%

-1%

51%

22%

8%

46%

16%

16%

20%

15%

15%

17%

12%

16%

13%

25%

15%

6,848

556

(688)

279

(33)

6,734

6,539

3,618

2,321

324

(2,463)

2,740

11,252

1,855

4,990

844

(2,371)

5,934

18,412

3,645

5,809

1,337

757

6,864

34%

177%

-868%

39%

-5%

551%

16%

-59%

72%

-49%

161%

117%

64%

96%

16%

58%

16%

8,775

2,207

209

6,359

58,557

24,426

9,002

8,012

17,117

46,444

9,038

1,849

3,431

7,299

4,239

16,203

4,386

46,940

10,275

36,665

840,249

9,915

2,054

342

7,520

45,540

18,577

4,740

5,013

17,211

52,283

11,742

1,845

3,918

8,971

4,470

16,275

5,063

50,334

11,617

38,717

932,373

18,486

10,348

1,285

6,853

47,731

15,804

8,365

5,991

17,570

59,876

14,018

2,052

4,203

9,391

4,972

19,137

6,103

52,638

13,028

39,610

925,657

28,100

16,954

1,552

9,593

56,942

17,880

11,081

7,691

20,290

67,572

16,227

2,248

4,782

10,410

5,534

21,638

6,733

54,564

13,960

40,603

1,103,639

-43%

-38%

-96%

5%

62%

13%

428%

29%

31%

27%

114%

17%

-9%

7%

79%

24%

17%

898%

-6%

139%

13%

-7%

64%

18%

-22%

-24%

-47%

-37%

1%

13%

30%

0%

14%

23%

5%

0%

15%

7%

13%

6%

11%

86%

404%

276%

-9%

5%

-15%

76%

20%

2%

15%

19%

11%

7%

5%

11%

18%

21%

5%

12%

2%

-1%

52%

64%

21%

40%

19%

13%

32%

28%

15%

13%

16%

10%

14%

11%

11%

13%

10%

4%

7%

3%

19%

362,023

409,135

398,913

462,475

22%

13%

-2%

16%

315,083

358,801

346,275

407,911

23%

14%

-3%

18%

2015E

PEG

2014E

P/BV

2014E

ROE

2014E

Div Yield

2014E

15.0

15.1

18.9

14.6

12.8

12.4

17.3

13.9

14.2

10.6

13.1

13.3

16.4

12.8

10.0

11.2

14.2

11.5

12.0

9.7

3.4

2.0

3.6

3.6

0.7

0.0

1.6

1.7

0.7

0.0

1.9

2.0

2.7

1.4

1.3

1.6

1.3

1.4

1.9

2.0

14.0

13.5

15.9

10.5

11.1

13.7

8.2

10.9

14.4

19.9

1.9%

2.2%

2.4%

2.2%

0.0%

1.2%

0.0%

1.9%

1.4%

3.7%

23.1

16.2

83.9

12.7

21.9

36.9

14.9

11.9

7.9

25.6

18.6

32.8

13.0

14.4

16.5

10.6

21.2

20.4

39.5

17.1

16.3

22.2

5.5

31.9

18.1

32.0

34.7

27.1

42.8

22.8

19.5

20.4

16.9

39.7

20.4

23.7

14.4

11.5

30.2

29.6

16.9

10.2

11.3

29.4

18.5

23.6

13.0

16.4

16.5

17.8

10.2

20.5

22.3

26.5

14.9

20.7

14.7

31.0

19.9

20.8

29.5

24.0

37.0

22.7

19.5

17.8

27.2

35.8

15.6

19.9

12.9

10.1

18.8

23.8

14.3

8.8

11.3

10.3

16.2

20.6

12.1

14.5

14.8

14.8

8.0

15.8

22.4

17.6

12.3

19.1

10.0

26.7

17.2

18.8

25.7

21.2

31.5

20.2

16.5

16.4

21.7

31.1

0.9

0.0

0.1

0.9

3.8

1.2

8.0

0.6

0.0

0.5

2.6

0.9

3.5

0.0

2.9

0.0

0.2

1.5

0.7

0.0

1.0

2.7

0.0

3.3

7.9

0.7

1.8

1.8

2.2

3.7

2.3

1.5

0.0

2.7

2.4

1.4

1.8

1.8

4.3

3.3

3.1

1.8

2.0

2.1

2.0

2.7

2.4

2.0

1.3

3.3

0.7

2.3

2.2

1.3

1.2

2.6

0.7

4.8

4.8

4.1

4.8

4.4

7.1

2.7

2.2

2.3

2.2

7.2

12.8

6.1

12.4

17.5

14.2

12.5

18.3

19.8

15.0

6.4

11.6

10.9

16.0

12.8

8.1

15.5

7.3

11.6

10.0

4.9

8.1

13.0

17.8

24.2

19.7

17.3

27.0

19.1

12.3

11.8

12.0

8.4

20.1

14.4%

1.8%

0.0%

1.8%

4.1%

0.6%

5.3%

2.9%

0.7%

0.7%

1.4%

0.7%

3.6%

1.6%

0.0%

3.2%

2.3%

0.0%

0.3%

1.1%

0.6%

1.7%

1.4%

1.3%

1.1%

0.0%

0.7%

2.1%

0.7%

0.9%

2.0%

1.3%

0.7%

1.6%

127.5

94.4

33.2

21.2

96.5

14.6

43.9

52.5

34.8

26.8

26.8

13.5

24.1

19.1

13.4

21.8

8.5

80.0

20.7

0.3

6.4

0.1

0.4

3.8

2.2

7.4

2.0

4.3

3.7

17.3

14.7

25.2

15.6

N/A

16.4

0.2%

0.4%

0.0%

2.0%

0.0%

0.0%

46%

64%

21%

40%

24%

13%

32%

40%

15%

14%

16%

9%

13%

11%

18%

13%

11%

3%

7%

3%

17%

12.7

44.4

215.5

6.9

14.4

12.2

15.8

13.4

17.4

27.1

47.9

5.1

10.9

16.7

23.0

29.1

11.3

19.1

21.5

18.8

20.6

10.9

47.6

131.2

5.8

21.0

16.0

30.1

26.2

17.0

24.5

38.8

5.6

9.5

15.2

22.0

29.0

10.0

18.0

19.0

17.8

19.5

8.7

9.5

34.8

6.4

17.9

18.8

17.0

20.4

16.7

21.9

32.9

5.1

8.7

16.1

20.8

24.7

8.4

17.4

16.9

17.4

18.7

6.0

5.8

28.8

4.6

14.4

16.6

12.8

14.5

14.4

19.2

28.3

4.7

7.8

14.5

17.6

21.8

7.6

16.9

15.8

17.0

16.0

0.2

0.1

0.3

0.5

0.9

0.0

0.3

0.6

1.9

1.7

1.9

0.5

0.8

7.2

1.8

1.6

0.6

5.4

1.8

7.3

1.8

2.2

3.4

1.9

1.9

2.5

3.1

3.3

1.1

3.6

2.4

4.3

0.8

0.7

1.4

1.9

2.7

1.0

4.9

5.1

4.9

2.5

19.5

35.4

5.6

32.0

17.0

16.2

19.1

7.4

21.3

11.3

13.6

0.2

8.4

9.6

9.8

11.0

0.1

28.7

30.6

28.4

15.5

2.4%

0.6%

0.2%

9.8%

2.2%

3.3%

1.0%

1.2%

3.6%

1.9%

1.1%

1.8%

1.9%

7.7%

1.6%

0.8%

3.0%

5.5%

5.0%

5.6%

2.1%

7%

15%

22.0

20.9

19.6

17.0

2.2

2.7

16.0

2.2%

3%

17%

22.7

20.5

20.0

17.0

2.0

2.5

13.9

1.7%

2015E

2012

2013

-5%

2%

-3%

-5%

11%

-17%

1%

-4%

22%

-21%

14%

13%

15%

14%

28%

11%

21%

21%

18%

9%

16.0

21.2

20.6

14.0

14.7

15.1

12.0

10.9

11.5

9.9

14.3

15.4

18.2

13.9

14.2

10.2

17.4

13.4

17.2

8.4

10%

26%

-86%

-6%

3%

23%

31%

4%

24%

473%

3%

21%

-12%

24%

114%

93%

-75%

12%

-26%

-41%

23%

10%

54%

22%

-32%

-5%

18%

24%

29%

4%

16%

31%

24%

13%

-32%

485%

10%

-28%

25%

-12%

16%

-30%

-13%

0%

39%

0%

-13%

0%

-41%

108%

-1%

77%

-36%

9%

7%

-63%

3%

-9%

54%

18%

13%

16%

0%

0%

14%

-38%

11%

31%

19%

11%

14%

61%

24%

19%

16%

0%

184%

14%

15%

8%

13%

12%

20%

28%

30%

-1%

51%

22%

8%

46%

16%

16%

11%

15%

14%

17%

12%

18%

9%

25%

15%

25.5

20.5

12.0

11.9

22.5

45.3

19.5

12.4

9.8

146.8

19.1

39.5

11.4

17.8

35.4

20.5

5.4

22.8

29.4

10.1

20.0

24.3

8.4

39.0

12.2

33.0

32.1

53.3

29.3

20.3

23.7

22.1

49.4

-13%

66%

-828%

40%

32%

548%

-24%

-60%

178%

-46%

225%

118%

82%

100%

23%

59%

16%

-27%

-50%

-96%

5%

118%

13%

493%

29%

5%

24%

108%

17%

-12%

-10%

-10%

25%

-15%

3%

-17%

11%

17%

-7%

64%

18%

-31%

-24%

-48%

-49%

2%

11%

24%

-9%

14%

10%

5%

0%

14%

6%

13%

5%

6%

25%

400%

277%

-9%

17%

-15%

77%

29%

2%

12%

18%

10%

9%

-6%

6%

18%

19%

3%

12%

2%

4%

14%

5%

13%

11%

P/E (x)

2014E

Você também pode gostar

- The Forex Trading Course: A Self-Study Guide to Becoming a Successful Currency TraderNo EverandThe Forex Trading Course: A Self-Study Guide to Becoming a Successful Currency TraderAinda não há avaliações

- PSEi Stock RatingsDocumento2 páginasPSEi Stock Ratingsmhon_23Ainda não há avaliações

- PSE Stock RatingsDocumento2 páginasPSE Stock RatingsSara WeissAinda não há avaliações

- Philippine Equity ResearchDocumento9 páginasPhilippine Equity ResearchgwapongkabayoAinda não há avaliações

- Days Sr. No BUY Price Sell Price Profit/ Loss Profit Percentage Profit /day PPD PercentDocumento2 páginasDays Sr. No BUY Price Sell Price Profit/ Loss Profit Percentage Profit /day PPD PercentRohan PatilAinda não há avaliações

- OVERNIGHT RATESDocumento360 páginasOVERNIGHT RATESAmanSrivastavaAinda não há avaliações

- Technical Guide: FinancialsDocumento9 páginasTechnical Guide: FinancialswindsingerAinda não há avaliações

- Brent Daily Report: Technicals Other Markets Other CommoditiesDocumento1 páginaBrent Daily Report: Technicals Other Markets Other CommoditiesSaswata MajumderAinda não há avaliações

- Delivery: Open PositionsDocumento3 páginasDelivery: Open PositionsKrishna Pradeep LingalaAinda não há avaliações

- Appendix (Step 1) : Bond Quotes Maturity Date Coupon Rate Ask PriceDocumento5 páginasAppendix (Step 1) : Bond Quotes Maturity Date Coupon Rate Ask PriceSantosh KumarAinda não há avaliações

- Philippine stock technical guideDocumento9 páginasPhilippine stock technical guidewindsingerAinda não há avaliações

- Amortizacion Del Credito: No. Período Cuotaextr Capital InterésDocumento2 páginasAmortizacion Del Credito: No. Período Cuotaextr Capital InteréstuluadigitalAinda não há avaliações

- The Philippine Stock Exchange, Inc Daily Quotations Report December 11, 2012Documento6 páginasThe Philippine Stock Exchange, Inc Daily Quotations Report December 11, 2012srichardequipAinda não há avaliações

- Input Derived: T Cash Flows PVCF PVCF T T (T+1)Documento8 páginasInput Derived: T Cash Flows PVCF PVCF T T (T+1)kanak257Ainda não há avaliações

- Derivative FuturesDocumento2 páginasDerivative FuturesShankar VasuAinda não há avaliações

- Daily Calls: ICICI Securities LTDDocumento14 páginasDaily Calls: ICICI Securities LTDAnujAsthanaAinda não há avaliações

- Technical Guide: FinancialsDocumento9 páginasTechnical Guide: FinancialswindsingerAinda não há avaliações

- Technical Guide: FinancialsDocumento9 páginasTechnical Guide: FinancialswindsingerAinda não há avaliações

- Break Even Analysis: Units Price Total Revenue Fixed Cost Variable Cost Total Cost Net Profit/ (Loss)Documento6 páginasBreak Even Analysis: Units Price Total Revenue Fixed Cost Variable Cost Total Cost Net Profit/ (Loss)Waqas MohiuddinAinda não há avaliações

- Manila Standard Today - Business Daily Stocks Review (March 14, 2013)Documento1 páginaManila Standard Today - Business Daily Stocks Review (March 14, 2013)Manila Standard TodayAinda não há avaliações

- Multi Bintang Indonesia TBK.: Company Report: July 2015 As of 31 July 2015Documento3 páginasMulti Bintang Indonesia TBK.: Company Report: July 2015 As of 31 July 2015Anton SocoAinda não há avaliações

- FSS Daily Market Summary, Monday, December 14, 2015Documento4 páginasFSS Daily Market Summary, Monday, December 14, 2015jaymidas_320416395Ainda não há avaliações

- KLSE Stock Screener PDFDocumento4 páginasKLSE Stock Screener PDFleekiangyenAinda não há avaliações

- Soft 07Documento6 páginasSoft 07ishara-gamage-1523Ainda não há avaliações

- Daily Trade Targ 10.00%: Broker Deposit Profit (USD) % R&R Profit (RM)Documento36 páginasDaily Trade Targ 10.00%: Broker Deposit Profit (USD) % R&R Profit (RM)tengkurakAinda não há avaliações

- FX Rate Sheet 2011-12-09Documento1 páginaFX Rate Sheet 2011-12-09Noor Ul Huda AshrafAinda não há avaliações

- Detailed StatementDocumento1 páginaDetailed StatementAdiRiskiyantoAinda não há avaliações

- Daily CallsDocumento7 páginasDaily CallsparikshithbgAinda não há avaliações

- Currency Insight 20120928101056Documento3 páginasCurrency Insight 20120928101056snehakopadeAinda não há avaliações

- EIH DataSheetDocumento13 páginasEIH DataSheetTanmay AbhijeetAinda não há avaliações

- Ambika - 13 jul-WPS OfficeDocumento6 páginasAmbika - 13 jul-WPS OfficekedarkAinda não há avaliações

- Investment Funds Monitor - 05-14-12Documento2 páginasInvestment Funds Monitor - 05-14-12Adrian GalangAinda não há avaliações

- S.No Year Acquirer TargetDocumento41 páginasS.No Year Acquirer Targetsrinu VasuAinda não há avaliações

- PSE Daily ReportDocumento7 páginasPSE Daily ReportsrichardequipAinda não há avaliações

- Gujarat Industries Power CompanyDocumento17 páginasGujarat Industries Power CompanySunmeet HalkaiAinda não há avaliações

- 6th March Exp 7th Mar Spot 11053 Fut Mar 11081 CallsDocumento169 páginas6th March Exp 7th Mar Spot 11053 Fut Mar 11081 CallsdineshAinda não há avaliações

- 11 March 15 DailycallsDocumento15 páginas11 March 15 DailycallsdineshganAinda não há avaliações

- National Stock ExchangeDocumento8 páginasNational Stock ExchangeCA Manoj GuptaAinda não há avaliações

- Financial Highlights MCBDocumento2 páginasFinancial Highlights MCBMuzammil HassanAinda não há avaliações

- Trading Journal TemplateDocumento39 páginasTrading Journal TemplateVariety VideosAinda não há avaliações

- Crox 20110728Documento2 páginasCrox 20110728andrewbloggerAinda não há avaliações

- BFSI Peer ComparisonDocumento8 páginasBFSI Peer ComparisonTejas PatilAinda não há avaliações

- Daily Calls: ICICI Securities LTDDocumento15 páginasDaily Calls: ICICI Securities LTDnectars59Ainda não há avaliações

- Profit & Loss Rs. in Crores)Documento4 páginasProfit & Loss Rs. in Crores)Gobinathan Rajendra PillaiAinda não há avaliações

- FX Foreign Exchange Rate SheetDocumento1 páginaFX Foreign Exchange Rate SheetSerah JavaidAinda não há avaliações

- Dailycalls 26Documento7 páginasDailycalls 26Shrikant KalantriAinda não há avaliações

- Exchange Rate 07 February 2023Documento2 páginasExchange Rate 07 February 2023Faisal MahbubAinda não há avaliações

- AirtelDocumento3 páginasAirtelAkhil JayathilakanAinda não há avaliações

- Manila Standard Today - Business Weekly Stock Review (October 27 - 31, 2014)Documento1 páginaManila Standard Today - Business Weekly Stock Review (October 27 - 31, 2014)Manila Standard TodayAinda não há avaliações

- EGX (30) Index: Trend Close CHG % CHG S/L 23-Oct-13Documento3 páginasEGX (30) Index: Trend Close CHG % CHG S/L 23-Oct-13api-237717884Ainda não há avaliações

- Daily Calls: ICICI Securities LTDDocumento16 páginasDaily Calls: ICICI Securities LTDxytiseAinda não há avaliações

- Valuation Guide 05th November 2014Documento13 páginasValuation Guide 05th November 2014janitha_dAinda não há avaliações

- EGX (30) Index: Trend Close CHG % CHG S/L 12-Nov-13Documento3 páginasEGX (30) Index: Trend Close CHG % CHG S/L 12-Nov-13api-237717884Ainda não há avaliações

- Profit & Loss Statement of Company Over 5 YearsDocumento1 páginaProfit & Loss Statement of Company Over 5 YearsAnwin KarimAinda não há avaliações

- Technical Analysis Signals Summary Sheet 2-11-03 13Documento14 páginasTechnical Analysis Signals Summary Sheet 2-11-03 13Randora LkAinda não há avaliações

- Daily Calls: SensexDocumento7 páginasDaily Calls: Sensexdrsivaprasad7Ainda não há avaliações

- EGX (30) Index: Trend Close CHG % CHG S/L 29-Oct-13Documento3 páginasEGX (30) Index: Trend Close CHG % CHG S/L 29-Oct-13api-237717884Ainda não há avaliações

- Morning Call Morning Call: Markets Snaps 3-Day Losing StreakDocumento4 páginasMorning Call Morning Call: Markets Snaps 3-Day Losing StreakrcpgeneralAinda não há avaliações

- Nama SPV Rayon Nama MR KUM 2020 Act Sales: TargetDocumento56 páginasNama SPV Rayon Nama MR KUM 2020 Act Sales: TargetRIKI RIKARDOAinda não há avaliações

- Helukabel Cables & Wires 2012 2013 PDFDocumento1.124 páginasHelukabel Cables & Wires 2012 2013 PDFJeremiah GilbolingaAinda não há avaliações

- Generator Start Up Checklist 1 0Documento2 páginasGenerator Start Up Checklist 1 0quynh_nguyen017724Ainda não há avaliações

- How To Prepare Schedule of Loads - Electrical Axis PDFDocumento9 páginasHow To Prepare Schedule of Loads - Electrical Axis PDFJeremiah GilbolingaAinda não há avaliações

- Generator Sizing - A Step by Step Guide - Power Electrics PDFDocumento5 páginasGenerator Sizing - A Step by Step Guide - Power Electrics PDFJeremiah GilbolingaAinda não há avaliações

- Carrefour Publication Oct 2014Documento4 páginasCarrefour Publication Oct 2014Jeremiah GilbolingaAinda não há avaliações

- Fire Pump Installation RequirementsDocumento48 páginasFire Pump Installation Requirementsczds6594Ainda não há avaliações

- Generator Sizing - How To Determine What Size Generator You Need - Generator Information PDFDocumento4 páginasGenerator Sizing - How To Determine What Size Generator You Need - Generator Information PDFJeremiah GilbolingaAinda não há avaliações

- How to Size Generators for Motors and AppliancesDocumento5 páginasHow to Size Generators for Motors and AppliancesJeremiah GilbolingaAinda não há avaliações

- Generator Sizing Guide: Technical Data TD00405018EDocumento16 páginasGenerator Sizing Guide: Technical Data TD00405018EComsip400Ainda não há avaliações

- 5-10T CivilDocumento1 página5-10T CivilJeremiah GilbolingaAinda não há avaliações

- Regulatory, Warning and Informative Traffic SignsDocumento14 páginasRegulatory, Warning and Informative Traffic SignsOrbe JeromeAinda não há avaliações

- TKT65xxC-1 TeknowareDocumento1 páginaTKT65xxC-1 TeknowareJeremiah GilbolingaAinda não há avaliações

- Ape FINAL2 STARTER Trading PCA3Documento1 páginaApe FINAL2 STARTER Trading PCA3Jeremiah GilbolingaAinda não há avaliações

- Carrefour Publication Oct 2014Documento4 páginasCarrefour Publication Oct 2014Jeremiah GilbolingaAinda não há avaliações

- PSEi COMPANIESDocumento2 páginasPSEi COMPANIESJeremiah GilbolingaAinda não há avaliações

- Carrefour Publication Oct 2014Documento4 páginasCarrefour Publication Oct 2014Jeremiah GilbolingaAinda não há avaliações

- Saudi Traffic Violations & Penalties CategoriesDocumento2 páginasSaudi Traffic Violations & Penalties CategoriesJeremiah GilbolingaAinda não há avaliações

- KSA Project Electrical Dept Material RequestDocumento2 páginasKSA Project Electrical Dept Material RequestJeremiah GilbolingaAinda não há avaliações

- NEC 2011 - Table 314.16 (A) Metal BoxesDocumento1 páginaNEC 2011 - Table 314.16 (A) Metal BoxesJeremiah Gilbolinga100% (5)

- MOI - Iqama System ViolationDocumento6 páginasMOI - Iqama System ViolationJeremiah GilbolingaAinda não há avaliações

- MOI - Alien VisasDocumento1 páginaMOI - Alien VisasJeremiah GilbolingaAinda não há avaliações

- The Scope of The Great Commission - ScopeDocumento3 páginasThe Scope of The Great Commission - ScopeJeremiah GilbolingaAinda não há avaliações

- Yongnuo RF-603Documento32 páginasYongnuo RF-603Jeremiah GilbolingaAinda não há avaliações

- Science, Technology, and Society 1Documento73 páginasScience, Technology, and Society 1Lala BubAinda não há avaliações

- Comparing views on Philippine historyDocumento4 páginasComparing views on Philippine historyJohn Ramirez100% (1)

- Masuso Spring ResortDocumento2 páginasMasuso Spring ResortWil AlgonesAinda não há avaliações

- Congressman JV Ejercito profileDocumento10 páginasCongressman JV Ejercito profilecucangAinda não há avaliações

- 2023 Division SHS Expo Activity MatrixDocumento3 páginas2023 Division SHS Expo Activity MatrixJohna Rose Resueño LavegaAinda não há avaliações

- Dulag, LeyteDocumento2 páginasDulag, LeyteSunStar Philippine NewsAinda não há avaliações

- Philippines Under Spanish Rule: A 333-Year ColonyDocumento15 páginasPhilippines Under Spanish Rule: A 333-Year ColonyJanelou PalenAinda não há avaliações

- Final Output in Social Science: Submitted byDocumento9 páginasFinal Output in Social Science: Submitted byRodmel Pantoja AmorinAinda não há avaliações

- A Schematic Diagram On The Changes of RA 8042 As Amended by RA 10022Documento29 páginasA Schematic Diagram On The Changes of RA 8042 As Amended by RA 10022Kristian Caumeran100% (1)

- HistoryDocumento11 páginasHistoryAbby BonggalAinda não há avaliações

- External Criticism On The Kartilya NG KatipunanDocumento3 páginasExternal Criticism On The Kartilya NG KatipunanPolai Aquino83% (6)

- Anthropometry and Its Role in Different Architectural SceneDocumento5 páginasAnthropometry and Its Role in Different Architectural SceneJOHN PATRICK BULALACAOAinda não há avaliações

- Top Architectural Firms in The PhilippinesDocumento11 páginasTop Architectural Firms in The Philippinesawesome bloggersAinda não há avaliações

- Rizal in Hong KongDocumento3 páginasRizal in Hong KongMichelle Gabriel QuiambaoAinda não há avaliações

- Sample Corporate ResumeDocumento2 páginasSample Corporate ResumeshairaAinda não há avaliações

- How Religion Hinders/Promotes Nation BuildingDocumento5 páginasHow Religion Hinders/Promotes Nation BuildingJoseph GariandoAinda não há avaliações

- The Intellectualization of Filipino - National Commission For Culture and The ArtsDocumento5 páginasThe Intellectualization of Filipino - National Commission For Culture and The ArtsElaineManinangAinda não há avaliações

- Political Law Review Syllabus Executive DepartmentDocumento4 páginasPolitical Law Review Syllabus Executive DepartmentClaudine SumalinogAinda não há avaliações

- Japanese Colonial PeriodDocumento19 páginasJapanese Colonial Periodjoanna reignAinda não há avaliações

- Chapter 1 2 RizalDocumento5 páginasChapter 1 2 RizalCherry BenitezAinda não há avaliações

- Drafting of the Biak-na-Bato Constitution discussedDocumento3 páginasDrafting of the Biak-na-Bato Constitution discussedRoxanne Salazar AmpongAinda não há avaliações

- Bonifacio EssayDocumento1 páginaBonifacio EssaynorielAinda não há avaliações

- Local History Kawit CaviteDocumento4 páginasLocal History Kawit Cavitegerald domingoAinda não há avaliações

- Literature ScrapbookDocumento3 páginasLiterature ScrapbookEmaniel GorgonioAinda não há avaliações

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocumento2 páginasCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsAinda não há avaliações

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocumento2 páginasCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsAinda não há avaliações

- Agung # 4 (August) 2015Documento36 páginasAgung # 4 (August) 2015Juno100% (1)

- Prelim-Reviewer SS032Documento4 páginasPrelim-Reviewer SS032Armstrong NevalgaAinda não há avaliações

- The Filipino Family in An Age of Complexity: News and EventsDocumento3 páginasThe Filipino Family in An Age of Complexity: News and EventsiRiseWithTheTheSunAinda não há avaliações

- Philippine Literature During the Third RepublicDocumento42 páginasPhilippine Literature During the Third RepublicRam Lloyd Suello100% (1)