Escolar Documentos

Profissional Documentos

Cultura Documentos

Paying Off A Mortgage - Answers

Enviado por

api-2715764740 notas0% acharam este documento útil (0 voto)

37 visualizações6 páginasTítulo original

paying off a mortgage - answers

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

DOCX, PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

37 visualizações6 páginasPaying Off A Mortgage - Answers

Enviado por

api-271576474Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato DOCX, PDF, TXT ou leia online no Scribd

Você está na página 1de 6

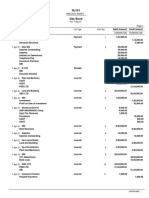

Paying Off A Mortgage

2) Answer the following questions:

a) How much loan would be paid off after 8 months?

Answer: $2050

b) How much will be repaid in total after 8 months?

Answer: $2000 x 8 = $16000

c) Hence, how much interest will be paid after 8 months?

Answer: $16000 - $2050 = $13950

d) How long will it take Deb to pay off the loan?

Answer: 299 months = 24.9 years

e) How much will Deb pay in total?

Answer: $596204

3) Explain why the principal repayment increases as time

goes by.

Answer: Principal repayment increases since there is

interest. The longer time it takes to repay the whole loan,

the more you have to pay since the interest also has to

be paid.

4) Suppose that after 10 years, Deb can afford to

increase her monthly repayments, and wishes to repay

$2500 per month. Enter 120 in cell E4 (since 120 months 10

years) and 2500 in cell E5. Scroll down, and you should

notice that the repayments increase to $2500 after 120

months.

(a) i) How long will it take to pay off the loan?

Answer: 241 months.

ii) How much will Deb have to pay in total?

Answer: $541674

(b) Repeat (a), if the increase in repayments takes place

after 2 years instead of 10 years.

(i) How long will it take to pay off the loan?

Answer: 189 months

(ii) How much will Deb have to pay in total?

Answer: $458359

5) Suppose after 15 years, Deb wins $10000 in the lottery,

and wishes to make a lump sum payment off the loan with

her winnings.

Remove the repayment change data in cells E4 and E5,

and enter 180 into cell F4, and 10000 into cell F5.

Scroll down, you should notice that the principal decreases

by $10000 after 180 months.

(a) i) How long will it take to repay the loan now?

Answer: 288 months.

ii) How much will Deb have to pay in total?

Answer: $584198

iii) How much will be saved by making the lump sum

payment?

Answer: $596204 - $584198 = $12006

(b) Repeat (a), if the lump sum payment is made after 5

years.

i)

How long will it take to repay the loan now?

Answer: 274 months

ii)

How much will Deb have to pay in total?

Answer: $557720

iii)

How will be saved in making the lump sum

payment?

Answer: $596204 - $557720 = $38484

2nd Answer: $584198 - $557720 = $26478

(c) Explain why the scenario in (b) results in a larger

saving.

Answer: This is because Deb paid the lump sum payment

after 5 years, whereas in (a), the lump sum payment is done

after 15 years and the longer it takes to repay the loan the

more the money to be paid. Meanwhile in 2), there is no

lump sum payment.

6)

(a) Suppose that, instead of $2000 payments, Deb wishes to

make payments so that the loan is paid off in 20 years.

i)

Based on your answer to 2(d), will the payments

need to be higher or lower than $2000?

Answer: The payments have to be higher than $2000.

ii)

Erase the lump sum payment data in cells F4 and

F5. Use trial and error on the repayment in cell B5 to

find the repayment such that the loan is paid off in

20 years.

Answer: 20 years = x months

1 year = 12 months

20 x 12 = 240 months

Deb has to pay $2155 to pay off the loan in 20 years.

iii)

How much will Deb have to pay in total?

Answer: $516433

(b) After 10 years, the interest rate increases by 0.25% to 8.65%

p.a. Enter 120 into cell G4, and 8.65% into G5.

i) How long will it take Deb to pay off the loan?

Answer: 311 months.

ii) How much will Deb have to pay in total?

Answer: $607152

c) Usually, when the interest rate rises, the monthly payment

increases accordingly such that the term of the loan

remains unchanged. Use trial and error method to find the

new repayments.

Answer: 24.9 years = 299 months

Monthly payment to be done in 299 months

So, monthly payment = $2025

Due to the interest rise, Deb has to pay $2025 per month

after 120 months since the interest raised after 120 months =

10 years.

d) By how much have the monthly repayments increased as

a result of interest rate rise?

Answer: The monthly payment has increases by $25 per

month.

7) Many banks offer honeymoon rates, whereby the

interest rate is very low initially, but increases after a short

while. In competition to a constant rate of 8.4% p.a.,

another bank offers Deb a honeymoon rate of 6.95%p.a. for

the first 12 months, and then 8.6% p.a. after that. Assuming

Deb takes 25 years to complete paying off her loan of

$250000, show manually the calculation using compound

interest formula that she will have to pay more money if she

borrows from the bank offering honeymoon rate.

Answer: I = 250000 x 1 x 6.95 / 100 = $17375

$250000 + $17375 = $267375

Compound Interest A = P (1 + i/100) n.

250000 ( 1 + 8.6/100)24

= $1 810 738.83 + 267375 = $ 2 078 113.83

More money paid = $ 2 078 113.83 - $596204

= $1 481 909.83

Você também pode gostar

- Running Pace AnalysisDocumento3 páginasRunning Pace Analysisapi-271576474Ainda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Business SummativeDocumento40 páginasBusiness Summativeapi-271576474Ainda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Sannis Final Pe Assessment Use This OneeeeDocumento48 páginasSannis Final Pe Assessment Use This Oneeeeapi-271576474Ainda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Dats PLC - FinalDocumento19 páginasDats PLC - Finalapi-271576474Ainda não há avaliações

- SemioticsDocumento20 páginasSemioticsapi-271576474Ainda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Dance Essay q1Documento2 páginasDance Essay q1api-271576474Ainda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Odd White LightDocumento1 páginaThe Odd White Lightapi-271576474Ainda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Chemistry Lab ReportDocumento8 páginasChemistry Lab Reportapi-271576474100% (9)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Banking Crisis in IndiaDocumento3 páginasBanking Crisis in IndiaLado BahadurAinda não há avaliações

- Invoice Statement C245713 2021 02 02 0645 PDFDocumento3 páginasInvoice Statement C245713 2021 02 02 0645 PDFAnnie LamAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Acct Statement XX3567 28112023Documento80 páginasAcct Statement XX3567 28112023hareshpadhiyar4646Ainda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Ritesh Kumar Nimish Bansal Ankur Mittal Shwetab KumarDocumento14 páginasRitesh Kumar Nimish Bansal Ankur Mittal Shwetab KumardhikejuAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Product Variants - CA Biz Elite/CA Biz - Premium /CA Biz-Advantage /CA Biz-Standard/ CA - SELDocumento4 páginasProduct Variants - CA Biz Elite/CA Biz - Premium /CA Biz-Advantage /CA Biz-Standard/ CA - SELVikram JhaAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- ' 19285537 Mr. Sai Krithik V.: ICICI Pru Savings Suraksha-LPDocumento2 páginas' 19285537 Mr. Sai Krithik V.: ICICI Pru Savings Suraksha-LPvinothmcakmdAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Wise Transaction Invoice Transfer 934057029 2319312755 enDocumento2 páginasWise Transaction Invoice Transfer 934057029 2319312755 enbouamara.ferhat1515Ainda não há avaliações

- 1 PDFDocumento4 páginas1 PDFVishal BawaneAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Axis Bank and Canara Bank ProductsDocumento12 páginasAxis Bank and Canara Bank ProductsManveeAinda não há avaliações

- Drozynski Maciej FinalDocumento2 páginasDrozynski Maciej FinalITAinda não há avaliações

- GO2Bank Template 2Documento5 páginasGO2Bank Template 2Roger kelly71% (14)

- Cash SeatworkDocumento3 páginasCash SeatworkRed TigerAinda não há avaliações

- Kashmir Avenue ChallanDocumento1 páginaKashmir Avenue ChallanDr Kashif's Cosmetic Laser ClinicAinda não há avaliações

- PFG Credit Card Design Solution-Part 2 Gaurav ChaturvediDocumento4 páginasPFG Credit Card Design Solution-Part 2 Gaurav Chaturvedikkiiidd0% (1)

- Treasury Management in BankDocumento58 páginasTreasury Management in BanknetraAinda não há avaliações

- Fin103 COPY SWIFTDocumento1 páginaFin103 COPY SWIFTbenzainvestcorporateAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Excel Skills - Loan Calculation & Analysis TemplateDocumento57 páginasExcel Skills - Loan Calculation & Analysis TemplateCyprienAinda não há avaliações

- 3rd Eye Capital - Exec SummaryDocumento1 página3rd Eye Capital - Exec SummarygahtanAinda não há avaliações

- TestbankDocumento3 páginasTestbankMarizMatampaleAinda não há avaliações

- Financial Markets and Institutions: Ninth Edition, Global EditionDocumento69 páginasFinancial Markets and Institutions: Ninth Edition, Global EditionAB123100% (1)

- All Products Payout Structure Dec'23 13Documento8 páginasAll Products Payout Structure Dec'23 13Albert PeterAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- LIC AAO 2016 Capsule by AffairscloudDocumento84 páginasLIC AAO 2016 Capsule by AffairscloudRamesh RyAinda não há avaliações

- Master Fee Protection AgreementDocumento3 páginasMaster Fee Protection AgreementAdewale A100% (2)

- Day Book 2Documento2 páginasDay Book 2The ShiningAinda não há avaliações

- Icelandic Finanical CrisisDocumento3 páginasIcelandic Finanical CrisisAman BurmanAinda não há avaliações

- Bank Terms RDocumento16 páginasBank Terms RVinay SonkhiyaAinda não há avaliações

- MF-Reference MaterialDocumento69 páginasMF-Reference MaterialRESHMA AJITH RCBSAinda não há avaliações

- State Bank of India - Fema Form - For Stucked PaymentDocumento2 páginasState Bank of India - Fema Form - For Stucked PaymentRishabh Thakur100% (2)

- E StatementDocumento5 páginasE StatementVarun Kumar BawaAinda não há avaliações

- Lines of Credit: Key TakeawaysDocumento2 páginasLines of Credit: Key TakeawaysKurt Del RosarioAinda não há avaliações