Escolar Documentos

Profissional Documentos

Cultura Documentos

Eligible Fees Reference # Fee Amount Eligible Amount: Tuition Tax Credit Receipt - Examination Fees

Enviado por

vugar74Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Eligible Fees Reference # Fee Amount Eligible Amount: Tuition Tax Credit Receipt - Examination Fees

Enviado por

vugar74Direitos autorais:

Formatos disponíveis

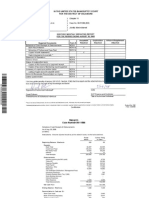

MEDICAL COUNCIL OF CANADA

2283 St. Laurent Blvd., Suite 100 Ottawa, ON K1G 5A2

Tuition tax credit receipt Examination fees

For Taxation Year 2013

Candidate Code

Candidate Name

Address

Receipt #: 233

2012021586

Vugar Aghazada

572 Panora Way NW

Calgary AB T3K-0N8

Eligible Fees

Reference #

Fee Amount

Exam Fee (MCCQE Part I Spring 2013)

714780

$920

Exam Fee (MCCQE Part I Fall 2013)

733795

$920

Sub-total

$1,840

Eligible Amount

$1,840

The following Ancillary fees and charges paid in respect of professional examinations are eligible for a tax credit to a cumulative maximum of

$250.

Ancillary Fees

Reference #

Fee Amount

Eligible Amount

Total Eligible Amount

$1,840

Sub-total

IT IS HEREBY CERTIFIED:

THAT, out of the total fees paid for the examination(s), the sum [identified above as the Total Eligible Amount] constitutes the

amount of eligible fees paid for purposes of paragraph 118.5(1)(d) of the Income Tax Act;

THAT the examination is required to obtain a professional status recognized by federal or provincial statute or to be licensed or

certified as a tradesperson where that status, license or certification allows the person to practice the profession or trade in Canada;

THAT no part of the above amount was levied for travel, parking, equipment of enduring value, or any charges other than examination

fees and ancillary fees (for example, the cost of examination materials used during the examination, such as identification cards and

certain prerequisite study materials).

February 22, 2014

Karen Meades, CPA CA

Chief Financial Officer

Date

Você também pode gostar

- Federal Income Tax: a QuickStudy Digital Law ReferenceNo EverandFederal Income Tax: a QuickStudy Digital Law ReferenceAinda não há avaliações

- Sharath Chandra 123 Merrimac ST Lowr BUFFALO NY 14214-1125: Budget PlanDocumento2 páginasSharath Chandra 123 Merrimac ST Lowr BUFFALO NY 14214-1125: Budget PlanSharath ChandraAinda não há avaliações

- Oakland Domain Awareness Center - Invoice Binder Scan 11-06-13 (June 2013) 208pgsDocumento208 páginasOakland Domain Awareness Center - Invoice Binder Scan 11-06-13 (June 2013) 208pgsoccupyoaklandAinda não há avaliações

- Electricity Bill Guide - 2Documento3 páginasElectricity Bill Guide - 2mansAinda não há avaliações

- Invoice: For Inquiry Please Quote: Thomson Reuters Contact For Billing InquiryDocumento4 páginasInvoice: For Inquiry Please Quote: Thomson Reuters Contact For Billing InquiryBrian PetersAinda não há avaliações

- Mynpower Bill 20 11 2013 PDFDocumento5 páginasMynpower Bill 20 11 2013 PDFJaved HussainAinda não há avaliações

- Chase Bank StatementDocumento1 páginaChase Bank StatementMiles PrevitireAinda não há avaliações

- PSL35Documento2 páginasPSL35musaismail8863Ainda não há avaliações

- Assessment ADCDocumento1 páginaAssessment ADCsanjose_guruAinda não há avaliações

- Migration Skills Assessment - Engineers AustraliaDocumento5 páginasMigration Skills Assessment - Engineers AustraliaamrezzatAinda não há avaliações

- Att Bill May 2012Documento4 páginasAtt Bill May 2012Kim Gardner100% (1)

- CA NoDocumento3 páginasCA NoGrish ChandraAinda não há avaliações

- Admin Review February 20121Documento1 páginaAdmin Review February 20121Sabbir IsmailAinda não há avaliações

- Admin ReviewDocumento1 páginaAdmin ReviewAcca Fia TuitionAinda não há avaliações

- 3 15 13 Online JournalDocumento65 páginas3 15 13 Online JournalMark ReinhardtAinda não há avaliações

- Examination and Service Fees - Medical Council of Canada - Le Conseil Médical Du CanadaDocumento3 páginasExamination and Service Fees - Medical Council of Canada - Le Conseil Médical Du CanadaJimmyTungAinda não há avaliações

- WSP-06 FeeSched Rev3Documento2 páginasWSP-06 FeeSched Rev3Leila Brenda ChAinda não há avaliações

- Uniform CPA Examination HandbookDocumento30 páginasUniform CPA Examination HandbookHermione PotterAinda não há avaliações

- Invoice: Consultants (Guy) IncDocumento3 páginasInvoice: Consultants (Guy) Incdale2741830Ainda não há avaliações

- Application For An Electrician's Licence Endorsed Electrical Fitting Work Only (Qualifications Gained Overseas)Documento3 páginasApplication For An Electrician's Licence Endorsed Electrical Fitting Work Only (Qualifications Gained Overseas)Vijender KumarAinda não há avaliações

- 1 30 13 Online JournalDocumento47 páginas1 30 13 Online JournalMark ReinhardtAinda não há avaliações

- Reegistro para La Licencia de Electricista NZDocumento2 páginasReegistro para La Licencia de Electricista NZargelbarajas100% (1)

- Proforma 2nd List of Excess and SurrendersDocumento5 páginasProforma 2nd List of Excess and SurrendersMuizz HaiderAinda não há avaliações

- FS Challenge Certificate Assessment Guideline Oct 04 2022Documento1 páginaFS Challenge Certificate Assessment Guideline Oct 04 2022harleydavidson103rmAinda não há avaliações

- 2 15 13 Online JournalDocumento71 páginas2 15 13 Online JournalMark ReinhardtAinda não há avaliações

- The Dha PSVDocumento2 páginasThe Dha PSVHengameh JavaheryAinda não há avaliações

- Application For An Electrician's Licence: (Qualifications Gained Overseas)Documento3 páginasApplication For An Electrician's Licence: (Qualifications Gained Overseas)Vijender KumarAinda não há avaliações

- Invoice Copy: KET For Schools-093/2019Documento1 páginaInvoice Copy: KET For Schools-093/2019Mark Byncent Mejorada BayugaAinda não há avaliações

- Asnt ApplicationDocumento6 páginasAsnt Applicationeldobie3Ainda não há avaliações

- Cfse CFSP Price Guide 2016Documento2 páginasCfse CFSP Price Guide 2016Vidaflor Cabada LaraAinda não há avaliações

- V. N. Hari,: Sudhakar & Kumar AssociatesDocumento28 páginasV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaAinda não há avaliações

- Canadian Council of Technicians AndtechnologistsDocumento7 páginasCanadian Council of Technicians AndtechnologistsHenry Vladimir AcostaAinda não há avaliações

- 2013 08 22 SSG Treasurers ReportDocumento2 páginas2013 08 22 SSG Treasurers Reportapi-234198781Ainda não há avaliações

- AB-088 Application For In-Service Press EquipmentDocumento3 páginasAB-088 Application For In-Service Press EquipmentcoxshulerAinda não há avaliações

- Tpi Inc: Invoice Number: Invoice Date: Invoice CurrencyDocumento1 páginaTpi Inc: Invoice Number: Invoice Date: Invoice Currencyabcdefghi_123456789Ainda não há avaliações

- SCWI Re-Exam PKGDocumento4 páginasSCWI Re-Exam PKGKishorsing RajputAinda não há avaliações

- Payslip 6 (31-08-2014)Documento1 páginaPayslip 6 (31-08-2014)shirmin1997Ainda não há avaliações

- 2013-14 Proposed FInal BudgetDocumento23 páginas2013-14 Proposed FInal BudgetPress And JournalAinda não há avaliações

- Schedules of AccountsDocumento3 páginasSchedules of Accountsabhii10267% (6)

- Stambaugh Ness, PC 2012-2013 Payroll Processing & Payroll Tax GuideDocumento151 páginasStambaugh Ness, PC 2012-2013 Payroll Processing & Payroll Tax GuideSteve Hake0% (1)

- Enterprise Technology System - QuestionDocumento8 páginasEnterprise Technology System - QuestionAman DattaAinda não há avaliações

- 2014 01 16 Report 004 14 Appendix DDocumento4 páginas2014 01 16 Report 004 14 Appendix DSoha GalalAinda não há avaliações

- Enterprise Technology System - QuestionDocumento8 páginasEnterprise Technology System - QuestionHafsa EnayatAinda não há avaliações

- Short Courses: Licence To Perform Dogging (Workcover Ticket) DGDocumento2 páginasShort Courses: Licence To Perform Dogging (Workcover Ticket) DGapi-68216762Ainda não há avaliações

- 4 12 13 Online JournalDocumento75 páginas4 12 13 Online JournalMark ReinhardtAinda não há avaliações

- Chase Bank StatementDocumento1 páginaChase Bank StatementslimlanzyAinda não há avaliações

- SAP Auto Saved)Documento7 páginasSAP Auto Saved)Moeed Ahmed BaigAinda não há avaliações

- 3 22 13 Online JournalDocumento77 páginas3 22 13 Online JournalMark ReinhardtAinda não há avaliações

- Request For An ACCA Transcript: Data ProtectionDocumento1 páginaRequest For An ACCA Transcript: Data ProtectionRoshan PunnooseAinda não há avaliações

- q4w2 Process For Handling Customer InquiriesDocumento6 páginasq4w2 Process For Handling Customer InquiriesPaul IglesiasAinda não há avaliações

- Fee Estimator - Per SemesterDocumento2 páginasFee Estimator - Per SemesterthindmanmohanAinda não há avaliações

- SiddarthDocumento1 páginaSiddarthManoj SinghAinda não há avaliações

- FS Out of Province Certificate Assessment Guideline Oct4 2022Documento2 páginasFS Out of Province Certificate Assessment Guideline Oct4 2022harleydavidson103rmAinda não há avaliações

- 10000006490Documento17 páginas10000006490Chapter 11 DocketsAinda não há avaliações

- 2 22 13 Online JournalDocumento52 páginas2 22 13 Online JournalMark ReinhardtAinda não há avaliações

- Request For Replacement Certificate FormDocumento1 páginaRequest For Replacement Certificate FormCef LeCefAinda não há avaliações

- IMPORTANT: Please Use The Same ID That You Used When Registering. Ielts Ac and GTDocumento4 páginasIMPORTANT: Please Use The Same ID That You Used When Registering. Ielts Ac and GTian pierceAinda não há avaliações

- Textbook of Urgent Care Management: Chapter 24, Revenue Cycle Management and PartnershipNo EverandTextbook of Urgent Care Management: Chapter 24, Revenue Cycle Management and PartnershipAinda não há avaliações