Escolar Documentos

Profissional Documentos

Cultura Documentos

IT Forms

Enviado por

arpannathTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

IT Forms

Enviado por

arpannathDireitos autorais:

Formatos disponíveis

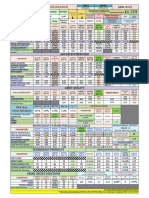

ITR 1 (SAHAJ)

ITR 2

For Individuals having Income from Salary & Interest.

For Individuals & HUFs not having Income from Business or Profession.

ITR 3 For Individuals/HUFs being partners in firms and not carrying out busine

ss or

profession under any proprietorship.

ITR 4 For Individuals & HUFs having income from a proprietory business or prof

ession.

ITR 4S (SUGAM) For Individuals/HUF having income from presumptive business.

ITR 5

For firms, AOPs,BOIs and LLP.

ITR 6

For Companies other than companies claiming exemption under section 11.

ITR 7 For persons including companies required to furnish return under section

139(4A) or section 139(4B) or section 139(4C) or section 139(4D).

Form 15CA

Information to be furnished for payments, chargeable to tax, to

a non-resident not being a company, or to a foreign company.

Form 3CA-3CD

Audit report under section 44AB of the Income-tax Act, 1961 in a

case where the accounts of the business or profession of a person have been aud

ited under any other law.

Form 3CB-3CD

Audit report under section 44AB of the Income-tax Act, 1961, in

the case of a person referred to in clause (b) of sub-rule (1) of rule 6G.

Form 3CEB

Report from an accountant to be furnished under section 92E rela

ting to international transaction(s).

Form 29B

Report under Section 115JB of the Income-tax Act, 1961 for compu

ting the book profits of the company.

Form 6B

Audit report under section 142(2A) of the Income-tax Act, 1961.

Form 10B

Audit report under section 12A(b) of the Income-tax Act, 1961, i

n the case of charitable or religious trusts or institutions.

Form 10BB

Audit report under section 10(23C) of the Income-tax Act, 1961,

in the case of any fund or trust or institution or any university or other educa

tional institution or any hospital or other medical institution referred to in s

ub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) of secti

on 10(23C).

Form 64

Statement of income paid or credited by Venture Capital Company

or Venture Capital Fund to be furnished under section 115U of the Income-tax Act

, 1961.

Form BB

Return of Net Wealth.

Form 26AS Tax Credit Statement.

Income Tax Act

Wealth Tax Act

Gift Tax Act

Expenditure Tax Act

Interest Tax Act

Você também pode gostar

- 5197 PDFDocumento1 página5197 PDFarpannathAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- HSBC Technology Manifesto 1 0Documento15 páginasHSBC Technology Manifesto 1 0arpannathAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Amazon Copywriting Secrets How Everyone Can Use The Power of Words To Get More Clicks Sales and P20200309 62415 1he8taq PDFDocumento4 páginasAmazon Copywriting Secrets How Everyone Can Use The Power of Words To Get More Clicks Sales and P20200309 62415 1he8taq PDFarpannath0% (3)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Database InfoDocumento1 páginaDatabase InfoarpannathAinda não há avaliações

- Performance of The Branch: Advances PortfolioDocumento1 páginaPerformance of The Branch: Advances PortfolioarpannathAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- 5197-Car Hire 04 Dates-Ltr 157 DT 23.04.19Documento1 página5197-Car Hire 04 Dates-Ltr 157 DT 23.04.19arpannathAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- 1971 PDFDocumento339 páginas1971 PDFarpannathAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Architecture of Aadhaar Enabled Payment System (AEPS)Documento1 páginaArchitecture of Aadhaar Enabled Payment System (AEPS)arpannathAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- 1st Round Training 2011Documento91 páginas1st Round Training 2011arpannathAinda não há avaliações

- SLBCDocumento10 páginasSLBCarpannathAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Canara Bank: Human Resource Management Section Phone No 033-2283-1 ) OljDocumento1 páginaCanara Bank: Human Resource Management Section Phone No 033-2283-1 ) OljarpannathAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Art Culture L2 IshaniDocumento103 páginasArt Culture L2 IshaniarpannathAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- E-Lock Installation GuideDocumento9 páginasE-Lock Installation GuidearpannathAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Subject (01) ECONOMICS: Ugc - Net Exam June 2013 DATE OF EXAM:30/06/2013 Keys - Paper 2Documento1 páginaSubject (01) ECONOMICS: Ugc - Net Exam June 2013 DATE OF EXAM:30/06/2013 Keys - Paper 2arpannathAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- LLP Master Data3Documento1 páginaLLP Master Data3arpannathAinda não há avaliações

- HasnuhanaDocumento2 páginasHasnuhanaarpannathAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)