Escolar Documentos

Profissional Documentos

Cultura Documentos

AP 5905 Inventories

Enviado por

xxxxxxxxxDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

AP 5905 Inventories

Enviado por

xxxxxxxxxDireitos autorais:

Formatos disponíveis

Page 1 of 9

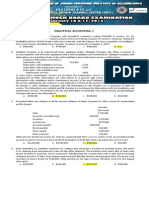

CPA REVIEW SCHOOL OF THE PHILIPPINES

Manila

AUDITING PROBLEMS

AUDIT OF INVENTORIES

PROBLEM NO. 1

The Pasay Company is a wholesale distributor of automobile replacement parts. Initial

amounts taken from Pasays accounting records are as follows:

Inventory at December 31, 2005 (based on

physical count on December 31, 2005)

Accounts payable at December 31, 2005:

Vendor

Anito Company

Victoria Company

Winston Company

Sogo Company

Rotonda Company

P400,000

Terms

Net 30

Net 30

Net 30

Net 30

Net 30

Sales in 2005

Amount

9,000

36,500

48,000

74,000

P167,500

P

P5,000,000

Additional information follows:

1.

Parts held on consignment from Anito to Pasay amounting to P9,000, were included

in the physical count of goods in Pasays warehouse on December 31, 2005, and in

accounts payable at December 31, 2005.

2.

P15,000 worth of parts which were purchased from Sogo and paid for in December

2005 were sold in the last week of 2005 and appropriately recorded as sales of

P21,000. The parts were included in the physical count on December 31, 2005,

because the parts were on the loading dock waiting to be picked up by the customer.

3.

Parts in transit on December 31, 2005, to customers, shipped FOB destination,

December 28, 2005, amounted to P11,000. The customers received the parts on

January 6, 2006. Sales of P15,000 to the customers for the parts were recorded by

Pasay on January 2, 2006.

4.

Retailers were holding P50,000, at cost, of goods on consignment from Pasay, at

their stores on December 31, 2005.

5.

Goods were in transit from Rotonda to Pasay on December 31, 2005. The cost was

P8,000 and these were shipped FOB shipping point on December 29, 2005.

REQUIRED:

Determine the adjusted balances of Inventory and Accounts Payable as of December 31,

2005 and Sales for the year 2005.

PROBLEM NO. 2

You were engaged by Quezon Corporation for the audit of the companys financial

statements for the year ended December 31, 2005. The company is engaged in the

wholesale business and makes all sales at 25% over cost.

The following were gathered from the clients accounting records:

AP-5905

Page 2 of 9

SALE S

Date

Reference

Balance forwarded

Dec. 27

SI No. 965

Dec. 28

SI No. 966

Dec. 28

SI No. 967

Dec. 31

SI No. 969

Dec. 31

SI No. 970

Dec. 31

SI No. 971

Dec. 31

Closing entry

Note: SI = Sales Invoice

PU R C HAS E S

Amount

Date

Reference

Amount

P5,200,000

Balance forwarded

P2,800,000

40,000

Dec. 28

RR No. 1059

24,000

150,000

Dec. 30

RR No. 1061

70,000

10,000

Dec. 31

RR No. 1062

42,000

46,000

Dec. 31

RR No. 1063

64,000

68,000

Dec. 31

Closing entry

(3,000,000)

16,000

P

(5,530,000)

P

RR = Receiving Report

Accounts receivable

Inventory

Accounts payable

P500,000

600,000

400,000

You observed the physical inventory of goods in the warehouse on December 31 and were

satisfied that it was properly taken.

When performing sales and purchases cut-off tests, you found that at December 31, the

last Receiving Report which had been used was No. 1063 and that no shipments had been

made on any Sales Invoices whose number is larger than No. 968. You also obtained the

following additional information:

a) Included in the warehouse physical inventory at December 31 were goods which

had been purchased and received on Receiving Report No. 1060 but for which the

invoice was not received until the following year. Cost was P18,000.

b) On the evening of December 31, there were two trucks in the company siding:

Truck No. CPA 123 was unloaded on January 2 of the following year and received

on Receiving Report No. 1063. The freight was paid by the vendor.

Truck No. ILU 143 was loaded and sealed on December 31 but leave the company

premises on January 2. This order was sold for P100,000 per Sales Invoice No.

968.

c) Temporarily stranded at December 31 at the railroad siding were two delivery trucks

enroute to Brooks Trading Corporation. Brooks received the goods, which were

sold on Sales Invoice No. 966 terms FOB Destination, the next day.

d) Enroute to the client on December 31 was a truckload of goods, which was received

on Receiving Report No. 1064. The goods were shipped FOB Destination, and

freight of P2,000 was paid by the client. However, the freight was deducted from

the purchase price of P800,000.

QUESTIONS:

Based on the above and the result of your audit, determine the following:

1. Sales for the year ended December 31, 2005

a. P5,250,000

b. P5,400,000

c. P5,150,000

d. P5,350,000

2. Purchases for the year ended December 31, 2005

a. P3,000,000

b. P3,018,000

c. P3,754,000

d. P3,818,000

3. Inventory as of December 31, 2005

a. P864,000

b. P968,000

c. P800,000

d. P814,000

4. Accounts receivable as of December 31, 2005

a. P350,000

b. P370,000

c. P220,000

d. P120,000

5. Accounts payable as of December 31, 2005

a. P418,000

b. P400,000

c. P354,000

d. P1,218,000

AP-5905

Page 3 of 9

PROBLEM NO. 3

Makati Company is preparing its 2005 financial statements. Prior to any adjustments,

inventory is valued at P1,605,000. During your audit, you found the following information

relating to certain inventory transactions from your cutoff test.

a.

Goods valued at P110,000 are on consignment with a customer. These goods were

not included in the ending inventory figure.

b.

Goods costing P87,000 were received from a vendor on January 5, 2006. The

related invoice was received and recorded on January 12, 2006. The goods were

shipped on December 31, 2005, terms FOB shipping point.

c.

Goods costing P85,000, sold for P102,000, were shipped on December 31, 2005,

and were delivered to the customer on January 2, 2006. The terms of the invoice

were FOB shipping point. The goods were included in the ending inventory for 2005

and the sale was recorded in 2006.

d.

A P35,000 shipment of goods to a customer on December 31, terms FOB destination

was not included in the year-end inventory. The goods cost P26,000 and were

delivered to the customer on January 8, 2006. The sale was properly recorded in

2006.

e.

The invoice for goods costing P35,000 was received and recorded as a purchase on

December 31, 2005. The related goods, shipped FOB destination were received on

January 2, 2006, and thus were not included in the physical inventory.

f.

Goods valued at P154,000 are on consignment from a vendor. These goods are not

included in the physical inventory.

g.

A P60,000 shipment of goods to a customer on December 30, 2005, terms FOB

destination, was recorded as a sale in 2006. The goods, costing P37,000 and

delivered to the customer on January 6, 2006, were not included in the 2005 ending

inventory.

REQUIRED:

1.

2.

Compute the proper inventory amount to be reported on Makatis balance sheet for

the year ended December 31, 2005.

By how much would the net income have been misstated if no adjustments were

made for the above transactions? (Disregard tax implications)

PROBLEM NO. 4

You were engaged to perform an audit of the accounts of the Manila Company for the

year ended December 31, 2005, and you observed the taking of the physical inventory of

the company on December 30, 2005. Only merchandise shipped by the company to

customers up to and including December 30, 2005 have been eliminated from inventory.

The inventory as determined by physical inventory count has been recorded on the books

by the companys controller. No perpetual inventory records are maintained. All sales are

made on an FOB shipping point basis. You are to assume that all purchase invoices have

been correctly recorded. The inventory was recorded through the cost of sales method.

The following lists of sales invoices are entered in the sales books for the month of

December 2005 and January 2006, respectively.

a)

b)

Sales

invoice amount

P 150,000

100,000

DECEMBER 2005

Sales

Cost of

invoice date

merchandise sold

Dec. 21

P 100,000

Dec. 31

40,000

Date shipped

Dec. 31, 2005

Nov. 03, 2005

AP-5905

Page 4 of 9

c)

d)

e)

Sales

invoice amount

50,000

200,000

500,000

DECEMBER 2005

Sales

Cost of

invoice date

merchandise sold

Dec. 29

30,000

Dec. 31

120,000

Dec. 30

280,000

Date shipped

Dec. 30, 2005

Jan. 03, 2006

Dec. 29, 2005

(shipped to consignee)

f)

g)

h)

Sales invoice

amount

P 300,000

200,000

400,000

JANUARY 2006

Sales invoice

Cost of merchandise

date

sold

Dec. 31

P 200,000

Jan. 02

115,000

Jan. 03

275,000

Date shipped

Dec. 30, 2005

Jan. 02, 2006

Dec. 31, 2005

REQUIRED:

Prepare the necessary adjusting entries at December 31, 2005.

PROBLEM NO. 5

The physical inventory of Taguig Company as of December 26, 2005 totaled P1,965,000.

You agreed on the December 26 count as the company has a good internal control

system. In trying to establish the December 31 inventory, you noted the following

transactions from December 27 to December 31, 2005.

Sales (20% markup on cost)

Credit memos issued:

For goods returned on:

December 15

December 20

December 29

For goods delivered to customers not in

accordance with specifications

Credit memos received:

For goods returned on:

December 10

December 26

December 28

Purchases:

Placed in stock

In transit, FOB shipping point

In transit, FOB destination

P 600,000

27,000

35,000

36,000

9,500

17,000

23,000

8,000

120,000

50,000

33,000

REQUIRED:

Inventory as of December 31, 2005.

PROBLEM NO. 6

Mandaluyong Company is an importer and wholesaler. Its merchandise is purchased

from several suppliers and is warehoused until sold to customers.

In conducting an audit for the year ended December 31, 2005 the companys CPA

determined that the system of internal control was good. Accordingly, the CPA observed

the physical inventory at an interim date, November 30, 2005 instead of at year end. The

following information was obtained from the general ledger:

AP-5905

Page 5 of 9

Inventory, January 1, 2005

Physical inventory, November 30, 2005

Sales for 11 months ended November 30, 2005

Sales for the year ended December 31, 2005

Purchases for 11 months ended November 30, 2005

(before audit adjustments)

Purchases for the year ended December 31, 2005

(before audit adjustments)

P 1,312,500

1,425,000

12,600,000

14,400,000

10,125,000

12,000,000

The CPAs audit disclosed the following information:

a) Shipments received in November and included in the physical

inventory but recorded as December purchases.

b) Shipments received in unsalable condition and excluded from

physical inventory. Credit memos had not been received nor

chargebacks to vendors been recorded:

Total at November 30, 2005

Total at December 31, 2005 (including the November

unrecorded chargebacks)

c) Deposit made with vendor and charged to purchases in October,

2005. Product was shipped in January, 2006.

d) Deposit made with vendor and charged to purchases in November,

2005. Product was shipped FOB destination, on November 29,

2005 and was included in November 30, 2005 physical inventory

as goods in transit.

e) Through the carelessness of the receiving department shipment in

early December 2005 was damaged by rain. This shipment was

later sold in the last week of December at cost.

P 112,500

15,000

22,500

30,000

82,500

150,000

REQUIRED:

1.

Gross profit rate for 11 months ended November 30, 2005.

2.

Cost of goods sold during the month of December 2005 using the gross profit

method.

3.

December 31, 2005 inventory using the gross profit method.

PROBLEM NO. 7

On April 21, 2005, a fire damaged the office and warehouse of Muntinlupa Company.

The only accounting record saved was the general ledger, from which the trial balance

below was prepared.

Muntinlupa Company

Trial Balance

March 31, 2005

DEBIT

Cash

P 180,000

Accounts receivable

400,000

Inventory, December 31, 2004

750,000

Land

350,000

Building

1,100,000

Accumulated depreciation

Other assets

56,000

Accounts payable

Accrued expenses

Common stock, P100 par

Retained earnings

Sales

CREDIT

P 413,000

237,000

180,000

1,000,000

520,000

1,350,000

AP-5905

Page 6 of 9

Purchases

Operating expenses

Totals

DEBIT

520,000

344,000

P3,700,000

CREDIT

.

P3,700,000

The following data and information have been gathered:

a.

The companys year-end is December 31.

b.

An examination of the April bank statement and cancelled checks revealed that

checks written during the period April 1 to 21 totaled P130,000: P57,000 paid to

accounts payable as of March 31, P34,000 for April merchandise purchases, and

P39,000 paid for other expenses. Deposits during the same period amounted to

P129,500, which consisted of receipts on account from customers with the exception

of a P9,500 refund from a vendor for merchandise returned in April.

c.

Correspondence with suppliers revealed unrecorded obligations at April 21 of

P106,000 for April merchandise purchases, including P23,000 for shipments in transit

on that date.

d.

Customers acknowledged indebtedness of P360,000 at April 21, 2005. It was also

estimated that customers owed another P80,000 that will never be acknowledged or

recovered. Of the acknowledged indebtedness, P6,000 will probably be uncollectible.

e.

The insurance company agreed that the fire loss claim should be based on the

assumption that the overall gross profit ratio for the past two years was in effect

during the current year. The companys audited financial statements disclosed the

following information:

Net sales

Net purchases

Beginning inventory

Ending inventory

f.

2004

P 5,300,000

2,800,000

500,000

750,000

2003

P 3,900,000

2,350,000

660,000

500,000

Inventory with a cost of P70,000 was salvaged and sold for P35,000. The balance of

the inventory was a total loss.

QUESTIONS:

Based on the above and the result of your audit, answer the following:

1.

How much is the adjusted balance of Accounts Receivable as of April 21, 2005?

a. P400,000

b. P360,000

c. P440,000

d. P354,000

2.

How much is the sales for the period January 1 to April 21, 2005?

a. P1,430,000

b. P1,510,000

c. P1,519,500

d. P1,506,000

3.

How much is the adjusted balance of Accounts Payable as of April 21, 2005?

a. P286,000

b. P237,000

c. P106,000

d. P343,000

4.

How much is the net purchases for the period January 1 to April 21, 2005?

a. P650,500

b. P660,000

c. P673,500

d. P683,000

5.

How much is the cost of sales for the period January 1 to April 21, 2005?

a. P786,500

b. P830,500

c. P835,725

d. P828,300

6.

How much is the estimated inventory on April 21, 2005?

a. P570,000

b. P623,500

c. P587,775

d. P579,500

How much is the estimated inventory fire loss?

a. P579,500

b. P535,000

c. P477,000

d. P512,000

7.

AP-5905

Page 7 of 9

PROBLEM NO. 8

The work-in-process inventories of Paraaque Company were completely destroyed by

fire on June 1, 2005. You were able to establish physical inventory figures as follows:

Raw materials

Work-in-process

Finished goods

January 1, 2005

P60,000

200,000

280,000

June 1, 2005

P120,000

240,000

Sales from January 1 to May 31, were P546,750. Purchases of raw materials were

P200,000 and freight on purchases, P30,000. Direct labor during the period was

P160,000. It was agreed with insurance adjusters than an average gross profit rate of

35% based on cost be used and that direct labor cost was 160% of factory overhead.

REQUIRED:

Based on the above and the result of your audit, you are to determine:

1.

2.

Raw materials used

a. P290,000

b. P140,000

c. P260,000

d. P170,000

The total value of goods put in process

a. P786,000

b. P600,000

c. P630,000

d. P430,000

3.

The value of goods manufactured and completed as of June 1, 2003

a. P365,000

b. P315,388

c. P445,000

d. P420,000

4.

The work in process inventory destroyed as computed by the adjuster

a. P314,612

b. P185,000

c. P366,000

d. P265,000

PROBLEM NO. 9

Malabon Sales Company uses the first-in, first-out method in calculating cost of goods

sold for the three products that the company handles. Inventories and purchase

information concerning the three products are given for the month of October.

Oct. 1

Inventory

Oct. 1-15

Purchases

Oct. 16-31

Purchases

Oct. 1-31

Oct. 31

Sales

Sales price

Product C

50,000 units

at P6.00

70,000 units

at P6.50

30,000 units

at P8.00

105,000 units

P8.00/unit

Product P

30,000 units

at P10.00

45,000 units

at P10.50

Product A

65,000 units

at P0.90

30,000 units

at P1.25

50,000 units

P11.00/unit

45,000 units

P2.00/unit

On October 31, the companys suppliers reduced their prices from the most recent

purchase prices by the following percentages: product C, 20%; product P, 10%; product A,

8%. Accordingly, Malabon decided to reduce its sales prices on all items by 10%, effective

November 1. Malabons selling cost is 10% of sales price. Products C and P have a

normal profit (after selling costs) of 30% on sales prices, while the normal profit on product

A (after selling cost) is 15% of sales price.

QUESTIONS:

Based on the above and the result of your audit, determine the following:

1.

Total cost of Inventory at October 31 is

a. P565,000

b. P557,310

c. P655,500

d. P617,500

AP-5905

Page 8 of 9

2.

The amount of Inventory to be reported on the companys balance sheet at October

31 is

a. P569,850

b. P559,350

c. P543,810

d. P595,350

3.

The Allowance for inventory write down at October 31 is

a. P5,650

b. P85,650

c. P13,500

4.

d. P60,150

The cost of sales, before loss on inventory writedown, for the month of October is

a. P1,298,500

b. P1,022,260

c. P1,293,650

d. P1,208,000

PROBLEM NO. 10

Select the best answer for each of the following:

1. Which of the following audit procedures probably provides the most reliable evidence

concerning the entitys assertion of rights and obligations related to inventories?

a. Trace test counts noted during the entitys physical count to the entitys

summarization of quantities.

b. Inspect agreements to determine whether any inventory is pledged as collateral or

subject to any liens.

c. Select the last few shipping advices used before the physical count and determine

whether shipments were recorded as sales.

d. Inspect the open purchase order file for significant commitments that should be

considered for disclosure.

2. An auditor most likely to inspect loan agreements under which an entitys inventories

are pledged to support managements financial statement assertion of

a. Existence or occurrence.

c. Presentation and disclosure.

b. Completeness.

d. Valuation or allocation.

3. An auditor selected items for test counts while observing a clients physical inventory.

The auditor then traced the test counts to the clients inventory listing. This procedure

most likely obtained evidence concerning

a. Existence or occurrence.

c. Rights and obligations.

b. Completeness.

d. Valuation.

4. Periodic cycle counts of selected inventory items are made at various times during the

year rather than a single inventory count at year-end. Which of the following is

necessary if the auditor plans to observe inventories at interim dates?

a. Complete recounts by independent teams are performed.

b. Perpetual inventory records are maintained.

c. Unit cost records are integrated with production accounting records.

d. Inventory balances are rarely at low levels.

5. A client maintains perpetual inventory records in both quantities and pesos. If the

assessed level of control risk is high an auditor will probably

a. Apply gross profit tests to ascertain the reasonableness of the physical counts.

b. Increase the extent of tests of controls relevant to the inventory cycle.

c. Request the client to schedule the physical inventory count at the end of the year.

d. Insist that the client perform physical counts of inventory items several times during

the year.

6. After accounting for a sequential of inventory tags, an auditor traces a sample of tags to

the physical inventory listing to obtain evidence that all items

a. Included in the listing have been counted.

b. Represented by inventory tags are included in the listing.

c. Included in the listing are represented by inventory tags.

d. Represented by inventory tags are bona fide.

AP-5905

Page 9 of 9

7. If the perpetual inventory records show lower quantities of inventory that the physical

count an explanation of the difference might be unrecorded

a. Sales.

c. Purchases.

b. Purchase returns.

d. Purchase discounts.

8. The physical count of inventory of a retailer was higher than shown by the perpetual

records. Which of the following could explain the difference?

a. Inventory item has been counted but the tags placed on the items had not been

taken off the items and added to the inventory accumulation sheets.

b. Credit memos for several items returned by customers had not been recorded.

c. No journal entry had been made on the retailers books for several items returned to

its suppliers.

d. An item purchased FOB shipping point had not arrived at the date of the inventory

count and had not been reflected in the perpetual records.

9. An auditor is most likely to learn of slow-moving inventory through

a. Inquiry of sales personnel

b. Inquiry of warehouse personnel

c. Physical observation of inventory

d. Review of perpetual inventory records.

10. Purchase cut-off procedures should be designed to test whether all inventory

a. Purchased and received before year-end was paid for.

b. Ordered before year-end was received.

c. Purchased and received before year-end was recorded.

d. Owned by the company is in the possession of the company at year-end.

11. The audit of year-end inventories should include steps to verify that the clients

purchases and sales cutoffs were adequate. This audit steps should be designed to

detect whether merchandise included in the physical count at year-end was not

recorded as a

a. Sale in the subsequent period

b. Purchase in the current period

c. Sale in the current period

d. Purchase in the subsequent period

12. An auditors observation of physical inventories at the main plant at year-end provides

direct evidence to support which of the following objectives?

a. Accuracy of the priced-out inventory.

b. Evaluation of lower of cost or market test.

c. Identification of obsolete or damaged merchandise to evaluate allowance (reserve)

for obsolescence.

d. Determination of goods on consignment at another location.

End of AP-5905

AP-5905

Você também pode gostar

- Handout Audit of InventoriesDocumento4 páginasHandout Audit of InventoriesJAY AUBREY PINEDA0% (2)

- AP 5905Q InventoriesDocumento4 páginasAP 5905Q Inventoriesxxxxxxxxx100% (1)

- Land & Building Cost Adjustments"TITLE "Machinery Depreciation Calculation" TITLE "Factory Equipment Impairment Analysis"TITLE "Mining Property Depletion & Depreciation ScheduleDocumento4 páginasLand & Building Cost Adjustments"TITLE "Machinery Depreciation Calculation" TITLE "Factory Equipment Impairment Analysis"TITLE "Mining Property Depletion & Depreciation ScheduleLlyod Francis LaylayAinda não há avaliações

- Auditing Appplications PrelimsDocumento5 páginasAuditing Appplications Prelimsnicole bancoroAinda não há avaliações

- Audit Ar With SolutionsDocumento14 páginasAudit Ar With Solutionsbobo kaAinda não há avaliações

- All About CASHDocumento18 páginasAll About CASHAshley Levy San Pedro100% (1)

- 10.28.2017 MT (Audit of Receivables)Documento7 páginas10.28.2017 MT (Audit of Receivables)PatOcampo100% (1)

- Receivables Problem 1: Account Is One To Six Months ClassificationDocumento4 páginasReceivables Problem 1: Account Is One To Six Months ClassificationMary Grace NaragAinda não há avaliações

- AP-5907 CashDocumento12 páginasAP-5907 CashxxxxxxxxxAinda não há avaliações

- Problem 5: QuestionsDocumento6 páginasProblem 5: QuestionsTk KimAinda não há avaliações

- Auditing ProblemsDocumento6 páginasAuditing ProblemsMaurice AgbayaniAinda não há avaliações

- Audit of InventoryDocumento7 páginasAudit of InventoryDianne Antoinette Basallo0% (1)

- Audit of Inventories - STDocumento7 páginasAudit of Inventories - STFrancine Holler0% (2)

- Advanced Acounting QizDocumento3 páginasAdvanced Acounting QizJamhel MarquezAinda não há avaliações

- AP Solutions 2016Documento13 páginasAP Solutions 2016Mary Ann Gumpay Rago100% (1)

- Audit of Cash TheoryDocumento7 páginasAudit of Cash TheoryShulamite Ignacio GarciaAinda não há avaliações

- Chapter-5 Homework InventoriesDocumento4 páginasChapter-5 Homework InventoriesKenneth Christian Wilbur0% (1)

- ApaDocumento2 páginasApaPaula Villarubia100% (1)

- MODAUD1 UNIT 2 - Audit of Cash and Cash TransactionsDocumento8 páginasMODAUD1 UNIT 2 - Audit of Cash and Cash TransactionsJake Bundok100% (1)

- AP 1403 Receivables Auditing ProblemsDocumento18 páginasAP 1403 Receivables Auditing ProblemsДжен Акино ОганизаAinda não há avaliações

- Problem 1Documento4 páginasProblem 1Live LoveAinda não há avaliações

- Problem 4Documento6 páginasProblem 4jhobsAinda não há avaliações

- CPA Review Cash Audit ProblemsDocumento5 páginasCPA Review Cash Audit ProblemsnikkaaaAinda não há avaliações

- Audit of ReceivablesDocumento48 páginasAudit of Receivablescarl fuerzasAinda não há avaliações

- Audit of ReceivablesDocumento29 páginasAudit of ReceivablesJoseph SalidoAinda não há avaliações

- TBCH10Documento10 páginasTBCH10rockerAinda não há avaliações

- Cebu CPAR Mandaue City FINAL PREBOARD EXAMINATION AUDITING PROBLEMSDocumento9 páginasCebu CPAR Mandaue City FINAL PREBOARD EXAMINATION AUDITING PROBLEMSLoren Lordwell MoyaniAinda não há avaliações

- Escorido Malfarta Accounts ReceivableDocumento41 páginasEscorido Malfarta Accounts ReceivableAna Marie EscoridoAinda não há avaliações

- AP - Cash and Cash EquivalentsDocumento11 páginasAP - Cash and Cash EquivalentsErnest Andales88% (8)

- MODAUD1 UNIT 4 - Audit of Inventories PDFDocumento9 páginasMODAUD1 UNIT 4 - Audit of Inventories PDFJake BundokAinda não há avaliações

- Sample partnership liquidation problemsDocumento3 páginasSample partnership liquidation problemsJay Bee SalvadorAinda não há avaliações

- Audit of InventoriesDocumento4 páginasAudit of InventoriesMc Gavriel VillenaAinda não há avaliações

- AudcisDocumento6 páginasAudcisJessa May MendozaAinda não há avaliações

- Palmones, Jayhan Grace M. QuizDocumento6 páginasPalmones, Jayhan Grace M. QuizjayhandarwinAinda não há avaliações

- Audit of EquityDocumento5 páginasAudit of EquityKarlo Jude Acidera0% (1)

- Auditing Problems Since 1977Documento7 páginasAuditing Problems Since 1977Io AyaAinda não há avaliações

- Nfjpia Nmbe Afar 2017 AnsDocumento10 páginasNfjpia Nmbe Afar 2017 AnshyosungloverAinda não há avaliações

- Cordillera Career Development College financial statements audit problemsDocumento33 páginasCordillera Career Development College financial statements audit problemsPraise Buenaflor14% (7)

- AP PreboardDocumento6 páginasAP PreboardMark Kenneth Chan BalicantaAinda não há avaliações

- Audit ReviewDocumento6 páginasAudit ReviewArnel RemorinAinda não há avaliações

- Cebu Cpar Center: Auditing Problems Audit of Inventories Problem No. 1Documento10 páginasCebu Cpar Center: Auditing Problems Audit of Inventories Problem No. 1PaupauAinda não há avaliações

- Ap-5905 Inventories PDFDocumento9 páginasAp-5905 Inventories PDFKathleen Jane SolmayorAinda não há avaliações

- Cpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Documento11 páginasCpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Angelou100% (1)

- 5 Questions InventoryDocumento15 páginas5 Questions Inventoryyousef0% (1)

- (Problems) - Audit of InventoriesDocumento22 páginas(Problems) - Audit of Inventoriesapatos40% (5)

- Ap 1Documento4 páginasAp 1Joseph PamaongAinda não há avaliações

- Substantive Testing For Inventories: Problem 1: The Makati Company Is On A Calendar Year Basis. The Following DataDocumento17 páginasSubstantive Testing For Inventories: Problem 1: The Makati Company Is On A Calendar Year Basis. The Following DataPaul Anthony AspuriaAinda não há avaliações

- Quizzers 9Documento12 páginasQuizzers 9Shanen Mendoza Young67% (6)

- InventoriesDocumento6 páginasInventoriesralphalonzo100% (3)

- Inventory Acctg 5Documento2 páginasInventory Acctg 5Deceryl AdaponAinda não há avaliações

- Chapter 3 Audit of InventoriesDocumento26 páginasChapter 3 Audit of InventoriesSteffany Roque100% (1)

- AP 9206-1 InventoriesDocumento5 páginasAP 9206-1 InventoriesmiobratataAinda não há avaliações

- AssignmentDocumento6 páginasAssignmentIryne Kim PalatanAinda não há avaliações

- Audit Cash Reconciliation QuizDocumento14 páginasAudit Cash Reconciliation QuizJandave ApinoAinda não há avaliações

- COMPUTATIONAL SKILLSDocumento5 páginasCOMPUTATIONAL SKILLSChayne Rodil100% (1)

- 123Documento11 páginas123Jandave ApinoAinda não há avaliações

- Problem: A) B) C) D) E)Documento1 páginaProblem: A) B) C) D) E)leshz zynAinda não há avaliações

- Unit 4. Audit of Inventories - Handout - Final - t31516Documento7 páginasUnit 4. Audit of Inventories - Handout - Final - t31516mimi96Ainda não há avaliações

- Audit of Inventories and Cost of Goods SoldDocumento9 páginasAudit of Inventories and Cost of Goods SoldDita Indah0% (1)

- 10.14.2017 Quiz 1 (Audit of Inventory)Documento5 páginas10.14.2017 Quiz 1 (Audit of Inventory)PatOcampoAinda não há avaliações

- Auditing Theory 250 QuestionsDocumento39 páginasAuditing Theory 250 Questionsxxxxxxxxx75% (4)

- Business Law Preboard FinalDocumento7 páginasBusiness Law Preboard Finalxxxxxxxxx100% (1)

- NFJPIA Mockboard 2011 Auditing TheoryDocumento6 páginasNFJPIA Mockboard 2011 Auditing TheoryKathleen Ang100% (1)

- Theory of Accounts Mockboard 2013 With AnswersDocumento9 páginasTheory of Accounts Mockboard 2013 With AnswersxxxxxxxxxAinda não há avaliações

- Practical Accounting 1 With AnswersDocumento10 páginasPractical Accounting 1 With Answerslibraolrack50% (8)

- At AnswerKeyDocumento9 páginasAt AnswerKeyRosalie E. BalhagAinda não há avaliações

- At AnswerKeyDocumento9 páginasAt AnswerKeyRosalie E. BalhagAinda não há avaliações

- Business Law Preboard FinalDocumento7 páginasBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Relevant Costing CPARDocumento13 páginasRelevant Costing CPARxxxxxxxxx100% (2)

- Financial Statement Analysis - CPARDocumento13 páginasFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- Cost of CapitalDocumento10 páginasCost of CapitalCharmaine ChuAinda não há avaliações

- Taxation With AnswersDocumento8 páginasTaxation With AnswersMarion Tamani Jr.50% (2)

- Business Law Preboard FinalDocumento7 páginasBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Business Law Preboard FinalDocumento7 páginasBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Practical Accounting 2 With AnswersDocumento11 páginasPractical Accounting 2 With Answerskidrauhl0767% (6)

- Audit of Cash and Cash EquivalentsDocumento38 páginasAudit of Cash and Cash Equivalentsxxxxxxxxx86% (81)

- MAS With Answers PDFDocumento13 páginasMAS With Answers PDF蔡嘉慧100% (1)

- Auditing Problems With AnswersDocumento12 páginasAuditing Problems With Answersaerwinde79% (34)

- Audit of ReceivablesDocumento32 páginasAudit of Receivablesxxxxxxxxx96% (55)

- Taxation With AnswersDocumento8 páginasTaxation With AnswersMarion Tamani Jr.50% (2)

- Audit of Stockholders EquityDocumento25 páginasAudit of Stockholders Equityxxxxxxxxx87% (39)

- Financial Statement Analysis - CPARDocumento13 páginasFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- Correction of ErrorsDocumento37 páginasCorrection of Errorsxxxxxxxxx75% (36)

- CHAPTER 7 Caselette - Audit of PPEDocumento34 páginasCHAPTER 7 Caselette - Audit of PPErochielanciola60% (5)

- Audit of LiabilitiesDocumento33 páginasAudit of Liabilitiesxxxxxxxxx96% (28)

- Psa 720Documento8 páginasPsa 720shambiruarAinda não há avaliações

- Audit of InventoryDocumento32 páginasAudit of Inventoryxxxxxxxxx92% (48)

- Psa 710Documento18 páginasPsa 710xxxxxxxxxAinda não há avaliações

- Psa 800 PDFDocumento20 páginasPsa 800 PDFshambiruarAinda não há avaliações

- Psa 700 RevDocumento86 páginasPsa 700 RevDave RamirezAinda não há avaliações

- Executive Summary - Essay Assignment Executive Summary - Essay AssignmentDocumento5 páginasExecutive Summary - Essay Assignment Executive Summary - Essay Assignmentmilk teaAinda não há avaliações

- OpAudCh09 CBET 01 501E Toralde, Ma - Kristine E.Documento5 páginasOpAudCh09 CBET 01 501E Toralde, Ma - Kristine E.Kristine Esplana ToraldeAinda não há avaliações

- Problems in Open Book ExamDocumento3 páginasProblems in Open Book Examxanax_1984Ainda não há avaliações

- Journal of Public Budgeting, Accounting & Financial Management Volume 27 Issue 2 2015 (Doi 10.1108/JPBAFM-27!02!2015-B004) Plummer, Elizabeth Patton, Terry K. - Using Financial Statements To ProviDocumento41 páginasJournal of Public Budgeting, Accounting & Financial Management Volume 27 Issue 2 2015 (Doi 10.1108/JPBAFM-27!02!2015-B004) Plummer, Elizabeth Patton, Terry K. - Using Financial Statements To ProviRosedian AndrianiAinda não há avaliações

- CA Final Auditpedia Exemption Charts 4 0 by CA Ravi Agarwal 1Documento138 páginasCA Final Auditpedia Exemption Charts 4 0 by CA Ravi Agarwal 1geetha sai bodapatiAinda não há avaliações

- English For The Students of AccountingDocumento127 páginasEnglish For The Students of AccountingSemraKöroğluAinda não há avaliações

- Singh ResumDocumento4 páginasSingh Resumsinghajay1981Ainda não há avaliações

- Process Audit ReportDocumento2 páginasProcess Audit ReportOlexei SmartAinda não há avaliações

- CV for Finance Officer with Budget and Accounting ExperienceDocumento3 páginasCV for Finance Officer with Budget and Accounting ExperienceericAinda não há avaliações

- AgingbyGeneralLedgerAccount - Receivables Aging by General Ledger Account ReportDocumento2 páginasAgingbyGeneralLedgerAccount - Receivables Aging by General Ledger Account ReportsureshAinda não há avaliações

- Lra Audit Full Form in Hotel IndustryDocumento14 páginasLra Audit Full Form in Hotel Industryविशाल कुमारAinda não há avaliações

- Proof of CashDocumento2 páginasProof of Cashmjc24100% (2)

- Accounting For Managers: Module - 1Documento31 páginasAccounting For Managers: Module - 1Madhu RakshaAinda não há avaliações

- IIM Udaipur M&A Course Covers Mergers, AcquisitionsDocumento5 páginasIIM Udaipur M&A Course Covers Mergers, AcquisitionsVinay KumarAinda não há avaliações

- RTP Group IDocumento202 páginasRTP Group Iravi_bansal85Ainda não há avaliações

- PPL Internship Report Abdullah Haider AliDocumento15 páginasPPL Internship Report Abdullah Haider AliAbdullah Haider AliAinda não há avaliações

- Shubham MoreDocumento60 páginasShubham MoreNagesh MoreAinda não há avaliações

- L11 Audit ReportDocumento10 páginasL11 Audit ReportTanishaAinda não há avaliações

- Risk of BispDocumento3 páginasRisk of BisppalwashaAinda não há avaliações

- Auditing Revenue Cycle and Cash ControlsDocumento24 páginasAuditing Revenue Cycle and Cash ControlsLuisitoAinda não há avaliações

- Complexities of Compliance Can Be Managed: HITRUST Approval For CSF Security AssessmentsDocumento17 páginasComplexities of Compliance Can Be Managed: HITRUST Approval For CSF Security AssessmentsSwetha RavichandranAinda não há avaliações

- Ghana: Tamale City ProfileDocumento33 páginasGhana: Tamale City ProfileUnited Nations Human Settlements Programme (UN-HABITAT)Ainda não há avaliações

- LK Myoh 2013Documento132 páginasLK Myoh 2013Arief KurniawanAinda não há avaliações

- Risk Management by Protiviti X MentorKartDocumento14 páginasRisk Management by Protiviti X MentorKartShubam VermaAinda não há avaliações

- Worldcom FraudDocumento20 páginasWorldcom FraudAfdal SyarifAinda não há avaliações

- Corporate Governance KAPLAN WEEK 2 PDFDocumento6 páginasCorporate Governance KAPLAN WEEK 2 PDFRachita ArikrishnanAinda não há avaliações

- A Knowledge Management Perspective To Shared Service CentersDocumento20 páginasA Knowledge Management Perspective To Shared Service Centersvanny rumapeaAinda não há avaliações

- Department of Humanities and Social Sciences SyllabusDocumento60 páginasDepartment of Humanities and Social Sciences SyllabusRajput RishavAinda não há avaliações

- Auditing The Control Environment: IppfDocumento40 páginasAuditing The Control Environment: Ippfdushi2010Ainda não há avaliações

- APM Terminals customs charges and proceduresDocumento133 páginasAPM Terminals customs charges and proceduressaurabhAinda não há avaliações