Escolar Documentos

Profissional Documentos

Cultura Documentos

IT Rates

Enviado por

beingviswa0 notas0% acharam este documento útil (0 voto)

7 visualizações2 páginasIncome Tax Rates for assessment year 2015-2016

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoIncome Tax Rates for assessment year 2015-2016

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

7 visualizações2 páginasIT Rates

Enviado por

beingviswaIncome Tax Rates for assessment year 2015-2016

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 2

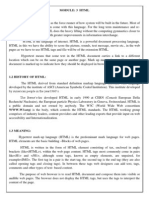

KNOW YOUR

INCOME - TAX RATES

TAX RATES

ASSESSMENT YEAR 2015-16

Companies/Co-operative Societies

and local authorities

Company Rate of income

tax (per cent)

In the case of a domestic company 30

In the case of a foreign company

Royalty received from Government or an Indian concern in 50

pursuance of an Agreement made by it with the Indian concern

after March 31, 1961, but before April 1, 1976, or fees for

rendering technical services in pursuance of an agreement

made by it after February 29, 1964 but before April 1, 1976 and

where such agreement has, in either case, been approved by

the Central Government

Other income 40

Surcharge - Surcharge is applicable at the rates given below—.

Assessment year 2014-15 Assessment year 2015-16

Ifnetincome| lfnet | |fnet income] If net income | If net income

does not income does not | is inthe range| is exceeds

exceed exceeds | exceeds of Rs. 10 Rs.10

Rs.icrore |Rs Icrore.| Rs 1crore crore crore

Domestic Nil 5%* Nil 5%* 10%**

company

Foreign Nil 2%* Nil 2%* 5%**

company

*Marginal relief - In the case of a company having a net income of exceeding Rs. 1

crore, the amount payable as income-tax and surcharge shall not exceed the total

amount payable as income-tax on total income of Rs. 1crore by more than the

amount of income that exceeds Rs. 1 crore.

**Marginal relief - In the case of a company having a net income of exceeding Rs.

10 crore (for the assessment year 2014-15), the amount payable as income-tax

and surcharge shall not exceed the total amount payable as income-tax and

surcharge on total income of Rs. 10 crore by more than the amount of income that

exceeds Rs. 10 crore.

Education cess - Itis 3 per cent of income-tax and surcharge.

Secondary and higher education cess - It is 1 per cent of income-tax and

surcharge.

e MINIMUM ALTERNATE TAX - The following rate of minimum alternate

tax shall be applicable

e Assessment year 2015-16

If book profit does not If book profit is in the range If book profit

exceed Rs.1 crore - | of Rs. 1 crore - Rs. 10 crore exceeds Rs. 10 crore

IT | SC | EC+SHEC|Total |IT | SC | EC-+SHEC| Total IT_|SC_| EC-+SHEC| Total

Domestic} 18.5 |- | 0.555 | 19.055|18.5/ 0.925} 0.58275 |20.00775|185|1.85 | 0.6105 | 20.9605

company

Foreign | 185 |- | 0.555 — |19.055/18.5/ 0.37 | 0.5661 —|19.4361 |18.5|0.925 0.58275 | 20.0775}

company

Co-operative Society

|. The following rates are applicable to a Co-operative society for AY 2015-16

Income Slabs Income Tax Rate

i. | Where the total income does not exceed 10% of the income.

Rs. 10,000/-.

ii, | Where the total income exceeds Rs. 10,000/- Rs. 1,000/- +

but does not exceed Rs. 20,000/- 20% of income in

excess of Rs. 10,000/-.

iii. | Where the total income exceeds Rs. 20,000/- Rs. 3.000/- +30% of

the amount by which

the total income

exceeds Rs. 20,000/-.

Surcharge: 10% of the Income Tax, where total taxable income is more than Rs. 1

crore.

Education Cess: 3% of the total of Income Tax and Surcharge.

Secondary & Higher education cess : 1% of total income tax and ec

LOCAL AUTHORITIES

Local authorities are taxable at the rate of 30 per cent.

Surcharge : 10% of the Income Tax, where total taxable income is more than

Rs. 1 crore.

Education cess: 3% of the total of Income Tax and Surcharge.

Income Tax Department

www.incometaxindia.gov.in

Nov, 2014/E-11

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Basic Concepts of Income Tax ActDocumento14 páginasBasic Concepts of Income Tax ActRaghu CkAinda não há avaliações

- Computerized Accounting SystemsDocumento5 páginasComputerized Accounting SystemsRaghu Ck100% (1)

- Hra Rule 2aDocumento3 páginasHra Rule 2aRaghu CkAinda não há avaliações

- Sa 200 AuditingDocumento32 páginasSa 200 AuditingRaghu CkAinda não há avaliações

- Value Added TaxDocumento4 páginasValue Added TaxRaghu CkAinda não há avaliações

- Balance of PaymentDocumento12 páginasBalance of PaymentAkhil James XaiozAinda não há avaliações

- Competency Mapping TelcoDocumento64 páginasCompetency Mapping TelcoRaghu CkAinda não há avaliações

- International Harmonization of Financial ReportingDocumento8 páginasInternational Harmonization of Financial ReportingRaghu Ck100% (1)

- Online Shopping ProjectDocumento11 páginasOnline Shopping ProjectRaghu CkAinda não há avaliações

- Categories of E-CommerceDocumento5 páginasCategories of E-CommerceRaghu CkAinda não há avaliações

- Foreign Direct InvestmentDocumento76 páginasForeign Direct InvestmentRaghu CkAinda não há avaliações

- Module 3 HTMLDocumento8 páginasModule 3 HTMLRaghu CkAinda não há avaliações

- Co Operative SocietyDocumento101 páginasCo Operative SocietyRaghu Ck100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)