Escolar Documentos

Profissional Documentos

Cultura Documentos

Form Vat-09

Enviado por

khajuriaonline0 notas0% acharam este documento útil (0 voto)

39 visualizações1 páginaFORM VAT-09

Título original

FORM VAT-09

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoFORM VAT-09

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

39 visualizações1 páginaForm Vat-09

Enviado por

khajuriaonlineFORM VAT-09

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

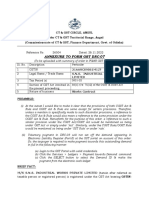

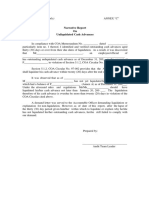

FORM VAT-09

(See rule 26)

NOTICE DIRECTING PAYMENT OF PENALTY UNDER SUB-SECTION

(2) OF SECTION 30 OF JAMMU AND KASHMIR VALUE ADDED TAX

ACT, 2005

To

M/s__________________________________

__________________________________

__________________________________

1.

This is to give you notice that a sum of Rs. ________________ is

payable by you as penalty in pursuance of order dated __________ passed

under sub section (1) of Section 30 of the Jammu and Kashmir Value

Added Tax Act, 2005.

2.

You are hereby required to pay the said sum into the Treasury

within 30 days of the receipt of this notice.

3.

In the event of failure to pay the aforesaid sum within the specified

period, proceedings for recovery may be initiated under Section____ or

Section _____ of the said Act.

4.

A challan in Form VAT-____ is enclosed.

Place:

Date:

Signature &

Designation of the

Issuing Authority.

Office seal.

Você também pode gostar

- Eclerx Services TRLDocumento9 páginasEclerx Services TRLChakravarthi B AAinda não há avaliações

- Annexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedDocumento5 páginasAnnexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedBiswajit MishraAinda não há avaliações

- st06 2012Documento1 páginast06 2012Hardik PatelAinda não há avaliações

- Indirect Tax Budget Updates 2022Documento36 páginasIndirect Tax Budget Updates 2022ajitAinda não há avaliações

- Electric BillDocumento1 páginaElectric BillFree DownloadAinda não há avaliações

- Amendments To The Revised Implementing Rules and Regulations of Republic Act No. 9184Documento6 páginasAmendments To The Revised Implementing Rules and Regulations of Republic Act No. 9184TabanginSnsAinda não há avaliações

- Customs Tariff Notification No.24/2014 Dated 11th July, 2014Documento1 páginaCustoms Tariff Notification No.24/2014 Dated 11th July, 2014stephin k jAinda não há avaliações

- Page 1 of 2Documento2 páginasPage 1 of 2Hr legaladviserAinda não há avaliações

- Maharashtra Amnesty Scheme, 2022 For GST Department - Taxguru - inDocumento4 páginasMaharashtra Amnesty Scheme, 2022 For GST Department - Taxguru - inDINESH CHANCHALANIAinda não há avaliações

- Sri Chowdeshwari Rice TradersDocumento2 páginasSri Chowdeshwari Rice Tradershemanth1234Ainda não há avaliações

- Penal Provisions STDocumento8 páginasPenal Provisions STKunalKumarAinda não há avaliações

- GST Rate Fs Bricks Tiles EnglishDocumento5 páginasGST Rate Fs Bricks Tiles EnglishdhananjayAinda não há avaliações

- QRMP Scheme Under GSTDocumento7 páginasQRMP Scheme Under GSTshraddhaAinda não há avaliações

- Cir 185 17 2022 CGSTDocumento5 páginasCir 185 17 2022 CGSTAmritesh RaiAinda não há avaliações

- The Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECDocumento2 páginasThe Gazette of India: Extraordinary (P Ii-S - 3 (I) ) : ART ECSatha SivamAinda não há avaliações

- Demand NoticeDocumento1 páginaDemand NoticeManuAinda não há avaliações

- Mvat Trade Circular 11t 2023 For Upload 26jun2023Documento28 páginasMvat Trade Circular 11t 2023 For Upload 26jun2023Shubham AgrawalAinda não há avaliações

- Resolution No. 05-2009: HereasDocumento3 páginasResolution No. 05-2009: HereasJill IsaiahAinda não há avaliações

- Certificate of Collection or Deduction of Tax: (See Rule 42)Documento1 páginaCertificate of Collection or Deduction of Tax: (See Rule 42)Ali ButtAinda não há avaliações

- 4460125244591Documento1 página4460125244591UmasankarAinda não há avaliações

- Property Forms 59eda09957c26Documento2 páginasProperty Forms 59eda09957c26khanjee0000000005Ainda não há avaliações

- 492005392342Documento1 página492005392342sukhindra kiskuAinda não há avaliações

- Service Agreement For 100 Stamp PaperDocumento6 páginasService Agreement For 100 Stamp PaperAditya DavaleAinda não há avaliações

- Form No. 2 Notice of Demand: NotesDocumento1 páginaForm No. 2 Notice of Demand: NotesYashu GoelAinda não há avaliações

- 1Documento3 páginas1vikram270693Ainda não há avaliações

- Section 23 Central Goods and Services Tax Act 2017 Persons Not Liable For RegistrationDocumento2 páginasSection 23 Central Goods and Services Tax Act 2017 Persons Not Liable For RegistrationbhaviknagoriAinda não há avaliações

- Tsembalami Logistics and Projects CC - CWDocumento2 páginasTsembalami Logistics and Projects CC - CWmndawezinhle03Ainda não há avaliações

- VILGST - CGST - Circular - Instruction No. 01 - 2022-GSTDocumento4 páginasVILGST - CGST - Circular - Instruction No. 01 - 2022-GSTJAYKISHAN VIDHWANIAinda não há avaliações

- AmendDocumento25 páginasAmendanshulagarwal62Ainda não há avaliações

- BST AppealDocumento4 páginasBST AppealvnbanjanAinda não há avaliações

- Ministry of Finance (Department of Revenue) NotificationDocumento1 páginaMinistry of Finance (Department of Revenue) NotificationKittuAinda não há avaliações

- Notification No.09/2013 - Service TaxDocumento2 páginasNotification No.09/2013 - Service Taxmaahi7Ainda não há avaliações

- Certificado de Registro de Marcas-Panamá-inglésDocumento2 páginasCertificado de Registro de Marcas-Panamá-inglésIrma SoberónAinda não há avaliações

- GST Weekly Update - 43-2023-24Documento6 páginasGST Weekly Update - 43-2023-24broabhi143Ainda não há avaliações

- Claim of ITC As GSTR-2B Is Mandatory W.E.F. 01.01.2022Documento3 páginasClaim of ITC As GSTR-2B Is Mandatory W.E.F. 01.01.2022ravindra kumar jainAinda não há avaliações

- COA M2004-014 AnnexC PDFDocumento1 páginaCOA M2004-014 AnnexC PDFJoel Mangubat AmanteAinda não há avaliações

- 784 Settlement of Arrears of Tax Interest Penalty or Late Fee For The Period Ending On or Before 30.06.2017Documento38 páginas784 Settlement of Arrears of Tax Interest Penalty or Late Fee For The Period Ending On or Before 30.06.2017santosh pandeyAinda não há avaliações

- cs33 2013Documento1 páginacs33 2013stephin k jAinda não há avaliações

- Amendments - Indirect Tax (Common) 2017Documento6 páginasAmendments - Indirect Tax (Common) 2017Prateek SinghalAinda não há avaliações

- Form37 BST PDFDocumento4 páginasForm37 BST PDFAshok BarotAinda não há avaliações

- Acg 17Documento2 páginasAcg 17pradipkshetri100% (2)

- Joy Brothers Inc. vs. NWPC FactsDocumento1 páginaJoy Brothers Inc. vs. NWPC FactsJay Kent RoilesAinda não há avaliações

- Government of Pakistan Revenue Division Federal Board of RevenueDocumento1 páginaGovernment of Pakistan Revenue Division Federal Board of RevenuehardajhbfAinda não há avaliações

- Rmo 38-83Documento1 páginaRmo 38-83saintkarriAinda não há avaliações

- Return Filing ProcedureDocumento6 páginasReturn Filing ProcedureVishwanath HollaAinda não há avaliações

- cs10 2013Documento1 páginacs10 2013stephin k jAinda não há avaliações

- GST Law Communique Dec 2023 1704557082Documento5 páginasGST Law Communique Dec 2023 1704557082nirmalseervi.mkdAinda não há avaliações

- 410019105078Documento1 página410019105078Sahamim Alam SardarAinda não há avaliações

- GST Automated NoticesDocumento6 páginasGST Automated NoticesMaunik ParikhAinda não há avaliações

- Notification No. 33 of 2012 Service TaxDocumento3 páginasNotification No. 33 of 2012 Service TaxAntyoday IndiaAinda não há avaliações

- E.Bill of KrishnenduDocumento1 páginaE.Bill of Krishnendumantu.saha2004Ainda não há avaliações

- Notification No. 35-2021 - Central TaxDocumento4 páginasNotification No. 35-2021 - Central TaxSIR GAinda não há avaliações

- Annex J - Notice To TaxpayerDocumento2 páginasAnnex J - Notice To TaxpayerChris RodriguezAinda não há avaliações

- F6zwe FinbillDocumento22 páginasF6zwe FinbillZvikomborero Tavonga MuchandibayaAinda não há avaliações

- Kodi DoganorDocumento84 páginasKodi DoganorErald QordjaAinda não há avaliações

- Summary of Notififcation Dated 26.12.2022Documento3 páginasSummary of Notififcation Dated 26.12.2022Akshat MehariaAinda não há avaliações

- Effective GST Changes W.E.F. October 01 2023Documento9 páginasEffective GST Changes W.E.F. October 01 2023ravitop2006Ainda não há avaliações

- B.ed. Entrance ExamDocumento21 páginasB.ed. Entrance ExamkhajuriaonlineAinda não há avaliações

- List of Chemical Names of Common Compounds - General Knowledge TodayDocumento6 páginasList of Chemical Names of Common Compounds - General Knowledge TodaykhajuriaonlineAinda não há avaliações

- Agricultural EconomicsDocumento45 páginasAgricultural Economicskhajuriaonline100% (2)

- Last Name Sales Country QuarterDocumento1 páginaLast Name Sales Country QuarterkhajuriaonlineAinda não há avaliações

- BM402-07 Financial ForecastingDocumento3 páginasBM402-07 Financial ForecastingkhajuriaonlineAinda não há avaliações

- Help E CommunicationDocumento9 páginasHelp E CommunicationkhajuriaonlineAinda não há avaliações

- Formvat 49Documento150 páginasFormvat 49khajuriaonlineAinda não há avaliações

- ChemistryDocumento46 páginasChemistryShikha JainAinda não há avaliações

- EconomicsDocumento2 páginasEconomicskhajuriaonlineAinda não há avaliações

- Rajasthan Public Service Commission, Ajmer Language Q.No. Question Option-1 Option-2 Option-3 Option-4 Question Paper - School Lecturer Exam 2013 (Coach - GK) Exam Date - 11.4.2015Documento8 páginasRajasthan Public Service Commission, Ajmer Language Q.No. Question Option-1 Option-2 Option-3 Option-4 Question Paper - School Lecturer Exam 2013 (Coach - GK) Exam Date - 11.4.2015khajuriaonlineAinda não há avaliações

- 1biology Tier IiDocumento50 páginas1biology Tier IikhajuriaonlineAinda não há avaliações

- Assessment of Working Capital Requirements Form Ii - Operating StatementDocumento42 páginasAssessment of Working Capital Requirements Form Ii - Operating StatementkhajuriaonlineAinda não há avaliações

- 1 Biology+tier+iiDocumento50 páginas1 Biology+tier+iikhajuriaonlineAinda não há avaliações

- Sale Tax Summary 06-07Documento5 páginasSale Tax Summary 06-07khajuriaonlineAinda não há avaliações

- M/S Uk Paint (I) Pvt. Ltd. Central Sale 4% Scrap SaleDocumento9 páginasM/S Uk Paint (I) Pvt. Ltd. Central Sale 4% Scrap SalekhajuriaonlineAinda não há avaliações

- Grade 10 Science - 2Documento5 páginasGrade 10 Science - 2Nenia Claire Mondarte CruzAinda não há avaliações

- What A Wonderful WorldDocumento2 páginasWhat A Wonderful WorldDraganaAinda não há avaliações

- Skylab Our First Space StationDocumento184 páginasSkylab Our First Space StationBob AndrepontAinda não há avaliações

- SATYAGRAHA 1906 TO PASSIVE RESISTANCE 1946-7 This Is An Overview of Events. It Attempts ...Documento55 páginasSATYAGRAHA 1906 TO PASSIVE RESISTANCE 1946-7 This Is An Overview of Events. It Attempts ...arquivoslivrosAinda não há avaliações

- Tim Horton's Case StudyDocumento8 páginasTim Horton's Case Studyhiba harizAinda não há avaliações

- Bus Organization of 8085 MicroprocessorDocumento6 páginasBus Organization of 8085 MicroprocessorsrikrishnathotaAinda não há avaliações

- Contoh Rancangan Pengajaran Harian (RPH)Documento7 páginasContoh Rancangan Pengajaran Harian (RPH)Farees Ashraf Bin ZahriAinda não há avaliações

- Atlantean Dolphins PDFDocumento40 páginasAtlantean Dolphins PDFBethany DayAinda não há avaliações

- Why Nations Fail - SummaryDocumento3 páginasWhy Nations Fail - SummarysaraAinda não há avaliações

- Solved SSC CHSL 4 March 2018 Evening Shift Paper With Solutions PDFDocumento40 páginasSolved SSC CHSL 4 March 2018 Evening Shift Paper With Solutions PDFSumit VermaAinda não há avaliações

- BUS 301 - Hospitality Industry Vietnam - Nguyễn Thị Thanh Thuý - 1632300205Documento55 páginasBUS 301 - Hospitality Industry Vietnam - Nguyễn Thị Thanh Thuý - 1632300205Nguyễn Thị Thanh ThúyAinda não há avaliações

- United States Court of Appeals, Third CircuitDocumento8 páginasUnited States Court of Appeals, Third CircuitScribd Government DocsAinda não há avaliações

- Robot 190 & 1110 Op - ManualsDocumento112 páginasRobot 190 & 1110 Op - ManualsSergeyAinda não há avaliações

- Harper 2001Documento6 páginasHarper 2001Elena GologanAinda não há avaliações

- Adobe Scan Sep 06, 2023Documento1 páginaAdobe Scan Sep 06, 2023ANkit Singh MaanAinda não há avaliações

- Linux Command Enigma2Documento3 páginasLinux Command Enigma2Hassan Mody TotaAinda não há avaliações

- DODGER: Book Club GuideDocumento2 páginasDODGER: Book Club GuideEpicReadsAinda não há avaliações

- 03-Volume II-A The MIPS64 Instruction Set (MD00087)Documento793 páginas03-Volume II-A The MIPS64 Instruction Set (MD00087)miguel gonzalezAinda não há avaliações

- Syllabus For Final Examination, Class 9Documento5 páginasSyllabus For Final Examination, Class 9shubham guptaAinda não há avaliações

- ViTrox 20230728 HLIBDocumento4 páginasViTrox 20230728 HLIBkim heeAinda não há avaliações

- SOLO FrameworkDocumento12 páginasSOLO FrameworkMaureen Leafeiiel Salahid100% (2)

- RulesDocumento508 páginasRulesGiovanni MonteiroAinda não há avaliações

- Corrugated Board Bonding Defect VisualizDocumento33 páginasCorrugated Board Bonding Defect VisualizVijaykumarAinda não há avaliações

- Green IguanaDocumento31 páginasGreen IguanaM 'Athieq Al-GhiffariAinda não há avaliações

- Task 2 - The Nature of Linguistics and LanguageDocumento8 páginasTask 2 - The Nature of Linguistics and LanguageValentina Cardenas VilleroAinda não há avaliações

- HelloDocumento31 páginasHelloShayne Dela DañosAinda não há avaliações

- Orchestral Tools - The Orchestral Grands ManualDocumento12 páginasOrchestral Tools - The Orchestral Grands ManualPiotr Weisthor RóżyckiAinda não há avaliações

- Economis Project-MCOM SEM 1Documento19 páginasEconomis Project-MCOM SEM 1Salma KhorakiwalaAinda não há avaliações

- Index-Formal Spoken Arabic Dialogue - Al Kitaab Based - MSA - From Langmedia Five CollegesDocumento5 páginasIndex-Formal Spoken Arabic Dialogue - Al Kitaab Based - MSA - From Langmedia Five CollegesD.ElderAinda não há avaliações

- IN THE BEGINNING WAS AFFECT RolnikDocumento22 páginasIN THE BEGINNING WAS AFFECT RolnikFabiana PaulinoAinda não há avaliações