Escolar Documentos

Profissional Documentos

Cultura Documentos

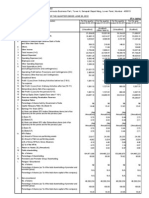

Table 4.4: Balance of Payments: Summary

Enviado por

Kumar AbhishekTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Table 4.4: Balance of Payments: Summary

Enviado por

Kumar AbhishekDireitos autorais:

Formatos disponíveis

External Sector

Table 4.4 : Balance of Payments : Summary

(US$ million)

2009-10 2010-11 2011-12 2012-13 2013-14

(PR)

(P)

II

III

IV

V

Current account

i.

Exports

ii.

Imports

iii. Trade balance

iv.

Invisibles (Net)

A. Services

B. Transfer

C. Income

Current account balance

Capital account

i.

External assistance

ii.

ECBs

iii. Short-term debt

iv.

Banking capital

of which

Non-resident deposits

v.

Foreign investment

A. FDI

B. Portfolio investment

vi. Other flows

Capital account balance

Errors & omissions

Capital account balance

(including errors &

omissions)

Overall balance

Reserve change

(-)indicates increase,

+ indicates decrease

61

2013-14

2014-15

H1 (Apr.- H1 (Apr.Sept. 2013) Sept. 2014)

(P)

(P)

182442

300644

-118202

80022

36016

52045

-8038

-38181

256159

383481

-127322

79269

44081

53140

-17952

-48053

309774

499533

-189759

111604

64098

63494

-15988

-78155

306581

502237

-195656

107493

64915

64034

-21455

-88163

318607

466216

-147609

115212

72965

65276

-23028

-32397

155152

238941

-83789

56830

35239

32744

-11153

-26959

166974

240188

-73214

55272

36069

32757

-13554

-17942

2890

2000

7558

2083

4941

12160

12034

4962

2296

10344

6668

16226

982

8485

21657

16570

1032

11777

-5044

25449

130

2455

589

11487

606

3429

69

-542

2922

50362

17966

32396

-13259

51634

-12

51622

3238

42127

11834

30293

-12484

63740

-2636

61104

11918

39231

22061

17170

-7008

67755

-2432

65323

14842

46710

19819

26891

-5105

89300

2689

91989

38892

26386

21564

4822

-10813

48787

-882

47905

13700

7762

14589

-6827

-6619

15806

453

16259

6473

38385

16183

22202

-3407

38539

-2522

36017

13441

-13441

13050

-13050

-12831

12831

3826

-3826

15508

-15508

-10701

10701

18076

-18076

Source : RBI

Notes : PR: Partially Revised; P: Provisional

some deceleration in export growth owing to

moderation in oil prices from an average of US$

105.1 per barrel in 2013-14 (second quarter) to

US$ 98.9 per barrel in 2014-15 (second

quarter).The outcome in terms of imports was

again somewhat mixed in the two quarters of the

first half of the current fiscal relative to last year.

This was largely due to the base effect of high gold

imports in the first quarter of 2013-14 and a sharp

correction in such imports in the second quarter

of 2013-14 as against a steady pick-up in the

first quarter of 2014-15 followed by a surge in

imports in the second quarter reflecting seasonal

demand spike and the easing of restrictions on gold

imports. The mixed outcome also owed to the pickup in non-gold non-POL imports in 2014-15

relative to the compression in 2013-14. Invisible

account covers (a) services, (b) transfers, and

Você também pode gostar

- Form 990: Exploring the Form's Complex SchedulesNo EverandForm 990: Exploring the Form's Complex SchedulesAinda não há avaliações

- MFM-103 Balance of Payment-Current ScenarioDocumento8 páginasMFM-103 Balance of Payment-Current ScenarioAhel Patrick VitsuAinda não há avaliações

- Balance of PaymentsDocumento14 páginasBalance of PaymentsJagannath PadhiAinda não há avaliações

- BOP India BullsDocumento19 páginasBOP India Bullsthexplorer008Ainda não há avaliações

- Balance of PaymentsDocumento6 páginasBalance of PaymentsTonmoy BorahAinda não há avaliações

- Barwa Real Estate Balance Sheet Particulars Note NoDocumento28 páginasBarwa Real Estate Balance Sheet Particulars Note NoMuhammad Irfan ZafarAinda não há avaliações

- Balance of Payment: Click To Edit Master Subtitle StyleDocumento6 páginasBalance of Payment: Click To Edit Master Subtitle StyleAshish chanchlaniAinda não há avaliações

- Bop India Oct Dec 2012Documento6 páginasBop India Oct Dec 2012mainu30Ainda não há avaliações

- Table 4.1-Overall Balance of PaymentsDocumento4 páginasTable 4.1-Overall Balance of PaymentsPrasanth BalantrapuAinda não há avaliações

- Analysis TransCanada Vs EnbridgeDocumento3 páginasAnalysis TransCanada Vs EnbridgeJohnGaglianoAinda não há avaliações

- Table 143: Key Components of India'S Balance of Payments - Us DollarDocumento1 páginaTable 143: Key Components of India'S Balance of Payments - Us DollargreatduderajAinda não há avaliações

- Summary Balance of Payments As PerDocumento2 páginasSummary Balance of Payments As PerFaisal ImranAinda não há avaliações

- Announces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Documento6 páginasAnnounces Q2 Results & Limited Review Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderAinda não há avaliações

- SEBI Apr 25 2011Documento2 páginasSEBI Apr 25 2011reachsubbusAinda não há avaliações

- At A GlanceDocumento2 páginasAt A GlanceHasan KhanAinda não há avaliações

- General Profile 076Documento3 páginasGeneral Profile 076Saurabh PrabhakarAinda não há avaliações

- Assignment Bop AnalysisDocumento9 páginasAssignment Bop AnalysisJustin SunnyAinda não há avaliações

- Chapter 6 enDocumento22 páginasChapter 6 enS. M. Hasan ZidnyAinda não há avaliações

- 3 - Sbi FFR I & II FormatDocumento3 páginas3 - Sbi FFR I & II FormatCA Shailendra Singh78% (9)

- Financial Results For The Quarter Ended 30 June 2012Documento2 páginasFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaAinda não há avaliações

- Table 140: India'S Overall Balance of Payments Us DollarDocumento3 páginasTable 140: India'S Overall Balance of Payments Us DollarParthapratim PalAinda não há avaliações

- Forecast of Deposits For Financial Year 2015/16: LidetaDocumento44 páginasForecast of Deposits For Financial Year 2015/16: Lidetaabayineh dinkuAinda não há avaliações

- Five Years Data of Foreign Direct Investment (FDI), Import, Export, Portfolio Investment & Balance of Payment of BangladeshDocumento1 páginaFive Years Data of Foreign Direct Investment (FDI), Import, Export, Portfolio Investment & Balance of Payment of BangladeshBijoy SalahuddinAinda não há avaliações

- MSD 2011/12 Preliminary BudgetDocumento123 páginasMSD 2011/12 Preliminary BudgetDebra KolrudAinda não há avaliações

- August 2014 Quarterly Refunding Combined Charges For Archives FINALDocumento81 páginasAugust 2014 Quarterly Refunding Combined Charges For Archives FINALalphathesisAinda não há avaliações

- Chapter 06 (English 2020) - External SectorDocumento14 páginasChapter 06 (English 2020) - External SectorM Tariqul Islam MishuAinda não há avaliações

- Session 16 To 18 International Linkages - Extensions of IS-LM in The Context of International Mobility of Goods (Fixed Price)Documento70 páginasSession 16 To 18 International Linkages - Extensions of IS-LM in The Context of International Mobility of Goods (Fixed Price)prernaAinda não há avaliações

- Session 16 To 18 International Linkages - Extensions of IS-LM in The Context of International Mobility of GoodsDocumento38 páginasSession 16 To 18 International Linkages - Extensions of IS-LM in The Context of International Mobility of GoodsprernaAinda não há avaliações

- Session 16 To 18 International Linkages - Extensions of is-LM in The Context of International Mobility of GoodsDocumento61 páginasSession 16 To 18 International Linkages - Extensions of is-LM in The Context of International Mobility of GoodsKartik Kumar PGP 2022-24 BatchAinda não há avaliações

- Secondary 3 Time Allowed: 1 Hour Maximum Marks: 100 MarksDocumento19 páginasSecondary 3 Time Allowed: 1 Hour Maximum Marks: 100 MarksOlivia LinAinda não há avaliações

- Thailand's Economic Fact Sheet: As of April 2014Documento5 páginasThailand's Economic Fact Sheet: As of April 2014Oon KooAinda não há avaliações

- PhilipsFullAnnualReport2013 EnglishDocumento250 páginasPhilipsFullAnnualReport2013 Englishjasper laarmansAinda não há avaliações

- Financial - CocaColaDocumento45 páginasFinancial - CocaColadung nguyenAinda não há avaliações

- Ravi 786Documento23 páginasRavi 786Tatiana HarrisAinda não há avaliações

- Bop Format and NumericalsDocumento10 páginasBop Format and NumericalsShikha AgarwalAinda não há avaliações

- Balance of Payments Format and NumericalsDocumento10 páginasBalance of Payments Format and NumericalsSarthak Gupta100% (2)

- Balance of PaymentDocumento42 páginasBalance of PaymentGaurav PareekAinda não há avaliações

- Name of The Insurer: Life Insurance Corporation of India Registration No. 512 Date of Registration With IRDAI: 01.01.2001Documento1 páginaName of The Insurer: Life Insurance Corporation of India Registration No. 512 Date of Registration With IRDAI: 01.01.2001nigam34Ainda não há avaliações

- Ndia S Rade Olicy: Foreign Trade Balance of Payments Trade Policies Foreign Trade Policy (FTP)Documento20 páginasNdia S Rade Olicy: Foreign Trade Balance of Payments Trade Policies Foreign Trade Policy (FTP)Murtaza BharthooAinda não há avaliações

- 20.3 Hotel Corporation of India LTD.: Industrial / Business OperationsDocumento2 páginas20.3 Hotel Corporation of India LTD.: Industrial / Business OperationsskjamuiAinda não há avaliações

- IslamDocumento11 páginasIslamTanvIr AnjumAinda não há avaliações

- Balance of Payments (2010-15)Documento18 páginasBalance of Payments (2010-15)Wasili MfungweAinda não há avaliações

- BOP Press Release July March 2015 2016Documento6 páginasBOP Press Release July March 2015 2016eissasamAinda não há avaliações

- P Data Extract From World Development IndicatorsDocumento14 páginasP Data Extract From World Development Indicatorseva gonzalez diazAinda não há avaliações

- Trends in Expenditure: 22 Receipts Budget, 2014-2015Documento1 páginaTrends in Expenditure: 22 Receipts Budget, 2014-2015ramAinda não há avaliações

- C C C C CDocumento5 páginasC C C C Cmrinmoy_nsuAinda não há avaliações

- Format of Revised Schedule VI To The Companies Act 1956 in ExcelDocumento2 páginasFormat of Revised Schedule VI To The Companies Act 1956 in ExcelAman ThindAinda não há avaliações

- Patriculars Equity and LiabilitiesDocumento12 páginasPatriculars Equity and LiabilitiesSanket PatelAinda não há avaliações

- Bop & Iip - Q1 12Documento7 páginasBop & Iip - Q1 12patburchall6278Ainda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento14 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Balance of Payments: External Sector: Business Economics North South UniversityDocumento10 páginasBalance of Payments: External Sector: Business Economics North South Universityshaharul islamAinda não há avaliações

- WBC 5yr SummaryDocumento2 páginasWBC 5yr SummaryPaskalis GlabadanidisAinda não há avaliações

- INDIA Balance of PaymentsDocumento11 páginasINDIA Balance of PaymentsMohana PriyaAinda não há avaliações

- Balance of Payment (Bop) : Ankita PandeyDocumento21 páginasBalance of Payment (Bop) : Ankita PandeyAnkita Sharma PandeyAinda não há avaliações

- YES Bank Annual Report 2014-15Documento4 páginasYES Bank Annual Report 2014-15Nalini ChunchuAinda não há avaliações

- Chapter 2-Flow of FundsDocumento78 páginasChapter 2-Flow of Fundsธชพร พรหมสีดาAinda não há avaliações

- Statement of Grade For (Faculty of Commerce) - Master of Business Administration (Integrated) - Semester VI - Regular Examination: Apr-2013Documento47 páginasStatement of Grade For (Faculty of Commerce) - Master of Business Administration (Integrated) - Semester VI - Regular Examination: Apr-2013Mukesh BishtAinda não há avaliações

- Amity University Kolkata IfmDocumento8 páginasAmity University Kolkata IfmPinki AgarwalAinda não há avaliações

- MTA July 2011 Financial Plan Vol 2Documento469 páginasMTA July 2011 Financial Plan Vol 2Garth JohnstonAinda não há avaliações

- Presentation (Company Update)Documento25 páginasPresentation (Company Update)Shyam SunderAinda não há avaliações

- Brief History Security IcfDocumento5 páginasBrief History Security Icfmakarandphage@yahoo.co.inAinda não há avaliações

- Money Bills in INDIADocumento2 páginasMoney Bills in INDIAKumar AbhishekAinda não há avaliações

- 2 - Inofaq - BWHDocumento17 páginas2 - Inofaq - BWHjeysamAinda não há avaliações

- 1Documento8 páginas1Sujay Vikram SinghAinda não há avaliações

- Beedi and Cigar Workers Act 1966Documento13 páginasBeedi and Cigar Workers Act 1966Ash1ScribdAinda não há avaliações

- Labour Laws MCQDocumento22 páginasLabour Laws MCQKumar Abhishek100% (2)

- Low Lattitude ClimateDocumento3 páginasLow Lattitude ClimateKumar AbhishekAinda não há avaliações