Escolar Documentos

Profissional Documentos

Cultura Documentos

ch5 5

Enviado por

Bob0 notas0% acharam este documento útil (0 voto)

8 visualizações2 páginas..

Título original

ch5-5

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documento..

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

8 visualizações2 páginasch5 5

Enviado por

Bob..

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 2

Road to recovery

Graham Fulcher discusses the eff

non-life insurance sector and the

ts of global ecor

warning signs to

Gtoham Fulcher is

the leader ofthe

Watson Wyatt UK

nn looking atthe effects of recession

fon the non-life sector, we have not

concentrated on the increase in claims,

Which is likely to be greatest in classes

such as trade credit, payment protection,

mortgage indemnity, DxO and EXO, oF

the downturn in premium volumes, which

Islikely to be greatest in classes such as

construction, marine construction and cargo

workers’ compensation, but instead on some

‘of the broader possible eects.

Medium-term economic effects

Whatever the short-term path for interest

rates and inflation as governments attempt

to.use fiscal and monetary policies to

avoid a profound slump, there are likely

to be medium-term impacts on economic

variables. Fundamentally the crisis stemmed.

from a high level of Western consumers’

and companies’ indebtedness. To reverse

this will equite a period of one or all of the

following: high inflation rates, high debt

defaults or low consumption and hence, low

‘economic growth

Aer a long period, until around two

years ago, of low and stable inflation,

non-life insurers are rediscovering the skills

needed to navigate through a world of

‘unpredictable inflation, with its resulting

effect on an industry which takes premiums

upfront in exchange for guaranteeing

against uncertain future payouts,

‘Many commentators are predicting

that the economic crisis will cause a long.

term fall in the power ofthe West ang,

2008

particularly, the Anglo-Saxon economic

model, and a transfer of economic power

to China or the Middle East, What will this

mean for the non-life industry, which has

traditionally been dominated by the West?

Will we see Sino and Sovereign Wealth Fund

investment in the insurance industry? Or

hhave the losses they have suffered in Forts,

and the UK and US banking sectors dented

their appetite for Western financial services?

Foreign exchange rates are also likely

to continue their volatility as the global

economy attempts to readjust to a new

equilibrium — for instance, the rise of,

the Renminbi as a reserve currency at the

expense ofthe dollar.

For many non-life insurers, classe foreign

exchange mismatch tsk — between assets

and liabilities

reserves ate commonly closely matched

Is less ofan issue as claims

to the underlying liabilities, However,

many insurets weting business globally

for example

‘themselves with a mismatch between capital

‘commonly held in local cutrency for the

head office and capital drivers, principally

based on potential claims liabilities and

at Lloye’s, have already found

premium levels; and expense levels based

on the currency of domicile of staff and

premium levels.

Counterparty risk

Some key lessons for financial institutions

from the financial crisis are that:

‘m Companies accepting and transferring risk

should assess the impact on thele business if

they are no longer able to transfer this risk

1m Simply repackaging and renaming a risk

does not remove the risk altogether

1m Rating agency assessments are as fallible

as any other long-term financial assessments

and should not be used to abdicate risk

‘management responsibilities

For non-life insurers this lkely to lead to:

‘m Greater focus on counterparty risk and a

likely resurgence in the syndication of risk

among a poo! of (insurers at the expense

of its transfer to a smaller number of highly

rated players

'm Greater focus on the business model of

trading risk via facultative reinsurance

1 Greater mana,

matches between losses-occurring,

reinsurance and riskattaching insurance,

‘especially when written on a multi-year

basis in clases like construction and

political risk;

The perceived regulat

not prevent the crisis in the banking industry

failures that did

have led toa wide range of proposals for

future regulatory reforms. Many ofthese

proposals as currenty drafted apply across

the financial services industry, including

Insurance, Insurance trade bodies such asthe

ABI and CEA have already warned publicly

against the risk of a one-size-fitsall approach

to financial service However, with

the role that major insurer AIG played in

at the fllures

‘occurred where it acted in a quas-banking,

the crisis, notwithstanding

‘capacity, it seems inevitable that part of

the regulatory backlash will impact on the

insurance industry.

Likely medium-term effects include

1A greater focus on modelling of risk but

ater scrutiny of the output of complex

with g

‘models and a requiement to test this outp

using stress and scenariosype testing

1A focus on any insurers considered

intrinsic to the financial system

An attempt to move regulatory regimes to

anti-cyclicality

A move to greater global co-ordination

rnothwithstanding a short-teem trend to

local supervision

A focus on remuneration polices

and thelr alignment with sound risk

management

A backlash against jurisdictions perceived

either as tax havens or weakly regulated,

The capital needs of Lloyd's insurers, partly

driven by exchange-rate fluctuations,

have proved one of the ew areas where

institutional investors have been willing to

respond. Although individually beneficial

to those companies, the net effect ofthis

availability of capital has been to mitigate

some ofthe hardening expected in the

‘commercial lines market. Afterall, it was the

availabilty of cheap and easy credit to both

Individuals and banks

CUM mr iCaey

Pencil)

res eto

Pech une ey

POM ure cl Cod

CLC

By contras

nas been firmer in some classes, leaving

he reinsurance market

some direct insurers in a classical squeeze

between hardening reinsurance rates and.

softer direct rates. Many commentators

predicted the death of the reinsurance cycle

‘due to mechanisms such as sidecats and

catastrophe bonds but, unlike post 2004/08,

these have not formed a ready source of

capital —in turn offsetting rate-hardening,

Te sidecar class of 2006/07 relied on

heavy gearing to bridge the gap between the

Insurance returns available and the etuen

‘on equity required by the sponsoring hedge

funds. The drying-up of credit has severely

{dampened the formation of sidecars in 2008,

As for catastrophe bonds, the recent crisis

should, in the longer term, be the proof

of thei ‘zero-beta’ and true diversification

from standard credit risk. However, the

csi has revealed some flaws in the

structuring to date of these bonds around

collateral issues forthe principal on the

bbond and the underlying interest paid on

that principal. Further, the hardening ofthe

bond market, beyond reinsurance hardening

Insurance

has, at present, led to a disconnect between

reinsurance and catastrophe bond prices,

There are reports of the banking industry

already reverting to the payment of high

bonuses. However, current and future

legislative or regulatory intervention at the

UK, US, EU or global level is likely to place

limit on the remunerative

of the investment banking and hedge fund

Industries to mathematically qualified

sraduates. Further public

activities of these companies and their effect

ger at the

‘on the ‘real’ economy is likely to make

socially

‘employment in these sectors le

attractive. Could the credit crunch represent

4 one-off opportunity for the non-life

Insurance industry to increase the calibre of

Company strategies will also need to

evolve. The requirements of Solvency

were expected to favour larger, more

diversified entities, but the recent crisis has

‘caused them to think again. Dispersion

Of risk should not be confused with true

dliversiication — especially when there isa

‘common driver to risk and especially when

that common driver is particularly key in

the tail, Banks found that supposedly hugely

all subject to th

same mortgage default and liquidity risks. As

diversified books we

another example, some motor insurers allow

for diversification between different target

markets and different distribution channels

but inthe tall they are all likely to be driven

by the risk of retrospective legislation with a

severely adverse effect on motor claims.

The crisis has also shown that the risks of

getting into a business that you do not

understand have been underestimate,

numberof insurers with financial services

‘operations learn their cost,

Further, insurers will need to

combine strategic thinking with their

risk management and understand thy

defensibilty and adaptability of their

strategy if there is a sucden quantum change

In economic conditions, institutional

arrangement and legislative conditions.

20923

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- ch19 3Documento40 páginasch19 3BobAinda não há avaliações

- Calc 1141 2Documento27 páginasCalc 1141 2BobAinda não há avaliações

- International: 2020 VisionDocumento5 páginasInternational: 2020 VisionBobAinda não há avaliações

- The Global Financial Crisis: - An Actuarial PerspectiveDocumento3 páginasThe Global Financial Crisis: - An Actuarial PerspectiveBobAinda não há avaliações

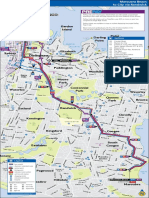

- 376 - 377 Bus Time TableDocumento19 páginas376 - 377 Bus Time TableBobAinda não há avaliações

- 376 - 377 Bus MapDocumento1 página376 - 377 Bus MapBobAinda não há avaliações

- ch4 5Documento37 páginasch4 5BobAinda não há avaliações

- Is Insurance A Luxury?Documento3 páginasIs Insurance A Luxury?BobAinda não há avaliações

- Signs of Ageing: HealthcareDocumento2 páginasSigns of Ageing: HealthcareBobAinda não há avaliações

- Hapter Xercise OlutionsDocumento5 páginasHapter Xercise OlutionsBobAinda não há avaliações

- Takaful: An Islamic Alternative To Conventional Insurance Sees Phenomenal GrowthDocumento3 páginasTakaful: An Islamic Alternative To Conventional Insurance Sees Phenomenal GrowthBobAinda não há avaliações

- Pension Benefit Design: Flexibility and The Integration of Insurance Over The Life CycleDocumento43 páginasPension Benefit Design: Flexibility and The Integration of Insurance Over The Life CycleBobAinda não há avaliações

- Code of Conduct For Candidates: Effective December 1, 2008Documento2 páginasCode of Conduct For Candidates: Effective December 1, 2008BobAinda não há avaliações

- The Uk Actuarial Profession The Actuaries' Code: ApplicationDocumento3 páginasThe Uk Actuarial Profession The Actuaries' Code: ApplicationBobAinda não há avaliações

- Chapter 3: Professionalism Exercise Sample Solutions Exercise 3.1Documento6 páginasChapter 3: Professionalism Exercise Sample Solutions Exercise 3.1BobAinda não há avaliações

- Draft Standards For The Development of Spreadsheets: 1 Spreadsheets Can Be AssetsDocumento5 páginasDraft Standards For The Development of Spreadsheets: 1 Spreadsheets Can Be AssetsBobAinda não há avaliações

- Institute of Actuaries of India: Professional Conduct Standards (Referred To As PCS)Documento9 páginasInstitute of Actuaries of India: Professional Conduct Standards (Referred To As PCS)BobAinda não há avaliações

- Rules of Professional ConductDocumento9 páginasRules of Professional ConductBobAinda não há avaliações

- Chapter 2 Exercises and Solutions: Exercise 2.1Documento3 páginasChapter 2 Exercises and Solutions: Exercise 2.1BobAinda não há avaliações

- Code of Professional Conduct November 2009: IndexDocumento10 páginasCode of Professional Conduct November 2009: IndexBobAinda não há avaliações

- Doors Of: December 2009/january 2010Documento6 páginasDoors Of: December 2009/january 2010BobAinda não há avaliações

- Code of Professional Conduct: Section 5Documento4 páginasCode of Professional Conduct: Section 5BobAinda não há avaliações