Escolar Documentos

Profissional Documentos

Cultura Documentos

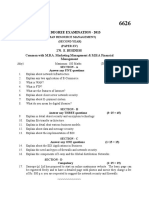

M.B.A. Degree Examination, May 2015 (Financial Management) : 250: Investm Ent, Security and Portfolio M Anagem Ent

Enviado por

Ravi Krishnan0 notas0% acharam este documento útil (0 voto)

15 visualizações1 página6890

Título original

6890

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documento6890

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

15 visualizações1 páginaM.B.A. Degree Examination, May 2015 (Financial Management) : 250: Investm Ent, Security and Portfolio M Anagem Ent

Enviado por

Ravi Krishnan6890

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 1

6890

Total No. of Pages: 1

Register Number:

Name of the Candidate:

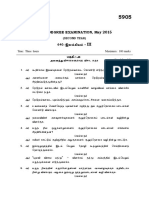

M.B.A. DEGREE EXAMINATION, May 2015

(FINANCIAL MANAGEMENT)

(SECOND YEAR)

250: INVESTM ENT, SECURITY AND PORTFOLIO M ANAGEM ENT

Time: Three hours

Maximum: 75 marks

SECTION - A

Answer any FIVE questions

1.

2.

3.

4.

5.

6.

7.

What is new issue market?

Define investment.

Write short note on Intrinsic value approach

Define systematic risk.

Briefly explain Industry life cycle.

What do you mean by breadth of the market?

What is SWAP?

SECTION - B

Answer any THREE questions

8.

9.

10.

11.

12.

(1 15 = 15)

Explain the advantage and disadvantages of portfolio management.

Elucidate the key elements in on Industry analysis.

Explain the salient features of stock exchange.

SECTION - D

COMPULSORY

16.

(3 10 = 30)

What are the various types of risk involved?

What are the major sources of information used in fundamental analysis?

Explain the uses and limitations of P and F charts?

Elucidate the role of SEBI.

List out the guidelines for using dollar cost averaging?

SECTION - C

Answer any ONE question

13.

14.

15.

(5 3 = 15)

(1 15 = 15)

Discuss the modern approaches of security analysis and portfolio management.

$$$$$$$

Você também pode gostar

- IPMNew Dec2012Documento1 páginaIPMNew Dec2012Umang ModiAinda não há avaliações

- M.B.A. Degree Examination, May 2015 (Financial Management) : 240: M Anagem Ent of Funds and AssetsDocumento1 páginaM.B.A. Degree Examination, May 2015 (Financial Management) : 240: M Anagem Ent of Funds and AssetsRavi KrishnanAinda não há avaliações

- M.B.A. Degree Examination, May 2015 (Financial Management) : 220: International FinanceDocumento1 páginaM.B.A. Degree Examination, May 2015 (Financial Management) : 220: International FinanceRavi KrishnanAinda não há avaliações

- M.B.A. Degree Examination, May 2015: (Human Resource Management)Documento1 páginaM.B.A. Degree Examination, May 2015: (Human Resource Management)Ravi KrishnanAinda não há avaliações

- M.B.A. Degree Examination, May 2015 (Financial Management) : 230: Financial Analysis and Industrial FinancingDocumento3 páginasM.B.A. Degree Examination, May 2015 (Financial Management) : 230: Financial Analysis and Industrial FinancingRavi KrishnanAinda não há avaliações

- I Economics Analysis For BusinessDocumento2 páginasI Economics Analysis For BusinessNarayanan BhaskaranAinda não há avaliações

- May 2011Documento19 páginasMay 2011raviudeshi14Ainda não há avaliações

- Sapm QBDocumento8 páginasSapm QBSiva KumarAinda não há avaliações

- Sapm 2Documento3 páginasSapm 2Mythili KarthikeyanAinda não há avaliações

- Answer ALL Questions A (10 × 2 20 Marks)Documento3 páginasAnswer ALL Questions A (10 × 2 20 Marks)Vem Baiyan CAinda não há avaliações

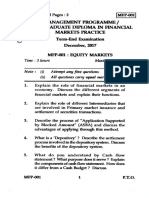

- 2 Management Programme / T. Post Graduate Diploma in Financial 0-Markets Practice 00 Term-End Examination December, 2017 Mfp-001: Equity MarketsDocumento2 páginas2 Management Programme / T. Post Graduate Diploma in Financial 0-Markets Practice 00 Term-End Examination December, 2017 Mfp-001: Equity MarketsRohit GhuseAinda não há avaliações

- M.B.A. Degree Examination - 2011: 230. Financial Analysis and Industrial FinanciingDocumento2 páginasM.B.A. Degree Examination - 2011: 230. Financial Analysis and Industrial FinanciingRavi KrishnanAinda não há avaliações

- Security Analysis and Portfolio Management QBDocumento13 páginasSecurity Analysis and Portfolio Management QBAnonymous y3E7iaAinda não há avaliações

- Mba (Banking & Insurance)Documento128 páginasMba (Banking & Insurance)Rama LingamAinda não há avaliações

- KKKKDocumento2 páginasKKKKGURJARAinda não há avaliações

- Answer Any ONE Question.: Section - CDocumento2 páginasAnswer Any ONE Question.: Section - CRavi KrishnanAinda não há avaliações

- Financial Management For Agri. Business - Sum-2010Documento1 páginaFinancial Management For Agri. Business - Sum-2010THE MANAGEMENT CONSORTIUM (TMC) ‘All for knowledge, and knowledge for all’Ainda não há avaliações

- Master of Business Administration-MBA Semester 3Documento1 páginaMaster of Business Administration-MBA Semester 3TayeworkAinda não há avaliações

- MBA/M-l7: Analysis ManagementDocumento2 páginasMBA/M-l7: Analysis ManagementGURJARAinda não há avaliações

- M.B.A. Degree Examination, May 2015: (Human Resource Management)Documento2 páginasM.B.A. Degree Examination, May 2015: (Human Resource Management)Ravi KrishnanAinda não há avaliações

- A2318 ECA44 (For Candidates Admitted From 2008) Ii Year - Iv Semester Major Paper Xvii - Financial Markets and Services Time: 3 Hours Max. Marks: 75Documento2 páginasA2318 ECA44 (For Candidates Admitted From 2008) Ii Year - Iv Semester Major Paper Xvii - Financial Markets and Services Time: 3 Hours Max. Marks: 75kaviyaAinda não há avaliações

- Question Bank EEFA 2 MarksDocumento9 páginasQuestion Bank EEFA 2 MarksSathish KrishnaAinda não há avaliações

- M.B.A. Degree Examination, May 2015 (International Business)Documento1 páginaM.B.A. Degree Examination, May 2015 (International Business)Shaik TousifAinda não há avaliações

- Poim P 1Documento2 páginasPoim P 1nidhi malikAinda não há avaliações

- MODEL I SAPM - 1,2,3 UnitsDocumento2 páginasMODEL I SAPM - 1,2,3 UnitsSabha PathyAinda não há avaliações

- OM0010 - Operations Management - Sem 3 - Aug - Fall 2011 - AssignmentDocumento2 páginasOM0010 - Operations Management - Sem 3 - Aug - Fall 2011 - AssignmentDeepak ThakurAinda não há avaliações

- Tutorial Sheet For Engineering and Managerial EconomicsDocumento3 páginasTutorial Sheet For Engineering and Managerial Economicssaxena_sumit1985Ainda não há avaliações

- Instruction: Answers Should Written in English OnlyDocumento2 páginasInstruction: Answers Should Written in English OnlyLishanthAinda não há avaliações

- Strategic Management & Business PolicyDocumento13 páginasStrategic Management & Business PolicyGopi PathakAinda não há avaliações

- Gnanamani College of Technology: Ba7021 Security Analysis and Portfolio ManagementDocumento1 páginaGnanamani College of Technology: Ba7021 Security Analysis and Portfolio ManagementSabha PathyAinda não há avaliações

- Questio Bak Unit 12345 NbaDocumento8 páginasQuestio Bak Unit 12345 NbarajapatnaAinda não há avaliações

- M.B.A. DEGREE EXAMINATION December 2014: (Financial Management)Documento1 páginaM.B.A. DEGREE EXAMINATION December 2014: (Financial Management)Ravi KrishnanAinda não há avaliações

- (Accredited by NAAC With "A" Grade) (MBA - Approved by AICTE, New Delhi) (Affiliated To Bharathidasan University, Tiruchirappalli - 24)Documento5 páginas(Accredited by NAAC With "A" Grade) (MBA - Approved by AICTE, New Delhi) (Affiliated To Bharathidasan University, Tiruchirappalli - 24)Maria Monisha DAinda não há avaliações

- Sri Venkateswara University:: Tirupati Syllabus Bba - Sixth SemesterDocumento13 páginasSri Venkateswara University:: Tirupati Syllabus Bba - Sixth SemesterSreenivasulu reddyAinda não há avaliações

- Question Paper IBMDocumento2 páginasQuestion Paper IBManuneelakantanAinda não há avaliações

- I BBA Syllabus 2015 16Documento19 páginasI BBA Syllabus 2015 16Prabhakar RaoAinda não há avaliações

- Mba DEC 2022 Exam - MergedDocumento13 páginasMba DEC 2022 Exam - MergedAman SharmaAinda não há avaliações

- Mba (Bank MGT.)Documento32 páginasMba (Bank MGT.)Sneha Angre0% (1)

- B.A. DEGREE EXAMINATION December 2014: (Economics)Documento2 páginasB.A. DEGREE EXAMINATION December 2014: (Economics)Ravi KrishnanAinda não há avaliações

- New BookDocumento6 páginasNew Bookmuzammil04786Ainda não há avaliações

- Btech Apm 6 Sem Industrial Management 2010Documento4 páginasBtech Apm 6 Sem Industrial Management 2010Soumya BeraAinda não há avaliações

- 20HS5103 Economics Subject Question BankDocumento3 páginas20HS5103 Economics Subject Question BankVallabh JAinda não há avaliações

- OM0010Documento2 páginasOM0010Tenzin KunchokAinda não há avaliações

- Model Question Pape1Documento5 páginasModel Question Pape1Vijay SinghAinda não há avaliações

- Third Semester Master of Business Administration (MBA) Examination Entrepernurial Development Paper II Section BDocumento18 páginasThird Semester Master of Business Administration (MBA) Examination Entrepernurial Development Paper II Section BTHE MANAGEMENT CONSORTIUM (TMC) ‘All for knowledge, and knowledge for all’Ainda não há avaliações

- MTTM 005 Previous Year Question Papers by IgnouassignmentguruDocumento45 páginasMTTM 005 Previous Year Question Papers by IgnouassignmentguruReshma RAinda não há avaliações

- IOMDocumento11 páginasIOMBIBIN RAJ B SAinda não há avaliações

- Industrial Engineering Question Bank Vishal Shinde Kbtcoe NashikDocumento4 páginasIndustrial Engineering Question Bank Vishal Shinde Kbtcoe NashikAashishAinda não há avaliações

- Security Analysis and Port Folio Management: Question Bank (5years) 2 MarksDocumento7 páginasSecurity Analysis and Port Folio Management: Question Bank (5years) 2 MarksVignesh Narayanan100% (1)

- Instructions:: Gujarat Technological UniversityDocumento1 páginaInstructions:: Gujarat Technological UniversityHardik RakholiyaAinda não há avaliações

- Mathematics ModelDocumento31 páginasMathematics ModelBrian BurchAinda não há avaliações

- Managerial Economics and Financial AnalysisDocumento4 páginasManagerial Economics and Financial Analysissrihari100% (1)

- Business Studies March 2007 EngDocumento2 páginasBusiness Studies March 2007 EngPrasad C MAinda não há avaliações

- Model Test Question Paper - Managerial Economics - Nov-Dec 2015Documento2 páginasModel Test Question Paper - Managerial Economics - Nov-Dec 2015jeganrajraj100% (6)

- Industrial EngDocumento1 páginaIndustrial EngMuralee DharanAinda não há avaliações

- Engineering Economics and Financial AccountingDocumento5 páginasEngineering Economics and Financial AccountingAkvijayAinda não há avaliações

- Imp Ques - Managerial EconomicsDocumento6 páginasImp Ques - Managerial EconomicsPavan Kumar NAinda não há avaliações

- Business Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideNo EverandBusiness Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideAinda não há avaliações

- Neyveli Lignite Corporation Limited: Corporate Office: P & A DepartmentDocumento1 páginaNeyveli Lignite Corporation Limited: Corporate Office: P & A DepartmentRavi KrishnanAinda não há avaliações

- ,y, Y, Y, Yf F F F F F F Fpak Pak Pak Pak - : B.Lit. Degree Examination, May 2015Documento2 páginas,y, Y, Y, Yf F F F F F F Fpak Pak Pak Pak - : B.Lit. Degree Examination, May 2015Ravi KrishnanAinda não há avaliações

- Environmental Impact Assessment of Mining Projects: Dr. Gurdeep Singh 1.0 ScreeningDocumento10 páginasEnvironmental Impact Assessment of Mining Projects: Dr. Gurdeep Singh 1.0 ScreeningRavi KrishnanAinda não há avaliações

- Heavy Media SeparationDocumento4 páginasHeavy Media SeparationRavi KrishnanAinda não há avaliações

- JKPH, Yf Fpa Tuyhw: B.A./B.Sc./B.Music/B.Dance Degree Examination, May 2015 (Part-I - Tamil)Documento1 páginaJKPH, Yf Fpa Tuyhw: B.A./B.Sc./B.Music/B.Dance Degree Examination, May 2015 (Part-I - Tamil)Ravi KrishnanAinda não há avaliações

- B.Lit. Degree Examination, May 2015:, Yf Fpak - IIIDocumento2 páginasB.Lit. Degree Examination, May 2015:, Yf Fpak - IIIRavi KrishnanAinda não há avaliações

- Ciueila (K Ehlfkk : B.A./B.Sc./B.Music/B.Dance Degree Examination, May 2015 (Part-I - Tamil)Documento1 páginaCiueila (K Ehlfkk : B.A./B.Sc./B.Music/B.Dance Degree Examination, May 2015 (Part-I - Tamil)Ravi KrishnanAinda não há avaliações

- M.Sc. Degree Examination, 2013: SECTION - B (3 × 20 60)Documento1 páginaM.Sc. Degree Examination, 2013: SECTION - B (3 × 20 60)Ravi KrishnanAinda não há avaliações

- M.B.A. DEGREE EXAMINATION December 2014: (Human Resource Management)Documento1 páginaM.B.A. DEGREE EXAMINATION December 2014: (Human Resource Management)Ravi KrishnanAinda não há avaliações

- M. B.A. Degree Examination - 2013: 270. E. Business Common With M.B.A. Marketing Management & M.B.A Financial ManagementDocumento1 páginaM. B.A. Degree Examination - 2013: 270. E. Business Common With M.B.A. Marketing Management & M.B.A Financial ManagementRavi KrishnanAinda não há avaliações

- B.A. DEGREE EXAMINATION December 2014: (Economics)Documento2 páginasB.A. DEGREE EXAMINATION December 2014: (Economics)Ravi KrishnanAinda não há avaliações

- M.SC .Degree Examination - 2013: 530. Aerial Photography and PhotogrammetryDocumento2 páginasM.SC .Degree Examination - 2013: 530. Aerial Photography and PhotogrammetryRavi KrishnanAinda não há avaliações

- Answer Any ONE Question.: Section - CDocumento2 páginasAnswer Any ONE Question.: Section - CRavi KrishnanAinda não há avaliações

- M.B.A. Degree Examination - 2011: 230. Financial Analysis and Industrial FinanciingDocumento2 páginasM.B.A. Degree Examination - 2011: 230. Financial Analysis and Industrial FinanciingRavi KrishnanAinda não há avaliações

- M.B.A. (Financial Management) DEGREE EXAMINATION - 2013: 230. Financial Analysis and Industrial FinancingDocumento2 páginasM.B.A. (Financial Management) DEGREE EXAMINATION - 2013: 230. Financial Analysis and Industrial FinancingRavi KrishnanAinda não há avaliações

- M.B.A. Degree Examination - 2011: 220. International FinanceDocumento1 páginaM.B.A. Degree Examination - 2011: 220. International FinanceRavi KrishnanAinda não há avaliações

- B.A. Degree Examination, 2010: 710. History of TamilnaduDocumento2 páginasB.A. Degree Examination, 2010: 710. History of TamilnaduRavi KrishnanAinda não há avaliações

- Register Number: Name of The Candidate: 2: Total No. of PagesDocumento2 páginasRegister Number: Name of The Candidate: 2: Total No. of PagesRavi KrishnanAinda não há avaliações