Escolar Documentos

Profissional Documentos

Cultura Documentos

M.B.A. Degree Examination - 2011: 230. Financial Analysis and Industrial Financiing

Enviado por

Ravi KrishnanTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

M.B.A. Degree Examination - 2011: 230. Financial Analysis and Industrial Financiing

Enviado por

Ravi KrishnanDireitos autorais:

Formatos disponíveis

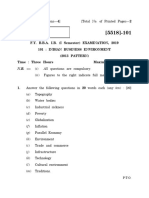

Total No.

of Pages: 2

6528

Register Number:

Name of the Candidate:

M.B.A. DEGREE EXAMINATION - 2011

(FINANCIAL MANAGEMENT)

(SECOND YEAR)

(PAPER-XI)

230. FINANCIAL ANALYSIS AND INDUSTRIAL FINANCIING

December)

(Time: 3 Hours

Maximum: 75 Marks

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

SECTION-A

Answer any FIVE Questions

(53=15)

What is meant by Interest converge ratio?

What are the objectives of cash flow statement?

What are the limitations of ratio analysis?

What do you understand by current liabilities and current assets?

Write short notes on short term needs

What is meant by SIDC?

What is meant by capital market?

SECTION-B

Answer any THREE Questions

(310=30)

What are the sources of short term finance?

State and explain how accounting ratios are classified.

State the objectives of funds flow statement.

From the following data find out a) Current assets, b) Current liabilities, c) Stock,

d) Fixed assets.

Current Ratio:2.5, Liquid Ratio 1.5, Fixed assets to proprietary fund 0.75, Working

capital Rs 60,000; Reserves and surplus Rs 40,000; Bank overdraft Rs 10,000.There is no

long term loan or fictitious asset.

Compute cash from operations from the following figures.

1.12.93

31.12.93

Sundry Debtors

10,000

12,000

Provision for bad debts

1,000

1,200

Bills Receivable

4,000

3,000

Bills Payable

5,000

6,000

Sundry Creditors

8,000

9,000

Inventories

5,000

8,000

Short Term Investments

10,000

12,000

Outstanding Expenses

1,000

1,500

Prepaid expenses

Accrued Income

Income received in advance

2,000

3,000

2,000

1,000

4,000

1,000

13.

SECTION-C

Answer any ONE Question

(115=15)

Explain the role of LIC for the development of Indian Capital Market

14.

Explain the difficulties for financing SSI.

15.

Discuss the role of Commercial Banks in Industrial Financing

16.

SECTION-D

(Compulsory)

(115=15)

Explain the need and importance of short term financial needs of concern.

---------------------

Você também pode gostar

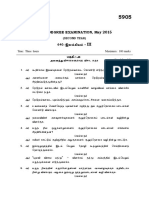

- M.B.A. Degree Examination, May 2015 (Financial Management) : 230: Financial Analysis and Industrial FinancingDocumento3 páginasM.B.A. Degree Examination, May 2015 (Financial Management) : 230: Financial Analysis and Industrial FinancingRavi KrishnanAinda não há avaliações

- Financial Soundness Indicators for Financial Sector Stability in Viet NamNo EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamAinda não há avaliações

- M.B.A. Degree Examination - 2011: 220. International FinanceDocumento1 páginaM.B.A. Degree Examination - 2011: 220. International FinanceRavi KrishnanAinda não há avaliações

- Private Debt: Yield, Safety and the Emergence of Alternative LendingNo EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingAinda não há avaliações

- Answer Any ONE Question.: Section - CDocumento2 páginasAnswer Any ONE Question.: Section - CRavi KrishnanAinda não há avaliações

- Business Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideNo EverandBusiness Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideAinda não há avaliações

- M.B.A. Degree Examination, May 2015: (Human Resource Management)Documento2 páginasM.B.A. Degree Examination, May 2015: (Human Resource Management)Ravi KrishnanAinda não há avaliações

- Banking and Beyond: The Evolution of Financing along Traditional and Alternative AvenuesNo EverandBanking and Beyond: The Evolution of Financing along Traditional and Alternative AvenuesCaterina CrucianiAinda não há avaliações

- M.B.A. Degree Examination, May 2015 (Financial Management) : 220: International FinanceDocumento1 páginaM.B.A. Degree Examination, May 2015 (Financial Management) : 220: International FinanceRavi KrishnanAinda não há avaliações

- Handbook of Basel III Capital: Enhancing Bank Capital in PracticeNo EverandHandbook of Basel III Capital: Enhancing Bank Capital in PracticeAinda não há avaliações

- Answer ALL Questions A (10 × 2 20 Marks)Documento3 páginasAnswer ALL Questions A (10 × 2 20 Marks)Vem Baiyan CAinda não há avaliações

- The Handbook of Market Intelligence: Understand, Compete and Grow in Global MarketsNo EverandThe Handbook of Market Intelligence: Understand, Compete and Grow in Global MarketsAinda não há avaliações

- Mba (Banking & Insurance)Documento128 páginasMba (Banking & Insurance)Rama LingamAinda não há avaliações

- Anu Mba 3 Years Final Year Question Paper June 2010Documento41 páginasAnu Mba 3 Years Final Year Question Paper June 2010gauravAinda não há avaliações

- 104EXMBADocumento27 páginas104EXMBAAnonymous 5lbkhbAinda não há avaliações

- 2013Documento6 páginas2013blackmafia1297Ainda não há avaliações

- Mba DEC 2022 Exam - MergedDocumento13 páginasMba DEC 2022 Exam - MergedAman SharmaAinda não há avaliações

- M.B.A. Degree Examination, May 2015 (Financial Management) : 240: M Anagem Ent of Funds and AssetsDocumento1 páginaM.B.A. Degree Examination, May 2015 (Financial Management) : 240: M Anagem Ent of Funds and AssetsRavi KrishnanAinda não há avaliações

- M.B.A. DEGREE EXAMINATION December 2014: (Financial Management)Documento1 páginaM.B.A. DEGREE EXAMINATION December 2014: (Financial Management)Ravi KrishnanAinda não há avaliações

- IPMNew Dec2012Documento1 páginaIPMNew Dec2012Umang ModiAinda não há avaliações

- MS-3 Management Programme Term-End Examination June, 2015 Ms-3: Economic and Social EnvironmentDocumento2 páginasMS-3 Management Programme Term-End Examination June, 2015 Ms-3: Economic and Social Environmentdebaditya_hit326634Ainda não há avaliações

- M.B.A. Degree Examination, May 2015 (Financial Management) : 250: Investm Ent, Security and Portfolio M Anagem EntDocumento1 páginaM.B.A. Degree Examination, May 2015 (Financial Management) : 250: Investm Ent, Security and Portfolio M Anagem EntRavi KrishnanAinda não há avaliações

- Smu Mba Winter 2013 Solved AssignmentDocumento85 páginasSmu Mba Winter 2013 Solved AssignmentTusharr AhujaAinda não há avaliações

- DBA7103Documento22 páginasDBA7103Ankit AgarwalAinda não há avaliações

- Accounting Theory and Policy - (Final Paper) - International Islamic University MalaysiaDocumento6 páginasAccounting Theory and Policy - (Final Paper) - International Islamic University MalaysiaMaas Riyaz Malik100% (1)

- MTTM 005 Previous Year Question Papers by IgnouassignmentguruDocumento45 páginasMTTM 005 Previous Year Question Papers by IgnouassignmentguruReshma RAinda não há avaliações

- Managerial Economics and Financial AnalysisDocumento4 páginasManagerial Economics and Financial Analysissrihari100% (1)

- bt31R07 12 11 09rahulDocumento40 páginasbt31R07 12 11 09rahulPradeep NelapatiAinda não há avaliações

- M B A (QuestionsDocumento89 páginasM B A (QuestionsShijo JosephAinda não há avaliações

- EEC-10 - June 13 - 2Documento8 páginasEEC-10 - June 13 - 2RohitKumarAinda não há avaliações

- Mcom 2012Documento306 páginasMcom 2012Amol KastureAinda não há avaliações

- 2019 Mba 3rd Sem Mba Question PapersDocumento9 páginas2019 Mba 3rd Sem Mba Question Paperssauravnagpal309Ainda não há avaliações

- M.B.A. Degree Examination, May 2015: (Human Resource Management)Documento1 páginaM.B.A. Degree Examination, May 2015: (Human Resource Management)Ravi KrishnanAinda não há avaliações

- BBA-301 Jnu Jun 2015Documento1 páginaBBA-301 Jnu Jun 2015giit_rkcl7917Ainda não há avaliações

- Accounting and Finance For ManagersDocumento3 páginasAccounting and Finance For ManagersHemanthSKFAinda não há avaliações

- PGDBM SyllybusDocumento54 páginasPGDBM SyllybusEd ReyAinda não há avaliações

- Mca 103Documento2 páginasMca 103kola0123Ainda não há avaliações

- 1st Sem PapersDocumento66 páginas1st Sem PapersJanvi 86 sec.BAinda não há avaliações

- Jntuworld: R09 Set No. 2Documento4 páginasJntuworld: R09 Set No. 2adi05320% (1)

- MBA Question PapersDocumento68 páginasMBA Question PapersRashmi Hulsurkar100% (1)

- Nr-310106-Manageria Econ and Prin AcDocumento4 páginasNr-310106-Manageria Econ and Prin AcSRINIVASA RAO GANTAAinda não há avaliações

- 2nd Year English (MCO)Documento9 páginas2nd Year English (MCO)Kksia AroraAinda não há avaliações

- 0102 Managerial Economics and Financial AnalysisDocumento7 páginas0102 Managerial Economics and Financial AnalysisFozia PanhwerAinda não há avaliações

- B.A. DEGREE EXAMINATION December 2014: (Economics)Documento2 páginasB.A. DEGREE EXAMINATION December 2014: (Economics)Ravi KrishnanAinda não há avaliações

- P. G. D. B. M. (Semester-I) Examination, 2012 101: Principles and Practices of Management and Organisational Behavior (2008 Pattern)Documento54 páginasP. G. D. B. M. (Semester-I) Examination, 2012 101: Principles and Practices of Management and Organisational Behavior (2008 Pattern)Muhamad AdibAinda não há avaliações

- Question Bank 2012 Class XIIDocumento179 páginasQuestion Bank 2012 Class XIINitin Dadu100% (1)

- Third Semester Master of Business Administration (MBA) Examination Entrepernurial Development Paper II Section BDocumento18 páginasThird Semester Master of Business Administration (MBA) Examination Entrepernurial Development Paper II Section BTHE MANAGEMENT CONSORTIUM (TMC) ‘All for knowledge, and knowledge for all’Ainda não há avaliações

- B.B.A (I.b) 2013 PatternDocumento93 páginasB.B.A (I.b) 2013 PatternPRAJWAL JADHAVAinda não há avaliações

- Financial Management (Paper Code-303) End Term Papers - Shilpa Arora - IINTMDocumento6 páginasFinancial Management (Paper Code-303) End Term Papers - Shilpa Arora - IINTMMatthew HughesAinda não há avaliações

- P. G. D. B. M. (Semester-I) Examination, 2012 101: Principles and Practices of Management and Organisational Behavior (2008 Pattern)Documento54 páginasP. G. D. B. M. (Semester-I) Examination, 2012 101: Principles and Practices of Management and Organisational Behavior (2008 Pattern)Arjun ChhikaraAinda não há avaliações

- Mba 516Documento2 páginasMba 516api-3782519Ainda não há avaliações

- What Is Double Entry Book KeepingDocumento1 páginaWhat Is Double Entry Book KeepingumarrchAinda não há avaliações

- Assignment QuestionsDocumento2 páginasAssignment QuestionsPankaj GoplaniAinda não há avaliações

- (2019 PATTRN) - April - 2023Documento145 páginas(2019 PATTRN) - April - 2023Kadam RohitAinda não há avaliações

- MBA (International Business)Documento52 páginasMBA (International Business)Nazhia KhanAinda não há avaliações

- NR 310106 MepaDocumento8 páginasNR 310106 MepaSrinivasa Rao GAinda não há avaliações

- Revalidation Test Paper Question GR IIIDocumento9 páginasRevalidation Test Paper Question GR IIIMinhaz AlamAinda não há avaliações

- Eco Iv Ec 04Documento7 páginasEco Iv Ec 04Sourav KumarAinda não há avaliações

- Financial ServicesDocumento2 páginasFinancial Servicesannugautam1902Ainda não há avaliações

- Heavy Media SeparationDocumento4 páginasHeavy Media SeparationRavi KrishnanAinda não há avaliações

- Crusher Using RulesDocumento2 páginasCrusher Using RulesRavi KrishnanAinda não há avaliações

- Neyveli Lignite Corporation Limited: Corporate Office: P & A DepartmentDocumento1 páginaNeyveli Lignite Corporation Limited: Corporate Office: P & A DepartmentRavi KrishnanAinda não há avaliações

- Method of SamplingDocumento3 páginasMethod of SamplingRavi KrishnanAinda não há avaliações

- TADocumento71 páginasTARavi KrishnanAinda não há avaliações

- Gravity ConcentrationDocumento12 páginasGravity ConcentrationRavi KrishnanAinda não há avaliações

- Ion EchangeDocumento3 páginasIon EchangeRavi KrishnanAinda não há avaliações

- Environmental Impact Assessment of Mining Projects: Dr. Gurdeep Singh 1.0 ScreeningDocumento10 páginasEnvironmental Impact Assessment of Mining Projects: Dr. Gurdeep Singh 1.0 ScreeningRavi KrishnanAinda não há avaliações

- Ciueila (K Ehlfkk : B.A./B.Sc./B.Music/B.Dance Degree Examination, May 2015 (Part-I - Tamil)Documento1 páginaCiueila (K Ehlfkk : B.A./B.Sc./B.Music/B.Dance Degree Examination, May 2015 (Part-I - Tamil)Ravi KrishnanAinda não há avaliações

- M.Sc. Degree Examination, 2013: SECTION - B (3 × 20 60)Documento1 páginaM.Sc. Degree Examination, 2013: SECTION - B (3 × 20 60)Ravi KrishnanAinda não há avaliações

- ,y, Y, Y, Yf F F F F F F Fpak Pak Pak Pak - : B.Lit. Degree Examination, May 2015Documento2 páginas,y, Y, Y, Yf F F F F F F Fpak Pak Pak Pak - : B.Lit. Degree Examination, May 2015Ravi KrishnanAinda não há avaliações

- B.Lit. Degree Examination, May 2015:, Yf Fpak - IIIDocumento2 páginasB.Lit. Degree Examination, May 2015:, Yf Fpak - IIIRavi KrishnanAinda não há avaliações

- JKPH, Yf Fpa Tuyhw: B.A./B.Sc./B.Music/B.Dance Degree Examination, May 2015 (Part-I - Tamil)Documento1 páginaJKPH, Yf Fpa Tuyhw: B.A./B.Sc./B.Music/B.Dance Degree Examination, May 2015 (Part-I - Tamil)Ravi KrishnanAinda não há avaliações

- VDGFHDocumento1 páginaVDGFHRavi KrishnanAinda não há avaliações

- M. B.A. Degree Examination - 2013: 270. E. Business Common With M.B.A. Marketing Management & M.B.A Financial ManagementDocumento1 páginaM. B.A. Degree Examination - 2013: 270. E. Business Common With M.B.A. Marketing Management & M.B.A Financial ManagementRavi KrishnanAinda não há avaliações

- 6167Documento1 página6167Ravi KrishnanAinda não há avaliações

- 6876Documento2 páginas6876Ravi KrishnanAinda não há avaliações

- 6775Documento2 páginas6775Ravi KrishnanAinda não há avaliações

- 6789Documento2 páginas6789Ravi KrishnanAinda não há avaliações

- M.B.A. Degree Examination, May 2015: (Human Resource Management)Documento2 páginasM.B.A. Degree Examination, May 2015: (Human Resource Management)Ravi KrishnanAinda não há avaliações

- M.B.A. DEGREE EXAMINATION December 2014: (Human Resource Management)Documento1 páginaM.B.A. DEGREE EXAMINATION December 2014: (Human Resource Management)Ravi KrishnanAinda não há avaliações

- B.A. DEGREE EXAMINATION December 2014: (Economics)Documento2 páginasB.A. DEGREE EXAMINATION December 2014: (Economics)Ravi KrishnanAinda não há avaliações

- 6890 IDocumento2 páginas6890 IRavi KrishnanAinda não há avaliações

- Financial Statement AnalysisDocumento79 páginasFinancial Statement AnalysisAbdi Rahman Bariise100% (2)

- 6874Documento2 páginas6874Ravi KrishnanAinda não há avaliações

- M.SC .Degree Examination - 2013: 530. Aerial Photography and PhotogrammetryDocumento2 páginasM.SC .Degree Examination - 2013: 530. Aerial Photography and PhotogrammetryRavi KrishnanAinda não há avaliações

- M.SC .Degree Examination - 2013: 530. Aerial Photography and PhotogrammetryDocumento2 páginasM.SC .Degree Examination - 2013: 530. Aerial Photography and PhotogrammetryRavi KrishnanAinda não há avaliações

- Register Number: Name of The Candidate: 2: Total No. of PagesDocumento2 páginasRegister Number: Name of The Candidate: 2: Total No. of PagesRavi KrishnanAinda não há avaliações

- M.B.A. Degree Examination, May 2015 (Financial Management) : 250: Investm Ent, Security and Portfolio M Anagem EntDocumento1 páginaM.B.A. Degree Examination, May 2015 (Financial Management) : 250: Investm Ent, Security and Portfolio M Anagem EntRavi KrishnanAinda não há avaliações

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNo EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNota: 4.5 de 5 estrelas4.5/5 (17)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNo Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNota: 4.5 de 5 estrelas4.5/5 (3)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNo EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNota: 4.5 de 5 estrelas4.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNo EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNota: 5 de 5 estrelas5/5 (6)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- Financial Risk Management: A Simple IntroductionNo EverandFinancial Risk Management: A Simple IntroductionNota: 4.5 de 5 estrelas4.5/5 (7)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successNo EverandReady, Set, Growth hack:: A beginners guide to growth hacking successNota: 4.5 de 5 estrelas4.5/5 (93)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNota: 4.5 de 5 estrelas4.5/5 (32)

- Value: The Four Cornerstones of Corporate FinanceNo EverandValue: The Four Cornerstones of Corporate FinanceNota: 4.5 de 5 estrelas4.5/5 (18)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNo EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNota: 4.5 de 5 estrelas4.5/5 (34)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetNo EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetNota: 5 de 5 estrelas5/5 (2)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamAinda não há avaliações

- How to Measure Anything: Finding the Value of Intangibles in BusinessNo EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessNota: 3.5 de 5 estrelas3.5/5 (4)

- Joy of Agility: How to Solve Problems and Succeed SoonerNo EverandJoy of Agility: How to Solve Problems and Succeed SoonerNota: 4 de 5 estrelas4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNo EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNota: 4.5 de 5 estrelas4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsNo EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsNota: 5 de 5 estrelas5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNo EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNota: 4.5 de 5 estrelas4.5/5 (79)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNo EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNota: 4 de 5 estrelas4/5 (32)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialAinda não há avaliações

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNo EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNota: 4.5 de 5 estrelas4.5/5 (4)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)No EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Nota: 4.5 de 5 estrelas4.5/5 (4)

- The Synergy Solution: How Companies Win the Mergers and Acquisitions GameNo EverandThe Synergy Solution: How Companies Win the Mergers and Acquisitions GameAinda não há avaliações