Escolar Documentos

Profissional Documentos

Cultura Documentos

IRS (Public Policy Positions) - Request Exhibits

Enviado por

CREW0 notas0% acharam este documento útil (0 voto)

11 visualizações29 páginasExhibits related to the IRS' efforts to ascertain policy positions of tax exempt organizations or organizations seeking tax exempt status.

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoExhibits related to the IRS' efforts to ascertain policy positions of tax exempt organizations or organizations seeking tax exempt status.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

11 visualizações29 páginasIRS (Public Policy Positions) - Request Exhibits

Enviado por

CREWExhibits related to the IRS' efforts to ascertain policy positions of tax exempt organizations or organizations seeking tax exempt status.

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 29

EXHIBIT A

Case 2:10-cv-04307-CMR Document 5-1 Filed 11/22/10 Page 1 of 6

IN THE UNITED STATES DISTRICT COURT

FOR THE EASTERN DISTRICT OF PENNSYLVANIA

ZSTREET,

Plaintiff, 1 CIVIL ACTION NO. 2:10-ev-04307-CMR

v.

DOUGLAS H. SHULMAN,

IN HIS OFFICIAL CAPACITY AS

COMMISSIONER OF

INTERNAL REVENUE,

Defendant.

DECLARATION OF JEROME M. MARCUS, ESQUIRE

I, Jerome M. Marcus, declare as follows:

i

2,

3.

Tam counsel for Z STREET, the plaintiff in the above-captioned matter.

Shortly after the Complaint in this case was filed, I leamed that another organization was

2 charitable exemption from tax under Section 501(c)(3) of the Intemal Revenue

Code, and that this organization had been victimized by the same IRS policy as that at

issue in this ease.

| contacted an adviser to this organization and through that person I learned that the IRS

had sent a letter to this organization asking about its views regarding Israel. Because of

‘the adviser’s concern that the IRS would take adverse action to the organization if it were

known that the organization had publicly revealed the IRS's inquiry, the adviser was

willing to speak with me only ifI agreed that I would retain the adviser’s name in

confidence. For the same reason, the adviser also refused to reveal to me the identity of

ly the

the organization which was seeking the $01(¢)(3) certification, and accor

adviser would not provide me with the first page of the letter the organization had

received from the IRS, though the adviser was willing to provide me with the rest of the

letter.

Case 2:10-cv-04307-CMR Document 5-1 Filed 11/22/10 Page 2 of 6

4, The adviser did reveal to me that the organization was a Jewish religious organization

that had no publicly stated positions regarding the State of Israel.

5. The pages of the letter which the adviser provided to me are attached hereto as Exhibit A.

Tdeclare under penalty of perjury that the foregoing is true and correct.

A.

Jerome M. Marcus

Case 2:10-cv-04307-CMR Document 5-1 Filed 11/22/10 Page 3 of 6

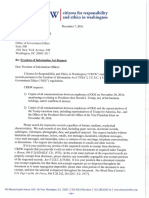

Exhibit A

Case 2:10-cv-04307-CMR Document 5-1 Filed 11/22/10 Page 4 of 6

Page 2

Sincerely yours,

S

Miny, Srna

Exenpt Organizations Specialist

Enclosure: Information Request

additional

1

Case 2:10-cv-04307-CMR Document 5-1 Filed 11/22/10 Page 5 of 6

Page 3

formation Requested:

Please read the Penalties of Perjury statement on pagé 1 stove. thes,

please sign and date below, indicating you agree to the Declaration.

Name Bate

Your most recent response to our letter dated February 9, 2010 was not

signed by a board member under Penalties of Perjury. Please have an

officer sign the following Penalties of Perjury statement regarding

your response:

under penalties of perjury, I declare that I have examined

the information in response to the IRS letver dated February

5, 2010, including accompanying documents, and, to the best

of my knowledge and belief, the information contains al] the

relevant facts relating to the request for the information,

and such facts are true, correct, end complete.

exe Sate

Does your organization support the existence of the land of Terael

Describe your organization's religious belief syste toward the land of

rsrael,

Please refer to the enclosed nawetartar

Your website hag an online Judaica store that sells merchandise

associated with the Jewish religion and culture. Please refer to the

enclosed webpage printout for example, and provide the following

information regarding your online store:

a. How will your organization obtain this merchandise? Will your

organization manufacture the merchandise, purchase it from

another organization, ar receive it by donation?

ZE your organization is purchasing the merchandise, is your

organization or its menbers related to the suppliex in any way?

Please explain,

Case 2:10-cv-04307-CMR Document 5-1 Filed 11/22/10 Page 6 of 6

Page 4

R@ merchandise determined?

ww ware the sales prices of

4. Distinguish your online store for a fox-profit operation,

Does your online stexe soli any books ox other media in which any

of your keard monbers hold copyrights to? If so, plesse indicate

which media,

Ig the online store conducted for the ccnvenience of the members

of your orgenization?

How important is the online store xelated to the nature and extent

of the exempt function you intend to serve?

h, Is the online store maintained and operated by volunteer lebor?

PLEASE DIRECT ALL CORRESPONDENCE REGARDING YOUR CASE TO:

Ug Natl: street Address:

Internal Revenue Service Internal Revenue Service

Exanpt Organizations Exenpt Organizations

P. 0. Box 2308 550 Main St, Federal Bldg.

Cincinnati, On 45201 Cincinnati, oH 45202

AM: Tracy Dornette ACIN: Tracy Dornette

Room 4504 Room 4504

Group 7830 Group 7830

Letter 1312 (Rev, 22/2007)

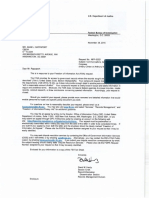

EXHIBIT B

IRS to Jewish group: ‘Does your organization support the existence of the land of Israel”.

none

Page 1 of 4

November 24,

Categories:

Mise

IRS to Jewish group: ‘Does

your organization support

the existence of the land of

Israel?"

‘A Pennsyivania Jewish group that has claimed

the Internal Revenue Servis is targeting pro-

Israel groups introduced in federal court today @

letter from an IRS agent to another, unnamed

organization that tax experts said was likely

outside the usual or appropriate scope of an IRS.

inquiry.

"Does your organization support the existence of

the land of Israel?" IRS agent Tracy Dornette

wrote the organization, according to this week's

court filing, as part of its consideration of the

organizations application for tax exempt status.

“Describe your organization's religious belief

sytem toward the land of Israel.”

‘The document emerged in the course of a

lawsuit filed in August by Z Street, a hawkish

group that casts itself as the Zionist answer to

the liberal J Street. Z Street claims that a

different IRS agent reviewing its application for

tax exempt status said the agency is "carefully

scrutinizing organizations that are in any way

connected with Israel" and that "a special unit" is

determining whether its activities "contradict the

Administration's public policies.

‘The IRS can deny tax exempt status to groups

that work against "established public policy," a

‘Adverisement

Did you know...

Nestlé employs more

than 44,000 people

in 47 states.

Print Powered By Byr

hhtp:/Awww.politico.com/blogs/bensmith/1110/IRS_to_Jewish_group_Does_your_organiza.

amic

12/6/2010

IRS to Jewish group: ‘Dees your organization support the existence of the land of Israel”

POLITICO

shared the correspondence with Z Street. Z

Street does not know the name of the group and

may subpoena the tax adviser, who is no longer

cooperating with them, for more information,

Marcus sai

Several experts on non-profit tax law said the

questions to the organization were unusual, at

best, though they were also skeptical of the

claim that the IRS is specifically targeting pro-

Israel groups.

“The claims go far beyond what should be the

IRS's role," said Paul Caron a University of

Cincinnati law professor and the author of

TaxProf Blog.

Ellen April, a law professor at Loyola University

in Los Angeles said the second question was

appropriate’ in the context of an application

seeking a tax exemption on religious grounds.

“The first one is not the way | would want any of

my agents to do it” she said.

Former LR.S. Commissioner Sheldon Cohen said

he was skeptical of Z Street's motives in its high-

profile lawsuit, rather than pursuing its concerns

in tax court

"They were hardly into the process when they

screamed rape ~ nobody lifted the dress yet,” he

said, noting that 501(c)3 groups can't advocate

for political positions.

But he called the specific questions "unusual."

"Ive never seen that kind of inquiry," he said,

Page 2 of 4

precedent established in its denial of a tax exemption to Bob Jones University over racial

discrimination, and Z Street is suggesting that the IRS has begun applying some such policy to pro-

israel groups. The State Department has complained of tax exempt contributions to groups that

fund weapons and equipment for West Bank settles, which Z Street co-founder Lori Lowenthal

Marcus said 2 Street has never come close to doing.

"Given that we have fallen within this net, how big is the net?" she asked

‘The agent's question was contained in correspondence with "a Jewish religious organization’ with

No stated position on Israel, Z Street says in its court filing. The group's tax adviser, Z Street says,

‘Adverlsement

Did you know...

Nestlé employs more

than 44,000 people

ina? states.

Good Food, Good Life

Print Powered By a 7

hitp://www-politico.com/blogs/bensmith/1110RS_to_Jewish_group_Does_your_organiza.... 12/6/2010

IRS to Jewish group: 'Does your organization support the existence of the land of Israel?”

POLITICO

Page 3 of 4

misguided agent.

‘questions shot back at them more than once," he said,

‘The IRS has sought to dismiss Z Street's claim on

technical grounds. A spokesman said he couldn't

immediately comment on the new filing; in

‘August, @ spokesman said he couldn't comment

‘on an ongoing case.

Posted by Ben Smith 02:35 Pa

‘And Ofer Lion, a California tax lawyer, said he thought the question was probably the work ofa

“People who work in the field and have done a lot of these applications have seen these bizarre

Z Street maintains, however, that the questions are more evidence of a broader policy targeting

pro-Israel groups. The organization claims that the agency is “improperly considering the political

viewpoint of applicants" and engaging in “clear viewpoint discrimination."

‘Advertisement

Did you know...

Nestlé employs mora

than 44,000 people

in 7 stan

7

2s NEStlé

3s

Good Food, Good Life

http://www politico.com/blogs/bensmith/ 1 10/IR

| to_Jewish_group_Does_your_organiza..

Print Powered By

12/6/2010

EXHIBIT _C

O-cv-04307-CMR Document 1 Filed 08/25/10 Page 1 of 11

IN THE UNITED STATES DISTRICT COURT

* por ‘THE EASTERN DISTRICT OF PENNSYLVANIA.

Z STREET,

Plaintiff,

i 4

DOUGLAS H. SHULMAN,

JN HIS OFFICIAL CAPACITY AS

COMMISSIONER OF INTERNAL REVENUE.

Defendant.

COMPLAINT

COMES NOW the Plaintiff, Z STREET, a pro-Israel Pennsylvania nonprofit

organization, by its undersigned counsel, and alleges as follows:

INTRODUCTION

The plaintiif in this ease, Z STREET, is a nonprofit organization devoted to educating the

public about the facts relating to the Middle East, and that relate to the existence of Israel as a

Jewish State, and Israel's right to refuse to negotiate with, make concessions to, or appease

terrorists. The case is brought because, through its corporate counsel, Z STREET was informed

explicitly by an IRS Agent on July 19, 2010, that approval of Z STREET’s application for tax-

exempt status has been ut least delayed, and may be denied because of a special IRS policy in

place regarding organizations in any way connected with Israel, and further that the applications

of many such Israel-related organizations have been assigned to “a special unit in the D.C. office

to determine whether the organization's activities contradict the Administration's public policies.”

‘These statements by an IRS official that the 18S maintains special policies (hereinafter the

Case 2:10-cv-04307-CMR Document 1 Filed 08/25/10 Page 2 of 11

“israel Special Policy”) governing applications for tax-exempt status by organizations which deal

with Israel, and which requires particularly intense scrutiny of such applications and an enhanced

tisk of denial if' made by organizations which espouse or support positions inconsistent with the

‘Obama administration’s Israel policies, constitute an explicit admission of the crudest form of

viewpoint discrimination, and one which is both totally un-American and flatly unconstitutional

under the First Amendment.

ZSTREET brings this case seeking a Declaratory Judgment that the Israel Special Policy

violates the First Amendment to the United States Constitution; and for injunctive relief barring

application of the Israel Special Policy to Z STREET’s application for tax-exempt status or to

similar applications by any other organization; and to compel full publie disclosure regarding the

origin, development, approval, substance and application of the Isracl Special Poliey.

JURISDICTION AND VENUE

|. This Court has jurisdiction over the subject matter of this Action by operation af 28

§1331 (federal question) and 28 U.S.C. §2201

2. Venue lies in this District by operation of 28 U.S.C. 1391(¢) inasmuch as a substantial

part of the events or omissions giving rise to the claim occurred here, and inasmuch as

the Plaintif? resides here.

FACTS:

3. Z STREET filed in the Commonwealth of Pennsylvania for incorporation as a non-profit

on November 24, 2009.

4, On December 29, 2009, Z STREET applied to the United States Internal Revenue

Service for status as an organization recognized under Section 501{c)(3) of the Internal

Case 2:10-cv-04307-CMR Document 1 Filed 08/25/10 Page 3 of 11

Revenue Code (“the Code”), which status (also known as “tax-exempt” status) would

allow those persons donating money to 7, STREET to deduct such donations from their

taxable income, thereby diminishing the net after-tax cost of such donations to their

donors, and so increasing the amount and number of such donations. Defendant the

Commissioner of Internal Revenue is charged by Section 501(¢)(3) ofthe Code to grant

tax-exempt status to those organizations that exclusively engage in charitable and

educational activities.

Section 501(c)(3) of the Code provides for the exemption from Federal income tax of

“organizations organized and operated exclusively for religious, cheritable, scientific,

literary, or educational purposes, no part of the net earnings of which inures to the benefit

of any private shareholder or individual. Section 1.501 (e)(3}-1(d)(2) of the Treasury

Regulations (the “Regulations”) provides that the term “charitable” is used in Section

501(c)(3) of the Code in its generally accepted legal sense.

In

7. STREET was incorporated exclusively for charitable and educational purpos«

addition, its Articles of Incorporation specifically provide that, “No part of the net

earnings of the corporation shall inure to the benefit of, or be distributable to, its

directors, officers, or other private persons, except that the corporation shalt be authorized

and empowered to pay reasonable compensation for services rendered and to make

payments and distributions in furtherance of its exempt purposes.”

Z STREET’s website, public awareness campaigns, and all other activities are

educational. 7. STREET’s website and other educational materials provide a full and fair

9

n,

Case 2:10-cv-04307-CMR Document’ Filed 08/25/10 Page 4 of 11

exposition of the pertinent facts to permit an individual of the publie to form an

independent opinion or conclusion.

ZSTREET's positions are supported by research, original documents, facts, and opinions

from recognized academic and other knowledgeable sources, which sources are provided

in its materials and on its website, and therefore, Z STREET'S activities are educational

and charitable in nature.

Z STREET is therefore explicitly organized for charitable and educational purposes

within the meaning of Section $01(c)(3) of the Code

Regulation Section 1.501(¢3)-1(d)(2) provides that the term “charitable” includes

“advancement of education,” and Section 1.501(c)(3)-1(4)(3)() of the Regulations

defines “education” as: (a) the instruction or training of the individual for the purpose of

improving or developing his capabilities; or (b) the instruction of the public on subjects,

useful to the individual and beneficial to the community, The second example of Section

‘ions whose activities consist

1.501(€)(3)-1(€)(3)(i) of the Regulations refers to organi

of presenting public discussion groups, forums, panels, lectures, or other similar

programs as being educational.

An organization engeged in the advocacy of controversial viewpoints or positions with

the intent of molding public opinion or creating public sentiment does not preclude such

organization from qualifying for tax-exemption under Section 501(¢)(3) of the Code, so

Jong as the organization presents a sufficiently full and fair exposition of the pertinent

facts as to permit an individual or the public to form an independent opinion or

conclusion. Treas, Reg. 1.501{c)(3)-1(d)(2); Revenue Procedure 86-43, 1986-2 CB 729.

Case 2:10-cv-04307-CMR Document 1 Filed 08/25/10 Page 5 of 11

12. In Revenue Procedure 86-43, 1986-2 C.B, 729, the IRS established a methodology test 10

determine whether an organization's advocacy activities are educational. Although the

IRS will render no judgment as to the organization’s advocacy position, the IRS witl look

to the method used by the organization to develop and present its views. fd. The method

is not educational if it fails to provide: (a) a factual foundation for the viewpoint being

advocated: ot (b) a developed presentation of the relevant facts that would materially aid

a listener or reader in a learning process. In addition, the presence of any of the following

factors in the presentations made by the organization is indicative that the method used

by the organization to advocate its viewpoints is not educational:

4.

1. The presentation of viewpoints unsupported by facts is a significant

portion of the organization's communicatior

2. The facts that purport to support the viewpoints are distorted;

3. The organization's presentations make substantial use of inflammatory

and disparaging terms and express conclusions mare on the hasis of strong,

emotional feelings than of objective evaluations; or

“The approach used in the organization's presentations is not aimed at

developing an understanding by the intended audience or readership

because it does not consider their background or training in the subject

matter.

Moreover, IRS policy stipulates that there may be exceptional circumstances

where an organization's advocacy may be educational even if one or more of the

listed factors are present, PLR 199907021. In such case, the IRS will look to all

Case 2:10-cv-04307-CMR Document 1 Filed 08/25/10 Page 6 of 11

the facts and circumstances to determine whether an organization may be

considered educational despite the presence of one or more of such factors.

13. In Private Letter Ruling 199907021, the IRS ruled that an organization which published

newsletters to its members, produced a series of daily radio commentaries, and engaged

in other educational activities about national and foreign policy issues was a charitable

organization. The IRS concluded that the organization's activities were educational

because the organization (1) included the opposition’s position; (2) supported its position

with facts; and (3) cited independent sources that support the facts contained in the

articles

14, In a letter dated May 15, 2010, IRS Agent Diane Gentry, to whom the 7. STREET file had

been assigned, sent an IRS Letter 2382 requesting additional information to aid her in her

review of Z STREHT's IRS Form 1023 (the "Application"). Z STREET, by its corporate

counsel, submitted a response on June 17, 2010, providing all of the requested

information, most of which had already been provided in Z STREEI"s initial application,

including information about each of Z STREET's board members. In fact, detailed

personal information about cach Z STREET board member had to be supplied to the IRS

three times, a number in excess of the experiences of Z STREET board members for any

other board an which they sit.

15. In an effort to learn the status of the application, and the reason for the delay in issuance

of the requested 501(c)(3) certification, Z STRFET’s corporate counsel made follow up

calls to IRS Agent Gentry of the IRS on July 7, and 14, 2010, which went unanswered.

Counsel left a message in each instance, which was not returned.

Case 2:10-cv-04307-CMR Document 1 Filed 08/25/10 Page 7 of 11

16. On July 19, 2010, Z STREET’s corporate counsel called again, and this time spoke with

IRS Agent Gentry who advised Z STREET’s counsel that she had two concerns

regarding the Application: (1) the advocacy activities in general, and (2) the IRS's special

concern about applications from organizations whose activities are related to Israel, and

that are organizations whose positions contradict the US Administration's Israeli policy.

17. Furthermore Agent Gentry advised Z Street's counsel that she questioned whether 2,

STREET activities were educational as described under Section 501(c)(3) of the Code,

but instead might be lobbying, or that Z STRERT might be an “action organization,”

which is the case when the only way to accomplish the purpose of the organization is,

through legislation. In fact, none of Z STREET's purposes can be accomplished through

legislative action.

18. IRS Agent Gentry also informed Z STRERT’s counsel that the IRS will look to the

method used by the organization to develap and present its views. She stated further that

the method is not educational if it fails to provide: (a) a factual fyundation for the

viewpoint being udvocated; or (b) a developed presentation of the relevant tacts that

would materially aid « listener or rewder in a learning process

19. To the extent that this concern is actually animating the IRS’s response to Z STREET'S

application for 501(c)(3) status, it is baseless. Z STREET’s application provides eminent,

fuctual, proof that the organization’s website, public awareness campaigns, and other

activities are educational ones conducted in conjunction with advocacy. ‘The application

makes clear and all the evidence supports that Z STREET does and will provide a full

and fair exposition of the pertinent facts as to permit an individual or the public to form

Case 2:10-cv-04307-CMR Document 1 Filed 08/25/10 Page 8 of 11

an independent opinion or conclusion, and that Z STREET'S positions are and will be

supported by research, original documents, facts, and opinions from recognized academic

and other knowledgeable sources.

20, Further, in addition to its application for $01(c)(3) status, 7. STREET also applied for

501(h) status. which allows a tax-exempt organization to engage in lobbying, to the

extent any is engaged in, by measuring the amount of money the organization spends on

lobbying, and for an organization the size of Z STREET, that amount is 20% of the

exempt purpose expenditures. Z STREET has not engayed in any lobbying activities no

matter how defined, but had it done so, less than 20% of its total expenditures were spent

‘on lobbying.

21, Agent Gentry also informed Z STREET"s counsel that the IRS is carefully scrutinizing

organizations that are in any way connected with Israel

22. Agent Gentry further stated to counsel lor Z SURELT: “these cases are being sent to &

special unit in the D.C. office to determine whether the organization's uetivities contradict

the Administration's public policies.”

23. Z STREET, and its President, Lori fowenthul Marcus, have publicly taken positions wn

issues relating to Israel that are inconsistent with positions taken by the Obama

administration.

24, The IRS's admissions by Agent Gentry make clear that the [RS maintains an Israel

Special Policy governing the processing of applications for tax exemption by

organizations which are believed to be operated by persons holding political views

inconsistent with those espoused by the Obama administration, and that the Israel Special

Case 2:10-cv-04307-CMR Document 1 Filed 08/25/10 Page 9 of 11

Policy mandates that such applications be scrutinized differently and at greater length,

and therefore that they take longer to process than those made by organizations without

that characteristic, or even that the tax-exempt application might be denied altogether on

that basis

25, Z STREET has been and continues to be injured in its business and property by the Israel

Special Policy inasmuch as its application for tax-exempt status has been affected by the

application of a clearly unconstitutional policy which has held up the granting of its

501{¢)(3) status, as admitted by the IRS agent in charge of reviewing and determining Z.

STREET’s application. This delay has impaired and continues to impair Z STREET’s

ability to raise funds and has thereby restricted the scope of its operation and its ability to

speuk and to educate the public regarding the issues that are the focus and purpnse of 7

SIRE

v

ion for tux-exempt

26. As of the date of the filing of this Complaint, Z STRENT's appli

status hus not been approved,

27. Organizations engaged in the same deyrce of political advocacy but which lake positions

more closely aligned with the Obama administration's views and policies regarding Israel

have been granted tax-exempt status and, on information and belief, such applications

have been granted more quickly than Z STREET’s application and without the same

delays or intensity of review.

:10-cv-04307-CMR Document 1 Filed 08/25/10 Page 10 of 11

Case

COUNTI

Pursuant to the Declaratory Judgment Act,

28 U.S.C. §2201, and the First Amendment

To the United States Constitution

28, Plaintiff repeats and re-alleges paragraphs | through 27 as if fully set forth herein.

29, Limitation of the issuance of tax-exempt status to a nonprofit educational organization on

the basis of the substantive views held by the persons who operate the organization

constitutes a restriction on the freedom of speech of such persons,

30. The existence and application of the Israel Special Policy identified above constitutes

blatant viewpoint discrimination in violation of the First Amendment to the United States

Constitution,

WHEREFORE, Plaintiff seeks a Declaration that Defendant's substance and application of

smpt status constitutes discrimination

the Israel Special Policy to any application for tax-ex

among viewpoints and a violation of the Plaintiffs riphl to frecdam of speech as guaranteed

by the First Amendment to the United States Constitution,

Plaintiff further secks injunctive relief:

‘A. Barring application of the Special Policy to its pending application for tax-exempt

status pursuant to §501(c)(3) of the Code;

B. Requiring that Defendant adjudicate Plaintiff's zpplication for tax-exempt status

expeditiously and fairly and without any consideration of whether the positions

Case 2:10-cv-04307-CMR Document 1 Filed 08/25/10 Page 11 of 11

espoused by the Plaintiff or its officers are or are not consistent or inconsistent with

the policy positions taken by the Obama administration;

Mandating complete disclosure to the public regarding the origin, development,

approval, substance and application of the Special Policy

Award to Plaintiff of its attorney's fees and costs pursuant 10 28 U.S.C. §2412; and

Such other and further relief as the Court may deem proper,

Jerome M. Mare

Attorney LD, 50708

P.O, Box 182

Merion Station, PA 19066

Voice: 610 664 1184

Email; contact@ZSTREET.ORG

ul

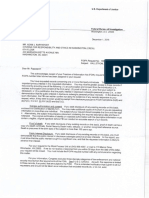

EXHIBIT D

Lawsuit Accuses IRS of Screening Israel-Related Charities ~ Forward.com hnp://www. forward com/articles/130743/

1of2

Forward.com

Lawsuit Accuses IRS of Screening Israel-Related

Charities

By Josh Nathan-Kazis

Pubished August 25, 2010,

UPDATED: September 3, 4 p.m, ET

A hawkish pro-Israel activist group has filed a lawsuit alleging that the Internal Revenue Service is impeding or

denying applications for tax-exemat status from nonprofit organizations that oppose the Obama administration's

Israel policies. But experts in nonprofit tax law say that the allegations seem far-fetched

Ina complaint fled in federal court in Pennsylvania on August 26, the group, called Z Street, alleged that an IRS.

‘agent told an attorney for the organization that delays in the processing of its application for tax-exemption were

due to the case receiving extra scrutiny over whether it would oppose administration policy on Israel

AAs the Forward reported in January, some argue that the 1983 U.S. Supreme Court decision in the case of Bob

Jones University v. United States couid be interpreted to deny nonproft status to organlzations that oppose

established American foreign policy. The Bob Jones decision, which found that "an institution seeking

tax-exempt status must... not be contrary to established public policy," was written to bar tax exempt groups

from participating in racial discrimination.

Legal experts were split on the question of whether longstanding foreign policy, such as America’s opposition to

Jewish settlements in the West Bank, could fall within the realm of "public policy" as described in Bob Jones. All

agreed, however, that the IRS had never used Bob Jones to deny tax-exempt status to nonprofits that oppose

‘American foreign policy.

The Z Street lawsuit alleges that its application for tax-exempt status, which was filed last December, has been

held up due to an IRS procedure specifically targeting groups opposing administration policy on Israel.

According to Z Street's complaint, IRS agent Diane Gentry said that applications for tax-exempt status from

nonprofits working on Israel-related issues "are being sent to a special unit in the D.C. office to determine

whether the organization's activities contradict the Administration's public policies.”

A spokesperson for Z Street said that there was no recording of the conversation with Gentry and declined to

provide notes from the exchange, citing its potential bearing on ongoing tigation, That conversation was

purportedly held between Gentry and an attorney handing Z Street's application for exemption. That attorney is

rot involved in the lawsuit, which was filed by another attorney, Jerome M. Marcus.

Gentry did not respond to a request for comment

In response to a request for comment fram the Forward, IRS spokesman Bruce Friedland wrote: “The IRS, by

law, cannot comment on specific charities or even confirm whether a specific exemption request exists.”

He continued: “When any organization applies for tax exempt status, itis the responsibilty of the IRS to ensure

that the organization's funds will be used to accomplish charitable purposes.”

Friedland declined to speak generally about the existence of a unit dedicated to screening the activities of

12/6/2010 4:52 PM

Lawsuit Accuses IRS of Sereening Israel-Related Charities ~ Ferward.com itp: www. forward comfarticles/130743

20f2

Istael-related applicants for tax exemptions. But a congressional staff member close to the issue called

allegations of such a unit “utter nonsense."

Friedland also declined to answer general questions about the IRS's interpretation of Bob Jones and whether it

‘could be used to deny exempt status to organizations that oppose elements of the foreign policy of the United

States,

‘The allegations of a special IRS Israel unit aroused skepticism from experts. Sheldon 8, Cohen, a former IRS

commissioner, said he doubted there was any such unit. “We'd know about it,” he said, "Revenue agents are

rot bashful about talking about what they work on.... The U.S. government is a sieve. This is not top-secret

stuff.”

(Of the questions about the existence the special unit, Marcus, Z Street's counsel, said that he agreed that they

were difficut to believe. “If the statement hadn't been made to us by the IRS, |, too, would be reluctant to

believe it,” he said. “And while i's possible that the IRS agent misapprehended the government's policy, the

likelihood that the agent was talking about something that does not exist at all seems to me (unlikely)

Marcus continued, “Our case is designed to get to the bottom of what the IRS policy really is.”

Other experts suggested that Z Street's application for tax exemption could have been forwarded to the central

office in Washington, D.C. for other reasons. The internal Revenue Manual describes a broad set of reasons

\why exemption applications could be automatically referred to agency's quality assurance department, including

cases involving “terrorist countries, and cases where the IRS has received third-party contact requesting that

the applicant be denied exemption.”

Contact Josh Nathan-Kazis at nathankazis@forward.com or on Twitter @joshnatt

eR

Copyright © 2010, Forward Assaciation, Ine, All Rights Reserved.

12/6/2010 4:52 PM

EXHIBIT E

Z Street, cont'd - Ben Smith - POLITICO.com,

POLITICO

Page | of 3

August 27, 204

Categories:

Middle East

Z Street, cont'd

Internal Revenue Service spokesman Bruce

Friedland hasn't responded to my inquiries about

the general questions raised about a pro-lsrael

group's lawsuit against the IRS: Whether there's

actually @ unit giving special scrutiny to groups |

inked to the Middle East conflict, and whether

their policy stands figure into that consideration

in any way.

‘The Forward adds an interesting legal twist:

As the Forward reported in January, some argue

that the 1983 U.S. Supreme Court decision in the

case of Bob Jones University v. United States

could be interpreted to deny nonprofit status

to organizations that oppose established

American foreign policy. The Bob Jones

decision, which found that “an institution

seeking tax-exempt status must... not be

contrary to established public policy,” was

written to bar tax exempt groups from

participating in racial discrimination.Legal

experis were split on the question of

longstanding foreign policy, such as America’s

opposition to Jewish settlements in the West

Bank, could fall within the realm of ‘public

policy” as described in Bob Jones. All agreed,

however, that the IRS had never used Bob Jones

to deny tax-exempt status to nonprofits that

‘oppose American foreign policy.

‘There's quite a bit of skepticism that this could

be implemented secretly, however. It would be

‘Advertisement

Did you know...

Nestié employs more

than 44,000 people

in 47 states.

§ Nestlé

Good Lite

ce

Good Food,

http://www politico.com/blogs/bensmith/0810/Z_ Street_contd. html

Print Powered By

12/6/2010

Z Street, cont'd - Ben Smith - POLITICO.com Page 2 of 3

POLITICO

nice if the IRS responded to questions about it

Incidentally, | heard the other day from a former officer of @ pro-Palestinian group, who said he'd

been told years ago by the IRS that they had a similar special unit giving pro-Arab groups special

scrutiny

Posted by Ben Smith 01:25 PM

‘Advericement

Did you know

Nestlé employs more

than 44,000 people

in 47 states.

Print Powered By | ol Dynamics

http://www politico.com/blogs/bensmith/0810/Z_Street_contd.html 12/6/2010

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- 2016 12 28 Final ResponseDocumento2 páginas2016 12 28 Final ResponseCREWAinda não há avaliações

- Via Electronic Mail OnlyDocumento2 páginasVia Electronic Mail OnlyCREWAinda não há avaliações

- 2017-01-06 Documents Produced 1Documento365 páginas2017-01-06 Documents Produced 1CREWAinda não há avaliações

- 2016 12 30 Responsive DocumentsDocumento15 páginas2016 12 30 Responsive DocumentsCREWAinda não há avaliações

- 2017-01-06 Final ResponseDocumento2 páginas2017-01-06 Final ResponseCREWAinda não há avaliações

- 2016 12 16 FOIA RequestDocumento3 páginas2016 12 16 FOIA RequestCREWAinda não há avaliações

- 2016-12-21 FOIA Request (Communications With Trump and Congress)Documento3 páginas2016-12-21 FOIA Request (Communications With Trump and Congress)CREWAinda não há avaliações

- 2016-12-21 FOIA Request (Documents To Congress)Documento3 páginas2016-12-21 FOIA Request (Documents To Congress)CREWAinda não há avaliações

- Florida Office of The Attorney General (Daily Schedules and Travel) Request 9-14-16Documento5 páginasFlorida Office of The Attorney General (Daily Schedules and Travel) Request 9-14-16CREWAinda não há avaliações

- 2017-01-06 Documents Produced 2Documento36 páginas2017-01-06 Documents Produced 2CREWAinda não há avaliações

- 2016 12 16 FOIA RequestDocumento3 páginas2016 12 16 FOIA RequestCREWAinda não há avaliações

- 2016 12 16 FOIA RequestDocumento3 páginas2016 12 16 FOIA RequestCREWAinda não há avaliações

- New York Office of The Attorney General (Trump Foundation Investigation) Request 9-14-16Documento2 páginasNew York Office of The Attorney General (Trump Foundation Investigation) Request 9-14-16CREWAinda não há avaliações

- Final Installment 10-17-2016Documento47 páginasFinal Installment 10-17-2016CREWAinda não há avaliações

- FOIA Request - OGE (Trump Transition) 12-7-16Documento3 páginasFOIA Request - OGE (Trump Transition) 12-7-16CREWAinda não há avaliações

- FOIA Request - OGE (Trump Tweets) 12-6-16Documento3 páginasFOIA Request - OGE (Trump Tweets) 12-6-16CREWAinda não há avaliações

- Plaintiffs' Reply in Support of Motion For Preliminary InjunctionDocumento2 páginasPlaintiffs' Reply in Support of Motion For Preliminary InjunctionCREWAinda não há avaliações

- FBN Materials 422.15Documento64 páginasFBN Materials 422.15CREWAinda não há avaliações

- FBI Denial 11-29-2016Documento1 páginaFBI Denial 11-29-2016CREWAinda não há avaliações

- FBI Denial 12-1-2016Documento2 páginasFBI Denial 12-1-2016CREWAinda não há avaliações

- Final Response Letter 10-17-2016Documento2 páginasFinal Response Letter 10-17-2016CREWAinda não há avaliações

- Plaintiffs' Memorandum in Support of Motion For Temporary InjunctionDocumento6 páginasPlaintiffs' Memorandum in Support of Motion For Temporary InjunctionCREWAinda não há avaliações

- Memorandum in Opposition To Plaintiffs' Motion For Temporary Injunction and Declaration of Amy Frederick With ExhibitsDocumento19 páginasMemorandum in Opposition To Plaintiffs' Motion For Temporary Injunction and Declaration of Amy Frederick With ExhibitsCREWAinda não há avaliações

- FBI Denial 12-1-2016Documento2 páginasFBI Denial 12-1-2016CREWAinda não há avaliações

- FBI (Congress Communications Re Comey Letter) 11-22-16Documento3 páginasFBI (Congress Communications Re Comey Letter) 11-22-16CREWAinda não há avaliações

- FBI (Giuliani Communications) 11-22-16Documento3 páginasFBI (Giuliani Communications) 11-22-16CREWAinda não há avaliações

- FBI (Kallstrom Communications) 11-22-16Documento3 páginasFBI (Kallstrom Communications) 11-22-16CREWAinda não há avaliações

- Amended Complaint For Declaratory Judgment, Temporary, and Permanent InjunctionDocumento22 páginasAmended Complaint For Declaratory Judgment, Temporary, and Permanent InjunctionCREWAinda não há avaliações

- Second Declaration of James L. MartinDocumento9 páginasSecond Declaration of James L. MartinCREWAinda não há avaliações

- Complaint For Declaratory Judgment, Temporary and Permanent InjunctionDocumento8 páginasComplaint For Declaratory Judgment, Temporary and Permanent InjunctionCREWAinda não há avaliações