Escolar Documentos

Profissional Documentos

Cultura Documentos

Statement of Assets & Liabilities As On September 30, 2015. (Result)

Enviado por

Shyam SunderDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Statement of Assets & Liabilities As On September 30, 2015. (Result)

Enviado por

Shyam SunderDireitos autorais:

Formatos disponíveis

GTV Engineering Limited

Regd. Otfice & Works : 216-217-218, New lndustrial Areall, Mandideep-462 046, (Bhopal)

retephone : 00e1-7480'23s30e,

trou, ,;:;?l"if,l?zli.l!":I,

Ltlrrii;f,T*ffl*n

Grv /BSE/15

To

Rakesh Parekh

Sp. Assistant

Listing Department

Bombay Stock Exchange Limited,

P.] Towers, Dalal Street

Mumbai- 400001

Subiecfi Submission of Statement of Assets and Liabilities

Dear Sir,

This is with reference to your mail dated 28u' December 2015 in which you have asked

us to submit the Statement of Assets and liabilities which were not given with the

financial results.

Please find the signed scanned copy of Statement of Assets and Liabilities along

the financial results attached herewith.

Regards

For GTV Engineering Limitod

Rajat

anY Secretary

Company Secretary and Compliance Officer

with

GTv ENGINEERING

I.IMITED

N.w lndustrial

UNAUDITED TINANCIAL RESULE FOR THE OUARTER ENDED SEPTEMBER 30. 2015

,ART-1

Yeaito Date Jigureslo Period.nded

:ulars

months ended

30/09/201s)

3 months ended

130/06/2orsl

brresponding 3

nonths ended in the

/earto Date figures

brcurrent Period

/e.rto Datefigures

br the previous year

ccounting yeat

Inded (30/09/20151

:nded (3olo9/2014)

rnded

30losl2oL4l

unaudted

(al Net Sales/lncomefrom Operations

b) otherOperatlng lncome

Unaudited

3tlo3l207sl

Unaudited

Unaudited

Unaudited

Audited

L.

580-72

663 68

1151.53

1118.09

3332 69

60 58

52 38

72.74

112.96

27.83

592 50

356 52

431.00

543 60

7A7 52

885 60

2108.37

0.00

0.00

000

000

0.00

0.o0

L2.90

791

11,00

20,81

19.48

66.94

Expendilure

in

$ftk

in trade and work in

b. Consumption of raw materials

c. Purchase

oftraded Boods

d. Employees @st

e. Depreciation

f. Other

expenditure

Total

(Anvitemexceedin8lo%ofthe

r^til Fr..ndifr'..

ther

before lnterest and Aceotional ftems

l3{l

lionalfrems

l+)/

1. Ner Profit

10.20

950

20.45

19 00

53 92

30.43

51.90

88 43

101 54

200.13

t2

25 00

68.33

49,70

237.73

534.tr

5fl.O4

653.78

1098.y)

1104.15

3259.59

32 35

20.68

990

53 03

t4-94

73 10

098

000

o_98

ooo

11 49

33 33

20 6A

000

qgo

54 01

7.22

1-30

190

462

I10

56 55

7.12

1,:t{,

1.$

4.62

3.10

55.55

2A

f6 h. <h^w^ e.nrr:r.[n

l. Profit from Operations before Other lncomq lnteresl and

. Protit

10.25

58.00

40,2L

B ManufaduringExpenses

570.81

Loss (-)

l54l

trom Ordinary Adivilies beforetax

(7+81

l+l/ loss Ll fr.m OrdinrruAdiviti.< rftprtiy lq-1nl

Lossl-l

forthe Deriod

111-121

4. Paid-up equity share capital (Face Value of the Share shall be

5. Resede excludlng Rev.luation ReseNes as per balance sheet

15. Earnin8s Per Share

(EPS)

al

Easic and

diluted

EPS

of

7.32

1.30

1.90

852

310

40 42

000

712

000

000

0.00

130

1-90

000

462

0.00

40 42

310

3123a

312.38

312 38

372 3A

312.38

3r2 3a

1935 78

1935.78

2074 70

1935.78

207a.ao

1935.78

o.23

o.04

0.6

0.24

0.10

1.29

799900

799900

799900

799900

799900

799900

25.6ar"

2s.61'{

25.5196

25.61%

25.6134

25.6L/r

before

li.aordinary itemsforthe period,for the yearto date and forthe

,revious ye.r (not to be annualized)

b) Basic and

liluted EPS after Enraordinary itehsfo. the period, foathe Vear to date

ind torthe previous year (notto be annuali2ed)

IART-2

PARTICUI,AS OF SHARE HOTDIilG

17. Public Sha.eholding

- No, of shares

- PercentaBe of shareholdinS

18. PromoteE and promotergaoup

sh.reholding

++

a) Pledged/ncumbered

Numbd of shares

ofshares (as a % ofthetotal shareholdinS of

promoter and promotea groupl

-

- Pe.cent.Se

- Percenta8e

ofshares

(as a%

2323988

2123944

2323988

2323988

2323988

ofthetotal share capital ofthe

comDanvl

bl Non+ncumbered

- Number ofShares

-Percentageof shares(as a%of

and promotergroup)

- Percentate

ol shares

(as a %

thetotal shareholdinSof promoter

otlhe total share @pital orthe

74.3

100 00%

t4.3

74,1

74,3gyo

100.00%

100.0016

2323988

f 439%

14,3

100.00%

100.00%

100.00%

COMPLAII{TS

t

1) The above results have been taken on

2)The Companydoes

reco.d

in

it

{t

the meeling ofthe Board of DiredoE of the Company held on 09 ,.1 2015.

not heve any Exceptional or Extraordinary ilem to repon foathe ebove period.

have reviewed the said Resuhs.

4) FlEures have been

re{roup.d whercver necssary

Dil.r m.112015

Forand dn behalfofthe

Plaer M.ndid..D

For

bard

Gryf 4tineerin! limit.d

MaheSh Ag

ManaSing Di

IL

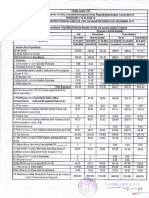

GTV ENGINEERING LIMITED

STATEMENT OF ASSETS AND LIABILITIES

Note No.

Particulars

As at 30.09.2015 As at 31.03.2015

Audited

Unaudited

EQUITY AND LIABILITIES

A

1

Shareholders'funds

(a) Share capital

31,238,880

31,238,880

(b) Reserves and surplus

794.M7.W3

193,578,E4

225.,@,63

224,817,874

9,2lJ7,653

g,2i4,gg3

2 Non-current

(a)

liabilities

Iong-term borrowings

(b) Deferred tax

(c)

liability

4ffi,235

4

Long term advance from customers

3 Current

9,689,888

53,2@,5T1

liabilities

5

34,U3,U0

%,407,520

(b) Trade payables

69,474,596

u,6/'3327

Other current liabilities

(d) Short-term provisions

&,572,ffi7

39,@6,8@

u7,190

(a)

Short-tenn borrowings

(c)

Total

B

488,235

43,541,359

7.036,W

169,X17,793

ll,.,7u,616

4m,ffi,3il

89,877,047

95.948.750

97,954,2:57

95,94E.,7il

87,9il,81

81000,000

ASSETS

1

Non{urent

assets

(a) Fixed assets

(i) Tangible assets

(b)

Non<u:rent investnrents

10

85,0m,000

(c)

Other non<urent assets

11

1500 000

1,500,m0

E6,500,m0

85,500,000

2 Current assets

(a) Inventories

72

33,837,783

M,498,659

(b) Trade receivables

13

6,327,872

72,59,%5

l@406,394

45,801,155

(c) Cash and cash

equivalents

74

15

(d) Short-term loans and advances

222t59,614

Total

fioi,,,ffi,W

73,ffi,2U3

70[.,702,7&

2o5,%4757

89,E77,W7

For GTV Engineeri

Managing

Você também pode gostar

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento5 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Documento9 páginasStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Documento6 páginasAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam Sunder0% (1)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento23 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Pdfnews PDFDocumento5 páginasPdfnews PDFMurthy KarumuriAinda não há avaliações

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Documento4 páginasAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento6 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results For Dec 31, 2015 (Standalone) (Result)Documento4 páginasFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Documento9 páginasStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento8 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results For December 31, 2015 (Result)Documento3 páginasFinancial Results For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Statement On Impact of Audit Qualifications For The Period Ended March 31, 2016 (Company Update)Documento5 páginasStatement On Impact of Audit Qualifications For The Period Ended March 31, 2016 (Company Update)Shyam SunderAinda não há avaliações

- Numericals On MAT-115JBDocumento2 páginasNumericals On MAT-115JBReema Laser100% (1)

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For September 30, 2016 (Result)Documento8 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 páginasFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Ger S G, Eejeeb Y We S,: Crjsi"Documento5 páginasGer S G, Eejeeb Y We S,: Crjsi"Suraj KediaAinda não há avaliações

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento8 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Updates On Financial Results For March 31, 2015 (Result)Documento3 páginasUpdates On Financial Results For March 31, 2015 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Documento11 páginasStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento8 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 páginasFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento12 páginasStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Financial Results & Limited Review For March 31, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review For March 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Financial Results For Dec 31, 2015 (Standalone) (Result)Documento2 páginasFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- PDF Processed With Cutepdf Evaluation EditionDocumento3 páginasPDF Processed With Cutepdf Evaluation EditionShyam SunderAinda não há avaliações

- Standalone Financial Results For March 31, 2016 (Result)Documento11 páginasStandalone Financial Results For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results For September 30, 2016 (Result)Documento3 páginasStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 páginasTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderAinda não há avaliações

- Investor Presentation For December 31, 2016 (Company Update)Documento27 páginasInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderAinda não há avaliações

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 páginasStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderAinda não há avaliações

- In y Ter CompanyDocumento6 páginasIn y Ter CompanyEllenAinda não há avaliações

- Worksheet On Accounting Ratios Board QPDocumento10 páginasWorksheet On Accounting Ratios Board QPCfa Deepti BindalAinda não há avaliações

- Internship 3Documento30 páginasInternship 3Sumithra K - Kodaikanal centerAinda não há avaliações

- Mba ZC415 Course HandoutDocumento11 páginasMba ZC415 Course HandoutareanAinda não há avaliações

- Case Study 4Documento3 páginasCase Study 4DiinShahrun100% (1)

- Ias 16 Property Plant Equipment v1 080713Documento7 páginasIas 16 Property Plant Equipment v1 080713Phebieon MukwenhaAinda não há avaliações

- Horizontal and Vertical AnalysisDocumento3 páginasHorizontal and Vertical AnalysisNashwa SaadAinda não há avaliações

- Understanding Financial StatementDocumento14 páginasUnderstanding Financial StatementNHELBY VERAFLORAinda não há avaliações

- Three Methods of Estimating Doubtful AccountsDocumento8 páginasThree Methods of Estimating Doubtful AccountsJay Lou PayotAinda não há avaliações

- MGT 101 Final Term Solved Papers by Cyber DevilDocumento10 páginasMGT 101 Final Term Solved Papers by Cyber DevilTayyab RasheedAinda não há avaliações

- Consolidated Financial Statements - IntercomapnyDocumento6 páginasConsolidated Financial Statements - IntercomapnyCORNADO, MERIJOY G.Ainda não há avaliações

- Peb 16augDocumento24 páginasPeb 16augFahmy ArdhiansyahAinda não há avaliações

- Partnership ReviewDocumento5 páginasPartnership ReviewAirille CarlosAinda não há avaliações

- Goto 1702966919Documento5 páginasGoto 1702966919Anonymous XoUqrqyuAinda não há avaliações

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Documento5 páginasJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotAinda não há avaliações

- FMA AssignmentDocumento2 páginasFMA AssignmentGetahun MulatAinda não há avaliações

- General Purpose Financial StatementDocumento10 páginasGeneral Purpose Financial Statementfaith olaAinda não há avaliações

- ACC 201 Accounting Cycle WorkbookDocumento78 páginasACC 201 Accounting Cycle Workbookarnuako15% (13)

- Financial Statement, Taxes and Cash Flow (With Answers)Documento16 páginasFinancial Statement, Taxes and Cash Flow (With Answers)Haley James ScottAinda não há avaliações

- Name of Examinee: - : Prepare The FollowingDocumento15 páginasName of Examinee: - : Prepare The FollowingNoel CarpioAinda não há avaliações

- Specific Intangible AssetDocumento30 páginasSpecific Intangible Assetlana del reyAinda não há avaliações

- Financial Management (Chapter 1: Getting Started-Principles of Finance)Documento25 páginasFinancial Management (Chapter 1: Getting Started-Principles of Finance)Bintang LazuardiAinda não há avaliações

- Teuer Furniture Case A DCFDocumento115 páginasTeuer Furniture Case A DCFAndrew SawyerAinda não há avaliações

- QuestionDocumento2 páginasQuestionyaniAinda não há avaliações

- Accounting For Merchandising Operations: © 2009 The Mcgraw-Hill Companies, Inc., All Rights ReservedDocumento41 páginasAccounting For Merchandising Operations: © 2009 The Mcgraw-Hill Companies, Inc., All Rights ReservedLong DemonAinda não há avaliações

- Balance SheetDocumento1 páginaBalance SheetsarvodayaprintlinksAinda não há avaliações

- New 14-128 TOP T1haiDocumento15 páginasNew 14-128 TOP T1haiwatchiexpertAinda não há avaliações

- Financial Plan - JanaDocumento4 páginasFinancial Plan - JanajemmieAinda não há avaliações

- CBSE Class 12 Accountancy - Cash Flow StatementDocumento14 páginasCBSE Class 12 Accountancy - Cash Flow StatementVandna Bhaskar38% (8)

- Financial Accounting: Weygandt KimmelDocumento82 páginasFinancial Accounting: Weygandt Kimmelclarysage13100% (1)