Escolar Documentos

Profissional Documentos

Cultura Documentos

Kerala VAT Form 4D Compounded Tax Permission

Enviado por

prem_k_sDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Kerala VAT Form 4D Compounded Tax Permission

Enviado por

prem_k_sDireitos autorais:

Formatos disponíveis

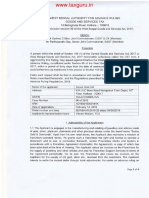

THE KERALA VALUE ADDED TAX RULES, 2005

FORM No. 4D

Permission to pay compounded tax under section 8(a)

{See Rule 11 (2)}

TIN

To

Sri/M/s. ………

……………….

Whereas on consideration of your application dated………….the

undersigned is satisfied that you are eligible for payment of compounded

tax u/s 8 (a) of the KVAT Act,2003, permission is hereby granted to you

to pay tax at compounded rates as specified here under and subject to

conditions, for the year 200…/….

Sl No Particulars

1 Name and address of the dealer

Tax payers Identification Number

2 under Kerala Value Added Tax Act,

2003

3 Name and address of awarder

4 Descreption of works/projects

5 Work order No and date

6 Gross amount of Contract

Amount due for payment during the

7

year

Applicable section and clause and

8

rate of tax

9 Amount of compounded tax payable

Office from which the permission is

10

granted

This permission will be valid upto……………………..

Signature

Name and designation of Assessing authority

Place

Date

(Seal)

Conditions

1. Returns shall be submitted as per Rule 24 along with proof for payment of tax.

2. Permission-holder shall neither collect tax nor claim input tax credit on tax paid on

inputs

3. Purchase tax u/s 6(2) shall be paid in respect of purchases from persons other than

registered dealers.(applicable in cases covered by sec.8(a)(i))

4. Contracts shall not involve transfer of material in the form of goods.

Você também pode gostar

- VAT ApppealDocumento7 páginasVAT ApppealhhhhhhhuuuuuyyuyyyyyAinda não há avaliações

- A. R. Builders & DevelopersDocumento5 páginasA. R. Builders & DevelopersdeepakAinda não há avaliações

- VAT FormDocumento8 páginasVAT FormSonila JainAinda não há avaliações

- Form 25Documento2 páginasForm 25renukamds3399Ainda não há avaliações

- 2023721217646921CircularNo 1of2023-2024Documento4 páginas2023721217646921CircularNo 1of2023-2024krebs38Ainda não há avaliações

- C1 - Form of Agreement FastnersDocumento6 páginasC1 - Form of Agreement Fastnersvishnu RajAinda não há avaliações

- Admitted Due: exception in WPDocumento4 páginasAdmitted Due: exception in WPAditya JunejaAinda não há avaliações

- Application For License Form 4Documento2 páginasApplication For License Form 4Aijaz KhajaAinda não há avaliações

- Statutory Instruments.: S.I. No. 389 of 2013Documento30 páginasStatutory Instruments.: S.I. No. 389 of 2013JAinda não há avaliações

- 2023 LHC 4338Documento4 páginas2023 LHC 4338Your AdvocateAinda não há avaliações

- New FormsDocumento7 páginasNew FormsAndrew NelsonAinda não há avaliações

- Form IiDocumento2 páginasForm Iigaurav100% (1)

- Tax Tribunal Upholds Deduction u/s 54 for Property SaleDocumento7 páginasTax Tribunal Upholds Deduction u/s 54 for Property SaleSuyash BarmechaAinda não há avaliações

- Doc-20231022-Wa0005 231022 090138Documento9 páginasDoc-20231022-Wa0005 231022 090138kumarhealthcare2000Ainda não há avaliações

- 772 New-Regulations06112014121917 001Documento12 páginas772 New-Regulations06112014121917 001Stephen TanAinda não há avaliações

- Contract Labour Rules Forms in Word FormatDocumento38 páginasContract Labour Rules Forms in Word FormatAshwinSiddaramaiahAinda não há avaliações

- Commented Draft SPA Anita AhmadDocumento12 páginasCommented Draft SPA Anita AhmadAhmad HazimAinda não há avaliações

- Change of Address: Procedures ManualDocumento2 páginasChange of Address: Procedures ManualAyesha NaazAinda não há avaliações

- RTA Rooming Accomodation Agreement FormR18Documento7 páginasRTA Rooming Accomodation Agreement FormR18sefioAinda não há avaliações

- Registration of Establishment Under BOCW Act 1996Documento7 páginasRegistration of Establishment Under BOCW Act 1996ramuAinda não há avaliações

- General tenancy agreement guideDocumento8 páginasGeneral tenancy agreement guidesomeguyinozAinda não há avaliações

- Form 7 CLDocumento1 páginaForm 7 CLjitendrakumarmishraAinda não há avaliações

- GST Weekly Update - 10-2023-24Documento4 páginasGST Weekly Update - 10-2023-24Ayush JhaAinda não há avaliações

- Fiscal Law Case Study on Titas Gas vs Commissioner of TaxesDocumento9 páginasFiscal Law Case Study on Titas Gas vs Commissioner of TaxesArannya AfrozAinda não há avaliações

- (Sample Agreement) TANPA PENJAMINDocumento10 páginas(Sample Agreement) TANPA PENJAMINkaarthikAinda não há avaliações

- Form 28 (SEE RULES 54,58 (1), (3) AND (4) ) Application and Grant of No Objection CertificateDocumento2 páginasForm 28 (SEE RULES 54,58 (1), (3) AND (4) ) Application and Grant of No Objection CertificateRajesh NaiduAinda não há avaliações

- Fiscal Law Case-StudyDocumento8 páginasFiscal Law Case-Studyarannya afrozAinda não há avaliações

- Forms-3 C.L.ACTDocumento1 páginaForms-3 C.L.ACTChandan Kumar DasAinda não há avaliações

- Contract LabourDocumento6 páginasContract Laboura.raviAinda não há avaliações

- Samar-I Electric Cooperative vs. CirDocumento2 páginasSamar-I Electric Cooperative vs. CirRaquel DoqueniaAinda não há avaliações

- Documents Required for Service Tax RegistrationDocumento7 páginasDocuments Required for Service Tax RegistrationVinay SinghAinda não há avaliações

- Contract Labour Application For LicenseDocumento2 páginasContract Labour Application For LicenseDipak Ranjan MukherjeeAinda não há avaliações

- Form 28 (SEE RULES 54,58 (1), (3) AND (4) ) Application and Grant of No Objection CertificateDocumento2 páginasForm 28 (SEE RULES 54,58 (1), (3) AND (4) ) Application and Grant of No Objection CertificateNikesh KiranAinda não há avaliações

- Advance Ruling on ITC SettlementDocumento4 páginasAdvance Ruling on ITC Settlementkinnar2013Ainda não há avaliações

- Applicatoin For LicenceDocumento2 páginasApplicatoin For LicenceAmeet RanjanAinda não há avaliações

- Volga D 604 AgreementDocumento5 páginasVolga D 604 AgreementSaddam YusufAinda não há avaliações

- Form II (Central) LL Renewal ApplicationDocumento1 páginaForm II (Central) LL Renewal Applicationsaravanan ssAinda não há avaliações

- Form II (Central) LL Renewal ApplicationDocumento1 páginaForm II (Central) LL Renewal Applicationsaravanan ssAinda não há avaliações

- Form C Capital Gain SchemeDocumento2 páginasForm C Capital Gain SchemeSiva Raman100% (2)

- Forms PDFDocumento351 páginasForms PDFNeelanjan ChakrabortyAinda não há avaliações

- 187 State of Karnataka V Ecom Gill Coffee Trading PVT LTD 13 Mar 2023 463904Documento7 páginas187 State of Karnataka V Ecom Gill Coffee Trading PVT LTD 13 Mar 2023 463904Nithyananda N LAinda não há avaliações

- Refund Forms For Centre and StateDocumento20 páginasRefund Forms For Centre and StateShail MehtaAinda não há avaliações

- EOI FormDocumento4 páginasEOI Formsaqirshaikh7Ainda não há avaliações

- LHC rules notices under Section 161 of Income Tax Ordinance 2001 not barred by limitation periodDocumento9 páginasLHC rules notices under Section 161 of Income Tax Ordinance 2001 not barred by limitation periodSajjad AbidiAinda não há avaliações

- Case Study of Law in A Project.Documento14 páginasCase Study of Law in A Project.sayed0tufail0shahAinda não há avaliações

- Taxi and Private Hire Booking Office Licence Renewal Application ChecklistDocumento8 páginasTaxi and Private Hire Booking Office Licence Renewal Application ChecklistAr. RajaAinda não há avaliações

- Chg1 V2608 - MOTD 16082016 - Ram Charan Company P LTD - Arun M, R Karthik Digittaly SignedDocumento6 páginasChg1 V2608 - MOTD 16082016 - Ram Charan Company P LTD - Arun M, R Karthik Digittaly SignedAnonymous KnUvRMH6NAinda não há avaliações

- Judge Note 138Documento83 páginasJudge Note 138Balakrishna GM Gowda50% (2)

- Booking Office 3124Documento8 páginasBooking Office 3124m227765hAinda não há avaliações

- Taxation Law Case Comment on Sainath Rajkumar Sarode vs. State of MaharashtraDocumento8 páginasTaxation Law Case Comment on Sainath Rajkumar Sarode vs. State of MaharashtraPreeti BafnaAinda não há avaliações

- AJK TEVTA Vs Commissioner Inland RevenueDocumento11 páginasAJK TEVTA Vs Commissioner Inland RevenueRashid Hussain TunioAinda não há avaliações

- Draft Contract Agrt For SSL Certificate 03Documento4 páginasDraft Contract Agrt For SSL Certificate 03Yadesa BerbadaAinda não há avaliações

- FORM NO. 13 APPLICATION FOR CERTIFICATE FOR LOWER OR NIL TAX DEDUCTION/COLLECTIONDocumento6 páginasFORM NO. 13 APPLICATION FOR CERTIFICATE FOR LOWER OR NIL TAX DEDUCTION/COLLECTIONRajasekar SivaguruvelAinda não há avaliações

- J.K. Lasser's Your Income Tax 2024, Professional EditionNo EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionAinda não há avaliações

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNo EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnAinda não há avaliações

- Introduction to Negotiable Instruments: As per Indian LawsNo EverandIntroduction to Negotiable Instruments: As per Indian LawsNota: 5 de 5 estrelas5/5 (1)

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionAinda não há avaliações

- Soccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2No EverandSoccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2Ainda não há avaliações

- MS Forged Socket Weld Fittings Data SheetDocumento7 páginasMS Forged Socket Weld Fittings Data Sheetprem_k_sAinda não há avaliações

- Topics in Finance Part III-Leverage: American Journal of Business Education - April 2010 Volume 3, Number 4Documento6 páginasTopics in Finance Part III-Leverage: American Journal of Business Education - April 2010 Volume 3, Number 4prem_k_sAinda não há avaliações

- SP Occasional Paper - Intangible Assets Final2Documento26 páginasSP Occasional Paper - Intangible Assets Final2almahdi_zainuddinAinda não há avaliações

- The Quick Way To Learn Microsoft Onenote!Documento76 páginasThe Quick Way To Learn Microsoft Onenote!prem_k_sAinda não há avaliações

- The Quick Way To Learn Microsoft Onenote!Documento76 páginasThe Quick Way To Learn Microsoft Onenote!prem_k_sAinda não há avaliações

- Topics in Finance Part III-Leverage: American Journal of Business Education - April 2010 Volume 3, Number 4Documento6 páginasTopics in Finance Part III-Leverage: American Journal of Business Education - April 2010 Volume 3, Number 4prem_k_sAinda não há avaliações

- Chapter 4 Accounting For Bonus IssueDocumento9 páginasChapter 4 Accounting For Bonus Issueprem_k_sAinda não há avaliações

- Format For Material Approval PDFDocumento1 páginaFormat For Material Approval PDFprem_k_sAinda não há avaliações

- Wastewater Treatment Plant Operator Certification Training: Rotating Biological ContactorsDocumento52 páginasWastewater Treatment Plant Operator Certification Training: Rotating Biological Contactorsprem_k_sAinda não há avaliações

- 11kv RMU SpecDocumento21 páginas11kv RMU SpecHappi Gwegweni100% (2)

- Letter of Comfort for SEZ DevelopersDocumento1 páginaLetter of Comfort for SEZ Developersprem_k_sAinda não há avaliações

- Arunabha PDFDocumento28 páginasArunabha PDFAnonymous Of0C4dAinda não há avaliações

- 3103 PDFDocumento22 páginas3103 PDFprem_k_sAinda não há avaliações

- M40 Pumpable Concrete Mix DesignDocumento29 páginasM40 Pumpable Concrete Mix DesignChirag TanavalaAinda não há avaliações

- Rotating Biological ContactorsDocumento2 páginasRotating Biological Contactorsprem_k_sAinda não há avaliações

- Rotating Biological ContactorsDocumento2 páginasRotating Biological Contactorsprem_k_sAinda não há avaliações

- Comparison of Overall Performance Between Moving-Bed and Conventional Sequencing Batch ReactorDocumento10 páginasComparison of Overall Performance Between Moving-Bed and Conventional Sequencing Batch Reactorprem_k_sAinda não há avaliações

- ADF Health Manual Vol 20, Part8, Chp2Documento18 páginasADF Health Manual Vol 20, Part8, Chp2Ahmad Usman Tahir100% (2)

- LNT Form WorkDocumento12 páginasLNT Form Workprem_k_sAinda não há avaliações

- MBR Process: Membrane Bioreactors MBR PlantsDocumento1 páginaMBR Process: Membrane Bioreactors MBR Plantsprem_k_sAinda não há avaliações

- SBR ManualDocumento27 páginasSBR ManualbjhamnaniAinda não há avaliações

- CV - Prem-Rev 1Documento3 páginasCV - Prem-Rev 1prem_k_sAinda não há avaliações

- TT06 - Retirement Planning NeedsDocumento3 páginasTT06 - Retirement Planning Needsprem_k_sAinda não há avaliações

- Acr 19Documento5 páginasAcr 19prem_k_sAinda não há avaliações

- NTBCL Rights Issue DetailsDocumento227 páginasNTBCL Rights Issue Detailsprem_k_sAinda não há avaliações

- The FIDIC Suite of ContractsDocumento9 páginasThe FIDIC Suite of ContractsRaluca CazanescuAinda não há avaliações

- IRCTC Sample Ticket FormatDocumento1 páginaIRCTC Sample Ticket FormatAbhishek Tiwari44% (32)