Escolar Documentos

Profissional Documentos

Cultura Documentos

LandBank - Cash Card Form

Enviado por

Pete RahonDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

LandBank - Cash Card Form

Enviado por

Pete RahonDireitos autorais:

Formatos disponíveis

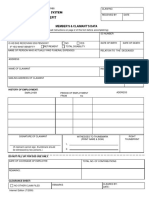

LANDBANK Cash Card Enrollment Form

Date:

Name of Agency/Overseas Remittance Officer (ORO).Branch

Address:

Contact No/s. : Verified by ORMSD:

Authorized Signatory (Agency/ORO) Endorsed by:

CARDHOLDER’S INFORMATION

PHOTO

Last Name First Name Middle Name

Name to Appear on Card (Maximum of 23 Characters)

Address in Philippines:

Zip Code

Home Abroad:

Zip Code

Contact Number: / / Sex: Female

Home Office Mobile Male

E-mail Address: ____________________________________Date of Birth: / /

month day year

Mother’s Maiden Name:

Last Name First Name Middle Name

Type of ID presented: ID Number: TIN:

Philhealth ID Number:________________________ Pag-ibig ID Number:______________________________

(Mandatory) (Mandatory)

Any existing account with LBP? Yes No If yes, pls. specify Account No. _________________

Cardholder’s Signature Date signed

FOR BANK USE ONLY

LANDBANK OFW Cash Card/Account Number: Card Link to Phone Yes

No

6 0 3 1 3 1

SMART MOBILE SIM (Linked to LANDBANK OFW Cash Card)

Cash Card Released by: PIN Mailer Released by: Approved by:

Date: _________________ Date: ___________________ Date: _______________

Cash Card/ Pin Mailer Card Linking

Received by: Assisted/Witnessed by:

Date: _______________ Date: ___________________

TERMS AND CONDITIONS

1. The Card. LANDBANK Cash Card is a card with stored value also known as a PREPAID DEBIT card. It is a non-interest

bearing account.

2. Card Value. The stored value in the PREPAID DEBIT card expressed in Philippine currency.

3. Cash Card Activation. Landbank OFW Cash Card is activated upon the issuance at designated LANDBANK Units or

authorized Agency/Banks. The cash card can be linked to SMART mobile SIM and can be activated using the mobile phone.

4. Validity and Renewal. Unless earlier terminated by LANDBANK or returned by the cardholder, the card is valid from date

of issuance/renewal and shall be deactivated at the end of the second year. The Card shall be placed inactive if without credit

transaction after a period of one hundred eighty (180) days from date of last remittance. The Cardholder may request for

reactivation by visiting his/her branch of account or thru phone banking facility subject to existing policies on client

identification. If no request for reactivation is submitted/called in after one (1) year from date of deactivation and the card value

becomes zero, the card shall be closed. However, if there is a remaining amount in the account, the amount shall be retained in the

account but the card shall be put in an inactive status until the cardholder request for the reactivation/renewal of the card subject

to reactivation and/or renewal fees. Renewal request at the branch of account/issuing unit shall be subject to banking policies.

Approval thereof shall, in all cases, be at the sole discretion of LBP.

5. Loading Value. The cardholder loads PESO value into the cash card either through:

- LANDBANK units – cardholder personally hands over the amount (Philippine/Foreign currency) to any

authorized/accredited loading agency/bank for credit/load to the cash card.

- Account to Account Transfer – cardholder transfer Philippine Peso amount from OFW Cash Card to

beneficiary cash card or to another OFW cash card using the SMART mobile phone.

6. Withdrawals. The cardholder can withdraw from any LBP or ExpressNet, Megalink, BancNet member bank’s ATM. No

bank charges shall apply if withdrawals are made at LBP ATMs.

7. Loss of the Card. The cardholder is responsible for the card PIN’s confidentiality. In case of loss/theft, the cardholder shall

immediately call LBP (phone banking or branch of account) to report the loss/theft. Any loss incurred prior to complete blocking

shall be for the account of the cardholder.

8. Captured cards. LANDBANK OFW Cash Card captured at any LBP ATM shall not be perforated and can be claimed by

the cardholder. A captured card that remains unclaimed thirty (30) days from the date of transmittal to the issuing branch shall be

perforated for security reasons. Purchase of a new card shall be required. However, cards captured at any Expressnet, Bancnet,

Megalink member banks shall be perforated subject to bank’s policy on disposition of unclaimed cards.

9. Replacement of Card/Mobile SIM. LBP will replace a card with inherent defect in the magnetic stripe at no cost within 30

calendar days from date of issuance. Replacements due to loss/theft, wear and tear shall be subject to replacements fee. The

cardholder must surrender the damaged card or submit an affidavit of loss. The replacement card shall be replaced with a new

account number and may be claimed after five (5) banking days for Metro Manila branches and fifteen (15) days for Provincial

branches/issued by ORO from receipt of the request and compliance. The remaining PESO value in the cancelled cash card shall

be transferred to the replacement. Mobile SIM shall be replaced by SMART at the cost of the cardholder.

10. Service Charges and Other Fees. LBP may increase or impose additional charges/fees in providing this service. The

cardholder agrees to pay the increase and/or additional charges/fees that may be imposed in the future. The cardholder also agrees

that applicable roaming and VAS fee shall be charged against cardholder’s mobile load.

11. Change of Telephone Number/ Residence. The cardholder shall immediately notify LBP through written notice of any

change in residence, office mailing address and or telephone number.

12. Limitations on Liability. LBP is not liable for any loss or damage of whatever nature in connection with the use of the card

such as, but not limited to the following instances.

a. Disruption, failure or delay relating to or in connection with the ATM and Point-of-Sale (POS) functions of the

card due to circumstances beyond the control of the LBP.

b. Fortuitous, events and force majeure such as, but not limited to, prolonged power outages, breakdown of

computers and communications facilities, typhoons, floods, public disturbances and other similar or related cases.

c. Loss or damage which the cardholder may suffer arising out of any unauthorized utilization of the card due to theft

or disclosure of PIN or violation of other measures with or without the cardholder’s participation.

d. Inaccurate, incomplete or delayed information received due to disruption or failure of any communication facilities

used for the card; and

e. Indirect, incidental or consequential loss, loss of profit or damage that the cardholder may suffer or has suffered by

reason of the use or failure/inability to use the card under the terms hereof.

13. Insurance. THE CASH CARD FUND IS NOT INSURED WITH PDIC.

14. Escheat. Laws on unclaimed balances apply.

15. Rules and Regulations. The cardholder agrees to be bound by the rules, regulations and official issuances applicable to this

service now existing or which may hereinafter be issued, as well as, such other terms and conditions governing the use of this

service.

16. Agreement to the Terms and Conditions. The cardholder’s signature herein or the cardholder’s receipt of the card from the

purchaser constitutes the cardholder’s agreement to the above terms and conditions.

Cardholder’s/Purchaser’s signature: _______________________ Date ___________________

Você também pode gostar

- Summary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeNo EverandSummary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeAinda não há avaliações

- IRR RA 5980 Financing Company ActDocumento9 páginasIRR RA 5980 Financing Company Actskylark74Ainda não há avaliações

- Individual or Joint Specimen Signature Card 06-06-2014Documento1 páginaIndividual or Joint Specimen Signature Card 06-06-2014Dhexter VillaAinda não há avaliações

- Affidavit of Explanation. Bacduyan.10.2019Documento1 páginaAffidavit of Explanation. Bacduyan.10.2019black stalkerAinda não há avaliações

- Personal Loan Application Form PBCOMDocumento2 páginasPersonal Loan Application Form PBCOMRobbie NewmanAinda não há avaliações

- AUTHORIZATION LETTER - Pag IbigDocumento1 páginaAUTHORIZATION LETTER - Pag IbigFeliz NavidadAinda não há avaliações

- Co-Signer Statement For Surety BondDocumento2 páginasCo-Signer Statement For Surety BondEda Esller Santos100% (1)

- Subject: Authorization Letter To Claim ID CARDDocumento2 páginasSubject: Authorization Letter To Claim ID CARDSandra Mae NavarreteAinda não há avaliações

- Buaya Ii 4103 Imus Cavite Philippines and An Active Subscriber of SMARTDocumento1 páginaBuaya Ii 4103 Imus Cavite Philippines and An Active Subscriber of SMARTAnneCanapiAinda não há avaliações

- Letter To Credit Card HoldersDocumento3 páginasLetter To Credit Card HoldersHector LegaspiAinda não há avaliações

- SM TAYTAY - New Tenant Profile Form PDFDocumento2 páginasSM TAYTAY - New Tenant Profile Form PDFtokstutonAinda não há avaliações

- 2016 SSS Guidebook DeathDocumento13 páginas2016 SSS Guidebook DeathPau Line Escosio100% (1)

- Subscriber Request Form 2019Documento1 páginaSubscriber Request Form 2019john kingAinda não há avaliações

- GCashxAlipay MOA 2020 PDFDocumento24 páginasGCashxAlipay MOA 2020 PDFThata Tumulak100% (1)

- Forth Bridge Solutions Intl. Inc.: Memorandum of Contract and AgreementDocumento5 páginasForth Bridge Solutions Intl. Inc.: Memorandum of Contract and AgreementJubilee Ace InternationalAinda não há avaliações

- Esrs Employer Enrollment Form: Employer ID Number Employer/Business Name Pag-IBIG Servicing Branch Employer TypeDocumento1 páginaEsrs Employer Enrollment Form: Employer ID Number Employer/Business Name Pag-IBIG Servicing Branch Employer TypeGina Garcia100% (1)

- Application Form For ACR I-CARD NEWDocumento2 páginasApplication Form For ACR I-CARD NEWchachiAinda não há avaliações

- Loan Application Form - With PreterminationDocumento2 páginasLoan Application Form - With PreterminationIngge AstreraAinda não há avaliações

- Subject: Authorization Letter Claiming (Documents)Documento2 páginasSubject: Authorization Letter Claiming (Documents)Vian Madera100% (1)

- Deed of Absolute Sale of A Motor Vehicle. OpenDocumento2 páginasDeed of Absolute Sale of A Motor Vehicle. OpenchrisdonaalAinda não há avaliações

- Transaction SlipDocumento2 páginasTransaction SlipSIMPLEJG88% (8)

- CenomarDocumento2 páginasCenomartoscanini2008100% (1)

- Dear SmartDocumento1 páginaDear Smarthannah100% (1)

- Daily Time RecordDocumento2 páginasDaily Time RecordLeonil Estaño83% (6)

- 13 QFRM - IncomeDocumento3 páginas13 QFRM - IncomeAidalyn MendozaAinda não há avaliações

- Harmonised Application Form Application For Schengen VisaDocumento4 páginasHarmonised Application Form Application For Schengen Visam.shehreyar.khanAinda não há avaliações

- RHED Financing Application Form 1Documento2 páginasRHED Financing Application Form 1Kenneth InuiAinda não há avaliações

- Authorization For Credit Investigation and AppraisalDocumento1 páginaAuthorization For Credit Investigation and AppraisalMarvin CeledioAinda não há avaliações

- eSRS Reg Form PDFDocumento1 páginaeSRS Reg Form PDFDarlyn Etang100% (1)

- Individual Application License To Own and Possess FirearmDocumento1 páginaIndividual Application License To Own and Possess Firearmsilv3rw0lfAinda não há avaliações

- Tertiary Education Subsidy (Tes) Application Form Commission On Higher EducationDocumento1 páginaTertiary Education Subsidy (Tes) Application Form Commission On Higher EducationMona Gong100% (1)

- DTRDocumento6 páginasDTRRoden SonAinda não há avaliações

- 0619-E Jan 2018 Rev Final - FFDocumento1 página0619-E Jan 2018 Rev Final - FFthis is my nameAinda não há avaliações

- Affidavit of Damage To VehicleDocumento1 páginaAffidavit of Damage To Vehicleroxsanne capatiAinda não há avaliações

- Requirements To Be Accredited As Tax AgentDocumento3 páginasRequirements To Be Accredited As Tax AgentAvril Reina0% (1)

- RE: Authorization of MR. - : Requesting PartyDocumento1 páginaRE: Authorization of MR. - : Requesting PartyPaul Villania100% (1)

- Affidavit - Sim ExpiredDocumento4 páginasAffidavit - Sim ExpiredAeris Sycamine Garces AquinoAinda não há avaliações

- aAFF OF LOSS BalitaDocumento2 páginasaAFF OF LOSS BalitaRobert MarollanoAinda não há avaliações

- BDO Credit Card Application FormDocumento3 páginasBDO Credit Card Application FormAnna Fritz Sandoval100% (1)

- PHILGASEA Membership Form 1Documento1 páginaPHILGASEA Membership Form 1Jean Kenneth AlontoAinda não há avaliações

- Affidavit of Loss Postal IDDocumento1 páginaAffidavit of Loss Postal IDGilda Maria Laigo0% (1)

- Request Letter For ConveyanceDocumento1 páginaRequest Letter For ConveyanceDamanMandaAinda não há avaliações

- SSS Member Loan Application FormDocumento2 páginasSSS Member Loan Application FormJr Sam90% (49)

- Vendor Supplier Registration Information SheetDocumento3 páginasVendor Supplier Registration Information SheetEnzo MarquezAinda não há avaliações

- Funeral bpn-103 PDFDocumento2 páginasFuneral bpn-103 PDFHazel SabadlabAinda não há avaliações

- Sample Statement of Account For Travel AgencyDocumento3 páginasSample Statement of Account For Travel AgencyKJ S Bee100% (1)

- BDO Business Online Banking - Standard Services (No Workflow)Documento14 páginasBDO Business Online Banking - Standard Services (No Workflow)July FermiaAinda não há avaliações

- CONTRACT OF SERVICE MRBDocumento3 páginasCONTRACT OF SERVICE MRBmennaldzAinda não há avaliações

- Overseas Employment Certificate: Balik ManggagawaDocumento1 páginaOverseas Employment Certificate: Balik ManggagawaJm Rollon100% (1)

- PhilPaSS PrimerDocumento22 páginasPhilPaSS PrimerCoolbuster.NetAinda não há avaliações

- Promissory Note For The City AssessorsDocumento1 páginaPromissory Note For The City Assessorsfaith rollanAinda não há avaliações

- Soa 0020230429297Documento1 páginaSoa 0020230429297Redilyn Corsino Agub0% (1)

- HLF111 CertificateEngagement V05Documento1 páginaHLF111 CertificateEngagement V05julesniko23Ainda não há avaliações

- Change of Billing AddressDocumento2 páginasChange of Billing AddressAlexander Salado Ibrahim100% (1)

- Rwallet Cash Card Application Form: Corporation/Company/Business Unit: Department: LocationDocumento2 páginasRwallet Cash Card Application Form: Corporation/Company/Business Unit: Department: LocationJaynard AlejandrinoAinda não há avaliações

- Food Card Application Form - HDFC BankDocumento2 páginasFood Card Application Form - HDFC BankVinay KumarAinda não há avaliações

- Gtbank Visa Card Application Form1Documento2 páginasGtbank Visa Card Application Form1Cyril DoeAinda não há avaliações

- Terms and Conditions - Debit Card Issuance & OperationsDocumento4 páginasTerms and Conditions - Debit Card Issuance & OperationshemnathAinda não há avaliações

- A2 FormDocumento5 páginasA2 Formshivam parmarAinda não há avaliações

- MAINS 2013 Application Form OfficialDocumento4 páginasMAINS 2013 Application Form OfficialPete RahonAinda não há avaliações

- June 2011 Sulyapinoy IssueDocumento8 páginasJune 2011 Sulyapinoy IssuePete RahonAinda não há avaliações

- July 2011 SulyapinoyDocumento8 páginasJuly 2011 SulyapinoyPete RahonAinda não há avaliações

- MAINS-2013-Admission Guide (최종배포용) - 0913Documento7 páginasMAINS-2013-Admission Guide (최종배포용) - 0913Pete RahonAinda não há avaliações

- 8th KLT/TOPIK PassersDocumento109 páginas8th KLT/TOPIK PassersPete Rahon100% (2)

- Sulyap April 2011 IssueDocumento8 páginasSulyap April 2011 IssuePete RahonAinda não há avaliações

- Sulyap April 2011 IssueDocumento8 páginasSulyap April 2011 IssuePete RahonAinda não há avaliações

- Sulyapinoy Nov 2010 IssueDocumento12 páginasSulyapinoy Nov 2010 IssuePete RahonAinda não há avaliações

- Moueps2009 1Documento12 páginasMoueps2009 1데이브자바이Ainda não há avaliações

- Feb 2011 Sulyapinoy IssueDocumento8 páginasFeb 2011 Sulyapinoy IssuePete RahonAinda não há avaliações

- Jan 2011 SULYAPINOYDocumento8 páginasJan 2011 SULYAPINOYPete RahonAinda não há avaliações

- Contingency Evacuation Plan As of 10-5-10Documento1 páginaContingency Evacuation Plan As of 10-5-10Pete RahonAinda não há avaliações

- March 2011 Sulyapinoy IssueDocumento8 páginasMarch 2011 Sulyapinoy IssuePete RahonAinda não há avaliações

- Oct 2010 - Sulyapinoy IssueDocumento8 páginasOct 2010 - Sulyapinoy IssueZackzeeAinda não há avaliações

- International Workshop For Peace and Disarmament in The Asia-Pacific RegionDocumento1 páginaInternational Workshop For Peace and Disarmament in The Asia-Pacific RegionPete RahonAinda não há avaliações

- SDW2010 Photo and Poetry Contest Guidelines FINALDocumento6 páginasSDW2010 Photo and Poetry Contest Guidelines FINALPete RahonAinda não há avaliações

- Buan Hapgu Village-EngDocumento2 páginasBuan Hapgu Village-EngPete RahonAinda não há avaliações

- MAINS Admission Guide2011Documento6 páginasMAINS Admission Guide2011Pete RahonAinda não há avaliações

- Gubyeongareum VillageDocumento2 páginasGubyeongareum VillagePete RahonAinda não há avaliações

- Mains: (Master of Arts in Inter-Asia NGO Studies)Documento4 páginasMains: (Master of Arts in Inter-Asia NGO Studies)Pete RahonAinda não há avaliações

- Buan Hapgu VillageDocumento2 páginasBuan Hapgu VillagePete RahonAinda não há avaliações

- September 2010 Sulyapinoy IssueDocumento8 páginasSeptember 2010 Sulyapinoy IssuePete RahonAinda não há avaliações

- Poetry ContestsDocumento1 páginaPoetry ContestsPete RahonAinda não há avaliações

- Sulyapinoy August 2010 IssueDocumento8 páginasSulyapinoy August 2010 IssuePete RahonAinda não há avaliações

- Coalition of Cambodian Apparel WorkersDocumento6 páginasCoalition of Cambodian Apparel WorkersPete RahonAinda não há avaliações

- Pulse Asia - Dec 21Documento12 páginasPulse Asia - Dec 21Pete RahonAinda não há avaliações

- Registration FormDocumento1 páginaRegistration FormPete RahonAinda não há avaliações

- Invite and Programme For Dec 7-1Documento2 páginasInvite and Programme For Dec 7-1Pete RahonAinda não há avaliações

- LGUs Lecture Nov 30 2009Documento49 páginasLGUs Lecture Nov 30 2009Pete RahonAinda não há avaliações

- TransgendersDocumento7 páginasTransgendersJastine Mae FajilanAinda não há avaliações

- EXIM Financing and Documentationt200813Documento340 páginasEXIM Financing and Documentationt200813Ramalingam Chandrasekharan0% (1)

- Definition of Financial ManagementDocumento5 páginasDefinition of Financial Managementzainabqaisar07Ainda não há avaliações

- INVOICE GambiaDocumento2 páginasINVOICE GambiaPhilippe AKUE-ABOSSEAinda não há avaliações

- Consumer LendingDocumento51 páginasConsumer LendingAvi ThakurAinda não há avaliações

- Baniya Kirana Stores F.Y. 2074-75 TaxDocumento17 páginasBaniya Kirana Stores F.Y. 2074-75 TaxasasasAinda não há avaliações

- Pritesh S Pingale Bank StatementDocumento8 páginasPritesh S Pingale Bank StatementDnyaneshwar WaghmareAinda não há avaliações

- Arroyo vs. Yu de SaneDocumento8 páginasArroyo vs. Yu de SaneButch MaatAinda não há avaliações

- Sunrise Bank LTDDocumento43 páginasSunrise Bank LTDsaurabchirania100% (3)

- Invoice PDFDocumento3 páginasInvoice PDFHarish MaharAinda não há avaliações

- Galanesia Invoice For Transaction 5495Documento2 páginasGalanesia Invoice For Transaction 5495Agus SuAinda não há avaliações

- 04-Timesheet AF Install LabourDocumento14 páginas04-Timesheet AF Install Labourahmad AinurAinda não há avaliações

- 1563879154024Documento30 páginas1563879154024Rahul GoyalAinda não há avaliações

- Hybrid Script 8-8-23Documento17 páginasHybrid Script 8-8-23Andrés FlórezAinda não há avaliações

- CPS Missing Credit FormatDocumento6 páginasCPS Missing Credit FormatArumugam KrishnanAinda não há avaliações

- Noting and ProtestingDocumento3 páginasNoting and ProtestingKanad Bharat Lahane50% (2)

- Duplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallDocumento1 páginaDuplicate Bill: For Any Queries On This Bill Please Contact MSEDCL CallNarendra VermaAinda não há avaliações

- Your Booking Is Confirmed!: Chinna Babu (U)Documento2 páginasYour Booking Is Confirmed!: Chinna Babu (U)Banavath Brahmendra NayakAinda não há avaliações

- CV TN 09012016Documento2 páginasCV TN 09012016Parag ShettyAinda não há avaliações

- A Case Study On The Growth of Rural Banking in India: IjcsbeDocumento12 páginasA Case Study On The Growth of Rural Banking in India: IjcsbeHarivenkatsai SaiAinda não há avaliações

- What Is Euro BondDocumento5 páginasWhat Is Euro Bondpranoti_shinde8167Ainda não há avaliações

- Islamic Banking User Manual-WAKALADocumento20 páginasIslamic Banking User Manual-WAKALAPranay SahuAinda não há avaliações

- Synopsis of Companies Act, 2013Documento10 páginasSynopsis of Companies Act, 2013Ankit Srivastava0% (1)

- Letters of CreditDocumento8 páginasLetters of CreditCzarPaguioAinda não há avaliações

- To Islamic Finance: DR Masahina SarabdeenDocumento20 páginasTo Islamic Finance: DR Masahina SarabdeenNouf AAinda não há avaliações

- Commodities Primer - RBS (2009)Documento166 páginasCommodities Primer - RBS (2009)tacolebelAinda não há avaliações

- Savings Account - 18850100017771 Dharakeshwar Sa: AddressDocumento1 páginaSavings Account - 18850100017771 Dharakeshwar Sa: AddressLearn UrselfAinda não há avaliações

- The Credit Card DilemmaDocumento6 páginasThe Credit Card DilemmaAlejandro AguirreAinda não há avaliações

- Long Business Systems, Inc. (Lbsi)Documento13 páginasLong Business Systems, Inc. (Lbsi)semirbekAinda não há avaliações

- MCB Bank Pakistan - Personal Product - Credit Card OnlineDocumento4 páginasMCB Bank Pakistan - Personal Product - Credit Card OnlineNaveed MeerAinda não há avaliações