Escolar Documentos

Profissional Documentos

Cultura Documentos

Case On UTV Software Communications LTD

Enviado por

Shail MalviyaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Case On UTV Software Communications LTD

Enviado por

Shail MalviyaDireitos autorais:

Formatos disponíveis

Case on UTV Software Communications Ltd.

UTV Software Communications Ltd (UTV), India's first integrated global media and

entertainment company, has seen recent rapid expansion, both in existing businesses and

into new growth sectors. The entire UTV focus is on creating, aggregating and

disseminating outstanding content - we are a creatively led company which believes in

setting not following trends. UTV is in fact India's only diversified media and

entertainment company with content creation abilities across platforms and genres.

The UTV group has expanded into 5 verticals, all of which allow for synergy across in

terms of content development, communication and development of thought leadership.

This also creates exciting opportunities for employees to move across businesses in order

to broaden their experience and enrich their career.

These 5 verticals include the following:

Broadcasting

Games Content

Motion Pictures

New Media

TV Content

Listed on India's premier stock exchange, The Bombay Stock Exchange UTV has

subsidiaries with offices across India, UK, USA and Japan. The Walt Disney Company

holds a strategic stake in UTV

Corporate structure

UTV is listed on the Mumbai Stock Exchange and the Indian National Stock Exchange,

and its motion picture division UTV Motion Pictures Plc is listed on the London Stock

Exchange's Alternative Investment Market (AIM).

In August 2006, The Walt Disney Company acquired a 14.85 percent stake in UTV.[2]

This was subsequently hiked to 32.1 percent in 2008, the same level as UTV's founders

Ronnie Screwvala and his associates. The remaining share is publicly traded.

Analyse the case by using various Financial Ratios.

Determine the Optimum Cost of Capital of the company.

Calculate Leverages of the company.

Balance Sheet

Mar Mar

Sources Of Funds '07 '08 Mar '09

Total Share Capital 22.89 24.84 34.2

Equity Share Capital 22.89 24.84 34.2

Share Application Money 3.75 0 39.01

Pref. Share Capital 0 0 0

Reserves 141.37 177.78 983.29

Revaluation Reserve 0 0 0

1,056.5

Networth 168.01 202.62 0

Secured Loans 159.14 244.79 181.65

Unsecured Loans 0 0 165

Total Debt 159.14 244.79 346.65

1,403.1

Total Liabilities 327.15 447.41 5

Application Of Funds

Gross Block 46.5 35.16 31.3

Less: Accum. Depreciation 7.27 7.89 7.48

Net Block 39.23 27.27 23.82

Capital Work in Progress 1.3 1.8 0.02

Investments 78.52 78.05 482.67

Inventories 83.18 26.79 152.74

Sundry Debtors 45.29 100.17 55.18

Cash& Bank Balance 7.54 1.53 62.68

Total Current Assets 136.01 128.49 270.6

Loans and Advances 120.09 355.19 749.48

Fixed Deposits 1.5 0.8 1.08

1,021.1

Total CA, Loans & Advances 257.6 484.48 6

Current Liabilities 48.93 138.98 119.16

Provisions 0.56 5.22 5.37

Total CL & Provisions 49.49 144.2 124.53

Net Current Assets 208.11 340.28 896.63

Miscellaneous Expenses 0 0 0

1,403.1

Total Assets 327.16 447.4 4

Contingent Liabilities 8.17 8.19 14.32

Book Value (Rs) 71.75 81.56 297.55

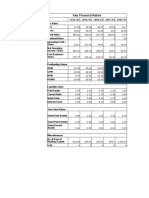

Profit & Loss A/c.

Mar Mar

'07 '08 Mar '09

Income

Sales Turnover 152.45 286.29 251.19

Excise Duty 0 0 0

Net Sales 152.45 286.29 251.19

Other Income 33.03 10.23 68.34

Stock Adjustments 0 0 0

Total Income 185.48 296.52 319.53

Expenditure

Raw Materials 0 0 0

Power & Fuel Cost 0 0 0

Employee Cost 14.14 15.75 20.75

Other Manuf. Expenses 122.76 233.57 239.6

Selling and Admin Expenses 15.11 10.57 2.77

Miscellaneous Expenses 4.57 6.5 4.1

Preoperative Exp Capitalised 0 0 0

Total Expenses 156.58 266.39 267.22

Operating Profit -4.13 19.9 -16.03

PBDIT 28.9 30.13 52.31

Interest 7.21 19.02 14.29

PBDT 21.69 11.11 38.02

Depreciation 3.07 3.35 2.91

Other Written Off 0 0 0

Profit Before Tax 18.62 7.76 35.11

Extra-ordinary items 1 0.11 2

PBT (Post Extra-ord Items) 19.62 7.87 37.11

Tax -16.97 3.4 11.29

Reported Net Profit 36.59 4.48 25.82

Total Value Addition 156.58 266.38 267.21

Pref. Dividend 0 0 0

Equity Dividend 5.72 3.42 0

Corporate Dividend Tax 0.8 0.58 0

Per share data

(annualised)

Shares issue (lakhs) 228.94 248.43 341.95

EPS(Rs) 15.98 1.8 7.55

Equity Dividend (%) 25 10 0

Book Value (Rs) 71.75 81.56 297.55

Você também pode gostar

- Profit and Loss Account of Akzo NobelDocumento15 páginasProfit and Loss Account of Akzo NobelKaizad DadrewallaAinda não há avaliações

- Swot Analysis I. Strenghts: WeaknessesDocumento5 páginasSwot Analysis I. Strenghts: WeaknessesNiveditha MAinda não há avaliações

- Amit Icici Bank LimitedDocumento25 páginasAmit Icici Bank LimitedAmit JainAinda não há avaliações

- Hero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17Documento25 páginasHero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17pranav sarawagiAinda não há avaliações

- Bal SheetDocumento6 páginasBal SheetSabyasachi PandaAinda não há avaliações

- Krispy Kriem Doughnuts: Prepared By: Sanae DRISSI Sofia SBITI Alae Eddine ALAMI Sara HafyaneDocumento18 páginasKrispy Kriem Doughnuts: Prepared By: Sanae DRISSI Sofia SBITI Alae Eddine ALAMI Sara Hafyaneh_anisAinda não há avaliações

- Dion Global Solutions Limited: SourceDocumento15 páginasDion Global Solutions Limited: SourceAnish DalmiaAinda não há avaliações

- Future RetailDocumento15 páginasFuture RetailVaibhav SaithAinda não há avaliações

- Sourses of Funds: Balance Sheet 2010 2009Documento4 páginasSourses of Funds: Balance Sheet 2010 2009Deven PipaliaAinda não há avaliações

- Three Statement Model (Beauty of Our FM - ADF) - CompletedDocumento9 páginasThree Statement Model (Beauty of Our FM - ADF) - CompletedAnkit SharmaAinda não há avaliações

- Finance Tata Chemicals LTDDocumento5 páginasFinance Tata Chemicals LTDzombeeeeAinda não há avaliações

- 2 - Aditya - Balaji TelefilmsDocumento12 páginas2 - Aditya - Balaji Telefilmsrajat_singlaAinda não há avaliações

- Bajaj Auto Financial AnalysisDocumento16 páginasBajaj Auto Financial AnalysisprachimadaanAinda não há avaliações

- Lakme: Latest Quarterly/Halfyearly As On (Months)Documento7 páginasLakme: Latest Quarterly/Halfyearly As On (Months)Vikas UpadhyayAinda não há avaliações

- Analysis of Working CapitalDocumento7 páginasAnalysis of Working CapitalAzfar KawosaAinda não há avaliações

- Hero MotoCorp LTDDocumento10 páginasHero MotoCorp LTDpranav sarawagiAinda não há avaliações

- Bajaj Auto Fundamental Analysis: BY Sagir Kazi Submitted To:-Prof - Nitin TikkeDocumento25 páginasBajaj Auto Fundamental Analysis: BY Sagir Kazi Submitted To:-Prof - Nitin TikkeRohan NimkarAinda não há avaliações

- Balaji TelefilmsDocumento23 páginasBalaji TelefilmsShraddha TiwariAinda não há avaliações

- Financial Risk AnalysisDocumento6 páginasFinancial Risk AnalysisolafedAinda não há avaliações

- Binani Cement LTD Profit and Loss A/c: Mar '06 Mar '07 IncomeDocumento8 páginasBinani Cement LTD Profit and Loss A/c: Mar '06 Mar '07 IncomemrupaniAinda não há avaliações

- Balance Sheet and P&L Analysis for Mar-19, Mar-18, Mar-17Documento5 páginasBalance Sheet and P&L Analysis for Mar-19, Mar-18, Mar-17Dishant PatelAinda não há avaliações

- Book 1Documento18 páginasBook 1Ankit PichholiyaAinda não há avaliações

- Juhayna Food Industries: in Millions of EGP (Except For Per Share Items)Documento11 páginasJuhayna Food Industries: in Millions of EGP (Except For Per Share Items)Shokry AminAinda não há avaliações

- Varun Motors Income Statement Analysis 2015-2019Documento3 páginasVarun Motors Income Statement Analysis 2015-2019AnilAinda não há avaliações

- Ratio Analysis Berger Asian PaintsDocumento11 páginasRatio Analysis Berger Asian PaintsHEM BANSALAinda não há avaliações

- Divi's Laboratories LTD: Finanance For Managers Activity 2Documento10 páginasDivi's Laboratories LTD: Finanance For Managers Activity 2Madhan kumarAinda não há avaliações

- Financial Ratios of Federal BankDocumento35 páginasFinancial Ratios of Federal BankVivek RanjanAinda não há avaliações

- Renuka Sugars P and L AccntDocumento13 páginasRenuka Sugars P and L AccntDivya NadarajanAinda não há avaliações

- India Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008Documento6 páginasIndia Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008amitkr91Ainda não há avaliações

- Balance Sheet of Empee DistilleriesDocumento4 páginasBalance Sheet of Empee DistilleriesArun PandiyanAinda não há avaliações

- Equities and Liabilities Shareholder'S FundsDocumento21 páginasEquities and Liabilities Shareholder'S Fundsakarshika raiAinda não há avaliações

- Financial Management AssignmentDocumento5 páginasFinancial Management AssignmentSREEJITH RAinda não há avaliações

- Consolidated Balance Sheet of Zodiac Clothing Company - in Rs. Cr.Documento8 páginasConsolidated Balance Sheet of Zodiac Clothing Company - in Rs. Cr.Shashank PatelAinda não há avaliações

- Income Latest: Financials (Standalone)Documento3 páginasIncome Latest: Financials (Standalone)Vishwavijay ThakurAinda não há avaliações

- Accounts Term PaperDocumento86 páginasAccounts Term PaperVikramjit ਮਿਨਹਾਸAinda não há avaliações

- Emu LinesDocumento22 páginasEmu LinesRahul MehraAinda não há avaliações

- Ambuja & ACC Final RatiosDocumento23 páginasAmbuja & ACC Final RatiosAjay KudavAinda não há avaliações

- Shree Cement Financial Model Projections BlankDocumento10 páginasShree Cement Financial Model Projections Blankrakhi narulaAinda não há avaliações

- Aditya nuVODocumento12 páginasAditya nuVOPriyanshi yadavAinda não há avaliações

- Escorts Fsa WorksheetDocumento14 páginasEscorts Fsa Worksheetkaushal talukderAinda não há avaliações

- Kotak Mahindra Group 12 Section BDocumento3 páginasKotak Mahindra Group 12 Section BROHAN SONIAinda não há avaliações

- Asian PaintsDocumento40 páginasAsian PaintsHemendra GuptaAinda não há avaliações

- Equities and Liabilities Shareholders FundsDocumento5 páginasEquities and Liabilities Shareholders Fundsshiv mehraAinda não há avaliações

- Balance Sheet: Sources of FundsDocumento14 páginasBalance Sheet: Sources of FundsJayesh RodeAinda não há avaliações

- FSA Project Financial AnalysisDocumento10 páginasFSA Project Financial Analysissambit mishraAinda não há avaliações

- FM Cce2Documento7 páginasFM Cce2shrutiAinda não há avaliações

- 12 - Ishan Aggarwal - Shreyans Industries Ltd.Documento11 páginas12 - Ishan Aggarwal - Shreyans Industries Ltd.rajat_singlaAinda não há avaliações

- 32 - Akshita - Sun Pharmaceuticals Industries.Documento36 páginas32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaAinda não há avaliações

- in Rs. Cr.Documento19 páginasin Rs. Cr.Ashish Kumar SharmaAinda não há avaliações

- 19-7-2022 Class Work HeroMoto DataDocumento16 páginas19-7-2022 Class Work HeroMoto DataMridav GoelAinda não há avaliações

- Balance Sheet of Cipla 1Documento6 páginasBalance Sheet of Cipla 1anjalipawaskarAinda não há avaliações

- TataCoffee BalanceSheetDocumento2 páginasTataCoffee BalanceSheetSaif MohammedAinda não há avaliações

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocumento12 páginasMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhAinda não há avaliações

- Key Financial RatiosDocumento16 páginasKey Financial Ratioskriss2coolAinda não há avaliações

- Capital and Liabilities:: United Western BankDocumento15 páginasCapital and Liabilities:: United Western BankAbhishek KarumbaiahAinda não há avaliações

- UltraTech Financial Statement - Ratio AnalysisDocumento11 páginasUltraTech Financial Statement - Ratio AnalysisYen HoangAinda não há avaliações

- Exhibit+1Documento28 páginasExhibit+1pre.meh21Ainda não há avaliações

- Sub: Financial Accounting Sub: Financial AccountingDocumento14 páginasSub: Financial Accounting Sub: Financial AccountingMilan PateliyaAinda não há avaliações

- UTV Software Communications LTDDocumento4 páginasUTV Software Communications LTDNeesha PrabhuAinda não há avaliações

- Discounted Cash Flow: A Theory of the Valuation of FirmsNo EverandDiscounted Cash Flow: A Theory of the Valuation of FirmsAinda não há avaliações

- Simple Interest - WSDocumento2 páginasSimple Interest - WSKrishnamohanAinda não há avaliações

- Sbi Po Ratio - English - 1578405778Documento10 páginasSbi Po Ratio - English - 1578405778వన మాలిAinda não há avaliações

- French Vs UK GAAPDocumento155 páginasFrench Vs UK GAAPKen Li0% (1)

- ArbitrageDocumento3 páginasArbitragemadihasaleems100% (1)

- Compound Interest: Compounded Mo Re Than Once A Yea RDocumento24 páginasCompound Interest: Compounded Mo Re Than Once A Yea RCristine CañeteAinda não há avaliações

- FM423 Practice Exam II SolutionsDocumento9 páginasFM423 Practice Exam II SolutionsruonanAinda não há avaliações

- Financial Management: Jia, Ning (贾宁) School of Economics and Management Tsinghua UniversityDocumento53 páginasFinancial Management: Jia, Ning (贾宁) School of Economics and Management Tsinghua University王振權Ainda não há avaliações

- Session 9 - Bank Capital PDFDocumento8 páginasSession 9 - Bank Capital PDFrizzzAinda não há avaliações

- Quiz 4 CADocumento8 páginasQuiz 4 CAbasilnaeem7Ainda não há avaliações

- Mobile Money - Investment Opportunities For SACCOsDocumento20 páginasMobile Money - Investment Opportunities For SACCOsKivumbi WilliamAinda não há avaliações

- Bba502 b1850 MQP Answer KeysDocumento16 páginasBba502 b1850 MQP Answer KeysSarah SajjadAinda não há avaliações

- Logistics Management Lesson 3 Measuring Logistics Costs and PerformanceDocumento5 páginasLogistics Management Lesson 3 Measuring Logistics Costs and PerformanceJan Kryz Marfil PalenciaAinda não há avaliações

- Royal Pink Dorm Feasibility StudyDocumento58 páginasRoyal Pink Dorm Feasibility StudyMickayAinda não há avaliações

- FIN 5001 - Course OutlineDocumento6 páginasFIN 5001 - Course OutlineJoe Thampi KuruppumadhomAinda não há avaliações

- Pemi Additional FormDocumento1 páginaPemi Additional FormJun GomezAinda não há avaliações

- Toys R Us LBO Model BlankDocumento34 páginasToys R Us LBO Model BlankCatarina AlmeidaAinda não há avaliações

- HihiDocumento20 páginasHihiCath OquialdaAinda não há avaliações

- FIN 4604 Sample Questions IIDocumento25 páginasFIN 4604 Sample Questions IIEvelyn-Jiewei LiAinda não há avaliações

- Chapter 31 Corporate Finance Ross Test BankDocumento65 páginasChapter 31 Corporate Finance Ross Test Bankali0% (1)

- Business Valuation ExercisesDocumento12 páginasBusiness Valuation Exercisesanamul haqueAinda não há avaliações

- Regal Cars Has Been Manufacturing Exotic Automobiles For More ThanDocumento1 páginaRegal Cars Has Been Manufacturing Exotic Automobiles For More ThanTaimour HassanAinda não há avaliações

- Advanced Partnership AccountingDocumento24 páginasAdvanced Partnership AccountingElla Mae TuratoAinda não há avaliações

- Investment - 2019 Edition - Chapter 21Documento1 páginaInvestment - 2019 Edition - Chapter 21Lastine AdaAinda não há avaliações

- International Journal of Economics, Commerce and Management, Ijecm - Co.ukDocumento17 páginasInternational Journal of Economics, Commerce and Management, Ijecm - Co.ukMalcolm ChristopherAinda não há avaliações

- FinanceDocumento117 páginasFinancenarendraidealAinda não há avaliações

- M. Com. Sem II Question - Banks - Corporate - FinanceDocumento34 páginasM. Com. Sem II Question - Banks - Corporate - FinanceAjish JoyAinda não há avaliações

- Guideline For ApplicantsDocumento116 páginasGuideline For ApplicantsErald QordjaAinda não há avaliações

- First Security Islami Bank LTD/ Ratio AnalysisDocumento22 páginasFirst Security Islami Bank LTD/ Ratio AnalysisManzurul KarimAinda não há avaliações

- PremWatsaFairfaxNewsletter7 12-20-11Documento6 páginasPremWatsaFairfaxNewsletter7 12-20-11able1Ainda não há avaliações

- Nigerian Stock Recommendation For August 7th 2023Documento4 páginasNigerian Stock Recommendation For August 7th 2023DMAN1982Ainda não há avaliações