Escolar Documentos

Profissional Documentos

Cultura Documentos

Cost of Bad Credit

Enviado por

Linda FerrariDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Cost of Bad Credit

Enviado por

Linda FerrariDireitos autorais:

Formatos disponíveis

How Much Is Your Credit Score Costing You?

Imagine spending a third of a million dollars more than someone else just because your credit

score wasn’t as high as theirs. Unfortunately, it happens all the time. Consumers feel like they get

backed into a corner to pay more because their credit score falls within a range that is not high

enough to qualify for the best loans. Here are some examples of what you would pay for a

$300,000 loan if you had the following scores:

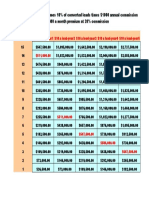

Home Financing: A 30-Year Fixed with a loan principal amount of $300,000

FICO Score APR Rate Monthly Payment Interest Paid

720-850 6.513% $1899 $383,557

700-719 6.638% $1924 $392,464

675-699 7.175% $2031 $431,264

620-674 8.325% $2270 $517,069

560-619 10.839% $2821 $715,392

550-559 11.647% $3005 $781,644

Rates updated on July 1, 2007

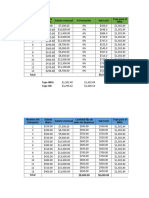

This table shows that if your scores are below 620, and you improve those scores to above 720,

you could potentially SAVE $1,106.00 per month on your mortgage payment. That pencils out to

an extra $13,272 a year and a whopping $385,557 over the life of the loan. Wouldn’t you rather

have that money available for retirement, or improving your overall situation in the way of lifestyle,

education or investing? It’s a lot of money. It’s enough money to really change your life for the

better, and it’s worth fighting for. Even if your scores are low right now, you don’t have to give up

on your dream of homeownership.

There are many options that will allow you to get into a loan now, spend the next 6-12 months

working to improve your scores, and refinance for a better rate. Your mortgage professional can

assist you in this important process. Then, you can take proactive steps to improve your credit

scores to get the best loan possible. As you can see above, there are 385,557 good reasons to

start right now! This newsletter is aimed at showing you how you can do just that.

C r e d i t R e s o u r c e C o r p . , 1 0 4 8 I r v i n e A v e n u e , # 6 3 6 , N e wp o r t B e a c h , C A 9 2 6 6 0

T e l 8 6 6 . 5 4 1 . 2 5 0 0 F a x 9 4 9 . 9 7 5 . 8 5 2 2 w w w. c r e d i t r e s o u r c e c o r p . c o m

Você também pode gostar

- Cases in Finance 3rd Edition Demello Solutions ManualDocumento8 páginasCases in Finance 3rd Edition Demello Solutions ManualCindyCurrydwqzr100% (84)

- Cases in Finance 3rd Edition Demello Solutions ManualDocumento8 páginasCases in Finance 3rd Edition Demello Solutions Manuallovellhebe2v0vn100% (21)

- Ebook Cases in Finance 3Rd Edition Demello Solutions Manual Full Chapter PDFDocumento17 páginasEbook Cases in Finance 3Rd Edition Demello Solutions Manual Full Chapter PDFfintanthamh4jtd100% (10)

- Lesson 1 DebtDocumento21 páginasLesson 1 DebtAlf ChingAinda não há avaliações

- Filedate 3141Documento29 páginasFiledate 3141claudette.sundermeyer830Ainda não há avaliações

- Building Wealth Chart #1Documento4 páginasBuilding Wealth Chart #1Caleb ReynoldsAinda não há avaliações

- Financial Literacy-Middle School 13-PresenationDocumento31 páginasFinancial Literacy-Middle School 13-PresenationRodel floresAinda não há avaliações

- Simple Financial Plan & Unit Economics - Lead Gen - Template - v3.0 by Future Flow - PUBLICDocumento52 páginasSimple Financial Plan & Unit Economics - Lead Gen - Template - v3.0 by Future Flow - PUBLICRaúl GuerreroAinda não há avaliações

- Loan Amortization and Compounding vs DiscountingDocumento6 páginasLoan Amortization and Compounding vs DiscountingHafiz AbdulwahabAinda não há avaliações

- Total RevenueDocumento1 páginaTotal RevenueethanselphAinda não há avaliações

- Loan Amount Closing Costs: 30 Year Amortization Per $1000 FinancedDocumento1 páginaLoan Amount Closing Costs: 30 Year Amortization Per $1000 Financedapi-26011493Ainda não há avaliações

- W07 Case Study Loan AssignmentDocumento66 páginasW07 Case Study Loan AssignmentArmando Aroni BacaAinda não há avaliações

- How To Invest in The Best CompanyDocumento10 páginasHow To Invest in The Best Companysamir SenseAinda não há avaliações

- 8 Get Your Finances & Credit in OrderDocumento15 páginas8 Get Your Finances & Credit in OrdercropdownunderAinda não há avaliações

- CALCULATE: Impact of Credit Score On LoansDocumento2 páginasCALCULATE: Impact of Credit Score On LoansElise Smoll (Elise)100% (1)

- Budget Basics For Modular Home Buyers - How Much Home Can I Afford?Documento3 páginasBudget Basics For Modular Home Buyers - How Much Home Can I Afford?SEAN NAinda não há avaliações

- Matematicas Financiera - Solver función para determinar tasa máxima de interés y flujo de cajaDocumento10 páginasMatematicas Financiera - Solver función para determinar tasa máxima de interés y flujo de cajaLeidy Carolina MEDINA GOMEZAinda não há avaliações

- Northstar Financial Companies, Inc. 2019 Year-End CommentaryDocumento6 páginasNorthstar Financial Companies, Inc. 2019 Year-End CommentaryNorthstar Financial Companies, IncAinda não há avaliações

- Why Rent When You Can Buy?Documento8 páginasWhy Rent When You Can Buy?CycleSLC100% (2)

- Financial PlanDocumento28 páginasFinancial PlannabeelaraoAinda não há avaliações

- Chapter 14 HW SolutionDocumento10 páginasChapter 14 HW SolutionIsmail Özdemir100% (1)

- Dream Deferred 4-16-14 Pcap 2loDocumento1 páginaDream Deferred 4-16-14 Pcap 2loapi-252908061Ainda não há avaliações

- Description: Tags: 08ffelnet-AyDocumento1 páginaDescription: Tags: 08ffelnet-Ayanon-867101Ainda não há avaliações

- Private Health Insurance Risk Equalisation Financial Year Results 2018-19Documento80 páginasPrivate Health Insurance Risk Equalisation Financial Year Results 2018-19jimmy rodolfo LazanAinda não há avaliações

- Quantitative Problems Chapter 12Documento12 páginasQuantitative Problems Chapter 12AndrewVazAinda não há avaliações

- Libro (2)Documento4 páginasLibro (2)Lluvia NeftaliAinda não há avaliações

- Purchasing Power ImpactDocumento1 páginaPurchasing Power ImpactCraigFrazerAinda não há avaliações

- Description: Tags: 08ffelnet-AyDocumento1 páginaDescription: Tags: 08ffelnet-Ayanon-270272Ainda não há avaliações

- Quantitative Problems Chapter 12 Mortgage CalculationsDocumento9 páginasQuantitative Problems Chapter 12 Mortgage Calculationswaqar hattarAinda não há avaliações

- Financial Ratio Analysis,,,Documento22 páginasFinancial Ratio Analysis,,,Meshack MateAinda não há avaliações

- Personal Finance 2nd Edition Walker Solutions ManualDocumento14 páginasPersonal Finance 2nd Edition Walker Solutions Manualsmiletadynamia7iu4100% (21)

- Income Disclosure Statement: JULY 2018 - JUNE 2019Documento1 páginaIncome Disclosure Statement: JULY 2018 - JUNE 2019tinotenda ganaganaAinda não há avaliações

- Project Management - Fixer UpperDocumento12 páginasProject Management - Fixer UpperKedara Gouri AvulaAinda não há avaliações

- Quize 14Documento15 páginasQuize 14Daniella Mae ElipAinda não há avaliações

- Asbcalcv33Documento1 páginaAsbcalcv33st6861fAinda não há avaliações

- In Economica Steban MurciaDocumento2 páginasIn Economica Steban MurciaANONYMUS HACKERAinda não há avaliações

- Credit Can Enhance Your Life: Print This PageDocumento5 páginasCredit Can Enhance Your Life: Print This Pageray lamarAinda não há avaliações

- Description: Tags: 08ffelgross-FyDocumento1 páginaDescription: Tags: 08ffelgross-Fyanon-260266Ainda não há avaliações

- Description: Tags: 08ffelgross-FyDocumento1 páginaDescription: Tags: 08ffelgross-Fyanon-959842Ainda não há avaliações

- Assignment 3 BookDocumento14 páginasAssignment 3 Bookapi-604969350Ainda não há avaliações

- Asb CalculatorDocumento1 páginaAsb CalculatorAbdul RoisAinda não há avaliações

- Description: Tags: 08ffelnet-FyDocumento1 páginaDescription: Tags: 08ffelnet-Fyanon-176920Ainda não há avaliações

- Private Equity Real Estate Exam SolutionDocumento10 páginasPrivate Equity Real Estate Exam SolutionangadAinda não há avaliações

- CONDICIONES DE FARODocumento3 páginasCONDICIONES DE FARONorma VillegaAinda não há avaliações

- Silvercreek Home PDFDocumento5 páginasSilvercreek Home PDFAnonymous HiKVd77Ainda não há avaliações

- Business Statistics Canadian 3rd Edition Sharpe Test BankDocumento16 páginasBusiness Statistics Canadian 3rd Edition Sharpe Test Bankjohnburnettgpbtfdynmi100% (25)

- Ebook Business Statistics Canadian 3Rd Edition Sharpe Test Bank Full Chapter PDFDocumento31 páginasEbook Business Statistics Canadian 3Rd Edition Sharpe Test Bank Full Chapter PDFhuyenquyen9eemjd100% (11)

- AMORTIZATIONDocumento10 páginasAMORTIZATIONManuella RyanAinda não há avaliações

- Description: Tags: 08ffelnet-FyDocumento1 páginaDescription: Tags: 08ffelnet-Fyanon-269948Ainda não há avaliações

- Instruksi: Baca Cara Penggunaan Software Secara SeksamaDocumento24 páginasInstruksi: Baca Cara Penggunaan Software Secara SeksamaditaAinda não há avaliações

- Loan Calculator with 3 Years and Extra PaymentsDocumento5 páginasLoan Calculator with 3 Years and Extra PaymentskumarAinda não há avaliações

- City of Galveston RFP Employee Health Insurance Addendum #3Documento75 páginasCity of Galveston RFP Employee Health Insurance Addendum #3garbagepatchAinda não há avaliações

- Figure out buy vs rent with IRRDocumento6 páginasFigure out buy vs rent with IRRLogan WilsonAinda não há avaliações

- 15 Vs 30 Year AmoritzationDocumento1 página15 Vs 30 Year AmoritzationMichael J. KellyAinda não há avaliações

- Finance ProjectDocumento8 páginasFinance Projectapi-355063431Ainda não há avaliações

- Test #3 Review - Loan and NPV 2Documento2 páginasTest #3 Review - Loan and NPV 2nikhil.dharmavaramAinda não há avaliações

- Test Bank For Business Statistics 3rd Canadian Edition Norean R Sharpe Norean D Sharpe Richard D de Veaux Paul F Velleman David WrightDocumento15 páginasTest Bank For Business Statistics 3rd Canadian Edition Norean R Sharpe Norean D Sharpe Richard D de Veaux Paul F Velleman David Wrightdanielsantiagojnwdmbagzr100% (37)

- Cash Flow ReportDocumento3 páginasCash Flow ReportTuba TunaAinda não há avaliações

- Corporate Finance2Documento7 páginasCorporate Finance2Daniel Chris0% (1)

- On The Behavior of Gravitational Force at Small ScalesDocumento6 páginasOn The Behavior of Gravitational Force at Small ScalesMassimiliano VellaAinda não há avaliações

- 2014 mlc703 AssignmentDocumento6 páginas2014 mlc703 AssignmentToral ShahAinda não há avaliações

- Main Research PaperDocumento11 páginasMain Research PaperBharat DedhiaAinda não há avaliações

- Maverick Brochure SMLDocumento16 páginasMaverick Brochure SMLmalaoui44Ainda não há avaliações

- Attributes and DialogsDocumento29 páginasAttributes and DialogsErdenegombo MunkhbaatarAinda não há avaliações

- 4 Wheel ThunderDocumento9 páginas4 Wheel ThunderOlga Lucia Zapata SavaresseAinda não há avaliações

- Trading As A BusinessDocumento169 páginasTrading As A Businesspetefader100% (1)

- ServiceDocumento47 páginasServiceMarko KoširAinda não há avaliações

- Orc & Goblins VII - 2000pts - New ABDocumento1 páginaOrc & Goblins VII - 2000pts - New ABDave KnattAinda não há avaliações

- Case 5Documento1 páginaCase 5Czan ShakyaAinda não há avaliações

- To Introduce BgjgjgmyselfDocumento2 páginasTo Introduce Bgjgjgmyselflikith333Ainda não há avaliações

- M8-2 - Train The Estimation ModelDocumento10 páginasM8-2 - Train The Estimation ModelJuan MolinaAinda não há avaliações

- Acne Treatment Strategies and TherapiesDocumento32 páginasAcne Treatment Strategies and TherapiesdokterasadAinda não há avaliações

- Impact of IT On LIS & Changing Role of LibrarianDocumento15 páginasImpact of IT On LIS & Changing Role of LibrarianshantashriAinda não há avaliações

- Site Visit Risk Assessment FormDocumento3 páginasSite Visit Risk Assessment FormAmanuelGirmaAinda não há avaliações

- Federal Complaint of Molotov Cocktail Construction at Austin ProtestDocumento8 páginasFederal Complaint of Molotov Cocktail Construction at Austin ProtestAnonymous Pb39klJAinda não há avaliações

- SD8B 3 Part3Documento159 páginasSD8B 3 Part3dan1_sbAinda não há avaliações

- Lecture Ready 01 With Keys and TapescriptsDocumento157 páginasLecture Ready 01 With Keys and TapescriptsBảo Châu VươngAinda não há avaliações

- Instrumentation Positioner PresentationDocumento43 páginasInstrumentation Positioner PresentationSangram Patnaik100% (1)

- تاااتتاااDocumento14 páginasتاااتتاااMegdam Sameeh TarawnehAinda não há avaliações

- Inside Animator PDFDocumento484 páginasInside Animator PDFdonkey slapAinda não há avaliações

- Pub - Essentials of Nuclear Medicine Imaging 5th Edition PDFDocumento584 páginasPub - Essentials of Nuclear Medicine Imaging 5th Edition PDFNick Lariccia100% (1)

- Journal Entries & Ledgers ExplainedDocumento14 páginasJournal Entries & Ledgers ExplainedColleen GuimbalAinda não há avaliações

- Decision Maths 1 AlgorithmsDocumento7 páginasDecision Maths 1 AlgorithmsNurul HafiqahAinda não há avaliações

- 2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTDocumento5 páginas2-Port Antenna Frequency Range Dual Polarization HPBW Adjust. Electr. DTIbrahim JaberAinda não há avaliações

- DLL - The Firm and Its EnvironmentDocumento5 páginasDLL - The Firm and Its Environmentfrances_peña_7100% (2)

- Forensic Science From The Crime Scene To The Crime Lab 2nd Edition Richard Saferstein Test BankDocumento36 páginasForensic Science From The Crime Scene To The Crime Lab 2nd Edition Richard Saferstein Test Bankhilaryazariaqtoec4100% (25)

- Music 7: Music of Lowlands of LuzonDocumento14 páginasMusic 7: Music of Lowlands of LuzonGhia Cressida HernandezAinda não há avaliações

- Striedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsDocumento22 páginasStriedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsOsny SillasAinda não há avaliações

- 20 Ua412s en 2.0 V1.16 EagDocumento122 páginas20 Ua412s en 2.0 V1.16 Eagxie samAinda não há avaliações