Escolar Documentos

Profissional Documentos

Cultura Documentos

Simple One Page LBO 10-18-08

Enviado por

Adam WuegerDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Simple One Page LBO 10-18-08

Enviado por

Adam WuegerDireitos autorais:

Formatos disponíveis

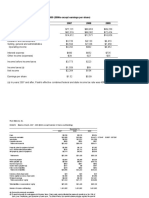

Reddy Ice (Illustrative ONLY) Simplified LBO Model

$ in millions

Uses Sources Credit Statistics

Lev. Mult. Interest

$ Amount Year1 Year2 Year3 Year4

Acq. Price (1) 7.9x $500 Debt 3.0x 9.0% $189 Debt / EBITDA 2.5x 1.9x 1.4x 0.8x

Debt Fees 2.25% 4 Equity 316 EBITDA / Interest 4.2x 5.2x 6.9x 10.3x

% Paydown 14% 29% 46% 66%

Total Uses $504 Total Sources $504

Year 5 IRR Calc Year 5 Assumptions

Entry 12/31/07 ($316) EBITDA $81 Case Trigger 1

Exit 12/31/12 $622 Exit Multiple 8.0x Case: Base Case

IRR 14.5% Net Debt $24

ROIC 2.0x

Historical Financials Projected Financials

Year1 Year2 Year3 Year4 Year5 Year6

12/31/03 12/31/04 12/31/05 12/31/06 12/31/07 12/31/08 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13

Revenue $160 $165 $168 $175 $180 $185 $191 $196 $202 $208 $215

% growth 3% 2% 4% 3% 3% 3% 3% 3% 3% 3%

Gross Profit $80 $79 $87 $86 $90 $93 $97 $101 $105 $109 $114

% of Revenue 50% 48% 52% 49% 50% 51% 51% 52% 52% 53% 53%

EBITDA $46 $50 $57 $56 $63 $66 $70 $73 $77 $81 $85

% of Revenue 29% 30% 34% 32% 35% 36% 37% 37% 38% 39% 40%

Less:

Interest Expense (16) (13) (11) (7) (4) (1)

Taxes 40% *(EBITDA minus Interest) assumes no D&A for simplification (20) (22) (25) (28) (31) (33)

Increase in NWC (3) (3) (3) (3) (3) (3)

Capex (1) (1) (1) (2) (2) (2) (2) (2) (2) (2) (2)

Free Cash Flow Available for Debt $26 $29 $33 $37 $41 $45

Less: Debt Repayment Opening ($26) ($29) ($33) ($37) ($41) ($24)

Ending Debt Balance Exit Multiple $189 $163 $134 $102 $65 $24 $0

file:///conversion/tmp/scratch/47168907.xls LBO Model 12/08/2021 02:45:32 LBO Model

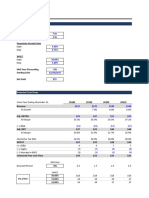

Active Case 1

12/31/07 12/31/08 12/31/09 12/31/10 12/31/11

Revenue (Active Case) $180 $185 $191 $196 $202

Base Case $180 $185 $191 $196 $202

Downside Case $180 $135 $135 $135 $135

% Gross Profit Margin (Active Case) 50.0% 50.5% 51.0% 51.5% 52.0%

Base Case 50.0% 50.5% 51.0% 51.5% 52.0%

Downside Case 50.0% 50.0% 50.0% 50.0% 50.0%

% EBITDA Margin (Active Case) 35.0% 35.8% 36.5% 37.3% 38.0%

Base Case 35.0% 35.8% 36.5% 37.3% 38.0%

Downside Case 35.0% 35.0% 35.0% 35.0% 35.0%

12/31/12 12/31/13 12/31/14

$208 $215 $221

$208 $215 $221

$135 $135 $135

52.5% 53.0% 53.5%

52.5% 53.0% 53.5%

50.0% 50.0% 50.0%

38.8% 39.5% 40.3%

38.8% 39.5% 40.3%

35.0% 35.0% 35.0%

Você também pode gostar

- Monmouth Case SolutionDocumento19 páginasMonmouth Case Solutiondave25% (4)

- Lady M DCF TemplateDocumento4 páginasLady M DCF Templatednesudhudh100% (1)

- Example in ElectrostaticsDocumento36 páginasExample in ElectrostaticsJoseMiguelDomingo75% (4)

- Notice of Appeal Criminal Case MTC To RTCDocumento3 páginasNotice of Appeal Criminal Case MTC To RTCLex Dagdag100% (1)

- American Chemical CorpDocumento14 páginasAmerican Chemical CorpAkya BhatnagarAinda não há avaliações

- Flash Memory Case SolutionDocumento10 páginasFlash Memory Case SolutionsahilkuAinda não há avaliações

- Sbux, Peet, and Pro-Forma Pete-DdrxDocumento12 páginasSbux, Peet, and Pro-Forma Pete-DdrxfcfroicAinda não há avaliações

- The Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94Documento3 páginasThe Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94NarinderAinda não há avaliações

- DPC Case SolutionDocumento11 páginasDPC Case Solutionburiticas992Ainda não há avaliações

- Stock Valuation TempDocumento5 páginasStock Valuation TempANH Nguyen TrucAinda não há avaliações

- Flash - Memory - Inc From Website 0515Documento8 páginasFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Jones Electrical SolutionDocumento21 páginasJones Electrical SolutioneduardoAinda não há avaliações

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsAinda não há avaliações

- DCF Template: Start StepDocumento11 páginasDCF Template: Start StepBrian DongAinda não há avaliações

- LBO (Leveraged Buyout) Model For Private Equity FirmsDocumento2 páginasLBO (Leveraged Buyout) Model For Private Equity FirmsDishant KhanejaAinda não há avaliações

- DCF Template: Exit MultipleDocumento11 páginasDCF Template: Exit MultipleShane BrooksAinda não há avaliações

- Millions of Dollars Except Per-Share DataDocumento7 páginasMillions of Dollars Except Per-Share DataalejandroAinda não há avaliações

- Monmouth Case SolutionDocumento16 páginasMonmouth Case SolutionAjaxAinda não há avaliações

- Millions of Dollars Except Per-Share DataDocumento23 páginasMillions of Dollars Except Per-Share DataPedro José ZapataAinda não há avaliações

- CDL Ar2013Documento224 páginasCDL Ar2013lizAinda não há avaliações

- Final Sheet DCF - With SynergiesDocumento4 páginasFinal Sheet DCF - With SynergiesAngsuman BhanjdeoAinda não há avaliações

- Millions of Dollars Except Per-Share DataDocumento14 páginasMillions of Dollars Except Per-Share DataAjax0% (1)

- BREIT Monthly Performance - February 2020Documento26 páginasBREIT Monthly Performance - February 2020MAYANK AGGARWALAinda não há avaliações

- Q4 2022 Earnings PresentationDocumento45 páginasQ4 2022 Earnings PresentationZerohedgeAinda não há avaliações

- Analisis FinancieroDocumento124 páginasAnalisis FinancieroJesús VelázquezAinda não há avaliações

- Financial Projections Slide TemplatesDocumento4 páginasFinancial Projections Slide Templatestutus RiyonoAinda não há avaliações

- UST Debt Policy Spreadsheet (Reduced)Documento9 páginasUST Debt Policy Spreadsheet (Reduced)Björn Auðunn ÓlafssonAinda não há avaliações

- Private Equity Model Template For InvestorsDocumento12 páginasPrivate Equity Model Template For InvestorsousmaneAinda não há avaliações

- Flash MemoryDocumento14 páginasFlash MemoryPranav TatavarthiAinda não há avaliações

- Iblf Excel (Mehedi)Documento12 páginasIblf Excel (Mehedi)Md. Mehedi HasanAinda não há avaliações

- MonmouthDocumento28 páginasMonmouthAndrew SumirAinda não há avaliações

- BF 07arDocumento86 páginasBF 07arAlexander HertzbergAinda não há avaliações

- Company Name: Financial ModelDocumento13 páginasCompany Name: Financial ModelGabriel AntonAinda não há avaliações

- Class Exercise Fashion Company Three Statements Model - CompletedDocumento16 páginasClass Exercise Fashion Company Three Statements Model - CompletedbobAinda não há avaliações

- Complete Private Equity ModelDocumento16 páginasComplete Private Equity ModelMichel MaryanovichAinda não há avaliações

- Week 8 Capital Budgeting ApplicationsDocumento6 páginasWeek 8 Capital Budgeting ApplicationsFayzan RafiqAinda não há avaliações

- Sea Limited NYSE SE FinancialsDocumento36 páginasSea Limited NYSE SE FinancialsAdrian KurniaAinda não há avaliações

- The Presentation MaterialsDocumento32 páginasThe Presentation Materialsvinicius.alves.david9754Ainda não há avaliações

- Straco Corporation Limited SGX S85 FinancialsDocumento80 páginasStraco Corporation Limited SGX S85 FinancialsP.RaviAinda não há avaliações

- $ in Millions, Except Per Share DataDocumento59 páginas$ in Millions, Except Per Share DataTom HoughAinda não há avaliações

- 2019-09-21T174353.577Documento4 páginas2019-09-21T174353.577Mikey MadRat100% (1)

- CLW Analysis 6-1-21Documento5 páginasCLW Analysis 6-1-21HunterAinda não há avaliações

- Report 4Documento30 páginasReport 4Riya ThakurAinda não há avaliações

- Capxm Final RoundDocumento21 páginasCapxm Final RoundManoj KuchipudiAinda não há avaliações

- BofA Q3 2020Documento33 páginasBofA Q3 2020Zerohedge100% (1)

- Tax BudgetDocumento31 páginasTax BudgetJim ParkerAinda não há avaliações

- QR Shopper: To Perform A Financial Analysis For A Startup Tech Company in Rochester, New YorkDocumento3 páginasQR Shopper: To Perform A Financial Analysis For A Startup Tech Company in Rochester, New YorkRajat SinghAinda não há avaliações

- Genzyme DCF PDFDocumento5 páginasGenzyme DCF PDFAbinashAinda não há avaliações

- Investor Presentation - VFINALDocumento24 páginasInvestor Presentation - VFINALfranfpAinda não há avaliações

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Documento6 páginasSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoAinda não há avaliações

- Flash Memory ExcelDocumento4 páginasFlash Memory ExcelHarshita SethiyaAinda não há avaliações

- PI Industries Limited BSE 523642 Financials RatiosDocumento5 páginasPI Industries Limited BSE 523642 Financials RatiosRehan TyagiAinda não há avaliações

- LBO Completed ModelDocumento210 páginasLBO Completed ModelBrian DongAinda não há avaliações

- BofA Q2 2017Documento28 páginasBofA Q2 2017ZerohedgeAinda não há avaliações

- Millions of Dollars Except Per-Share DataDocumento17 páginasMillions of Dollars Except Per-Share DataWasp_007_007Ainda não há avaliações

- D-Mart (Full Financial Model)Documento51 páginasD-Mart (Full Financial Model)HaRi See RamAinda não há avaliações

- American Chemical CorpDocumento23 páginasAmerican Chemical CorpÞorgeir DavíðssonAinda não há avaliações

- Monmouth VfinalDocumento6 páginasMonmouth VfinalAjax100% (1)

- Antero Resources Corp $36.74 Rating: Positive Positive Very PositiveDocumento3 páginasAntero Resources Corp $36.74 Rating: Positive Positive Very Positivephysicallen1791Ainda não há avaliações

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsAinda não há avaliações

- Break Down Your Money: How to Get Beyond the Noise to Profit in the MarketsNo EverandBreak Down Your Money: How to Get Beyond the Noise to Profit in the MarketsAinda não há avaliações

- Introduction To Finance: Course Code: FIN201 Instructor: Tahmina Ahmed Section: 7 Chapter: 1 and 2Documento27 páginasIntroduction To Finance: Course Code: FIN201 Instructor: Tahmina Ahmed Section: 7 Chapter: 1 and 2Tarif IslamAinda não há avaliações

- Slide 4 Code of Conducts Professional PracticeDocumento23 páginasSlide 4 Code of Conducts Professional PracticeAjim Senamo D'clubAinda não há avaliações

- Rule 30 - TrialDocumento5 páginasRule 30 - TrialCecil BernabeAinda não há avaliações

- HIS102 (KFI) - Fall of Roman EmpireDocumento22 páginasHIS102 (KFI) - Fall of Roman EmpireTasnim Alam Piyash 1731712Ainda não há avaliações

- Microsoft Dynamics AX Lean AccountingDocumento26 páginasMicrosoft Dynamics AX Lean AccountingYaowalak Sriburadej100% (2)

- Impropriety of JudgesDocumento8 páginasImpropriety of JudgesPrincess Ruksan Lawi SucorAinda não há avaliações

- Ethnic Networks, Extralegal Certainty, and Globalisation - PeeringDocumento23 páginasEthnic Networks, Extralegal Certainty, and Globalisation - PeeringRGinanjar Nur RahmatAinda não há avaliações

- 2020 - UMass Lowell - NCAA ReportDocumento79 páginas2020 - UMass Lowell - NCAA ReportMatt BrownAinda não há avaliações

- Unit 6 Citizenship ReadingDocumento4 páginasUnit 6 Citizenship Readingtuokafonmon268Ainda não há avaliações

- Walmart Morningstar ReportDocumento26 páginasWalmart Morningstar ReportcmcbuyersgAinda não há avaliações

- Roman EmperorsDocumento10 páginasRoman EmperorsAbdurrahman Shaleh ReliubunAinda não há avaliações

- Preamble of The Philippine ConstitutionDocumento21 páginasPreamble of The Philippine ConstitutionKriss Luciano100% (1)

- Nestle Multinational CompanyDocumento3 páginasNestle Multinational CompanyShebel AgrimanoAinda não há avaliações

- Inter Regional Transfer FormDocumento2 páginasInter Regional Transfer FormEthiopian Best Music (ፈታ)Ainda não há avaliações

- Volkswagen Emission ScandalDocumento4 páginasVolkswagen Emission ScandalProfVicAinda não há avaliações

- Irr SSMDocumento25 páginasIrr SSMPaulo Edrian Dela PenaAinda não há avaliações

- Family Law 1 Final Project TopicsDocumento2 páginasFamily Law 1 Final Project TopicsSiddharth100% (4)

- Hazrat Abu Bakr and Hazrat UmarDocumento22 páginasHazrat Abu Bakr and Hazrat UmarUzair siddiquiAinda não há avaliações

- Colleges and Universities 2023 1Documento8 páginasColleges and Universities 2023 1gods2169Ainda não há avaliações

- People V SabalonesDocumento49 páginasPeople V SabalonesKarlo KapunanAinda não há avaliações

- Bitanga vs. Pyramid Construction Engineering Corporation, G.R. No. 173526, 28 August 2008Documento3 páginasBitanga vs. Pyramid Construction Engineering Corporation, G.R. No. 173526, 28 August 2008Bibi JumpolAinda não há avaliações

- उच्चत्तर शिक्षा शिभाग शिक्षा मंत्रालय भारत सरकार के तहत एक स्वायत्त संगठन ( (An Autonomous Organization under the Department of Higher Education, Ministry of Education, Government of India)Documento1 páginaउच्चत्तर शिक्षा शिभाग शिक्षा मंत्रालय भारत सरकार के तहत एक स्वायत्त संगठन ( (An Autonomous Organization under the Department of Higher Education, Ministry of Education, Government of India)DivyanshAinda não há avaliações

- Ethics of Ethical HackingDocumento3 páginasEthics of Ethical HackingnellutlaramyaAinda não há avaliações

- Muhannad Evidence 1 Contemporary PresentationDocumento24 páginasMuhannad Evidence 1 Contemporary PresentationMuhannad LallmahamoodAinda não há avaliações

- Epstein Exhibit 16Documento16 páginasEpstein Exhibit 16Hannah NightingaleAinda não há avaliações

- Semiconductor FundamentalsDocumento18 páginasSemiconductor FundamentalsromfernAinda não há avaliações

- Indira Gandhi Work DoneDocumento4 páginasIndira Gandhi Work DoneRupesh DekateAinda não há avaliações