Escolar Documentos

Profissional Documentos

Cultura Documentos

Copy

Enviado por

Saren JoseDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Copy

Enviado por

Saren JoseDireitos autorais:

Formatos disponíveis

Tax is a compulsory charge on resources (usually money) imposed by an authority on people without

a quid pro quo exchange of goods / services. Tax design comprises a set of rules on the basis of which

a tax is charged from the people. The Tax System can be classified into Arbitrary Tax System and

Rule based Tax System. The latter leads to increased objectivity, higher degree of predictability,

creation of taxpayer rights, better planning and increased satisfaction. Tax design refers to the rules

which decide who will pay tax and how much. It does not include procedural rules.

The basic design of Tax System is the relation connecting Tax with Tax Base and Tax Rate which is

as follows:-

Tax = Tax Base x Tax Rate

All other features that affect tax liability of tax payers are included under specific features like

exemptions, deductions, variable and differential rates, other special provisions etc. A person is taxed

on the basis of the presence of tax base which is nothing but the element on which tax is imposed. It is

objectively quantifiable, variable and linked with economic activity. Tax rate refers to the tax charged

on per unit of the tax base. One extraordinary point under tax rates is that under digressive taxation

the effective tax rates are progressive in nature. The tax base on which no tax is levied comes under

the notion of exemptions. This can be classified as person specific, activity specific, quality specific

and quantity specific. Reduction of tax payable on the basis of presence or absence of some other pre-

requisites, without affecting the tax base and tax rate leads to deductions from tax liability. The

significance of tax design can be understood from the economic efficiency of tax, equitable

distribution of tax burden in the society, cost of compliance and administration etc.

Tax classification under different ways can be there but the primary concern is classification as Direct

and Indirect Taxes. The main point of difference between these two is that while the former comprises

taxpayer paying tax from his or her own resources, the latter consists of taxpayer collecting the tax

from others and paying the same. The former type of taxation is more predictable and levied per unit

of time.

Tax Incidence refers to the burden of taxation in a market. It always falls on the Surplus – either

producer surplus or consumer surplus. Import duty leads to increase in market price and the incidence

of import duty falls on the buyers with reduction in consumer surplus. Export duty results in decrease

of market price and the incidence of export duty falls on the suppliers with reduction in producer

surplus. The tax incidence in case of non tariff barriers is on buyers with benefit to the suppliers.

The benefits from taxation like provision for public goods and services; social welfare gain from

income redistribution; and gain from modification of behavior largely overcome its disadvantages like

cost of compliance; cost of administration; losses from modification of behavior; and dead weight loss

which refers to the real cost of tax i.e. the loss of economic activity resulting from the disincentive.

All taxes lead to some distortion of economic activities, which distorts the market equilibrium, market

efficiency and social welfare. Taxation is indispensable for the government.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- E Ticket PDFDocumento2 páginasE Ticket PDFnazar40% (5)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Gmail - APEC Schools - S202103135 - SY21 Assessment of FeesDocumento2 páginasGmail - APEC Schools - S202103135 - SY21 Assessment of FeesMerry Chris Anne AdonaAinda não há avaliações

- Broward County Clerk's Daughter Arrest in RICO CaseDocumento46 páginasBroward County Clerk's Daughter Arrest in RICO CaseAndreaTorres100% (1)

- Thq002-Inst. Sales PDFDocumento2 páginasThq002-Inst. Sales PDFAndrea AtendidoAinda não há avaliações

- OutputDocumento6 páginasOutputSylvia MorenoAinda não há avaliações

- WK BDHDSB V Ketua Pengarah Hasil Dalam NegeriDocumento12 páginasWK BDHDSB V Ketua Pengarah Hasil Dalam NegeriAnonymous tZ68R0u0Ainda não há avaliações

- Form16 (2021-2022)Documento2 páginasForm16 (2021-2022)COMMON SERVICE CENTERAinda não há avaliações

- Shop Building Tax ReceiptDocumento1 páginaShop Building Tax ReceipttalentoAinda não há avaliações

- Unadjusted Part of Mobilization Advance Received Prior To July 01Documento3 páginasUnadjusted Part of Mobilization Advance Received Prior To July 01CA Ishu BansalAinda não há avaliações

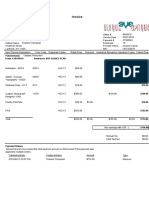

- Invoice: Patient Name: Order # 28798120 Insurance: VSP CHOICE PLANDocumento2 páginasInvoice: Patient Name: Order # 28798120 Insurance: VSP CHOICE PLANUniqueEye OptiqueAinda não há avaliações

- Scorpio N (FBD)Documento1 páginaScorpio N (FBD)Rishabh MahajanAinda não há avaliações

- Gmail - Booking Confirmation On IRCTC, Train - 12424, 10-Jul-2022, 2A, NDLS - GHY (1) - 2Documento1 páginaGmail - Booking Confirmation On IRCTC, Train - 12424, 10-Jul-2022, 2A, NDLS - GHY (1) - 2Girwar SinghAinda não há avaliações

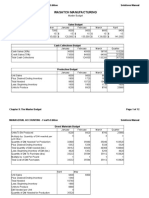

- Acct 2020 Excel Budget Problem FinalDocumento12 páginasAcct 2020 Excel Budget Problem Finalapi-301816205Ainda não há avaliações

- 2306 Manila WaterDocumento6 páginas2306 Manila WaterRegina Raymundo AlbayAinda não há avaliações

- Notas Localizacion ARg 1Documento2 páginasNotas Localizacion ARg 1Viviana E. EstradaAinda não há avaliações

- Account StatementDocumento12 páginasAccount StatementRajneesh Jhorad0% (1)

- Sold-To Party Address Information: Sales Order DetailsDocumento1 páginaSold-To Party Address Information: Sales Order Detailsshakilmagura9424Ainda não há avaliações

- PAGE - 216 (DAY - 16: Date Sales Executives Product Customer QTY Sold (In Boxes)Documento5 páginasPAGE - 216 (DAY - 16: Date Sales Executives Product Customer QTY Sold (In Boxes)sourabh6chakrabort-1Ainda não há avaliações

- Tax Audit ChecklistDocumento1 páginaTax Audit ChecklistSwapnil S DeshpandeAinda não há avaliações

- Kolom Jurnal KhususDocumento6 páginasKolom Jurnal KhususOkta VianiAinda não há avaliações

- Bill statement chargesDocumento6 páginasBill statement chargesjjayAinda não há avaliações

- Elements of Cost Accounting Exam QuestionsDocumento2 páginasElements of Cost Accounting Exam QuestionsEmilia JacobAinda não há avaliações

- 2nd QuarterDocumento112 páginas2nd QuarterRodnel MonceraAinda não há avaliações

- Light Bill Sept 2019Documento1 páginaLight Bill Sept 2019Sanjyot KolekarAinda não há avaliações

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherDocumento15 páginasREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGoogleAinda não há avaliações

- I. Applicant Information.: Mbit Computraining Pvt. LTDDocumento2 páginasI. Applicant Information.: Mbit Computraining Pvt. LTDMUKULAinda não há avaliações

- Bank statement activity and dispute rights under $1Documento3 páginasBank statement activity and dispute rights under $1shani ChahalAinda não há avaliações

- Qun SamaleswartDocumento1 páginaQun SamaleswartPANKAJ RAJAinda não há avaliações

- InvoiceDocumento1 páginaInvoiceE BestariAinda não há avaliações

- Tax1 (T31920)Documento82 páginasTax1 (T31920)Charles TuazonAinda não há avaliações