Escolar Documentos

Profissional Documentos

Cultura Documentos

Final Project On Cash Flow Analysis For Union Bank of India

Enviado por

Karthik SpTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Final Project On Cash Flow Analysis For Union Bank of India

Enviado por

Karthik SpDireitos autorais:

Formatos disponíveis

1

UNION BANK OF INDIA BANGALORE UNIVERSITY

Introduction

Cash is the basic input needed to keep the operations of the business

going on a continuing basis; it is also the final output expected to be realized

by selling the product manufactured by the manufacturing unit. Cash is the

both the beginning and the end of the business operations.

Sometimes, it so happens that a business unit earns sufficient profit,

but in spite of this it is not able to pay its liabilities when the become due.

Therefore, a business should be always try to keep sufficient cash, neither

more nor less because shortage of cash will threaten the firms liquidity and

solvency, whereas excessive cash will not be fruitful utilized, will simply

remain ideal and affect the profitability of a concern. Effective cash

management, therefore, implies a proper balancing between the two

conflicting objectives of liquidity

The management of cash also assumes importance because it is

difficult to predict cash inflows and outflows accurately and there is no

perfect coincidence between the inflows and outflows of cash giving rise to

either cash outflows exceeding inflows or cash inflows exceeding outflows.

CASH FLOW ANALYSIS B.B.M IN FINANCE

2

UNION BANK OF INDIA BANGALORE UNIVERSITY

Cash flow statement is one important tool of cash management because it

throws light on cash inflows and cash outflows of a particular period.

Meaning of Cash Flow Statement

A funds flow statement based on working capital is very useful in long-

range financial planning but this statement may conceal or exclude too

much. This is so because it does not take into considerations the movements

among the individual current assets and current liabilities i.e. it shows net

change in working capital. Moreover, this statement treats increases in

receivables, inventories and prepaid expenses and decreases in accounts

payable, outstanding expenses and bank over draft as equivalent to decrease

in cash. Likewise, decreases in receivables, inventories and prepaid

expenses and increases in creditors, bills payable, outstanding expenses and

bank overdraft are treated as equivalent to increases in cash. This is not a

correct treatment because this items do not decrease cash or make cash

available. Sundry creditors, bills payable, outstanding expenses become

payable in the next period. Similarly, inventories and receivable make cash

available in the next period. It is quite possible that there may be sufficient

working capital as revealed by the funds flow statement and still the

company may be unable to meet its current liabilities as and when they fall

due. It may be due to an accumulation of inventories and an increase in

trade debtors caused by a slow down in collections. In such a situation, a

cash flow statement is more useful because it gives detailed information to

the management about the sources of cash inflows and outflows. A cash

CASH FLOW ANALYSIS B.B.M IN FINANCE

3

UNION BANK OF INDIA BANGALORE UNIVERSITY

flow statement can be defined as a statement which summarizes sources of

cash inflows and uses of cash outflows of a firm during a particular period

of time, say a month or a year. Such a statement can be prepaid from the

data made available from comparative balance sheet, profit and loss account

and additional information. This statement reports cash receipts and

payments classified according to entities major activities operating,

investing and financing during the period a format that reconciles the

begging and ending cash balances. It reports a net cash inflow or net cash

outflow for each activity and for the overall business. It also reports from

where cash has come and how it has been spent.

Objectives

Information about the cash flows of an enterprise is useful in providing

users of financial statements with a basis to assess the ability of the

enterprise to generate cash and cash equivalents and the needs of the

enterprise to utilize those cash flows. The economic decisions that are

taken by users require an evaluation of the ability of an enterprise to

generate cash and cash equivalents and the timing and certainty of their

generation.

The Statement deals with the provision of information about the

historical changes in cash and cash equivalents of an enterprise by means

of a cash flow statement which classifies cash flows during the period from

operating, investing and financing activities.

CASH FLOW ANALYSIS B.B.M IN FINANCE

4

UNION BANK OF INDIA BANGALORE UNIVERSITY

Scope

1. An enterprise should prepare a cash flow statement and should

present it for each period for which financial statements are presented.

2. Users of an enterprise’s financial statements are interested in

how the enterprise generates and uses cash and cash equivalents. This is

the case regardless of the nature of the enterprise’s activities and

irrespective of whether cash can be viewed as the product of the enterprise,

as may be the case with a financial enterprise. Enterprises need cash for

essentially the same reasons, however different their principal revenue-

producing activities might be. They need cash to conduct their operations, to

pay their obligations, and to provide returns to their investors.

Usefulness of Cash Flow Statement

Cash Flow Statement is very useful to the management for short

term planning due to the following reasons:-

CASH FLOW ANALYSIS B.B.M IN FINANCE

5

UNION BANK OF INDIA BANGALORE UNIVERSITY

(i) Predict future cash flows. This statement is often use as an

indicator of the amount, timing and certainty of future cash flows on the

basis of what happened in the past. This approach is better than accrual basis

data presented by profit and loss account and balance sheet.

(ii) Determine the ability to pay dividends and other

commitments. This statement indicates the sources and uses of cash under

operating, investing and financing activities, helps share holders to know

whether the business can make the payment of amount of dividends on their

investments in shares and creditors to receive interest and principal amount

in time.

(iii) Show the relationship of net income to changes in the

business cash. Generally there is direct relation between net income and

cash. I net income leads to increase in cash and wise versa. But there may

be a situation where a company’s net income is high but decrease in cash

balance and increase in cash balance when net income is low. Every user is

interested to know the reasons or difference between the net income and net

cash provided by operations. The net income generally tells the progress of

the business while cash flow relates to the liquidity of business. The uses or

helped to assess the reliability of net profit with the help of this statement.

(iv) Efficiency in Cash Management. This statement is very

useful to the management in evaluating financial policies and cash position.

It will help the management to make the reliable cash flow projections for

CASH FLOW ANALYSIS B.B.M IN FINANCE

6

UNION BANK OF INDIA BANGALORE UNIVERSITY

the immediate future and will tell surplus or deficiency of cash so that

management may be able to make plan for investment of surplus cash or to

tap the sources where from the deficiency is to be met. Thus it is an

important financial tool for the management as it helps in the efficient cash

management.

(v) Discloses Movement of Cash. Previous year cash flow

statement when compared with the budget of that year will indicate as to

what extent the resources of the enterprise were raised and applied. Actual

results when compared with the original forecast may highlight the trend of

the movement of cash that may otherwise remain undetected,

(vi) Discloses Success or Failure of Cash Planning. A

Comparison of projected Cash flow Statement with the actual Cash flow

Statement will reveal the success or failure of cash planning and incase of

failure, necessary remedial steps can be taken to improve the position. It also

provides better measure for inter period and inter firm comparison.

(vii) Evaluate Management Decision. This statement, by

providing information relating to companies investing and financial

activities, gives the investors and creditors about cash flow information

which help them evaluate management decisions.

(viii) Enhances the Comparability of Report. It enhance the

comparability of the reporting of operating performances by different

CASH FLOW ANALYSIS B.B.M IN FINANCE

7

UNION BANK OF INDIA BANGALORE UNIVERSITY

enterprises, because it eliminates the effect of using different accounting

treatments for the same transactions and events.

Limitations of Cash Flow Statement

Inspite of various uses of Cash Flow Statement, it has the

following limitations:

1. Cash Flow Statement gives the main items of inflow and

outflow of cash only and does not show the liquidity position of the

company.

2. This statement is not a substitute of income statement which

shows both cash and non cash items. Therefore, net cash flow does not

necessarily mean net income of the business.

3. It cannot replace funds flow statement as it cannot show the

financial position of the concern in totality.

CASH FLOW ANALYSIS B.B.M IN FINANCE

8

UNION BANK OF INDIA BANGALORE UNIVERSITY

Definitions

The following terms are used in this Statement with the meanings

specified:

(i) Cash comprises cash on hand and demand deposits with

banks.

(ii) Cash equivalents are short term, highly liquid investments that

are readily convertible into known amounts of cash and which are subject

to an insignificant risk of changes in value.

(iii) Cash flows are inflows and outflows of cash and cash

equivalents.

(iv) Operating activities are the principal revenue-producing

activities of the enterprise and other activities that are not investing or

financing activities.

(v) Investing activities are the acquisition and disposal of long-

term assets and other investments not included in cash equivalents.

CASH FLOW ANALYSIS B.B.M IN FINANCE

9

UNION BANK OF INDIA BANGALORE UNIVERSITY

(vi) Financing activities are activities that result in changes in the

size and composition of the owners’ capital (including preference share

capital in the case of a company) and borrowings of the enterprise.

(vii) Cash and Cash Equivalents Cash equivalents are held for the

purpose of meeting short-term cash commitments rather than for investment

or other purposes. For an investment to qualify as a cash equivalent, it must

be readily convertible to a known amount of cash and be subject to an

insignificant risk of changes in value. Therefore, an investment normally

qualifies as a cash equivalent only when it has a short maturity of, say, three

months or less from the date of acquisition. Investments in shares are

excluded from cash equivalents unless they are, in substance, cash

equivalents; for example, preference shares of a company acquired shortly

before their specified redemption date (provided there is only an

insignificant risk of failure of the company to repay the amount at

maturity). Cash flows exclude movements between items that constitute

cash or cash equivalents because these components are part of the cash

management of an enterprise rather than part of its operating, investing

and financing activities. Cash management includes the investment of excess

cash in cash equivalents.

CASH FLOW ANALYSIS B.B.M IN FINANCE

10

UNION BANK OF INDIA BANGALORE UNIVERSITY

CLASSIFICATION OF CASH FLOWS

(i) Cash Flows from Operating Activities

The amount of cash flows arising from operating activities is a key

indicator of the extent to which the operations of the enterprise have generated

sufficient cash flows to maintain the operating capability of the enterprise,

pay dividends, repay loans and make new investments without recourse to

external sources of financing. Information about the specific

components of historical operating cash flows is useful, in conjunction

with other information, in forecasting future operating cash flows.

Cash flows from operating activities are primarily derived from the

principal revenue-producing activities of the enterprise. Therefore,

they generally result from the transactions and other events that enter

into the determination of net profit or loss. Examples of cash flows from

operating activities are:

(a) Cash receipts from the sale of goods and the rendering of

services;

(b) Cash receipts from royalties, fees, commissions and other

revenue;

CASH FLOW ANALYSIS B.B.M IN FINANCE

11

UNION BANK OF INDIA BANGALORE UNIVERSITY

(c) Cash payments to suppliers for goods and services;

(d) Cash payments to and on behalf of employees;

(e) Cash receipts and cash payments of an insurance enterprise

for premiums and claims, annuities and other policy benefits;

(f) Cash payments or refunds of income taxes unless they can be

specifically identified with financing and investing activities; and

(g) Cash receipts and payments relating to futures contracts,

forward contracts, option contracts and swap contracts when the contracts

are held for dealing or trading purposes.

Some transactions, such as the sale of an item of plant, may give rise

to a gain or loss which is included in the determination of net profit or loss.

However, the cash flows relating to such transactions are cash flows from

investing activities.

An enterprise may hold securities and loans for dealing or trading

purposes, in which case they are similar to inventory acquired specifically

for resale. Therefore, cash flows arising from the purchase and sale of

dealing or trading securities are classified as operating activities. Similarly,

cash advances and loans made by financial enterprises are usually classified

as operating activities since they relate to the main revenue-producing

CASH FLOW ANALYSIS B.B.M IN FINANCE

12

UNION BANK OF INDIA BANGALORE UNIVERSITY

activity of that enterprise.

(ii) Cash Flows from Investing Activities

The separate disclosure of cash flows arising from investing activities

is important because the cash flows represent the extent to which

expenditures have been made for resources intended to generate future

income and cash flows. Examples of cash flows arising from investing

activities are:

(a) Cash payments to acquire fixed assets (including

intangibles). These payments include those relating to capitalized research

and development costs and self-constructed fixed assets;

(b) Cash receipts from disposal of fixed assets (including

intangibles);

(c) Cash payments to acquire shares, warrants or debt instruments

of other enterprises and interests in joint ventures (other than payments

for those instruments considered to be cash equivalents and those held for

dealing or trading purposes);

CASH FLOW ANALYSIS B.B.M IN FINANCE

13

UNION BANK OF INDIA BANGALORE UNIVERSITY

(d) Cash receipts from disposal of shares, warrants or debt

instruments of other enterprises and interests in joint ventures (other than

receipts from those instruments considered to be cash equivalents and those

held for dealing or trading purposes);

(e) Cash advances and loans made to third parties (other than

advances and loans made by a financial enterprise);

(f)Cash receipts from the repayment of advances and loans made to

third parties (other than advances and loans of a financial enterprise);

(g) Cash payments for futures contracts, forward contracts, option

contracts and swap contracts except when the contracts are held for dealing

or trading purposes, or the payments are classified as financing activities;

and

(h) Cash receipts from futures contracts, forward contracts, option

contracts and swap contracts except when the contracts are held for dealing

or trading purposes, or the receipts are classified as financing activities.

When a contract is accounted for as a hedge of an identifiable position,

the cash flows of the contract are classified in the same manner as the cash

flows of the position being hedged.

CASH FLOW ANALYSIS B.B.M IN FINANCE

14

UNION BANK OF INDIA BANGALORE UNIVERSITY

Financing Activities

The separate disclosure of cash flows arising from financing activities

is important because it is useful in predicting claims on future cash flows by

providers of funds (both capital and borrowings) to the enterprise.

Examples of cash flows arising from financing activities are:

(a) Cash proceeds from issuing shares or other similar

instruments;

(b) Cash proceeds from issuing debentures, loans, notes, bonds,

and other short or long term borrowings;

(c) Cash repayments of amounts borrowed.

(d) Cash payments to redeem preference shares and

(e) Payment of dividend.

Preparation 0f cash flow statement

An organization should prepare a cash flow statement according to

according to Account standard-3. The following basic information are

required for the preparation for the cash flow statement:

(1) Comparative Balance Sheets. Balance sheets at the beginning and at

the end of the accounting period are required to indicate to indicate

the amount of changes that have taken place in assets and liabilities

and capital.

CASH FLOW ANALYSIS B.B.M IN FINANCE

15

UNION BANK OF INDIA BANGALORE UNIVERSITY

(2) Profit and loss account. This account of the current period enables to

determine the amount of cash provided by or used in operating

activities during the accounting period after making adjustments for

non cash current assets and current liabilities.

(3) Additional data. In addition to the above statements, additional data

are collected to determine how cash has been provided or used e.g.

sale or purchase of asset for cash.

This statement is prepared in three stages as given below :

1. Net profit before taxation and extra ordinary items.

2. Cash flows from operating, investing and financing activities.

3. Cash flow statement

These are discussed one by one

1. Net profit before taxation and extraordinary items. This will not be equal

to the net profit as reported in the profit and loss account. It is so because of

taxation and certain non operating items (e.g., loss or profit on sale of fixed

assets, dividend received or paid, amount transferred to general, provision

for taxation, fictitious assets written of f etc.) charged to the profit and loss

account . Tax paid and non-operating items are adjusted to the figure of

profit or loss in order to get the net profit before taxation and extraordinary

items.

2. Cash flows from operating, investing and financing activities. Net profit

before taxation and extraordinary items is further adjusted with reference to

depreciation in order to get the figure of operating profit before working

capital changes. This figure is further adjusted for changes in current assets

CASH FLOW ANALYSIS B.B.M IN FINANCE

16

UNION BANK OF INDIA BANGALORE UNIVERSITY

(except cash)/bank balance), current liabilities and tax paid deducted to get

the amount of net cash provided or used by operating activities. All the

increases in current assets except cash and decreases in current liabilities

decrease cash. It is so because increase in debtors takes place as current

sales are greater than cash collections; inventories increase when the current

cost of goods purchased is more than the current cost of goods sold leading

to reduction in cash. Increase in prepaid expenses reduces cash from

operations because more cash is paid than is required for their current

services. Likewise, decrease in current liabilities reduces cash from

operations because decrease in current liabilities takes place when they are

paid in cash. Similarly all decreases in current assets except cash and

increases in current liabilities increase cash from operations. Creditors

would increase because current purchases are more than the cash paid to

them during the current period. Decrease in prepaid expenses indicates that

less payment has been made for services than are currently used, i.e., some

cash has been saved causing an increase in cash from operations.

Changes in fixed assets and fixed liabilities have not been adjusted

as these are shown separately in the cash flow statement. It is so because

current assets (i.e., debtors as a result of credit sales, inventories as a result

of purchases and sales and prepaid expenses caused by operating expenses)

and current liabilities (i.e., creditors because of credit purchases and

outstanding expenses caused by non-payment of some of the expenses of the

current period) are directly related to operations.

CASH FLOW ANALYSIS B.B.M IN FINANCE

17

UNION BANK OF INDIA BANGALORE UNIVERSITY

Reporting Cash Flows from Operating Activities .

An enterprise should report cash flows from operating activities

using either:

(a) the direct method, whereby major classes of gross cash receipts and

gross cash payments are disclosed; or

(b) the indirect method, whereby net profit or loss is adjusted for the

effects of transactions of a non-cash nature, any deferrals or

accruals of past or future operating cash receipts or payments,

and items of income or expense associated with investing or

financing cash flows.

The direct method provides information which may be useful in

estimating future cash flows and which is not available under the indirect

method and is, therefore, considered more appropriate than the

indirect method. Under the direct method, information about major classes

of gross cash receipts and gross cash payments may be obtained either:

(a) from the accounting records of the enterprise; or

(b) by adjusting sales, cost of sales (interest and similar income and

interest expense and similar charges for a financial enterprise)

and other items in the statement of profit and loss for:

CASH FLOW ANALYSIS B.B.M IN FINANCE

18

UNION BANK OF INDIA BANGALORE UNIVERSITY

i) changes during the period in inventories and operating

receivables and payables;

ii) other non-cash items; and

iii) other items for which the cash effects are investing or

financing cash flows

Under the indirect method, the net cash flow from operating

activities is determined by adjusting net profit or loss for the effects of:

(a) changes during the period in inventories and operating receivables

and payables;

(b) non-cash items such as depreciation, provisions, deferred taxes,

and unrealized foreign exchange gains and losses; and

(c) all other items for which the cash effects are investing or financing

cash flows.

Alternatively, the net cash flow from operating activities may be presented

under the indirect method by showing the operating revenues and expenses

excluding non-cash items disclosed in the statement of profit and loss and

the changes during the period in inventories and operating receivables and

payables.

CASH FLOW ANALYSIS B.B.M IN FINANCE

19

UNION BANK OF INDIA BANGALORE UNIVERSITY

Reporting Cash Flows from Investing and Financing Activities

An enterprise should report separately major classes of gross cash

receipts and gross cash payments arising from investing and financing

activities, except to the extent that cash flows described in paragraphs 22

and 24 are reported on a net basis.

Reporting Cash Flows on a Net Basis

Cash flows arising from the following operating, investing or

financing activities may be reported on a net basis:

(a) cash receipts and payments on behalf of customers when the cash

flows reflect the activities of the customer rather than those of the

enterprise; and

(b) cash receipts and payments for items in which the turnover is quick,

the amounts are large, and the maturities are short.

Examples of cash receipts and payments referred to in paragraph

22(a) are:

(a) the acceptance and repayment of demand deposits by a bank;

(b) funds held for customers by an investment enterprise; and

CASH FLOW ANALYSIS B.B.M IN FINANCE

20

UNION BANK OF INDIA BANGALORE UNIVERSITY

c) rents collected on behalf of, and paid over to, the owners of

properties

Examples of cash receipts and payments referred to in paragraph 22(b) are

advances made for, and the repayments of:

(a) principal amounts relating to credit card customers;

(b) the purchase and sale of investments; and

(c) other short-term borrowings, for example, those which have a

maturity period of three months or less.

Cash flows arising from each of the following activities of a financial

enterprise may be reported on a net basis:

(a) cash receipts and payments for the acceptance and repayment of

deposits with a fixed maturity date;

(b) the placement of deposits with and withdrawal of deposits from other

financial enterprises; and

cash advances and loans made to customers and the repayment of those

advances and loans

Special items

1 Foreign Currency Cash Flows

CASH FLOW ANALYSIS B.B.M IN FINANCE

21

UNION BANK OF INDIA BANGALORE UNIVERSITY

Cash flows arising from transactions in a foreign currency should be

recorded in an enterprise’s reporting currency by applying to the foreign

currency amount the exchange rate between the reporting currency and the

foreign currency at the date of the cash flow. A rate that approximates the

actual rate may be used if the result is substantially the same as would arise

if the rates at the dates of the cash flows were used. The effect of changes in

exchange rates on cash and cash equivalents held in a foreign currency should

be reported as a separate part of the reconciliation of the changes in cash and

cash equivalents during the period.

Cash flows denominated in foreign currency are reported in a manner

consistent with Accounting Standard (AS) 11, Accounting for the Effects

of

4

Changes in Foreign Exchange Rates . This permits the use of an exchange

rate that approximates the actual rate. For example, a weighted average

exchange rate for a period may be used for recording foreign currency

transactions.

Unrealized gains and losses arising from changes in foreign

exchange rates are not cash flows. However, the effect of exchange rate

changes on cash and cash equivalents held or due in a foreign currency is

reported in the cash flow statement in order to reconcile cash and cash

equivalents at the beginning and the end of the period. This amount is

presented separately from cash flows from operating, investing and

CASH FLOW ANALYSIS B.B.M IN FINANCE

22

UNION BANK OF INDIA BANGALORE UNIVERSITY

financing activities and includes the differences, if any, had those cash

flows been reported at the end-of-period exchange rates

2 Extraordinary Items

The cash flows associated with extraordinary items should be classified as

arising from operating, investing or financing activities as appropriate and

separately disclosed .

The cash flows associated with extraordinary items are disclosed

separately as arising from operating, investing or financing activities in the

cash flow statement, to enable users to understand their nature and effect on

the present and future cash flows of the enterprise. These disclosures are in

addition to the separate disclosures of the nature and amount of extraordinary

items required by Accounting Standard (AS) 5, Net Profit or Loss for the

Period, Prior Period Items and Changes in Accounting Policies

3 Interest and Dividends

Cash flows from interest and dividends received and paid should each

be disclosed separately. Cash flows arising from interest paid and interest

and dividends received in the case of a financial enterprise should be

classified as cash flows arising from operating activities. In the case of other

enterprises, cash flows arising from interest paid should be classified as cash

flows from financing activities while interest and dividends received

should be classified as cash flows from investing activities. Dividends paid

should be classified as cash flows from financing activities.

CASH FLOW ANALYSIS B.B.M IN FINANCE

23

UNION BANK OF INDIA BANGALORE UNIVERSITY

The total amount of interest paid during the period is disclosed in the

cash flow statement whether it has been recognized as an expense in the

statement of profit and loss or capitalized in accordance with Accounting

Standard (AS) 10, Accounting for Fixed Assets.

Interest paid and interest and dividends received are usually classified

as operating cash flows for a financial enterprise. However, there is

no consensus on the classification of these cash flows for other

enterprises. Some argue that interest paid and interest and dividends

received may be classified as operating cash flows because they

enter into the determination of net profit or loss. However, it is more

appropriate that interest paid and interest and dividends received are

classified as financing cash flows and investing cash flows

respectively, because they are cost of obtaining financial resources or

returns on investments.

Some argue that dividends paid may be classified as a component of

cash flows from operating activities in order to assist users to determine the

ability of an enterprise to pay dividends out of operating cash flows.

However, it is considered more appropriate that dividends paid should be

classified as cash flows from financing activities because they are cost of

obtaining financial resources.

CASH FLOW ANALYSIS B.B.M IN FINANCE

24

UNION BANK OF INDIA BANGALORE UNIVERSITY

4 Taxes on Income

Cash flows arising from taxes on income should be separately

disclosed and should be classified as cash flows from operating activities

unless they can be specifically identified with financing and investing

activities.

Taxes on income arise on transactions that give rise to cash flows that are

classified as operating, investing or financing activities in a cash flow

statement. While tax expense may be readily identifiable with investing or

financing activities, the related tax cash flows are often impracticable to

identify and may arise in a different period from the cash flows of the

underlying transactions. Therefore, taxes paid are usually classified as cash

flows from operating activities. However, when it is practicable to identify

the tax cash flow with an individual transaction that gives rise to cash

flows that are classified as investing or financing activities, the tax cash

flow is classified as an investing or financing activity as appropriate. When

tax cash flow are allocated over more than one class of activity, the total

amount of taxes paid is disclosed

5. Investments in Subsidiaries, Associates and Joint Ventures

CASH FLOW ANALYSIS B.B.M IN FINANCE

25

UNION BANK OF INDIA BANGALORE UNIVERSITY

When accounting for an investment in an associate or a subsidiary

or a joint venture, an investor restricts its reporting in the cash flow

statement to the cash flows between itself and the investee/joint venture,

for example, cash flows relating to dividends and advances.

6 Acquisitions and Disposals of Subsidiaries and Other Business Units

The aggregate cash flows arising from acquisitions and from

disposals of subsidiaries or other business units should be presented

separately and classified as investing activities.

An enterprise should disclose, in aggregate, in respect of both

acquisition and disposal of subsidiaries or other business units during the

period each of the following:

(a) the total purchase or disposal consideration; and

(b) the portion of the purchase or disposal consideration discharged by

means of cash and cash equivalents.

The separate presentation of the cash flow effects of acquisitions and

disposals of subsidiaries and other business units as single line items

helps to distinguish those cash flows from other cash flows. The cash flow

effects of disposals are not deducted from those of acquisitions.

CASH FLOW ANALYSIS B.B.M IN FINANCE

26

UNION BANK OF INDIA BANGALORE UNIVERSITY

7 Non-cash Transactions

Investing and financing transactions that do not require the use of cash or

cash equivalents should be excluded from a cash flow statement. Such

transactions should be disclosed elsewhere in the financial statements in a

way that provides all the relevant information about these investing and

financing activities

Many investing and financing activities do not have a direct impact on

current cash flows although they do affect the capital and asset structure

of an enterprise. The exclusion of non-cash transactions from the cash flow

statement is consistent with the objective of a cash flow statement as these

items do not involve cash flows in the current period. Examples of non-cash

transactions are:

(a) the acquisition of assets by assuming directly related liabilities;

(b) the acquisition of an enterprise by means of issue of shares; and

(c) the conversion of debt to equity.

Components of Cash and Cash Equivalents

An enterprise should disclose the components of cash and cash

equivalents and should present a reconciliation of the amounts in its cash

flow statement with the equivalent items reported in the balance sheet.

CASH FLOW ANALYSIS B.B.M IN FINANCE

27

UNION BANK OF INDIA BANGALORE UNIVERSITY

In view of the variety of cash management practices, an enterprise

discloses the policy which it adopts in determining the composition of cash

and cash equivalents.

The effect of any change in the policy for determining components

of cash and cash equivalents is reported in accordance with Accounting

Standard (AS) 5, Net Profit or Loss for the Period, Prior Period Items and

Changes in Accounting Policies.

Other Disclosures

An enterprise should disclose, together with a commentary by

management, the amount of significant cash and cash equivalent balances

held by the enterprise that are not available for use by it.

There are various circumstances in which cash and cash equivalent

balances held by an enterprise are not available for use by it. Examples

include cash and cash equivalent balances held by a branch of the enterprise

that operates in a country where exchange controls or other legal restrictions

apply as a result of which the balances are not available for use by the

enterprise.

Additional information may be relevant to users in understanding

the financial position and liquidity of an enterprise. Disclosure of this

CASH FLOW ANALYSIS B.B.M IN FINANCE

28

UNION BANK OF INDIA BANGALORE UNIVERSITY

information, together with a commentary by management, is

encouraged and may include:

(a) the amount of undrawn borrowing facilities that may be available

for future operating activities and to settle capital commitments,

indicating any restrictions on the use of these facilities; and

(b) the aggregate amount of cash flows that represent increases in

operating capacity separately from those cash flows that are

required to maintain operating capacity.

The separate disclosure of cash flows that represent increases in

operating capacity and cash flows that are required to maintain operating

capacity is useful in enabling the user to determine whether the enterprise is

investing adequately in the maintenance of its operating capacity. An

enterprise that does not invest adequately in the maintenance of its operating

capacity may be prejudicing future profitability for the sake of current

liquidity and distributions to owners.

CASH FLOW ANALYSIS B.B.M IN FINANCE

29

UNION BANK OF INDIA BANGALORE UNIVERSITY

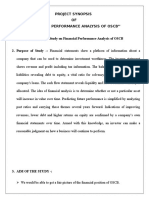

RESEARCH DESIGN

STATEMENT OF THE PROBLEM:

A financial statement contains income statement

showing sales, Revenues, tax, expenses etc. on the

CASH FLOW ANALYSIS B.B.M IN FINANCE

30

UNION BANK OF INDIA BANGALORE UNIVERSITY

other side; the balance sheet shows the liabilities and

assets position during the year.

The study of financial performance is composed of

the following:

1. Analysis of the liquidity and between current

liabilities and assets.

2. Analysis of the liquidity and profitability of the

current assets and current liabilities.

3. Analysis of the long term financial of the firm

over a period of time.

4. Analysis of various components of working

capital E.g.: Cash Marketable securities

receivable and inventories

The study takes into consideration the external analyst point of view and

with the help of the past and latest financial statements, financial position,

will tried to be analyzed impartially.

OBJECTIVES OF THE STUDY:

Based on the information furnished in the financial statements, various

objectives of the cash flow statement

CASH FLOW ANALYSIS B.B.M IN FINANCE

31

UNION BANK OF INDIA BANGALORE UNIVERSITY

1. explain importance of cash flow statement for investors and other

stockholders;

2. compare the differences between cash flow statement with other

financial

statements;

3. explain regulations relating to preparation of cash flows;

4. familiar with the methodology for preparation of cash flow statement

and

different components of cash flow statement; and

5. comprehend how cash flow statement can be used in real life for

different

decision making.

SCOPE OF STUDY:

CASH FLOW ANALYSIS B.B.M IN FINANCE

32

UNION BANK OF INDIA BANGALORE UNIVERSITY

The scope of the study is confined to detail analysis of cash flow

statement in union bank of india

1. An enterprise should prepare a cash flow statement and should

present it for each period for which financial statements are presented.

2. Users of an enterprise’s financial statements are interested

in how the enterprise generates and uses cash and cash equivalents.

This is the case regardless of the nature of the enterprise’s activities

and irrespective of whether cash can be viewed as the product of the

enterprise, as may be the case with a financial enterprise.

Enterprises need cash for essentially the same reasons, however

different their principal revenue-producing activities might be.

They need cash to conduct their operations, to pay their obligations,

and to provide returns to their investors.

CASH FLOW ANALYSIS B.B.M IN FINANCE

33

UNION BANK OF INDIA BANGALORE UNIVERSITY

METHODOLOGY:

The schedule that was planned to be executed or the methodology of approach may

be explained as follows.

➢ An in depth study of the banking norms & procedures that are used in

analyzing the data obtained from the corporal clients.

➢ An overview of the procedures followed in analyzing the data

obtained. The methods followed are: Ratio analysis an effective tool

in analysis.

➢ Proper & effective collection of the various data required in to with the

analysis in relevance with the current economic growth.

➢ An efficient analysis with an eye for errors or blunders that may occur

due to inefficiency. This is the most prominent feature of the study &

was executed with utmost care & diligence.

➢ It also included the study of various circulars & notes that were passed

by the management in this regard. Thus having a higher hand on the

literature study of the project as a whole.

CASH FLOW ANALYSIS B.B.M IN FINANCE

34

UNION BANK OF INDIA BANGALORE UNIVERSITY

TOOLS FOR DATA COLLECTION:

The data so collected from various annual reports & financial Statements for 5 years

been classified & tabulated for better understanding & to give a complete picture at 1

place.

TOOLS FOR ANALYSIS:

The tabulated data has been analyzed thoroughly through various ratios and graphs,

which is used.

LIMITATION OF THE STUDY:

1. Time: The time allotted for the project has been only around 2 months.

The study could be done only for the past 5 years.

2. Finance: Due to limited financial resources as in depth research could not be

undertaken.

3. The face value of the figures given in the balance sheet was used for the

project.

ANALYSIS AND INTERPRETATION:

CASH FLOW ANALYSIS B.B.M IN FINANCE

35

UNION BANK OF INDIA BANGALORE UNIVERSITY

For the purpose of Analysis and interpretation, statement of Current Assets and

Current Liabilities, master tables and graphs were used for the effective presentation.

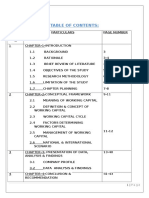

CHAPTER SCHEME:

Chapter 1: - Introduction

Chapter 2: - Research design Consists of research design with the statement of

problem, objective of Study, materials and tools used, limitation and overview

required.

Chapter 3: - Company Profile

Chapter 4: - Contains the analysis and interpretation of cash flow statement . It

mainly, forms a part of our evaluation process in analyzing their financial

performance. It also includes the required graphical presentations wherever

necessary.

Chapter 5: - Contains the findings and recommendations & bibliography and

annexure to the report that has aided the study.

CASH FLOW ANALYSIS B.B.M IN FINANCE

36

UNION BANK OF INDIA BANGALORE UNIVERSITY

PROFILE OF UNION BANK OF INDIA

THE VISION STATEMENT

CASH FLOW ANALYSIS B.B.M IN FINANCE

37

UNION BANK OF INDIA BANGALORE UNIVERSITY

CASH FLOW ANALYSIS B.B.M IN FINANCE

38

UNION BANK OF INDIA BANGALORE UNIVERSITY

THE HISTORY

The dawn of twentieth century witnesses the birth of a banking

enterprise par excellence- UNION BANK OF INDIA- that was flagged off

by none other than the Father of the Nation, Mahatma Gandhi.

Since that the golden moment, Union Bank of India has this far

unflinchingly traveled the arduous road to successful banking........ A

journey that spans 88 years.

We at Union Bank of India, reiterate the objectivity of our inception to the

profound thoughts of the great Mahatma... "We should have the ability to

carry on a big bank, to manage efficiently crores of rupees in the course of

our national activities. Though we have not many banks among us, it does

not follow that we are not capable of efficiently managing crores and tens of

crores of rupees." Union Bank of India is firmly committed to consolidating

and maintaining its identity as a leading, innovative commercial Bank, with

a proactive approach to the changing needs of the society. This has resulted

in a wide gamut of products and services, made available to its valuable

clientele in catering to the smallest of their needs.

Today, with its efficient, value-added services, sustained growth, consistent

profitability and development of new technologies, Union Bank has ensured

complete customer delight, living up to its image of, “GOOD PEOPLE TO

BANK WITH”. Anticipative banking- the ability to gauge the customer's

CASH FLOW ANALYSIS B.B.M IN FINANCE

39

UNION BANK OF INDIA BANGALORE UNIVERSITY

needs well ahead of real-time - forms the vital ingredient in value-based

services to effectively reduce the gap between expectations and deliverables.

The key to the success of any organization lies with its people. No wonder,

Union Bank's unique family of about 26,000 qualified / skilled employees is

and ever will be dedicated and delighted to serve the discerning customer

with professionalism and wholeheartedness.

Union Bank is a Public Sector Unit with 55.43% Share Capital held by the

Government of India. The Bank came out with its Initial Public Offer (IPO)

in August 20, 2002 and Follow on Public Offer in February 2006. Presently

44.57 % of Share Capital is presently held by Institutions, Individuals and

Others. Over the years, the Bank has earned the reputation of being a

techno-savvy and is a front runner among public sector banks in modern-day

banking trends. It is one of the pioneer public sector banks, which launched

Core Banking Solution in 2002. Under this solution umbrella, All Branches

of the Bank have been 1135 networked ATMs, with online telebanking

facility made available to all its Core Banking Customers - individual as

well as corporate. In addition to this, the versatile Internet Banking provides

extensive information pertaining to accounts and facets of banking. Regular

banking services apart, the customer can also avail of a variety of other

value-added services like Cash Management Service, Insurance, Mutual

Funds and Demat. The Bank will ever strive in its endeavour to provide

services to its customer and enhance its businesses thereby fulfilling its

vision of becoming “THE BANK OF FIRST CHOICE IN OUR CHOSEN

AREA BY BUILDING BENEFICIAL AND LASTING RELATIONSHIP

CASH FLOW ANALYSIS B.B.M IN FINANCE

40

UNION BANK OF INDIA BANGALORE UNIVERSITY

WITH CUSTOMERS THROUGH A PROCESS OF CONTINUOUS

IMPROVEMENT”.

CORPORATE MISSION

• A logical extension of the Vision Statement is the Mission of the Bank,

which is to gain market recognition in the chosen areas.

• To build sizeable markets share in each of the chosen areas of business

through effective strategies in terms of pricing, product packaging and

promoting the product in the market.

• To facilitate a process of restructuring of branches to support a greater

efficiency in the retail banking field.

• To sustain the mission objective through harnessing technology driven

banking and delivery channels.

• To promote confidence and commitment among the staff members, to

address the expectations of the customers efficiently and handle technology

banking with ease.

ORGANIZATION STRUCTURE

has a lean three-tier structure. The delegated powers have been enhanced.

The decentralized power structure has accelerated decision making process

and thereby Bank quickly responds to changing needs of the customers and

has also been able to adjust with the changing environment. Bank has nine

General Manager Offices at Ahmedabad, Pune, Lucknow, Delhi, Bangalore,

CASH FLOW ANALYSIS B.B.M IN FINANCE

41

UNION BANK OF INDIA BANGALORE UNIVERSITY

Bhopal, Mumbai, Calcutta and Chennai which function as an extended arm

of corporate office. It also has two Zonal Offices at Bhopal and Pune. Tier 3

comprises of 54 Regional Offices at various geographical center of the

country.

OBJECTIVES OF THE STUDY

• To analyze the risk management in Banks.

• To analyze the risk management in Union Bank of India.

• To analyze the Gross NPA, Net NPA and Capital Adequacy Ratio of

Union Bank of India.

RESEARCH METHODOLOGY

Analysis of past data a helps to understand the effectiveness of Risk

Management Strategies of Bank. This is a conclusive research.

DATA COLLECTION

Basically there are methods of data collection they Secondary data To

achieve the objective, information is¬ Primary data ¬are: collected through

secondary data. Secondary data one those which have been already been

collected. it may be published or unpublished data. Some of the data are

collected through visit and personal observation. But mainly data are

collected form financial statement (annual report) of Union Bank of India.

CASH FLOW ANALYSIS B.B.M IN FINANCE

42

UNION BANK OF INDIA BANGALORE UNIVERSITY

all the information which are collected, through data are analyzed

interpreted and tabulated to full fill be objective. In this study I have used

Secondary Data.

TOOLS OF ANALYSIS

It is essential to use a systematic research methodology for the assessment of

a project because without the use of a research methodology analysis of any

company or organization will not be possible. In the present analysis mostly

secondary data have been used. It is worth a while to mention that I have

used the following types of published data :

• Balance Sheet • Profit & Loss A/c

• Prospectus of the Company

• General Body meeting reports

• Schedules

LIMITATIONS OF THE STUDY

• The research work is mainly based on secondary data that is, it is based on

audited accounts and its audited accounts are ambiguous then the result will

be misleading.

• Less importance has been given to primary data which is actually the

original data and more reliable.

CASH FLOW ANALYSIS B.B.M IN FINANCE

43

UNION BANK OF INDIA BANGALORE UNIVERSITY

• The research work is completed in five months, which is not enough for

any type of proper and reliable research work.

Business Operations

Union Bank has huge and varied customer base approximating to 24

millions. Bank is targeting customers from all demographic and economic

profiles and introducing products and services to meet their needs. The Bank

operates in all the areas including retail lending, personal banking, corporate

banking, international banking and investments & treasury. Bank’s lending

also caters to the rural and semi urban centers, financing Agriculture and

allied activities, rural artisans, micro & medium enterprises in these areas.

Bank has opened 198 “Village Knowledge Centres” to provide information

to the local community on better agriculture practices, commodities,

marketing facilities and financial education. Bank also offers third party

products like life and general insurance, mutual funds, on-line trading,

wealth management services through tie- up with other FIs. Bank places

customer at the centre of all its operations and has transformed the process,

people and organizational structure. Bank has initiated a large scale

transformation process named “Nav Nirman” to address two critical aspects

of growth-instilling the drive of sales & marketing across bank staff and

reconfiguration of bank’s business model. The transformation process

focuses on four key initiatives

a) Retail Asset ( marketing & processing)

CASH FLOW ANALYSIS B.B.M IN FINANCE

44

UNION BANK OF INDIA BANGALORE UNIVERSITY

b) SME marketing & processing)

c) Branch sales and services( improving the customer experience in the

branch)

d) Centralization of key processes

Bank has brought all its branches under Core banking solutions .Union Bank

is the first large bank to achieve 100% CBS roll out. Bank has taken lead to

establish alternate delivery channels in the form of ATMs, internet banking,

phone banking and Mobile Banking. Bank has introduced many technology

based services like RTGS, online NEFT free of cost, on line application for

products and services and online redressel of grievances.

Diversification

Union Bank in partnership with Bank of India and Dai-Ichi of Japan has

formed a subsidiary for distribution of Life insurance products, which has

started selling the products.

Bank has signed an agreement with Belgian KBC group for setting up a joint

venture AMC in India. Union Bank has signed MoU with NSIC for training

and setting up Incubation cum Training centers to promote first generation

entrepreneurs in MSME segment.

Bank has entered into MoU with NCMSL for financing against

warehouse receipts for agri. commodities kept at NCMSL warehouses.

CASH FLOW ANALYSIS B.B.M IN FINANCE

45

UNION BANK OF INDIA BANGALORE UNIVERSITY

Bank has announced opening 100 specialised Business Banking branches

across the country to focus exclusively on MSME sector with turn around

time of 2 weeks for sanction of proposals.

Bank has launched mobile banking facility “Umobile” which facilitates

limited transactions and other services through mobile phones.

Growth & Performance

Total business of the Bank at the end of Dec’08 stood at Rs.2,22,625 crore

registering a growth of 28.33 % over Dec’07.The bank’s total deposits as on

31st Dec’08 reached a level of Rs.1,29,647 crore from Rs.99227 crore as on

Dec’07 ,an increase of 30.66%. Gross advances of the Bank reached a

st

level of Rs.92,978 crore as on 31 Dec’08,registering a growth of 25.22%

over Dec’07.The Capital Adequacy Ratio of the Bank (BASEL I ) is at

12.32% & BASEL II at 13.41 % as on Dec’08.The net interest margin of

the Bank increased to 2.97% for the nine months period ended Dec’08.Return

on average assets improved f rom 1.31% in Dec’07 to 1.92% in

Dec’08(QoQ) indicating more efficient use of Funds. The asset quality

recorded a significant improvement with steep reduction in Net NPAs from

0.35% in Dec’07 to 0.14% in Dec’08 and the Gross NPAs from 2.10% to

1.68%.

CASH FLOW ANALYSIS B.B.M IN FINANCE

46

UNION BANK OF INDIA BANGALORE UNIVERSITY

OUR TRAINING SYSTEM

Seldom has there been a time in which it has been necessary for

Organizations to attune Attitudes, upgrade Skills and kindle sparks of

Knowledge in their human force to the extent and with the rapidity required

today.

Those who dominate the market in times to come will be those who are

prepared to seize opportunities as they come.

At Union Bank, the training facilities offer an admirable approach to these

opportunities.

Ask and it shall be Given.

TO BE THE BEST COME TO BEST

Union bank has one of the best training systems in India. The training

experience here goes back to over four decades. Presently the training

structure consists of the Staff College at Bangalore, and seven centers in

various parts of the country. The training is designed, delivered and

assessed, based on systems suggested and put in place by our overseas

consultants M/s. Vinstar Limited (AGL Group) of New Zealand. These

systems have been tested and refined by practical application.

The training system of Union Bank has been awarded the prestigious

CASH FLOW ANALYSIS B.B.M IN FINANCE

47

UNION BANK OF INDIA BANGALORE UNIVERSITY

Golden Peacock National Training Award instituted by the Institute of

Directors, New Delhi for the best training system in the Country.

In our pursuit of achieving higher standards we have further upgraded our

systems and sized up to 'international norms'. After a rigorous audit, in

February 2001, the College is awarded ISO 9001 certification (for Design

and Development of Customised Training Programs) by Det Norske Veritas,

of the Netherlands. We are the only Bank to obtain ISO certification for the

training system.

FROM PHILOSOPHY TO REALITY

We have devised an outcome-oriented training process. Each and every

module is designed so that learning takes place through interaction. It is also

ensured that this learning is translated into action at the work place. Our

training programs actually deliver value to the Organization. Post course

surveys conducted by us have confirmed this.

Yes, we have translated yet another cliché into reality. We invite

Organizations to give the enriching experience to the employees, to create

learning and growing organizations.

THE COLLEGE AMBIENCE FOR LEARNING

CASH FLOW ANALYSIS B.B.M IN FINANCE

48

UNION BANK OF INDIA BANGALORE UNIVERSITY

Union Bank Staff College stretching over 36 acres of sylvan setting, on the

out skirts of Bangalore city, has been the cynosure of appreciation as an apt

option, for the best ambience for learning. Here physical, mental, spiritual

and social upgradation of self for an individual and building of teams of

performers of outstanding Organizations take place in the most natural way.

We have got excellent, air-conditioned learning centers [we call them

"channels" of learning], computer-backed presentation packages, interactive

learning processes, salubrious living conditions in hostel rooms with

provisions for intellectual and physical games, group exercises and

teambuilding fun in verdurous mango-groves, where mimicking monkeys

and shy sheep are, perhaps, the only onlookers! Yoga, somnolent reverie

after a relaxed splash in the swimming pool, or a stroll down the jogging

tracks and exercise stations or a stretch of paddling or rowing on the boat

around the natural pond are true tonics for invigoration. If the weather does

not encourage outdoor relaxation (unusual in the 'Garden City' of

Bangalore!) a workout in the luxury of the Gymnasium, a game of snooker,

a solitary tryst with computer games or online learning facilities - are other

options.

THE FACILITATORS

Our 'facilitators' to learning - "Faculty" or "Trainers" in the common

parlance- are experienced bank officers with many years of exposure in the

CASH FLOW ANALYSIS B.B.M IN FINANCE

49

UNION BANK OF INDIA BANGALORE UNIVERSITY

entire gamut of banking. All the facilitators have been through an intensive

orientation program on adult learning processes drawn up by Vinstar of New

Zealand. They are also exposed periodically to updating of skills and

awareness in leading institutions in the country. Some have also been

nurtured with professional training abroad at premiere institutions like

Columbia Business School, New York and the Manchester Business School,

England.

THE PROGRAMS

Currently the College is running training programs in the following

disciplines: 1.International Banking 2.Credit 3.Information Technology

4.General Banking 5.Marketing and 6.Management and human resource

development.

Union Bank is also organizing executive education programs in association

with Icfian Business School - an arm of the Institute of Chartered Financial

Analysts of India, Hyderabad. In this stream following programs are offered:

1.Finance for Non-Finance executives 2.Treasury and forex management

3.Software- project management 4.The Service edge - improving service

quality

CASH FLOW ANALYSIS B.B.M IN FINANCE

50

UNION BANK OF INDIA BANGALORE UNIVERSITY

RISK MANAGEMENT

1 Risk is inherent part of Bank’s business. Effective Risk Management is

critical to any Bank for achieving financial soundness. In view of this,

aligning Risk Management to Bank’s organizational structure and business

strategy has become integral in banking business. Over a period of year,

Union Bank of India (UBI) has taken various initiatives for strengthening

risk management practices. Bank has an integrated approach for

management of risk and in tune with this, formulated policy documents

taking into account the business requirements / best international practices

or as per the guidelines of the national supervisor. These policies address the

different risk classes viz., Credit Risk, Market Risk and Operational Risk.

CASH FLOW ANALYSIS B.B.M IN FINANCE

51

UNION BANK OF INDIA BANGALORE UNIVERSITY

2 The issues related to Credit Risk are addressed in the Policies stated

below;

1 Loan Policy.

2 Credit Monitoring Policy.

3 Real Estate Policy.

4 Credit Risk Management Policy.

5 Collateral Risk Management Policy.

6 Recovery Policy.

7 Treasury Policy.

3 The Policies and procedures for Market Risks are articulated in the ALM

Policy and Treasury Policy.

4 The Operational Risk Management involves framework for management

of operational risks faced by the Bank. The issues related to this risk is

addressed by;

1 Operational Risk Management Policy.

2 Business Continuity Policy.

3 Outsourcing Policy.

4 Disclosure Policy.

5 Besides, the above Board mandated Policies, Bank has detailed ‘Internal

Control Principles’ communicated to the business lines for ensuring

CASH FLOW ANALYSIS B.B.M IN FINANCE

52

UNION BANK OF INDIA BANGALORE UNIVERSITY

adherence to various norms like Anti-Money Laundering, Information

Security, Customer complaints, Reconciliation of accounts, Book-keeping

etc.

OVER SIGHT MECHANISM

1 Our Board of Directors has the overall responsibility of ensuring that

adequate structures, policies and procedures are in place for risk

management and that they are properly implemented. Board approves our

risk management policies and also sets limits by assessing our risk appetite,

skills available for managing risk and our risk bearing capacity.

2 Board has delegated this responsibility to a sub-committee: the

Supervisory Committee of Directors on Risk Management & Asset Liability

Management. This is the Apex body / Committee is responsible for

supervising the risk management activities of the Bank.

3 Further, Bank has the following separate committees of top executives and

dedicated Risk Management Department:

1 Credit Risk Management Committee (CRMC): This Committee deals

with issues relating to credit policies and procedure and manages the credit

risk on a Bank-wide basis.

CASH FLOW ANALYSIS B.B.M IN FINANCE

53

UNION BANK OF INDIA BANGALORE UNIVERSITY

2 Asset Liability Management Committee (ALCO): This Committee is

the decision-making unit responsible for balance sheet planning and

management from the angle of risk-return perspective including

management of market risk.

3 Operational Risk Management Committee (ORMC): This Committee

is responsible for overseeing Bank’s operational risk management policy

and process.

4 Risk Management Department of the Bank provides support functions to

the risk management committees mentioned above through analysis of risks

and reporting of risk positions and making recommendations as to the level

and degree of risks to be assumed. The department has the responsibility of

identifying, measuring and monitoring the various risk faced the bank, assist

in developing the policies and verifying the models that are used for risk

measurement from time to time.

CREDIT RISK

1 Credit Risk Management Policy of the Bank dictates the Credit Risk

Strategy.

2 These Polices spell out the target markets, risk acceptance / avoidance

CASH FLOW ANALYSIS B.B.M IN FINANCE

54

UNION BANK OF INDIA BANGALORE UNIVERSITY

levels, risk tolerance limits, preferred levels of diversification and

concentration, credit risk measurement, monitoring and controlling

mechanisms.

3 Standardized Credit Approval Process with well-established methods of

appraisal and rating is the pivot of the credit management of the bank.

4 Bank has comprehensive credit rating / scoring models being applied in

the spheres of retail and non-retail portfolios of the bank.

5 The Credit rating system of the Bank has eight borrower grades for

standard accounts and three grades for defaulted borrowers.

6 Proactive credit risk management practices in the form of studies of rating-

wise distribution, rating migration, probability of defaults of borrowers,

Portfolio Analysis of retail lending assets, periodic industry review, Review

of Country, Currency, Counter-party and Group exposures are only some of

the prudent measures, the bank is engaged in mitigating risk exposures.

7 The current focus is on augmenting the bank’s abilities to quantify risk in

a consistent, reliable and valid fashion, which will ensure advanced level of

sophistication in the Credit Risk Measurement and Management in the years

ahead.

MARKET WRISK

CASH FLOW ANALYSIS B.B.M IN FINANCE

55

UNION BANK OF INDIA BANGALORE UNIVERSITY

1 Bank has well-established framework for Market Risk management with

the Asset Liability Management Policy and the Treasury Policy forming the

fulcrum for procedures, processes and structure. It has a major objective of

protecting the bank’s net interest income in the short run and market value

of the equity in the long run for enhancing shareholders wealth. The

important aspect of the Market Risk includes liquidity management, interest

rate risk management and the pricing of assets and liabilities. Further, Bank

views the Asset Liability Management exercise as the total balance sheet

management with regard to its size, quality and risk.

2 The ALCO is primarily entrusted with the task of market risk

management. The Committee decides on product pricing, mix of assets and

liabilities, stipulates liquidity and interest rate risk limits, monitors them,

articulates Bank’s interest rate view and determines the business strategy of

the Bank.

3 Bank has put in place a structured ALM system with 100% coverage of

data on both assets and liabilities. To measure liquidity and interest rate risk,

Bank prepares various reports such as Structural Liquidity, Interest Rate

Sensitivity, Fortnightly Dynamic Statement etc. Besides RBI reporting many

meaningful analytical reports such as Duration Gap analysis, Contingency

Funding Plan, Contractual Maturity report etc. are generated at periodic

intervals for ALCO, which meets regularly. Statistical and mathematical

models are used to analyze the core and volatile components of assets and

CASH FLOW ANALYSIS B.B.M IN FINANCE

56

UNION BANK OF INDIA BANGALORE UNIVERSITY

liabilities.

4 The objective of liquidity management is to ensure adequate liquidity

without affecting the profitability. In tune with this, Bank ensures adequate

liquidity at all times through systematic funds planning, maintenance of

liquid investments and focusing on more stable funding sources.

5 The Mid Office group positioned in treasury with independent reporting

structure on risk aspects ensure compliance in terms of exposure analysis,

limits fixed and calculation of risk sensitive parameters like VaR, PV01,

Duration, Defeasance Period etc. and their analysis.

OPERATIONAL RISK

1 Operational Risk, which is intrinsic to the bank in all its material products,

activities, processes and systems, is emerging as an important component of

the enterprise-wide risk management system. Recognizing the importance of

Operational Risk Management, Bank has adopted a Comprehensive

Operational Risk Management Policy. This would entail the bank to move

towards enhanced level of sophistication in the years ahead and to capture

qualitative and quantitative measures of Operational Risk indicators in

management of operational risk.

2 Bank has comprehensive system of internal controls, systems and

CASH FLOW ANALYSIS B.B.M IN FINANCE

57

UNION BANK OF INDIA BANGALORE UNIVERSITY

procedures to monitor and mitigate risk. Bank has also institutionalized new

product approval process to identify the risk inherent in the new product and

activities.

3 The Internal audit function of the Bank and the Risk Based Internal Audit,

compliments the banks ability to control and mitigate risk.

Bank’s Preparedness to meet Basel II norms

1.Bank carried out a comprehensive Self-Assessment exercise spanning

all the risk areas and evolved a road map to move towards

implementation of Basel II as per RBI’s directions. The program in

implementation of Risk Management, Organizational Structure, Risk

measures, risk data compilation and reporting etc. is as per this laid down

road map.

2. The Polices framed and procedures / practices adopted are

benchmarked to the best in the industry on a continuous basis and the

Bank has a clear intent to reach an advanced level of sophistication in

management of risks in the coming year.

3 The ever-improving risk management practices in the Bank will result

in Bank emerging stronger, which in turn would confer competitive

CASH FLOW ANALYSIS B.B.M IN FINANCE

58

UNION BANK OF INDIA BANGALORE UNIVERSITY

advantage in the Market.

4 Bank will implement New Capital Accord w.e.f. 31/03/2008. The

parallel run, till implementation, is currently underway.

CASH FLOW ANALYSIS B.B.M IN FINANCE

59

UNION BANK OF INDIA BANGALORE UNIVERSITY

ANALYSIS AND INTERPRETATION OF DATA

4.1 TABLE SHOWING DIVIDEND PAYOUT RATIO

NET PROFIT

Particulars Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

Rs. In crores

Dividend 29.85 24.20 17.04 17.11 15.66

Payout Ratio

Net Profit

Interpretation:-

The dividend payout ratio net profit is constantly decreasing year by year.

In the year 2006 it was 29.85 crores while in the year 2009 it has decreased

to 24.20 crores, but it has gradually decreased to 17.04 crores in 2007 and

stays constant in 2009 with 17.11 crores but again it is decreased to 15.66 in

2010. This shows that the dividend payout ratio net profit was decreasing

during those years.

CASH FLOW ANALYSIS B.B.M IN FINANCE

60

UNION BANK OF INDIA BANGALORE UNIVERSITY

4.1.1GRAPH SHOWING DIVIDEND PAYOUT RATIO NET PROFIT

Inference:

From the above graph it clear shows that the net profit of dividend payout

ratio is decreasing gradually.

4.2 TABLE SHOWING DIVIDEND PAYOUT RATIO CASH

PROFIT

Particulars Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

Dividend 26.47 21.95 15.87 15.85 14.54

Payout Ratio

Cash Profit

CASH FLOW ANALYSIS B.B.M IN FINANCE

61

UNION BANK OF INDIA BANGALORE UNIVERSITY

INTERPRETATION :

The cash profit dividend payout ratio is also decreasing year by year . In the

year 2006 it was 26.47 crores and it has gradually decreased to 21.95 crores

in 2007 and again gradually decreases as it was decreased in the previous

year , it has decreased to 15.87 crores in 2008 and stays constant with 15.85

crores in 2009 and again it has just decreased to 14.54 crores in 2010. This

shows that the cash profit dividend payout ratio has only decreased and

never increased during these 5 years

4.2.1 GRAPH SHOWING THE CASH PROFIT OF DIVIDEND PAYOUT

RATIO

Inference:

CASH FLOW ANALYSIS B.B.M IN FINANCE

62

UNION BANK OF INDIA BANGALORE UNIVERSITY

From the above graph it clear shows that the cash profit of dividend payout

ratio is decreasing gradually for the following years.

4.3 TABLE SHOWING EARNING RETENTION RATIO

Particulars Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

Earning 70.11 75.82 82.97 82.80 84.35

Retention

Ratio

INTERPRETATION

The earning retention ratio was 70.11 crores during the year 2006 and has

increased to 75.82 crores in 2007 and again gradually increases in the year

2008 with 82.97 crores and stays constant in the next year 82.80 and again it

has just increased to 84.35 in 2010. This shows that earning retention ratio

has increased year by year. The increase in earning retention ratio is good

for the bank

CASH FLOW ANALYSIS B.B.M IN FINANCE

63

UNION BANK OF INDIA BANGALORE UNIVERSITY

4.3.1 GRAPH SHOWING EARNING RETENTION RATIO

Inference:

From the above graph it clear shows that the earning retention ratio is

increasing gradually.

4.4 TABLE SHOWING CASH EARNING RETENTION RATIO

particulars Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

Cash 73.49 78.06 84.13 84.07 85.47

Earning

Retention

Ratio

CASH FLOW ANALYSIS B.B.M IN FINANCE

64

UNION BANK OF INDIA BANGALORE UNIVERSITY

INTERPRETATION :

The cash earning retention ratio is constantly increasing year by year . the

cash earning retention ratio was 73.49 crores in 2006 . in the year 2007 it is

increased to 84.13 crores and again it is increased in the next year as it is

increased in the previous year to 84.13 crores in 2008 and remains constant

in the next year with 84.13 crores in 2009 and in the year 2010 it is just

increased to 85.47 crores … this shows that the cash earning retention ratio

is only increased and not decreased during thoese 5 years

4.4.1 GRAPH SHOWING CASH EARNING RETENTION RATIO

CASH FLOW ANALYSIS B.B.M IN FINANCE

65

UNION BANK OF INDIA BANGALORE UNIVERSITY

Inference:

From the above graph it clear shows that the cash earning retention ratio is

increasing gradually.

4.5. TABLE SHOWING ADJUSTED CASH FLOW TIMES

Particulars Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

AdjustedCas 97.44 91.38 69.74 74.82 76.06

h Flow

Times

INTERPRETATION :

The adjusted cash flow times is constantly decreasing year by year . the

adjusted cash flow times was 97.44 crores in 2006 and in the year 2007 it is

CASH FLOW ANALYSIS B.B.M IN FINANCE

66

UNION BANK OF INDIA BANGALORE UNIVERSITY

just decreased to 91.38 crores . in the year 2008 it is gradually decreased to

69.74 crores but only from 2009 it has started increasing , it is increased to

74.82 crores in 2009 . in the year 2010 again it is just increased to 76.06

crores

4.5.1 GRAPH SHOWING ADJUSTED CASH FLOW TIMES

Inference:

From the above graph it is inferred that the adjusted cash flow times were

fluctuating during these years

4.6 TABLE SHOWING EARNINGS PER SHARE

CASH FLOW ANALYSIS B.B.M IN FINANCE

67

UNION BANK OF INDIA BANGALORE UNIVERSITY

particulars Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

Earnings Per 13.37 16.74 27.46 34.18 41.08

Share

INTERPRETATION :

The earning per share is constantly increasing year by year. The earning per

share was 13.37 crores in 2006 and in the year 2007 it is just increased to

16.74 crores . in the year 2008 it is gradually increased to 27.46 crores . in

the year 2009 it is increased to 34.18 crores and again it is increased in

2010 as it was increased in previous year , it is increase to 34.18 crores by

2010 . this shows that the earning per share is only increasing and has never

decreased during those 5 year

CASH FLOW ANALYSIS B.B.M IN FINANCE

68

UNION BANK OF INDIA BANGALORE UNIVERSITY

4.6.1 GRAPH SHOWING EARNINGS PER SHARE

Inference:

From the above graph it clear shows that the earnings per share is increasing

gradually.

4.7 TABLE SHOWING NET CASH FROM OPERATING

ACTIVITIES

particulars Mar '06 Mar '07 Mar '08 Mar '09 Mar '10

Net Cash -1124.99 1956.28 1930.64 5599.13 -505.07

From