Escolar Documentos

Profissional Documentos

Cultura Documentos

DL NewBusPermit-BACOOR

Enviado por

Olive Dago-ocDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

DL NewBusPermit-BACOOR

Enviado por

Olive Dago-ocDireitos autorais:

Formatos disponíveis

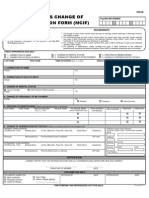

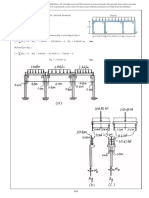

REPUBLIC OF THE PHILIPPINES

PROVINCE OF CAVITE

MUNICIPALITY OF BACOOR

BUSINESS PERMITS AND LICENSING OFFICE

_____________________________ _____________________

CITY/MUNICIPALITY DATE OF APPLICATION

SURNAME FIRST NAME M.I. TEL. NO.

NAME OF TAXPAYER

COMPLETE ADDRESS OF TAXPAYER

BUSINESS TRADE NAME

TEL. NO.

COMPLETE ADDRESS OF BUSINESS

BUILDING PERMIT NO. (IF BLDG. IS OWNED DATE ISSUED CERTIFICATE OF OCCUPANCY DATE ISSUED

ASSESSED VALUE OF BLDG. IF USED AS THEATER, INDICATE CLASS ESTIMATE AREA USED IN BUSINESS

IF PLACE OF BUSINESS IS RENTED

OWNER ADDRESS ADMINISTRATOR RENT START RENT PER MO.

(IF OWNED NOT AVAILABLE) (MO. / YR.)

CITY/MUNICIPAL TAXES PAID FOR THE PREVIOUS YEAR IN CASE OF TRANSFER

YEAR COVERED TOTAL AMOUNT PAID DATE OF LAST PAYMENTS LAST OFFICIAL RECIEPT NO.

IF TRANSFER OF OWNERSHIP BUSINESS PERMIT NO.

FROM WHOM ACQUIRED

IF TRANSFER OF BUSINESS, FROM WHERE

ADDRESS

LINE OF BUSINESS/ACTIVITIES SUBSCRIBED CAPITAL PAID-UP CAPITAL CODE

KIND OF OWNERSHIP % ALIEN CAP INVESTMENT TIN

SINGLE PROPRIETORSHIP PARTNERSHIP CORPORATION

(RESIDENCE CERTIFICATE NO. DATE OF ISSUE PLACE OF ISSUE

INDIVIDUAL OR CORPORATE

SSS NO. NO. OF EMPLOYEES

BUREAU OF COMMERCE REG. NO. DATE OF ISSUE SEC. REG. NO. DATE OF ISSUE

LOCATIONAL CLEARANCE DATE OF ISSUE SEC. REG. NO. DATE OF ISSUE

DELIVERY VANS/ (a) AS DEALER/PRODUCER OF DISTILLED SPIRITS, SOFTDRINKS, CIGARETTES, ETC NO. OF UNITS

TRUCKS OWNED (b) AS DEALER/PRODUCER OF OTHER PRODUCTS NO. OF UNITS

________________________________________ __________________________________________

(PRINT NAME OF MANAGER) SIGNATURE OF APPLICANT/REPRESENTATIVE

__________________________________________

POSITION / TITLE

SUBSCRIBED AND SWORN TO BEFORE ME THIS ____________________________ DAY OF ______________, ___________ AT

THE CITY/MUNICIPALITY OF ___________________________ AFFIANT EXHIBITED TO ME HIS/HER RESIDENCE CERTIFICATE

NO. A. ______________________________ ISSUED AT ______________________ ON __________________________________

DOC. NO. __________

PAGE NO. _________

BOOK NO. _________ _________________________________________

SERIES OF _________ ADMINISTERING OFFICER

TO BE FILLED BY THE PROCESSOR/ ASSESSOR

ENDORSEMENTS

DATE ENDORSEMENT

OFFICE RECEIVED DATE RELEASED REMARKS (AUTHORIZED OFFICIAL)

HEALTH DEPARTMENT

FIRE/ELECTRICAL DEPARTMENT

ENGINEERING DEPT/

BUILDING OFFICIALS

ZONING

ASSESSMENTS

CITY/MUNICIPAL TAXES, FEES & CHARGES TO BE PAID FOR THE CURRENT LICENSE PERIOD

MODE OF PAYMENT ANNUALY BI-ANNUALY QUARTERLY

LOCAL TAXES REFERENCES AMOUNT PENALTY TOTAL ASSESSED BY

(SUBCHARGE & INT.)

SEC 15-19

LOCAL BUSINESS 37 & 44 RCMM

TAX ON DELIVERY VANS/TRUCKS SEC 34, RCMM

TAX ON STORAGE FOR COMBUSTIBLE/ SEC. 19(25)

FLAMMABLE OR EXPLOSIVE SUBSTANCE RCMM

TAX ON SIGNBOARD/BILLBOARDS SEC. 40 RCMM

REGULATORY FEES/CHARGES

MAYOR’S PERMIT FEE SEC 105 RCMM

GARBAGE CHARGES SEC. 63 RCMM

SEC105(b)

DELIVERY VANS/TRUCK PERMIT FEE RCMM

SANITARY INSPECTION FEE SEC.109, RCMM

BUILDING INSPECTION FEE P.D. 1096

ELECTRICAL INSPECTION FEE P.D. 1096

MECHANICAL INSPECTION FEE P.D. 1096

PLUMBING INSPECTION FEE PD. 1096

SIGNBOARD/BILLBOARDS P.D. 1096

RENEWAL FEE

SIGNBOARD/BILLBOARDS SEC. 105 (b)

PERMIT FEE 13, RCMM

STORAGE AND SALE OF COMBUSTIBLE SEC. 105 (b)

FLAMMABLE OR EXPLOSIVE SUBSTANCE 11, RCMM

ZONING

· REFER TO DS FOR INSPECTION/ASSESSMENT P____________ P _____________ P ____________

_ ___________________ _____________________ ___________________

RECOMMENDING APPROVAL

ASSESSMENTS REVIEWED BY:

_________________________________ _________________________________

LICENSE DIVISION Chief - BPLO

APPROVED BY: HON. STRIKE B. REVILLA

MUNICIPAL MAYOR

___________________________________________

DATE ISSUED

OR. NO. ____________________

PERMIT NO. ________________

INSTRUCTIONS:

1. DO NOT FILL UP SHADE BLOCKS, THESE ARE FOR CODING PURPOSE

2. FILL UP ALL THE UNSHADED BLOCKS IN THE FRONT PAGE, PRINT LEGIBLY, CORRECTLY AND COMPLETELY

OTHERWISE IT SHALL BE RETURNED FOR PROPER ACCOMLISHMENTS.

3. FOR LINE OF BUSINESS:

a) INDICATE ALL BUSINESS ACTIVITIES USE A SEPARATE SHEET; IF NECESSARY

b) INDICATE CAPITAL INVESTMENTS ( FOR CORPORATION, BOTH ITS PAID-UP AND SUBSCRIBED ) FOR EACH (LINE BUSINESS)

4. THIS FORMS SHALL BE SUPPORTED BY:

a) ZONING OR LOCATIONAL CLEARANCE.

b) OTHER CLEARANCES OR PERMITS FROM VARIOUS OFFICES OR AGENCIES, DEPENDING ON THE FUTURE OF BUSINESS.

c) ARTICLE OF INCORPORATION AND REGULATION WITH THE SEC FOR PARTNERSHIP OR CORPORATION.

d) TAX EXEMPTION CERTIFICATE IF BUSINESS IS CLAIMING TAX EXEMPTION.

e) DECLARATION SHEETS.

Você também pode gostar

- Business Permit Business Permit: General Santos City General Santos CityDocumento1 páginaBusiness Permit Business Permit: General Santos City General Santos Citybktsuna0201100% (1)

- Business PermitDocumento1 páginaBusiness PermitVELOX MABUHAYAinda não há avaliações

- Employer'S Virtual Pag-Ibig Enrollment FormDocumento2 páginasEmployer'S Virtual Pag-Ibig Enrollment FormJhonna Magtoto100% (2)

- APPLICATION FORM - SPES Form 2 - FINALDocumento1 páginaAPPLICATION FORM - SPES Form 2 - FINALrriza ben caluya100% (1)

- Primewater BillDocumento1 páginaPrimewater BillMark Fel PunoAinda não há avaliações

- Cessation of BusinessDocumento2 páginasCessation of BusinesslhemnavalAinda não há avaliações

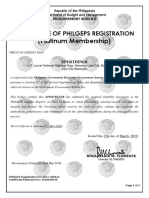

- Philgeps 2022Documento3 páginasPhilgeps 2022Hillary Ann AbuelAinda não há avaliações

- Notice of AwardDocumento54 páginasNotice of AwardJasmin UrbanozoAinda não há avaliações

- Certificate of Business Name Registration: Gadget Ni HachiDocumento1 páginaCertificate of Business Name Registration: Gadget Ni HachiHachi CruzAinda não há avaliações

- Cebu City CIVIL STRUCTURAL PERMITfor Building PermitDocumento2 páginasCebu City CIVIL STRUCTURAL PERMITfor Building PermitAudrey ChuaAinda não há avaliações

- Electronic Business Permit - Renewal: Subject To InspectionDocumento3 páginasElectronic Business Permit - Renewal: Subject To InspectionRose Salminao100% (1)

- Pag-Ibig - Members Change of InfoDocumento2 páginasPag-Ibig - Members Change of Infolucci_1182Ainda não há avaliações

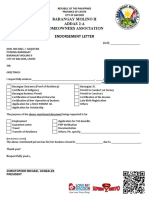

- Barangay Molino Ii Addas 2-A Homeowners Association Endorsement LetterDocumento1 páginaBarangay Molino Ii Addas 2-A Homeowners Association Endorsement LetterBARANGAY MOLINO II100% (1)

- Toda Letter-RequestDocumento1 páginaToda Letter-RequestHernan Regnim BanaAinda não há avaliações

- Business Permit 2011Documento1 páginaBusiness Permit 2011Patrick Henry LopezAinda não há avaliações

- License To Operate FDADocumento2 páginasLicense To Operate FDAx9hhzc28kb100% (1)

- Bir Form 1600Documento44 páginasBir Form 1600Jerel John CalanaoAinda não há avaliações

- Table of ContentsDocumento1 páginaTable of ContentsMacLaw MacOfficeAinda não há avaliações

- SampleDocumento11 páginasSampleYanyan RivalAinda não há avaliações

- Certificate of Employment and CompensationDocumento1 páginaCertificate of Employment and CompensationJezel Catunao100% (1)

- Certificate of Appearance: Engr. James L. YecyecDocumento1 páginaCertificate of Appearance: Engr. James L. YecyecRio AlbaricoAinda não há avaliações

- eSRS Reg Form PDFDocumento1 páginaeSRS Reg Form PDFDarlyn Etang100% (1)

- Certificate of Final Electrical Inspection - 0Documento3 páginasCertificate of Final Electrical Inspection - 0RM DulawanAinda não há avaliações

- Form Brgy - ClearanceDocumento3 páginasForm Brgy - ClearanceMapulang Lupa Valenzuela CityAinda não há avaliações

- Electronic Official Receipt: City Government of Manila City Treasurer'S OfficeDocumento2 páginasElectronic Official Receipt: City Government of Manila City Treasurer'S OfficeBarangay 708 Zone 78 District VAinda não há avaliações

- Calamity Loan Application Form (CLAF, HQP-SLF-066) (Applicable To Imus Branch Members Only)Documento2 páginasCalamity Loan Application Form (CLAF, HQP-SLF-066) (Applicable To Imus Branch Members Only)egabad78% (9)

- (Platinum Membership) : Certificate of Philgeps RegistrationDocumento3 páginas(Platinum Membership) : Certificate of Philgeps RegistrationJohn Allen MeaAinda não há avaliações

- BIR FORM 2307 SampleDocumento6 páginasBIR FORM 2307 SampleEasyHear Philippines by NuGen Hearing Devices, Inc.Ainda não há avaliações

- Barangay ClearanceDocumento18 páginasBarangay ClearancePaula Anjelica RiveraAinda não há avaliações

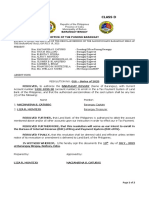

- Application For Building Permit (Indorsement To BFP)Documento1 páginaApplication For Building Permit (Indorsement To BFP)Arjay AletaAinda não há avaliações

- Regular Contractor'S License: Verzontal Infrastructure Corporation (Formerly: Verzontal Builders. Inc.)Documento2 páginasRegular Contractor'S License: Verzontal Infrastructure Corporation (Formerly: Verzontal Builders. Inc.)mary kris marasiganAinda não há avaliações

- Canvass Bgy - Cagugubngan Form.Documento1 páginaCanvass Bgy - Cagugubngan Form.Liga ng mga Barangay Catubig ChapterAinda não há avaliações

- 2013 - Business Permit - FrontDocumento1 página2013 - Business Permit - FrontrobinrubinaAinda não há avaliações

- Iso Abstract of CanvassDocumento1 páginaIso Abstract of CanvassBfpcar K PasilAinda não há avaliações

- Invoice and Receipts of Accountable FormsDocumento1 páginaInvoice and Receipts of Accountable Formssan nicolas 2nd betis guagua pampangaAinda não há avaliações

- Annex E - Certification For Damaged Documents Due To Typhoon OdetteDocumento1 páginaAnnex E - Certification For Damaged Documents Due To Typhoon OdetteDijey Reymundo50% (2)

- Bir Form 2307Documento2 páginasBir Form 2307Geraldine BacoAinda não há avaliações

- FA0 CFD 01Documento2 páginasFA0 CFD 01Jric Doctorr100% (1)

- E Liwag 01312007 OLDDocumento2 páginasE Liwag 01312007 OLDdaqs06Ainda não há avaliações

- Barangay Molino II Office of The Punong Barangay: Republic of The Philippines Province of Cavite City of BacoorDocumento2 páginasBarangay Molino II Office of The Punong Barangay: Republic of The Philippines Province of Cavite City of BacoorBARANGAY MOLINO IIAinda não há avaliações

- Unified Multi-Purpose Id (Umid) Card Application Form: Social Security SystemDocumento3 páginasUnified Multi-Purpose Id (Umid) Card Application Form: Social Security SystemDorothy Joy Villa GatocAinda não há avaliações

- Certificate of EmploymentDocumento1 páginaCertificate of EmploymentKim Andrei Estrella Apeña0% (1)

- Annex 3 - Rspfcpb-MooeDocumento1 páginaAnnex 3 - Rspfcpb-MooeSK GACAO PALO, LEYTEAinda não há avaliações

- ANNEX 4A - Calendar of OJT HoursDocumento1 páginaANNEX 4A - Calendar of OJT HoursKurt Allen PaningbatanAinda não há avaliações

- lexa: Florence FashionDocumento1 páginalexa: Florence FashionAlexandra FernandezAinda não há avaliações

- Sample Acknowledgement Letter For In-Kind DonationsDocumento1 páginaSample Acknowledgement Letter For In-Kind DonationsRowena Furog Baduya EmpanadoAinda não há avaliações

- Community Tax Certificate PRINTDocumento2 páginasCommunity Tax Certificate PRINTClarenz0% (1)

- 2303 Certificate of RegistrationDocumento4 páginas2303 Certificate of RegistrationLeo EstabilloAinda não há avaliações

- Original Copy Business Permit Application Form BPLOs PDFDocumento2 páginasOriginal Copy Business Permit Application Form BPLOs PDFNicole Canarias100% (1)

- CERTIFICATE OF PHILGEPS REGISTRATION (Platinum Membership) - BLAFF CONSTRUCTION & SUPPLIES - Updated 06022022Documento3 páginasCERTIFICATE OF PHILGEPS REGISTRATION (Platinum Membership) - BLAFF CONSTRUCTION & SUPPLIES - Updated 06022022Darvie Joy Ellevira100% (1)

- Certificate of EmploymentDocumento1 páginaCertificate of EmploymentZildjianAinda não há avaliações

- Move-Out Clearance For Tenant/S: Additional Instructions by Chief Engineer And/computation by Accounting, If AnyDocumento1 páginaMove-Out Clearance For Tenant/S: Additional Instructions by Chief Engineer And/computation by Accounting, If AnytristanmunarAinda não há avaliações

- COA C2018-002 AnnexA-PIFDocumento3 páginasCOA C2018-002 AnnexA-PIFRetcheAinda não há avaliações

- Office of The Building Official Application For Building PermitDocumento2 páginasOffice of The Building Official Application For Building Permitrmrv valdezAinda não há avaliações

- 2023 - 016 BIR - ETPS-ResolutionDocumento2 páginas2023 - 016 BIR - ETPS-ResolutionIinday AnrymAinda não há avaliações

- Letter of Intent (LANECO)Documento1 páginaLetter of Intent (LANECO)radjita t. enterinaAinda não há avaliações

- Pilar Sorsogon Bpls-FormDocumento4 páginasPilar Sorsogon Bpls-FormKevin Albert Dela CruzAinda não há avaliações

- Unified Business Permit Application FormDocumento2 páginasUnified Business Permit Application FormCatherine Castro0% (1)

- Bgo Casso F 002Documento1 páginaBgo Casso F 002MindZeroJ5Ainda não há avaliações

- Appointment Letter Format-1Documento4 páginasAppointment Letter Format-1Olive Dago-ocAinda não há avaliações

- Business Style For UratexDocumento1 páginaBusiness Style For UratexOlive Dago-ocAinda não há avaliações

- Module 5Documento2 páginasModule 5Jaecel SibbalucaAinda não há avaliações

- Sec Cert and Board Resolution FormatDocumento2 páginasSec Cert and Board Resolution FormatOlive Dago-oc0% (1)

- Deed of Sale FormatDocumento2 páginasDeed of Sale FormatOlive Dago-ocAinda não há avaliações

- Deed of Sale FormatDocumento1 páginaDeed of Sale FormatOlive Dago-ocAinda não há avaliações

- Vendor Non-Compete Agreement Example FormatDocumento3 páginasVendor Non-Compete Agreement Example FormatOlive Dago-ocAinda não há avaliações

- LTO FormDocumento1 páginaLTO FormOlive Dago-ocAinda não há avaliações

- FORMAT - Acknowledgment by An Individual and A CorporationDocumento2 páginasFORMAT - Acknowledgment by An Individual and A CorporationOlive Dago-ocAinda não há avaliações

- Form - Incident ReportDocumento1 páginaForm - Incident ReportOlive Dago-ocAinda não há avaliações

- Xyz Bank Automatic Debit Agreement (Auto Loan)Documento1 páginaXyz Bank Automatic Debit Agreement (Auto Loan)Olive Dago-ocAinda não há avaliações

- UNDERTAKING - Lending Auto Loan (XYZ BANK)Documento1 páginaUNDERTAKING - Lending Auto Loan (XYZ BANK)Olive Dago-ocAinda não há avaliações

- Affidavit of Undertaking - Purchased ItemDocumento1 páginaAffidavit of Undertaking - Purchased ItemOlive Dago-ocAinda não há avaliações

- Non-Disclosure Agreement - FormDocumento3 páginasNon-Disclosure Agreement - FormOlive Dago-ocAinda não há avaliações

- Appointment Letter FormatDocumento4 páginasAppointment Letter FormatOlive Dago-ocAinda não há avaliações

- Bio Data PDFDocumento1 páginaBio Data PDFjonathan86% (7)

- BDO CHECK Format - Our Lady of PillarDocumento1 páginaBDO CHECK Format - Our Lady of PillarOlive Dago-ocAinda não há avaliações

- Betafoam Corporation Company ProfileDocumento1 páginaBetafoam Corporation Company ProfileOlive Dago-ocAinda não há avaliações

- FORMAT - Affidavit For Change of Motor VehicleDocumento1 páginaFORMAT - Affidavit For Change of Motor VehicleOlive Dago-oc100% (1)

- Authorization LetteAuthorization Letter - Request For Tax Clearancer - Request For Tax ClearanceDocumento1 páginaAuthorization LetteAuthorization Letter - Request For Tax Clearancer - Request For Tax ClearanceOlive Dago-oc0% (1)

- FORMAT - Affidavit of Damage To Vehicle Cannibalized VehicleDocumento2 páginasFORMAT - Affidavit of Damage To Vehicle Cannibalized VehicleOlive Dago-ocAinda não há avaliações

- Avega - Referral FormDocumento1 páginaAvega - Referral FormOlive Dago-ocAinda não há avaliações

- Affidavit of Damage To Vehicle Hitting A Post While BackingDocumento2 páginasAffidavit of Damage To Vehicle Hitting A Post While BackingOlive Dago-ocAinda não há avaliações

- WSP Rawalpindi Field Note PressDocumento16 páginasWSP Rawalpindi Field Note PressOlive Dago-ocAinda não há avaliações

- Hua Hin Prepared For Water Shortage - Bangkok Post - NewsDocumento1 páginaHua Hin Prepared For Water Shortage - Bangkok Post - NewsOlive Dago-ocAinda não há avaliações

- Business Letters and Logo Samples PDFDocumento31 páginasBusiness Letters and Logo Samples PDFJai Mohammed100% (1)

- Peza CheklistDocumento24 páginasPeza CheklistAce Christian OcampoAinda não há avaliações

- Business Correspondence For English 2aDocumento14 páginasBusiness Correspondence For English 2ajera garciaAinda não há avaliações

- Business Letter About Dissolving PartnershipDocumento1 páginaBusiness Letter About Dissolving Partnershipnet6351Ainda não há avaliações

- TTW Ar2012 en 01Documento124 páginasTTW Ar2012 en 01Olive Dago-ocAinda não há avaliações

- Business Opportunity Identification and SelectionDocumento15 páginasBusiness Opportunity Identification and SelectionAnonymous 3H6fFBmAinda não há avaliações

- Geography Cba PowerpointDocumento10 páginasGeography Cba Powerpointapi-489088076Ainda não há avaliações

- Witness Affidavit of Emeteria B, ZuasolaDocumento4 páginasWitness Affidavit of Emeteria B, ZuasolaNadin MorgadoAinda não há avaliações

- Accredited Architecture QualificationsDocumento3 páginasAccredited Architecture QualificationsAnamika BhandariAinda não há avaliações

- How To Start A Fish Ball Vending Business - Pinoy Bisnes IdeasDocumento10 páginasHow To Start A Fish Ball Vending Business - Pinoy Bisnes IdeasNowellyn IncisoAinda não há avaliações

- Marketing For Hospitality & TourismDocumento5 páginasMarketing For Hospitality & Tourismislahu56Ainda não há avaliações

- Cable 3/4 Sleeve Sweater: by Lisa RichardsonDocumento3 páginasCable 3/4 Sleeve Sweater: by Lisa RichardsonAlejandra Martínez MartínezAinda não há avaliações

- Evaluating The Procurement Strategy Adopted in The Scottish Holyrood Parliament Building ProjectDocumento13 páginasEvaluating The Procurement Strategy Adopted in The Scottish Holyrood Parliament Building ProjectNnamdi Eze100% (4)

- Unix Training ContentDocumento5 páginasUnix Training ContentsathishkumarAinda não há avaliações

- 1-10 Clariant - Prasant KumarDocumento10 páginas1-10 Clariant - Prasant Kumarmsh43Ainda não há avaliações

- Lecun 20201027 AttDocumento72 páginasLecun 20201027 AttEfrain TitoAinda não há avaliações

- G6Documento14 páginasG6Arinah RdhAinda não há avaliações

- Problemas Del Capitulo 7Documento26 páginasProblemas Del Capitulo 7dic vilAinda não há avaliações

- Megohmmeter: User ManualDocumento60 páginasMegohmmeter: User ManualFlavia LimaAinda não há avaliações

- Diagrame Des MomentsDocumento1 páginaDiagrame Des Momentsabdoul ndiayeAinda não há avaliações

- Abhijit Auditorium Elective Sem 09Documento3 páginasAbhijit Auditorium Elective Sem 09Abhijit Kumar AroraAinda não há avaliações

- FZCODocumento30 páginasFZCOawfAinda não há avaliações

- Fss Operators: Benchmarks & Performance ReviewDocumento7 páginasFss Operators: Benchmarks & Performance ReviewhasanmuskaanAinda não há avaliações

- Group Terms&ConditionsDocumento5 páginasGroup Terms&Conditionsbelen rodriguezAinda não há avaliações

- 2UEB000133 ACS2000 4kV Motor Temp Supervision Rev BDocumento3 páginas2UEB000133 ACS2000 4kV Motor Temp Supervision Rev BSherifAinda não há avaliações

- PosdmDocumento29 páginasPosdmChandraBhushan67% (3)

- Annex B Brochure Vector and ScorpionDocumento4 páginasAnnex B Brochure Vector and ScorpionomarhanandehAinda não há avaliações

- Dilip - SFDC CPQ Architect14 GCDocumento5 páginasDilip - SFDC CPQ Architect14 GCmariareddy17100% (1)

- Design, Analysis &optimization of Crankshaft Using CAEDocumento6 páginasDesign, Analysis &optimization of Crankshaft Using CAEInternational Journal of Application or Innovation in Engineering & ManagementAinda não há avaliações

- Managing Apps in Windows 10Documento29 páginasManaging Apps in Windows 10CourageMarumeAinda não há avaliações

- Nilfisck SR 1601 DDocumento43 páginasNilfisck SR 1601 DGORDAinda não há avaliações

- Life Lessons AssignmentDocumento5 páginasLife Lessons Assignmentapi-332560669Ainda não há avaliações

- Nogales V Capitol Medical CenterDocumento2 páginasNogales V Capitol Medical CenterGraceAinda não há avaliações

- Misca 367 of 2008Documento5 páginasMisca 367 of 2008Kabelo TsehareAinda não há avaliações

- HCMA ZW370 6 Brochure - 02 - 22Documento24 páginasHCMA ZW370 6 Brochure - 02 - 22Carlos Arturo AcevedoAinda não há avaliações