Escolar Documentos

Profissional Documentos

Cultura Documentos

Creed Rice Market Report

Enviado por

nsopheaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Creed Rice Market Report

Enviado por

nsopheaDireitos autorais:

Formatos disponíveis

Market Report

May 11, 2011

U.S.D.A. World Market Price:

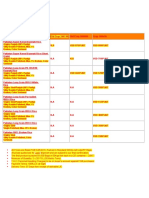

World Market Price This week Last week 1 Year Ago 2010 Loan WMP and Loan Rates

LDP

Value Factors 05/11/11 05/04/11 05/12/10 Factors ‘10 crop L/G M/G

Long Grain To be 18.50 15.03 00.00 9.91 Yield 52.78/14.31 61.03/8.69

Medium Grain issued 18.19 14.75 00.00 9.65 WMP 11.64 12.24

Short Grain May 11 18.19 14.75 00.00 9.65 Loan 6.23 6.50

Brokens 8:30am 13.09 10.35 - 7.01 Difference (5.41) (5.74)

Posting: (May/June Shipment)

Southern U.S. - Long Grain Abbreviation Quote Basis

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $22.50 per cwt. sacked, F.A.S. U.S. Gulf

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $22.50 per cwt, BULK, FOB Vessel US Gulf

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $23.0 per cwt. containerized FOB US Gulf

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $550.00 per mt sacked delivered Laredo TX

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $24.00 per cwt sacked delivered Miami FL

U.S. #3 Long Grain, max. 15% Broken, Hard Milled #3/15 $21.50 per cwt. sacked, F.A.S. U.S. Gulf

U.S. #3 Long Grain, max. 15% Broken, Hard Milled #3/15 $540.00 per mt sacked delivered Laredo TX

U.S. #2 Long Grain Brown, max. 4% Broken, 75% yield #2/4/75 no quote per mt bulk FOB vessel NOLA

U.S. #1 Parboiled L/G Brown, max. 4% Broken, 88% yield #1/4/88 no quote per mt bulk FOB vessel NOLA

U.S. #1 Parboiled L/G MILLED, max. 4% Broken (except 0.8% damage) #1/4 Parb no quote per mt sacked FOB vessel NOLA

U.S. #1 Parboiled L/G MILLED, max. 4% Broken #1/4 Parb $600.00 per mt bulk FOB vessel NOLA

U.S. #2 Long Grain Paddy, 55/70 yield #2 55/70 $280.00 per mt bulk F.O.B. vessel NOLA

Long Grain, max. 20% broken, Hard milled (Ghana specs) #4/20/hm $20.50 per cwt. sacked, F.A.S. U.S. Gulf

U.S. #5 L/G, max. 20% broken, WELL MILLED #5/20/wm $20.00 per cwt. sacked, F.A.S. U.S. Gulf

Southern U.S. - Medium Grain

U.S. #2 Medium Grain, max. 4% broken, Hard Milled #2/4% no quote per mt bulk FOB vessel NOLA

U.S. #2 Medium Grain Paddy, 58/69 yield #2 58/69 no quote per mt bulk FOB vessel NOLA

Southern U.S. - Package Quality

Package Quality Parboiled L/G, max. 4% broken (0.8% damage) Pkg. Parb. $28.00 per cwt. bulk F.O.B. mill

Package Quality Long Grain Milled, max. 4% broken Pkg. L/G $21.50 per cwt. bulk F.O.B. mill

Package Quality Long Grain Milled, max. 4% broken (select variety) Pkg. L/G $24.00 per cwt. bulk F.O.B. mill

Package Quality Long Grain Brown Rice, max. 4% broken Pkg. Br. $31.00 per cwt. bulk F.O.B. mill

Package Quality Medium Grain Milled, max. 4% broken Pkg. M/G $35.00 per cwt. bulk F.O.B. mill

California - Medium Grain

U.S. #1 Medium Grain, max. 4% Broken #1/4 $835.00 per mt sacked containerized FOB Mill

U.S. #1 Medium Grain, max. 4% Broken #1/4 $875.00 per mt sacked containerized Oakland

U.S. #1 Medium Grain milled rice, except max. 7% Broken (Japan Specs) #1/7% $875.00 per mt sacked in 30kg bags FOB vessel

U.S. #3 Medium Grain Brown rice, max. 8% broken (Korea Specs) #3 Brown $810.00 per mt in totes containerized Oakland

U.S. #1 Medium Grain Paddy, 58/69 yield #1 58/69 $550.00 per mt bulk ex-spout Sacramento CA

California - Package Quality

Package Rice for Industrial Use and Repackers #1/4% $37-$38 per cwt. bulk F.O.B. Mill

U.S. South Brokens:

Flour Quality brokens Flour Qlty $15.00 per cwt. bulk, F.O.B. rail

Pet Food Quality / #4 Brewers (milled) contracts M/A $13.50 per cwt. bulk, F.O.B. rail

U.S. California Brokens:

Flour Quality brokens Flour Qlty $19.00 per cwt. bulk, F.O.B. mill

Pet Food Quality / #4 Brewers contracts M/A $14.00 per cwt. bulk, F.O.B. mill

Copyright © 2011 Creed Rice. Co., Inc. All Rights reserved www.creedrice.com

May 11, 2011 - Page 1 of 4

Far East Report

SOUTHEAST ASIAN MARKETS season harvest, and Iraq on hold, and The Philippines yet

In Thailand, the market remains extremely to come to the table. In a word...Boring!

quiet, not because prices are not competitive

(they are), but due to the general lack of fresh Thailand Exports

demand offshore...or pent up demand as is the Jan. 1 - Apr. 27, 2011: 3,812,490 mt

case with The Philippines. Jan. 1 - Apr. 27, 2010: 2,610,203 mt

Jan. 1 - Apr. 27, 2009: 2,602,447 mt

Prices are mostly sideways with 100% B

Thai Baht 30.10-30.15 : 1 US Dollar

quoted at $500 per mt FOB Bangkok; 5% is $480

and parboil is $505. However, due to the lack of business,

today’s quoted levels are biddable. The exceptions are INDIA AND PAKISTAN

both white and fragrant brokens, and Hom Mali. In India, the big news in the market is

In the meantime, any new Iraq tender will the slight easing of the export ban in Andra

likely be delayed somewhat, account the injury Pradesh Province under certain conditions for a

suffered by the director of the grain board in the period of two months. The provisions allow paddy to be

roadside bombing reported in our issue last week. This exported on an interstate basis under monitored pricing.

seems to be the best prospect for volume business for And, that parboil rice has no restrictions and can be sold

white rice in the near future. There are some shipments offshore. This comes as no real surprise, as we have been

of white rice ongoing to West Africa, albeit slow, as is the anticipating a similar plan in previous reports of ours.

parboil market. This will not likely effect the global supply situation much,

Otherwise, the market is quiet and the undertone with the exception of putting some additional pressure on

steady to slightly softer. Thai parboil, which they are already feeling from Brazil.

In Vietnam, export activity has been pretty In Pakistan, it is most difficult to focus on the

healthy for the first third of 2011 with a total commercial sector with so much media coverage

of 2.5 MMT according to the Vinafood web on the political arena. However, we will do our

site...660,000 MT in April alone. The Agricultural best.

Ministry has projected that 2011 exports may reach as The market is quiet with stable but firm prices, as IRRI-

high as 7.4 MMT. This may prove to be a little bit of an 6 5% is quoted at $480-490 per mt FOB Karachi; 25% is

optimistic goal...we shall see. $440 and brokens are $390. Parboil is slightly higher than

Prices are steady to firm, with 5% quoted at $480 per Thai at $515-520.

mt FOB HCMC; whilst 25% is $445. The Viet prices are Export activity on coarse rice is mostly confined to

basically on par with Thai on the higher grades. core markets in the region along with the usual border

Otherwise, the market is quiet with Indonesia trade with Iran. Basmati is rather widely traded, and

now out of the market as they complete their main priced around $1300 FOB.

OFFSHORE QUOTES

Thailand Vietnam India Pakistan Uru. Arg. Brazil

100%B $500.00 5% $480.00 Export ban, MEP $900

5% $480.00 5% N/A 5% $480.00 $515.00 $515.00

10% $475.00 10% $475.00 10% N/A 10% no quote $505.00 $505.00

15% $470.00 15% $465.00 15% N/A 15% no quote no quote no quote

25% $455.00 25% $445.00 25% N/A 25% $440.00

Parb. 5% N/A Parb 5% $515.00 $480.00

Brokens $415.00 Brokens $415.00 Var. 1121 $1350 Parb 15%* $500.00 Brokens

Parb. 100B sorted $505.00 MEP-5% $490.00 Basmati Brokens $390.00 $385

Thai Hom Mali $930.00 MEP-25% $470.00 Traditional $1800 Basmati Paddy

Frag. Brokens $465.00 Pusa $1300 S. Kernal $1300.00 $300.00

All prices basis U.S. dollars per metric ton, F.O.B. vessel, corresponding home port *Bangladesh Specs.

Copyright © 2011 Creed Rice. Co., Inc. All Rights reserved www.creedrice.com

May 11, 2011 - Page 2 of 4

CBOT Rough Rice Futures (05/09/11 Volume: 969 Open Interest: 22,239)

Contract Tuesday’s Close Net Change From Prices

Month Price Monday Last Report One Year Ago 05/11/10

‘11 May $13.980 UP 0.035 DOWN 1.165 ‘10 May $11.690

‘11 Jul $14.170 UP 0.045 DOWN 1.220 ‘10 Jul $11.895

‘11 Sep $15.070 UP 0.065 DOWN 1.095 ‘10 Sep $11.420

‘11 Nov $15.390 UP 0.065 DOWN 1.060 ‘10 Nov $11.605

‘12 Jan $15.695 UP 0.065 DOWN 1.025 ‘11 Jan $11.900

‘12 Mar $16.015 UP 0.065 DOWN 0.980 ‘11 Mar $12.190

U.S. Paddy Market Report ideas are $12.00 per cwt.

Texas - Buyers’ bids are slightly higher this week ranging $5.75-$6.75 California - 2010 Calrose M/G is bid at $13.00 per cwt over loan

per cwt over loan depending on variety. We are beginning to see with last trades at $13.50-$13.75. 2011 new crop traded this week at

some firm offers at $7.00 per cwt over loan. New crop planting is $13.00 per cwt over loan.

almost completed.

Louisiana - Bids are unchanged again this week at $10.90 per cwt

Reflective Prices (all basis per cwt FOB country, 2010 Crop)

FOB farm. New crop planting in SW Louisiana is almost completed.

Texas Louisianna Mid-South California

Mid South - Floods continue to cause substantial problems. There Long grain $12.25-13.25 $10.90 $10.00b/11.00a *

has been a little planting in the last few day, but most of the flooded

Med Grain * 14.50 new crop $17.25 $20.55

areas will take some time to drain. This situation merits continuous

monitoring. The cash market is basically unchanged with bids for L/G is #2 55/70, M/G is #2 58/69 (California #1)

long grain at $11.00 per cwt loaded barge up-river while sellers’ price * - These areas do not have sufficient supplies of this type to quote.

U.S. Report basis bulk. The paddy market is completely dead account the

aforementioned conditions of the river, but for argument sake let’s

U.S. GULF, MERCOSUR, & FUTURES call the market bid/asked at levels that reflect $265/$285.

The Southern market remains very quiet as most of the focus is As regards futures, we witnessed a major correction highlighted

on the horrendous flooding in the heartland of America. Whereas, by a limit down session on Wednesday of last week. Overall, rice

the impact on the rice growers throughout this region has yet to contracts were down $1.00-1.20 for the week.

be determined, it is estimated that over $500 million worth of No real changes in the Mercosur markets as harvest is finished

damage has already been done to Arkansas Agriculture alone. We in most areas.

anticipate, given weather forecast for the next few weeks, that the Our crop estimates remain (basis paddy):

flooded farmland will slowly begin to subside in rice producing Brazil -- 13.4 MMT

areas in N.E. Ark. and the boot heel of MO. However, it is a case Argentina -- 1.7 MMT

by case situation, as obviously high areas will drain first and the Uruguay -- 1.5 MMT

growers in those areas will be reprieved first. Now, this is not

to lessen the overall scope of the disaster...as some officials have CALIFORNIA, AUSTRALIA & THE “MED”

compared this to the damage done by Hurricane Katrina. In short, The general state of the market is basically

will we lose some acreage?..absolutely yes. How much remains to unchanged as mills continue to ship against old

be seen, as there is still about a 3-4 week window of opportunity business to Korea, Japan, and Libya. Prices on both

to plant or replant. But, that is about it and yields will suffer to paddy and milled are basically steady.

some degree on the later rice. As the Mississippi River continues As regards new business, we understand an

to rise, and flood waters flow South, there are growing concerns additional 12,000 mt has been purchased in the local

about additional flooding in places like Baton Rouge and LSU, in market earmarked for Libya, and rumors about an

particular. However, the silver lining, if there is one, is that the additional 10,000 mt for new crop. We firmly believe Libya

Army Corp of Engineers are already planning on releasing water will be an importer of California rice for the next

into floodways by opening the Morganza spillway North of Baton marketing year, as we do not see the situation in

Rouge and the Bonnet Carre spillway near New Orleans (which Egypt changing with the ban.

would drain into Lake Pontchartrain). Elsewhere, in Australia, their crop (like in

There is practically nothing of essence to discuss in our rice Mercosur) is practically complete and our estimate

market in the Gulf, so I will not attempt to do so. is unchanged at 800,000 mt basis paddy.

For nominal purposes, we are finding quotes from vendors The undertone of the global market for Calrose remains

for #2-4% long grain around $515 per mt bagged FOB or $490 firm and the outlook for the next marketing year is bright.

Copyright © 2011 Creed Rice. Co., Inc. All Rights reserved www.creedrice.com

May 11, 2011 - Page 3 of 4

Upcoming Tenders: USDA Export Sales Highlights

(April 22 - 28, 2011)

May 17 KCCO Inv. 2000000147 tender to buy 1030mt of US

#5, max 20% Long Grain and 1030mt of US #5, max 20% Medium Sales

grain, for inland plant shipment June 6-20, June 21 - July 5 Net sales of 19,900 MT were down 49 percent from the previous

week and 70 percent from the prior 4-week average. Increases were

reported for:

May 26 AARQ TRQ tender Haiti (7,400 MT)

AARQ Association for the Administration of Rice Quotas, Inc. Mexico (5,700 MT)

NOTICE OF OPEN TENDER Saudi Arabia (2,500 MT)

Independent bids are invited for rights to ship U.S.-origin milled rice to the European Guinea-Conakry (1,100 MT)

Union under a tariff-rate quota (TRQ) granted by the EU to the United States. Equatorial Guinea (500 MT)

Bids must be submitted on May 26, 2011 for the July 2011 TRQ Tranche, in which the

following quantity is available:

Volume (metric tons) EU Duty Exports

Semi-Milled or Milled Rice 9,680 zero Exports of 59,900 MT were up 12 percent from the previous week,

(HTS item 1006.30)

but down 13 percent from the prior 4-week average. The primary

TRQ Certificates will be awarded to the highest bidder(s). Any person or entity incor- destinations were:

porated or domiciled in the United States is eligible to bid. The minimum bid quantity Mexico (21,700 MT)

is 18 metric tons. Performance security (the lesser of $50,000 or the total value of the Japan (14,400 MT)

bid) must be submitted with each bid. Potential bidders may obtain the required bid Saudi Arabia (9,200 MT)

forms and bid instructions from: Ghana (5,300 MT)

Jordan (2,100 MT)

AARQ Administrator

Economic Consulting Services, LLC Source: USDA

2001 L Street, NW, Suite 1000

Washington, D.C. 20036

Tel: (202) 466-1150 Fax: (202) 785-3330

Note: Potential bidders should consult regulations in the Official Journal of the Euro-

Upcoming Events:

pean Union to determine the applicable tariff rate on semi-milled/milled rice. AARQ June 7-9, 2011 TRT Americas Conference 2011

disclaims any responsibility for advising potential bidders on applicable tariff rates.

Potential bidders should also consult EC regulations relating to testing for unauthor- For more info go to: trtamericas.com

ized GMOs.

June 26-30, 2011 USA Rice Millers’ Association Convention

For more info go to: www.usarice.com

Tenders Results: Please note:

May 3 KCCO Inv. 2000000064 cancelled by KCCO due to a June 8 No Creed Rice Market Report to be issued account our atten-

change in program requirements. dance at the TRT Americas Conference.

June 29 No Creed Rice Market Report to be issued account our atten-

dance at the RMA convention.

USDA Crop Progress

Rice Planted - Selected States -- Week Ending Rice Emerged - Selected States -- Week Ending

May 8, May 1, May 8, 2006- 2010 May 8, May 1, May 8, 2006- 2010

State State

2010 2011 2011 Avg. 2010 2011 2011 Avg.

Arkansas 94 45 53 80 Arkansas 79 33 43 61

California 23 5 30 38 California 2 - - 9

Louisiana 95 94 96 93 Louisiana 88 81 93 83

Mississippi 87 71 77 84 Mississippi 72 53 67 68

Missouri 96 13 14 74 Missouri 70 5 10 50

Texas 95 92 93 94 Texas 69 78 79 84

6 States 83 49 57 76 6 States 67 37 45 57

Rice Co-Products - Spot market prices basis $ per short ton bulk, FOB mill (virtually no spot supply available for sale in South, except hulls)

Texas Louisiana Arkansas California

Bran: $110-$115 $105 Not Available ($110) $140-$150

Mill Feed: $45 $35 Not Available ($40)

Ground Hulls: $5 $5 $15

Unground Hulls: $5 $5 $12 $8

Creed Rice Co. Inc. 800 Wilcrest Suite 200 Houston, Texas 77042 USA

Ph 1.713.782.3260 Fax 1.713.782.4671 www.creedrice.com email: ricecreed@aol.com & creedinc@swbell.net

Brokers • Consultants • Market Reports • Arbitrators

Copyright © 2011 Creed Rice. Co., Inc. All Rights reserved www.creedrice.com

May 11, 2011 - Page 4 of 4

Você também pode gostar

- Creed Market ReportDocumento4 páginasCreed Market ReportnsopheaAinda não há avaliações

- Creed Rice Market Report.Documento4 páginasCreed Rice Market Report.nsopheaAinda não há avaliações

- Creed Market ReportDocumento4 páginasCreed Market ReportangkorriceAinda não há avaliações

- PricesDocumento2 páginasPricessoftbreezeAinda não há avaliações

- Container and Substrate Production of Raspberries HansonDocumento20 páginasContainer and Substrate Production of Raspberries HansonYana SamirAinda não há avaliações

- Requirements & TermsDocumento4 páginasRequirements & TermsmasariieAinda não há avaliações

- 9 1 10 SpecialsDocumento1 página9 1 10 SpecialsTalcove ExoticwoodsAinda não há avaliações

- Mou CustomerDocumento9 páginasMou Customerdovi deasyAinda não há avaliações

- Regan's Product HandbookDocumento131 páginasRegan's Product Handbookjomz100% (7)

- Shelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Documento1 páginaShelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Brittany EtheridgeAinda não há avaliações

- Master Stonefruit Programme 2020Documento1 páginaMaster Stonefruit Programme 2020foreverourgodAinda não há avaliações

- Master Strawberry Programme 2020Documento1 páginaMaster Strawberry Programme 2020foreverourgodAinda não há avaliações

- Major Decline in Onion Plantation: Required WTD Natural WTD Optimal ScenarioDocumento1 páginaMajor Decline in Onion Plantation: Required WTD Natural WTD Optimal ScenarioGengjiaqi CHANGAinda não há avaliações

- Container EMHU634152 StocktonDocumento1 páginaContainer EMHU634152 StocktonSusan Diggs HibdonAinda não há avaliações

- Vist Our Yard at 5637 Davidson Road, Just Off Motherlode DRDocumento1 páginaVist Our Yard at 5637 Davidson Road, Just Off Motherlode DRrrr44Ainda não há avaliações

- Fob, F, Elf: Green Coffee C ContractDocumento6 páginasFob, F, Elf: Green Coffee C ContractcoffeepathAinda não há avaliações

- Rice Data SheetDocumento6 páginasRice Data SheetDandapani Sivakumar SharmaAinda não há avaliações

- Starview Farms Order Form 2020 Meghan Cook May 2020Documento1 páginaStarview Farms Order Form 2020 Meghan Cook May 2020Meghan CookAinda não há avaliações

- Product Details Macadamia Nuts: SpecificationsDocumento10 páginasProduct Details Macadamia Nuts: SpecificationsJess keramaAinda não há avaliações

- Covington Informacion 2Documento3 páginasCovington Informacion 2jlarreluceAinda não há avaliações

- Cmu170420 3Documento4 páginasCmu170420 3jenAinda não há avaliações

- The Economics of Small-Scale Indoor Mushroom Cultivation: Stephen RussellDocumento20 páginasThe Economics of Small-Scale Indoor Mushroom Cultivation: Stephen RussellEmir KarabegovićAinda não há avaliações

- Korean Natural Farming Recipe1Documento9 páginasKorean Natural Farming Recipe1Anonymous KWgCUokT100% (1)

- New FOB Price Anesta LLC 1621151439Documento1 páginaNew FOB Price Anesta LLC 1621151439Ankit AgarwalAinda não há avaliações

- GC 08-18 A8 AgribusinessDocumento1 páginaGC 08-18 A8 AgribusinessNikki MaxwellAinda não há avaliações

- Updates For Genomic GiantDocumento8 páginasUpdates For Genomic GiantHolstein PlazaAinda não há avaliações

- Real Price IndexDocumento3 páginasReal Price IndexAsif IqbalAinda não há avaliações

- April Monthly Retail 2023Documento6 páginasApril Monthly Retail 2023swogtfAinda não há avaliações

- Rice Preferences, Price Margins and Constraints of Rice Value Chain Actors in Nueva Ecija, PhilippinesDocumento47 páginasRice Preferences, Price Margins and Constraints of Rice Value Chain Actors in Nueva Ecija, Philippinesirri_social_sciences100% (2)

- Wholesale Price List: Item No. Gluten-Free MixesDocumento6 páginasWholesale Price List: Item No. Gluten-Free MixesnoniAinda não há avaliações

- Split-Top Roubo WorkbenchDocumento29 páginasSplit-Top Roubo WorkbenchamelieAinda não há avaliações

- Composite Fish Farming - 8870851Documento5 páginasComposite Fish Farming - 8870851Telugu kabbilli SirishaAinda não há avaliações

- Also Available TodayDocumento1 páginaAlso Available TodayJm2345234029Ainda não há avaliações

- Weekly Cattle Market Update: For The Week Ending May 1, 2020Documento4 páginasWeekly Cattle Market Update: For The Week Ending May 1, 2020jenAinda não há avaliações

- Pasture Sowing Costs: OperationsDocumento4 páginasPasture Sowing Costs: Operationsapi-25932006Ainda não há avaliações

- Harvest Shepherd's Pie With Whipped Sweet PotatoDocumento3 páginasHarvest Shepherd's Pie With Whipped Sweet PotatoVALERIE JOY CATUDIOAinda não há avaliações

- Crops PDFDocumento12 páginasCrops PDFUsama JavedAinda não há avaliações

- Таблица огородDocumento18 páginasТаблица огородMarunaAinda não há avaliações

- FiberMax & Stoneville - 2013 Georgia Cotton Variety GuideDocumento2 páginasFiberMax & Stoneville - 2013 Georgia Cotton Variety GuideFiberMax & Stoneville CottonAinda não há avaliações

- Erguvan Olive Oil Price ListDocumento1 páginaErguvan Olive Oil Price ListEMS Metalworking MachineryAinda não há avaliações

- Aico MM LABORATORYDocumento2 páginasAico MM LABORATORYWinwin CahindeAinda não há avaliações

- Proforma 1 PolloDocumento1 páginaProforma 1 PolloJhonathan075Ainda não há avaliações

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocumento1 páginaNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeAinda não há avaliações

- Presentation 1Documento2 páginasPresentation 1api-644492588Ainda não há avaliações

- Giant Eagle Dec. 2Documento3 páginasGiant Eagle Dec. 2SistersShoppingAinda não há avaliações

- ProduceDocumento2 páginasProduceapi-239040842Ainda não há avaliações

- 10 - Cost-Analysis - 2 0Documento13 páginas10 - Cost-Analysis - 2 0J-red MondejarAinda não há avaliações

- PEANUT MARKETING NEWS - November 13, 2020 - Tyron Spearman, EditorDocumento1 páginaPEANUT MARKETING NEWS - November 13, 2020 - Tyron Spearman, EditorMorgan IngramAinda não há avaliações

- State Minimum Cigarette PricingDocumento12 páginasState Minimum Cigarette Pricingebenezer GubeAinda não há avaliações

- Planet Holstein Sale Updates2013Documento5 páginasPlanet Holstein Sale Updates2013Holstein PlazaAinda não há avaliações

- Prairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideNo EverandPrairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideAinda não há avaliações

- Hemp Hurds as Paper-Making Material United States Department of Agriculture, Bulletin No. 404No EverandHemp Hurds as Paper-Making Material United States Department of Agriculture, Bulletin No. 404Ainda não há avaliações

- Persuasive Writing Exam - Muhamad Saiful Azhar Bin SabriDocumento3 páginasPersuasive Writing Exam - Muhamad Saiful Azhar Bin SabriSaiful AzharAinda não há avaliações

- Shes Gotta Have It EssayDocumento4 páginasShes Gotta Have It EssayTimothy LeeAinda não há avaliações

- Travel Insurance CertificateDocumento9 páginasTravel Insurance CertificateMillat PhotoAinda não há avaliações

- Warnord 041600zmar19Documento4 páginasWarnord 041600zmar19rjaranilloAinda não há avaliações

- Cultural Materialism and Behavior Analysis: An Introduction To HarrisDocumento11 páginasCultural Materialism and Behavior Analysis: An Introduction To HarrisgabiripeAinda não há avaliações

- S No Clause No. Existing Clause/ Description Issues Raised Reply of NHAI Pre-Bid Queries Related To Schedules & DCADocumento10 páginasS No Clause No. Existing Clause/ Description Issues Raised Reply of NHAI Pre-Bid Queries Related To Schedules & DCAarorathevipulAinda não há avaliações

- 10 Types of Innovation (Updated)Documento4 páginas10 Types of Innovation (Updated)Nur AprinaAinda não há avaliações

- Fare Matrix: "No Face Mask, No Ride" "Two Passengers Only"Documento4 páginasFare Matrix: "No Face Mask, No Ride" "Two Passengers Only"Joshua G NacarioAinda não há avaliações

- Invoice: Page 1 of 2Documento2 páginasInvoice: Page 1 of 2Gergo JuhaszAinda não há avaliações

- Binder PI T4 Weber July 2017Documento63 páginasBinder PI T4 Weber July 2017Nilesh GaikwadAinda não há avaliações

- Oracle Fusion Global Human Resources Payroll Costing GuideDocumento90 páginasOracle Fusion Global Human Resources Payroll Costing GuideoracleappshrmsAinda não há avaliações

- Chapter 11 Accounting PrinciplesDocumento45 páginasChapter 11 Accounting PrinciplesElaine Dondoyano100% (1)

- "Underdevelopment in Cambodia," by Khieu SamphanDocumento28 páginas"Underdevelopment in Cambodia," by Khieu Samphanrpmackey3334100% (4)

- Case Study - Royal Bank of Canada, 2013 - Suitable For Solution Using Internal Factor Evaluation Analyis PDFDocumento7 páginasCase Study - Royal Bank of Canada, 2013 - Suitable For Solution Using Internal Factor Evaluation Analyis PDFFaizan SiddiqueAinda não há avaliações

- 8299 PDF EngDocumento45 páginas8299 PDF Engandrea carolina suarez munevarAinda não há avaliações

- Senior High School: Rules of Debit and CreditDocumento19 páginasSenior High School: Rules of Debit and CreditIva Milli Ayson50% (2)

- Sample TRF For Master TeacherDocumento10 páginasSample TRF For Master TeacherBernard TerrayoAinda não há avaliações

- E Commerce AssignmentDocumento40 páginasE Commerce AssignmentHaseeb Khan100% (3)

- RamadanDocumento12 páginasRamadanMishkat MohsinAinda não há avaliações

- Top 10 Division Interview Questions and AnswersDocumento16 páginasTop 10 Division Interview Questions and AnswersyawjonhsAinda não há avaliações

- CPFContributionRatesTable 1jan2022Documento5 páginasCPFContributionRatesTable 1jan2022ysam90Ainda não há avaliações

- SLP Application For Withdrawal of Case From Supreme Court On SettlementDocumento2 páginasSLP Application For Withdrawal of Case From Supreme Court On SettlementharryAinda não há avaliações

- BPI Lesson 1 - Surveys & Investigation PDFDocumento60 páginasBPI Lesson 1 - Surveys & Investigation PDFMayAinda não há avaliações

- ACR Format Assisstant and ClerkDocumento3 páginasACR Format Assisstant and ClerkJalil badnasebAinda não há avaliações

- Climate Change (B Ok - CC)Documento481 páginasClimate Change (B Ok - CC)Rashid LatiefAinda não há avaliações

- GS Mains PYQ Compilation 2013-19Documento159 páginasGS Mains PYQ Compilation 2013-19Xman ManAinda não há avaliações

- SCRIPT IRFANsDocumento2 páginasSCRIPT IRFANsMUHAMMAD IRFAN BIN AZMAN MoeAinda não há avaliações

- Cebu BRT Feasibility StudyDocumento35 páginasCebu BRT Feasibility StudyCebuDailyNews100% (3)

- PS2082 VleDocumento82 páginasPS2082 Vlebillymambo0% (1)

- HIMYM Episode 4 Season 1Documento29 páginasHIMYM Episode 4 Season 1ZayAinda não há avaliações