Escolar Documentos

Profissional Documentos

Cultura Documentos

Tata Home Finance Ltd. (A Comprehensive Case Study On MIS)

Enviado por

amitnaskarDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Tata Home Finance Ltd. (A Comprehensive Case Study On MIS)

Enviado por

amitnaskarDireitos autorais:

Formatos disponíveis

CASE STUDY 1

TATA HOME FINANCE LTD. (A Comprehensive Case Study on MIS)

KEY CONCEPTS

Enterprise approach to MIS. Organisation structuring principles. Life cycle model of system development. Modeling of different views of business. Business analysis and strategy. MIS goal supporting business goal. MIS strategy supporting business strategy. User driven information system. Shift to just-in-time information. Integration of business rules in the system. Use of business growth cycle. MIS focus on decision-making, access and availability of information. MIS focus on critical success factors and mission critical applications. Choice of technology and architecture to suit business operations and business management. Meeting needs of statutory information, decision support information and just-in-time information simultaneously. Business knowledge, rules and policies, process knowledge readily available on database.

CASE INDEX

1. Introduction 2. Business Infrastructure 3. Business

* Information stated here is true at a point of time when collected for presenting as live case for analysis and understanding of a business scenario. The contents would undergo change as the time goes by. The purpose is to use the case as a learning medium and the author has no intention to commercial or give suggestion on the companys business operations. Author is grateful to the management of Tata Home Finance (THF) for giving information to build this case.

Management Information Systems

4. THF organisation : THF Enterprise Model : THF Business Model 5. Current System and Technology 6. MIS Reports Currently in use 7. Guidelines for Customer 8. Key Features, Rules and Control Points 9. Processing a Loan Proposal 10. Moving THF to Information Driven Organisation 10.1 Business Analysis and Strategy 10.2 Effectiveness of Business Strategies 10.3 Information Management Strategy (IMS) 10.4 Information System Architecture Models THF Business Function Architecture Relation Model Core Business Model 10.5 Technology Platform for IMS Strategy 10.6 Application Systems Architecture 11. Management Information System: A Model

1. INTRODUCTION

Tata Home Finance Ltd. (THF) is located at Shivajinagar, Pune-411 004, India. THF was established in the year 1999 to serve the home market need of funds for buying a new house or to improve the existing house. In addition to head ofce in Pune, THF has branches at Mumbai, New Delhi, Bangalore, Ahmedabad, Hyderabad and Chennai. THFs well-trained personnel assist the customer in offering a Total Home Solution that is right from funding to helping the customer to build a dream home. The personnel are trained to answer all kinds of questions, doubts across the table. The total funds disbursed since inception are Rs.500 million against the total number of over 1000 accounts. Total Employee strength is a little over hundred today and is planned to grow to 200 in next two or three years. THF right now is in home nance products business but has plans to diversify into other products and services in Insurance, Deposits, Credit Cards, Mutual Funds, Customer Durables, and Property Advisory Services. It is estimated the total housing shortage in urban Indian is to the tune of 6.6 millions. The housing nance market is Rs. 250 million and is expected to grow at 10 to 12% per annum. Because of Government initiatives on a number of fronts such as modication of rent control act, increase in the interest exemption to Rs. 150000, 40% tax depreciation on housing investments by corporate and many more; the market for housing is expected grow at the rate of 30% annually.

Tata Home Finance Ltd.

THF therefore feels strongly that there is perceptible shift towards formal funding sources and THF could be an additional player in the Home Finance Market. The competitors of THF are HDFC, ICICI, LIC housing, and all banks. These organisation are already established and they enjoy brand image and loyalty from their existing customers. The present Home Finance Market is a buyers market, therefore the competition is well placed in this market and THF has a challenge to become successful in a short duration. The challenge is accepted on the strategy of leveraging on TATA strong brand equity reecting Trust, Stability, and Integrity, the values home owner respects most. The business in % by product is given in Table 1.1. The Mission Statement of THF is To be the rst choice in fullling the needs for a home, by providing nancial and other value added services through personalised and world class service at competitive rates.

Table 1.1 Product and Percentage of Business

Percentage of business 90 2 2 6

Product name Individual home loans Home improvements/Extension Loan against home LOC thru corporate loans Land nance (Plot) Project nance Loan take-over IHL undertaken by CO with DAS Step up/Down repayment plan Loan against lease rentals All products

100

2. BUSINESS INFRASTRUCTURE

The business infrastructure is small today but is planned to grow rapidly in next one year. The Infrastructure Business Model is given in Fig. 1.1. The infrastructure scope is so determined that customer can get all services at single window for building a dream home. The structure is designed to reach anybody any where also caters to all kinds of customers, namely Corporates, Group Housing, Family and Individuals, who wish to go for Housing Complex, Apartments, Flats, Plots and bungalows. THF has its own infrastructure of alliances and partners working in building and construction industry to meet multi dimensional needs of the customers, spreads across the society.

3. BUSINESS

THF, besides offering initial services to build condence in the customer, has several innovative products carefully built for all types and kinds of customers. The products currently offered and their business in percentage is given in Table 1.1.

Management Information Systems

Head Office

Regional Offices

Branch Offices Direct Sales Agency (DSA)

Builder

Franchisee

Network of Organisation, Interior Designers, Furniture Makers, etc.

Fig. 1.1 Business Infrastructure

The business is obtained through several channels. Each branch deals with Walk-in customers and helps them to run through a process of request for loan, starting from Assessment, Requirement, Application submitting, Sizing and Costing, Technical and Legal guidance, Facilitation, Processing and Disbursement. Next important business sourcing is through Builders and Real Estate Developers through Project Tie-ups. The personal approach to customers is through DSAs. DSA visits prospects and solicits business. The corporate business is brought through Sales Manager who interacts with CEO and MD of the organisation. The break up of business by channels is shown in Table 1.2.

Table 1.2 Breakup of Business by Channels

Channels Branch Builders DSAs Sales Mangers Total Percentage of business 80 5 15 100

4. THE ORGANISATION

THF Enterprise Model

THF organisation structure is at, built over ve levels (Figs 1.2 and 1.3). The structuring principles are single window service concept, Dual approval, segregation of competencies, select jobs multi-skilled. The formal communication channels are

Tata Home Finance Ltd.

Board Managing Director

COO

Ex. VP

CMO Marketing

GM Control and Compliance

GM Credit Collections

GM Legal and CS GM HR

NM A/C

GM Resources

Fig. 1.2 THF Enterprise Model

Board

Legal Commercial Oficer

Customer Relations Officer

Tech Officer

Tech Officer Sales Officer(S)

A/Cs Officer

Fixed Deposit Officer

Collection Officer

Fig. 1.3 A Typical Branch Model

Branch to Region to Head ofce. Functional reporting as per levels within the branch and dual reporting to Regional and Head ofce functionaries.

THF Business Model

THF Business model is based on ve business functions, namely Resourcing of Funds, Marketing and Sales, Legal and Commercials, Finance and Accounting and Services. THF Business Model is shown in Fig. 1.4.

5. CURRENT SYSTEMS AND TECHNOLOGY

The Current Uses

Business software Loan Management Solution (LMS) for Front End Loan Management operation

THF Business Functions

Management Information Systems

Resouring of Funds Accounting Services

Marketing and Sales Credit Management

Legal and Corporate Affairs Contracting and Documentation HR MIS Systems and IT Credit Appraisal Risk Assessment and Management

Control and Compliance

Capital market

Relation Management

Control and Compliance

Bank Loans Value Added Services Administration

Enquiring and processing

Document Validations and Verifications Settlements

Compliance Requirement Provisions Collection

NHB Refinance

Technical and Other Servises

Finance Management

Promotions and Advertising

Fig. 1.4 THF Business Model

Tata Home Finance Ltd.

Accounting Software: Tally for Financial Accounting An Integrated Software for Loan Management and Accounting with interface to back end Financial Accounting Software THF has realised the need of a better system to overcome the problems faced due to current software application systems. Besides non availability of on-line real time information for operations and decision making, following difculties are encountered in the information management. Open separate set of books for each branch. Make accounting entries separately for each branch. Consolidate manually the accounts for each branch and then at head ofce. To overcome these problems the information management strategy is evolved. It has components. ERP Systems. For centralised accounting for branches and head ofce. Loan Management System. Front End Customer Interaction System. For handling queries, assisting customers in proposal building, proposal Application Processing and decision making. As a step towards implementation of this strategy, THF evaluated number of ERP packages most suited for Finance/management industry and have signed for ORACLE-Financials. It is also working with a local software company to build integrated loan management system for front end interaction and back end integration with provision to go on web a year later.

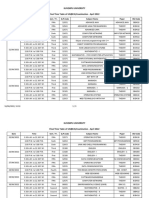

6. MIS REPORTS CURRENTLY IN USE

Since THF has started operations very recently the management feels that MIS needs improvement for effective business operations achieve customer satisfaction. The current list of MIS reports is shown in Table 1.3. THF generates 11 reports through present MIS. The 11 reports can be classied in the following category.

7. GUIDELINES FOR CUSTOEMR

THF Offers Loan for Following Purposes

Buy a new house/Flat (Under construction or ready possession) Buy an existing well maintained house/at Construct a house on a plot of land Home improvement Loan Purchase of Plot

Management Information Systems

Table 1.3

No. Report 1.

MIS Reports

Frequency Daily Orgainator and Responsibility Branch Accounts Ofcer Branch Accounts ofcer Branch Manager Recipient Central Accounts Contents Purpose Accounting entry Accounting entiry

Disbursement Details Pay-in-Slip

2.

Daily

3. 4.

Section Report Every day

Rolling Weekly Every Friday Branch Manager Disbursement Weekly Corporate on DSA Weekly report on DSA 10 Day Performance Expenses Statement Every Monday Every Monday Every 10th 15 days Branch Manager

5.

6. 7. 8.

Branch Manager Branch Manager Branch Accounts Ofcer AO, Central Acounts AO,Central Accounts Branch Manager

9.

10 Day Perfornance 10. Monthly Financial 11. Monthly Delinquency Report

Every 11th Day On 5th day of month First Working day of month

Details of disbursements made during a day Central Accounts Details of bank depositions at branch CMO Business of Branch for the day Central Resources Disbursement Dept. forcast of next year CMO Status on delinquent cases CMP Perfornance of operations CMO Overall review of operations Central Accounts Expenses incurred by the branch in cash Sr. Vice Presidents Performance of the Company Sr. Vice Presidents Financial Data for the month and YTD Central Collection Status on Department delinquent cases

Assess performance Funding arrangements Deciding course of action on delinquent cases Assess performance Perfornnce Reporting to Board Accounting entry and cash imprest replenishment Reporting to the Sr. Manag ement Reporting to the Board Deciding courses of action on delinquent cases

THF gives general guidelines through a brochure to the prospect in Question-Answer form. A prospect interaction begins with this brochure and discussion an additional queries is handled on front desk. The guidelines not only answer FAQs but state business rules and policies to be used in application processing. The few typical rules as illustration are as mentioned. Applicant age should be greater than 21 years. Maximum loan possible Rs.10 million. Maximum loan amount is 85% of cost of property.

Tata Home Finance Ltd.

Maximum repayment period is 15 years but not extending beyond age 65. Loan against home is 50% of market value of the property. And other. For all categories of product offers, THF has prepared checklists to ensure, ascertain and conrm number of key aspects fo the proposal. The checklists are part of the new proposed MIS. This ensures impersonal scrutiny, objective assessment, no processing error and no human error in viewing and decision making. Following is the list of FAQs for variety of products offered by THF.

HOME LOAN Can I apply a home loan from Tata Home Finance?

Yes, you can. If you are at least 21 years of age and are employed or self employed with a regular income. You can apply for a home loan even before you have identied your home.

Can I have a co-applicant?

You can include your spouse/parents/brother/sister as co-applicant. We will be glad to include his/her income in enhancing your loan amount (provided the co-applicant meets certain conditions). You can even have your nance/nance as a co-applicant.

How much loan can I get?

The loan amount you are eligible for will be based on your repayment capacity. This can then help you decide the budget for your home. You can get a loan from Rs. 10,000 up to a maximum of Rs. 10 million. Your loan amount will depend upon your repayment capacity, as mutually determined by you and Tata Home Finance (subject to a maximum of 85% of the cost of property). In case you wish to construct a house on a plot of land, the loan amount could go up to 100% of the cost of construction.

What will be the repayment period for my loan?

We give you an option to select your term of loan. Depending on you convenience, you can decide the number of years you want to take to repay your loan. The maximum repayment period is 15 years and should not extend beyond your retirement age of 65 years if you are self employed, which is even earlier.

Can I repay the loan ahead of schedule?

Yes, you have the option of prepaying the loan either in part or in full.

What is the security for the loan?

The primary security for the home loan shall be rst mortgage of the home being purchased/constructed. It is in your interest to ensure that the title of the house is clear, marketable and free from encumbrances. Further co-lateral security by way of providing guarantee of individual guarantor acceptable to Tata Home Finance and/or assignment of Life Insurance policy on a case to case basis.

Management Information Systems

How will my home loan get disbursed?

Once you accept the sanction letter, your home loan will be disbursed on the basis of the following. Selection of the property. Submission of legal and property documents as acceptable to THF. Payments of your own contribution. The loan amount will be disbursed in full or in installments depending on the progress of construction.

HOME EXTENSION LOAN How does a home extension loan from Tata Home Finance help me?

A home extension loan is just one of the means by which your dream of extending your existing home can come true. You can use it for the following. Add a room. Have an additional or bigger bathroom/toilet. Construct an extra room on the terrace.

How much loan I get?

You can get a loan from Rs.10,000 up to a maximum of Rs. 1 Crore. Your loan amount will depend on you repayment capacity, as mutually determined by you and Tata Homenance (subject to a maximum of 85 per cent of the cost of extension). In certain cases, we would nance even 100 per cent of the extension cost.

What will be repayment period for my loan?

The maximum repayment period is 15 years and should not extend beyond your retirement age or 65 years if you are self employed which ever is earlier.

How will the home extension loan get disbursed?

Once you accept the sanction letter, your home extension loan will be disbursed on meeting the following. Submission of legal and property documents. Investment of your own contribution The loan amount will be disbursed in full or in installments depending on the progress of the extension work. Other vital details for the Home Extension Loan like the co-applicant, repayment of the loan and security for the loan are same as the Home Loan from Tata Homenance.

How does a home improvement loan from Tata Home Finance help me?

A home improvement loan is just one of the means by which your dream of adding life and value to your existing home can come true. You can use if for:

Tata Home Finance Ltd.

Internal and External repairs Tiling and ooring Roong Grills and aluminium windows Bore-well Paving of compound wall.

Internal and external painting Water proong on terrace Plumbing Enclosing an open balcony Construction of water tank

How much loan can I get?

You can get a loan from Rs. 10,000 up to a maximum of Rs. 20 Lakhs. Your loan amount will depend on your repayment capacity, as mutually determined by you and Tata Homenance (subject to a maximum of 70% of the cost of improvement.) In certain cases, we could nance even 10% of the improvement cost.

What will be the repayment period for may loan?

The maximum repayment period is 8 years and should not extend beyond your retirement age or 65 years if you are self employed, which ever is earlier.

How will the home improvement loan get disbursed?

Once you accept the sanction letter, your home extension loan will be disbursed on meeting the following. Submission of legal and property documents Investment of your own contribution The loan amount will be disbursed in full or in installments depending on the progress of the improvement work. Other vital details for the Home Improvement Loan like the co-applicant, repayment, pre-payment of the loan and security for the loan are same as the Home Loan from Tata Homenance.

LOAN AGAINST HOME How does a loan against home from Tata Home Finance help me?

A loan against home is just one of the means by which you can encash your investment in your existing home without having to dispose it off. You can use the loan amount for different purposes for instance, to: Finance higher studies of your children. Meet the wedding expenses of your daughter. Invest in business. Even to buy a second home. The loan amount can be used for any purpose, other than speculative or illegal purpose.

Management Information Systems

How much loan can I get?

You can get a loan from Rs. 10000 up to a maximum of Rs. 1 crore. Your loan amount will depend on your repayment capacity, as mutually determined by you and Tata Homenance (subject to a maximum of 50% of the market value of property, as evaluated by our valuer).

What will be the repayment period for my loan?

The maximum repayment period is 8 years and should not extend beyond you retirement age or 65 days if you are self-employed, which ever is earlier.

How will the home extension loan get disbursed?

Once you accept the sanction letter, your loan against home will be disbursed on meeting the following. Submission of legal and property documents. Investment of your own contribution. The loan amount will be disbursed in full or in installments depending on the progress of the extension work. Other vital details for the Loan Against Home like the co-applicant, repayment, pre-payment of he loan and security for the loan are same as the Home Loan from Tata Homenance.

What documents will I require while applying for the loan?

The following list of documents will be needed while applying for a loan. Residence and age proof, which can be established from the Ration Card, Birth Certicate, School Leaving Certicate, Election ID, PAN Card, Drivers License or Passport (any one). For salaried individuals: Latest salary slip Form 16 from the employer For salaried individuals: Certied copies of Balance Sheet and Prot and Loss account, Income Tax Returns acknowledgements, Advance Tax challans (for both company/rm and personal account) for the last three years. Memorandum/Articles of Association for companies/partnership deed for rms and a brief prole or your company/rm.

For Home Improvement loan and home extension loan

Detailed cost estimate of the extension from your Architect Engineer/Interior Designer.

What will be the rate of interest?

For the latest interest rates, please refer to the enclosed rate card.

Tata Home Finance Ltd.

What are the fees applicable?

For the applicable fees, please refer to the enclosed rate card.

How do I repay the loan?

Repayment of your loan will be in equated monthly installments (EMIs) which will commence from the month following full and nal disbursement. The EMIs are payable every month and will be collected in the form of post dated cheques or directly deducted from your salary by your employer. In case of part disbursal of the loan, a pre-EMI interest is payable till the full and nal disbursal is made.

8. KEY FEATURES, RULES AND CONTROL POINTS

Home Loan

Loan Application Eligibility Loan Amount limit Loan Amount (Flat) Loan Amount for plot of land for home construction Security against loan 21 years 85% of cost of property Rs. 10000 to Rs. 1000000 Maximum 100% of cost of construction Maximum 15 years not exceeding 65 yeas of age First mortgage against home with conditions or Individual guarantor or Assignment of Life Policy Selection and submission of legal and property documents and Initial payment of your own contribution Payment of processing fees Payment of administrative charges

Loan disbursement

Home Extension Loan

Loan application eligibility Loan amount possibility Loan amount (Flat) Loan amount for plot of land for home construction 21 years 85% of cost of property Rs. 10,000 to Rs. 10,000,000 Maximum 100% of cost of production

Management Information Systems

Security against loan Security against loan

Loan disbursement

Maximum 15 years not exceeding of age 65 years First mortgage against home with conditions or Individual guarantor or Assignment of Life Policy Selection and submission of legal and property documents and Initial payment of your own contribution Payment of processing fees Payment of administrative charges

Home Improvement Loan

Loan application eligibility Loan amount possibility Loan amount (Flat) Security against loan Security against loan 21 years 70% of cost of improvement Rs. 10,000 to Rs. 2,00,000 Maximum 15 years not exceeding of age 65 years First mortgage against home with conditions or Individual guarantor or Assignment of Life Policy Selection and submission of legal and property documents and Initial payment of your own contribution Payment of processing fees Payment of administrative charges

Loan disbursement

Loan Against Home

Loan application eligibility Loan amount possibility Loan amount (Flat) Loan amount for plot of land for home construction Security against loan 21 years 85% of cost of property Rs. 10,000 to Rs. 10,00,000 Maximum 100% of cost of production Maximum 15 years not exceeding 65 years of age

Tata Home Finance Ltd.

Security against loan

Loan disbursement

First mortgage against home with conditions or Individual guarantor or Assignment of Life Policy Selection and submission of legal and property documents and Initial payment of your own contribution Payment of processing fees Payment of administrative charges

Support Documents to Loan Application

List of Documents Residence and Proof of Age, Latest Salary Slip, Form 16 from the Employer, Certied copies of Balance Sheet and P & L Account, IT returns and acknowledgement, Advance Tax Challans, Memorandum and Articles of Association. Detailed Cost Estimate from Architect/Engineer, etc.

Repayment Choices

Post dated cheques Deduction from salary

9. MOVING THF TO INFORMATION DRIVEN ORGANISATION

The management of THF has taken a bold step to modernise the business processes in line with the mission statement and with the objective of cutting cost of business operations and maximising the gains to shareholders. THF approached the problem systematically using Life Cycle Model of system development and using the increment model of development.

9.1

Business Analysis and Strategy

THF faces competition from established organisation such as HDFC, ICICI, LIC Housing and some leading banks. Since, all players are attacking the same market segments; the prospective customer can be win over only through creation of broad image of a trusted fund provider with the difference. The Strategy is to attract the prospects to THF by providing broad band of services at competitive rates. THF is now riding the growth phase in Sigmoid or S curve after just coming out from the phase of Introduction. It would therefore need business strategies that will accelerate the pace of growth in next year or two. To build business strategy for rapid growth THF has focused on customer and customer services that would bring rapid growth and attain a position of strength in the Home nance market. The strategy is built on the following four factors.

Management Information Systems

Products to meet most sought requirements of customer Cost benet ratio attractive to the customer. Service excellence through effective response. Total solution assistance to build a dream home. THF has 11 different home nance products meeting the needs of individuals, groups and corporates for new home, home improvements, plots and bungalow. The products are so designed that they can be customised to specic requirements of the customer. The product design is such that if information is complete and correct, the funds can be sanctioned and disbursed in less than 48 hours. THF product and service strategy is such, that the benets the customer gets are signicant compared to cost of loan servicing. The strategy is backed by wide range of techno-commercial information support for quick and better decision making. THF has taken care for providing excellent service across all stages of home nance servicing. It has a information rich web site giving information on products, facilities and answers to frequently asked questions. It has a four tier organisation infrastructure where customer can nd a service provider of his choice. The service and interaction is possible through web site, direct sales agents (DSA), branch ofces, regional ofces, builder partners, franchisees and will snit network or reputed manufactures, traders, specialists and consultants in home making industry. This kind of support base creates condence and comfort in the mind of customer to come under the umbrella of THF. All this support provides reach, knowledge, funds and assistance at every stage of home building. The fourth strategy is to provide total solution to the customer, through offer of funds at the least cost, technical and legal assistance to complete the home fast, beyond home construction and offer services through THF partners at attractive discounts to make a beautiful home. THF has now competed strategy build up and they are operative in most of the regions of the country.

9.2

Effectiveness of Business Strategies

All the four strategies and critical resource management, that is funds, empowered, people, products, Business partners, systems and solutions. While THF has good resource management skills, it is necessary to manage them cost effectively to achieve dual objective of performance excellence and highest customer satisfaction. This is possible through continuous monitoring and mending of strategies and evaluating the business performance against these strategies; THF recognises that this can be achieved through information support to customer as well as to THF personnel at any level, when needed anywhere. THF therefore has gone into detail requirement study of information needs required to manage the following Customer servicing Customer performance monitoring THF performance evaluation Cost control; Finance and operations Credit appraisal Risk assessment

Tata Home Finance Ltd.

Adherence to service standards, evaluation and monitoring Proposal processing: entry to disbursement to collection and recovery THF has identied following business processes as mission critical applications. Loan application processing system Credit risk appraisal system Customer relations management system Funds management system All other functional systems such as Accounting, HR, Purchase etc. are important but do not have direct impact on the business of THF. All such systems will be either integrated or interfaced with mainly the business system mentioned above through suitable system architecture.

9.3

Information Management Strategy (IMS)

Provide access to information from anywhere any time. Customer access to the proposal for status monitoring and tracking. Near Paperless transaction processing to cut and control cost of customer servicing through reduction in processing time, overheads defaulters and bad debts. Do additional business to the tune of 30% within same manpower through quick decisions and better control on cost and performance, resource. Create a business management database/data warehouse that is useful to customer, DSAs, Sales Managers and Marketing Managers. Besides real time on line systems develop data mining application for strategic management of business.

Objective

Scope of New System

The scope covers broad band of systems and applications with emphasis on the following. Customer Interaction Customer Relations Resource Management Marketing and Sales Product Design and evaluation Credit appraisal and Risk Assessment Proposal Processing Building Support and dedicated database for designing innovative products Accounting and Finance Management Customer Servicing Strategic Management E-training and Learning

Management Information Systems

9.4

Information System Architecture

THF Business Function Systems Architecture

The Business System Architecture required for business strategy implementation is given in Fig. 1.5. It has main functions namely Customer Relations MGT Disbursement Management Loan Management System Marketing and Sales Resource Management Training

Relationship Model

The business model is executed through relations management between major partners in home nancing business. THF considers home nancing as a people to people business where trust, integrity and service are held in high esteem. Relationship Model is shown in Fig. 1.6. The core business functions model is given in Fig. 1.7. This business functions is fundamental of THF business operation.

9.5 Technology Platform for IMS Strategy

Keeping in view the dynamic nature of business and need of satisfying the requirement of information at any time and anywhere, THF has chosen following technology platform. Operating system platform: NT 4.0 Unix Network: Internet/Internal/Extranet/LAN Application Technology: Client/Server, Web Enabled applications. Application Solution: Oracle 8 i, Oracle Financials, Oracle Applications-11 i. Front End: VB, IIS 4.0 Back End: Database server, Application server, Microsoft transaction server, web server Security: Firewall servers and Proxy server

9.6

Application System Architecture

Four-pronged business strategy is supported by state of the art technology based information Management solution. the solution is designed for THF enterprise as a business solution supporting information needs for Operations management, Business Management and Strategic Management of Resource and Product. The solution is designed for supporting the following. Continuous Innovative Product Management. Fastest Service delivery.

Tata Home Finance Ltd.

The Business Function System Architecture

Customer Relation Management Customer Interaction, Proposal Building Loan Application Process Property Appraisal

Disbursement Management

Loan Management System Emi Collection System Monitoring and Default Handling Loan Disbursement System Debt Management System

Marketing and Sales Product Development

Documentation Systems for Contract Document Verification and Validity Checking Business Rules Condition and Constraints Approvals and Recommendation Contract Implementation

Sales and Advertisement Sales Force Management Business Partners Management Marketing Operations

Credit and Risk Appraisal

Decision, Funds and Emi

Recovery Through Legal System

Training Relation Management Resources Management Investment Portfolio Management Fixed Deposits Management Forecasting of Disbursement, Collection and Recovery Relation Management Investor Banker Tata Finance Funding Agencies Customer Partners Agencies; Bankers, Investments Communication E-learning Basics of Finance, Banking, Commerce Statutory Compliance THF Product Credit Appraisal Risk Appraisal

Fig. 1.5 Business Functions System Architecture

Management Information Systems

Resource Managements

Funds Management

Bankers Investors Funding Agencies FD Holders

Funds Disbursement Mnagement Front Officer DSA SM Dream Home Service Management Loan Translation Management Finance and Accounts Support Service Management Franchisee Builders Home Service Providing Consultant Individuals Corporates Groups

Fig. 1.6 Relationship Model

The MKT and Sales Proposal Decision Funds Management

Solicit Business to Business Customer Submits Proposal Disburse Funds Resources Funds Repays Funds Repays Funds THF Finance Accounts Credit

Fig. 1.7

Business Function Model

Cost control, Collection and Recovery Measures, and Resource Management. The solution is expected to build THF towards First choice of customer for all home nance requirements and offer value added services. World class services provider at competitive rates. The solution is made of 17 different applications systems, comprising ERP system, Legacy systems; Groupware Applications, CRM and data warehousing systems. Figure 1.9 shows application systems architecture Each applications is designed with following characteristic. No data redundancy. Business policy, rules and guidelines embedded in the application. Layered approval systems with technology application of work group and work ow.

Tata Home Finance Ltd.

Web Server Nt 4.0 Iis

Database Server Unix Oracle 8i

Corporate Application Server Oracle 8i Financials

Legacy Systems Server HR Payrolls

Firewall Server Internet The Intranet Lan

Local ISP

1 Mbps Leased Line

Proxy Server

Clients Regions

Clients Branches

Clients Builders

Clients Business Partners

Clients Dsa

Fig. 1.8 Technology Solution Architecture

Access to information processing to meet just in time need of decision making. Capable of information processing analysis and decision making as a support for all personnel across the organisation.

10. Management Information System (MIS)

With full implementation of this application system architecture, present MIS will be undergoing a sea change. Besides normal status reporting it will provide following additional reports for managers operating at various levels. 1. Project Status Report 2. Rejected Loan Applications

Management Information Systems

Customer Relations Management System

Credit Approval System Loan Proposal Processing and Approval System Techno-commercial Evaluation Legal Verification System Debt Management System Risk Assessment System Collection System Disbursement System Marketing Sales Product Management System

Resource Management System

Finance and Accounts System

DBMS HR Payroll Procurement Builders Architects &

Home Interior Providers

Data Warehouse / Data Mart / Data Mining Applications for Strategic Management of Resource Products, Market, Customers Past/present

Fig. 1.9 Application System Architecture

3. Turn Around Time Report 4. Demographic Details Report 5. Renance Claim Report 6. Rural Housing Loans Disbursed 7. Repayment Reports New MIS will strengthen decision making and is expected to improve management of the following.

Tata Home Finance Ltd.

Resource Risk Recovery This will also enable effective control on the following Cost Credit Customer choice All this will result into a truly world class service company offering a basket of products through single window creating a THF brand loyalty conrming trust, stability and integrity in Tata Home Finance.

Questions

1. Examine whether new MIS will succeed in giving the following to THF: (a) Competitive advantage (b) Better customer relations (c) Control on nancial resource 2. Prepare a reporting format for following reports stated in Table 1.3. (a) 10- day performance report (b) Monthly delinquency report (c) Expense statement 3. Study Business Function Systems Architecture (Fig. 1.5) and Technology Solution Architecture (Fig 1.8) and explain to what extent following objectives will be achieved and why? (a) Faster service delivery (b) Better control on collection & recovery 4. Identify from Business Functions Systems Architecture, Critical Information Systems which have strategic importance and offers competitive advantage to THF. Explain why the systems are critical? 5. Which are the DSSs in the THF system suite? Which decisions these systems are empowered to take? 6. You have learnt about CRM package and know its scope, standard features and modular structure. Compare THF Customer Relation Management Scope with this identify the gaps, if any. Suggest a conceptual model of CRM for THF. 7. What is e-learning solution catering to HR of THF? What is the advantage of e-learning process? 8. THF Data Warehouse (DWH) is an information repository. Identify DWH information entities and sources from where they will be pulled in DWH. 9. Explain the use of rewall and proxy servers in THF information system solution? What security threats THF is perceiving and from which sources? 10. Suggest ten standard queries in following areas of business function:

Management Information Systems

(a) Loan Proposals. (b) Recovery Status. (c) Default Customers. (d) Customer by THF Products. (e) Customers by Loan Amount Disbursed. (f) Customers Demographics and Segments. 11. THF has a website tata home nance with standard website features, like home page, products, services, ready reconers for EMI computations for varying loan amount and period, highlights about nancial status of THF; Members of the THF board and News. THF wants to improve the utility of this site by offering information support on various aspects of home before and after the construction. Suggest which new web pages and links should be added so that customer nds THF website a single window source of information.

Você também pode gostar

- MALC: Case Study: Product RangeDocumento6 páginasMALC: Case Study: Product RangeRitesh Kumar Tripathi100% (1)

- The Adventure Works Cycles: What Are The Business Problems?Documento13 páginasThe Adventure Works Cycles: What Are The Business Problems?Cristian MarteAinda não há avaliações

- Unilever TodayDocumento34 páginasUnilever TodayEmee Haque50% (2)

- MIS Meaning, Defin, Role, ScopeDocumento9 páginasMIS Meaning, Defin, Role, ScopejjeamnAinda não há avaliações

- Ancillarisation in IndiaDocumento14 páginasAncillarisation in IndiaSravani Raju100% (2)

- Total Quality Management at HDFC BankDocumento24 páginasTotal Quality Management at HDFC BankGarima GuptaAinda não há avaliações

- Chapter 8 Enterprise Business SystemsDocumento45 páginasChapter 8 Enterprise Business SystemsSaba KhalilAinda não há avaliações

- Pre-Delinquency Management (PDM) Solution: - Aniket Rane Neha SinghDocumento16 páginasPre-Delinquency Management (PDM) Solution: - Aniket Rane Neha SinghAniket RaneAinda não há avaliações

- Executive Summary: Analysis of Marketing Opportunities For WebtelDocumento39 páginasExecutive Summary: Analysis of Marketing Opportunities For WebtelHarish KumarAinda não há avaliações

- HR Workflows in TOPdeskDocumento2 páginasHR Workflows in TOPdeskTOPdesk0% (1)

- TriniChain Case Study v2019 Wo Ex PDFDocumento6 páginasTriniChain Case Study v2019 Wo Ex PDFRodrigo PadovanAinda não há avaliações

- PFA 3e 2021 SM CH 01 - Accounting in BusinessDocumento57 páginasPFA 3e 2021 SM CH 01 - Accounting in Businesscalista sAinda não há avaliações

- MBAAR AssignmentDocumento43 páginasMBAAR Assignmentkidszalor1412100% (3)

- Financial PlanningDocumento21 páginasFinancial Planninga r karnalkarAinda não há avaliações

- Question 1: Strategic Business Objectives of Information Systems. Although Many Managers Are Familiar With TheDocumento2 páginasQuestion 1: Strategic Business Objectives of Information Systems. Although Many Managers Are Familiar With TheDedar HossainAinda não há avaliações

- Group AssignmentDocumento9 páginasGroup AssignmentArnobAinda não há avaliações

- Management Information System (Mis) : 1. Technical ApproachDocumento4 páginasManagement Information System (Mis) : 1. Technical ApproachPrashanth BnAinda não há avaliações

- 1 Need of RestructuringDocumento29 páginas1 Need of RestructuringtiwariaradAinda não há avaliações

- Small and Medium EnterprisesDocumento9 páginasSmall and Medium EnterprisesGaurav KumarAinda não há avaliações

- Chapter 7Documento25 páginasChapter 7shortyno1Ainda não há avaliações

- Ist P1Documento3 páginasIst P1Naiyara Neeha100% (1)

- Red Hat GlobalDocumento14 páginasRed Hat GlobalChester Connolly100% (1)

- FPSB's Strategic PlanDocumento4 páginasFPSB's Strategic PlanAbhishek PradhanAinda não há avaliações

- Reputation Management A Complete Guide - 2020 EditionNo EverandReputation Management A Complete Guide - 2020 EditionAinda não há avaliações

- Evaluation of Bank Lending and Credit Management With Reference To HDFC Bank by MathewsDocumento73 páginasEvaluation of Bank Lending and Credit Management With Reference To HDFC Bank by MathewspmanojaswinAinda não há avaliações

- Prof Richard Heeks - Implementing and Managing EGovernment - An International Text-Sage Publications LTD (2005) - 227-250Documento24 páginasProf Richard Heeks - Implementing and Managing EGovernment - An International Text-Sage Publications LTD (2005) - 227-250aisyah azahrahAinda não há avaliações

- Organising and Planning For LSCM FunctionsDocumento13 páginasOrganising and Planning For LSCM FunctionsAnab ZaishaAinda não há avaliações

- <!DOCTYPE HTML PUBLIC "-//W3C//DTD HTML 4.01 Transitional//EN" "http://www.w3.org/TR/html4/loose.dtd"> <HTML><HEAD><META HTTP-EQUIV="Content-Type" CONTENT="text/html; charset=iso-8859-1"> <TITLE>ERROR: The requested URL could not be retrieved</TITLE> <STYLE type="text/css"><!--BODY{background-color:#ffffff;font-family:verdana,sans-serif}PRE{font-family:sans-serif}--></STYLE> </HEAD><BODY> <H1>ERROR</H1> <H2>The requested URL could not be retrieved</H2> <HR noshade size="1px"> <P> While trying to process the request: <PRE> TEXT http://www.scribd.com/titlecleaner?title=Slyb+4th+sem.docx HTTP/1.1 Host: www.scribd.com Proxy-Connection: keep-alive Accept: */* Origin: http://www.scribd.com X-CSRF-Token: 98d61cd1c2a3ddfc02003b181cbec6dec1015a70 User-Agent: Mozilla/5.0 (Windows NT 6.1; WOW64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/27.0.1453.94 Safari/537.36 X-Requested-With: XMLHttpRequest Referer: http://www.scribd.com/upload-document?archive_doc=23353812&metadatDocumento3 páginas<!DOCTYPE HTML PUBLIC "-//W3C//DTD HTML 4.01 Transitional//EN" "http://www.w3.org/TR/html4/loose.dtd"> <HTML><HEAD><META HTTP-EQUIV="Content-Type" CONTENT="text/html; charset=iso-8859-1"> <TITLE>ERROR: The requested URL could not be retrieved</TITLE> <STYLE type="text/css"><!--BODY{background-color:#ffffff;font-family:verdana,sans-serif}PRE{font-family:sans-serif}--></STYLE> </HEAD><BODY> <H1>ERROR</H1> <H2>The requested URL could not be retrieved</H2> <HR noshade size="1px"> <P> While trying to process the request: <PRE> TEXT http://www.scribd.com/titlecleaner?title=Slyb+4th+sem.docx HTTP/1.1 Host: www.scribd.com Proxy-Connection: keep-alive Accept: */* Origin: http://www.scribd.com X-CSRF-Token: 98d61cd1c2a3ddfc02003b181cbec6dec1015a70 User-Agent: Mozilla/5.0 (Windows NT 6.1; WOW64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/27.0.1453.94 Safari/537.36 X-Requested-With: XMLHttpRequest Referer: http://www.scribd.com/upload-document?archive_doc=23353812&metadatAshish KhannaAinda não há avaliações

- Management Information SystemDocumento3 páginasManagement Information SystemAmar NathAinda não há avaliações

- MBAAR Assignment 1Documento13 páginasMBAAR Assignment 1MạnhThắngAinda não há avaliações

- Mis AssgmntDocumento7 páginasMis AssgmntRaziya SultanaAinda não há avaliações

- Basic Introduction of IT The Use of Technology: Integration of Stake HoldersDocumento14 páginasBasic Introduction of IT The Use of Technology: Integration of Stake HoldersFasih FerozeAinda não há avaliações

- International Business, AssignmentDocumento16 páginasInternational Business, Assignmentمحمد شاميم100% (1)

- RR CommunicationsDocumento19 páginasRR CommunicationsMeghanaThummala100% (1)

- V3 Service Operation: Finbarr Callan Lecturer, Best PracticeDocumento60 páginasV3 Service Operation: Finbarr Callan Lecturer, Best PracticeUsman Hamid100% (1)

- Digital Banking Strategy Roadmap: March 24, 2015Documento30 páginasDigital Banking Strategy Roadmap: March 24, 2015goranksAinda não há avaliações

- The Presentation Is About Corporate Governance of SQUARE - Remodified NewDocumento19 páginasThe Presentation Is About Corporate Governance of SQUARE - Remodified NewShelveyElmoDiasAinda não há avaliações

- Case Study (2) - Active Sports - Cost BehaviorDocumento6 páginasCase Study (2) - Active Sports - Cost BehaviorbilelAinda não há avaliações

- The Four Walls: Live Like the Wind, Free, Without HindrancesNo EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesNota: 5 de 5 estrelas5/5 (1)

- PEST Analysis of Bank1Documento4 páginasPEST Analysis of Bank1Vibhav Upadhyay100% (1)

- Section2-Internal Organisational EnvironmentDocumento12 páginasSection2-Internal Organisational EnvironmentAnasha Éttienne-TaylorAinda não há avaliações

- Beximco Pharma BDDocumento15 páginasBeximco Pharma BDTowsif Noor JameeAinda não há avaliações

- Bus 360 Final Project 2014Documento15 páginasBus 360 Final Project 2014api-267941857Ainda não há avaliações

- Primary Role of Company AuditorDocumento5 páginasPrimary Role of Company AuditorAshutosh GoelAinda não há avaliações

- ERP@ Hero HondaDocumento4 páginasERP@ Hero HondavishwesheswaranAinda não há avaliações

- Introduction To Financial ManagementDocumento46 páginasIntroduction To Financial ManagementChethan KumarAinda não há avaliações

- Global Environment 5Documento26 páginasGlobal Environment 5Manjesh KumarAinda não há avaliações

- 4 6032630305691534636 PDFDocumento254 páginas4 6032630305691534636 PDFDennisAinda não há avaliações

- Lecture 4-IS410D-Understanding IT Value Delivery in OrganizationsDocumento19 páginasLecture 4-IS410D-Understanding IT Value Delivery in OrganizationsAmel KsibiAinda não há avaliações

- Parle Products PVTDocumento13 páginasParle Products PVTrathod30Ainda não há avaliações

- Gtu Theory QuestionsDocumento4 páginasGtu Theory QuestionsbhfunAinda não há avaliações

- SCM TQM and Six SigmaDocumento15 páginasSCM TQM and Six SigmaKarthika SasikumarAinda não há avaliações

- Case Study: Selecting A Trade BankerDocumento5 páginasCase Study: Selecting A Trade BankerMohit SahajpalAinda não há avaliações

- Memorandum 2Documento4 páginasMemorandum 2Catie MaasAinda não há avaliações

- Daniel Rossi CVDocumento2 páginasDaniel Rossi CVglimgloAinda não há avaliações

- ch2 PDFDocumento24 páginasch2 PDFVignesh RajaramAinda não há avaliações

- Retail Facilities Maintenance: the Circle of Management: A 30-Year Experience Management NarrativeNo EverandRetail Facilities Maintenance: the Circle of Management: A 30-Year Experience Management NarrativeAinda não há avaliações

- Week 6 - Assessment and DesignDocumento42 páginasWeek 6 - Assessment and DesignamitnaskarAinda não há avaliações

- Erp Tata SteelDocumento17 páginasErp Tata SteelamitnaskarAinda não há avaliações

- FMEA Risk ManagementDocumento64 páginasFMEA Risk ManagementAbhishek Singh TomarAinda não há avaliações

- Modular Production SystemDocumento2 páginasModular Production SystemamitnaskarAinda não há avaliações

- Kuvempu University Final Time Table of UG (BCA) Examination - April 2022Documento5 páginasKuvempu University Final Time Table of UG (BCA) Examination - April 2022Noorulla AddoAinda não há avaliações

- Independent University, Bangladesh (IUB) Internship Report: "Wedding Management System"Documento63 páginasIndependent University, Bangladesh (IUB) Internship Report: "Wedding Management System"Dipanker SarkerAinda não há avaliações

- Cloud Services For SAP Ariba SolutionsDocumento24 páginasCloud Services For SAP Ariba SolutionsLucas DutraAinda não há avaliações

- Ac412 Auditing in A Computerised Environment: Group Presentation QuestionsDocumento9 páginasAc412 Auditing in A Computerised Environment: Group Presentation QuestionsTawanda Tatenda HerbertAinda não há avaliações

- Chapter 2 Hands-On MIS Application Problem Statement: Excel Tutorials LinksDocumento2 páginasChapter 2 Hands-On MIS Application Problem Statement: Excel Tutorials LinksAdoree RamosAinda não há avaliações

- RDBMS ProjectDocumento4 páginasRDBMS Projectsonu_nabha100% (1)

- EPICS: Engineering Projects in Community ServiceDocumento12 páginasEPICS: Engineering Projects in Community ServiceArpan MajumdarAinda não há avaliações

- New Approaches in Assessing Food Intake in Epidemiology: ReviewDocumento9 páginasNew Approaches in Assessing Food Intake in Epidemiology: ReviewMaría Camila Ferreira ZambranoAinda não há avaliações

- Equipment Failure Model and Data For Substation TransformersDocumento54 páginasEquipment Failure Model and Data For Substation TransformersAgustin A.100% (1)

- Activity Diagram For Freelance Market PlaceDocumento2 páginasActivity Diagram For Freelance Market PlaceNatpro CoolAinda não há avaliações

- Sample DB ProjectDocumento17 páginasSample DB ProjectZerihun BekeleAinda não há avaliações

- Online Electronic ShoppingDocumento71 páginasOnline Electronic ShoppingSuraj Dubey100% (1)

- Getting Started SIPLACE Explorer3.11 - ENDocumento112 páginasGetting Started SIPLACE Explorer3.11 - ENVladyslav KorchanAinda não há avaliações

- PNP MC No 2022-049 - Revised Guidelines and Procedures in The Implementation of The National Police Clearance System NpcsDocumento18 páginasPNP MC No 2022-049 - Revised Guidelines and Procedures in The Implementation of The National Police Clearance System NpcsLyn DomingoAinda não há avaliações

- Graph Databases For Dummies PDFDocumento51 páginasGraph Databases For Dummies PDFIvan Arenas Meza100% (1)

- Unit 4: Database Management SystemDocumento104 páginasUnit 4: Database Management SystemPoojitha ReddyAinda não há avaliações

- README ZoneminderDocumento43 páginasREADME Zonemindermariner411Ainda não há avaliações

- PHP ApisDocumento72 páginasPHP Apisjohnatan17Ainda não há avaliações

- b1 Crystal Data SheetDocumento4 páginasb1 Crystal Data SheetBoris HernandezAinda não há avaliações

- Oracle Corporation - 10KDocumento131 páginasOracle Corporation - 10KRolando KuznetsovAinda não há avaliações

- Certifier 7.3 ReferenceGuideDocumento154 páginasCertifier 7.3 ReferenceGuide彭仕安Ainda não há avaliações

- Vxflex Data SheetDocumento5 páginasVxflex Data SheetJesus SantiagoAinda não há avaliações

- Microsoft Access 2016 - Stewart MelartDocumento74 páginasMicrosoft Access 2016 - Stewart Melartmaidanez_ro324150% (2)

- LHR Q6 Capex Review - Final Report - 261113Documento103 páginasLHR Q6 Capex Review - Final Report - 261113AlejandroPoloLlanaAinda não há avaliações

- Mainframe Cost Optimization For DB2 For zOS Document PDFDocumento14 páginasMainframe Cost Optimization For DB2 For zOS Document PDFGabriel DAinda não há avaliações

- Oracle GoldenGate Pocket Reference-NSMDocumento4 páginasOracle GoldenGate Pocket Reference-NSMdineshnanidba100% (1)

- Tina Tandon: Soft Skills Profile SummaryDocumento1 páginaTina Tandon: Soft Skills Profile SummaryAnkit Grace ChandraAinda não há avaliações

- Real World Web: Performance & ScalabilityDocumento189 páginasReal World Web: Performance & ScalabilityOleksiy Kovyrin100% (26)

- What-S New in MicroStrategy 9.2.1 - Transaction Services Beta1 PDFDocumento19 páginasWhat-S New in MicroStrategy 9.2.1 - Transaction Services Beta1 PDFALTernativoAinda não há avaliações

- Portal: A Dataspace Retrieval - Rob SwigartDocumento315 páginasPortal: A Dataspace Retrieval - Rob SwigartrobotbuddhaAinda não há avaliações