Escolar Documentos

Profissional Documentos

Cultura Documentos

Cornell Research Report On Enron 1998

Enviado por

John Aldridge ChewDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Cornell Research Report On Enron 1998

Enviado por

John Aldridge ChewDireitos autorais:

Formatos disponíveis

Disclaimer

The following report is prepared by students at Cornell University's Johnson Graduate School of Management and is intended solely to serve as an example of student analytical work performed at the School. It is based on information available to the public and does not purport to be a complete statement of all data relevant to the securities mentioned. This report is not intended to provide investment advice of any description including but not limited to, recommendations or offers to buy or sell the securities mentioned. Neither the Parker Center, the Johnson Graduate School of Management, Cornell University, nor its faculty, staff or students make any warranties either express or implied as to the accuracy or utility of the information profiled and assume no risk or liability for its use. The authors and parties affiliated with them may, from time to time, hold a position in, and buy and sell the securities or derivatives thereof, of companies mentioned herein.

Enron Corporation

Enron Corporation

May 5, 1998 NYSE: ENE Recommendation: SELL Price Target: 42 Current Price: 52 week High and Low: Market Capitalization: Average Trading Volume: Book Value per Share: Price/Book: Debt/Equity: Fiscal Year End: $48 51.50 - 35.00 15,561M 1,096,240 $17.65 $2.35 1.38 December 31 1997 EPS 1998 (E) EPS 1999 (E) EPS P/E (1997 Earnings) P/E (1998 Earnings) P/E (1999 Earnings) (E) Dividend Per Share Beta 1.82 2.04 2.42 21.34 23.73 20.03 0.95 0.53 Partho Ghosh Lori Harris Jay Krueger Juan Ocampo Erik Simpson Jay Vaidhyanathan

Business Summary Enron Corporation (NYSE: ENE) is the largest integrated natural gas company in the world. The company is engaged in the exploration, production and transportation of natural gas and crude oil; marketing of electricity; and the development and operation of power plants, pipelines and other energy related assets. For the Fiscal year ended 12/97, total revenues rose 53% to $20.27B. Net income available to Common fell 85% to $15M. Performance Summary Enron Corp. Energy Peer Group DJIA S & P 500 YTD 1998 YTD 1998 YTD 1998 YTD 1998 Rate of Return Rate of Return Rate of Return Rate of Return 27.5% 7.53% 14.2% 14.59%

Recommendation Highlights Within a nine-month horizon, we would sell ENE based on a lack of upside potential near term.[He who hesitates is a damned fool. "- Mae West (1892-1980)] However, on a long-term horizon, we maintain a neutral view. ["You got to be careful if you don't know where you're going, because you might not get there. " - Yogi Berra] We maintain a target price, near term, of $42; ENE currently trades in the $48 range. Our conclusions are premised on the conservatism of our assumptions regarding two variables central to Enron's up-beat management perspective: the actual probability of turning US electricity deregulation and international power projects into tangible cash. In addition, our analysis has found that Enron takes more marginal risk than its competitors, in part to set up a high fixed cost platform for anticipated new markets internationally and in electricity, without a corresponding return to balance the risk. This is risky. Time will tell if it's prudent. Some central assumptions backing our valuation model EPS growth of 15% until 2005 and the assumed steady state inflation rate of 3.5% thereafter We deployed three different types of valuation models as a cross-reference against each other: EBO, Trading Comps and DCF Recognizing the different bundles of risk contained in the financial services and physical energy portion of Enron's business portfolio, we used comparable multiples of investment banks and clean energy companies

Enron Corporation

Table of Contents

1 Business and Industry Analysis 1.1 Who is Enron? 1.2 Industry and Market Analysis 1.3 Competitive Analysis 1.4 Business Analysis Accounting Analysis 2.1 Review of Main Accounting Policies 2.2 Beneish Model for Detecting Earnings Manipulation Financial Analysis 3.1 Ratio Analysis 3.2 Cash Flow Analysis Valuation 4.1 Cost of Equity 4.2 Weighted Average Cost of Capital 4.3 Discounted Cash Flow Analysis 4.4 Edwards-Bell-Ohlsen (EBO) Analysis 4.5 Comparable Multiple Valuation 3 3 5 6 10 11 11 12 13 13 15 17 17 17 18 19 21

Appendix 1 Discounted Cash Flow Valuation Appendix 2 Comparable Company Valuation

Enron Corporation

1

1.1

Business and Industry Analysis

Who is Enron?

The Company

Enron Corporation (NYSE: ENE) is the largest integrated natural gas company in the world. The company is engaged in the exploration, production and transportation of natural gas and crude oil; marketing of electricity; and the development and operation of power plants, pipelines and other energy related assets. For the Fiscal year ended 12/97, total revenues rose 53% to $20.27B. Net income available to Common fell 85% to $15M. Results reflect the 7/97 acquisition of Portland General Electric. Net income is also offset by $675M of restructuring charges. As shown in Chart 1, in the last 12 months Enrons shares have reached a high of $51.50 and a low of $35.00. Chart 1: Share Price History

Current Market Activity

There has been much recent activity in the retail energy markets due to deregulation and pending deregulation. It has yet to be determined if Enron's investments in the retail energy market will provide enough benefit from a first mover advantage to justify their current level of capital investment. Furthermore, as of April 22, 1998, Enron's CEO disclosed that Enron plans to scale back the full pursuit of the deregulating retail electricity markets, casting doubt on the projected returns of present commitments. However, we believe this pause on the pursuit of the retail power markets is temporary and once the state of deregulation is lucid, the retail market will be aggressively pursued. While this pause may affect Enron's first mover status in many markets, we applaud Enron for its awareness that the retail power markets will not be profitable initially.

Enron Corporation

The Money Business

Enrons Trade and Capital (ECT) business segment is a leader in the areas of financing and risk management. What has driven this business is the creation of ECT as a new hybrid natural gas and financial services firm in 1991 building a financial settlement contract business. This event consummated the merger between two existing entities, Enron Gas Services (EGS) and Enron Finance Corporation. The new entity specializes in managing risk rather than taking on risk. Enron financially engineers contracts which allows players in the market to buy and sell risk for longer periods of time. Most significantly, this gas bank hedges its exposure so that Enron itself takes little or no price risk. ECT has contributed 88.9% of total revenues and 28.6% of operating income for the year ending 12/97.

Winning Points for Innovation

The Enron business model is based on innovation, constant change, and capitalization on unique businesses and their competitive advantage within the energy industry. In recognition of their continuous commitment to originality, Enron was nominated as the Most Innovative Company by Fortune Magazine for the years 1996, 1997 and 1998 due to their many developments in the energy sector. Enrons ECT Group capitalizes on their expertise in the energy markets to create financial products for industrial financing and risk management. ECT is responsible for executing the first natural gas swap in 1989 as well as creating first-of-its-kind financing vehicles for independent oil and gas producers (VPP, EGS Cactus Fund, and EnVestor). Enron also originates exotic natural gas derivatives such as: quantity options, index-linked gas supply contracts, caps/floors, and bundled physical and financial energy contracts. In addition, Enron uses state-of-the-art at risk management techniques for natural gas, decomposing and managing fundamental exposures in the following areas: natural gas price book (risk of receiving fixed prices), basis book (risk price at one location will differ from another), index book (risk of not having availability of physical commodity), and Omnicrom book (risk of not having capacity in pipelines).

The Old Guard

The Oil and Gas segment of the Enron menage is the cash cow. Because we have already invested in the required capital expenditures in the creation of the second largest pipeline system in the world, this unit generates consistent net cash for clearly defined customer segments. This is the low margin, high volume business which balances the risks in the high-margin, low-volume businesses (e.g. the financial settlement contracts).

Extending the Scope-International

Enron is a pioneer in penetrating emerging markets before other Western countries. For example, its Bombay power project was the first and largest of its kind since the Indian government opened up the Indian markets to foreign investors, for the first time since Independence in 1947. An examination of the financial statements conveys that the international investments are not yet returning net cash to the business; however, by mastering the finer points of bureaucratic maneuvering in third world countries, Enron has built in a barrier of entry which provides it with a first mover advantage. If these markets, the fastest growing markets for energy in the world, come even close to projections, the cash flow will significantly impact Enrons income statement in the near future. Management believes this will be within five years. However, for the moment, the international business is a net user rather than producer of cash.

Enron Corporation

A Note on the Valuation

The first point to embrace in analyzing Enron is that they are a hybrid company, with many business units. It is therefore very difficult to get a sense of their competitive field. In a sense, the valuation of the company is difficult because it compares to evaluating a venture capital business due to such factors as their large infrastructure, long term gains on businesses, and their capital investing activities. The second key to Enrons business is that they are constantly changing the game, by changing the businesses that they are in which they operate. They create innovative business ideas and use this expertise as a competitive advantage. For example, Enron expanded into the finance business by turning their suppliers into customers through capital lending during the 1980s when it was difficult to secure loans from banks.

1.2

Industry and Market Analysis

A Few Facts About the Energy Industry (From the US Energy Information Administration)

U.S. energy consumption will increase 27% from 1996 to 2020. U.S. gas consumption will increase 46% from 1996 to 2020. Gas-fired power generation will grow to 33% of all US power generation. Worldwide energy demand will increase 50% over the next 20 years. Worldwide demand for electricity will increase by 75% from 1995 to 2015. As the gas and electric utility industries change and adapt to new regulations and new markets, we expect other companies to merge or join forces.

Threat of New Entrants into Market

In the oil and gas industry, Enrons competitive position could be threatened by the possibility of mergers and expansion of its competitors, who would then gain economies of scale through larger market coverage. In the trading and capital business, some competitors have recently opened trading floors within their operations. However, the services that Enron offers are innovative in supplying customers with products that help them to finance ventures as well as products to hedge their risks. The combined services that Enron offers is unique to the industry and the risk hedging business may benefit from the financing services. In the retail industry Enron is the new entrant into the market and as such will encounter competition and pricing wars in many situations.

Substitute & Threat of New Substitutes

In the oil and gas industry, Enron is well positioned as it is the largest global marketer in Natural Gas. It also has substantial interests in petroleum, hydroelectricity, nuclear energy, and wind and solar power.

Enron Corporation

Threats from new substitutes in the capital and trade industry are possible since other firms could begin to offer the financing services that Enron offers to firms. In addition, many firms presently offer the trading capabilities that Enron offers so that their customers may also hedge their energy prices.

Buyers & Bargaining Power of Buyers

In the retail markets, Government regulation will help to secure Enrons position in existing markets. Government deregulation of retail markets places Enron in a position of open competition with its competitors. Enron must competitively position itself in markets located in deregulated states and begin to expand its influence in states that are moving toward deregulation. As a result of the deregulation, Enrons margins will decline thus putting pressure on them to expand in order to gain market size, exposure, and power through economies of scale. Large industry buyers in retail markets may have increased bargaining power in the event of countrywide deregulation. The buyers in the oil and gas industry control the prices due to the commodity like nature of the product. The trade and capital services that Enron offers puts them in a power position with their customers. In many cases, Enrons financing group uses the trading group to support the customer, building off of ECT. The trading group further expands its business presence by offering Enrons knowledge and experience in energy markets.

Suppliers and Bargaining Power of Suppliers

The most important supplier for Enron is the independent oil and gas extractor, like Zilka Energy and Forest Oil. These firms supply the hydrocarbons which Enron transports, markets and hedges. Enron has increased its bargaining power over independent oil and gas extractors. It has done this by transforming them from mere suppliers to customers as well. In 1990 Enron developed the Volumetric Production Pament (VPP) vehicle for lending capital to cash-strapped independent producers. These VPPs were financed through securitization of the VPP notes with institutional investors. The VPP arrangement was a means of 'vertical integration on-the-cheap': in case of bankruptcy Enron owned the hydrocarbons in the ground, otherwise the price it would pay was predetermined. By the end of 1993, Enron originated more than $1billion in VPP contracts with independent oil and gas extractors.

1.3

Competitive Analysis

Across the nation and the globe, many retail energy consumers are on the threshold of being able, for the first time, to purchase gas and electricity from competitive energy providers and not exclusively from their local utility companies. Some electricity customers, and many natural gas customers, already have begun to choose unregulated

Enron Corporation

suppliers. Among the most aggressive and capable companies that will be vying for position during the deregulation era are the following companies: Florida Power and Light, Duke Energy, The Coastal Corporation, Enron, and Pacific Gas and Electric. Among the aforementioned group of the most well capitalized gas and electricity providers, Enron has a distinct competitive advantage on the global stage. Hence the following summaries detail the competitive stage for the national and global market. In addition to competition within the energy peer group, Enron competes on a project finance basis with Chase Manhattan Bank and Merrill Lynch. Therefore, we include the formerly mentioned investment banks in the qualitative analysis.

Florida Power & Light

With a size of $11.32 Billion market capitalization and $797 Million of capital expenditures for 1997, FPL is Enrons toughest competition for the Northeast power market. In early 1998, FPL Group formed a new subsidiary, FPL Energy, to manage more effectively its growing interests in electricity markets outside Florida Power & Light Company's service area. This new entity has a strong portfolio of clean fuel generation resources and a significant focus in the highly populated Northeast power market. FPL Group's strategy is to continue building an organization that will be successful in the future, in either regulated or unregulated power markets. Implementation of the growth strategy has involved strengthening the operations of the principal business, Florida Power & Light Company, while using core strengths to pursue growth opportunities in markets outside the state of Florida. In forming FPL Energy, the FPL Group took an important step to support its strategy. FPL Energy merges the domestic independent power business, formerly operated under FPL Group's ESI Energy subsidiary, and the overseas power projects, previously part of FPL Group International. Also included in FPL Energy are gas-fired cogeneration facilities in Massachusetts and New Jersey, purchased at the beginning of 1998, and generating plants presently under acquisition in Maine. In total, FPL Energy has power projects in 11 states and overseas with a capacity of 3,400 MW. The proposed acquisition in Maine will increase the MW capacity to more than 4,500 MW. In addition to combining all FPL Group's independent power resources, the new structure builds on the company's world-class skills in gas-fired combined-cycle generation and its leadership position in other clean fuel technologies, such as geothermal, solar and wind. Infrastructure will be the predominant variable in the determination of market share therefore is the best return on equity for shareholders, thus FPL has invested $797 Million in constructing and developing power projects. This level investment will most likely prove not to be sufficient to compete on a global scale since the $797 Million figure ranks FPL last in capital expenditures among the peer group analyzed.

Duke Energy

With a market capitalization value of $20.64 Billion and $2 Billion for 1997 of capital expenditures, Duke is a strong competitor and is quickly building infrastructure while maintaining the highest ROE within the peer group.

Enron Corporation

On June 18, 1997 Duke energy completed the merger of Duke Power company and PanEnergy Corp to create Duke Energy Corporation. With capital and investment expenditures of $2.0 billion in 1997 and $1.6 billion in 1996, Duke Powers merged company boasts the second largest level of capital expenditures within the peer group. It is expected that growth in the new merged company will be driven by further acquisitions, construction of greenfield projects and expansion of existing facilities as value-added opportunities present themselves. Dukes significant level of capital expenditures will give them prominence on the global power stage.

Coastal Corporation

Coastals market capitalization is $7.53 Billion. It is currently expanding rapidly and subsequently has a very low ROE. In 1997 Coastal announced a joint venture with Venezuelas PDVSA to produce, refine, and market extra-heavy crude from Venezuelas Orinoco belt. The same year Coastal announced a joint venture with Epcor Utilities of Canada to respond to Canadas deregulating electricity market by targeting municipalities and large commercial customers. They will offer products and services designed to improve the management of energy costs. The risk management products which form part of the product portfolio of Coastal are managed and developed at its Houston trading floor. As of the first quarter of 1996, Coastal was the 14th largest marketer of electric power and energy related risk management products in the U.S. (source: Houston Chronicle, July 7, 1996). Coastal Corp. is a smaller, scrappy, competitor which has experienced considerable success at copying Enrons innovative business strategy: it lays off risk and start-up cost in the international arena through such vehicles as joint-ventures and has developed a financial contracts settlements business. While Coastal is arguably a competitor of Enron, we will not focus on the company because it is smaller in size and therefore not a comparable. Coastal posts one of the lowest ROEs amongst the peer group.

Consolidated Natural Gas

With a $5.18 Billion market capitalization, CNG is another one of the smaller players in the industry. In the current environment, both parts of CNG, regulated and unregulated, have high demand and stiff competition. CNGs regulated businesses (the four local gas utilities and the interstate gas pipeline and storage system) provide a strong, steady earnings stream. Additionally, the unregulated businesses (E&P and energy marketing) and international segments offer more upside earnings potential. The largest part of CNGs earnings growth has come from the exploration and production segment, and it appears that this trend will continue. But CNG is determined to make energy marketing and the international business grow significantly as well. CNG is improving/expanding its international business for one reason: certain projects overseas offer higher riskadjusted rates of return than those offered in the United States. Compared to their larger competitors such as Enron, Pacific Gas & Electric and Duke Energy, CNGs method of selection is conservative, and the management has indicated that it will stay that way. Rather than scattering their attention and capital around the globe, CNG is focusing, at least initially, on building up business in Australia and parts of Latin America, such as Argentina and Brazil. Furthermore, CNG is concentrating on projects that allow them to build on their expertise in gas

Enron Corporation

transmission, gas distribution, electricity and E&P, and on already operating assets, as opposed to much riskier and capital intensive "greenfield" developments. CNGs strategy has advantages and disadvantages. On the positive side we believe that higher ROE and a highly focused business scope will reward CNG in the short run. However, with global deregulation in sight their strategy could be viewed as myopic. Enron and Duke Energy are blazing the trail by investing in more greenfield projects now at the expense of current ROE. But in the presence of deregulating markets it is clear that profits will start to erode for competing companies. Therefore, the best energy companies in the future will be the largest firms that have economies of scale in place for all of their operating assets. Accordingly, we believe CNG will be stunted on a global scale and will most likely be acquired by another more globally experienced energy corporation.

Pacific Gas & Electric

PCG has a market capitalization of $13.4 Billion in1997. At $1.7 Billion of capital expenditures, PCG ranks third in the peer group. Throughout the year, the California energy marketplace reacted to the state's landmark energy deregulation legislation, signed into law in late 1996. The forces of deregulation were particularly active in California where Pacific Gas & Electrics (PCG) utility business serves 13 million people. In February 1998 Enron won the right to supply California public schools with electricity in an unprecedented $500 Million deal and this deal punctuated the start of a new rivalry between PCG and Enron. (Enron later walked away from the deal due to certain state mandated price inclusions in the deal.) In 1997, PG&E Corporation focused primarily on opportunities presented in California and in the rapidly changing energy markets in other key regions of the U.S. The most recent highlight for PCG was a heated power contract battle in San Antonio, Texas with Enron. PCG won the contract in March 1998 to supply a sector of the San Antonio market for a new record amount of $2 Billion. This was quite a victory for PCG in Enrons own backyard. To display PCGs relative strength in infrastructure development they have totaled $1.7 Billion in capital and investment expenditures for FY1997 and plan to continue expansion at higher levels in 1998. The large level of capital expenditure for PCG has decreased their profitability ratios driving ROA to 2.66 and ROE to 8.34, however this strategy will help their longer-term growth prospects.

Chase Project Finance & Advisory

Chase is the global market leader in arranging U.S. dollar project financing, bringing a centralized, integrated view to infrastructure projects worldwide, providing bank loans, bonds, equity and advisory services to optimize their capitalization. Chase has been Ranked No.1 in project finance four times in a row. Chase has been the Global Lead Arranger, Global Project Finance Lead Arranger, North American Project Finance Arranger, and the Project Finance Arranger of the Year 1996. Three Transactions Recognized as Deal of the Year are the Aguaytia Power Project Peru; Aria West International, Indonesia; and Equate Petrochemical project.

Enron Corporation

Merrill Lynch Project Finance

Merrill Lynch maintained its position at No. 1, arranging almost $22 billion of private placement deals last year. Major project finance deals include Merrills role as the arranger in the financing the US$2.85 billion BarracudaCaratinga oil exploration and development project. The deal is novel because it is the first Latin American project finance deal where the arrangers will take on the commercial and convertibility risk. ABN Amro, ANZ Securities, Bank of Tokyo, Credit Suisse First Boston, and Fuji Bank make up one team, and the other consortium is composed of Deutsche Morgan Grenfell, Itochu and Merrill Lynch. BZW and Merrill Lynch are also believed to be preparing a #280m project financing for Sutton Bridge Power Station. The deal, expected in the next few weeks is likely to break new ground in the nascent UK market for project finance bonds.

1.4

Business Segments

Enron consists of the following main business segments:

Exploration and production

Enron Oil and Gas company (EOG) is engaged in the exploration for, and the development, production and marketing of, natural gas and crude oil primarily in major producing basins in the U.S., as well as in Canada, Trinidad and India. For the Fiscal Year ended 12/31/97, total revenues increased 7% to $783.5M. Net income decreased 13% to $122M. Results reflect increased natural gas and oil production volumes, offset by increased lease and well costs.

Enron Capital & Trade Resources (ECT)

ECT is one of the strongest financiers in the energy industry, having arranged over $3 billion in funding since 1991. ECT finds, manages, buys, sells, finances, and routes its products. ECT is Enron's most rapidly growing segment. As Enrons financial arm, ECT is one of the largest buyers and sellers of energy and energy services in North America. ECT's capabilities are further strengthened by the ownership of and direct access to physical assets. Through innovative risk management services, ECT brings stability to markets impacted by price volatility, assuring predictable revenues for energy producers and predictable prices for energy buyers. In fact, ECT pioneered the use of swaps, caps, floors and collars in the North American gas industry. ECT offers a full range of risk management products and services, which include swap, option and hybrid products; long-term, fixed-price contracts; innovative pricing structures such as commodity prices tied to alternative fuels and energy supply prices indexed to output; and utility, local distribution company and independent power producer contract restructuring alternatives.

Electricity transmission and distribution

Enron and Portland General Electric (PGE) corporation merged on July 1997 combining one of the leading low cost electric utilities with Enron. The merger will improve the combined company's business position by adding PGE's expertise in electric power marketing to ECT's expertise as one of the world's largest gas and electric power marketers.

10

Enron Corporation

Enron Energy services (EES)

EES is a new segment which intends to expand on the retail energy and power marketing business. Enron offers service in some areas across the country, but are not yet in all communities. This segment could become a major source of revenue in the future with the advent of regulation. EES will not generate significant cash flows in 1998.

Enron International

Enron International, a wholly-owned subsidiary of Enron, is one of the world's most successful developers of energy infrastructure. Enron International has completed power and pipeline projects in Europe, Asia and Latin America. It has also launched new merchant, finance and risk management services for third parties in emerging markets. Enron international has contributed to about 10% of Enron's operating income in recent years.

New business segments

Enron has launched new business segments which include Enron Wind Corp and Solarex which utilize alternative sources of energy. Zond provides fully integrated capabilities which include wind assessment, project siting, engineering, finance, turbine supply, construction, and operations. Solarex, founded in 1973, was the first organization to apply solar-electric technology for commercial needs on Earth. The breakdown of the companys operations is illustrated in Table 1. Table 1: Breakdown of Enrons Operations

Year ended 12/31/97 Transportation & Operations Capital & Trade Resources International Gas & Power Exploration & Production Elimination & Other Total Revenues 7.0% 88.9% 3.4% 4.4% -3.7% $20,273 Operating Income 53.2% 28.6% 8.4% 29.7% -19.8% $15 Assets 19.4% 52.3% 8.4% 14.7% 5.3% $23,422 Positive Outlook Positive Positive Positive Positive

2 Accounting Analysis

2.1 Review of Main Accounting Policies

Enrons material accounting policies are mainly related with two of its lines of business: its exploration and production operations, and its financial services operations. Oil and gas exploration and production activities are accounted for under the successful effort method of accounting. Development wells, related production equipment and lease acquisition costs are capitalized when incurred. If necessary, these costs are expensed in the period that management determines probable that the costs will not be recovered. Unsuccessful exploratory wells are expensed

11

Enron Corporation

when determined to be non-productive. Also, Enron uses the units of production depreciation method for proved reserves of oil and gas. In its financial services operations, financial instruments used in connection with trading activities are marked-tomarket, with resulting unrealized gains and losses recorded as "Assets and Liabilities from Price Risk Management Activities" in the consolidated balance sheet. Financial instruments are also utilized for hedging purpose. Additionally, consolidated financial statements include accounts of all majority owned subsidiaries of Enron, after eliminating significant intercompany transactions. Investments in unconsolidated subsidiaries are accounted for under the equity method. The nature of Enrons businesses requires a significant amount of estimates and assumptions which impact the companys financials. Nevertheless, both in its exploration and production operations as well as in its financial services operations, Enron uses accounting methods that are in line with industry practice. After close examination and scrutiny, we have found that Enrons financials provide an acceptable level of disclosure.

2.2

Beneish Model for Detecting Earnings Manipulation

As shown in Table 2, the 8-variable Beneish model shows that that Enron may be manipulating its earnings. We get a M-score of -1.89 for Enron, which is greater than the standard M-score of -2.22 used to gauge the likelihood of manipulation. The most significant factor contributing to the M-score manipulation statistic is the SGI. After close examination we were not concerned by the fact they were growing too fast because the sales increase comes from the recent acquisition of PGE. Additionally, the GMI shows deteriorating margins, the AQI shows increasing amounts of soft assets, DEPI shows depreciation expense slowing down, and LVGI indicate rapidly increasing leverage. However, further examination of these indicators showed no cause for concern. A further analysis using Lev and Thiagarajan indicators is shown in Table 3. CFO<NI in 1996 indicates low quality of earnings in 1996. In 1997, all indicators except the labor force signal show positive signals of the quality of earnings. Table 2: Beneish Model

DERIVED VARIABLES Other L/T Assets [TA-(CA+PPE)] DSRI GMI AQI SGI DEPI SGAI Total Accruals/TA LVGI 1997 9,583 0.625 1.448 1.308 1.526 1.017 0.649 0.012 1.041 -2.26 -1.89

Table 3: Lev & Thiagarajan Indicators

Lev & Thiagarajan indicators Receivables change R&D Capital expenditures Gross margin percentage SGA Expense Allowance for doubtful Accounts Labor force Audit qualification 1997 57.16% 30.85% 29.63% 47.18% 53.61% 87.94% 1.70% 0 Comments Positive sign Positive sign Positive sign Positive sign Positive sign Positive sign Negative sign Positive sign

M-score (5-variable model) M-score (8-variable model)

12

Enron Corporation

3 Financial Analysis

3.1 Ratio Analysis

Table 4 shows the ROE decomposition for Enron. Analysis of Enrons position vis-a-vis their competition follows the tables. Table 4: ROE Decomposition

Ratio/ROE Decomposition Net Profit Margin (or ROS) x Asset Turnover = Return on Assets

X

1997 0.03* 0.73 2.19%* 4.17 9.14%*

1996 0.05 0.79 3.98% 4.31 17.18%

1995 0.07 0.59 4.12% 4.25 17.49%

1994 0.08 0.77 3.86% 4.36 16.82%

1993 0.08 0.73 3.05% 4.31 13.13%

Financial Leverage

= Return on Equity

* Adding the J-Block loss back. Enron has a declining trend in ROS which we think is expected given the heated competitive pressures in the industry as deregulation occurs. Enrons significant level of capital expenditures has decreased net income while sales have increased dramatically, hence the declining ROS. Therefore the primary driver for Enrons ROA is going to be its ability to generate asset turnover. Enron is certainly keying into asset turnover but is constricted near-term by the large increases in its asset base. Once Enron has developed their infrastructure, ROA will increase as net sales continue in their upward trend. We believe Enron is taking risk above that of their competition in asset base buildup, therefore the potential for excess returns above their peer group is likely given their market position. Furthermore, Enron has had better ROE than their energy group peers primarily because of their highly leveraged position relative to their peers. We are not concerned that Enron is overly levered, however they are using substantial debt to finance their returns. On a going forward basis, Enron might be disadvantaged if other viable investing opportunities arise due to the high debt level on their balance sheet. Table 5: Financial Ratios of Enrons Competitors

Return on Equity 1996 1995 12.90 12.88 16.99 14.29 8.51 14.72 13.59 9.86 1.01 8.40 12.27 15.97 26.66 19.89 14.54 17.18 14.15 17.49 Return on Assets 1996 4.89 6.11 2.85 4.49 0.39 0.77 0.83 3.57 3.98

Florida Power Group Duke Energy Pacific & Gas Energy Coastal Corporation Consolidated Natural Gas Chase Project Finance Group Merrill Project Finance Group Weighted Average Median** Enron

1997 13.10 12.12 8.30 9.00 14.03 18.39 26.34 14.68 9.14*

1997 5.16 4.20 2.64 3.37 5.22 1.06 0.75 3.38 2.19*

1995 4.76 5.45 4.90 2.59 3.35 1.01 0.65 3.775 4.12

*Adjusting for J-Block Loss **1/4*(Investment bank median) + 3/4(Energy Company)

13

Enron Corporation

Table 5 shows the overall profitability of Enrons competitors. The structure of Duke energy is such that it may be the most important competitor for Enron on a unit for unit basis. Decomposing ROE, Duke has better financial position going forward. Both businesses are keen and well positioned with capital to be the preeminent energy companies on a pro-forma basis. Duke has a stronger capital structure with 0.73 LT Debt to Equity while Enron is loaded up at 1.38 Debt to Equity. This is a slight advantage for Duke in the event that significant purchasing opportunities avail themselves in the near term. In addition, both companies lead the pack in capital outlay in order to capture first mover advantage in both wholesale and retail power markets. Duke is further impresses in their ability to maintain high levels of investment and capital expenditures while showing one of the best ROE's in the peer group at 12.12%. Duke Energy cannot boast of the asset turnover that Enron does, but their slower growth strategy could be compared to that of two bikers in a race. Enron is the proverbial the lead biker taking all the wind while Duke tails from the windbreak to have higher Return on Sales. Duke shows wisdom in their strategy, however we need to keep a keen eye for Enron's ability to dominate once the infrastructure that they have been developing materializes into profitable assets. Next we believe competition will continue to be fierce from Pacific Gas & Energy. PG&E has one of the highest Return on Sales margins at 11%, however, they are tepid in their asset turnover ratio. We see this as room for improvement for PG&E and an advantage in the near term for Enron. Furthermore Enron is posts one of the best turnover ratios of their peer group at 0.82 in 1997. In addition Florida Power Group (FPL) has one of the top ROA and ROE figures among its peers boasting ratios of 5.16 and 13.10 respectively. The median ROA and ROE for the comparable group are 3.37 and 14.28, respectively. While FPL has excellent profitability numbers, we believe it is at the expense of their future prospects. In comparison, Enron has invested more heavily in future infrastructure resulting in lower profitability ratios, with respect to those of FPL at present. The other energy companies do not appear to pose a threat to Enron in the near term. We are of the opinion that competitors such as Coastal and Consolidated Natural Gas will be takeover targets for the formerly mentioned larger companies. It is important to note that Consolidated has the least leveraged balance sheet therefore we believe they are the most likely LBO candidate. While the investment banks are largely different entities than Enron on a macro level, they do share business segments with Enron in the area of project finance for the development of "greenfield" projects. Quantitatively Enron's Capital arm competes quite well with the large banks garnering returns on equity over 20%. Compared to Merrill (at 26% ROE) Enron's ROE is rather weak in near term performance, however against Chase Manhattan at 18.4% ROE Enron compares quite favorably. In summary, we look for Enron to maintain competitive advantage in project finance over the traditional investment banks because of their "real time" knowledge and experience from success and failure. These developmental experiences are impressive to capital seeking clients.

14

Enron Corporation

Table 6: Asset Efficiency Analysis

1997 Florida Power Group Duke Energy PG&E Coastal Corporation Consolidated NG Median for Energy GP. Enron Asset Turnover 0.51 0.68 0.55 0.85 0.96 0.615 0.82 Receivable Turnover 12.35 8.82 6.47 6.29 7.72 7.645 10.84 Inventory Turnover 12.19 0.68 18.86 9.91 30.16 11.05 156.99

Table 6 shows Enrons asset efficiency relative to its peer group. Enrons asset turnover has been relatively stable posting no growth over the past five years. However, Enron is superior compared to the median asset turnover in their peer group. The relatively low turnover ratio of the industry is due to the large fixed asset base necessary to operate in the energy business. Table 7: Operating Margins

1997 Florida Power Group Duke Energy PG&E Coastal Corporation Consolidated NG Median for Energy GROUP Enron Operating Margins 19.28 13.96 11.22 7.59 9.55 12.59 -0.58

Table 7 excluding the J-Block debacle, Enron has been profitable however they still lag behind their competitors. Operating profits for Enron will continue to be low considering all of their businesses and their first mover mentality. With the recent statement by CEO Ken Lay that Enron would back off from further development in Californias retail electricity market until it is more clear of the costs involved, we are confident that margins will rise slightly on a forward basis. Our projection is for Enron to increase operating margins to the median level in the industry and to be a leader in asset turnover. FPL boasts of one of the highest operating margins in the power industry at 19.28% compared to a tepid 12.98% median for the peer group. This impressive figure will be difficult to maintain as the markets deregulate, since the open price competition should narrow margins. We believe that the best utilities will compete on economies of scale, volume, and size while profit margins decrease throughout deregulated regions.

3.2

Cash Flow Analysis

Enron's cash flows show the company has typically financed its heavy capital investments as well as its financing requirements (mostly due to payment of dividends) with cash from operations. The situation has changed in the past two years, when increased needs for investing have required additional financing.

15

Enron Corporation

Chart 2 - Sources and Uses of Cash Flow

2,000 1,500 1,000 500 Millions 0 -500 -1,000 -1,500 -2,000 -2,500 CFO CFI CFF 89 90 91 92 93 94 95 96 97

Cash Flow from Operations (CFO)

Enron has consistently generated an important amount of cash from operations. Despite its decline in 1997 to $501M from $1,040M the previous year, its CFO is still well above the preceding years' levels. It seems that they have resolved the problems that contributed to the declining CFO prior to 1995.

Cash Flow from Investing (CFI)

CFI, which had traditionally been under $700M, jumped to $1.2B in 1996 and $2.4B in 1997. This increase has been mainly due to heavy investment in its international electricity division in projects such as India's Dabhol as well as to capital expenditures in the U.S. as Enron positions itself for the expected deregulation of the retail electricity market. Looking towards the future we expect Enron to continue its upward trend in CFI as it continues to develop international and retail infrastructure.

Cash Flow from Financing (CFF)

CFF has traditionally been negative or in the low hundreds of millions due to its strong cash flow from operations which has allowed Enron not only to pay a healthy dividend, but also to decrease its net long term debt. This has changed in 1996, when Enron had increased cash needs for investing while also increasing its dividends. In 1997, despite a sharp decrease in earnings, the company increased its dividend for the seventh consecutive year paying out $354M or $0.91 per share. Additionally, Enron has regularly relied on the capital markets, which it frequently taps for debt. Last year Enron issued over $1.8 Billion in debt and also acquired $427M of treasury stock in 1997. Enron's net change in cash was ($86M) in 1997, after an increase of $141M in 1996 and a decrease of $17M in 1995. This reflects Enron's increased need for cash for investing combined with its increasing dividend strategy. We believe that in the future Enron has the potential of generating substantial positive cash flows as it positions itself for the lucrative retail electric market.

16

Enron Corporation

4 Valuation

We estimated Enron's value using a discounted cash flow analysis (DCF), an Edwards-Bell-Ohlsen (EBO) model, and a comparable firms analysis. Based on these analyses, we believe Enrons intrinsic value is between $35.98 $45.56 per share. Because Enrons current share price is approximately $48, it is our opinion that Enron shares are currently overvalued.

4.1

Cost of Equity

In any type of valuation, two of the most critical parameters are the cost of equity and the weighted average cost of capital (WACC). For Enron, the cost of equity was computed by three methods (see Table 8). These three approaches yielded a costs of equity of 10.18%, 10.00%, and 9.39% respectively. We are very comfortable with these numbers because all three approaches yield similar values for the cost of equity. To determine the appropriate cost of equity, we used the average of the Standard CAPM and the 3 Factor Model which resulted in a cost of equity of 9.69%. Table 8: Cost of Equity Calculations

Method Standard CAPM 3 Factor APT Model Empirical CAPM Re

A

Re 9.38% 10.00% 10.18% 9.69%

A

Notes Re = 0.05068 + 0.0432 Re = 0.05068 + 0.0493 B Re = 0.7 + [0.6*0.53 ]

Yield on 3-month Treasury Bill as of April 30, 1998. The Beta for Enron is 0.53.

4.2

Weighted Average Cost of Capital

The weighted average cost of capital is based on the cost of equity along with such factors as the weighting of debt and equity along with the corporate tax rate. The examination of Enrons past capital structure policies showed that the firm traditionally has kept the levels of debt and equity relatively equal. The levels of debt and equity used in our analysis are 44% (debt level) and 56% (equity level). We believe this to accurately reflect past trends and the target capital structure for the company. The companys cost of debt, based on current market issues and conditions is 7.338% (Enron currently has outstanding bonds maturity in year 2023 that yield 7.388%). We based the effective corporate tax rate on the companys tax payments over the past 10 years and found this rate to be approximately 33%. These assumptions resulted in a baseline WACC of 7.61% WACC = [Rd *(1-t)*(% debt in capital structure)] + [Re*(% equity in capital structure)] WACC = [0.07388*(1-0.33)*(44%)]+[0.0968*(56%)] WACC = 7.61%

17

Enron Corporation

Because of the importance of the cost of equity and the WACC in valuation, sensitivity analysis on these parameters was conducted for both the discounted cash flow analysis and the EBO valuation.

4.3

Discounted Cash Flow Analysis

A discounted cash flow model estimates the value of a firm by predicting the future cash flows available to the capital providers of the firm (Total Enterprise Value). The market value of the firms current debt is subtracted from the TEV to arrive at the current estimated value of shareholders equity. The completed DCF for Enron is attached in Appendix 1.

Income Statement Assumptions

The revenue growth estimates for Enron are the foundation of the DCF model. We believe that Enrons revenues will grow at 35%, a percentage equal to the average of the last three years sales growth rates. We think this assumption is a reasonable one given the deregulation of the retail power market, the new technologies Enron is developing, and the success of Enron Capital and Trading. This sales growth is then phased down to 25% in years 3-4, 20% in years 5-6, 15% in years 7-8, 10% in years 9-10, and 3.5% thereafter. We selected 3.5% as the long term growth rate as this seems like a reasonable assumption for the inflation rate at that time. EPS for 1998 and 1999 are projected to be $1.89 and $2.59 respectively. Enrons cost of goods sold has been increasing over the last three years. However, because of efficiency improvements, we expect this increase to be nearing its apex. Thus we have projected Enrons cost of goods sold to be 85% of revenues for years 1-2. We kept the cost of goods level at 85% through most of the forecast period. Selling, General, & Administrative expenses are projected to remain at their historical 10 year average of 12% of revenues. Other major income statement items such as dividends on preferred security, other income, minority interests, and income taxes have all been assumed to stay constant at the average of 1995-1997 figures.

Balance Sheet Assumptions

The balance sheet items in a discounted cash flow analysis are projected based on a percentage of revenues. In most cases, we assumed that these items would remain constant at the average of their 1995-1997 percentage of sales. However, some adjustments have been made in these averages to account for recent trends in Enrons business model. The first change was to adjust current assets downward from 5.04% of revenues to 4.54% to account for Enrons trend of decreasing its amount of current assets. Second, the amount of retail energy PPE was increased by 0.5% of revenues each year to reflect Enrons movement towards the retail energy market. This took the percentage of retail energy PPE from 1.79% of revenues in 1998 to 5.79% in 2007. Because of this emphasis, other forms of PPE will decrease in importance. The amount of exploration and production PPE, transportation and distribution PPE, and wholesale energy PPE were adjusted downward by 8%, 3%, and 5%.

18

Enron Corporation

Results and Sensitivity

DCF analysis yields a price of $44.84/share. The valuation of Enron is extremely sensitive to adjustments in the Weighted Average Cost of Capital. This is due primarily to the large size of the terminal value. Consequently, Enrons projected share price would increase if interest rates were to fall , but would decrease if interest rates were to increase. As shown in Table 10 the value of Enron is much less sensitive to the initial assumptions of SG&A and the cost of goods sold. Table 9: DCF Sensitivity Analysis (Long term growth rate and WACC)

Long Term Growth Rate 2.0% 7.1% 7.3% 7.5% WACC 7.6% 7.7% 7.9% 8.1% $69.92 $57.97 $47.06 $41.95 $37.06 $27.88 $19.44 2.5% $73.25 $60.19 $48.34 $42.83 $37.57 $27.74 $18.76 3.0% $77.40 $62.92 $49.91 $43.90 $38.18 $27.57 $17.94 3.5% $82.70 $66.37 $51.88 $44.84* $38.94 $27.36 $16.94 4.0% $89.71 $70.87 $54.40 $46.93 $39.91 $27.09 $15.70 4.5% $99.41 $76.97 $57.77 $49.18 $41.18 $26.75 $14.12 5.0% $113.74 $85.73 $62.48 $52.29 $42.92 $26.29 $12.03

*Target Value

Table 10: DCF Sensitivity Analysis (SG&A and CGS)

Selling, General & Administrative Expenses 11.0% 12.0% 13.0% $48.46 $47.25 $46.04 $44.84 $43.63 $41.22 $47.25 $46.04 $44.84* $43.63 $42.42 $40.01 $46.04 $44.84 $43.63 $42.42 $41.22 $38.80

10.0% 83.0% 84.0% 85.0% 86.0% 87.0% 88.0% $49.67 $48.46 $47.25 $46.04 $44.84 $42.42 Cost of Goods Sold

14.0% $44.84 $43.63 $42.42 $41.22 $40.01 $37.60

*Target Value

4.4

Edwards-Bell-Ohlsen (EBO) Analysis

The EBO valuation method estimates the intrinsic value of equity through the discounting of future abnormal earnings. The input parameters to this model are forecasted earnings, estimated long-term growth rate, dividend payout ratio, book value/share, cost of equity capital, and the industrys target ROE. The fundamental assumptions used in this model are similar to those used in the DCF model. Specific information on key assumptions is listed below. In constructing this model, we decided to project long-term EPS growth from year 2000-2005. We made this assumption based on the fact that a majority of the American utility system has been forecasted to be deregulated by the year 2005. Enron should therefore experience continued growth in EPS.

19

Enron Corporation

Earnings Forecasts

The earnings forecasts used in the EBO model were based on the I/B/E/S mean analysts forecasts. We felt very comfortable using these forecasts because Enron is a widely followed company and the I/B/E/S forecasts took into consideration the estimates of 23 different analysts.

EBO Distribution for Implied price with Target ROE of 13%(ROE as a Random Variable)

14% 12% PROBABILITY 10% 8% 6% 4% 2% 0%

Long Term EPS Growth

The long-term EPS growth rate was also based on the I/B/E/S mean analysts forecasted long term growth rate. We felt this was the appropriate rate to use because it was the mean of the forecasted growth rates and was also the most frequently projected growth rate (6 out of 15 analysts who provided growth rate estimates projected 15% long-term EPS growth).

-1

18

35

51

68

84

10

11

13

Implied Stock Price

EBO Distribution for Implied price with LTG 15%(LTG as a Random Variable)

25% 20%

PROBABILITY

15% 10% 5%

Dividend Payout Rate

Enron has increased its dividend payout rate over the past three years. 0% On a per share basis, the dividend payout rate has increased from Implied Stock Price $0.8125/share in 1995, to $0.8625 in 1996, and $0.9125 in 1997. This payout rate has averaged just over 42% over the past three years. We do not expect a major change in this rate in the future as Enrons management team is firmly committed to distributing a fairly consistent percentage of its earnings to its shareholders.

10 1

Target ROE

he target ROE represents the equilibrium ROE for the industry. Due to the deregulation of the energy industry we expect the median ROE for industry to rebound its lows during the 1990s. Our choice of a 13.00% target ROE is supported by the 20 year average of 13.00% ROE of the energy industry (SIC codes 1310-1389) and the recent ROEs of our competitors in the industry.

Results and Sensitivity Analysis Our best-estimate EBO valuation yields a suggested intrinsic share value of $35.98. Table 11 shows a sensitivity analysis for two of the most important parameters, the projected long-term growth rate in earnings and the return on equity. The values in this table range from $27.36 - $48.97.

11 1

20

30

40

50

60

70

80

90

20

Enron Corporation

Table 11: EBO Sensitivity Analysis

Long Term Growth Rate 14.5% 15.0% 15.5% $46.18 $42.13 $35.46 $32.75 $47.54 $42.74 $39.15 $33.23 $30.76 $28.57 $39.73 $36.51 $27.09 $28.99

13.5% Return on Equity 8.18% 8.68% 9.68% 10.18% $40.95 $37.51 $31.83 $29.47 $27.36

14.0% $45.53 $38.04 $34.96 $29.89 $27.76

16.0% $48.25 $44.02 $37.06 $34.22

16.5% $44.68 $40.93 $34.74 $32.17 $29.87

* Target Value

Comparable Multiple Valuation

One and Two in common, Unit Three is unique towards Enron. Therefore calls for Enron to be valued with a weighted average comparable unregulated income from high multiple businesses, we have ascertained the most superior method of comp valuation is to place a 75% weighting on multiples. From the aforementioned methodology we derived a fair price of $45.56 per share (Refer to Comps Valuation Appendix 2). We would and current competitive position as it recovers from negative sentiment and the declining growth rates shown in 1997.

Enron Oil & Gas, Unit 2 Unit 1

Enron Capital & Trade (Pseudo

Bank/Project

21

H 4

AA

AB

AC

AD

AE

AF

AG

AH

AI

AJ

AK

AL

AM

AN

Enron Corporation

Year Ended December 31, 1996 $ 13,289 10,478 2,811 2,121 690 0 548 1,238 274 34 75 855 271 584 $ 1997 20,273 $ 17,311 2,962 2,947 15 0 550 565 401 69 80 15 (90) 105 $ 1998E 27,369 23,263 4,105 3,284 821 3 893 1,717 607 82 137 891 294 597 $ 1999E 36,948 31,405 5,542 4,434 1,108 4 1,206 2,318 795 111 185 1,228 405 823 $ 2000E 46,184 39,257 6,928 5,542 1,386 6 1,507 2,898 1,012 139 231 1,517 501 1,016 $ 2001E 57,731 49,071 8,660 6,928 1,732 7 1,884 3,623 1,268 173 289 1,893 625 1,268 $ 2002E 69,277 58,885 10,391 8,313 2,078 9 2,261 4,347 1,519 208 346 2,274 750 1,524 $ 2003E 83,132 70,662 12,470 9,976 2,494 10 2,713 5,217 1,822 249 416 2,730 901 1,829 $ 2004E 95,602 81,262 14,340 11,472 2,868 12 3,120 6,000 2,086 287 478 3,149 1,039 2,110 $

DCF ANALYSIS

5 Consolidated Statements of Income 6 (Dollars in Millions Except Per Share Data) 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 1995 Net Sales Cost of Sales Gross Profit SG&A Operating Income (EBIT) Int. Income Oth. (Exp.) Inc. - net Int. Exp. Divs on Preferred Securities Minority Interests Income Before Taxes Income Taxes Net Income NOPLAT Net Income Add Interest Exp. Less Int. Tax Shield NOPLAT $ 9,189 6,733 2,456 1,838 618 0 547 1,165 284 32 44 805 285 520

2005E 109,942 93,451 16,491 13,193 3,298 14 3,588 6,900 2,390 330 550 3,630 1,198 2,432 $

2006E 120,936 101,586 19,350 14,512 4,837 15 3,946 8,799 2,607 363 605 5,225 1,724 3,501

2007E 133,030 111,745 21,285 15,964 5,321 17 4,341 9,679 2,846 399 665 5,769 1,904 3,865

520 $ 284 (94) 710 $

584 $ 274 (90) 768 $

105 $ 401 (132) 374 $

597 $ 607 (200) 1,004 $

823 $ 795 (262) 1,355 $

1,016 $ 1,012 (334) 1,694 $

1,268 $ 1,268 (418) 2,118 $

1,524 $ 1,519 (501) 2,541 $

1,829 $ 1,822 (601) 3,050 $

2,110 $ 2,086 (688) 3,507 $

2,432 $ 2,390 (789) 4,033 $

3,501 2,607 (860) 5,247

3,865 2,846 (939) 5,772

Adjustments to FCF Depreciation $ Amortization of Intangibles (Inc.) Dec. Tot. Cur. Assets (Inc.) Dec. in Other LT Assets (Inc.) Dec. in Investment in Uncon. Subsidiaries (Inc.) Dec. in Risk Mgmt Activities Inc. (Dec.) in Minority Interests Inc. (Dec.) in Pref. Securities of Subsidiaries Inc. (Dec.) Tot. Cur. Liab. Cap Ex Terminal Value Total Free Cash Flow

432

474

600

860 $ 48 (2,538) (322) (915) (881) 433 235 2,533 (7,308) (6,851) $

1,093 $ 48 (2,463) (1,395) (1,250) (782) 553 430 2,431 (5,835) (5,816) $

1,413 $ 48 (2,375) (1,345) (1,205) (754) 533 414 2,344 (8,066) (7,299) $

1,779 $ 48 (2,969) (1,682) (1,507) (942) 666 518 2,930 (9,181) (8,221) $

2,149 $ 48 (2,969) (1,682) (1,507) (942) 666 518 2,930 (9,301) (7,548) $

2,596 $ 48 (3,562) (2,018) (1,808) (1,130) 800 621 3,516 (11,233) (9,122) $

3,005 $ 48 (3,206) (1,816) (1,627) (1,017) 720 559 3,165 (10,283) (6,947) $

3,479 $ 48 (3,687) (2,089) (1,871) (1,170) 828 643 3,639 (11,900) (8,048) $

3,852 48 (2,827) (1,601) (1,435) (897) 635 493 2,790 (9,372) (3,067)

4,264 48 (3,109) (1,762) (1,578) (987) 698 542 3,069 (10,372) 139,195 135,781

Total Enterprise Value Less MV of Debt Total Value of Equity Value/Share WACC

$ $ $

20,526 6,254 14,272 44.838 7.6%

Você também pode gostar

- NVRDocumento125 páginasNVRJohn Aldridge Chew100% (1)

- Munger's Analysis To Build A Trillion Dollar Business From ScratchDocumento11 páginasMunger's Analysis To Build A Trillion Dollar Business From ScratchJohn Aldridge Chew100% (4)

- Greenwald 2005 IP Gabelli in LondonDocumento40 páginasGreenwald 2005 IP Gabelli in LondonJohn Aldridge Chew100% (1)

- Cash Return on Capital Invested: Ten Years of Investment Analysis with the CROCI Economic Profit ModelNo EverandCash Return on Capital Invested: Ten Years of Investment Analysis with the CROCI Economic Profit ModelNota: 5 de 5 estrelas5/5 (3)

- Capital Returns: Investing Through the Capital Cycle: A Money Manager’s Reports 2002-15No EverandCapital Returns: Investing Through the Capital Cycle: A Money Manager’s Reports 2002-15Edward ChancellorNota: 4.5 de 5 estrelas4.5/5 (3)

- ATLAS HONDA Internship ReportDocumento83 páginasATLAS HONDA Internship ReportAhmed Aitsam93% (14)

- SGDE Example of A Clear Investment ThesisDocumento10 páginasSGDE Example of A Clear Investment ThesisJohn Aldridge ChewAinda não há avaliações

- Lecture 10 Moody's Corporation ExampleDocumento13 páginasLecture 10 Moody's Corporation ExampleJohn Aldridge ChewAinda não há avaliações

- Greenwald Class Notes 6 - Sealed Air Case StudyDocumento10 páginasGreenwald Class Notes 6 - Sealed Air Case StudyJohn Aldridge Chew100% (1)

- Global Crossing 1999 10-KDocumento199 páginasGlobal Crossing 1999 10-KJohn Aldridge Chew100% (1)

- Case Study 4 Clear Investment Thesis Winmill - Cash BargainDocumento69 páginasCase Study 4 Clear Investment Thesis Winmill - Cash BargainJohn Aldridge Chew100% (1)

- Lecture 6 An Investor Speaks of Investing in A Dying IndustryDocumento28 páginasLecture 6 An Investor Speaks of Investing in A Dying IndustryJohn Aldridge Chew100% (1)

- LPX 10K 2010 - Balance Sheet Case-StudyDocumento116 páginasLPX 10K 2010 - Balance Sheet Case-StudyJohn Aldridge ChewAinda não há avaliações

- Ghazi ValueInvestingCongress 100112Documento70 páginasGhazi ValueInvestingCongress 100112VALUEWALK LLC100% (1)

- Eminence CapitalMen's WarehouseDocumento0 páginaEminence CapitalMen's WarehouseCanadianValueAinda não há avaliações

- Hudsongeneralco10k405 1997Documento149 páginasHudsongeneralco10k405 1997John Aldridge ChewAinda não há avaliações

- Ek VLDocumento1 páginaEk VLJohn Aldridge ChewAinda não há avaliações

- Special Situation Net - Nets and Asset Based Investing by Ben Graham and OthersDocumento28 páginasSpecial Situation Net - Nets and Asset Based Investing by Ben Graham and OthersJohn Aldridge Chew100% (4)

- Distressed Investment Banking - To the Abyss and Back - Second EditionNo EverandDistressed Investment Banking - To the Abyss and Back - Second EditionAinda não há avaliações

- A Thorough Discussion of MCX - Case Study and Capital TheoryDocumento38 páginasA Thorough Discussion of MCX - Case Study and Capital TheoryJohn Aldridge Chew100% (2)

- Economies of Scale StudiesDocumento27 páginasEconomies of Scale StudiesJohn Aldridge Chew100% (4)

- Global Crossing 1999 10-KDocumento199 páginasGlobal Crossing 1999 10-KJohn Aldridge Chew100% (1)

- WMT Case Study #1 AnalysisDocumento8 páginasWMT Case Study #1 AnalysisJohn Aldridge Chew100% (1)

- Special Situation Net - Nets and Asset Based Investing by Ben Graham and OthersDocumento28 páginasSpecial Situation Net - Nets and Asset Based Investing by Ben Graham and OthersJohn Aldridge Chew100% (4)

- Case Study 4 Clear Investment Thesis Winmill - Cash BargainDocumento69 páginasCase Study 4 Clear Investment Thesis Winmill - Cash BargainJohn Aldridge Chew100% (1)

- Greenwald Class Notes 6 - Sealed Air Case StudyDocumento10 páginasGreenwald Class Notes 6 - Sealed Air Case StudyJohn Aldridge Chew100% (1)

- SQL Datetime Conversion - String Date Convert Formats - SQLUSA PDFDocumento13 páginasSQL Datetime Conversion - String Date Convert Formats - SQLUSA PDFRaul E CardozoAinda não há avaliações

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueAinda não há avaliações

- Sees Candy SchroederDocumento15 páginasSees Candy SchroederJohn Aldridge ChewAinda não há avaliações

- Buffett On ValuationDocumento7 páginasBuffett On ValuationAyush AggarwalAinda não há avaliações

- Sealed Air Case Study - HandoutDocumento17 páginasSealed Air Case Study - HandoutJohn Aldridge ChewAinda não há avaliações

- Students Grilled On Their Presentations and Review of CourseDocumento43 páginasStudents Grilled On Their Presentations and Review of CourseJohn Aldridge ChewAinda não há avaliações

- Nick Train The King of Buy and HoldDocumento13 páginasNick Train The King of Buy and HoldkessbrokerAinda não há avaliações

- Tobacco Stocks Buffett and BeyondDocumento5 páginasTobacco Stocks Buffett and BeyondJohn Aldridge ChewAinda não há avaliações

- Valuing Growth Managing RiskDocumento35 páginasValuing Growth Managing RiskJohn Aldridge Chew67% (3)

- Cornell Students Research Story On Enron 1998Documento4 páginasCornell Students Research Story On Enron 1998John Aldridge Chew100% (1)

- Bob Robotti - Navigating Deep WatersDocumento35 páginasBob Robotti - Navigating Deep WatersCanadianValue100% (1)

- WalMart Competitive Analysis Post 1985 - EOSDocumento3 páginasWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewAinda não há avaliações

- VII332Documento21 páginasVII332currygoatAinda não há avaliações

- Case Study - So What Is It WorthDocumento7 páginasCase Study - So What Is It WorthJohn Aldridge Chew100% (1)

- Warren Buffett and GEICO Case StudyDocumento18 páginasWarren Buffett and GEICO Case StudyReymond Jude PagcoAinda não há avaliações

- SNPK FinancialsDocumento123 páginasSNPK FinancialsJohn Aldridge Chew100% (1)

- Coors Case StudyDocumento3 páginasCoors Case StudyJohn Aldridge Chew0% (1)

- Dividend Policy, Strategy and Analysis - Value VaultDocumento67 páginasDividend Policy, Strategy and Analysis - Value VaultJohn Aldridge ChewAinda não há avaliações

- UPDATED AUG 2010 A Study of Market History Through Graham and Buffett and OthersDocumento83 páginasUPDATED AUG 2010 A Study of Market History Through Graham and Buffett and OthersJohn Aldridge Chew100% (1)

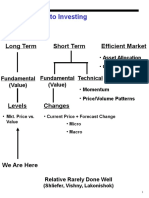

- Approaches To Investing: Long Term Short Term Efficient MarketDocumento71 páginasApproaches To Investing: Long Term Short Term Efficient MarketPeter WarmeAinda não há avaliações

- Murray Stahl - Value - Investor - May - 2013 PDFDocumento10 páginasMurray Stahl - Value - Investor - May - 2013 PDFkdwcapitalAinda não há avaliações

- Boyar's Intrinsic Value Research Forgotten FourtyDocumento49 páginasBoyar's Intrinsic Value Research Forgotten FourtyValueWalk100% (1)

- Office Hours With Warren Buffett May 2013Documento11 páginasOffice Hours With Warren Buffett May 2013jkusnan3341Ainda não há avaliações

- WalMart Competitive Analysis Post 1985 - EOSDocumento3 páginasWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewAinda não há avaliações

- Greenwald 2005 Inv Process Pres GabelliDocumento40 páginasGreenwald 2005 Inv Process Pres GabelliJohn Aldridge ChewAinda não há avaliações

- Wet Seal - VLDocumento1 páginaWet Seal - VLJohn Aldridge ChewAinda não há avaliações

- Class Notes #2 Intro and Duff and Phelps Case StudyDocumento27 páginasClass Notes #2 Intro and Duff and Phelps Case StudyJohn Aldridge Chew100% (1)

- The 400% Man: How A College Dropout at A Tiny Utah Fund Beat Wall Street, and Why Most Managers Are Scared To Copy HimDocumento5 páginasThe 400% Man: How A College Dropout at A Tiny Utah Fund Beat Wall Street, and Why Most Managers Are Scared To Copy Himrakeshmoney99Ainda não há avaliações

- Joe Koster's 2007 and 2009 Interviews With Peter BevelinDocumento12 páginasJoe Koster's 2007 and 2009 Interviews With Peter Bevelinjberkshire01Ainda não há avaliações

- Great Investor 2006 Lecture On Investment Philosophy and ProcessDocumento25 páginasGreat Investor 2006 Lecture On Investment Philosophy and ProcessJohn Aldridge Chew100% (1)

- Value Investing With Legends (Santos, Greenwald, Eveillard) SP2015Documento6 páginasValue Investing With Legends (Santos, Greenwald, Eveillard) SP2015ascentcommerce100% (1)

- Class 1 Introduction To Value InvestingDocumento36 páginasClass 1 Introduction To Value Investingoo2011Ainda não há avaliações

- Greenwald Class Notes 5 - Liz Claiborne & Valuing GrowthDocumento17 páginasGreenwald Class Notes 5 - Liz Claiborne & Valuing GrowthJohn Aldridge Chew100% (2)

- Anf VLDocumento1 páginaAnf VLJohn Aldridge ChewAinda não há avaliações

- Dangers of DCF MortierDocumento12 páginasDangers of DCF MortierKitti WongtuntakornAinda não há avaliações

- Death, Taxes and Reversion To The Mean - ROIC StudyDocumento20 páginasDeath, Taxes and Reversion To The Mean - ROIC Studypjs15Ainda não há avaliações

- Leon Cooperman Value Investing Congress Henry Singleton PDFDocumento37 páginasLeon Cooperman Value Investing Congress Henry Singleton PDFYashAinda não há avaliações

- David Tepper S 2007 Presentation at Carnegie Mellon PDFDocumento7 páginasDavid Tepper S 2007 Presentation at Carnegie Mellon PDFPattyPattersonAinda não há avaliações

- The Art of Vulture Investing: Adventures in Distressed Securities ManagementNo EverandThe Art of Vulture Investing: Adventures in Distressed Securities ManagementAinda não há avaliações

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNo EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsAinda não há avaliações

- Tech Stock Valuation: Investor Psychology and Economic AnalysisNo EverandTech Stock Valuation: Investor Psychology and Economic AnalysisNota: 4 de 5 estrelas4/5 (1)

- Financial Fine Print: Uncovering a Company's True ValueNo EverandFinancial Fine Print: Uncovering a Company's True ValueNota: 3 de 5 estrelas3/5 (3)

- Asian Financial Statement Analysis: Detecting Financial IrregularitiesNo EverandAsian Financial Statement Analysis: Detecting Financial IrregularitiesAinda não há avaliações

- SNPK FinancialsDocumento123 páginasSNPK FinancialsJohn Aldridge Chew100% (1)

- Tow Times Miller IndustriesDocumento32 páginasTow Times Miller IndustriesJohn Aldridge ChewAinda não há avaliações

- Chapter 20 - Margin of Safety Concept and More NotesDocumento53 páginasChapter 20 - Margin of Safety Concept and More NotesJohn Aldridge Chew100% (1)

- Assessing Performance Records - A Case Study 02-15-12Documento8 páginasAssessing Performance Records - A Case Study 02-15-12John Aldridge Chew0% (1)

- Niederhoffer Discusses Being WrongDocumento7 páginasNiederhoffer Discusses Being WrongJohn Aldridge Chew100% (1)

- CA Network Economics MauboussinDocumento16 páginasCA Network Economics MauboussinJohn Aldridge ChewAinda não há avaliações

- Coors Case StudyDocumento3 páginasCoors Case StudyJohn Aldridge Chew0% (1)

- Economies of Scale StudiesDocumento27 páginasEconomies of Scale StudiesJohn Aldridge ChewAinda não há avaliações

- WalMart Competitive Analysis Post 1985 - EOSDocumento3 páginasWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewAinda não há avaliações

- WalMart Competitive Analysis Post 1985 - EOSDocumento3 páginasWalMart Competitive Analysis Post 1985 - EOSJohn Aldridge ChewAinda não há avaliações

- Prof. Greenwald On StrategyDocumento6 páginasProf. Greenwald On StrategyMarc F. DemshockAinda não há avaliações

- GLBC 20000317 10K 19991231Documento333 páginasGLBC 20000317 10K 19991231John Aldridge ChewAinda não há avaliações

- Five Forces Industry AnalysisDocumento23 páginasFive Forces Industry AnalysisJohn Aldridge ChewAinda não há avaliações

- Quinsa Example of A Clear Investment Thesis - Case Study 3Documento18 páginasQuinsa Example of A Clear Investment Thesis - Case Study 3John Aldridge ChewAinda não há avaliações

- Tobacco Stocks Buffett and BeyondDocumento5 páginasTobacco Stocks Buffett and BeyondJohn Aldridge ChewAinda não há avaliações

- Burry WriteupsDocumento15 páginasBurry WriteupseclecticvalueAinda não há avaliações

- Capital Structure and Stock Repurchases - Value VaultDocumento58 páginasCapital Structure and Stock Repurchases - Value VaultJohn Aldridge ChewAinda não há avaliações

- Charlie Munger - Art of Stock PickingDocumento18 páginasCharlie Munger - Art of Stock PickingsuniltmAinda não há avaliações

- Dividend Policy, Strategy and Analysis - Value VaultDocumento67 páginasDividend Policy, Strategy and Analysis - Value VaultJohn Aldridge ChewAinda não há avaliações

- Revit 2019 Collaboration ToolsDocumento80 páginasRevit 2019 Collaboration ToolsNoureddineAinda não há avaliações

- C Sharp Logical TestDocumento6 páginasC Sharp Logical TestBogor0251Ainda não há avaliações

- Small Signal Analysis Section 5 6Documento104 páginasSmall Signal Analysis Section 5 6fayazAinda não há avaliações

- Ticket Udupi To MumbaiDocumento2 páginasTicket Udupi To MumbaikittushuklaAinda não há avaliações

- Lec # 26 NustDocumento18 páginasLec # 26 NustFor CheggAinda não há avaliações

- Palm Manual EngDocumento151 páginasPalm Manual EngwaterloveAinda não há avaliações

- AutoCAD Dinamicki Blokovi Tutorijal PDFDocumento18 páginasAutoCAD Dinamicki Blokovi Tutorijal PDFMilan JovicicAinda não há avaliações

- Milestone 9 For WebsiteDocumento17 páginasMilestone 9 For Websiteapi-238992918Ainda não há avaliações

- ABB Price Book 524Documento1 páginaABB Price Book 524EliasAinda não há avaliações

- Beam Deflection by Double Integration MethodDocumento21 páginasBeam Deflection by Double Integration MethodDanielle Ruthie GalitAinda não há avaliações

- Principles of SOADocumento36 páginasPrinciples of SOANgoc LeAinda não há avaliações

- Practical GAD (1-32) Roll No.20IF227Documento97 páginasPractical GAD (1-32) Roll No.20IF22720IF135 Anant PatilAinda não há avaliações

- Ethercombing Independent Security EvaluatorsDocumento12 páginasEthercombing Independent Security EvaluatorsangelAinda não há avaliações

- Paul Milgran - A Taxonomy of Mixed Reality Visual DisplaysDocumento11 páginasPaul Milgran - A Taxonomy of Mixed Reality Visual DisplaysPresencaVirtual100% (1)

- A Comparison of Pharmaceutical Promotional Tactics Between HK & ChinaDocumento10 páginasA Comparison of Pharmaceutical Promotional Tactics Between HK & ChinaAlfred LeungAinda não há avaliações

- Gravity Based Foundations For Offshore Wind FarmsDocumento121 páginasGravity Based Foundations For Offshore Wind FarmsBent1988Ainda não há avaliações

- ReviewerDocumento2 páginasReviewerAra Mae Pandez HugoAinda não há avaliações

- MCS Valve: Minimizes Body Washout Problems and Provides Reliable Low-Pressure SealingDocumento4 páginasMCS Valve: Minimizes Body Washout Problems and Provides Reliable Low-Pressure SealingTerry SmithAinda não há avaliações

- KrauseDocumento3 páginasKrauseVasile CuprianAinda não há avaliações

- Product Manual: Panel Mounted ControllerDocumento271 páginasProduct Manual: Panel Mounted ControllerLEONARDO FREITAS COSTAAinda não há avaliações

- Preventing OOS DeficienciesDocumento65 páginasPreventing OOS Deficienciesnsk79in@gmail.comAinda não há avaliações

- The "Solid Mount": Installation InstructionsDocumento1 páginaThe "Solid Mount": Installation InstructionsCraig MathenyAinda não há avaliações

- CEA 4.0 2022 - Current Draft AgendaDocumento10 páginasCEA 4.0 2022 - Current Draft AgendaThi TranAinda não há avaliações

- Health Informatics SDocumento4 páginasHealth Informatics SnourhanAinda não há avaliações

- AkDocumento7 páginasAkDavid BakcyumAinda não há avaliações

- Concrete For Water StructureDocumento22 páginasConcrete For Water StructureIntan MadiaaAinda não há avaliações

- IOSA Information BrochureDocumento14 páginasIOSA Information BrochureHavva SahınAinda não há avaliações

- Pro Tools ShortcutsDocumento5 páginasPro Tools ShortcutsSteveJones100% (1)