Escolar Documentos

Profissional Documentos

Cultura Documentos

Mini Case CH 3 Solutions

Enviado por

Timeka CarterDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Mini Case CH 3 Solutions

Enviado por

Timeka CarterDireitos autorais:

Formatos disponíveis

Chapter 13 Analysis of Financial Statements

MINI CASE

The first part of the case, presented in chapter 3, discussed the situation that Computron Industries was in after an expansion program. Thus far, sales have not been up to the forecasted level, costs have been higher than were projected, and a large loss occurred in 2004, rather than the expected profit. As a result, its managers, directors, and investors are concerned about the firms survival. Donna Jamison was brought in as assistant to Fred Campo, Computrons chairman, who had the task of getting the company back into a sound financial position. Computrons 2003 and 2004 balance sheets and income statements, together with projections for 2005, are shown in the following tables. Also, the tables show the 2003 and 2004 financial ratios, along with industry average data. The 2005 projected financial statement data represent Jamisons and Campos best guess for 2005 results, assuming that some new financing is arranged to get the company over the hump. Jamison examined monthly data for 2004 (not given in the case), and she detected an improving pattern during the year. Monthly sales were rising, costs were falling, and large losses in the early months had turned to a small profit by December. Thus, the annual data looked somewhat worse than final monthly data. Also, it appears to be taking longer for the advertising program to get the message across, for the new sales offices to generate sales, and for the new manufacturing facilities to operate efficiently. In other words, the lags between spending money and deriving benefits were longer than Computrons managers had anticipated. For these reasons, Jamison and Campo see hope for the company--provided it can survive in the short run. Jamison must prepare an analysis of where the company is now, what it must do to regain its financial health, and what actions should be taken. Your assignment is to help her answer the following questions. Provide clear explanations, not yes or no answers.

Mini Case: 13 - 1

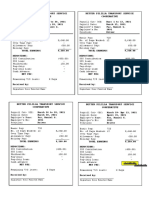

Balance Sheets Assets Cash Short-Term Investments. Accounts Receivable Inventories Total Current Assets Gross Fixed Assets Less: Accumulated Depreciation Net Fixed Assets Total Assets Liabilities And Equity Accounts Payable Notes Payable Accruals Total Current Liabilities Long-Term Debt Common Stock (100,000 Shares) Retained Earnings Total Equity Total Liabilities And Equity $ 2003 9,000 48,600 351,200 715,200 $ 1,124,000 491,000 146,200 $ 344,800 $ 1,468,800 2003 $ 145,600 200,000 136,000 $ 481,600 323,432 460,000 203,768 $ 663,768 $ 1,468,800 2004 $ 7,282 20,000 632,160 1,287,360 $ 1,946,802 1,202,950 263,160 $ 939,790 $ 2,886,592 2004 $ 324,000 720,000 284,960 $ 1,328,960 1,000,000 460,000 97,632 $ 557,632 $ 2,886,592 2005e $ 14,000 71,632 878,000 1,716,480 $ 2,680,112 1,220,000 383,160 $ 836,840 $ 3,516,952 2005e $ 359,800 300,000 380,000 $ 1,039,800 500,000 1,680,936 296,216 $ 1,977,152 $ 3,516,952

Mini Case: 13 - 2

Income Statements Sales Cost Of Goods Sold Other Expenses Depreciation Total Operating Costs EBIT Interest Expense EBT Taxes (40%) Net Income Other Data Stock Price Shares Outstanding EPS DPS Tax Rate Book Value Per Share Lease Payments 2004 $ $ 5,834,400 3,432,000 2,864,000 4,980,000 340,000 720,000 18,900 116,960 $ $ 5,816,960 3,222,900 $ $ 17,440 209,100 62,500 176,000 $ $ 146,600 (158,560) 58,640 (63,424) $ $ 87,960 (95,136) 2003 $ 8.50 100,000 $ 0.880 $ 0.220 40% $ 6.638 $ 40,000 $ 2004 6.00 2003 2005e $ 7,035,600 5,800,000 612,960 120,000 $ 6,532,960 $ 502,640 80,000 $ 422,640 169,056 $ 253,584 2005e $ 12.17 250,000 $ 1.014 $ 0.220 40% $ 7.909 $ 40,000

100,000 $ (0.951) $ 0.110 $ $ 40% 5.576 40,000

Mini Case: 13 - 3

Ratio Analysis Current Quick Inventory Turnover Days Sales Outstanding Fixed Assets Turnover Total Assets Turnover Debt Ratio TIE EBITDA Coverage Profit Margin Basic Earning Power ROA ROE Price/Earnings (P/E) Price/Cash Flow Market/Book

2003 2.3 0.8 4.8 37. 4 10. 0 2. 3 54.8% 3.3 2.6 2.6% 14.2% 6.0% 13.3% 9.7 8.0 1.3

2004 1.5 0.5 4.5 39. 5 6. 2 2. 0 80.7% 0.1 0.8 -1.6% 0.6% -3.3% -17.1% -6.3 27.5 1.1

2005e Industry Average 2.58 2.7 0.93 1.0 4.10 6.1 45.5 32.0 8.4 1 2.0 0 43.8% 6.3 5.5 3.6% 14.3% 7.2% 12.8% 12.0 8.1 1.5 7.0 2.5 50.0% 6.2 8.0 3.6% 17.8% 9.0% 17.9% 16.2 7.6 2.9

a.

Why are ratios useful? What are the five major categories of ratios?

Answer: Ratios are used by managers to help improve the firms performance, by lenders to help evaluate the firms likelihood of repaying debts, and by stockholders to help forecast future earnings and dividends. The five major categories of ratios are: liquidity, asset management, debt management, profitability, and market value.

Mini Case: 13 - 4

b.

Calculate the 2005 current and quick ratios based on the projected balance sheet and income statement data. What can you say about the companys liquidity position in 2003, 2004, and as projected for 2005? We often think of ratios as being useful (1) to managers to help run the business, (2) to bankers for credit analysis, and (3) to stockholders for stock valuation. Would these different types of analysts have an equal interest in the liquidity ratios?

Answer: Current Ratio05 = Current Assets/Current Liabilities = $2,680,112/$1,039,800 = 2.58 . Quick Ratio05 = (Current Assets Inventory)/Current Liabilities = ($2,680,112 - $1,716,480)/$1,039,800 = 0.93 . The companys current and quick ratios are higher relative to its 2003 current and quick ratios; they have improved from their 2004 levels. Both ratios are below the industry average, however. c. Calculate the 2005 inventory turnover, days sales outstanding (DSO), fixed assets turnover, and total assets turnover. How does Computrons utilization of assets stack up against other firms in its industry? = Sales/Inventory = $7,035,600/$1,716,480 = 4.10 .

Answer: Inventory Turnover05

DSO05 = Receivables/(Sales/365) = $878,000/($7,035,600/365) = 45.5 Days. Fixed Assets Turnover05 = Sales/Net Fixed Assets = $7,035,600/$836,840 = 8.41 . Total Assets Turnover05 = Sales/Total Assets = $7,035,600/$3,516,952 = 2.0 . The firms inventory turnover ratio has been steadily declining, while its days sales outstanding has been steadily increasing. While the firms fixed assets turnover ratio is below its 2003 level, it is above the 2004 level. The firms total assets turnover ratio is below its 2003 level and equal to its 2004 level. The firms inventory turnover and total assets turnover are below the industry average. The firms days sales outstanding is above the industry average (which is bad); however, the firms fixed assets turnover is above the industry average. (This might be due to the fact that Computron is an older firm than most other firms in the Mini Case: 13 - 5

industry, in which case, its fixed assets are older and thus have been depreciated more, or that Computrons cost of fixed assets were lower than most firms in the industry.) d. Calculate the 2005 debt, times-interest-earned, and EBITDA coverage ratios. How does Computron compare with the industry with respect to financial leverage? What can you conclude from these ratios?

Answer: Debt Ratio05 = Total Liabilities/Total Assets = ($1,039,800 + $500,000)/$3,516,952 = 43.8%. Tie05 = EBIT/Interest = $502,640/$80,000 = 6.3 .

/ Interest + + EBITDA Coverage05 = EBITDA + Payments Repayments Payments = ($502,640 + $120,000 + $40,000)/($80,000 + $40,000) = 5.5 . Lease Loan Lease

The firms debt ratio is much improved from 2004, and is still lower than its 2002 level and the industry average. The firms TIE and EBITDA coverage ratios are much improved from their 2003 and 2004 levels. The firms TIE is better than the industry average, but the EBITDA coverage is lower, reflecting the firms higher lease obligations.

e.

Calculate the 2005 profit margin, basic earning power (BEP), return on assets (ROA), and return on equity (ROE). What can you say about these ratios?

Answer: Profit Margin05 = Net Income/Sales = $253,584/$7,035,600 = 3.6%. Basic Earning Power05 = EBIT/Total Assets = $502,640/$3,516,952 = 14.3%.

Mini Case: 13 - 6

ROA05 = Net Income/Total Assets = $253,584/$3,516,952 = 7.2%. ROE05 = Net Income/Common Equity = $253,584/$1,977,152 = 12.8%. The firms profit margin is above 2003 and 2004 levels and is at the industry average. The basic earning power, ROA, and ROE ratios are above both 2003 and 2004 levels, but below the industry average due to poor asset utilization. f. Calculate the 2005 price/earnings ratio, price/cash flow ratios, and market/book ratio. Do these ratios indicate that investors are expected to have a high or low opinion of the company?

Answer: EPS = Net Income/Shares Outstanding = $253,584/250,000 = $1.0143. Price/Earnings05 = Price Per Share/Earnings Per Share = $12.17/$1.0143 = 12.0 .

Check: Price = EPS P/E = $1.0143(12) = $12.17. Cash Flow/Share05 = (NI + DEP)/Shares = ($253,584 + $120,000)/250,000 = $1.49.

Price/Cash Flow = $12.17/$1.49 = 8.2 . BVPS = Common Equity/Shares Outstanding = $1,977,152/250,000 = $7.91. Market/Book = Market Price Per Share/Book Value Per Share = $12.17/$7.91 = 1.54x. Both the P/E ratio and BVPS are above the 2003 and 2004 levels but below the industry average. g. Perform a common size analysis and percent change analysis. What do these analyses tell you about Computron?

Answer: For the common size balance sheets, divide all items in a year by the total assets for that year. For the common size income statements, divide all items in a year by the sales in that year. Mini Case: 13 - 7

Common Size Balance Sheets Assets Cash Short Term Investments Accounts Receivable Inventories Total Current Assets Gross Fixed Assets Less Accumulated Depreciation Net Fixed Assets Total Assets Liabilities And Equity Accounts Payable Notes Payable Accruals Total Current Liabilities Long-Term Debt Common Stock (100,000 Shares) Retained Earnings Total Equity Total Liabilities And Equity 2003 0.6% 3.3% 23.9% 48.7% 76.5% 33.4% 10.0% 23.5% 100.0 % 2003 9.9% 13.6% 9.3% 32.8% 22.0% 31.3% 13.9% 45.2% 100.0 % 2003 100.0 % 83.4% 9.9% 0.6% 93.9% 6.1% 1.8% 4.3% 1.7% 2.6% 2004 2005e Ind. 0.3% 0.4% 0.3% 0.7% 2.0% 0.3% 21.9% 25.0% 22.4% 44.6% 48.8% 41.2% 67.4% 76.2% 64.1% 41.7% 34.7% 53.9% 9.1% 10.9% 18.0% 32.6% 23.8% 35.9% 100.0 100.0 100.0 % % % 2004 2005e Ind. 11.2% 10.2% 11.9% 24.9% 8.5% 2.4% 9.9% 10.8% 9.5% 46.0% 29.6% 23.7% 34.6% 14.2% 26.3% 15.9% 47.8% 20.0% 3.4% 8.4% 30.0% 19.3% 56.2% 50.0% 100.0 100.0 100.0 % % % 2004 100.0 % 85.4% 12.3% 2.0% 99.7% 0.3% 3.0% -2.7% -1.1% -1.6% 2005e Ind. 100.0 100.0 % % 82.4% 84.5% 8.7% 4.4% 1.7% 4.0% 92.9% 92.9% 7.1% 7.1% 1.1% 1.1% 6.0% 5.9% 2.4% 2.4% 3.6% 3.6%

Common Size Income Statement Sales Cost Of Goods Sold Other Expenses Depreciation Total Operating Costs EBIT Interest Expense EBT Taxes (40%) Net Income

Mini Case: 13 - 8

Computron has higher proportion of inventory and current assets than industry. Computron has slightly more equity (which means less debt) than industry. Computron has more short-term debt than industry, but less long-term debt than industry. Computron has lower COGS than industry, but higher other expenses. Result is that Computron has similar EBIT as industry.

Mini Case: 13 - 9

For the percent change analysis, divide all items in a row by the value in the first year of the analysis.

Mini Case: 13 - 10

Percent Change Balance Sheets Assets Cash Short Term Investments Accounts Receivable Inventories Total Current Assets Gross Fixed Assets 2003 2004 0.0% -19.1% 0.0% -58.8% 0.0% 80.0% 0.0% 0.0% 0.0% 80.0% 73.2% 145.0 % 80.0% 172.6 % 96.5% 2004 122.5 % 260.0 % 109.5 % 175.9 % 209.2 % 0.0% 2005e 55.6% 47.4% 150.0 % 140.0 % 138.4 % 148.5 % 162.1 % 142.7 % 139.4 % 2005e 147.1 % 50.0% 179.4 % 115.9 % 54.6% 265.4 % 45.4% 197.9 %

Less Accumulated Depreciation 0.0% Net Fixed Assets Total Assets Liabilities And Equity Accounts Payable Notes Payable Accruals Total Current Liabilities Long-Term Debt 0.0% 0.0% 2003 0.0% 0.0% 0.0% 0.0% 0.0%

Common Stock (100,000 Shares) 0.0% Retained Earnings Total Equity

0.0% -52.1% 0.0% -16.0%

Mini Case: 13 - 11

Total Liabilities And Equity

0.0%

96.5%

139.4 % 2005e 105.0 % 102.5 % 80.3% 534.9 % 102.7 % 140.4 % 28.0% 188.3 % 188.3 % 188.3 %

Percent Change Income Statement Sales Cost Of Goods Sold Other Expenses Depreciation Total Operating Costs EBIT Interest Expense EBT Taxes (40%) Net Income

2003 0.0% 0.0%

2004 70.0% 73.9%

0.0% 111.8% 0.0% 518.8% 0.0% 0.0% 80.5% -91.7%

0.0% 181.6% 0.0% 208.2% 0.0% 208.2% 0.0% 208.2%

We see that 2005 sales grew 105% from 2002, and that NI grew 188% from 2003. So Computron has become more profitable. We see that total assets grew at a rate of 139%, while sales grew at a rate of only 105%. So asset utilization remains a problem.

Mini Case: 13 - 12

h.

Use the extended Du Pont equation to provide a summary and overview of Computrons financial condition as projected for 2005. What are the firms major strengths and weaknesses?

P rofit M argin

Answer: Du Pont Equation =

T otal A ssets T urnover

E quity M ultiplier

= 3.6% 2.0 ($3,516,952/$1,977,152) = 3.6% 2.0 1.8 = 13.0%. Strengths: The firms fixed assets turnover was above the industry average. However, if the firms assets were older than other firms in its industry this could possibly account for the higher ratio. (Computrons fixed assets would have a lower historical cost and would have been depreciated for longer periods of time.) The firms profit margin is slightly above the industry average, despite its higher debt ratio. This would indicate that the firm has kept costs down, but, again, this could be related to lower depreciation costs. Weaknesses: The firms liquidity ratios are low; most of its asset management ratios are poor (except fixed assets turnover); its debt management ratios are poor, most of its profitability ratios are low (except profit margin); and its market value ratios are low. i. What are some potential problems and limitations of financial ratio analysis?

Answer: Some potential problems are listed below: 1. Comparison with industry averages is difficult if the firm operates many different divisions. 2. Different operating and accounting practices distort comparisons. 3. Sometimes hard to tell if a ratio is good or bad. 4. Difficult to tell whether company is, on balance, in a strong or weak position. 5. Average performance is not necessarily good. 6. Seasonal factors can distort ratios. 7. Window dressing techniques can make statements and ratios look better.

Mini Case: 13 - 13

j.

What are some qualitative factors analysts should consider when evaluating a companys likely future financial performance?

Answer: Top analysts recognize that certain qualitative factors must be considered when evaluating a company. These factors, as summarized by the American Association Of Individual Investors (AAII), are as follows: 1. Are the companys revenues tied to one key customer? 2. To what extent are the companys revenues tied to one key product? 3. To what extent does the company rely on a single supplier? 4. What percentage of the companys business is generated overseas? 5. Competition 6. Future prospects 7. Legal and regulatory environment

Mini Case: 13 - 14

Você também pode gostar

- TB 02Documento60 páginasTB 02Yvonne Totesora100% (1)

- Gitman pmf13 ppt05Documento79 páginasGitman pmf13 ppt05moonaafreenAinda não há avaliações

- Chapter 7 SolutionsDocumento4 páginasChapter 7 Solutionshassan.murad33% (3)

- Ratio Analysis of "Square Textiles Limited"Documento3 páginasRatio Analysis of "Square Textiles Limited"Bijoy SalahuddinAinda não há avaliações

- 310 CH 10Documento46 páginas310 CH 10Cherie YanAinda não há avaliações

- Solutions. Chapter. 9Documento6 páginasSolutions. Chapter. 9asih359Ainda não há avaliações

- Gitman 12e 525314 IM ch11r 2Documento25 páginasGitman 12e 525314 IM ch11r 2jasminroxas86% (14)

- Five Year Financial Statement Analysis of Shell and PSODocumento87 páginasFive Year Financial Statement Analysis of Shell and PSOOmer Piracha83% (6)

- Cash Flow Statement PracticeDocumento6 páginasCash Flow Statement PracticeVinod Gandhi100% (3)

- Finance: CH 15 Capital Structure DecisionDocumento50 páginasFinance: CH 15 Capital Structure DecisionSarah A AAinda não há avaliações

- Chap 003Documento9 páginasChap 003Rajib Chandra BanikAinda não há avaliações

- Chapter 5 SolutionsDocumento16 páginasChapter 5 Solutionshassan.murad60% (5)

- 03B) Chapter 3 Questions - BrighamDocumento7 páginas03B) Chapter 3 Questions - BrighamMohammad Ather100% (1)

- Chapter 10Documento42 páginasChapter 10LBL_LowkeeAinda não há avaliações

- Chapter 2 Analysis of Financial StatementDocumento18 páginasChapter 2 Analysis of Financial StatementSuman ChaudharyAinda não há avaliações

- Chapter 3 Cash Flow and Financial PlanningDocumento69 páginasChapter 3 Cash Flow and Financial PlanningJully GonzalesAinda não há avaliações

- Stocks & Their Valuation - Rev 4Documento23 páginasStocks & Their Valuation - Rev 4Ginza putriAinda não há avaliações

- WCM QuestionsDocumento13 páginasWCM QuestionsjeevikaAinda não há avaliações

- A) Project ADocumento9 páginasA) Project AАнастасия ОсипкинаAinda não há avaliações

- Midland Energy's Cost of Capital CalculationsDocumento5 páginasMidland Energy's Cost of Capital CalculationsOmar ChaudhryAinda não há avaliações

- Delta Airlines Baggage Loading Cost SavingsDocumento37 páginasDelta Airlines Baggage Loading Cost SavingsenergizerabbyAinda não há avaliações

- Understand CVP Analysis and Break-Even PointDocumento18 páginasUnderstand CVP Analysis and Break-Even PointPeter ParkAinda não há avaliações

- Additional topics in variance analysisDocumento33 páginasAdditional topics in variance analysisAnthony MaloneAinda não há avaliações

- Capital Budgeting MathDocumento4 páginasCapital Budgeting MathMuhammad Akmal HossainAinda não há avaliações

- Unit 2 Capital StructureDocumento27 páginasUnit 2 Capital StructureNeha RastogiAinda não há avaliações

- Can One Size Fit All?Documento21 páginasCan One Size Fit All?Abhimanyu ChoudharyAinda não há avaliações

- Financial Management - Stock Valuation Assignment 2 - Abdullah Bin Amir - Section ADocumento3 páginasFinancial Management - Stock Valuation Assignment 2 - Abdullah Bin Amir - Section AAbdullah AmirAinda não há avaliações

- Modigliani & Miller Capital Structure TheoryDocumento2 páginasModigliani & Miller Capital Structure TheoryJoao Mariares de VasconcelosAinda não há avaliações

- Gitman 08Documento30 páginasGitman 08Samar Abdel RahmanAinda não há avaliações

- Chapter 2 SolutionsDocumento12 páginasChapter 2 Solutionshassan.murad75% (4)

- Financial Management Test 2: Answer ALL QuestionsDocumento3 páginasFinancial Management Test 2: Answer ALL Questionshemavathy50% (2)

- Optimum Capital StructureDocumento6 páginasOptimum Capital StructureAshutosh Pednekar100% (1)

- Analysis of Financial StatementsDocumento54 páginasAnalysis of Financial StatementsBabasab Patil (Karrisatte)Ainda não há avaliações

- Solution 1Documento5 páginasSolution 1Opeyemi OyewoleAinda não há avaliações

- Chapter 5 Financial Decisions Capital Structure-1Documento33 páginasChapter 5 Financial Decisions Capital Structure-1Aejaz MohamedAinda não há avaliações

- Operating and Financial LeverageDocumento64 páginasOperating and Financial Leveragebey_topsAinda não há avaliações

- 13 Ch08 ProblemsDocumento12 páginas13 Ch08 ProblemsAnonymous TFkK5qWAinda não há avaliações

- Hand Notes On Cost of Capital and Capital Structure: Composed By: H. B. HamadDocumento55 páginasHand Notes On Cost of Capital and Capital Structure: Composed By: H. B. HamadHamad Bakar HamadAinda não há avaliações

- RISK and RETURN With SolutionsDocumento33 páginasRISK and RETURN With Solutionschiaraferragni100% (2)

- Bond After-Tax Yield CalculatorDocumento7 páginasBond After-Tax Yield CalculatorJohnAinda não há avaliações

- Role of Financial Management in OrganizationDocumento8 páginasRole of Financial Management in OrganizationTasbeha SalehjeeAinda não há avaliações

- Financial Management Quiz AnalysisDocumento14 páginasFinancial Management Quiz AnalysisAdiansyach Patonangi100% (1)

- Financial Statement Analysis ExamDocumento21 páginasFinancial Statement Analysis ExamKheang Sophal100% (2)

- Mid Term ExamDocumento4 páginasMid Term ExamChris Rosbeck0% (1)

- Mportance OF Apital UdgetingDocumento16 páginasMportance OF Apital UdgetingtsayuriAinda não há avaliações

- Formulae Sheets: Ps It Orp S It 1 1Documento3 páginasFormulae Sheets: Ps It Orp S It 1 1Mengdi ZhangAinda não há avaliações

- Examples WACC Project RiskDocumento4 páginasExamples WACC Project Risk979044775Ainda não há avaliações

- Translation Exposure: Methods and ImplicationsDocumento14 páginasTranslation Exposure: Methods and ImplicationshazelAinda não há avaliações

- 03 CH03Documento41 páginas03 CH03Walid Mohamed AnwarAinda não há avaliações

- Financial Management 1Documento4 páginasFinancial Management 1Edith MartinAinda não há avaliações

- Financial Statement Analysis and Cash FlowDocumento10 páginasFinancial Statement Analysis and Cash FlowHằngg ĐỗAinda não há avaliações

- Answer Mini CaseDocumento11 páginasAnswer Mini CaseJohan Yaacob100% (3)

- Analysis of Financial Statements 1-10-19Documento28 páginasAnalysis of Financial Statements 1-10-19Shehzad QureshiAinda não há avaliações

- Analysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsDocumento9 páginasAnalysis of Financial Statements: Answers To Selected End-Of-Chapter Questionsfeitheart_rukaAinda não há avaliações

- Financial Statement Analysis (ch-6)Documento38 páginasFinancial Statement Analysis (ch-6)Wares KhanAinda não há avaliações

- Chapter 4 - Analysis of Financial StatementsDocumento50 páginasChapter 4 - Analysis of Financial Statementsnoor_maalik100% (1)

- Problems-Finance Fall, 2014Documento22 páginasProblems-Finance Fall, 2014jyoon2140% (1)

- Analysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsDocumento9 páginasAnalysis of Financial Statements: Answers To Selected End-Of-Chapter QuestionsDebasish PahiAinda não há avaliações

- Why Are Ratios UsefulDocumento5 páginasWhy Are Ratios UsefulLosing SleepAinda não há avaliações

- Manufacturing OperationsDocumento13 páginasManufacturing OperationsAlyssa Camille CabelloAinda não há avaliações

- Jawaban Soal ExerciseDocumento13 páginasJawaban Soal Exerciseqinthara alfarisiAinda não há avaliações

- Accounting 502 - Quiz 1 December 3, 2018: Not Required. (2 Points Each)Documento4 páginasAccounting 502 - Quiz 1 December 3, 2018: Not Required. (2 Points Each)Trish Dela CruzAinda não há avaliações

- CIR Failed Observe Due Process Rendering Assessments VoidDocumento4 páginasCIR Failed Observe Due Process Rendering Assessments VoidCyruz TuppalAinda não há avaliações

- Islamic House Financing in the UK: Problems and ProspectsDocumento25 páginasIslamic House Financing in the UK: Problems and ProspectsAbderrazzak ElmezianeAinda não há avaliações

- Amway Business Plan STP by Mandeep Kaur and Kulwinder SinghDocumento22 páginasAmway Business Plan STP by Mandeep Kaur and Kulwinder SinghKulwinder SinghAinda não há avaliações

- William Wenceslao - BA 202 Topic 6 Assignment - BY WILLDocumento4 páginasWilliam Wenceslao - BA 202 Topic 6 Assignment - BY WILLWiLliamLoquiroWencesLaoAinda não há avaliações

- Feasibility Study On Quail Egg ProductionDocumento30 páginasFeasibility Study On Quail Egg Productionjameskagome100% (1)

- Better Pililla Transport Service Cooperative Better Pililla Transport Service CooperativeDocumento1 páginaBetter Pililla Transport Service Cooperative Better Pililla Transport Service CooperativeHellen DeaAinda não há avaliações

- Unit 1. Fundamentals of Managerial Economics (Chapter 1)Documento50 páginasUnit 1. Fundamentals of Managerial Economics (Chapter 1)Felimar CalaAinda não há avaliações

- M&A StudyDocumento90 páginasM&A Studyapp04127Ainda não há avaliações

- Transfer of Property Act - BelDocumento36 páginasTransfer of Property Act - Belshaikhnazneen67% (3)

- MTN Group Business Report Highlights Cellular Growth Across AfricaDocumento170 páginasMTN Group Business Report Highlights Cellular Growth Across AfricaMercy OfuyaAinda não há avaliações

- CHAPTER 5 ADJUSTING PROCESS - AssignmentDocumento1 páginaCHAPTER 5 ADJUSTING PROCESS - AssignmentjepsyutAinda não há avaliações

- 6 EF2 - HDT - Budget1 - Taxes - Upto - GST - 2020BDocumento40 páginas6 EF2 - HDT - Budget1 - Taxes - Upto - GST - 2020BSuhasini GandhiAinda não há avaliações

- Income Withholding DeclarationDocumento2 páginasIncome Withholding DeclarationMoi EscalanteAinda não há avaliações

- Lisa Ortega Operates Ortega Riding Academy The Academy S Primar PDFDocumento1 páginaLisa Ortega Operates Ortega Riding Academy The Academy S Primar PDFAnbu jaromiaAinda não há avaliações

- Aqa Gcse Economics SpecificationDocumento27 páginasAqa Gcse Economics SpecificationastargroupAinda não há avaliações

- Tata Vs HyundaiDocumento49 páginasTata Vs HyundaiAnkit SethAinda não há avaliações

- National IncomeDocumento4 páginasNational Incomesubbu2raj3372Ainda não há avaliações

- Inflation's Causes and CostsDocumento55 páginasInflation's Causes and CostsSimantoPreeom100% (1)

- Mediobanca Securities Report - 17 Giugno 2013 - "Italy Seizing Up - Caution Required" - Di Antonio GuglielmiDocumento88 páginasMediobanca Securities Report - 17 Giugno 2013 - "Italy Seizing Up - Caution Required" - Di Antonio GuglielmiEmanuele Sabetta100% (1)

- Change in Demand and Supply Due To Factors Other Than PriceDocumento4 páginasChange in Demand and Supply Due To Factors Other Than PriceRakesh YadavAinda não há avaliações

- Corporate Overview and Key Financial Highlights of Food Manufacturer Driving Growth Through InnovationDocumento2 páginasCorporate Overview and Key Financial Highlights of Food Manufacturer Driving Growth Through InnovationBlueHexAinda não há avaliações

- The Project Feasibility StudyDocumento17 páginasThe Project Feasibility StudyJoshua Fabay Abad100% (2)

- Cebu Portland V CTADocumento1 páginaCebu Portland V CTAJL A H-DimaculanganAinda não há avaliações

- Short Run Decision AnalysisDocumento31 páginasShort Run Decision AnalysisMedhaSaha100% (1)

- News Letter January 2017Documento19 páginasNews Letter January 2017Sujata SinghAinda não há avaliações

- Lecture 2Documento24 páginasLecture 2Bình MinhAinda não há avaliações

- The Economic Cycle ExplainedDocumento12 páginasThe Economic Cycle ExplainedayushiAinda não há avaliações